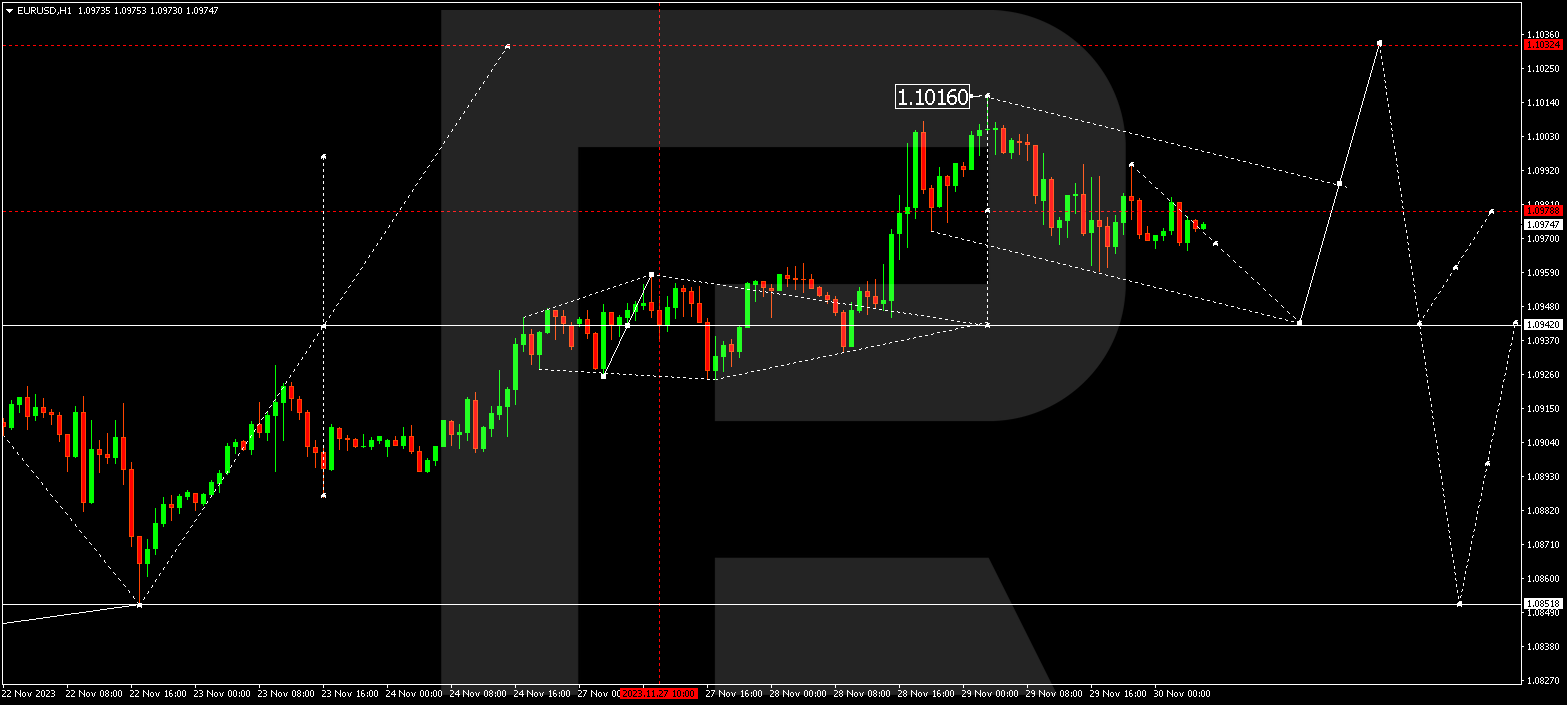

EURUSD, “Euro vs US Dollar”

EURUSD is forming a corrective structure to 1.0943. After the correction is over, a new growth structure to 1.1030 might develop. Next, a decline wave to 1.0850 could start. This is the first target.

