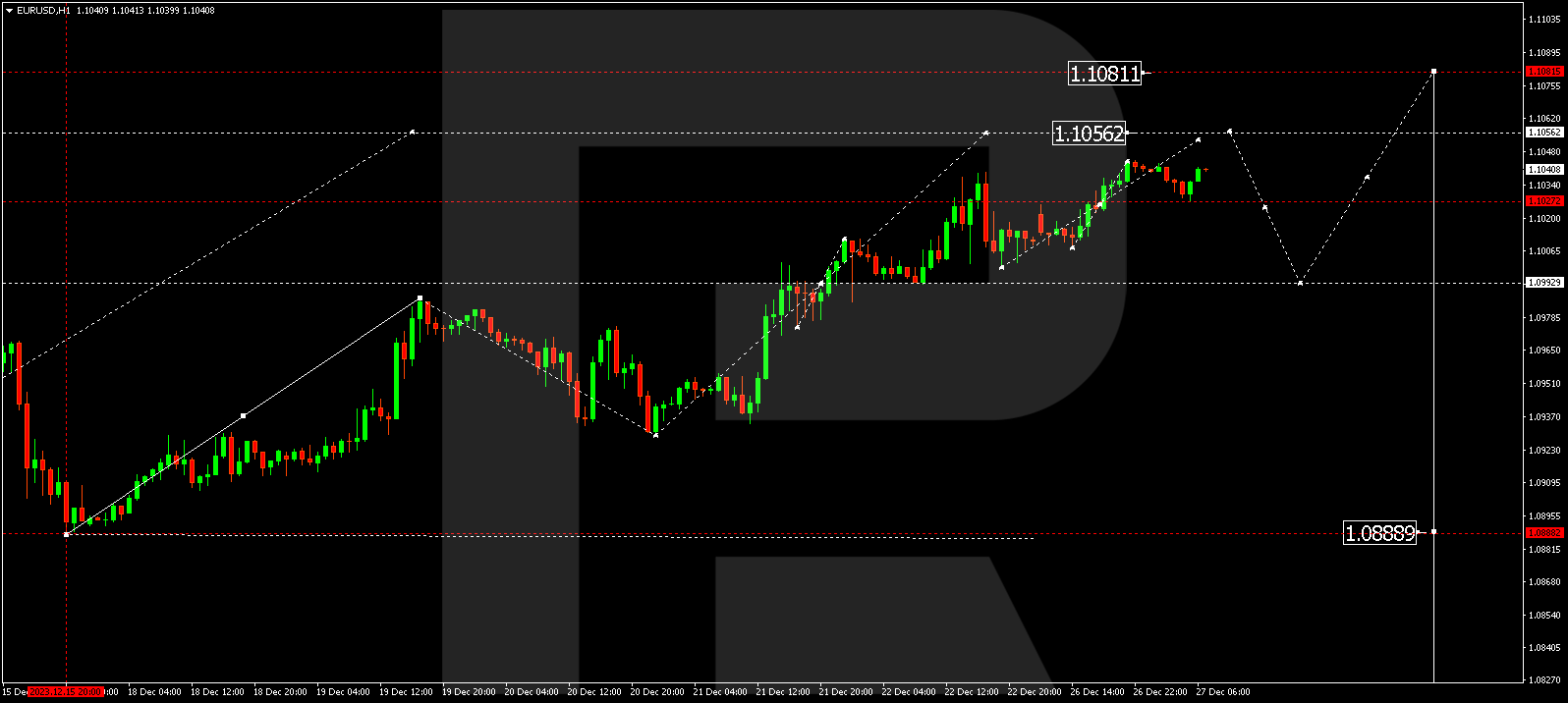

EURUSD, “Euro vs US Dollar”

EURUSD has completed a growth wave to 1.1044. A correction link to 1.1025 is not excluded today. Next, the growth wave might extend to 1.1056. Once this level is reached, a correction to 1.0993 might start, followed by a rise to 1.1088.

