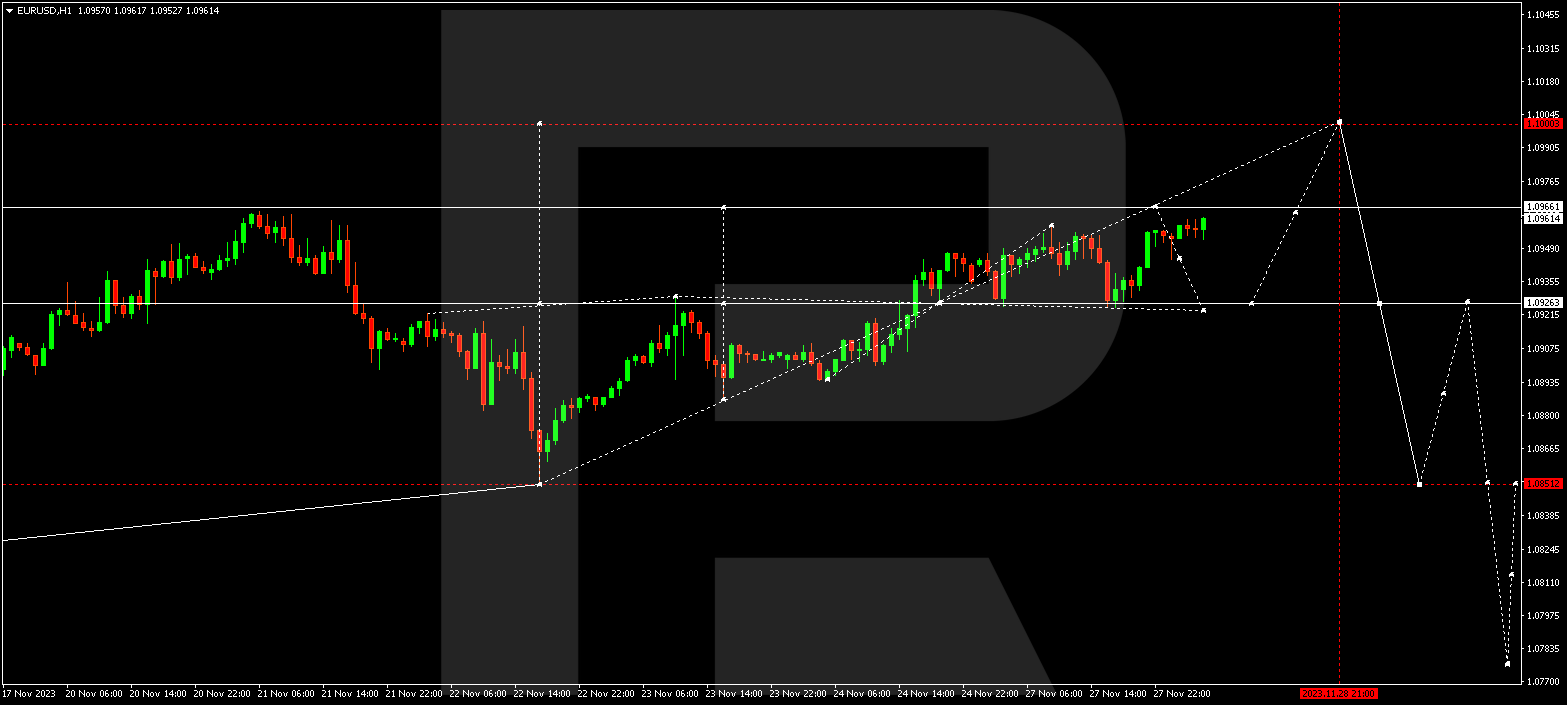

EURUSD, “Euro vs US Dollar”

EURUSD continues developing a wide consolidation range around 1.0926. Today the pair could rise to 1.0966. Next, a decline wave to 1.0926 might begin (a test from above). After that, a new growth link to 1.1000 is not excluded. Once this level is reached, a new decline wave to 1.0850 might start. This is the first target.

