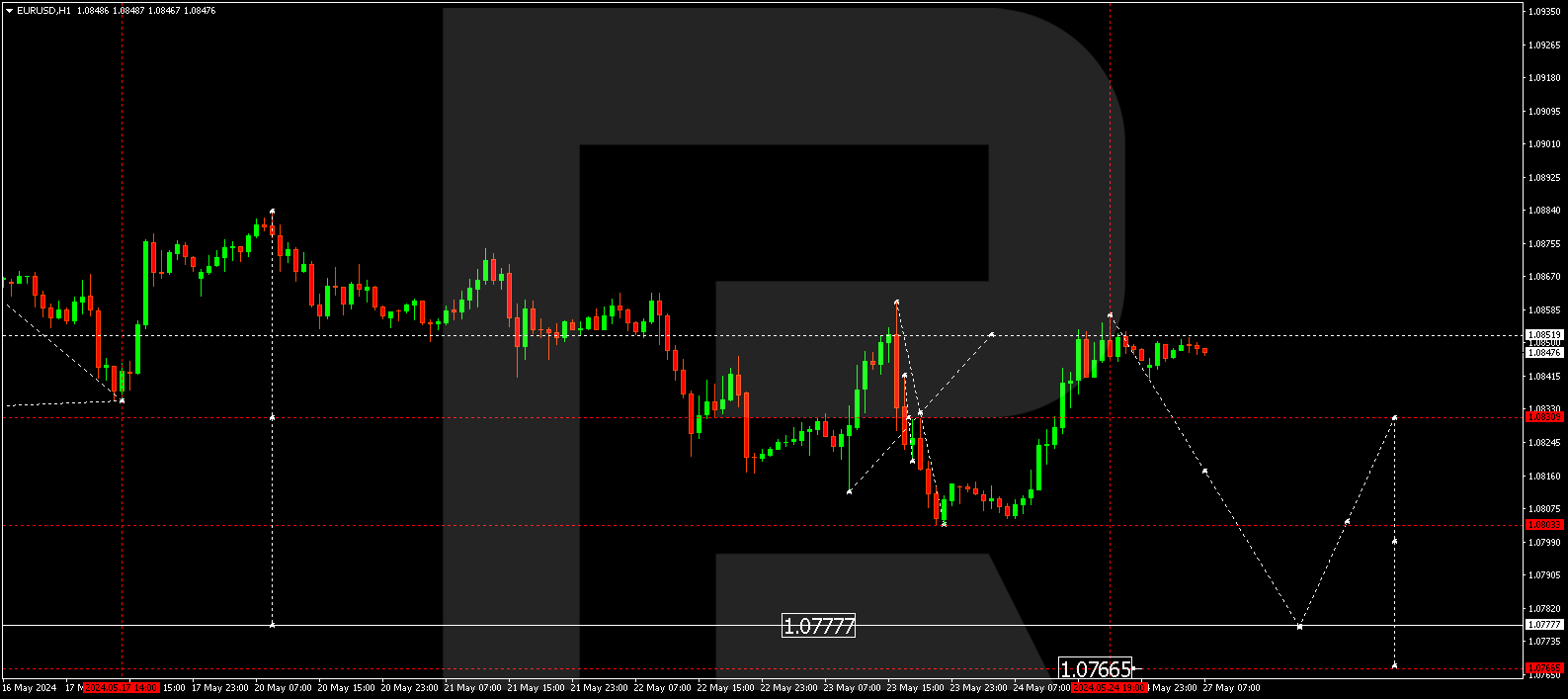

EURUSD, “Euro vs US Dollar”

The EURUSD pair is currently in a consolidation phase around 1.0830. The market has extended the range down to 1.0803, expanding it upwards to 1.0851 today. Another decline structure aiming for 1.0815 is expected. A breakout of this level will open the potential for a wave towards the local target of 1.0777.