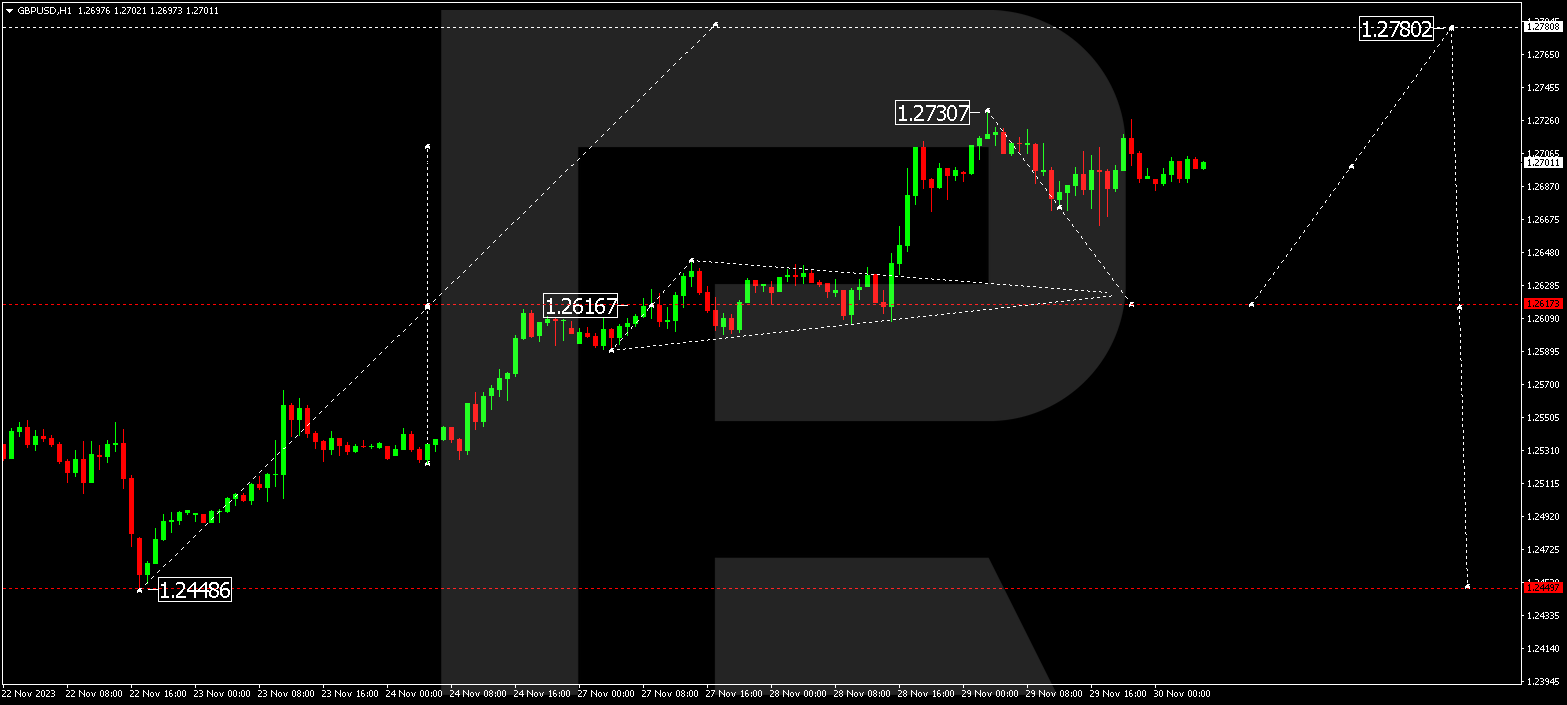

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a decline link to 1.2664 and a growth link to 1.2726. The pair might drop to 1.2620 today. After this level is reached, a growth link to 1.2780 could follow. Next, a decline to 1.2615 might start, from where the trend could continue to 1.2450. This is the first target.

