Forex4you Review

Amidst the emergence of Forex brokers in the world of trading, choosing the right broker is important. It’s not just about accessing the global currency markets; it’s about trust, reliability, and the tools necessary for effective trading. A good Forex broker acts as a bridge between you and the financial markets, providing essential services like market access, trading platforms, and valuable insights.

Established in 2007, Forex4you has carved a niche in the Forex market. What sets them apart is their commitment to offering both active and passive trading services. As a part of E-Global Trade & Finance Group, Inc., they bring a blend of experience and innovation to your trading journey. Regulated by the British Virgin Islands Financial Services Commission (BVI FSC), Forex4you is not just a broker; they’re a symbol of trust and regulatory compliance in the Forex trading world.

What is Forex4you?

Forex4you stands out as a user-friendly online trading platform, launched in 2007. It’s designed with a focus on the customer, ensuring that even beginners find it easy and approachable. This platform is known for its reliability and straightforward interface, catering to traders of all levels.

As a Forex broker, Forex4you offers an expansive range of trading options. Clients can trade in over 50 currency pairs, 50 stocks, 15 indices, and also delve into commodities like gold and oil. This variety provides traders with the flexibility to diversify their portfolios and explore different markets.

Security and regulation are paramount in Forex trading. Forex4you is authorized and regulated by the British Virgin Islands Financial Services Commission (FSC), a Tier-3 regulator. This regulatory oversight assures traders of a secure and transparent trading environment, which is essential in the online trading world.

Benefits of Trading with Forex4you

Trading with Forex4you has shown me that it’s an ideal platform for those just starting in Forex trading. They offer excellent conditions for novice traders like myself, making the initial journey less daunting. The environment is conducive to learning, with features that accommodate beginners’ needs.

One aspect I particularly appreciate about Forex4you is the lack of restrictions on trading strategies. Whether it’s scalping or algorithmic trading, they provide the freedom to explore various tactics. This flexibility has been pivotal in refining my trading approach and exploring different methods without limitations.

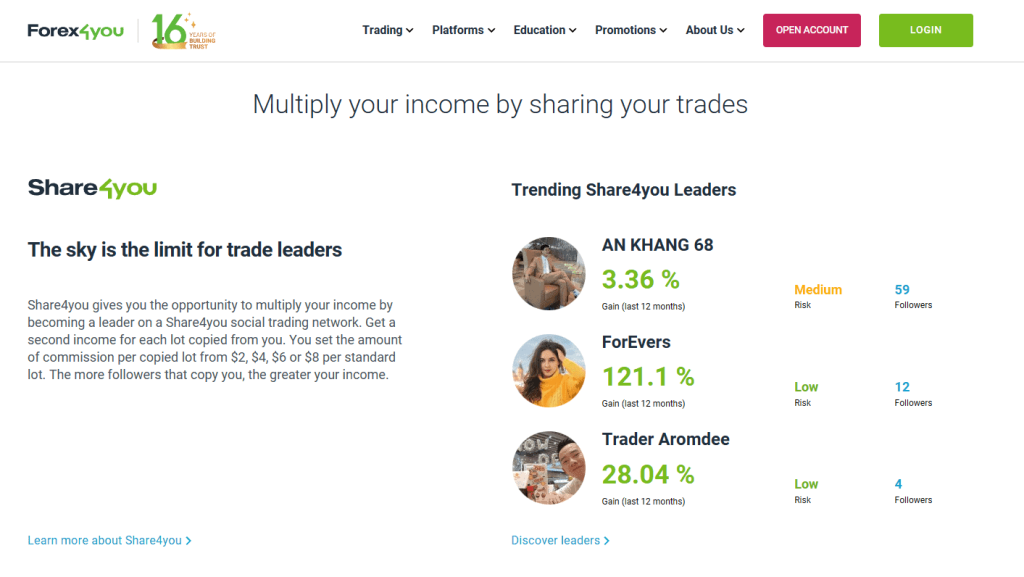

Forex4you’s social trading platform, Share4you, offers an intriguing possibility for passive income. By observing and copying the trades of experienced traders, I’ve been able to gain insights and earn passively. This feature is especially useful for those who may not have the time to trade actively but still want to participate in the market.