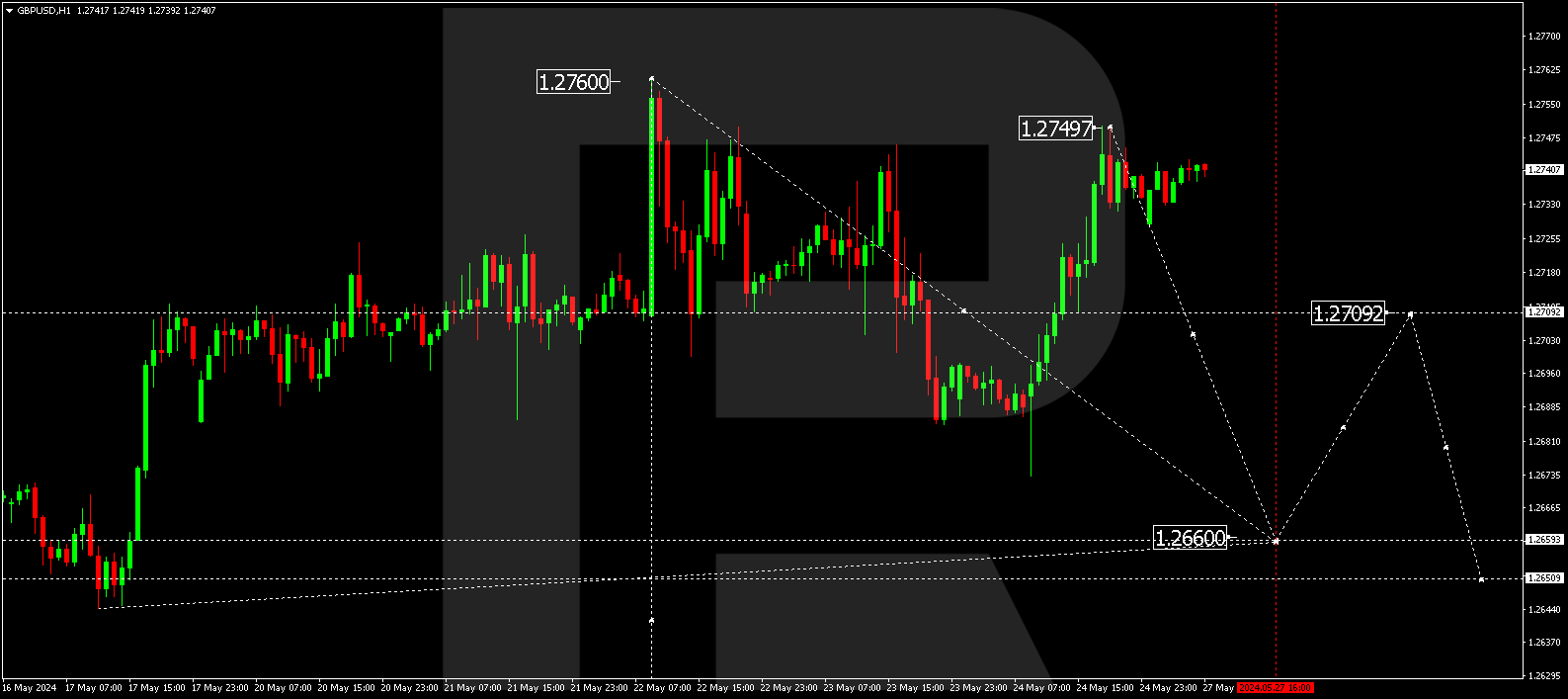

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair is currently in a consolidation phase around 1.2709. The market has extended the range towards 1.2749. A new decline wave is expected to start, aiming for 1.2660. Once the price reaches this level, a corrective phase is not ruled out, targeting 1.2709 (testing from below). A decline towards 1.2650 could follow, potentially continuing towards the local target of 1.2600.