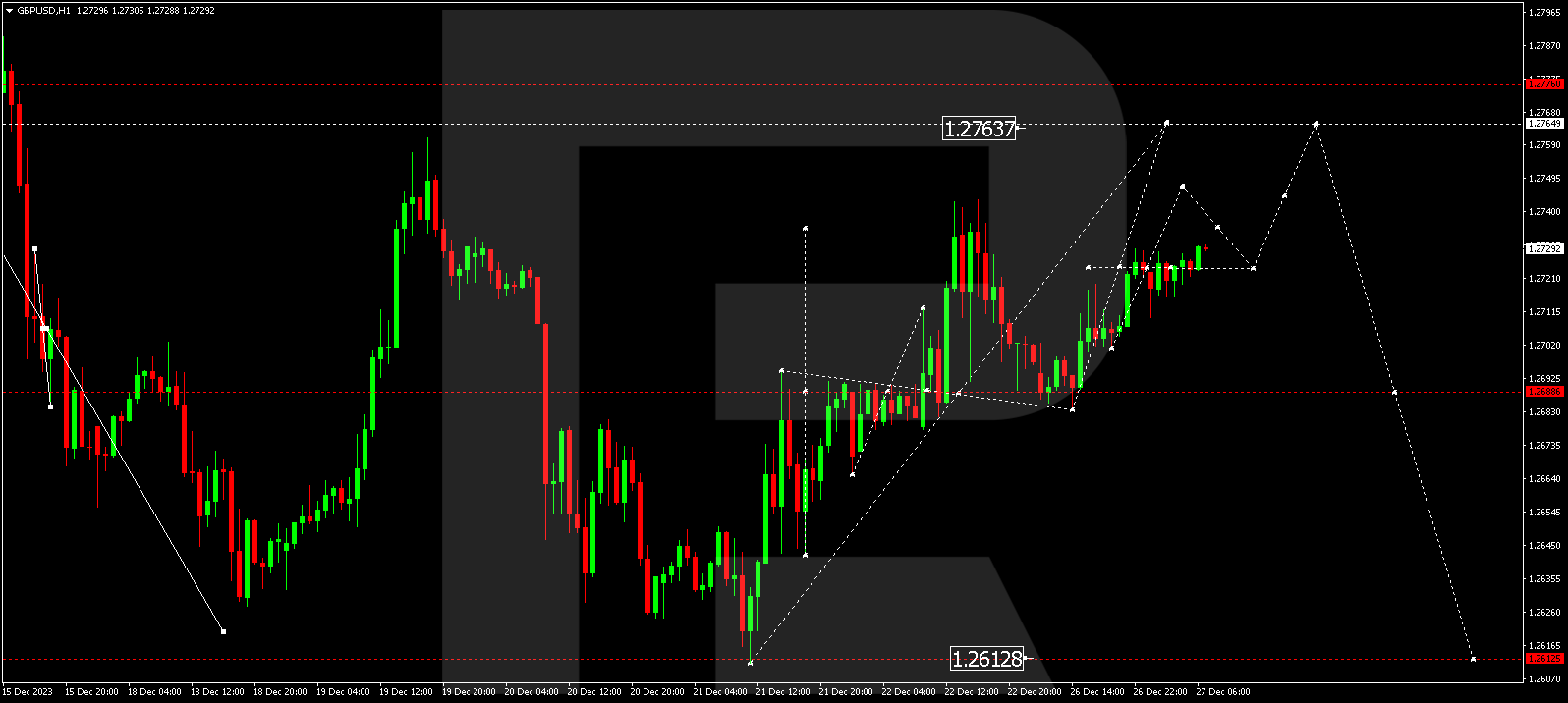

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is forming a consolidation range around 1.2720. A growth structure to 1.2747 is not excluded. Once this level is reached, a correction to 1.2720 is expected. Next, a growth link to 1.2765 might follow.