Knowing that Forex4you has a contingency insurance of $10 million adds a layer of security and peace of mind. This assurance is important, especially when dealing with the uncertainties of the Forex market. It’s a testament to their commitment to providing a secure trading environment.

Lastly, the availability of cent accounts with a minimum transaction amount of just 2 cents makes Forex4you highly accessible. This feature has allowed me to trade with minimal risk, which is perfect for someone still learning the ropes of Forex trading. It’s a great way to get started without the pressure of high stakes.

Forex4you Regulation and Safety

During my time trading with Forex4you, I’ve come to understand the importance of regulation in ensuring a secure trading environment. Forex4you is regulated by the British Virgin Islands Financial Services Commission (BVI FSC), an international regulator that operates within European legal frameworks. This information is vital for traders to know because it underlines the broker’s commitment to adhering to strict financial standards.

The BVI FSC’s rigorous control over its licensees provides a guarantee of responsible performance by Forex4you. This strict oversight is crucial for the safety of traders’ investments. Knowing that my funds are in segregated accounts, as required by the regulator, gives me confidence in the financial integrity of Forex4you. This separation of funds ensures that traders’ money is not used for any other purpose than their intended trades.

Another aspect of safety with Forex4you that I find reassuring is the negative balance protection. This feature is particularly important for traders, as it protects us from losing more money than what is in our trading accounts. It’s a safeguard against unforeseen market volatility, ensuring that we are not exposed to debts beyond our investments. Understanding these safety measures is essential for any trader considering Forex4you, as it highlights the broker’s commitment to providing a secure trading environment.

Forex4you Pros and Cons

Pros

- Quick customer support, even on weekends

- Ideal for beginner traders

- $10 million contingency insurance

- Freedom in trading strategies

- Passive income through Share4you

- Cent accounts with minimal transaction costs

Cons

- Not available for traders in the U.S., Canada, Japan, and EU countries

- Higher fixed fees for Pro accounts

Forex4you Customer Reviews

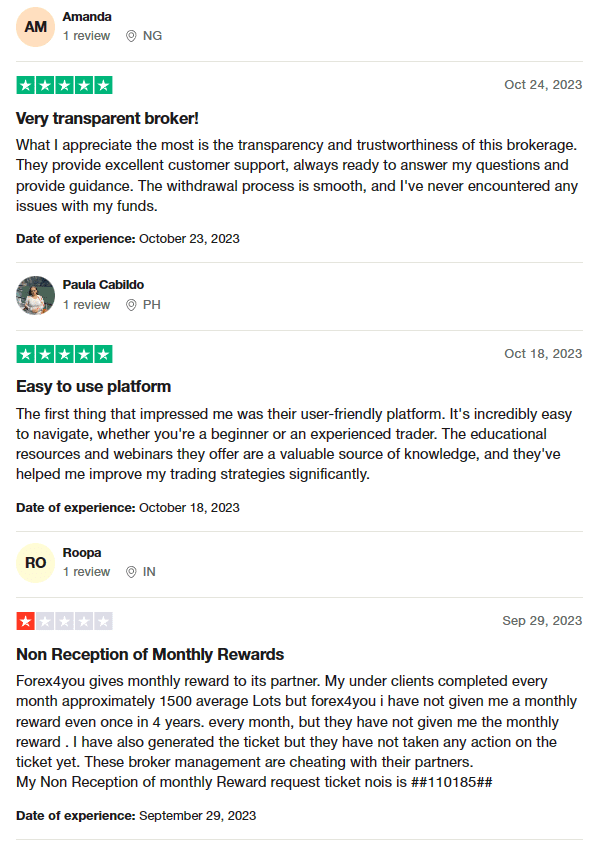

Forex4you has garnered a 3.8-star rating on Trustpilot, reflecting a mix of customer experiences. Generally, clients appreciate the transparency and trustworthiness of the brokerage, often highlighting the excellent customer support that is responsive and helpful. The smooth withdrawal process and reliable handling of funds are also noted positively. Many users find the platform user-friendly and navigable, suitable for both beginners and experienced traders. The availability of educational resources and webinars is praised for enhancing trading skills.

