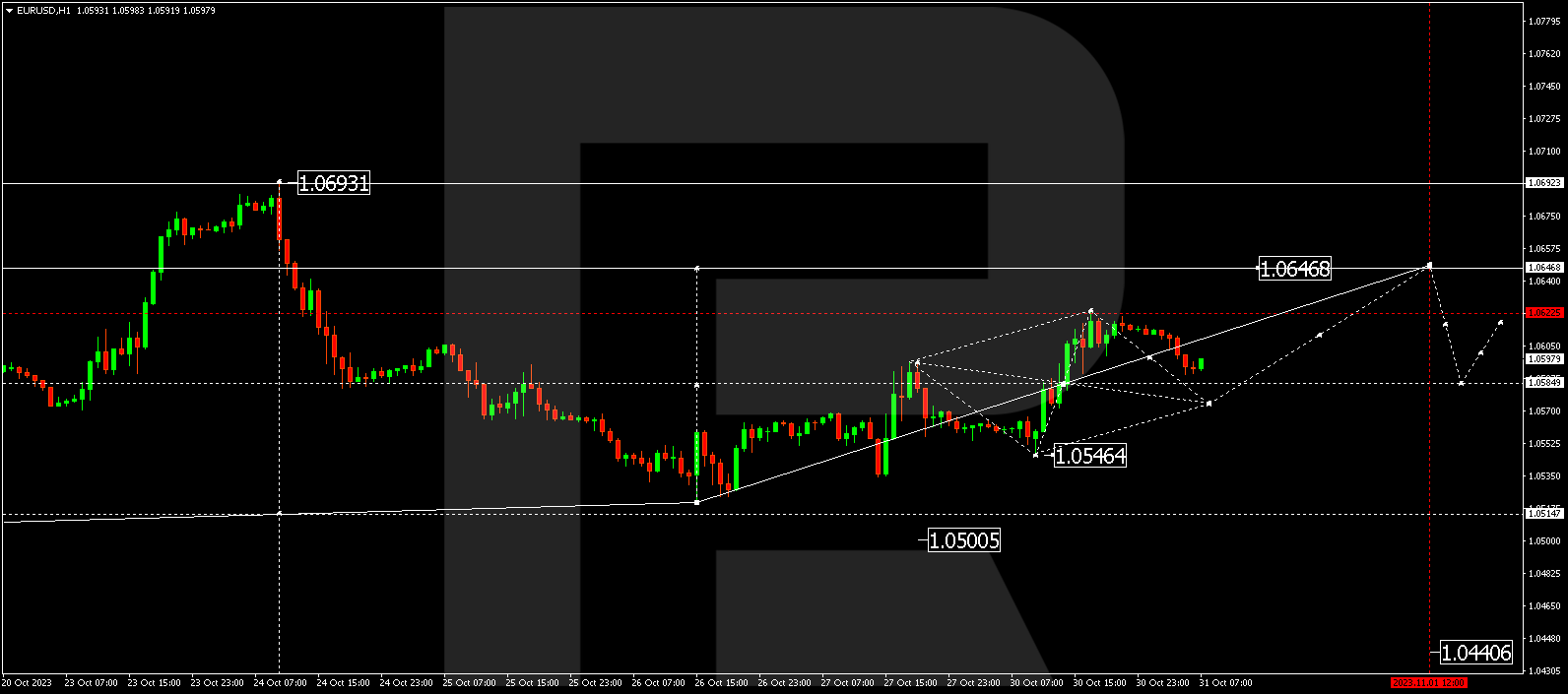

EURUSD, “Euro vs US Dollar”

EURUSD found support at 1.0546 and completed a structure of growth to 1.0585. By now, a consolidation range has formed around this level. Breaking it upwards, the price achieved a local target of 1.0622. Today a link of correction to 1.0585 (a test from above) is expected, followed by another corrective structure to 1.0648. After the price reaches this level, another declining wave to 1.0515 is expected to start.

