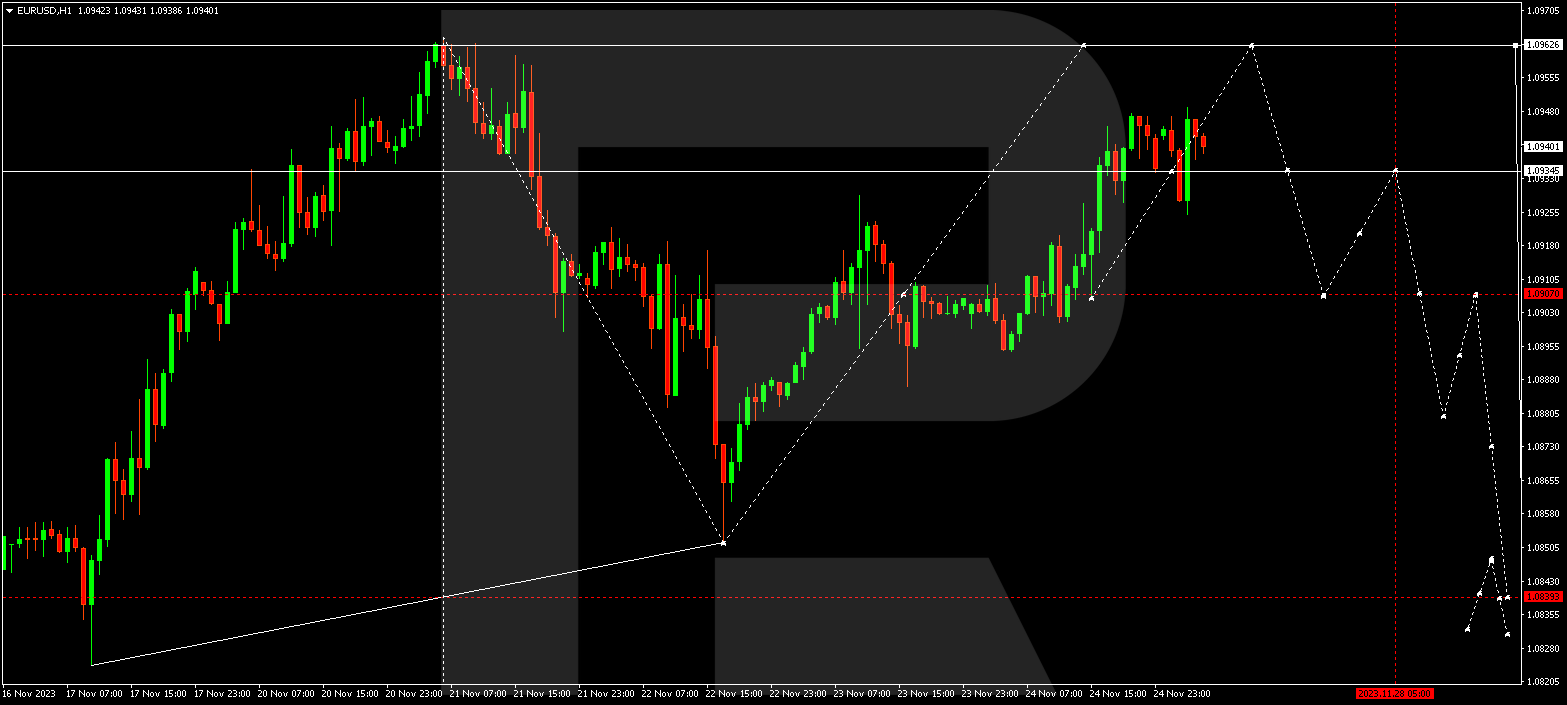

EURUSD, “Euro vs US Dollar”

EURUSD continues developing a wide consolidation range around 1.0907. The pair might reach the 1.0962 level today. A new decline wave to 1.0907 might begin, from where the trend could continue to 1.0840. This is the first target.