However, there are concerns about the broker’s partner program, with some reporting issues in receiving monthly rewards despite meeting criteria. This has led to dissatisfaction among certain partners who feel that the management has not adequately addressed their concerns.

Forex4you Spreads, Fees, and Commissions

Trading with Forex4you, I’ve noticed their spread and fee structure is quite straightforward. In their Cent Pro and Classic Pro accounts, there’s a fixed fee of $0.1 and $8 per full lot, respectively, along with the spreads. This clarity in costs is helpful for planning trades.

Regarding spreads, Forex4you offers them starting at 2.0 pips. Particularly in their Pro STP account, the live spreads for popular pairs like EUR/USD often hover around 0.1 pip, which is quite competitive.

Another point to note is that while there are no charges for depositing funds, withdrawing them incurs fees ranging from 0.8% to 2.5%, depending on the payment method used. This variation is something I always consider when planning my withdrawals.

Also, it’s important for traders to be aware of potential overnight trading fees, such as rollover or swap fees. Understanding these additional costs is crucial for any comprehensive trading strategy, ensuring there are no unexpected financial surprises during the trading journey.

Account Types

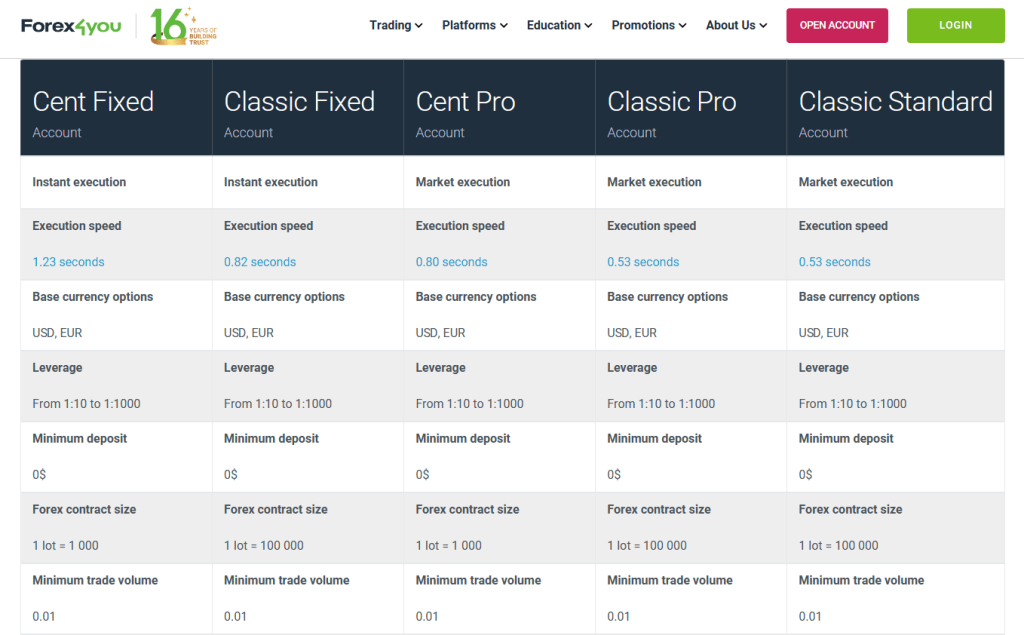

After testing the various trading account types offered by Forex4you, here’s a clear breakdown:

Cent Fixed Account

- Type: Cent account with fixed spreads.