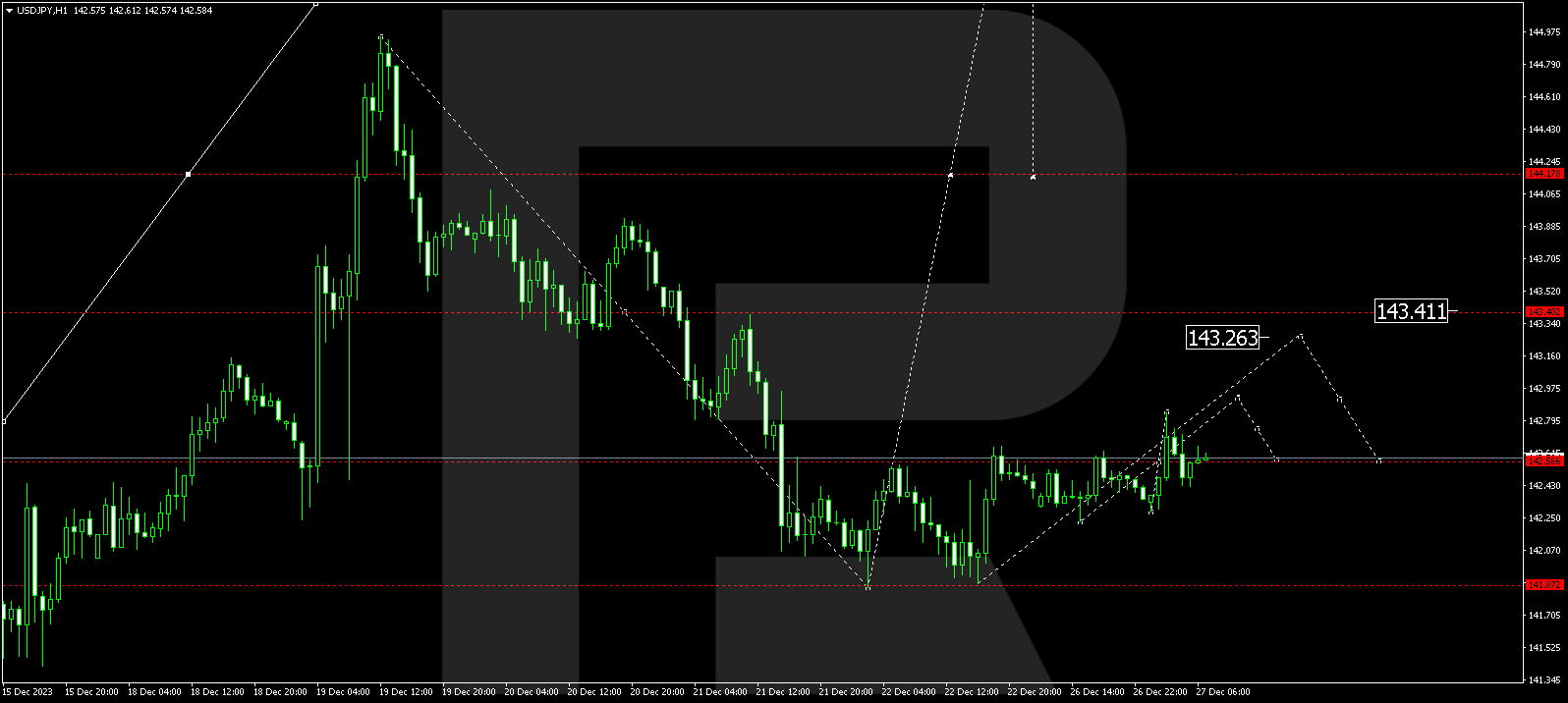

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues developing a consolidation range around 142.50 without any obvious trend. With an escape upwards, a correction to 143.43 could follow. With a downward escape, the potential for a decline wave to 140.00 might open. This is a local target.