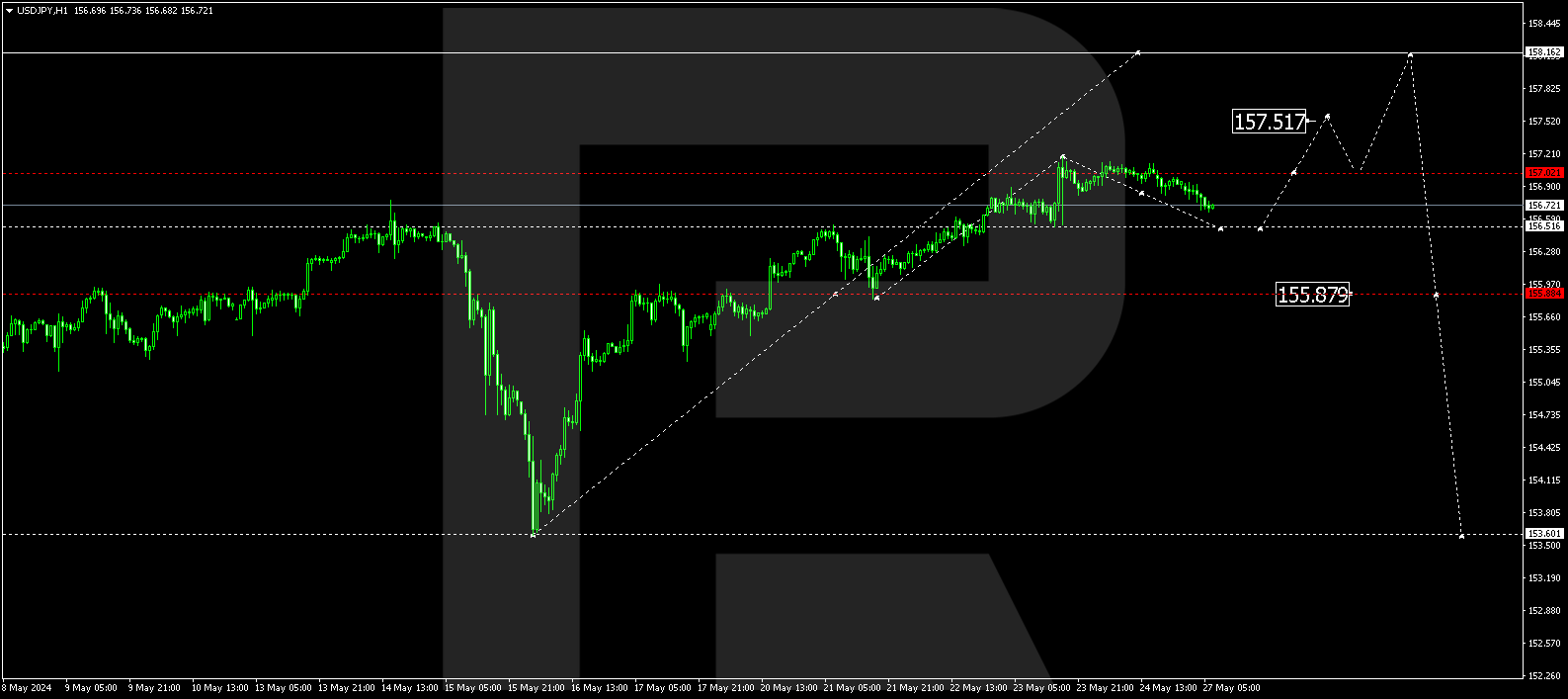

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair is forming a consolidation range around 156.51. The market has extended the range towards 157.18. Today, a decline towards 156.51 is expected (testing from above). A rise to 157.51 is not ruled out, potentially continuing towards 158.16. Subsequently, a new decline wave could start, aiming for 155.87 as the first target.

