FOREX.com Review

FOREX.com stands out as a trusted choice for traders globally, providing a secure platform with regulated operations across several countries in terms of forex trading central. Known for its reliability, FOREX.com offers a range of trading tools that support beginners and experienced traders alike.

Traders can access over 80 currency pairs along with CFDs, commodities, and indices, making it a comprehensive platform for diverse investment strategies. The platform also features powerful tools, including advanced charting, real-time data, and various research resources to aid informed decision-making.

With low spreads, FOREX.com ensures cost-effective advanced trading platform, while its mobile and web apps provide accessibility on the go giving performance analytics the will benefit traders in the long run. Customer support is available 24/5, helping users resolve issues quickly, which adds to its appeal as a user-friendly platform for forex and cfd traders at all levels.

What is FOREX.com?

FOREX.com is a globally recognized advanced trading platform that enables users to trade foreign exchange (forex) along with other assets like commodities, indices, and cryptocurrencies. Established to cater to both new and experienced active traders, it operates under strict regulatory oversight in multiple regions, ensuring a secure environment for trading.

The platform offers advanced trading tools, performance analytics, including real-time data, charting capabilities, and market analysis resources, designed to help users make well-informed trading decisions. With FOREX.com, traders gain access to over 80 currency pairs, low trading costs, and mobile-friendly options, making it a popular choice for those active traders seeking a comprehensive and reliable trading experience.

FOREX.com Regulation and Safety

FOREX.com is highly regulated, providing an added layer of security and trust for traders worldwide. It is overseen by major financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and other respected agencies globally. This regulatory backing ensures that FOREX.com adheres to strict standards for fair and transparent trading practices to prevent losing money rapidly.

Safety measures on FOREX.com include advanced encryption protocols and client fund segregation, which means user funds are held separately from the company’s assets, reducing the risk of misuse. The U.S. platform is regulated by the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC). Leverage is always risky, but FOREX.com puts a sizable effort into keeping money safe. These features, combined with regulatory oversight, make FOREX.com a secure platform for both novice and experienced traders seeking a trusted trading environment.

FOREX.com Pros and Cons

Pros

- Regulated

- Low spreads

- Advanced tools

- 24/5 support

Cons

- Limited crypto

- Inactivity fees (in some regions)

- Complex pricing

- US-only stocks

Benefits of Trading with FOREX.com

FOREX.com offers a wide range of trading instruments, including over 80 currency pairs, commodities, indices, and cryptocurrencies, making it a versatile choice for diverse trading ideas. Its comprehensive asset selection enables traders to explore multiple markets from one platform, adding convenience and flexibility.

The platform’s advanced trading tools, such as real-time charting, technical analysis indicators, and market insights, support users in making well-informed decisions. These tools are available on desktop and mobile trading, ensuring accessibility and a seamless trading experience wherever users are. Performance Analytics analyzes your past trades to help you make better decisions.

Additionally, FOREX.com provides competitive pricing with low spreads and no commissions on standard accounts, allowing traders to optimize their profits. With 24/5 customer support and extensive educational resources, FOREX.com is designed to assist traders at all levels, making it a popular choice in the online trading community.

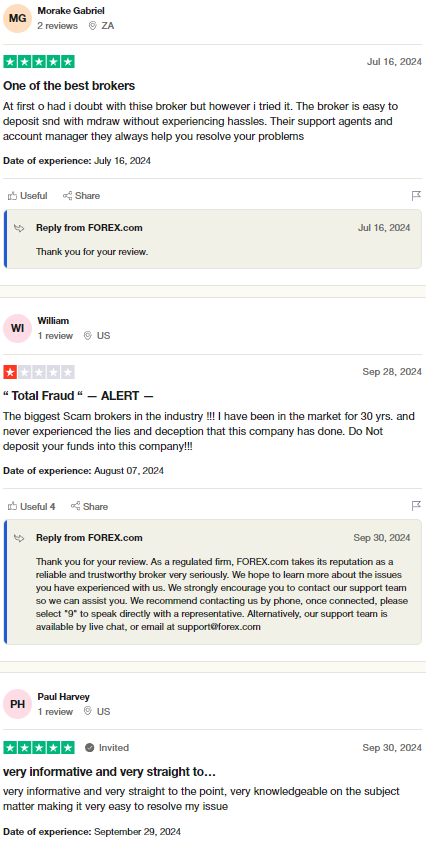

FOREX.com Customer Reviews

Customer reviews of FOREX.com highlight the platform’s reliability and ease of use, particularly praising its user-friendly interface and advanced tools. Many users appreciate the availability of real-time data and charting options, which make analysis straightforward for both new and experienced traders.

