Position in Rating | Overall Rating | Trading Terminals |

3rd  | 4.7 Overall Rating |    |

FP Markets Review

Trading in the financial market is a relative activity where each individual has varied trading needs, goals, and requirements. Therefore, a broker with limited trading options cannot be popular among all kinds of traders, investors, and financial institutions worldwide. Consequently, FP markets is an online brokerage service like many others that provides a wide range of trading instruments, tools, and trading accounts, making it a preferred broker for all types of traders.

FP markets is a regulated broker operating since 2005 that offers all standard trading facilities to its customers. Therefore, multiple asset classes, analytical tools, various account types, a good user interface, and different options for trading platforms are something that customers can expect from this platform. However, clients should not expect the same advanced trading tools as the top-range online brokers from FP markets.

In this FP review, traders and investors can learn about the various trading services that are offered by this broker. So that those who are searching for an online broker can decide whether or not FP markets is the broker you are looking for. Moreover, by exploring the advantages and disadvantages of this broker and comparing it with other potential brokers, it will be easy for anyone to rate FP markets on their own.

What is FP Markets?

FP markets is a brokerage service platform where traders, investors, and financial institutions can trade in various instruments, including Forex, indices, stocks, commodities, and cryptocurrencies. The authenticity of the FP market lies in its association with multiple regulatory bodies, such as the Australian Securities and Investments Commission ASIC, and the Cyprus Securities and Exchange Commission CySEC and registered license in the state of Saint Vincent and the Grenadines (SVG FSA).

FP markets have been working as an online broker since 2005 and provides trading services in a wide range of trading instruments, including forex, indices, and commodities such as raw materials, metals, and cryptocurrencies. In forex, traders who expect tight spreads and fast executions can also choose FP markets as their trading partners. Moreover, those who seek an opportunity to earn passive income can also opt for auto trading on the FP markets platform.

There are trading facilities available for professional traders and investors with advanced trading platforms, ECN accounts, fast executions, no slippage and tight spreads on FP markets. Similarly, novice traders who are looking for a safe and cost-friendly broker option can also invest with this platform with the zero commission standard account. So, FP markets is a good option for all kinds of traders be it seasoned or new, catering to their trading needs and financial goals.

Regardless of this, users should always weigh the pros and cons of any broker before making any investments. In the same way, FP markets may not be the right option for traders who want to trade in CFDs or prefer zero commission services from the broker.