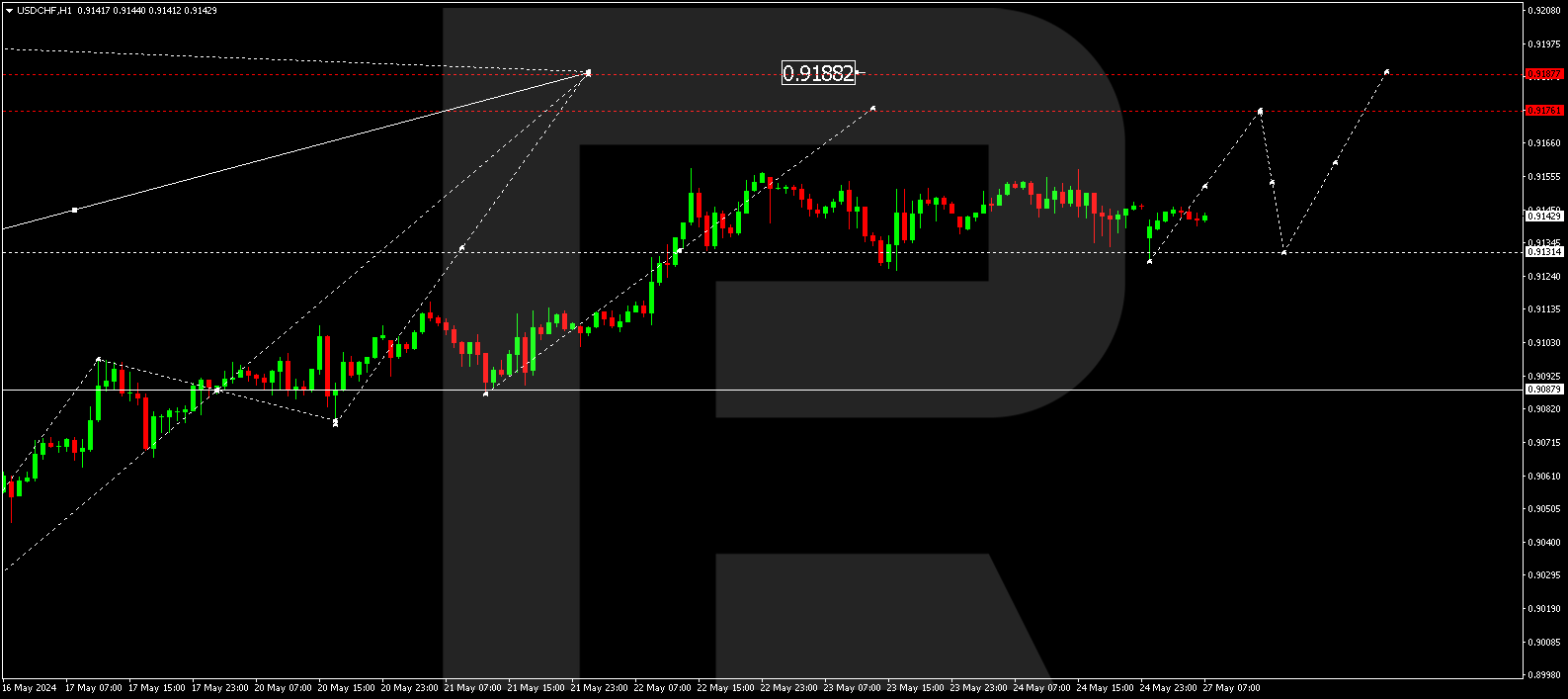

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair is currently in a consolidation phase around 0.9133 without any strong trend. Today, a link of growth towards 0.9176 is expected, with the trend potentially continuing to 0.9188. Next, a correction could start, aiming for 0.9090. Once the correction is complete, a rise towards 0.9220 is expected.

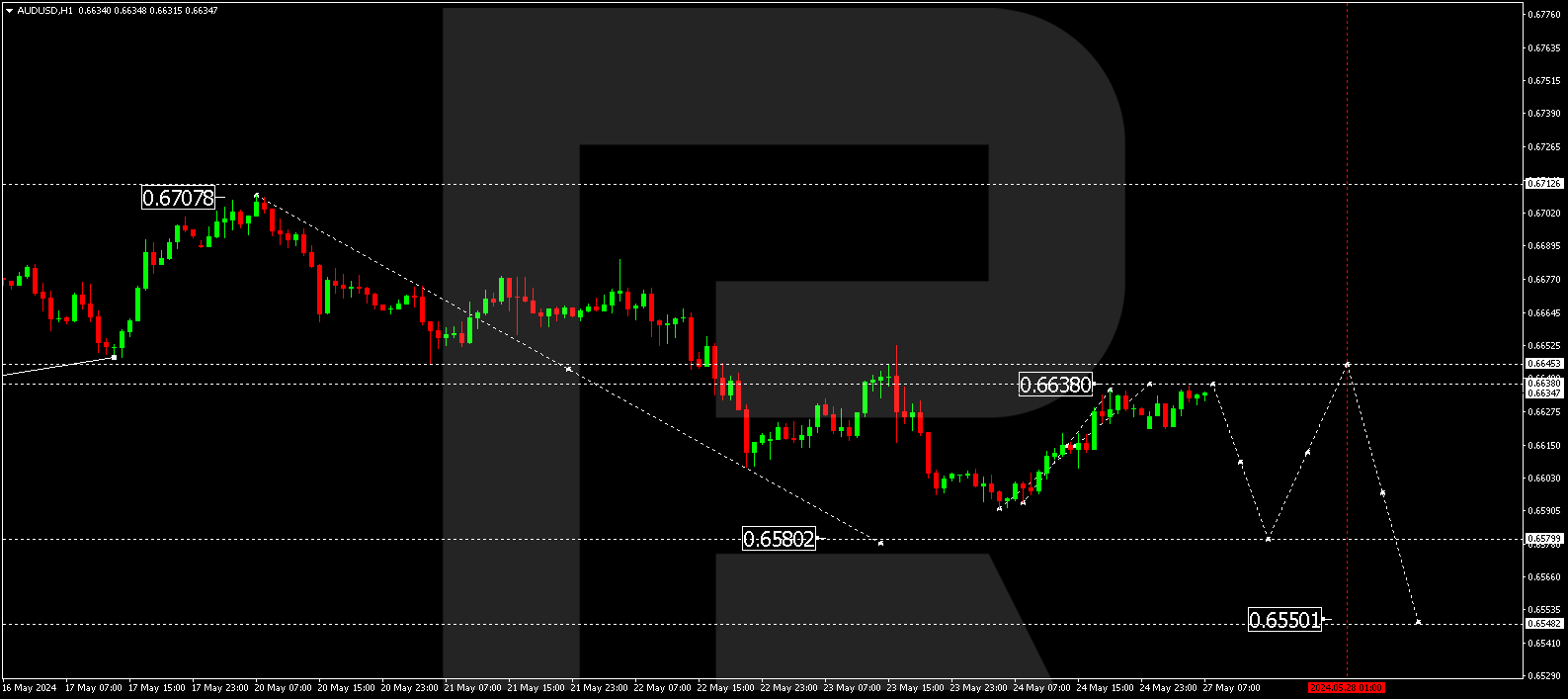

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair is forming a correction towards 0.6638. Once the correction is complete, a new decline wave could start, aiming for 0.6580 and potentially continuing towards 0.6550 as the first target.