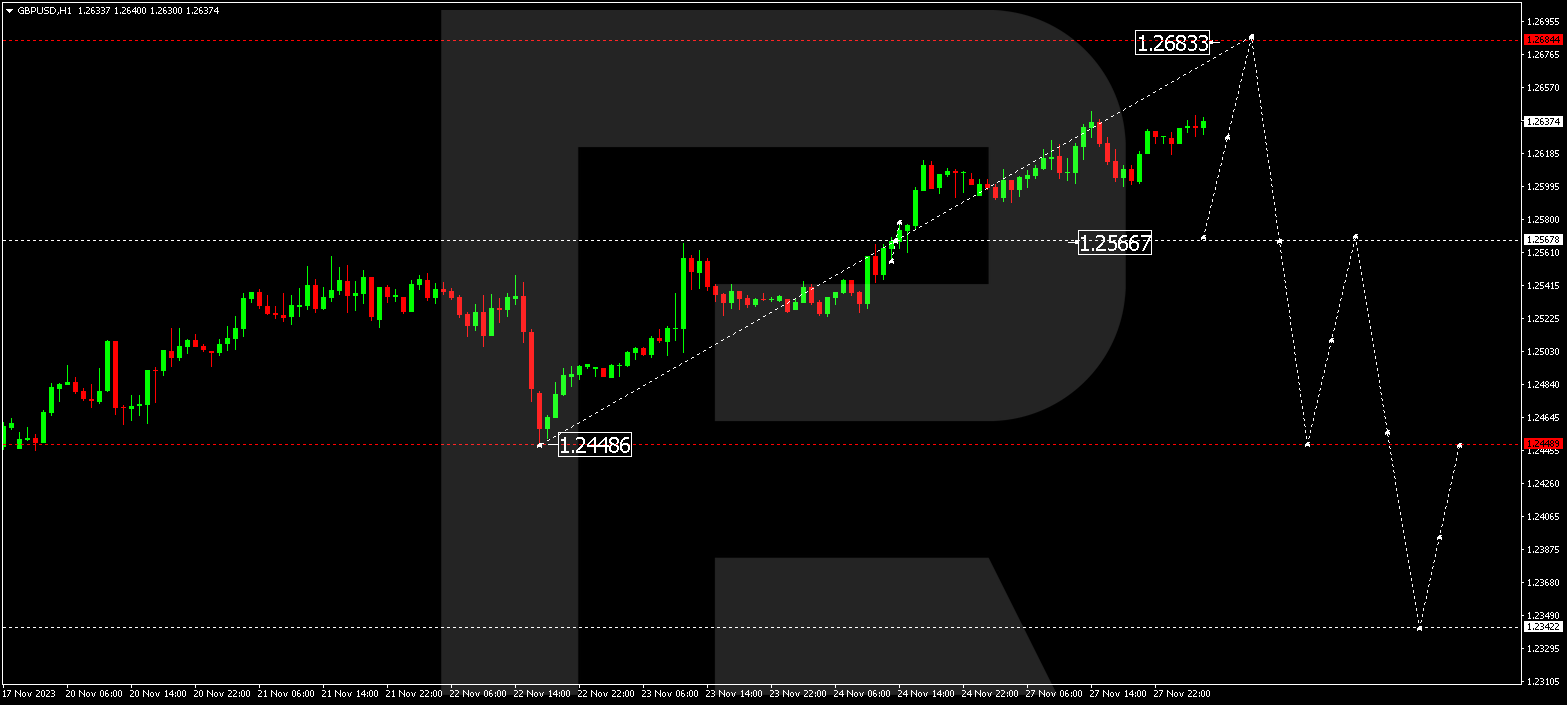

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has formed a narrow consolidation range around 1.2570. By now, the range has extended to 1.2640. A correction link to 1.2570 is not excluded (a test from above). After the correction is over, a growth link to 1.2684 is not excluded. Next, a decline wave to 1.2450 is expected to begin. This is the first target.