FOREX.com’s responsive customer support also garners positive feedback, as users report quick and helpful responses, especially during market hours. Additionally, the platform’s secure environment and adherence to regulatory standards make it a trusted choice, with customers frequently noting its strong reputation and commitment to safety.

Some users mention that while FOREX.com’s educational resources are valuable, they would like even more in-depth material on advanced trading strategies giving performance analytics. Overall, FOREX.com is well-regarded for its comprehensive features and solid support, making it a go-to platform for many in the trading community.

FOREX.com Spreads, Fees, and Commissions

FOREX.com offers competitive pricing, featuring tight spreads and minimal fees, which makes it appealing to both beginner and professional traders. The platform’s spreads vary by account type, with standard accounts incurring no commission and spreads starting from as low as 1.0 pip on major currency pairs.

For those seeking lower spreads, FOREX.com’s commission-based account offers spreads starting as low as 0.2 pips, with a small commission per trade. This account structure benefits high-frequency traders looking for cost-effective trading, allowing them to optimize their overall expenses.

Beyond spreads and commissions, FOREX.com charges no inactivity fees, which is a plus for traders who may not trade daily. Other costs are transparent, and the platform ensures users understand any additional charges, helping traders plan their expenses more accurately.

Account Types

FOREX.com offers a variety of retail investor accounts to suit different trading preferences, skill levels, and investment goals. These accounts provide flexibility in trading conditions, fees, and access to tools, ensuring that traders can choose the setup that best matches their needs according to minimum deposit.