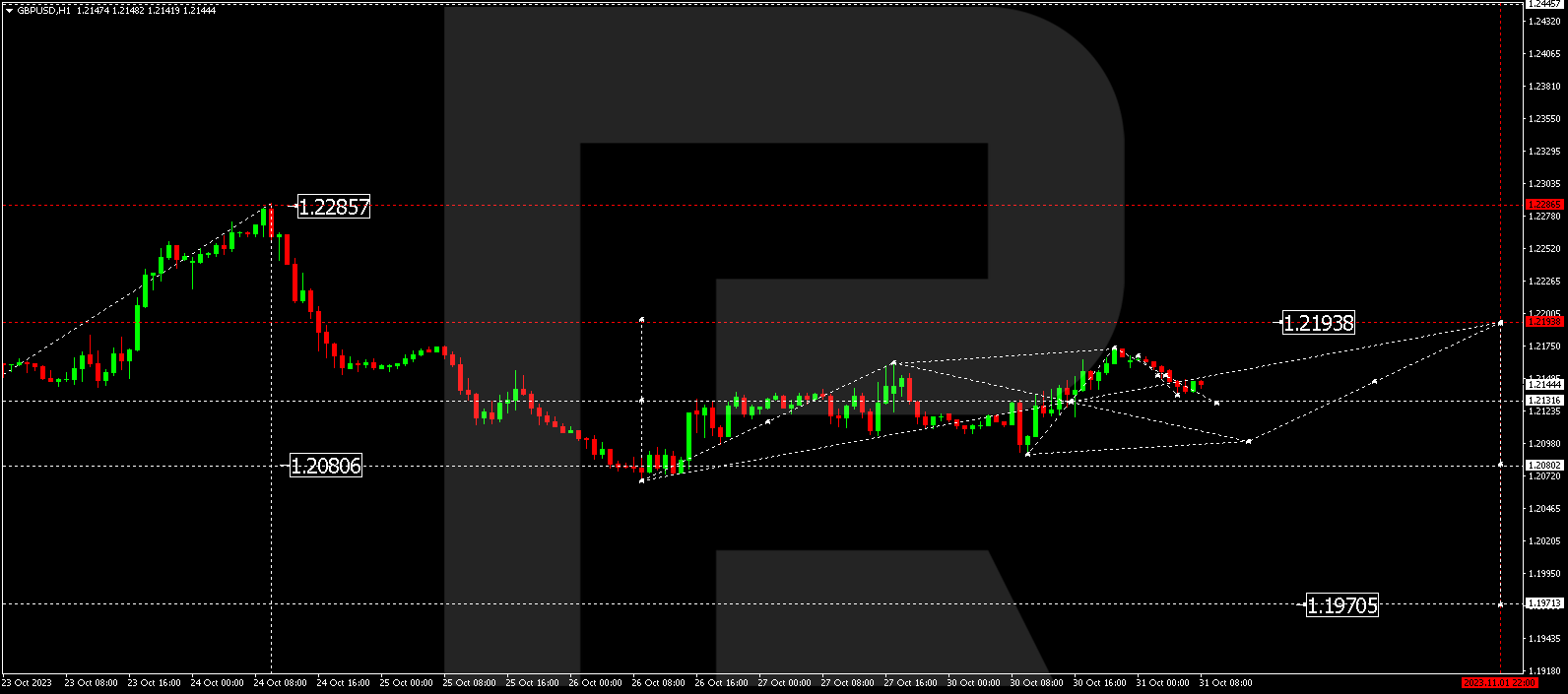

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD received support at 1.2090 and completed a structure of growth to 1.2132. By now, a consolidation range has formed around this level. Breaking it upwards, the price reached a local correction target of 1.2173. A link of decline to 1.2132 (a test from above) is expected today, followed by another corrective structure to 1.2193. A wave of decline to 1.2080 is expected to start next.