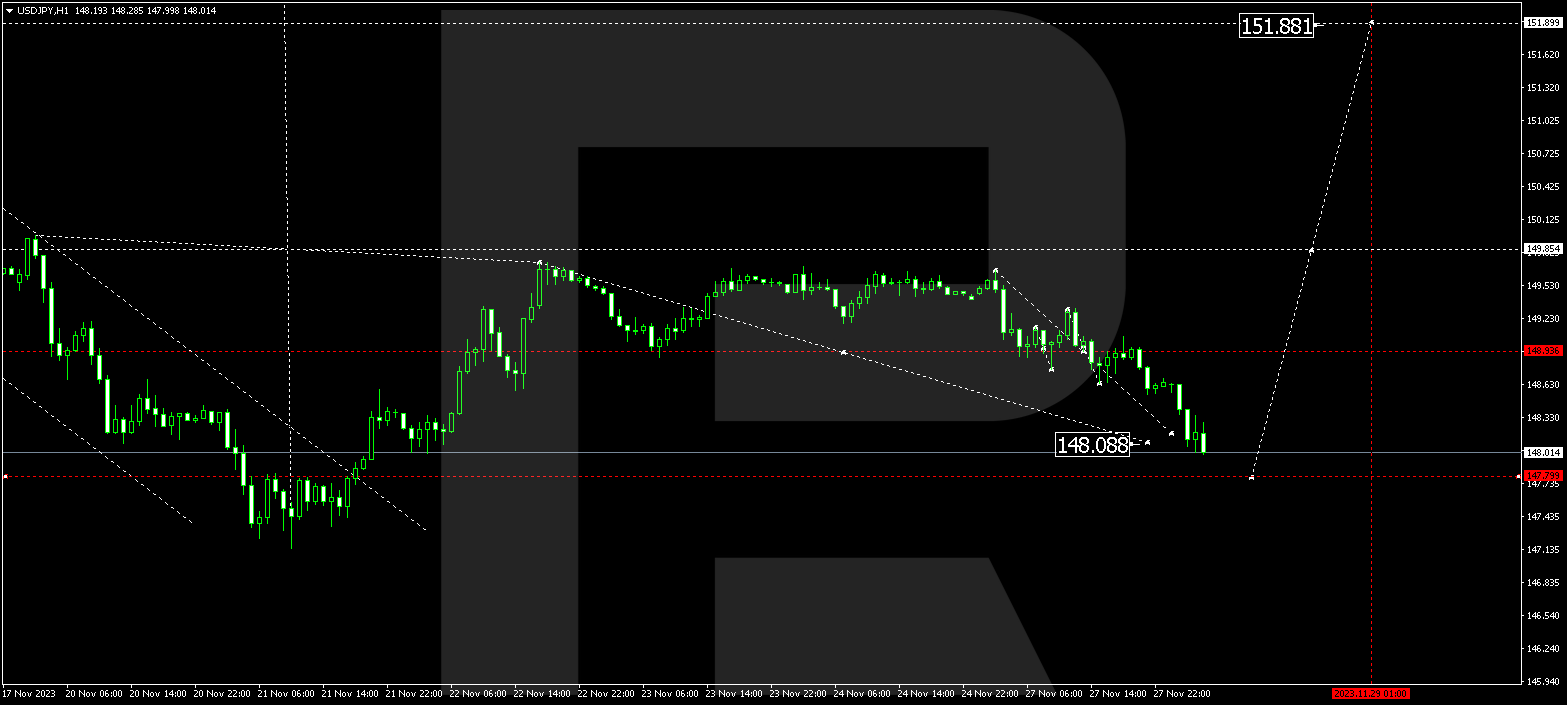

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a corrective wave to 148.08. A consolidation range is expected to develop today at the current lows. Today the range could extend to 147.77. Next, the pair might rise to 148.80, and if this level also breaks, the potential for growth to 151.88 could open. This is a local target.