Advantages and Disadvantages of Trading with FP Markets

FP Markets Pros and Cons

PROS

- The advanced trading platform of MT4 and MT5

- Fast order executions

- Useful educational and analytical tools

- Raw pricing

CONS

- No initial bonus or promotions

- Low leverage compared to other brokers

Analysis of the Main Features of FP Markets

4.7 Overall Rating |

4.5 Execution of Orders |

4.6 Investment Instruments |

4.8 Withdrawal Speed |

4.9 Customer Support |

4.5 Variety of Instruments |

4.6 Trading Platform |

FP Markets Customer Reviews

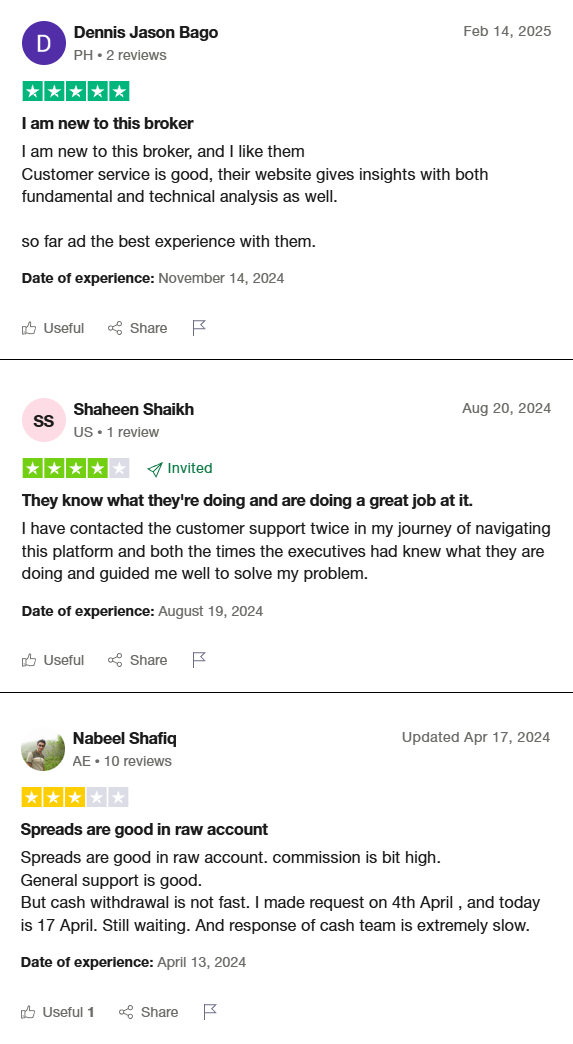

FP Markets receives positive feedback for its customer service, with users appreciating the support team’s knowledge and efficiency in resolving issues. Traders find the platform’s market insights, including fundamental and technical analysis, beneficial. The raw account spreads are competitive, but some users feel that commissions are slightly high. While general support is reliable, withdrawal processing times are slow, with reports of long waiting periods and delayed responses from the cash management team.

FP Markets Spreads, Fees, and Commissions

Tight Spreads are considered to be an extremely important ingredient for forex and other kinds of trading, as it reduces the trading cost for the consumers. This eventually results in a more profitable trader for day traders as well as long-term investors and financial institutions.

FP markets claim to provide the tightest spreads starting from 0 to 0.2 pips, which means that the bid price and ask price difference are very narrow for the customers. In forex, this is a great opportunity to invest with a broker offering tight spreads. Therefore, we can say that FP markets are a good choice for traders as it provides narrow spreads.

Compared to many other brokers, FP markets commission rates are high as many competitive trading platforms offer zero commission trading opportunities. Similarly, there are also those that provide the lowest commission rates to minimize the trading cost for customers. However, FP markets ask for high commission rates ranging from $ 1 to $ 9, varying to different account types.

As far as fees are concerned, FP markets do not apply any withdrawal fees on credit/debit cards or bank transfers. However, customers who want to cash out their payments through e-wallets or other online payment methods would have to pay a fee in accordance with the asset class and account type.

How FP Markets Fees Compare to other Brokers

Account Types

Some brokerage platforms understand the importance of individual differences in trading needs and provide multiple account types options. The same is the case with FP markets, as it provides a range of trading account choices for their clients.

Standard Account

The first account type is the standard account. Traders can open this account on an advanced MT4 and MT5 trading platform to avail the best user-interface trading experience. Moreover, the biggest advantage of the standard account is that it is a commission-free account with tight spreads of 0.1, along with fast order execution. This combination makes it an ideal trading condition for novice traders to take maximum trading benefits.

RAW account

The second account type is the raw account on MT4 and MT5, which is quite popular among traders. This account type is specialized for professional traders and long-term investors who demand the narrowest spreads. For this reason, the raw account holders can benefit from tight spreads of 0.0 pips. However, they have to bare the commission of $3 per lot each way.

IRESS retail account

As IRESS is a trading software operated by a private firm, traders can avail the advanced technological benefits of this account. Mostly, the IRESS account is demanded by seasoned and professional investors who want to take advantage of the best-integrated trading and market data-providing software. The IRESS retail CFD accounts require a minimum balance of $ 1000, with a $ 6 minimum commission rate, a $ 25 live market data fee which is waived off at a limit, a $ 60 IRESS fee, which is waived off if the commission reaches the $ 150 limit.

IRESS professional/wholesale account

The IRESS wholesale account offers the same trading features as the IRESS retail account. However, the only difference is the commission rate, which has no minimum requirement and starts off at a 0.5% fixed commission rate. Moreover, the DMA commission rate and margin rates are also negotiable on this account if the trading turnover reaches the monthly average threshold.

Other Accounts

Along with these accounts, FP markets also offers Islamic account for Muslim customers where all the trading features are same however there are swap-free transactions which is according to the Islamic law. Moreover, the most beneficial account is the demo account which is an important feature as those who are still at a trial stage and are not sure to invest with FP markets can open a demo account before opening a live trading account.