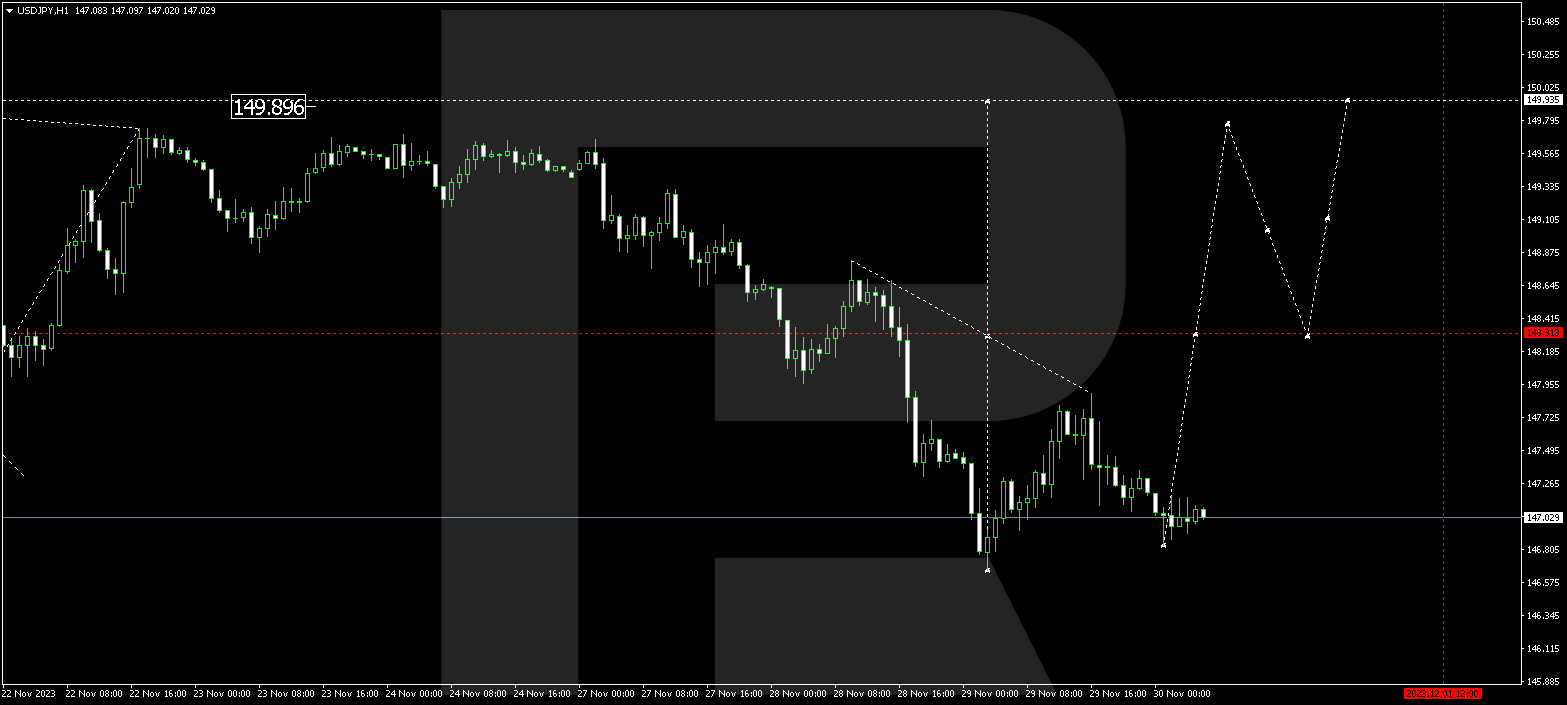

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a growth structure to 147.89. A decline structure to 146.66 is forming today. Practically, a consolidation range is forming at the lows of this decline wave. With an escape from it upwards, a correction to 149.30 might begin.