- Spreads: Starting from 2 pips.

- Order Execution Speed: Average 1.23 seconds.

- Suitability: Ideal for novice traders, especially for middle- and long-term strategies.

Classic Fixed Account

- Type: Standard account with fixed spreads.

- Spreads: From 2 pips.

- Order Execution Speed: Average 0.82 seconds.

- Suitability: Good for day trend and long-term strategies.

Cent Pro Account

- Type: Cent account with floating spreads.

- Spreads: Starting from 0.1 pips.

- Order Execution Speed: Average 0.80 seconds.

- Fixed Fee: 10 cents per lot.

- Suitability: Best for testing expert advisors and scalping strategies.

Classic Pro Account

- Type: Standard account with floating spreads.

- Spreads: Starting from 0.1 pips.

- Order Execution Speed: Average 0.53 seconds.

- Fixed Fee: $8 per lot.

- Suitability: Suitable for scalping, algorithmic trading, and arbitration.

Classic Standard Account

- Type: Standard account with floating spreads.

- Spreads: Starting from 0.9 pips.

- Order Execution Speed: Average 0.53 seconds.

- Fixed Fee: None.

- Suitability: Versatile for any trading strategy.

Each account type caters to different trading preferences and strategies, offering flexibility to traders with varying levels of experience and trading goals.

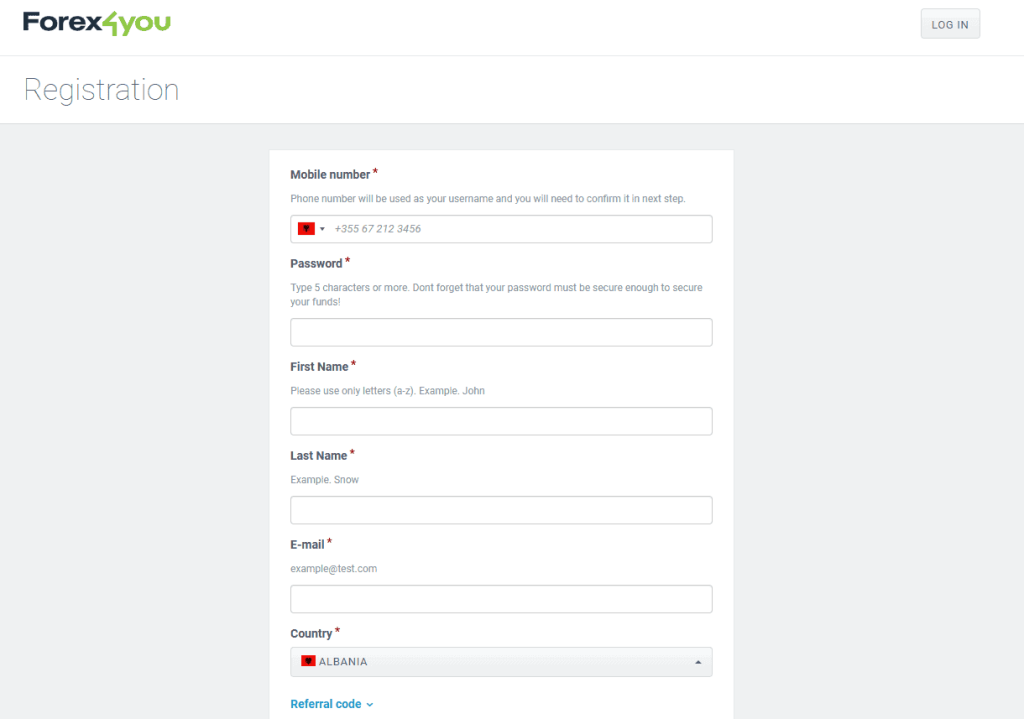

How to Open Your Account

- Visit the Forex4you main page and click on the “Open Account” button.

- Enter your phone number, which will also serve as your login.

- Provide your first and last name.