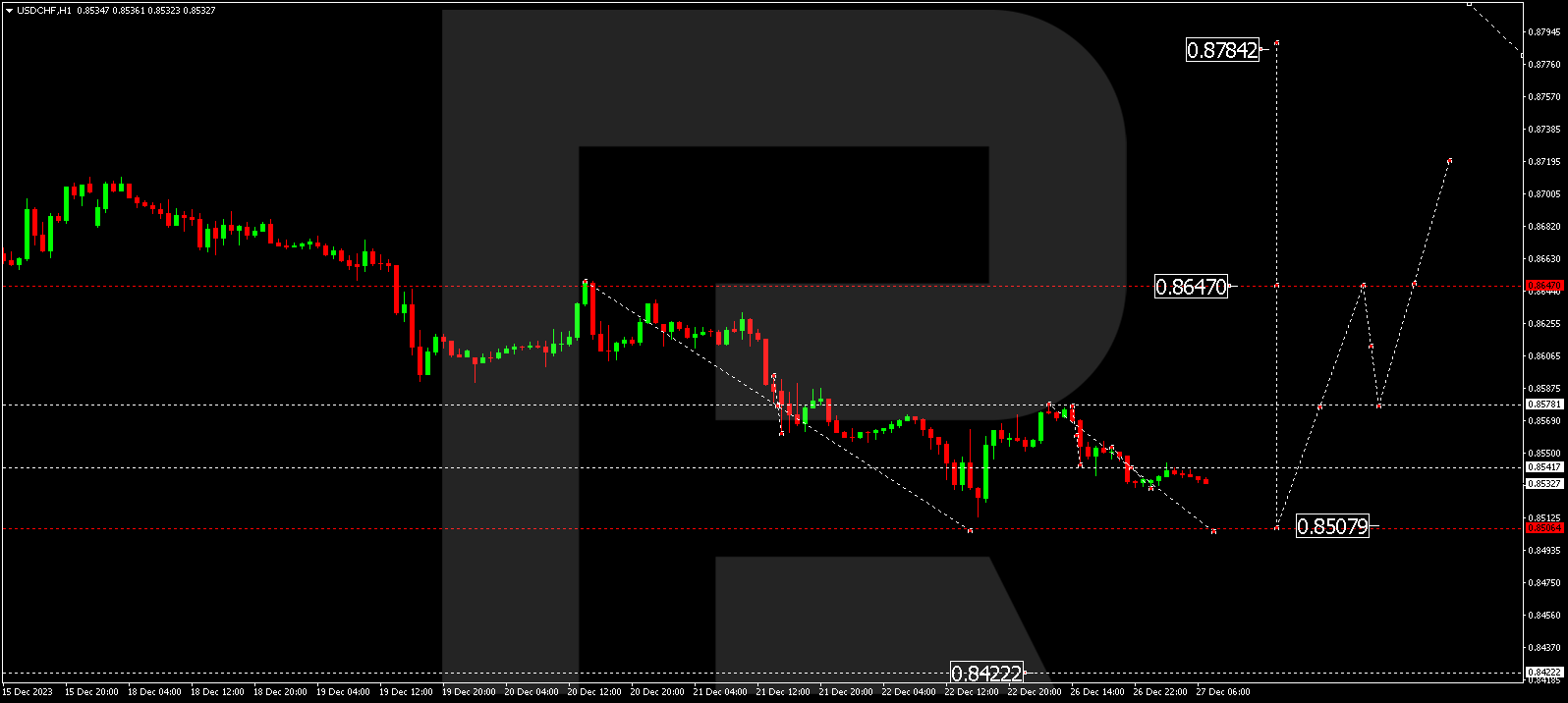

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a decline wave to 0.8537. A consolidation range is now forming around this level. With an escape downwards, the potential for a decline to 0.8508 might open. Once this level is reached, a new growth wave to 0.8647 could start, from where the trend could continue to 0.8784.