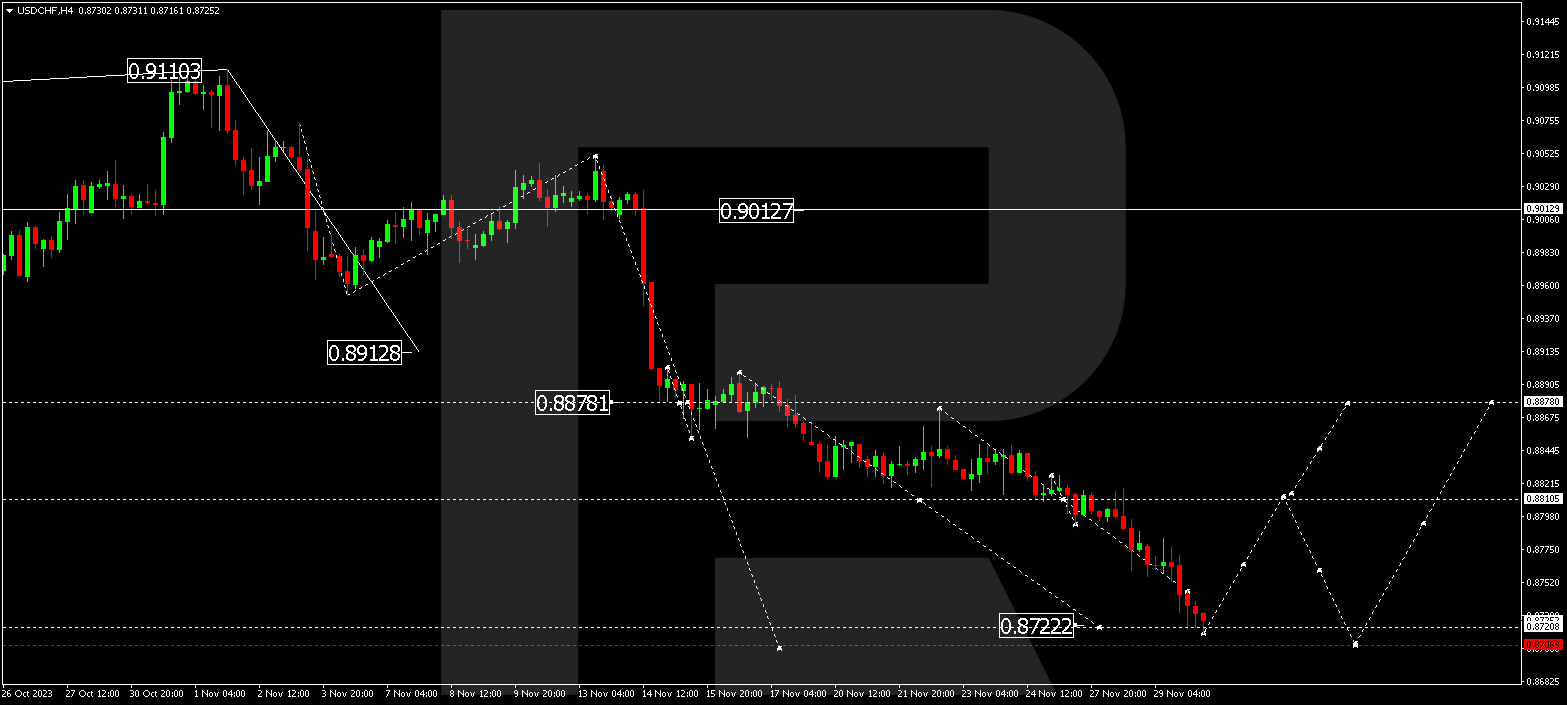

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has reached the target of the decline wave extension at 0.8722. A rise to 0.8815 could happen today. This is the first target. Once this level is reached, a corrective link to 0.8755 is not excluded.