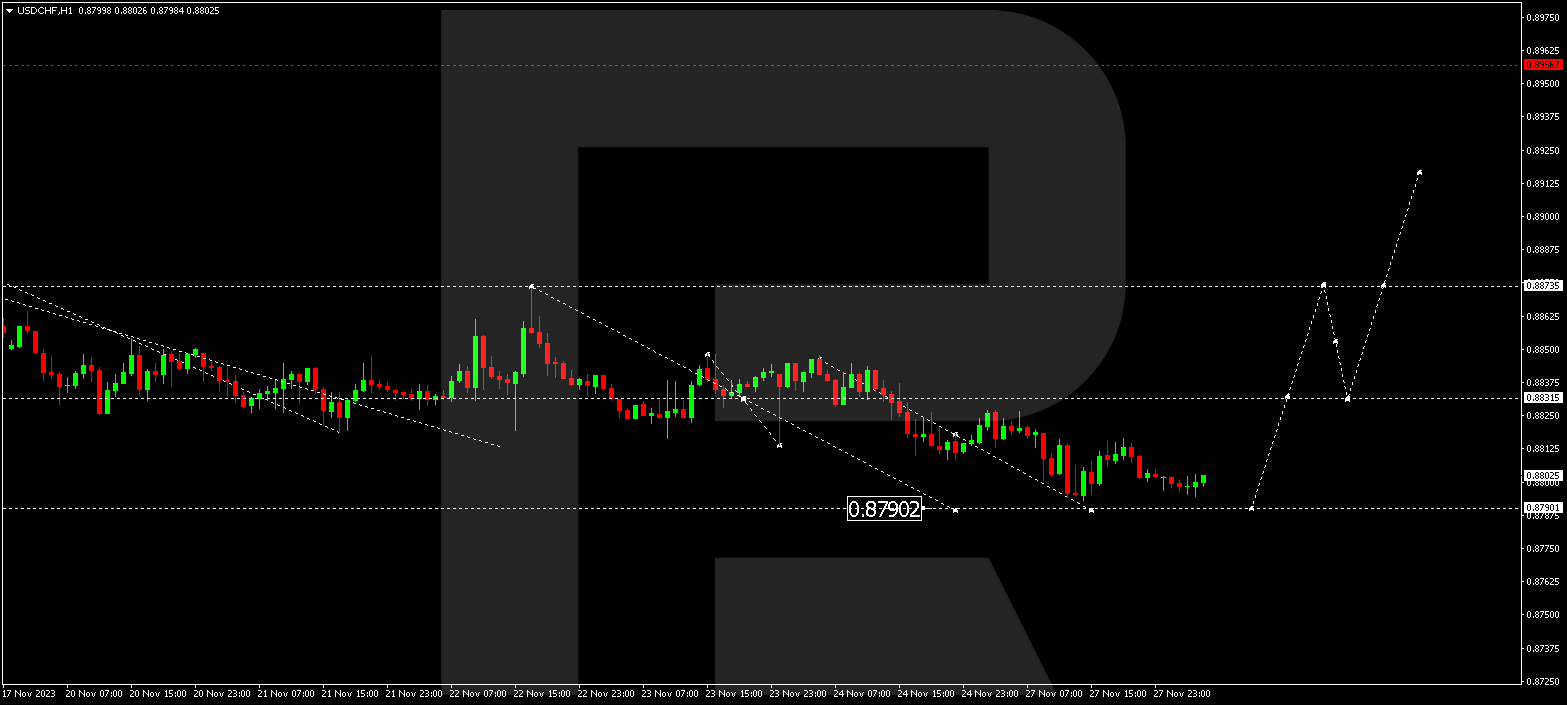

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues forming a consolidation range around 0.8840. By now, the range has extended to 0.8805. A new narrow consolidation range has formed above this level today. A new decline link to 0.8790 is not excluded. Next, a new growth wave to 0.8875 might start. This is the first target.

