If you're considering jumping into the vast ocean of Forex trading, understanding how to calculate potential profits and losses is essential. One tool that can greatly assist in this process is a Forex profit calculator, a powerful yet simple device designed to estimate the outcome of a Forex trade.

This article aims to provide you with a comprehensive understanding of how the Forex profit calculator works. It's designed for beginners, so no previous experience in the field is required. Let's begin.

Forex Trading: A Brief Introduction

Forex, short for foreign exchange, is a global marketplace for buying and selling currencies. This market is decentralized, meaning that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. With an average daily trading volume exceeding $6 trillion, the Forex market is the largest and most liquid in the world.

Forex trading involves the simultaneous buying of one currency and selling of another. This is done in pairs, such as the Euro (EUR) and the US Dollar (USD). When you trade Forex, you're speculating on the price change of these currency pairs.

Understanding Forex Profit Calculator

In the world of Forex trading, accurately predicting the potential profit or loss of a trade is crucial. A Forex profit calculator is designed to assist traders in doing just that.

This tool allows traders to estimate their potential profit or loss before placing a trade, by taking into consideration the various variables involved in a Forex transaction. It not only provides insights into the expected outcome of a specific trade but also serves as an invaluable risk management tool.

Here's a deeper look at the essential inputs of a Forex profit calculator:

- Currency Pair: Forex trading always involves two currencies – the base currency and the quote currency. The base currency is the first currency of the pair and the quote currency is the second. The exchange rate tells you how much of the quote currency is required to purchase one unit of the base currency.

- Trade Size (Lots): In Forex trading, a ‘lot' refers to the standardized quantity of a currency. A standard lot is typically 100,000 units of the base currency. There are also mini, micro, and nano lots which are 10,000, 1,000, and 100 units respectively. The lot size determines the level of exposure or risk in the trade.

- Opening Price: This is the price at which you plan to enter the market, or essentially, the current market price of the currency pair when you initiate the trade.

- Closing Price: This is the price at which you plan to exit the trade. It may be a price point you anticipate the pair to reach, or a predetermined price level at which you plan to close the trade to either secure profit or prevent further loss.

Remember that the calculated result from a Forex profit calculator is an estimate, not a guarantee. While it can provide valuable insights, it's also important to understand that actual outcomes may differ due to market volatility and other factors.

Also Read: Understanding Currency Pairs

Practical Example

Now that we have a better understanding of how a Forex profit calculator works, let's illustrate this with a more detailed example.

Suppose you're trading the GBP/USD pair. You expect that the GBP will appreciate against the USD, and so you decide to buy 1 standard lot (100,000 units) at an opening price of 1.3800.

Later, your prediction comes true, and the price of GBP/USD increases. You decide it's the right time to close your trading position and sell at a closing price of 1.3850.

To calculate your profit, you would:

- Input the Currency Pair: In this case, it's GBP/USD.

- Enter the Trade Size: Here, it's 1 standard lot or 100,000 units.

- Provide the Opening Price: That's 1.3800.

- Input the Closing Price: This is 1.3850.

