Hey traders, Ezekiel here with fresh market insights and a few extra tips to take your trading to the next level. Here’s what you need to know:

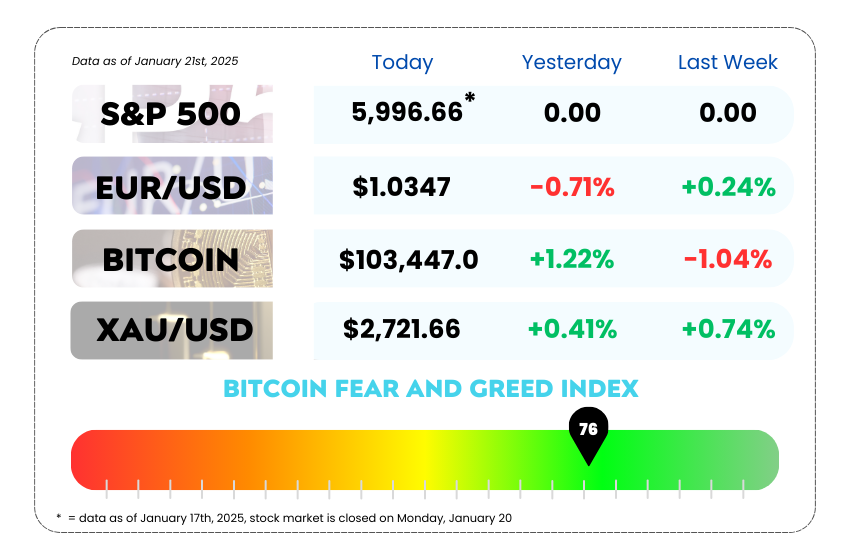

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• The dollar surges as Trump’s tariff plans shake up markets

• Trump’s currency crackdown sparks global volatility fears

• Unlock the Bullish Bump and Run’s power to predict market explosions with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

💵 The Dollar’s Rebound: Traders, Tariffs, and Uncertain Roads Ahead 💵

The US dollar flexed its muscles on Tuesday in Asia, recovering from its biggest drop in over a year. The greenback’s comeback reflects the markets’ growing bets that inflation may rise and Federal Reserve rate cuts could stall if President Trump’s latest tariff threats take shape. 📈💼

Trump’s talk of slapping 25% tariffs on Mexico and Canada by February sent shockwaves through the currency market. The Mexican peso and Canadian dollar both dropped over 1% against the dollar before regaining some ground.

Many traders are now speculating that these moves could set the stage for wider tariff escalations, possibly targeting China next. This, they believe, could strengthen the dollar further in the near term.

US Dollar Index Daily Chart as of January 21st, 2025 (Source: TradingView)

🌍 A Bigger Picture: Tariffs, Volatility, and the Global Market

This isn’t just about trade wars; it’s about how the global economy reacts. Trump’s earlier promises of massive tariffs — up to 60% on Chinese imports — have kept traders on edge, creating sharp moves in the $7.5-trillion-a-day foreign exchange market. The result? The dollar’s resilience, fueled by the potential for solid economic growth, combined with inflationary pressures from tariffs.

However, the Fed’s future actions remain uncertain. Overnight-indexed swaps now show a 69% chance of multiple Fed rate cuts this year, up from 46% just days ago. This mixed outlook keeps markets in watch-and-react mode. 📊

🛡️ Safe Havens Rally, While the Yuan Struggles

As the dollar rose, US Treasuries found relief too, as global cash trading resumed after the US holiday. Yields on the benchmark 10-year Treasury slid nearly 10 basis points to 4.53%, reflecting eased fears after Trump’s decision to hold off on China-specific tariffs—at least for now.

Meanwhile, the offshore yuan slipped 0.4%, dragging the Australian and New Zealand dollars with it. But the People’s Bank of China (PBOC) is showing its cards, setting the yuan reference rate at its strongest level since November 8 to signal support for the currency. 🇨🇳💴

Here’s what we’re watching:

- Volatility is here to stay. Trump’s tendency to make bold, off-the-cuff comments keeps traders in a constant state of reaction.

- The dollar’s resilience. Despite short-term swings, tariff-related inflation pressures and steady US economic expansion could keep the dollar strong.

- The yuan’s tricky balance. With the PBOC stepping in to stabilize, how far will China go to protect its currency amid tariff talk?

For traders, this is a classic case of balancing risk vs. reward in an ever-evolving macroeconomic landscape. 🧠 Keep your eyes on Fed policy moves, Trump’s next headline, and how the global market absorbs each shockwave.

💥 Trump’s Currency Crusade: The Dollar’s Grip Tightens 💥

On day one, President Trump wasted no time shaking things up, setting his sights on foreign currency manipulation and signaling that the rules of the global FX game may be about to change.

A forthcoming fact sheet from the US administration has traders buzzing, as it reportedly urges federal agencies to crack down on countries using currency practices to gain a trade edge.

The question on everyone’s mind: Who’s in the crosshairs this time? 🌏💸

🌎 A New Era for Currency Wars?

Trump’s plan is turning attention to countries already on the US Treasury’s “monitoring list” for currency practices—like China, Japan, Germany, and Singapore. But this time, strategists believe the administration might broaden its net, adding more names to the list. This could ramp up scrutiny on nations seen as weakening their currencies to stay competitive in global trade.

The move comes as the US dollar continues its reign across the FX market, boosted by strong economic growth and high interest rates. But this dominance isn’t without its downsides:

- For trading partners: The stronger dollar means added pressure on their currencies.

- For global stability: Fears of US intervention are keeping traders on edge, fueling volatility risks.

China, already a key target in Trump’s tariff wars, might find itself in an even tougher spot if its yuan weakens further. “This scrutiny could push countries to allow currency appreciation against the dollar,” one strategist noted. If not? Expect the “currency manipulator” tag to come flying out.

💵 Dollar Strength: A Blessing or a Burden?

The dollar’s strength isn’t new—it’s been a defining feature of the $7.5 trillion-a-day foreign exchange market for years. But Trump’s approach could add a layer of unpredictability, particularly if more countries come under fire.

And it’s not just speculation. Analysts point out that Trump’s earlier economic playbook—complete with tariffs, export controls, and currency manipulation charges—hinted at plans to lock in the dollar’s dominance. This latest fact sheet could be a remix of old strategies but with sharper teeth.

Microsoft’s stock story isn’t just about the here and now—it’s about positioning for the future. Despite short-term turbulence, AI’s potential to transform the company is undeniable. Keep an eye on how adoption grows over the next few years, and remember: slow and steady might win this race. 📈

MEMES OF THE DAY

When your perfect setup gets blindsided by surprise news… 🫠

That moment when the market humbles you faster than you can blink🚶♂️