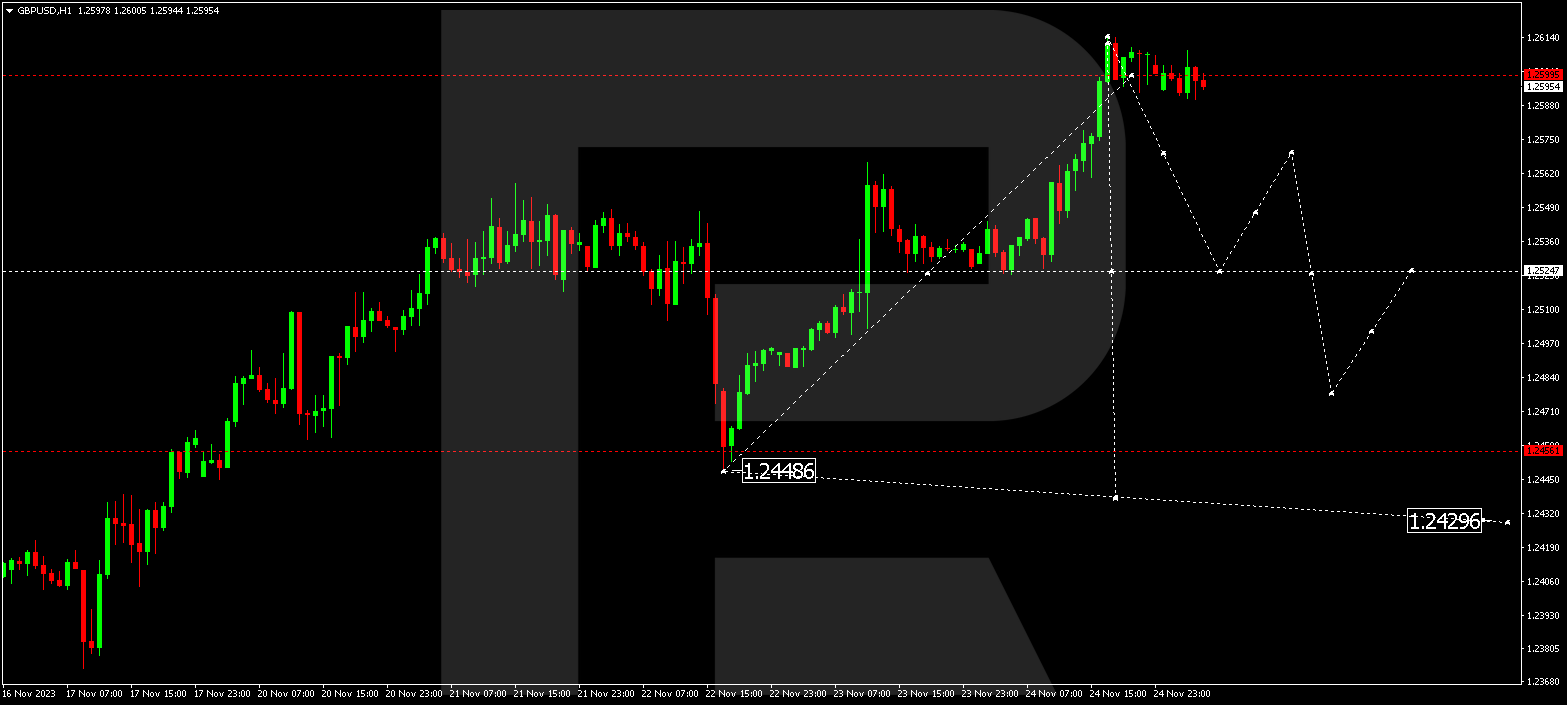

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD continues developing a wide consolidation range around 1.2525. The pair has just extended it to 1.2614. The price could drop to 1.2525 today. And if this level is breached, the potential for a wave down to 1.2455 might open. This is the first target.