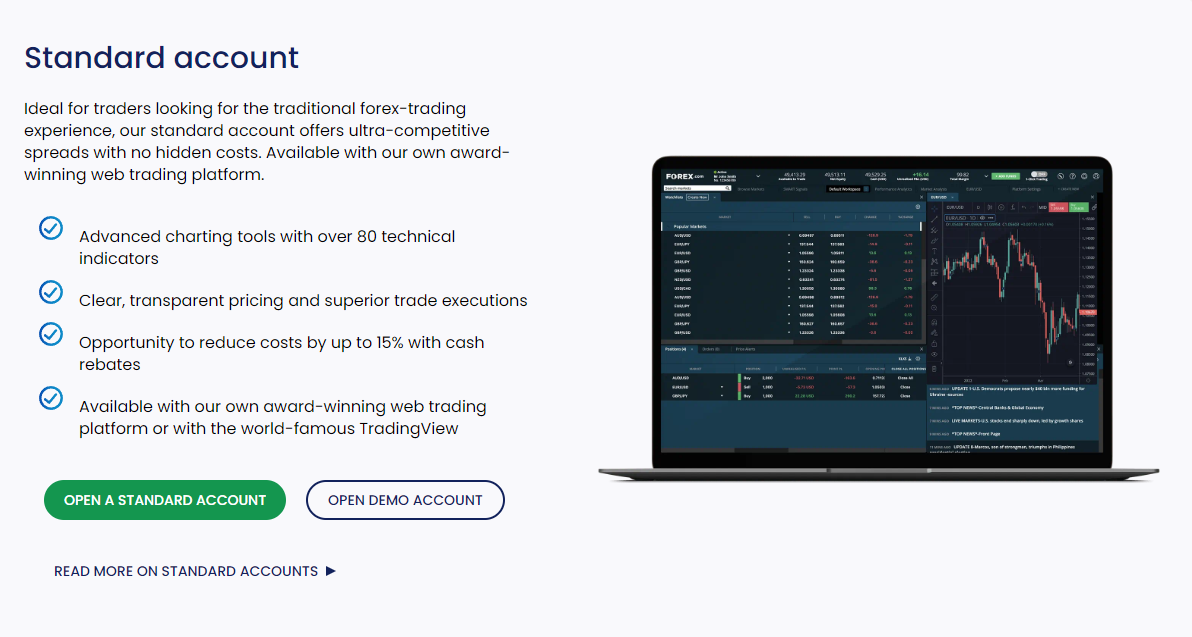

Standard Account

The Standard Account is designed for traders who prefer a straightforward, commission-free experience. It features competitive spreads starting as low as 1.0 pip, allowing for cost-effective trading without additional per-trade fees. This account type is ideal for beginner and intermediate traders looking for simplicity. This account require minimum deposit.

RAW Spread Account

The RAW Spread Account is tailored for those who want lower spreads and are comfortable with a small commission per trade. Spreads can be as low as 0.2 pips, which is advantageous for active or high-volume traders seeking to minimize spread costs while accessing the same trading tools and platforms as the Standard Account. This account require minimum deposit.

MetaTrader Account

The MetaTrader Account offers institutional-grade pricing and allows traders to interact directly with liquidity providers. This account type is intended for professional traders and institutions who want the deepest liquidity and fastest execution, with tighter spreads and transparent commissions. This account require minimum deposit.

Demo Account

The Demo Account provides a risk-free environment for traders to practice and learn with virtual funds. It mirrors real-market conditions and is ideal for beginners to explore FOREX.com’s features or for experienced traders to test new strategies without financial risk. This doesn’t account doesn’t require minimum deposit.

FOREX.com gives discounts such as active trader discounts, raw pricing accounts, raw pricing account, and other pricing that can help the traders on their journey.

How to Open Your Account

Opening an account with FOREX.com is a straightforward process, designed to be quick and accessible for new traders and experienced investors alike. By following a few simple steps, users can start trading within minutes, gaining access to FOREX.com’s range of assets and tools.

Step 1: Visit FOREX.com’s Website

Begin by navigating to the FOREX.com homepage. Select the “Open an Account” button, which will lead to the registration page where the process can be initiated.

Step 2: Fill Out the Application

Complete the online application form with required personal information, including contact details and financial background. This step ensures compliance with regulatory standards and helps tailor account options.

Step 3: Submit Verification Documents

Upload identification documents, such as a government-issued ID and proof of residence, to verify your identity. FOREX.com requires this step to comply with global regulations and secure the platform.

Step 4: Fund Your Account

Once verification is complete, proceed to fund the account using one of FOREX.com’s accepted payment methods, including bank transfer, credit/debit card, or online payment systems.

Step 5: Start Trading

After funding, your account is ready. Log in to access the platform, explore available markets, and begin trading. FOREX.com’s interface and tools are designed to support both immediate and gradual learning for all experience levels.

The traders must keep applying their trading strategy in tact to prevent retail investor accounts lose money along the journey. Active trader program is available for every traders who wants to practice risk management, applying trading idea, analyzing trading costs, to prevent investor accounts lose money.

FOREX.com Trading Platforms

FOREX.com offers a range of trading platforms tailored to meet the needs of different traders, from beginners to professionals. The platform’s proprietary Web Trader desktop platform and mobile app provide a user-friendly experience with intuitive navigation, real-time data, and customizable charting tools, ideal for traders seeking simplicity and functionality.

For advanced users, FOREX.com also supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), popular platforms known for robust features like algorithmic trading and customizable indicators. These platforms cater to traders who rely on technical analysis and automated strategies, enhancing their trading precision and efficiency.

All FOREX.com platforms are designed with accessibility in mind, offering seamless trading on desktop platform using web trading platform, mobile, and tablet devices. This flexibility ensures traders can stay connected and manage their portfolios easily, no matter where they are. Metatrader mobile apps offers a great experience on mobile trading platform which traders can place their trades on mobile.