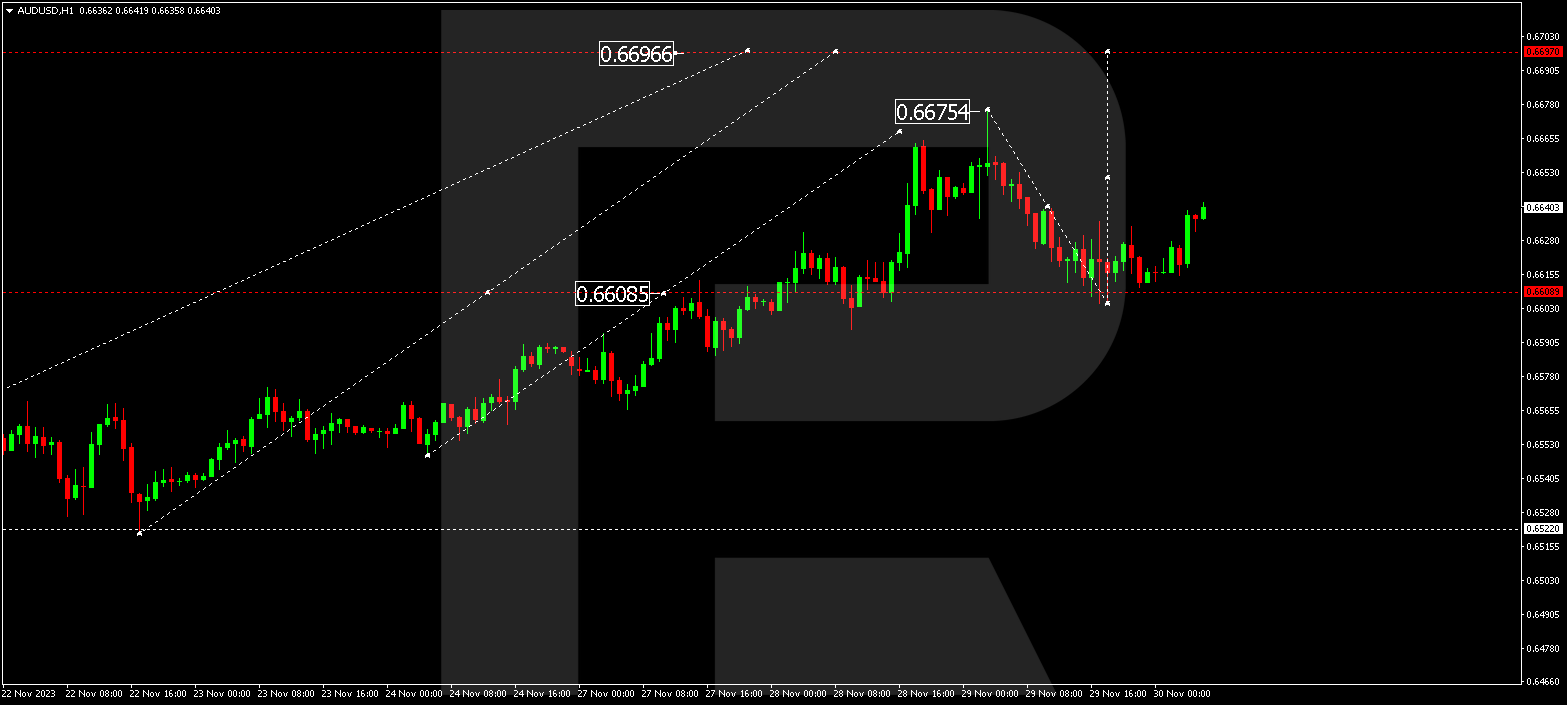

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a decline wave to 0.6605 and a correction to 0.6647. Practically, a consolidation range has formed. With an escape downwards, the decline wave might continue to 0.6522. With an escape upwards, a growth link to 0.6697 is not excluded. Next, a decline to 0.6522 is expected.