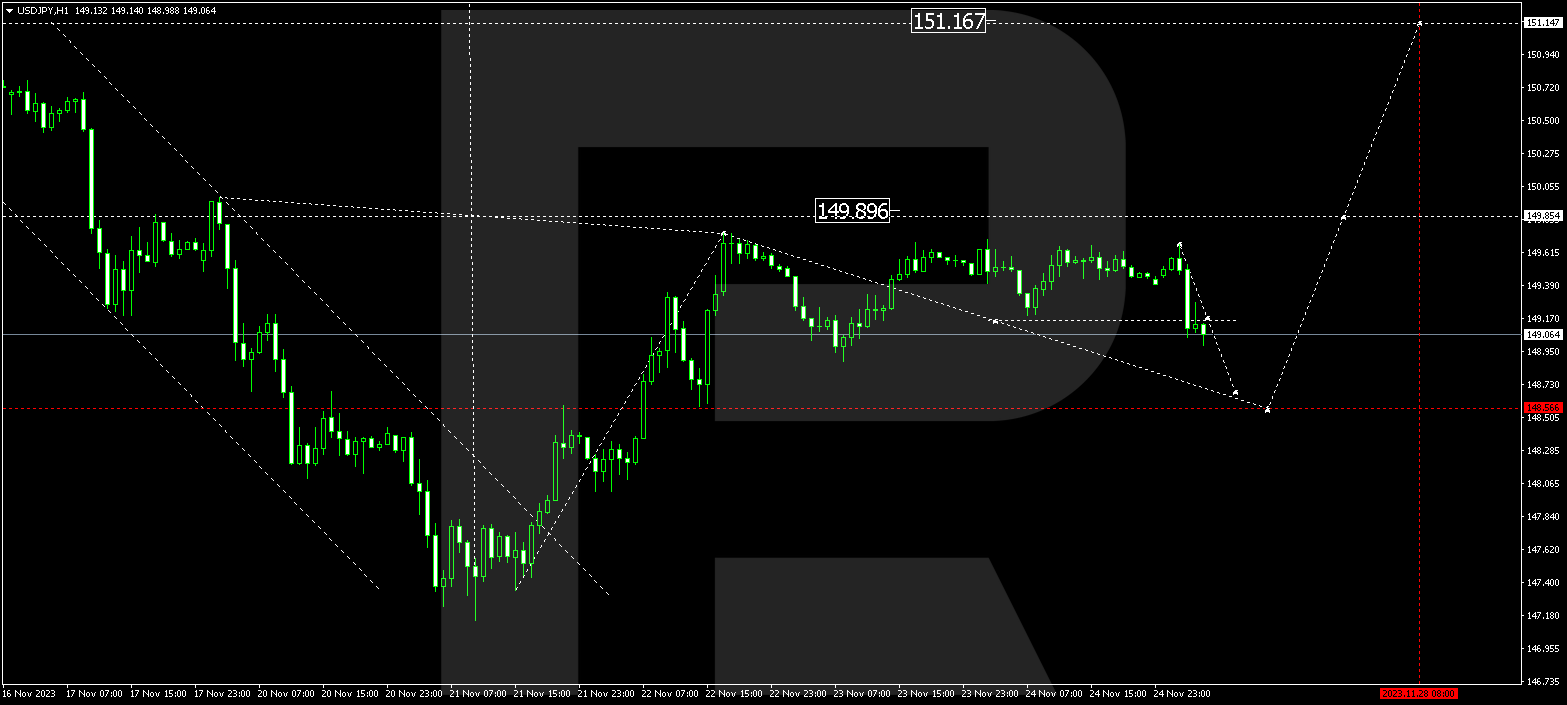

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is forming a consolidation range around 149.30. With an escape from the range downwards, the correction could continue to 148.56. Next, a rise to 149.90 is expected. With a breakout of this level upwards, the potential for a rise wave to 151.15 might open. This is a local target.