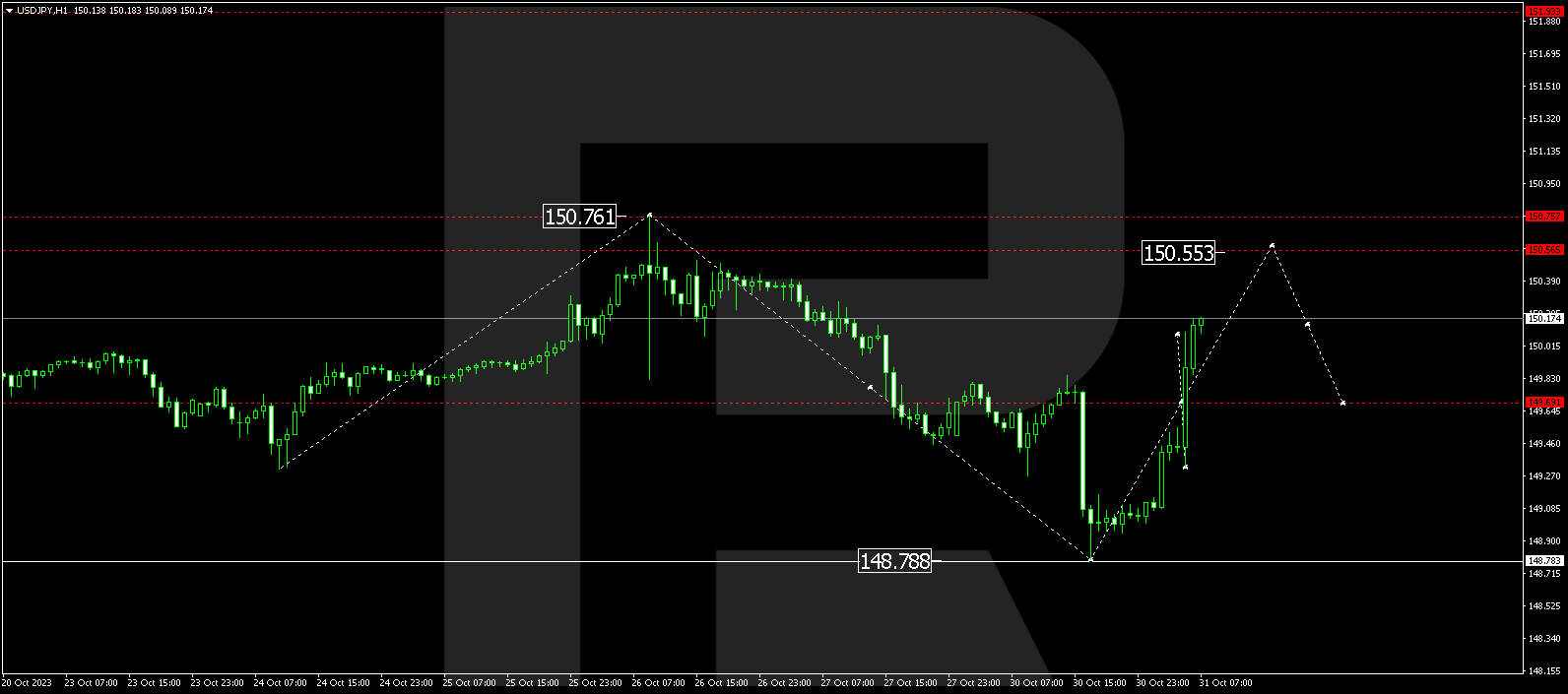

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a wave of decline to 148.80. The market is now forming a wave of growth to 150.55. Once the price hits this level, it could drop to 149.69.