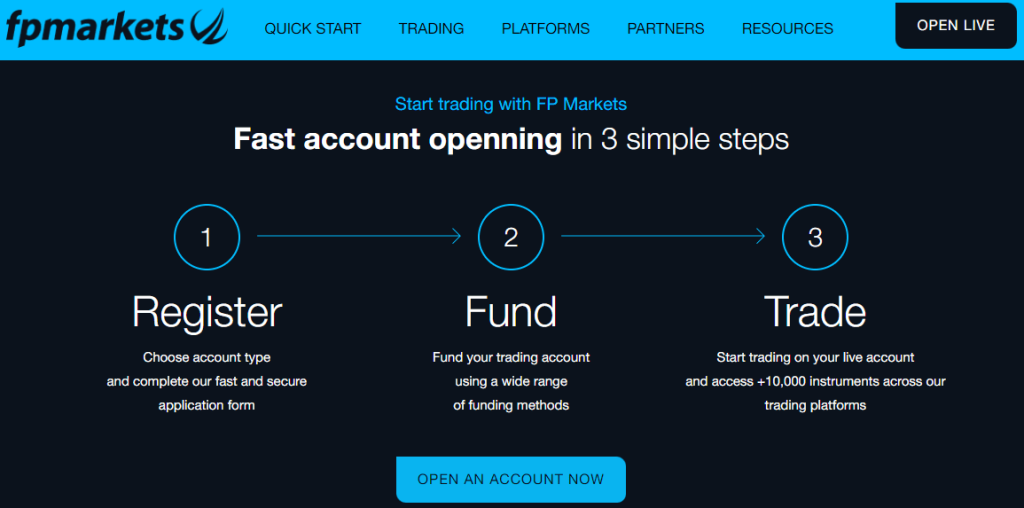

How To Open Your Account?

The account opening process on the FP markets is very easy. Anyone who is interested in opening an account on FP markets can go to the official website of the platform. On the very first landing page, there is an option to “open a live account.” However, you can also browse through the website as it provides all the relevant information regarding the FP markets trading services.

After clicking on the “open live account” tab, the website will take you through various account opening processes. The first step is to provide correct personal details, including the email, first name, last name, account type, country, gender, and phone number. After entering this information, clicks on the ” save and next” button.

This step requires more information related to the date of birth, address, zip code, and financial information. After providing this information again, click on “save and next.” The website will now take you to the account configuration process, where you will be asked to choose your preferred trading account, trading currency, leverage options, and choose a password and click ” save and next.”

The next step is the declaration, where questions will be asked about your trading experience, and you will have to accept the terms and conditions which the firm sets. The page also recommends to reads certain procedures from the website before agreeing to open an account. After reading, understanding, and agreeing to the terms and conditions, you can click on “Accept and open account.”

At this point, you will have access to a trading account and can start live trading after depositing the initial amount requirement. However, those who are unsure can also go for a demo account which has all the trading features of the platform, so that you can familiarize yourself with the trading process before actually investing in a live trading account.

What Can You Trade on FP Markets

There are multiple options available in the FP markets when it comes to trading instruments and asset classes. Traders, investors, and even big financial institutions can choose from varied trading options, including forex, indices, commodities, and cryptocurrencies. Moreover, FP markets claim to be offering more than 10,000 CFDs in multiple financial markets.

FP markets are majorly known as forex broker as it provides many facilities and advantages for trading forex. With more than 60 currency pairs, advanced technology of MT4 and MT5 trading platforms, access to the big names of the exchanges like NASDAQ, NYSE, etc., and providing tight spreads with fast market executions, there is everything that is needed for profitable forex trading.

As far as cryptocurrencies are concerned, traders can choose from Bitcoins, Ethereum, Litecoin, and many other major and minor digital currency options. The cryptocurrencies can also be traded on the MT4 and Mt5 platforms without the requirement of a crypto wallet. With the option of trading crypto in both rising and falling prices, traders can certainly choose this asset to diversify their portfolios.