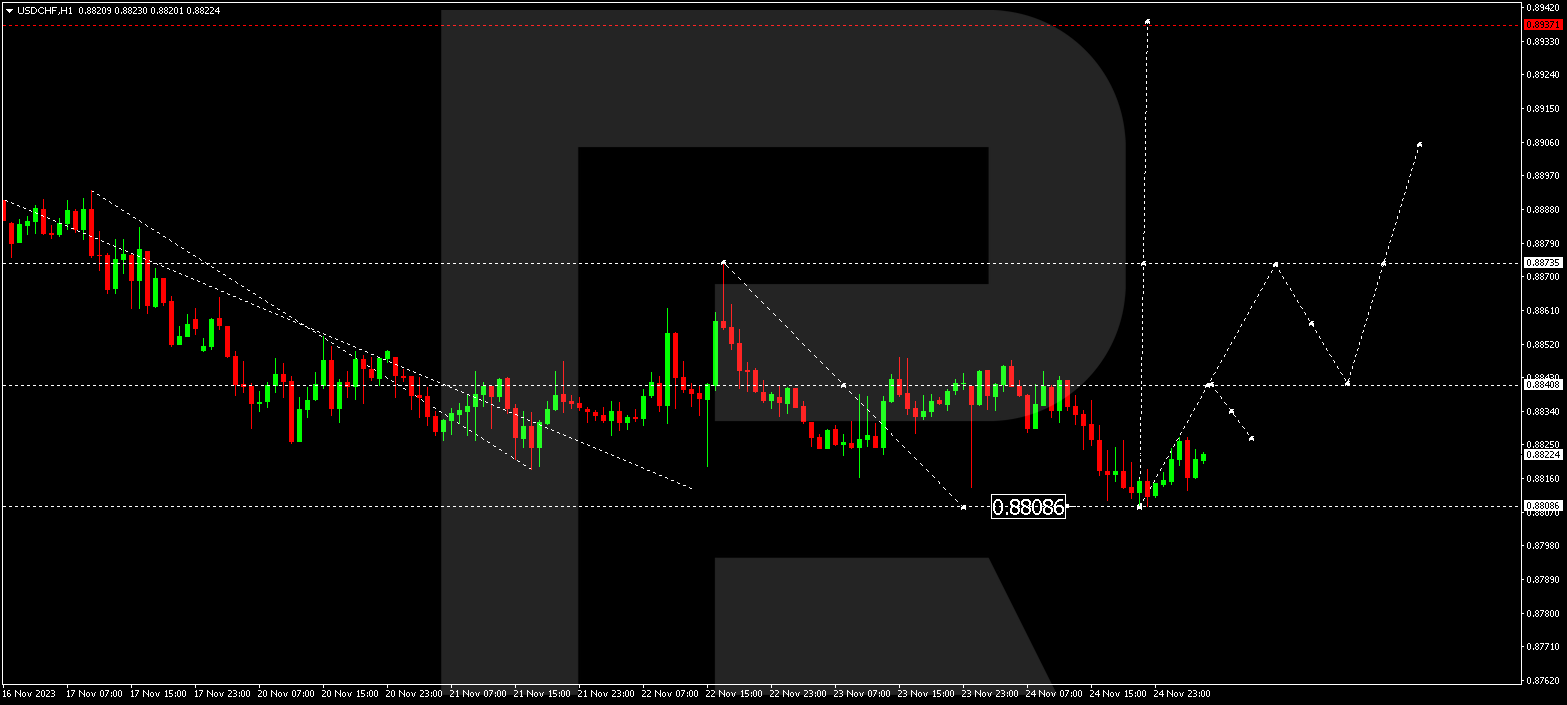

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues forming a consolidation range around 0.8841. By now, the market has extended the range to 0.8808. A consolidation range has formed above this level today. An escape upwards and the development of the wave to 0.8875 are expected. This is the first target.