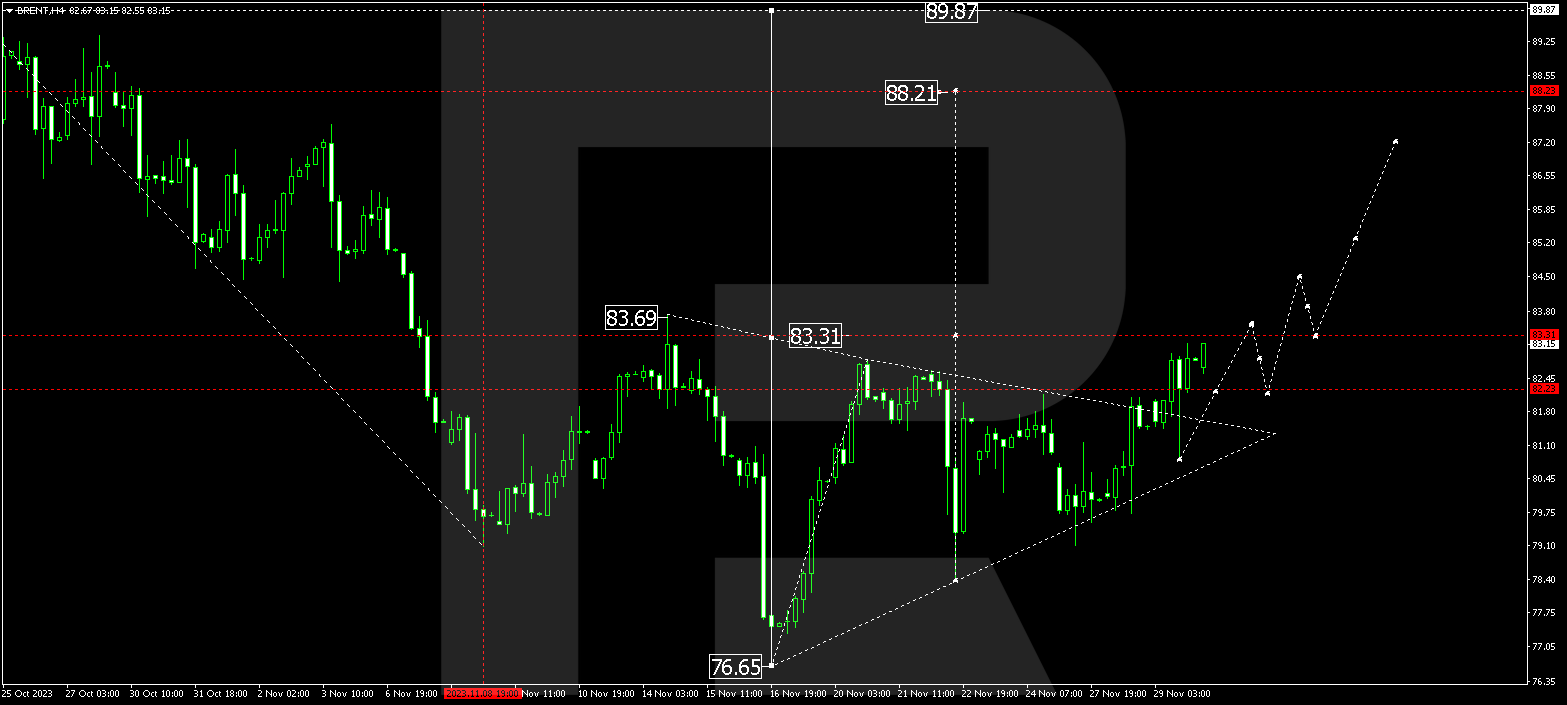

BRENT

Brent extends a growth wave to 83.33. Next, a consolidation range might form around this level. With an escape from this range upwards, the potential for a wave to 88.23 could open. This is a local target.

