Forex vs Stocks

When it comes to investing, there is a multitude of trading instruments. Investment vehicles and methods have evolved in light of the availability and speed of the internet. Though the big banks and institutional players rule the complex financial instruments and play a significant role, the retail trader is also not left in the dark.

Retail traders, individual investors, or traders form a significant part of the investment segment and provide much-needed liquidity for all the market participants. The majority of retail investors or traders are those individuals with access to stock markets, forex markets, cryptocurrency markets, futures, options, to name some.

When it comes to investing, no two individuals are the same. All individuals have their reason for investing and have different investment goals. Therefore every individual must assess their own needs and goals before choosing an investment vehicle or system.

This article highlights some of the significant points to the Forex, stocks, future, and cryptocurrency markets.

Contents

- Difference between Forex and Stock Market

- What is the difference between Forex and Stock markets trading instruments?

- Forex vs Stocks Which is more profitable?

- Conclusion

Difference between Forex and Stock Market

There are many differences between the forex and stock markets. Most investors will be familiar with both of them. The market size, liquidity, regulatory environments, volumes, and the markets’ structure are significant differences one should look into before choosing them.

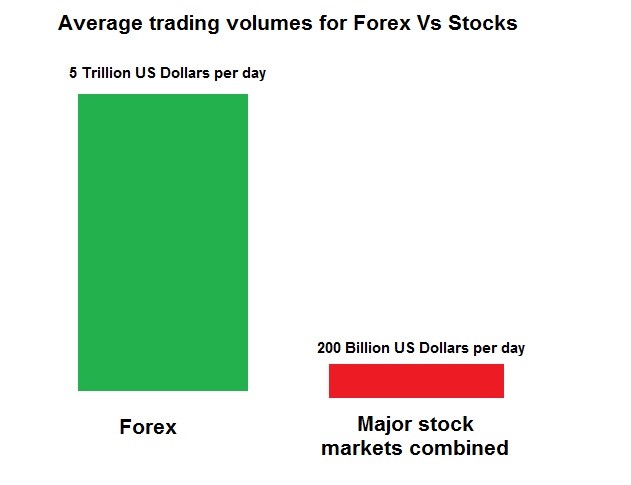

Forex vs Stock Market Size

The volume of business conducted daily speaks a lot about the Forex vs stock market size. The forex markets transactions reach a whooping 5 Trillion US Dollars per day. The major stock markets around the world trade 200 Billion US Dollars per day. A huge contrast in the trading size speaks where the money goes and where the investors are making their money work for them. The value of 5 Trillion dwarfs the 200 Billion, with forex markets creating a much needed colossal liquidity pool.

Forex markets provide unmatched liquidity to investors. At any given time, there are buyers and sellers available. However, in-stock markets, the liquidity is limited to the number of shares in circulation and the number of shareholders willing to buy or sell them.

Forex vs Stock Market hours

Forex market is open 24 hours a day, five days a week, from Monday to Friday. The forex market follows the sun and covers all the financial markets in every country, starting from Australia and ending in New York. The stock markets are open from 8 am to 4 pm or 5 pm depending on the location.

With its 24 X 5 working hours, the forex market provides access to anyone and everyone to trade at their schedule.

Forex vs Stock Market Structure

The forex market does not have a central location, and the trading happens through a network of banks connected. With no mediator to go through, the forex market provides real Over The Counter access to the retail investors. The stock markets, on the other hand, are traded mainly through the exchanges.

The authorities well regulate forex markets like the stock markets. However, the regulatory environment is different and has different requirements focussing on them.

Stock markets are centralized and allow international investors with many restrictions or may not allow investors from other countries. Forex markets, on the other hand, has no geographical limits or boundaries. The forex market is open to all and is accessible easily by global investors.

What is the difference between Forex and Stock markets trading instruments?

Though both markets provide trading instruments to the investor, these instruments vary a lot.