- Fill in your email address.

- Choose to receive a confirmation number either via phone or email.

- Enter the received confirmation number to complete registration.

- Complete the account verification process.

- Once verified, you can proceed to fund your account.

Forex4you Trading Platforms

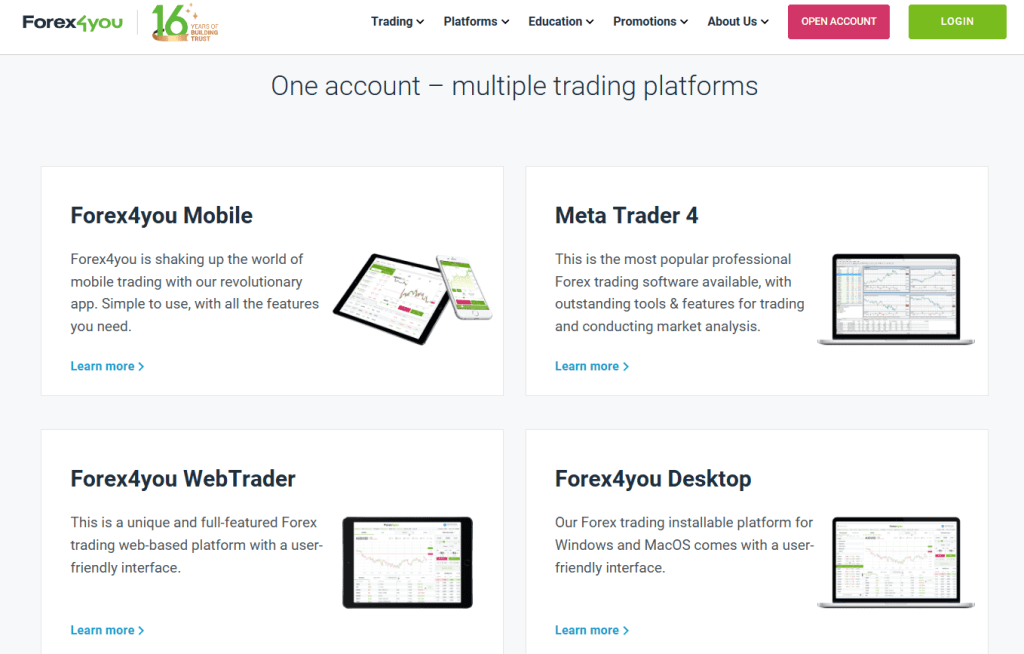

Forex4you provides a variety of trading platforms, each tailored to different trader needs. The Metatrader 4 (MT4) platform is known for its robust features and reliability, making it a popular choice among Forex traders. Its successor, Metatrader 5 (MT5), steps up with advanced tools and sophisticated analysis capabilities, ideal for traders seeking more comprehensive trading functionalities.

The Forex4you Mobile app stands out for its convenience, allowing traders to access financial markets anytime and anywhere. This app, built on unique proprietary technology, is user-friendly and intuitive, perfect for making quick trading decisions on the move. It’s a great option for those who value flexibility and mobility in their trading routine.

For web and desktop-based trading, Forex4you offers two distinct platforms. The Forex4you WebTrader is a full-featured, web-based platform with a user-friendly interface, ideal for traders who prefer not to download software. On the other hand, the Forex4you Desktop platform, available for Windows and MacOS, provides a fast, smooth trading experience packed with features. It’s designed for traders who prefer a traditional desktop setup with the added benefits of Forex4you’s proprietary technology.

What Can You Trade on Forex4you

During my trading experience with Forex4you, I found a diverse range of trading instruments available. The platform primarily focuses on the Forex market, offering the opportunity to trade in 41 currency pairs. This extensive selection caters to traders looking to engage in currency trading, from major pairs to more exotic options.