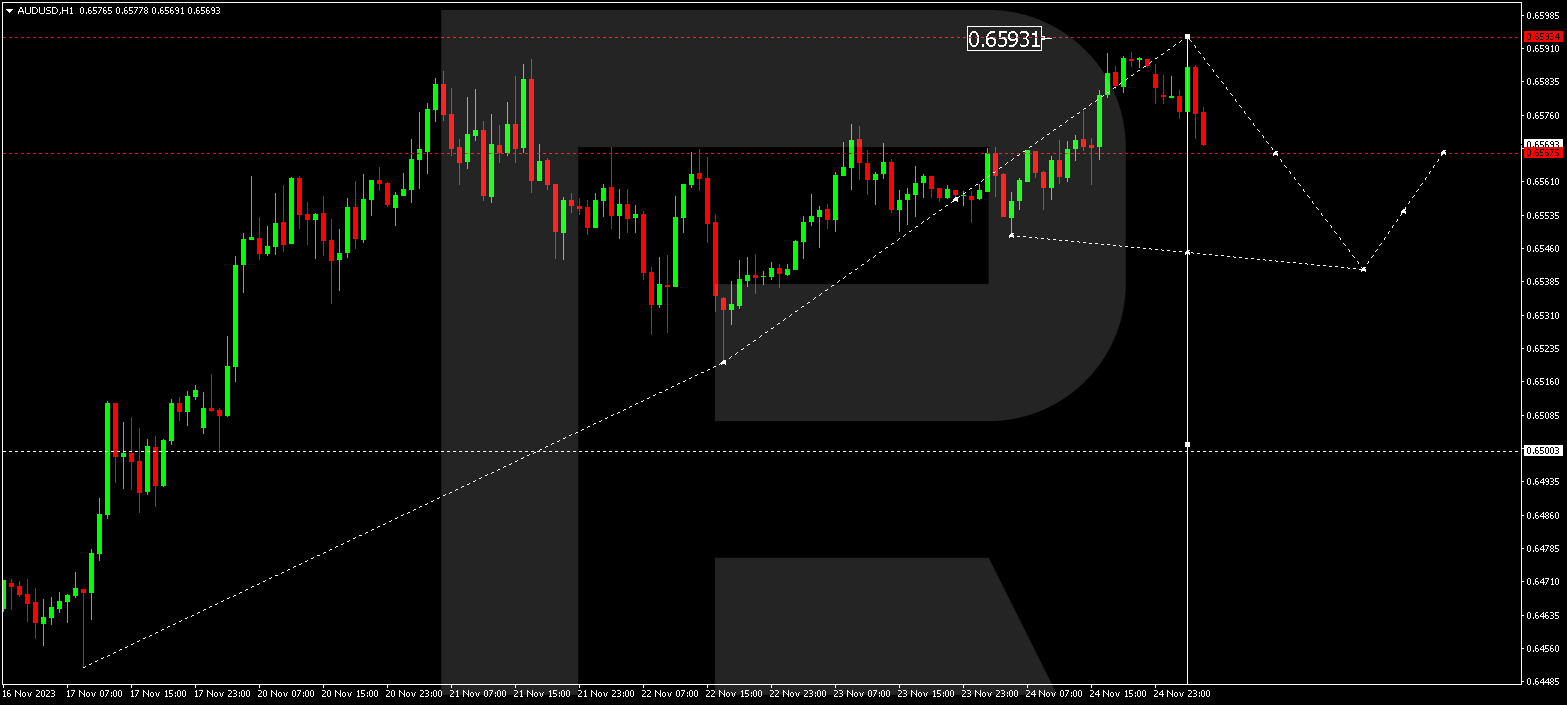

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues forming a consolidation range around 0.6567. By now, the range has extended to 0.6590. Today the market is forming a decline structure to 0.6567. With a breakout of this level downwards as well, the potential for a decline wave to 0.6540 could open, from where the trend might continue to 0.6500. This is the first target.