What Can You Trade on FOREX.com

FOREX.com offers a diverse range of trading options, allowing users to invest across various markets and build versatile portfolios. With choices spanning from forex to commodities, indices, and more, the platform caters to different trading styles and strategies, providing something for everyone.

Forex

Forex is the platform’s primary market in currency trading, offering over 80 currency pair, including majors, minors, and exotics. This variety allows traders to capitalize on global currency trading movements and develop strategies suited to their preferences and risk tolerance in terms of forex trades.

Indices

FOREX.com offers trading on major global indices, such as the S&P 500, FTSE 100, and Nikkei 225. Trading indices enables users to speculate on entire market sectors rather than individual stocks, making it popular for those seeking broader market exposure.

Commodities

The platform provides access to a range of commodities, including precious metals like gold and silver, as well as energies like oil and natural gas. Commodities trading is appealing to traders looking for assets that can serve as a hedge against inflation or economic uncertainty.

Cryptocurrencies

FOREX.com offers cryptocurrency trading on major digital currencies like Bitcoin, Ethereum, and Litecoin. This option allows traders to access the volatility and growth potential of the crypto market without needing a dedicated crypto exchange.

The products and services available to every traders at FOREX.com will depend on the users location and on which of its regulated entities holds your account. The trustworthy broker also gives education forex

Shares (U.S. Stocks)

FOREX.com allows to trade stocks on select U.S. stocks, giving users exposure to individual companies in one of the world’s largest equity markets. This feature is ideal for those who want to focus on company-specific performance and growth potential.

FOREX.com Customer Support

FOREX.com provides dedicated customer support, available 24/5 to assist traders with any issues or questions. Users can access support through multiple channels, including live chat, email, and phone, ensuring that help is available when they need it most, especially during active market hours.

The customer support team is known for its responsiveness and expertise, often addressing user inquiries promptly and with detailed guidance. In addition to direct support, FOREX.com offers an extensive FAQ section and educational resources, empowering users to resolve common questions independently and enhancing their overall trading experiences.

Advantages and Disadvantages of FOREX.com Customer Support

Withdrawal Options and Fees

FOREX.com provides a range of withdrawal options to make accessing funds convenient for traders globally. Each withdrawal method has its own processing times and may incur fees, allowing users to choose the most suitable option based on their urgency and cost preferences.

Bank Wire Transfer

With bank wire transfers, withdrawals typically take 2-5 business days to process. This method is reliable and secure, but it may include bank account fees, which can vary depending on the financial institution used by the trader.

Credit/Debit Card

FOREX.com allows withdrawals back to a credit or debit card that was previously used to fund the account. Processing usually takes 1-2 business days, providing a faster option, though the amount withdrawn to a card may be limited based on the initial deposit.

Online Payment Systems

Depending on the region, FOREX.com supports certain online payment methods, such as PayPal. These withdrawals are often processed within 24 hours, offering a quick and accessible solution, though small transaction fees might apply.

E-Wallets

Some regions allow withdrawals to e-wallets like Skrill or Neteller, which offer quick processing, often within the same day. This method is particularly appealing for traders seeking a fast and low-fee withdrawal option, although e-wallet availability may vary by location.

FOREX.com Vs Other Brokers

#1. FOREX.com vs AvaTrade

FOREX.com and AvaTrade are both established brokers, but they offer distinct features catering to different trader needs. FOREX.com is known for its extensive asset range, offering over 80 currency pair, U.S. stocks, indices, commodities, and cryptocurrencies, which appeals to traders seeking diverse market exposure. AvaTrade, meanwhile, covers a smaller but solid selection, including forex, stocks, indices, and crypto, but focuses heavily on trading CFDs. While both platforms support MetaTrader 4 and 5, FOREX.com also has its proprietary Web Trader, favored for its ease of use and advanced charting tools. AvaTrade shines with its multiple educational resources and copy trading via AvaSocial, suitable for beginner traders interested in learning and mirroring strategies. Pricing models differ, with FOREX.com offering competitive spreads and both commission-free and commission-based accounts, while AvaTrade sticks to fixed spreads, which may appeal to those preferring more predictable costs. Both brokers are regulated globally, with FOREX.com leading in U.S. market presence, whereas AvaTrade has strong international reach, especially in Europe and Australia.