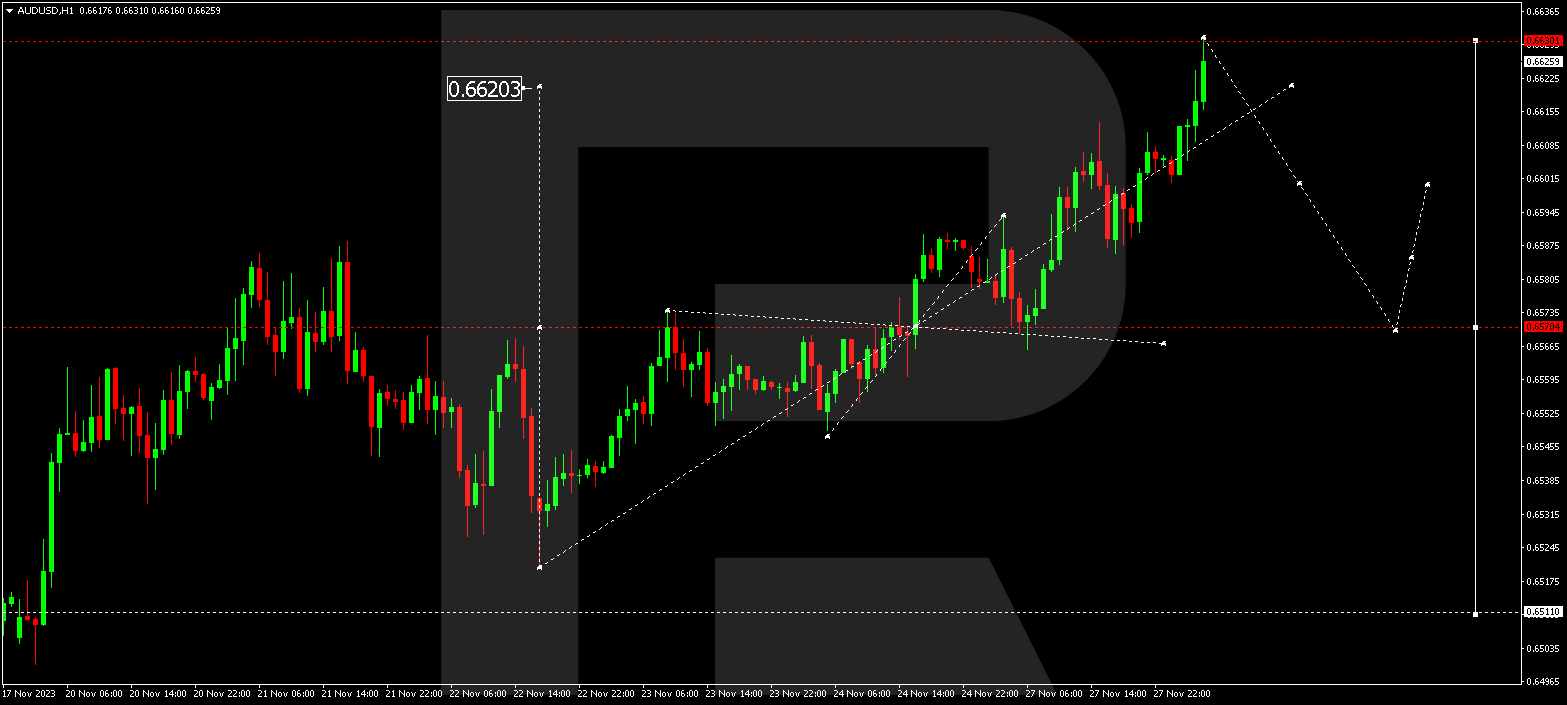

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues forming a consolidation range around 0.6570. By now, it has been extended to 0.6630. Today the market is forming a new narrow consolidation range under this level. The price is expected to escape the range downwards and develop a decline structure to 0.6570. This is the first target.