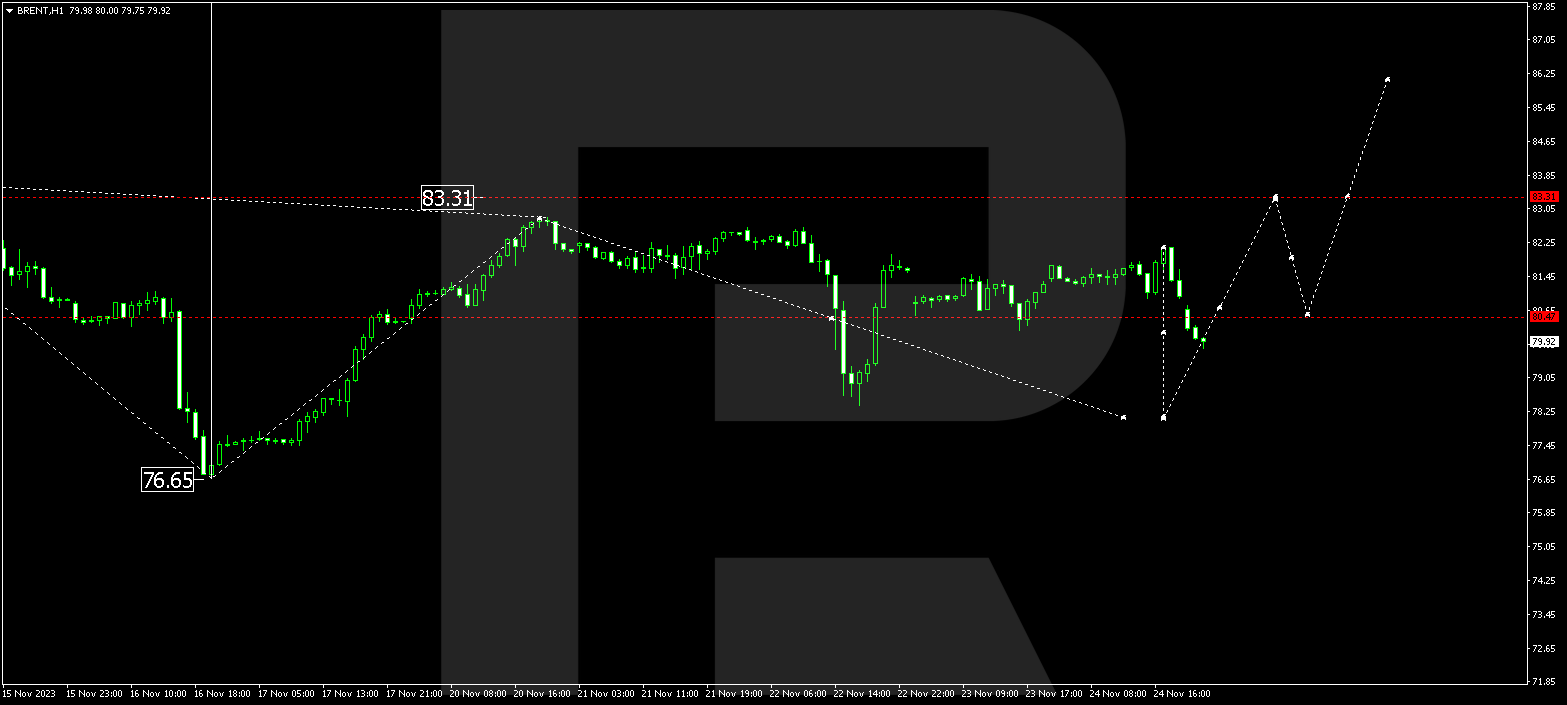

BRENT

Brent continues developing a consolidation range around 80.47. A decline to 78.18 might happen today. After the price reaches this level, a growth movement to 83.33 might follow. With a breakout of this level upwards, the potential for a wave up to 86.25 could open, from where the trend might continue to 88.45. This is a local target.