Forex4you also extends its offerings to Contract for Difference (CFD) trading. This includes CFDs on stocks of well-known companies listed on the New York Stock Exchange (NYSE), allowing traders to speculate on the price movements of these stocks without owning the actual shares. Additionally, the platform provides CFDs on precious metals like silver and gold, which are popular choices for diversifying portfolios and hedging against market volatility.

Another interesting aspect of Forex4you’s trading instruments is the availability of CFDs on cash instruments such as oil benchmarks WTI and BRENT, and various indices. These options provide a broader market exposure, enabling traders to explore opportunities beyond forex and stocks, and to speculate on the broader economic indicators and commodity prices.

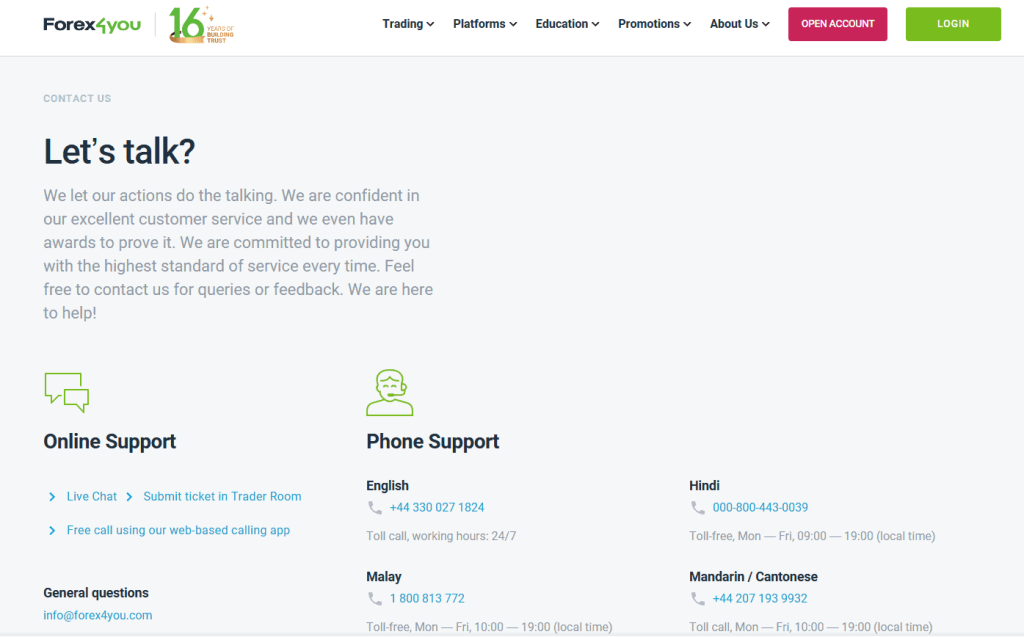

Forex4you Customer Support

In my dealings with Forex4you, I’ve utilized their customer support services on several occasions and found various convenient ways to reach out to them. Firstly, their direct phone support, with numbers listed on the site, has been particularly useful for immediate assistance. The response time is quick, and the support team is knowledgeable, providing precise solutions to queries.

Additionally, Forex4you offers support through email, which is ideal for more detailed inquiries that require thorough explanations. I’ve used this for less urgent issues and have consistently received comprehensive and helpful responses. The broker’s website also features a live chat option, which I found to be extremely efficient for quick questions and clarifications. The chat support is responsive, offering real-time assistance.

Lastly, the feedback form on the Forex4you website is another channel for reaching their support team. It’s a convenient option for leaving detailed feedback or inquiries, and I’ve found the responses via this method to be thorough and informative. Overall, the variety of customer support options available with Forex4you ensures that help is readily accessible in various formats, catering to different preferences and needs.

Advantages and Disadvantages of Forex4you Customer Support

Withdrawal Options and Fees

In my experience with Forex4you, their withdrawal process is impressively straightforward and efficient. The platform offers instant withdrawals upon request, which is a significant advantage for traders needing quick access to their funds. There’s also the flexibility of having no restrictions on the number of withdrawal requests, allowing for greater control over my finances.