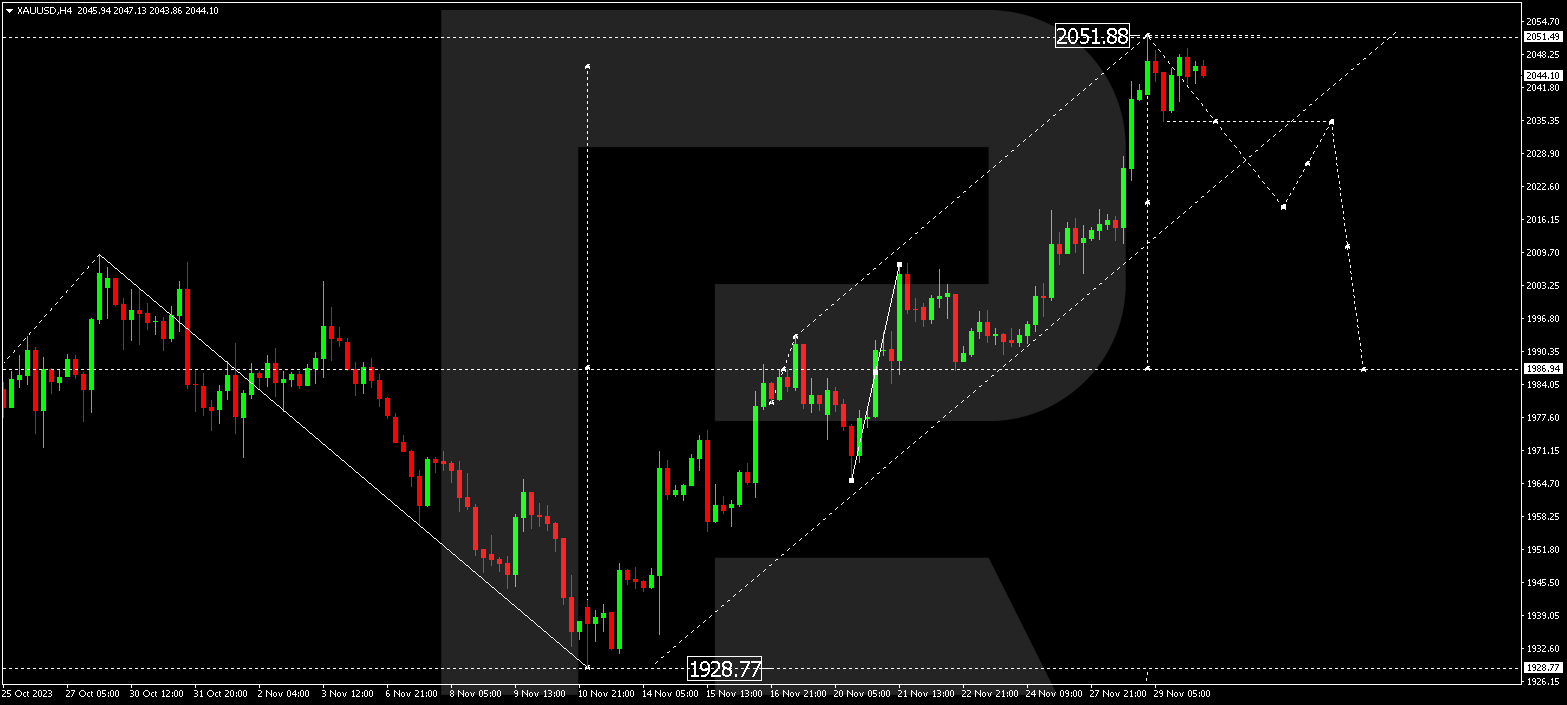

XAUUSD, “Gold vs US Dollar”

Gold has formed a consolidation range around 2011.55 and, breaking it upwards, climbed to 2051.88. A link of correction to 2011.55 is expected today. Subsequently, the price could rise to 2033.00.