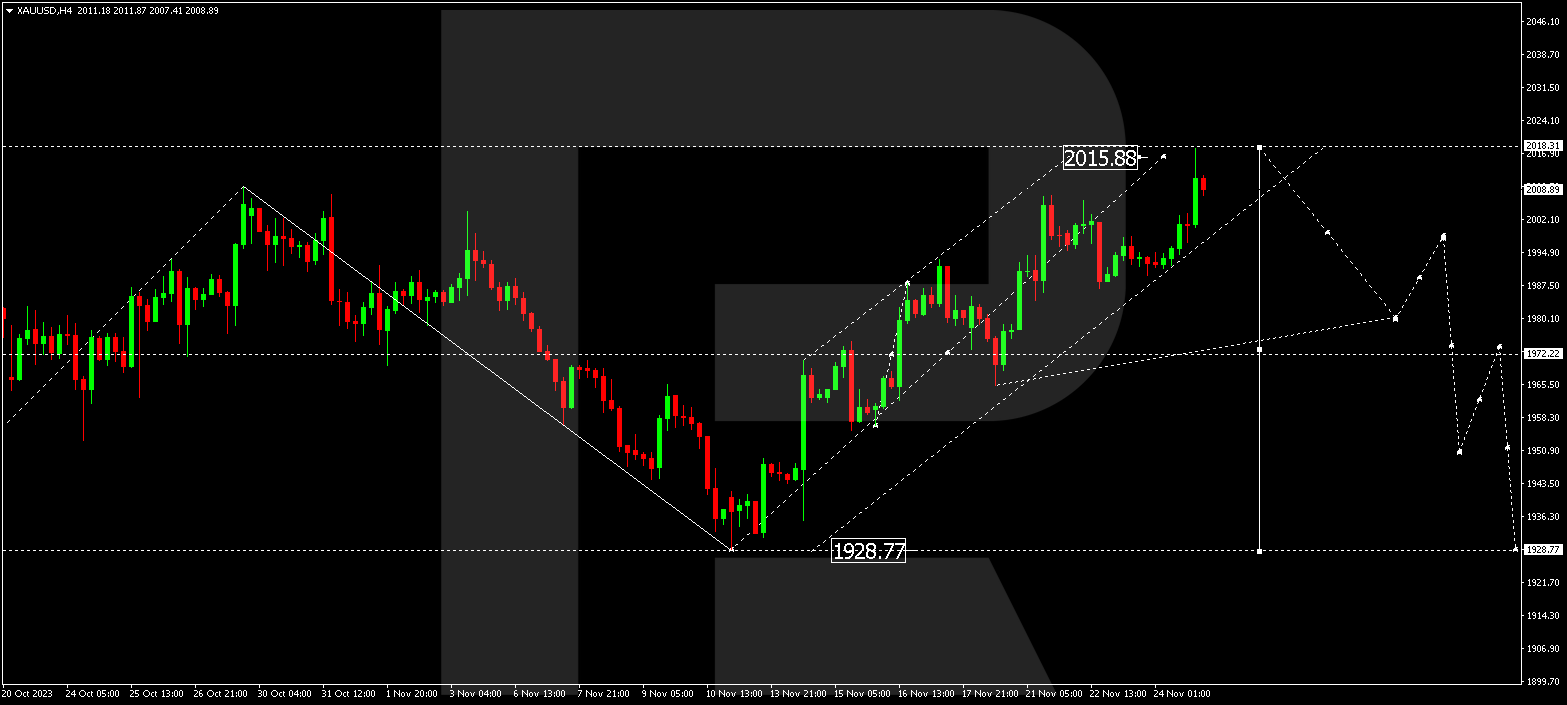

XAUUSD, “Gold vs US Dollar”

Gold continues forming a wide consolidation range around 1972.22. By now, the market has extended the range upwards to 2015.88. A decline structure to 1972.22 is expected today. With a breakout of this level downwards, the potential for the wave to 1928.77 might open. This is the first target.