Other than forex and cryptocurrencies, you can also go for trading high-value commodities like gold, silver, metals, energy, and agricultural products. Investing in these trading instruments allows the customers to make their financial portfolios most diverse and can avoid losses by not investing in only one asset.

Similarly, in stock indices, you have the option of choosing from 19 global indices at a margin rate of 1%. The important part is that trading in all these assets o not come with any restrictions. As FP markets gives freedom to you to trade long and short with low-cost trading opportunities.

FP Markets Customer Support

Customer support is crucial for traders when they are choosing any brokerage service. As trading involves many technical and analytical aspects, it requires assistance from financial analysts and expert advisors. During crucial trading decisions, customers are in need of support from these experts who can guide them and help in sailing their trading ship smoothly.

Consequently, FP markets provide considerably decent customer assistance with multiple communication methods for their customers. The customer support team includes expert advisors who provide technical and fundamental analysis to customers at crucial times. Moreover, the FAQ help center of the platform is also diverse and offers answers to all the basic questions of the users.

Moreover, if there are any other queries that require a prompt response, the customer can also contact customer support through the live chat box. Similarly, you can reach the support team through emails, and Australian customers can also access the toll-free number. Along with this, FP markets also provide social media accessibility through Twitter, Facebook, Instagram, and other platforms to keep the customers updated.

Customer support is also provided in multiple languages so that users worldwide can reach out and solve their problems. However, some reviews and feedback from customers also revealed that the multi-lingual support has many flaws, and it is a complicated procedure to reach out to the required language assistance. Moreover, as the forex market operates 24/7, the lack of customer support over the weekends is also a drawback of this platform.

Advantages and Disadvantages of FP Markets Customer Support

Contacts Table

Security for Investors

Withdrawal Options and Fees

Withdrawals or cashing out money is the first question every customer asks for when it comes to the performance of any brokerage service. Clients seek for easy and fast withdrawal procedures with minimum or no additional fees and charges. Moreover, brokers that offer varied withdrawal methods are also appreciated by the customers.

FP markets offer multiple withdrawal methods with zero withdrawal fees on credit/debit cards and bank transfers. Other withdrawal methods include e-wallets and notable online payment options such as Neteller, Skrill, Fast pay, perfect money, cryptocurrency solutions, and many others. Most of these withdrawal methods take 24 hours for transactions. However, bank transfers can take up to 2 to 5 business days.

As far as fees and charges are concerned, there are no charges for the card and bank transfers. However, third-party bank charges may be applied depending on the bank’s terms and conditions. On the other hand, online payments and e-wallets have additional charges ranging from 1% to 5%, depending on each withdrawal option. These additional fees can be upsetting for some customers who prefer online payment systems more than bank transfers.

FP Markets Vs Other Brokers

FP markets review is incomplete without comparing it with other financial market brokers. This comparison would provide a clear picture to the potential traders, investors, and financial institutions who are interested in investing with FP markets or are still searching for the right broker. The differentiation between these brokers will highlight the advantage and disadvantages of each firm for a better understanding.

#1. FP Markets vs Avatrade

Avatrade is a brokerage company founded in 2006 and has been offering services to more than 4000,000 registered users across the globe. The best part about Avatrade is that it is a secured firm that is regulated by not one but more than five regulatory authorities making the funds of the customers safe and protected. With advanced trading tools, a variety of trading instruments, and the availability of different account types, Avatrade can be a good choice.

However, various reviews also reflect the cons of Avatrade, like its complex user interface, slow trading platform, and poor customer service of Avatrade. Comparatively, FP markets have better customer service with an informative FAQ section that guides better, and the prompt response from live chats, along with EAs, helps in resolving issues quickly.

Nonetheless, the biggest advantage of FP markets is that it is cost-friendly, as even when it is not commission-free however, there are no additional charges like overnight premium, inactivity fees, or administration fees like with Avatrade.

#2. FP Markets vs Roboforex

Roboforex is one of the leading brokerage services in the market. It is a licensed company that has been operating since 2009 and has reached millions of customers worldwide. The high leverage of 1:2000 gives Roboforex an edge over other brokers with tight spreads and 24/7 customer service. Moreover, Roboforex also a very low initial eposit requirement of $10 and with accessibility to multiple trading terminals.