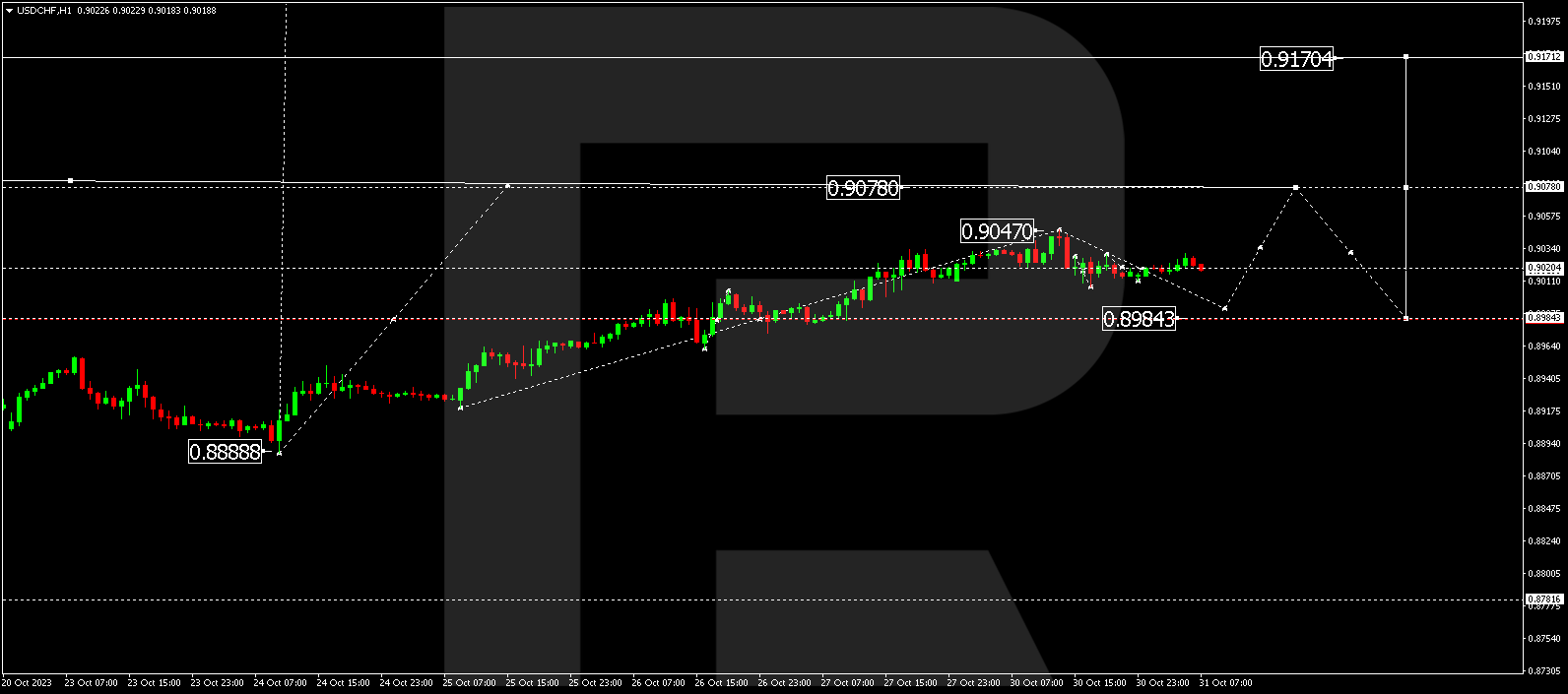

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a growth wave, reaching 0.9047. Today a structure of decline to 0.8985 could develop, followed by a link of growth to 0.9078. This is the first target.