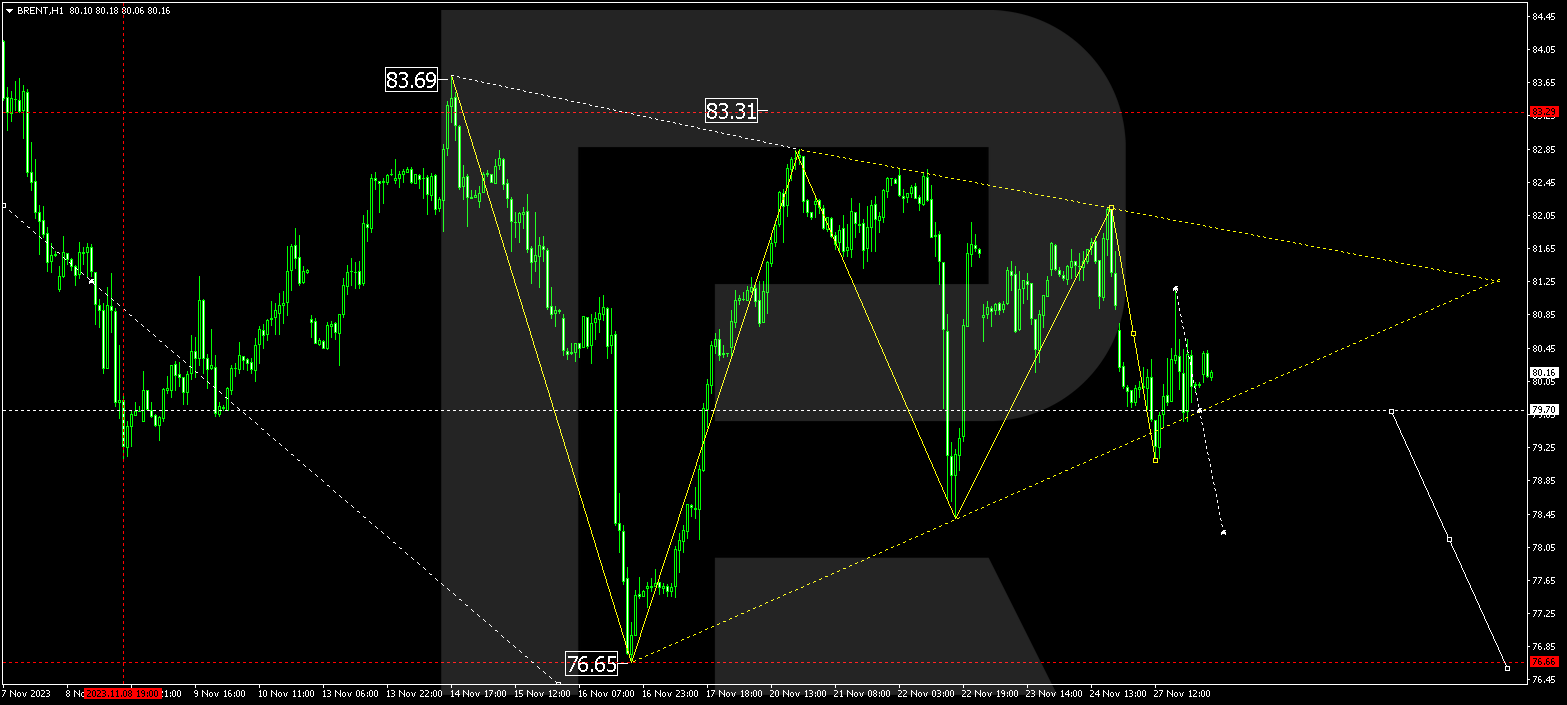

BRENT

Brent has formed a wide consolidation range around 80.50. A Triangle pattern is becoming visible. With an escape from the range downwards, this pattern will be interpreted as a downtrend consolidation pattern. The target is 70.00. With an escape upwards, this pattern will be interpreted as a trend reversal pattern with the target at 89.89.