Verdict: FOREX.com is ideal for traders wanting wide asset variety and flexible pricing, especially those in the U.S., where AvaTrade is unavailable. AvaTrade, however, is better suited for beginner and international traders who value fixed spreads and educational support, especially those exploring social trading features.

#2. FOREX.com vs RoboForex

FOREX.com and RoboForex offer robust trading options, but their strengths appeal to different trader profiles. FOREX.com is globally renowned for its regulatory compliance and broad asset selection, including forex, commodities, indices, U.S. stocks, and cryptocurrencies. This makes it suitable for traders seeking a secure, diverse trading experiences. RoboForex, on the other hand, is particularly appealing for high-leverage trading and provides access to unique asset classes like forex, commodities, stocks, indices, cryptocurrencies, and even ETFs. RoboForex also features various account types, including ECN and cent accounts, which support micro-lot trading, making it attractive to beginner traders or those testing strategies. Both platforms support MetaTrader 4 and 5, but RoboForex also offers proprietary platforms like R Trader, which has integrated strategy-building tools. In terms of pricing, FOREX.com has competitive spreads and a transparent commission structure on some account types, while RoboForex offers lower spreads, especially on ECN accounts, but with potential commission charges on high-volume trades.

Verdict: FOREX.com is ideal for traders prioritizing regulatory security and a broad, stable asset base, especially U.S. stocks. RoboForex stands out for traders looking for high-leverage, low-cost trading options, or for beginners seeking micro-lot capabilities and more specialized trading platforms.

#3. FOREX.com vs Exness

FOREX.com and Exness both cater to forex traders, yet each broker has unique features that suit specific trading needs. FOREX.com offers a regulated and secure environment with an extensive range of assets, including over 80 currency pairs, commodities, indices, U.S. stocks, and cryptocurrencies, making it ideal for traders seeking diverse investment options. Exness, while more limited in asset selection outside forex, is popular for its extremely high leverage options (up to unlimited in certain regions) and instant withdrawals, appealing to traders who prioritize fast, flexible access to their funds. Both brokers support MetaTrader 4 and 5, though FOREX.com also provides a proprietary Web Trader for ease of use and advanced charting capabilities. Exness offers a range of account types with variable and fixed spreads, suitable for scalpers and high-frequency traders, while FOREX.com has a blend of commission-free and commission-based accounts that cater to different trading idea.

Verdict: FOREX.com is best for traders looking for a broad asset selection in a secure, regulated environment, particularly U.S. traders who require compliance assurance. Exness is better suited for experienced forex traders who want high leverage, instant withdrawals, and account flexibility, especially those focused on aggressive trading strategies.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH FOREX.COM

Conclusion: FOREX.com Review

FOREX.com stands out as a reputable and versatile platform in terms of forex trading, offering a secure and regulated environment for traders at all experience levels. With a broad range of assets, advanced trading tools, and accessible pricing, it supports both basic and sophisticated trading strategies effectively.

The platform’s commitment to customer support, educational resources, and competitive spreads makes it an appealing choice for those seeking reliability and comprehensive features. Overall, FOREX.com is a solid option for traders looking to navigate multiple markets with ease and confidence.

FOREX.com Review: FAQs

Is FOREX.com regulated?

Yes, FOREX.com is regulated by multiple authorities, including the FCA in the UK, CFTC in the US, and other trusted global regulatory bodies. This ensures that the platform operates under strict standards for safety and transparency.

What types of accounts does FOREX.com offer?

FOREX.com provides different account options to cater to various trader needs, including standard accounts with no commissions, commission-based accounts with lower spreads, and even demo accounts for practice trading.

What fees does FOREX.com charge?

FOREX.com offers low spreads on standard accounts with no commissions. For commission-based accounts, there are reduced spreads with a small per-trade fee. There are also no inactivity fees, and any additional charges are clearly outlined.

OPEN AN ACCOUNT NOW WITH FOREX.COM AND GET YOUR BONUS