Stock markets or the share markets provide access to shares of a company, which is tradeable. An investor can buy and own the shares of a company as a shareholder. Traders then trade them in the stock markets and benefit from the price fluctuations of their shares. Stock markets offer shares in thousands of companies listed in them.

Forex markets offer currencies to trade. The currencies are traded in and pairs and appreciate and depreciate based on the country’s economy. Most forex traders trade with US Dollar pairs where 75% of the trading volume takes place.

Many successful Forex traders focus on trading in limited currency pairs. As the liquidity and volatility on one single currency pair offer enough trades per day, they apply different chart time frames to a single currency pair. They develop multiple strategies to understand the market structure and anticipate price movements and trends in a particular pair and specialize in them. Since the currency pair involves two countries, the trader has to study and follow these two countries’ economies to come to a final decision to enter a trade.

A typical stock exchange lists thousands of companies. The stock trader effectively will have access to all the charts of these company’s shares and will be looking for the best company’s shares to trade.

Very few trading instruments to focus on forex trading compared to the thousands of companies listed in share markets to sift through makes it easy for forex traders to understand, study, analyze, and trade.

Difference between Forex and Stock market Traders

Many investors in the stock market primarily buy shares and hold them for a more extended period. They are mostly long-term investors as the companies in which they own shares may take time to deliver results and, in turn, drive the share prices higher. However, there are many retail share market traders called day traders. Day traders are speculators; they buy and sell shares within the same day or in a day or two.

Though Import Export companies, Corporates, Banks, and other Financial Institutions hold forex trading positions for extended periods, most Forex retail traders trade for periods ranging from a few seconds to a few minutes. The other retail Day traders close positions within a day, while short term traders may hold positions for a few weeks.

The forex market is more volatile than the stock markets; the currency prices fluctuate widely and offer multiple trading opportunities to the traders. Stock markets fluctuate within a minimal range within the 6 to 8 hours of the daily trading window, but currency prices fluctuate much higher during the 24 hours during the opening and closing of every financial market of the globe. Thus providing multiple trading opportunities throughout the day and enabling Forex traders to turn them to profit.

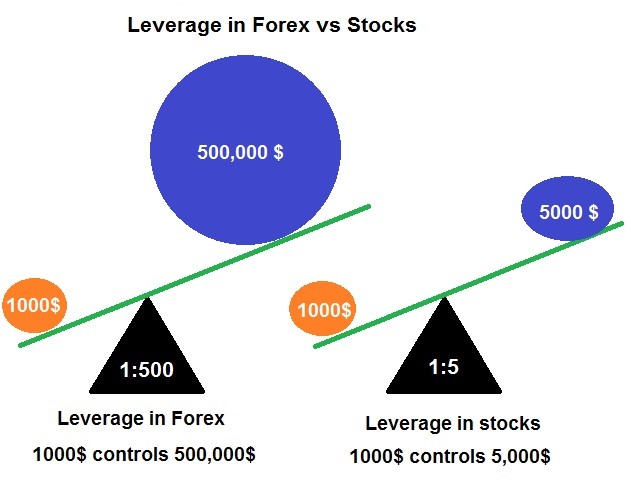

How much leverage is provided in forex and stock markets?

Leverage is the ability to trade a more significant position size with less cash balance in the trading account. Leverage is borrowing the broker’s cash against a small deposit for trading. Most stock markets provide significantly less leverage for margin trading. Typical leverages offered by stockbrokers may range between 1:2 and 1:5. However, forex brokers provide a high leverage, and it’s normal to find brokers providing leverage of 1:500.

The availability of high leverage provides easy access to funds for the trader. Leverage enables the trader to trade higher volumes and benefit from them.

However, traders should use leverage with caution as it can work against them.

Cost of trading Forex vs Stocks

Both Forex or Stocks have some costs associated with trading them. Spread is the difference between buying and selling price of the broker. Most forex brokers offer small spreads as a fixed cost. Some forex brokers provide zero spreads and charge a fixed flat fee on the trading volume. Typically the spreads are razor-thin in the major currency pairs.