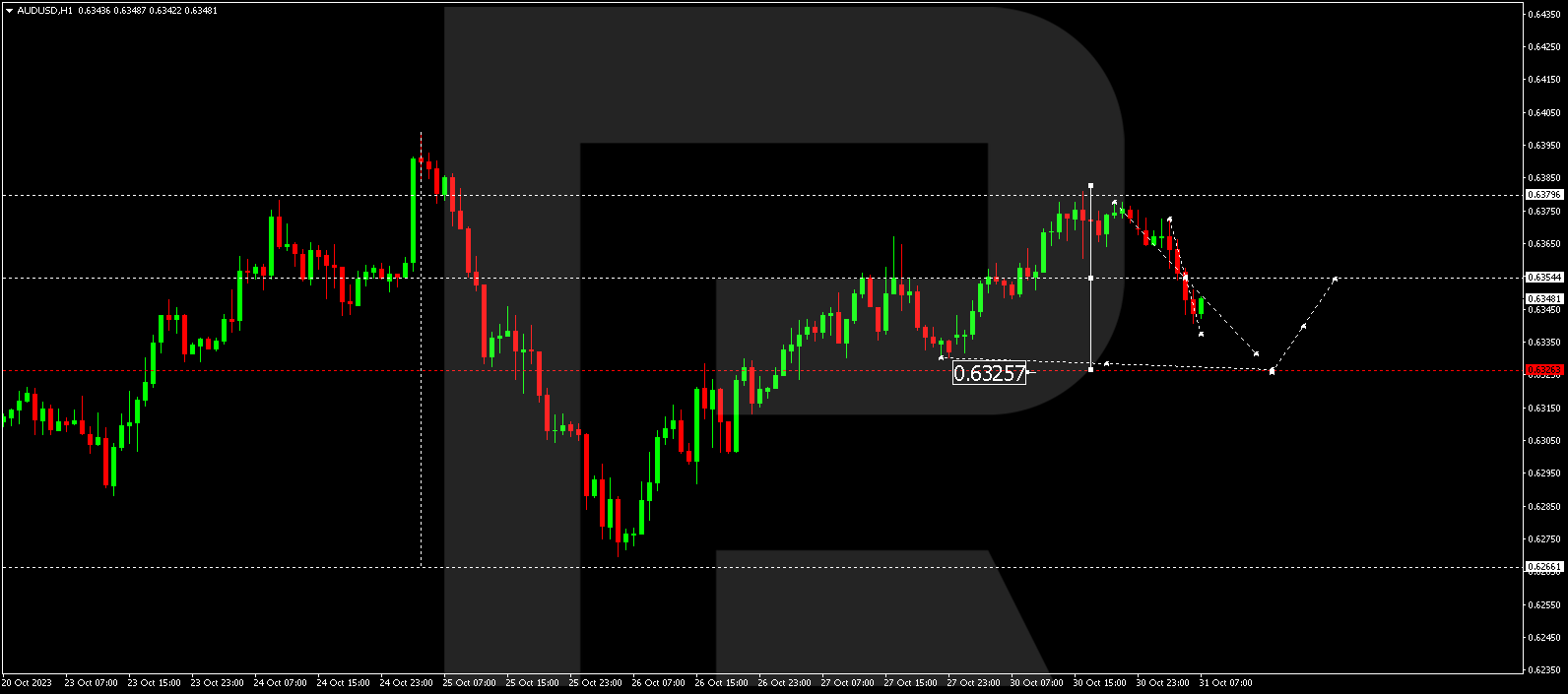

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has formed a consolidation range around 0.6355, which was expanded by the market to 0.6383. Today a link of decline to 0.6326 could develop, followed by growth to 0.6355.