With all the rights for Roboforex, it is certainly a better option for traders to invest with as it is also cost-friendly with no withdrawal charges, low minimum deposit requirement, and minimal commissions. However, FP markets could be a choice for big-budget investors or financial institutions as it offers a separate corporate account type for such customers, which is not available at Roboforex.

#3. FP Markets vs Alpari

Alpari is among the most experienced trading platforms in the financial market. Operating since 1998, Alpari has been able to perform better with each passing year and has spread over 2 million customers worldwide. Alpari provides multiple account types, high leverage of up to 1:3000, and an advanced trading platform of MT4 and MT5; Alpari has many advantages. However, the drawback of Alpari remains its limited accessibility of asset classes for its customers.

When FP markets offers a trading selection from forex, indices, commodities, and cryptocurrencies, in contrast, Alpari only deals in forex, metals, and CFDs with slow withdrawal processes and higher commission rates. For this reason, FP markets is a better choice than Alpari, with more trading instruments and comparatively lower trading costs for customers.

How FP Markets Compare against other Brokers

Conclusion: FP Markets Review

FP markets is a brokerage platform that has been providing trading services to customers since 2005. It is a regulated firm whichis licensed by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), with a registered office at Saint Vincent and the Grenadines (SVG FSA). Under the supervision of these security commissions, we can say that FP markets is genuine firm ensuring protection of data and funds.

FP markets provides multiple options to trade in when it comes to asset classes including forex, indices, commodities, and cryptocurrencies. Moreover, the trading conditions of this platform is also quite satisfactory with tights spreads ranging from 0.2 pips and fast market executions. These trading circumstances are ideal for forex traders who are seeking to access maximum profits.

In addition to this, like many other brokers, FP markets also provides advance trading platforms of MT4 and MT5 for best user-interface experience and investment opportunities through MAM and PAMM accounts. The initial deposit requirement is neither too high nor too low with $100 with offers and has options for commission-free accounts for trading.

Other additional trading options include, VPS services, EA’s accessibility, scalping, hedging against losses, and auto-trading for passive income generation. In oppose to these facilities there are also some limitations of FP markets which includes leverage of 1:500 which is low compared to other brokers, delayed withdrawals, and additional charges on withdrawals.

All in all, FP markets is among the average brokerage services that has all the trading options available however, there are other trading firms that offers more advanced tools, superior services. The overall cost of these brokers is higher than FP markets but those traders who are willing to bare the costs can certainly opt for better trading experiences.

FP Markets Review FAQs

Is FP Markets legit?

Yes FP markets is a legitimate firm that is licensed and regulated by two financial commissions. Moreover, FP markets has been in the financial industry since 2005 making it more than 15 years of experience in the field. In addition to this, FP markets has also redeemed many awards incuing the “Best Fx Broker Australia” award in 2020 and “Best Trade Execution” “#1 Most Satisfied Traders” award by Investment Trends Report.

Another credibility of FP markets is that it is providing financial services to more than 10,000 customers which ensures that the firm is working genuinely and is not a scam. Similarly, the reviews and feedback of the customers is also a proof of the legitimacy of the firm.

Is FP Markets regulated?

Yes FP markets is licensed by 1 tier highly trusted regulator that is Australian Securities & Investment Commission (ASIC). Similarly, it is also regulated by an average-risk regulator including the Cyprus Securities and Exchange Commission (CySEC), and the European Securities and Markets Authority (ESMA).

These regulators to only provide a license to any brokerage firm, but also ensures that the firm is performing according to the security threshold and keep all financial transactions under surveillance. This system provides safety of data and funds to the customers and makes sure that they are provided with a segregated account.

Is FP Markets an ECN broker?

Yes FP markets is an ECN broker, as it provides price feeds without any intermediatary from the liquidity providers.This allows the traders and investors to avoid desk dealing or third party brokers where most of the time manipulation of prices conflict of interests are involved.

Therefore, we can say that FP markets provide low-commissioned ECN accounts on advance trading platform of MT4 nad MT5 through price transparency, high liquidity, fast executions and minimal slippage.