On the other hand, Stockbrokers charge spreads, commissions, and also additional trading fees if applicable.

Trading a currency vs a company

There is a multitude of reasons for a company to fail. Newspapers are frequented with articles and reports of companies going bankrupt. Often there are reports of insiders using abusive practices and manipulation for trading gain.

Some of the biggest global companies have either broken down or wound up, or go bankrupt for various reasons. Litigation is another huge risk for companies. Failure of companies’ growth plans or a few rogue employees contributes to a company’s collapse, eventually contributing to the share holder’s loss.

Trading currencies are non-manipulative due to their sheer volume of 5 Trillion US Dollars trading volume per day and global investors’ participation. It is not possible for insider trading or to be manipulated by a few rogues. Regulatory oversight enhances forex market participants’ security and ensures that strict regulations provide complete control of the financial intermediaries and brokers.

Forex vs Stocks Which is more profitable?

Comparing Forex vs Stocks’ profitability is an important one for any trader before making a final decision.

Forex trading offers the trader to start trading with as low capital as possible with even a few hundred dollars. The high leverage enables the trader to take higher volume positions. The high volatility creates plenty of movement in the markets and gives numerous trading opportunities in a day. The low-cost spread makes trading costs as minimal as possible. The availability of a trading environment 24 X 5 makes participants from every part of the globe benefit.

With all the above features, the forex markets emerge as the favorites for the trader over the stock market.

Further read: How much money can you make trading forex?

Forex vs Stocks vs Futures

Futures are derivative instruments. Futures is a contract signed by a buyer and seller with clear terms and conditions to regulate the contract. The futures contract is traded through an exchange that acts as the intermediary in the transaction. As a derivative, the futures contract has no value of its own but derives its price from an underlying asset’s value.

A futures contract can have currencies or indices or a commodity as its underlying asset, and the contract expires at a predetermined time.

Similar to stocks, traders trade the futures contracts through an exchange. This brings the same disadvantages of having an intermediary, limited trading hours, and additional trading costs for futures trading.

However, the most significant disadvantage is less liquidity and reduced volatility. It is not possible to trade profitably any trading instrument without volatility. Futures contracts have lower volatility than the underlying asset themselves. The futures contract are susceptible to reduced trading activity and volatility towards the end of the contract period.

Let us assume the EURUSD futures monthly contract for the month of JAN 2021. This future contract has an expiry of 31 Jan 2021. The contract will attract fewer traders willing to trade them during the end of the contracts as the volatility will reduce and may not be attractive to investors.

On the other hand, Forex markets provide the trader with ample liquidity and volatility throughout the trading sessions while providing an OTC trading environment. The volatility and liquidity are present in the forex markets, no matter it is the beginning or end of the month.

Forex vs Stocks vs Crypto

Cryptocurrencies are unregulated though the cryptocurrencies have risen much in recent years. The absence of regulatory oversight is a significant hurdle for any educated investor to invest in cryptos.

The crypto company’s insiders can highly manipulate the cryptos; however, the regulatory oversight can minimize this in stocks.

The value of stocks are based on a company, its assets, and performance. The value of Forex currencies is based on the economy of the country. But the cryptocurrencies are not based on any real asset.

There are many cases of cryptocurrency theft, with losses running into massive amounts. Stocks and Forex do not have such risks associated with them.

The exchanges that are offering the cryptocurrencies lack consistency and offer different pricing for the same trading instrument. However, stocks and currency prices are the same across all exchanges with minor differences, if any.

Conclusion

The forex market emerges as a clear winner with its obvious advantages and benefits over the stock markets, futures, cryptocurrency markets.

With unmatched liquidity comes volatility. Volatility provides trading opportunities in return. A few hundred Dollars’ minimal investments provides entry to the market with massive leverage offered by the brokers providers the trader with great opportunities.

However, every instrument has its own benefits and may or may not be suitable for every investor. Therefore investors or traders should evaluate the trading instruments against their investment goals to decide them finally.