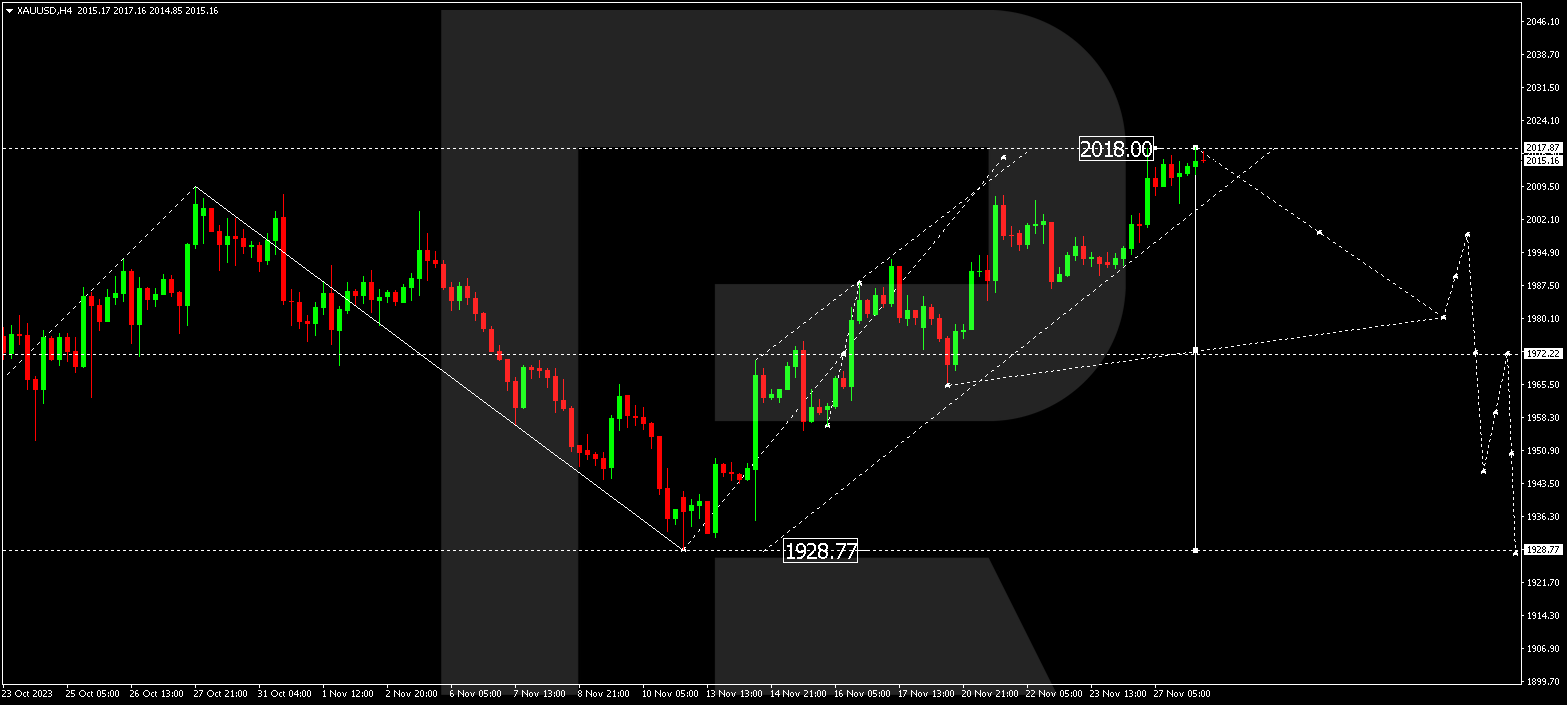

XAUUSD, “Gold vs US Dollar”

Gold continues forming a wide consolidation range around 1972.22. By now, the range has extended upwards to 2018.00. A narrow consolidation range might form under this level today. With an escape from the range downwards, a decline structure to 1972.22 could start. And if this level also breaks downwards, the wave might develop to 1928.77. This is the first target.