Forex4you provides five options for both deposit and withdrawal: WebMoney, Skrill, Neteller, and VISA and MasterCard credit cards. The withdrawal fees vary depending on the chosen electronic payment system, which is something to keep in mind. I found that money is credited instantly when using electronic systems, while withdrawals to VISA and MasterCard may take up to six business days.

Another important aspect to note is the currency options available for withdrawal and replenishment, which are EUR and USD. For those trading over $1,000, account verification is a mandatory step. Also, it’s important to be aware of the withdrawal limits for each method; for instance, the limit for Skrill is up to $2,500. This level of transparency in the withdrawal process adds to the user-friendly experience on Forex4you.

Forex4you Vs Other Brokers

#1. Forex4you vs AvaTrade

Forex4you and AvaTrade are both reputable in the online trading space, but they cater to slightly different trader needs. Forex4you is notable for its user-friendly platform, ideal for beginners, and offers instant withdrawal options. In contrast, AvaTrade, established in 2006, boasts a broader global reach with over 300,000 customers and a wide array of over 1,250 financial instruments. AvaTrade’s heavy regulation and licensing across multiple jurisdictions provide a high level of security and trust.

Verdict: For traders seeking a more diverse range of instruments and a globally recognized platform with robust regulation, AvaTrade might be the better choice. However, for those prioritizing ease of use and quick withdrawal options, particularly newer traders, Forex4you stands out.

#2. Forex4you vs RoboForex

RoboForex, since 2009, has emphasized cutting-edge technologies and diverse trading options, offering over 12,000 trading instruments across eight asset classes. It’s known for its flexibility in catering to various trading styles and volumes. On the other hand, Forex4you is more focused on Forex trading and is preferable for beginners and those looking for simple, straightforward trading experiences.

Verdict: For traders looking for a vast array of trading options and advanced platform choices like MetaTrader, cTrader, or RTrader, RoboForex is the superior option. Forex4you, however, is better suited for those new to Forex trading or who prefer a more streamlined trading experience.

#3. Forex4you vs Exness

Exness, a Cyprus-based broker since 2008, offers a significant monthly trading volume and an extensive range of over 120 currency pairings, including cryptocurrencies. It’s known for low commissions, instant order execution, and various account options. Forex4you, while also offering efficient trading services, doesn’t match the vast array of currency pairs and additional instruments provided by Exness.

Verdict: For traders seeking a wide range of currency pairs, including cryptocurrencies, and a platform with low commissions and instant execution, Exness is the better option. Forex4you, however, remains a solid choice for those who prefer a more focused and user-friendly platform for Forex trading.

Conclusion: Forex4you Review

Forex4you presents itself as a highly accessible and user-friendly platform, particularly suited for novice traders. Its instant withdrawal options, lack of restrictions on trading strategies, and options like social trading through Share4you make it an attractive choice for those starting in Forex trading. The platform’s commitment to transparency and trustworthiness, underscored by the responsive customer support and straightforward fee structure, adds to its appeal.

However, potential users should be aware of the limitations. Forex4you’s offerings might not be as expansive as some of its competitors, particularly in terms of trading instruments variety. Also, the broker is not available to traders in several major markets like the U.S., Canada, Japan, and EU countries, which could be a significant drawback for traders in these regions.

Also Read: AAAFx Review 2024 – Expert Trader Insights

Forex4you Review: FAQs

Is Forex4you suitable for beginners?

Yes, Forex4you is particularly user-friendly for beginners, offering a straightforward platform and resources that cater to those new to Forex trading.

Does Forex4you offer a wide range of trading instruments?

Forex4you focuses mainly on Forex trading and provides a moderate range of trading instruments, including over 50 currency pairs, stocks, and indices.

Are there any geographical restrictions for using Forex4you?

Yes, Forex4you services are not available to traders in the U.S., Canada, Japan, and EU countries.