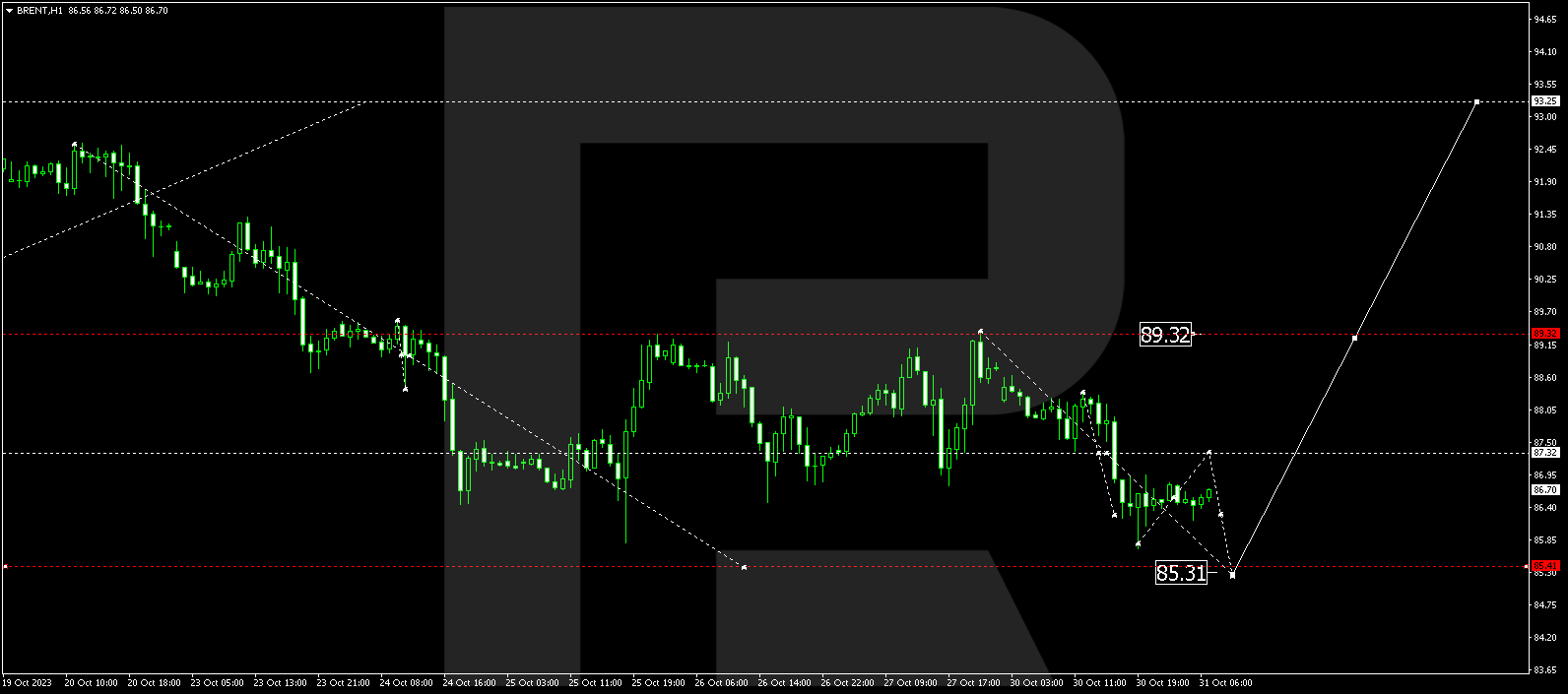

BRENT

Brent has corrected to 85.71. A link of growth to 87.32 is expected today followed by a decline to 85.33. Following this, a new upward trend to 89.32 could start. This is the first target.

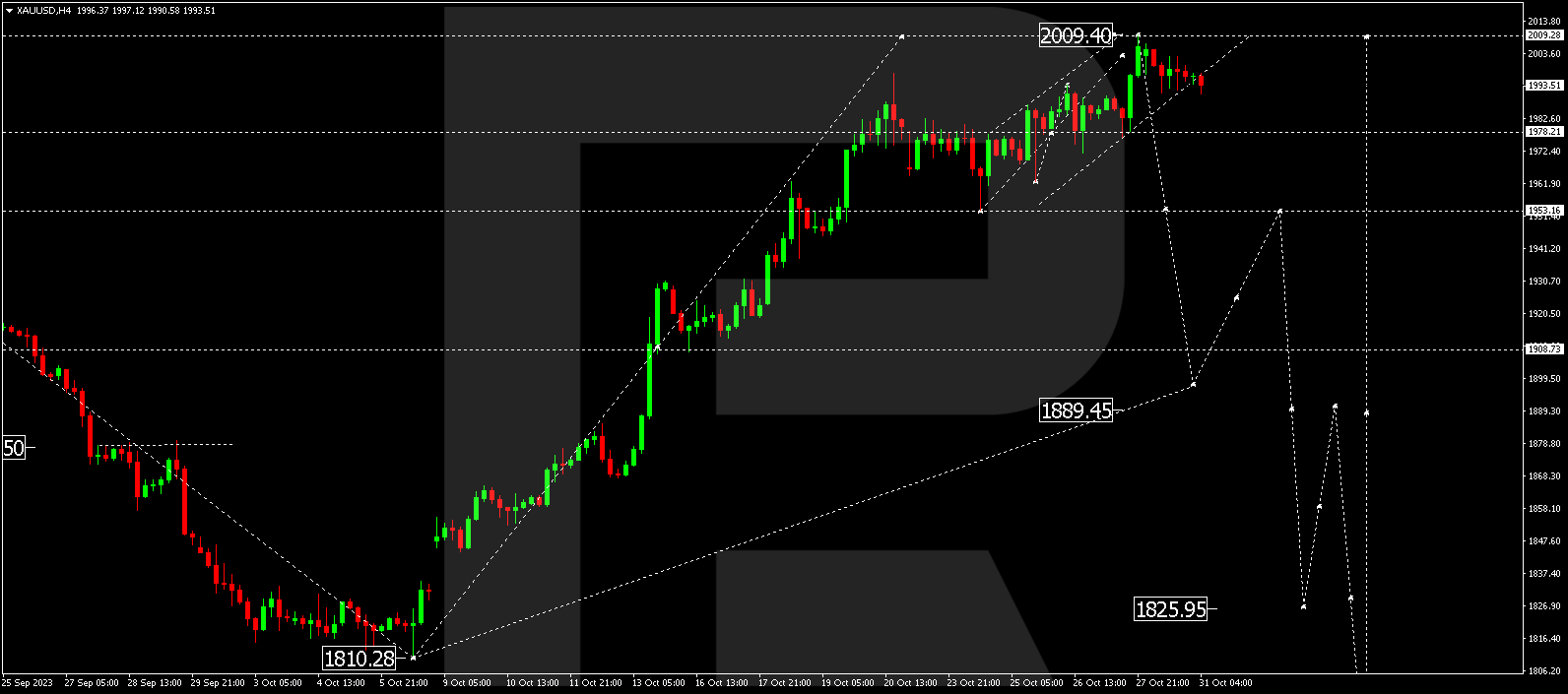

XAUUSD, “Gold vs US Dollar”

Gold continues its downward movement to 1978.22. After reaching this level, the price could rise to 1993.15. Practically, a wide consolidation range is forming around 1978.22. A downward breakout of the range will open the potential for a decline to 1900.00.