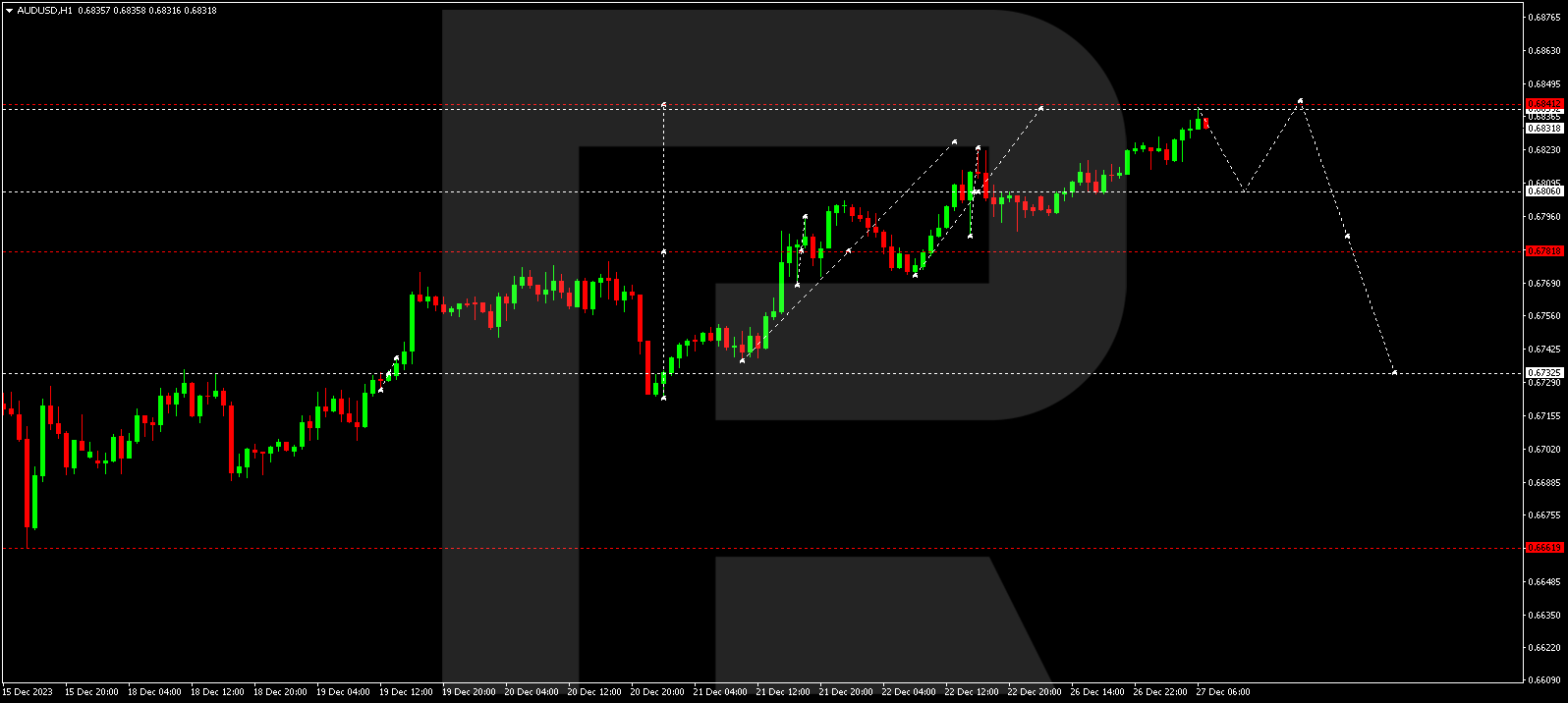

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a growth wave to 0.6840. A decline impulse to 0.6800 could begin today. With a breakout of this level, the potential for a decline wave to 0.6733 might open. This is the first target.