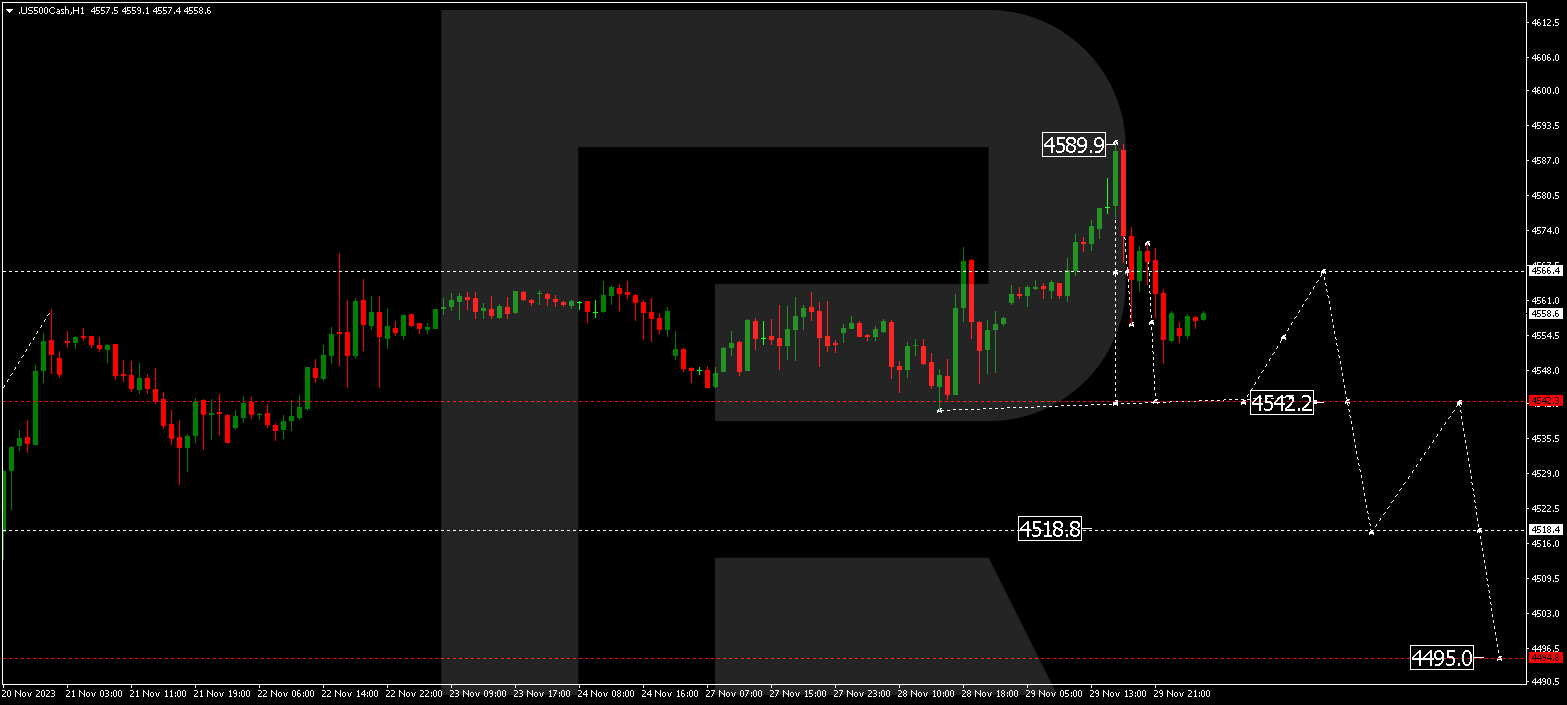

S&P 500

Gold has completed a decline impulse to 2035.20 and a correction to 2049.50. A decline to 2018.38 looks possible today. This is the first target. After the price reaches this level, a correction link to 2030.00 is expected.