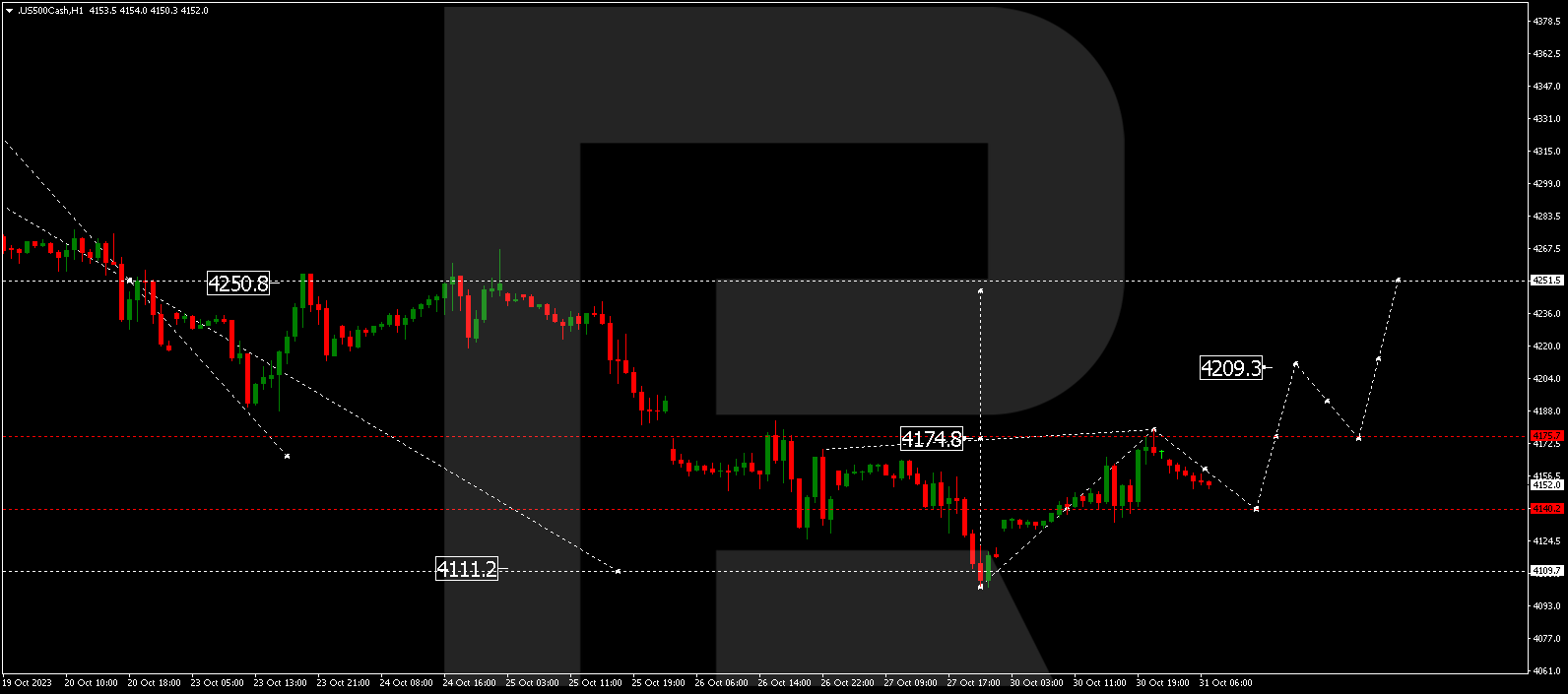

S&P 500

The stock index has completed a growth wave, reaching 4179.0. Today the market is forming a link of decline to 4140.0. After the price reaches this level, it could maintain its upward trajectory to 4251.5.