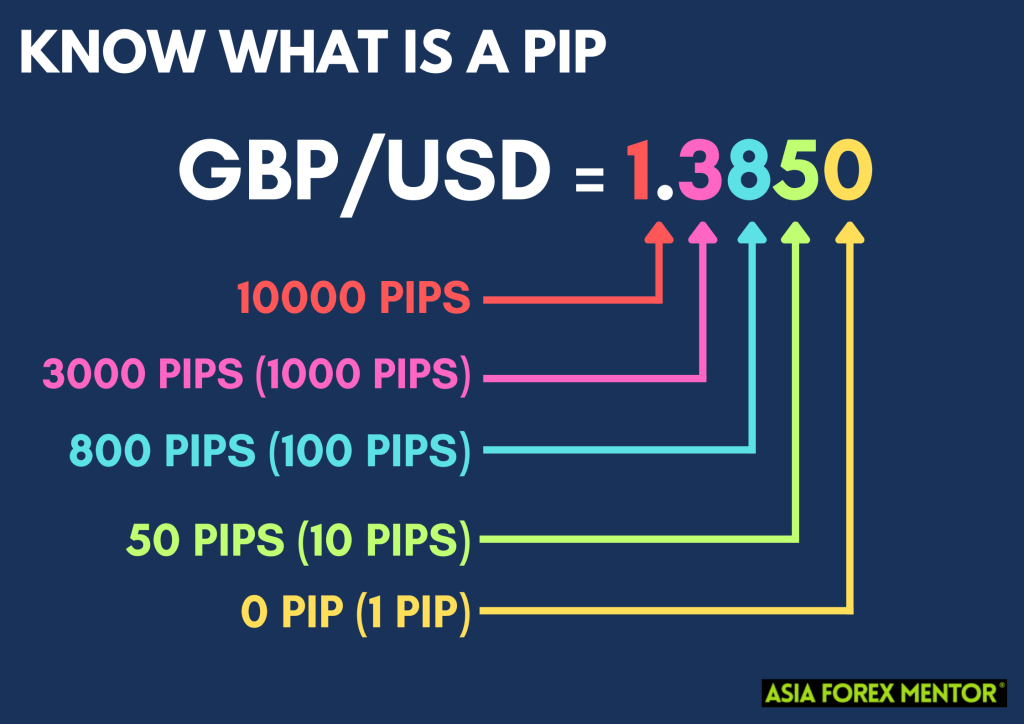

The calculator will first find the difference between the opening and closing prices (1.3850 – 1.3800), which equals 0.0050. This is the number of pip value – the smallest amount by which a currency quote can change – that the currency pair has moved.

In this example, the GBP/USD pair has moved 50 pips in your favor (as 0.0050 * 10,000 = 50 pips).

To find the total profit in USD, the calculator will multiply the pip movement by the trade size. In this case, each pip value is worth $10 (for a standard lot of 100,000 units), so a 50-pip move translates to a profit of $500 (50 pips * $10 per pip).

So, by accurately predicting the movement of the GBP against the USD and using a Forex profit calculator to understand the potential outcome, you were able to secure a profit of $500 from this trade.

Remember, this example assumes no trading costs or fees. In real trading, factors like the spread, commissions, swap fees, and others might impact your net profit.

You can also try our free Forex position lot size calculator here! You can use this free Forex tool from Asia Forex Mentor to determine the appropriate lot size and number of units required to accurately manage your risk. The majority of currency pairs are supported, and all you have to do is enter the necessary information and click the “Calculate” button.

Risk and Reward Considerations

In Forex trading, understanding the balance between risk and reward is essential. Every trade carries the potential for profit, but it also brings with it the risk of loss. This risk-reward ratio is a crucial part of any trading strategy. Let's elaborate on some considerations that help in managing this balance.

Stop-Loss and Take-Profit Orders

These are two crucial tools used in risk management. A stop-loss order limits potential losses by automatically closing a trade once it hits a certain level of loss. On the other hand, a take-profit order locks in your gains by closing the trade when it reaches a certain level of profit. Both of these tools help manage the risk-reward ratio by setting predefined limits.

Position Sizing

This involves deciding how much of your capital you're willing to risk on each trade. A general rule of thumb is not to risk more than 1-2% of your trading capital on a single trade. By managing the size of your positions, you can limit potential losses and ensure you have enough capital to continue trading even after a few losses.

Leverage

While leverage can amplify your profits, it can also magnify your losses. Using excessive leverage can quickly deplete your trading capital if the market goes against you. Therefore, it's crucial to understand how leverage works and use it wisely.

Risk-Reward Ratio

This ratio compares the potential profit of a trade to the potential loss. A commonly used risk-reward ratio is 2:1, meaning the potential profit is twice the potential loss. This doesn't mean you'll always make a profit, but it ensures that when you do, it outweighs your losses.

Also Read: Risk Reward Ratio Ultimate Guide

Factors Affecting Forex Profits

Several factors can impact the profitability of your Forex trades. Let's take a closer look at some of them:

Forex Spreads and Commissions

The spread, which is the difference between the bid and ask prices, and commissions charged by the broker, are transaction costs that can eat into your profits. When calculating potential profit, it's crucial to account for these costs.

Currency Pair Selection

Different currency pairs have different levels of volatility and liquidity. Some pairs can move hundreds of pips in a single day, while others may move very little. Your potential profit depends on choosing the right pairs that align with your trading strategy and risk tolerance.

Market Volatility

Forex markets can be highly volatile , with exchange rates fluctuating due to economic news, political events, and other factors. High volatility can lead to larger profits if you can accurately predict market movements. However, it can also lead to larger losses.

Trading Strategy

Your trading strategy and how well you stick to it can significantly impact your profits. A sound trading strategy should include clear entry and exit rules, and risk management techniques, and should align with your overall trading goals.