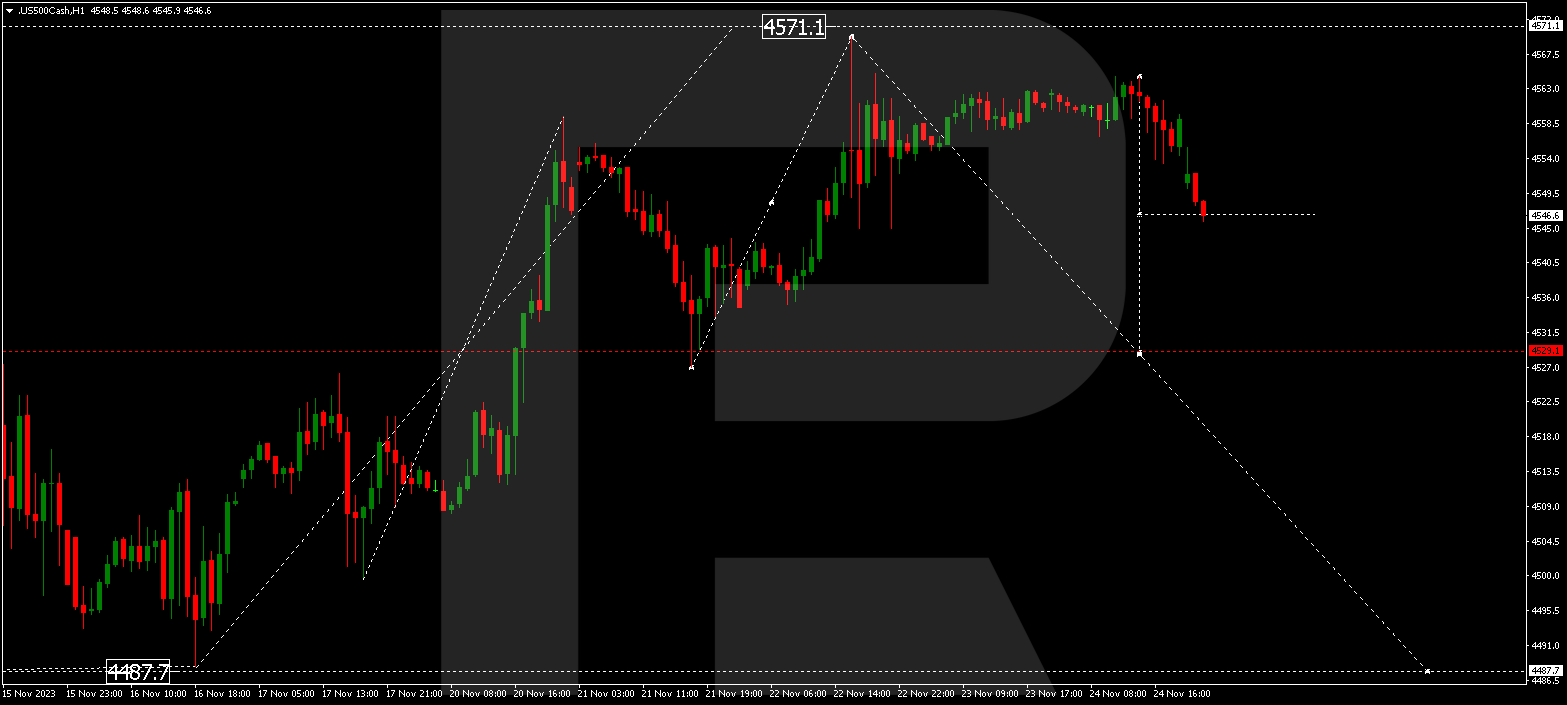

S&P 500

The stock index continues developing a consolidation range around 4530.0. By now, the market has extended the range to 4564.0. A decline link to 4530.0 is expected today. With a breakout of this level downwards, the potential for a decline wave to 4500.0 might open, from where the trend could continue to 4487.7. This is the first target.