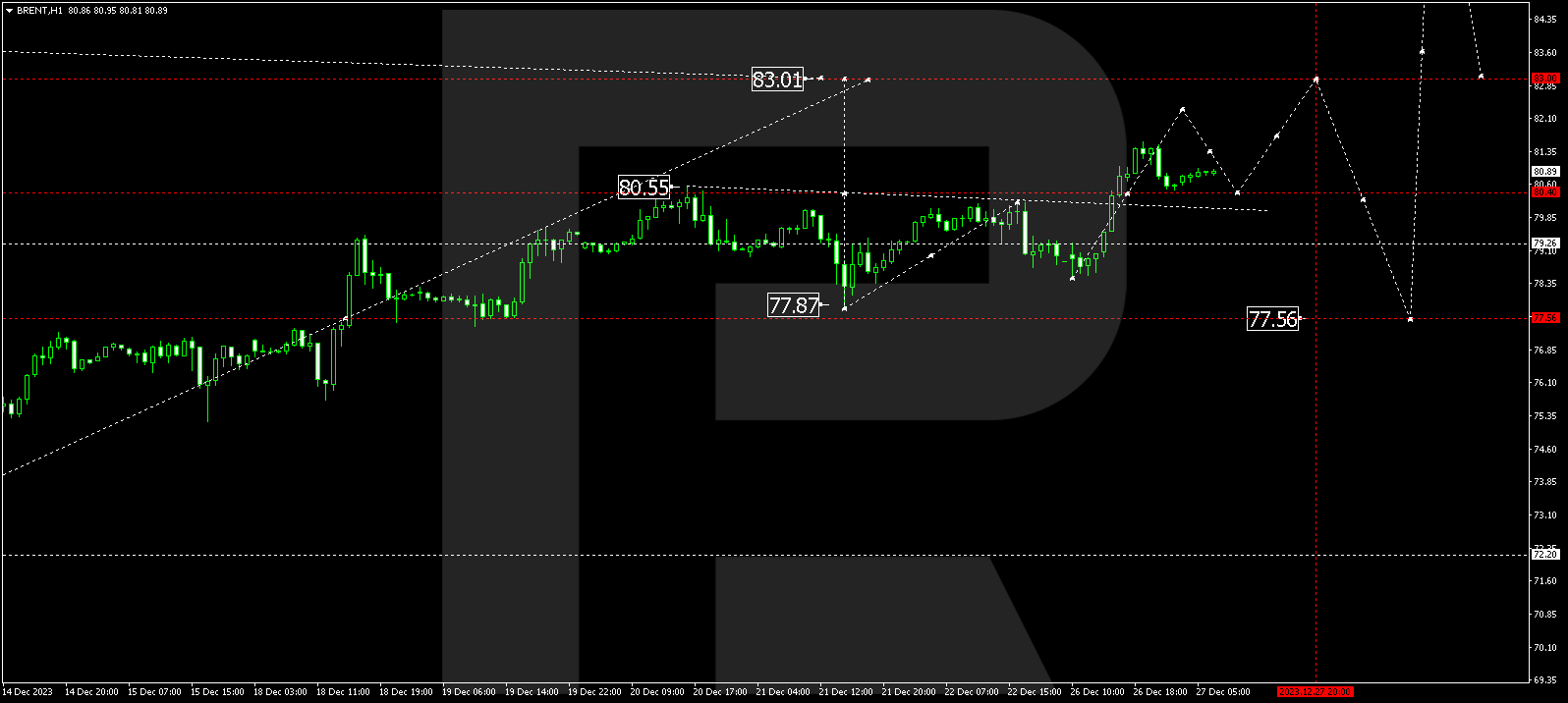

BRENT

Brent has broken the 80.55 level upwards, completing the growth structure to 81.56. A correction link to 80.55 might follow (a test from above) with a rise to 83.00. This is the first target.