Trading Discipline

Emotions like fear and greed can significantly affect your trading decisions. Maintaining trading discipline and sticking to your trading plan, irrespective of market conditions, can help improve your profitability in the long run.

Forex Profit Calculator: Beyond Basic Calculations

While the core functionality of a Forex profit calculator is to calculate potential profits and losses, its utility extends beyond these basic calculations. Here's how you can make the most of a Forex profit calculator:

Adjusting for Different Currency Pairs

A basic Forex profit calculator typically uses USD as the quote currency. However, if you're trading a pair where the USD isn't the quote currency, you'll need to adjust the profit calculation. For instance, if you're trading EUR/GBP, your profit will initially be calculated in GBP. If your account currency is USD, you'll need to convert the profit from GBP to USD using the current GBP/USD exchange rate.

Inclusion of Costs

A more advanced Forex profit calculator will also take into account the various costs associated with trading. These may include spreads, commissions, and financing fees (or swaps). By accounting for these costs, you can get a more accurate estimate of your net profit or loss.

Risk Management

A Forex profit calculator can also be a powerful risk management tool. Providing an estimate of potential losses can help you determine appropriate stop-loss levels. Furthermore, by comparing potential profits with potential losses, you can calculate the risk-reward ratio of your trades to ensure they align with your trading strategy.

Advanced Uses of Forex Profit Calculator

Beyond the basics, a Forex profit calculator can be used in several advanced ways to enhance your trading strategy:

Scenario Analysis

By inputting different opening and closing prices, you can use the Forex profit calculator to perform scenario analysis. This can provide insights into potential outcomes under different market conditions and help you prepare for various market scenarios. It can also help you understand the effect of price changes on your potential profit or loss, which can be useful when deciding on stop-loss and take-profit levels.

Performance Evaluation

By comparing the actual profits or losses of your trades with the estimates provided by the Forex profit calculator, you can evaluate the performance of your trading strategy. If the actual results consistently deviate from the estimates, it may indicate that your strategy needs adjustment.

Strategic Planning

By understanding the potential profit or loss of a trade, you can make more informed decisions about your trading strategy. For instance, you can determine whether a trade aligns with your risk-reward ratio, whether you should increase or decrease your position size, or whether you should reconsider the trade altogether.

Integration with Trading Plan

A Forex profit calculator should be integrated into your overall trading plan. This plan should outline your trading goals, risk tolerance, and capital management strategies. By using the calculator to estimate potential profits and losses, you can ensure your trades align with your plan and help you reach your trading goals.

Also Read: How to Use the Forex Compound Calculator?

Conclusion

In conclusion, the Forex profit calculator is more than just a simple calculator. It's a comprehensive tool that, when used correctly, can play an integral role in shaping a successful Forex trading strategy. It's not just about calculating profits and losses – it's about understanding the dynamics of the market, managing risk, and making informed trading decisions.

Several Forex academies like the Avatrade Academy offer courses on calculating Forex profit if you want to have a deeper understanding and comprehension about them. Remember, knowledge is power in the world of Forex trading, and the more you understand how to effectively use tools like the Forex profit calculator, the better prepared you'll be.

FAQS

How accurate is a Forex profit calculator?

A Forex profit calculator is a tool that provides an estimate of potential profits or losses based on the inputs provided by the user. While it can provide a relatively accurate estimate, it's important to understand that it doesn't account for all factors that can impact a trade, such as sudden market volatility or slippage (the difference between the expected price of a trade and the price at which the trade is executed). Furthermore, a Forex profit calculator doesn't guarantee profits; it's simply a tool to help you make more informed trading decisions.

Can a Forex profit calculator help me become a successful trader?

A Forex profit calculator is an essential tool that can contribute to trading success, but it's not a magic wand. Successful trading requires a comprehensive understanding of the Forex market, a well-defined trading strategy, effective risk management, and trading discipline. A Forex profit calculator can aid in risk management and strategic planning by providing an estimate of potential profits or losses, but it should be used in conjunction with other tools and techniques.

I'm a beginner in Forex trading. Is it necessary for me to use a Forex profit calculator?

While it's not absolutely necessary, using a Forex profit calculator can be extremely beneficial, especially for beginners. It can help you understand how different variables – such as the currency pair, trade size, and price movement – affect potential profits or losses. Moreover, it can assist in managing risk by giving you an estimate of potential losses, allowing you to set appropriate stop-loss orders. It's a valuable tool to aid in developing a trading strategy and understanding the potential outcomes of a trade before you execute it.