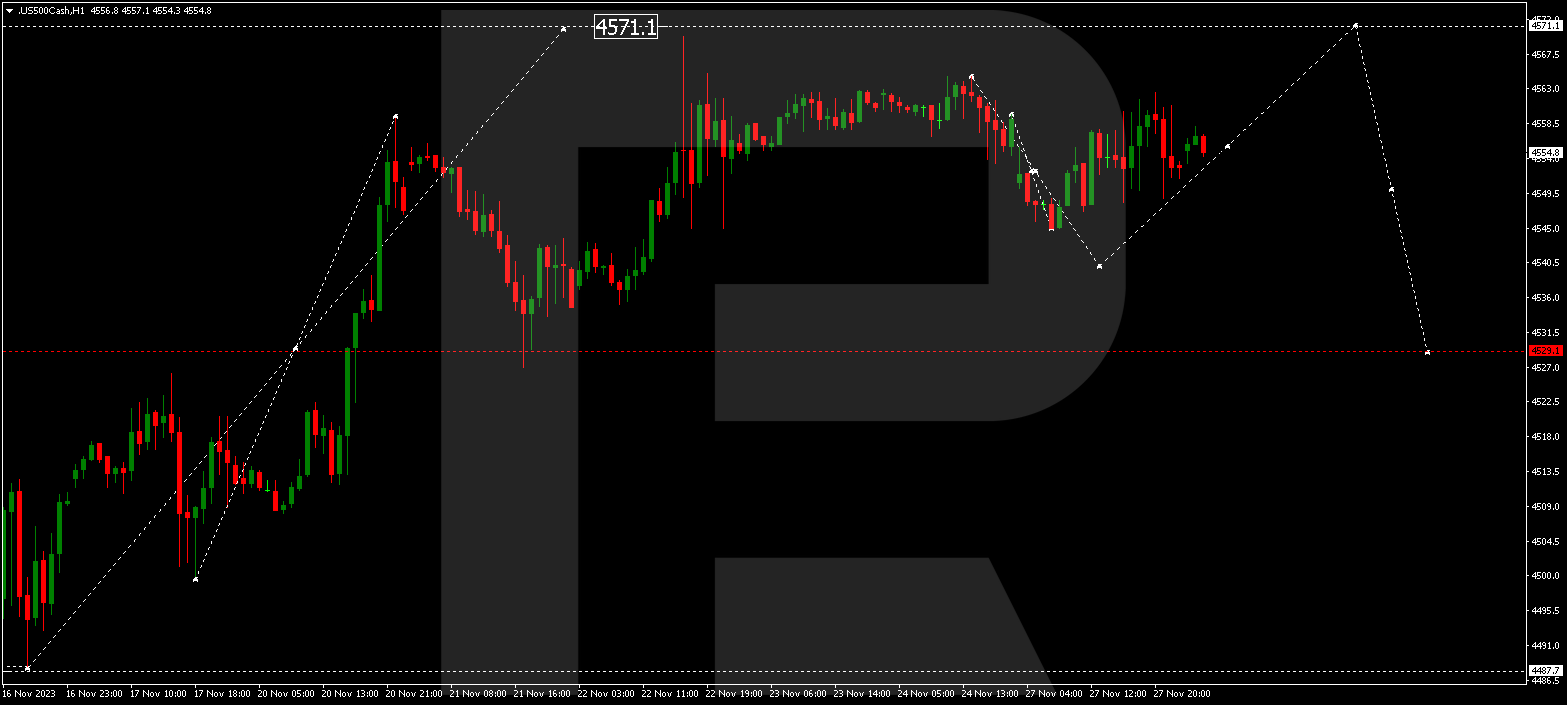

S&P 500

The stock index continues developing a consolidation range around 4552.0 without any strong trend. A decline link to 4540.0 is expected today. Next, a growth link to 4570.0 might form, followed by a decline to 4530.0. With a breakout of this level downwards, the potential or a wave to 4500.0 might open, from where the trend could continue to 4487.7. This is the first target.