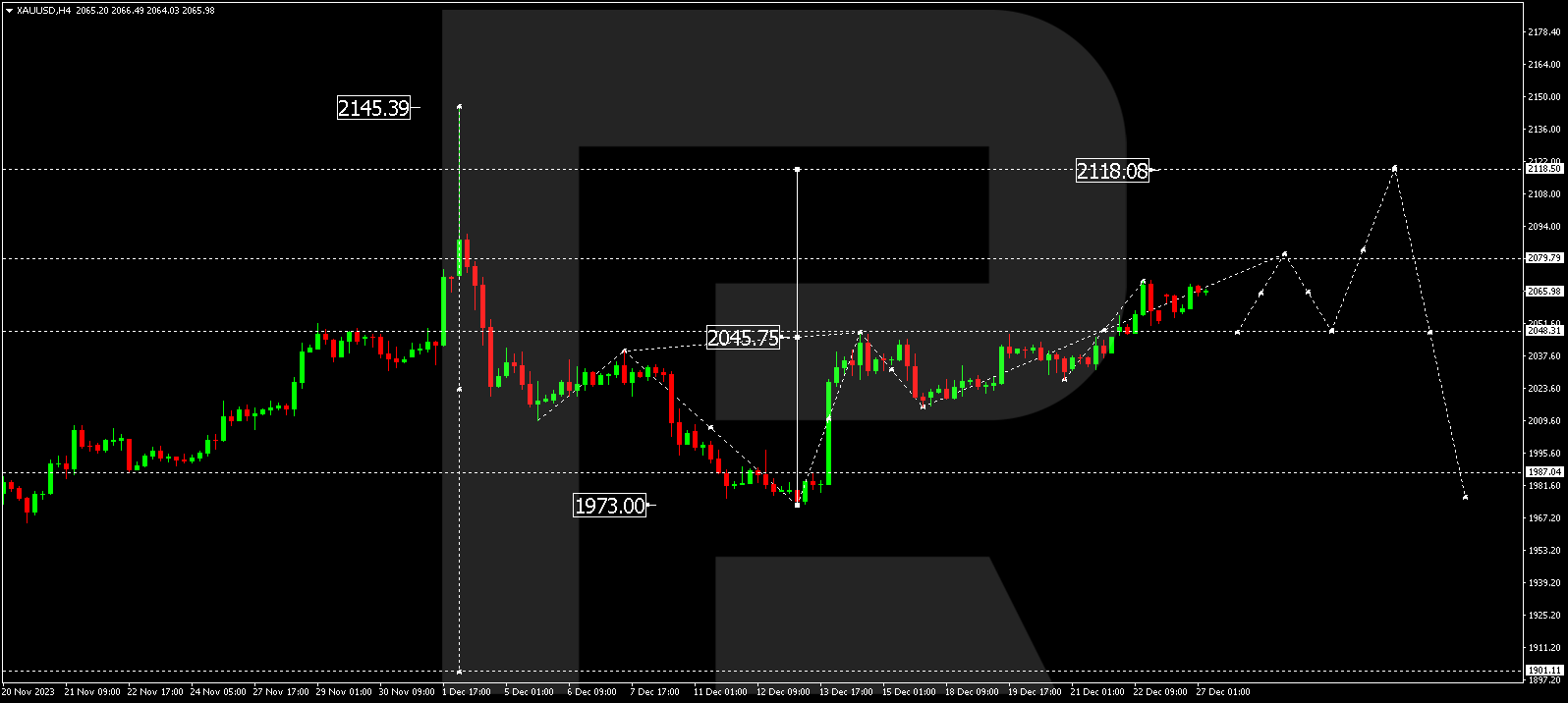

XAUUSD, “Gold vs US Dollar”

Gold continues developing a growth wave to 2079.80. Once this level is reached, a correction to 2045.76 might follow (a test from above). Next, a link of growth to 2118.00 is expected.

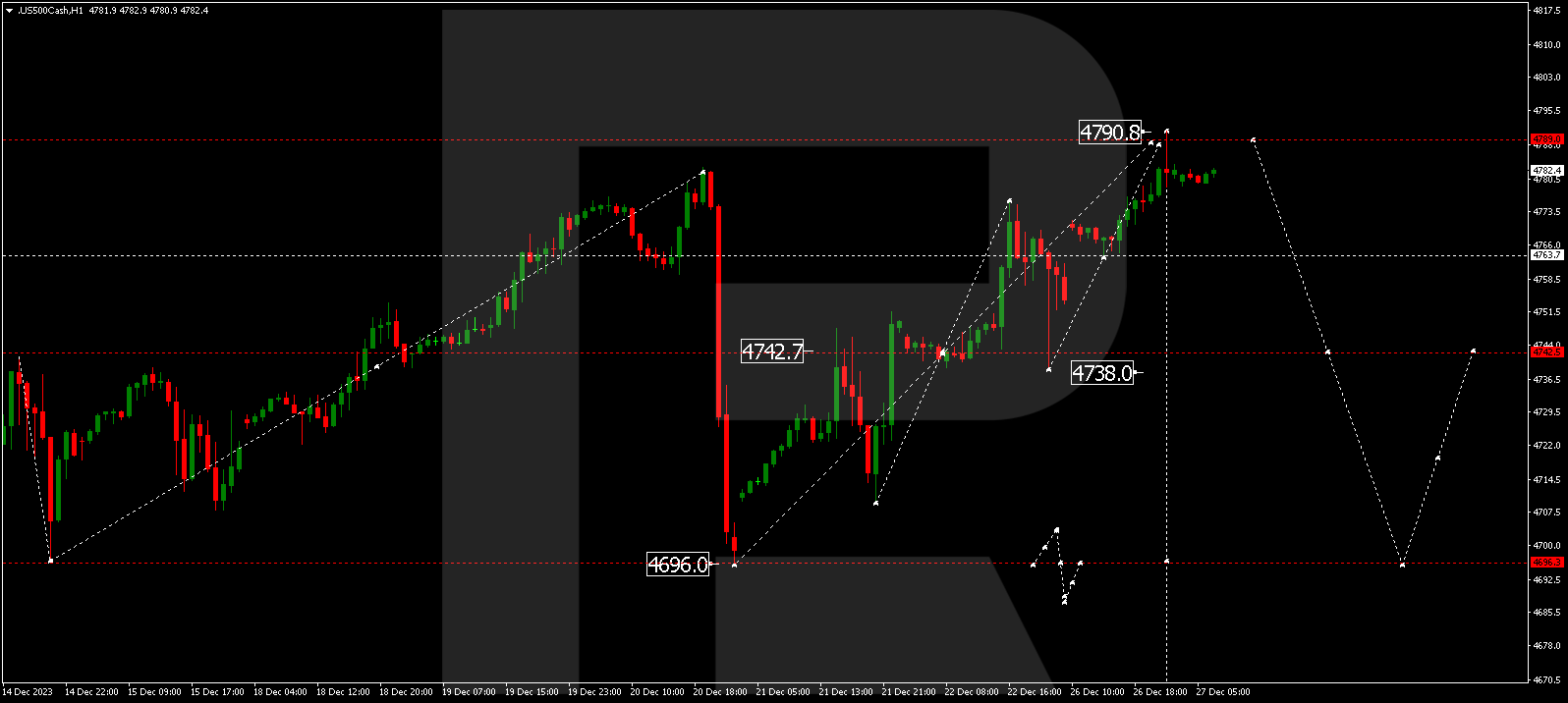

S&P 500

The stock index has completed a growth wave to 4790.0. A consolidation range is expected to form under this level. With a downward escape, a new decline wave to 4742.5 could begin. This is the first target.