BRENT

Brent is forming a growth wave towards 82.35. After the price reaches this level, a correction is not ruled out, targeting 81.40. Subsequently, a new growth structure could follow, aiming for 84.64 and potentially continuing towards 86.16 as the first target.

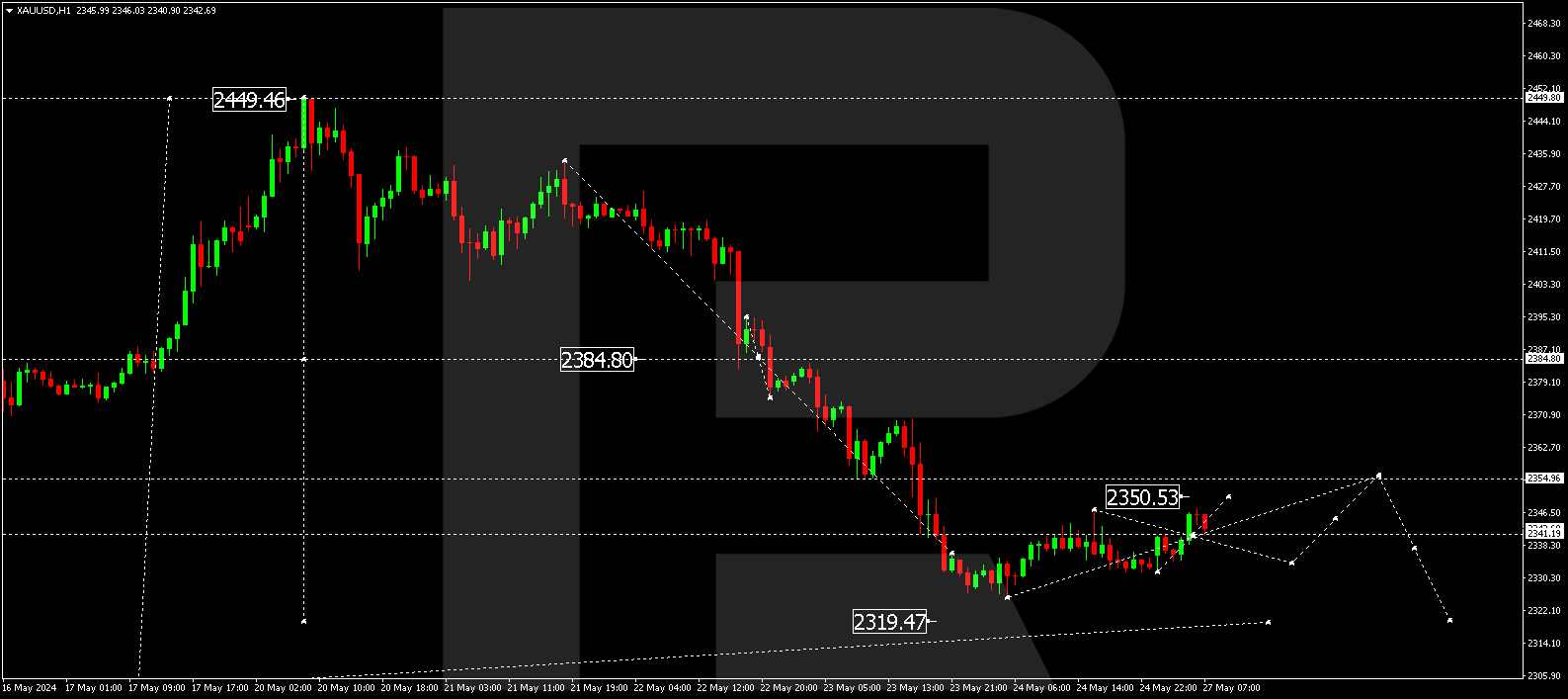

XAUUSD, “Gold vs US Dollar”

Gold is forming a consolidation range around 2341.20. Today, a rise towards 2355.00 could occur, followed by a decline towards 2319.50, representing the first target of the decline wave.

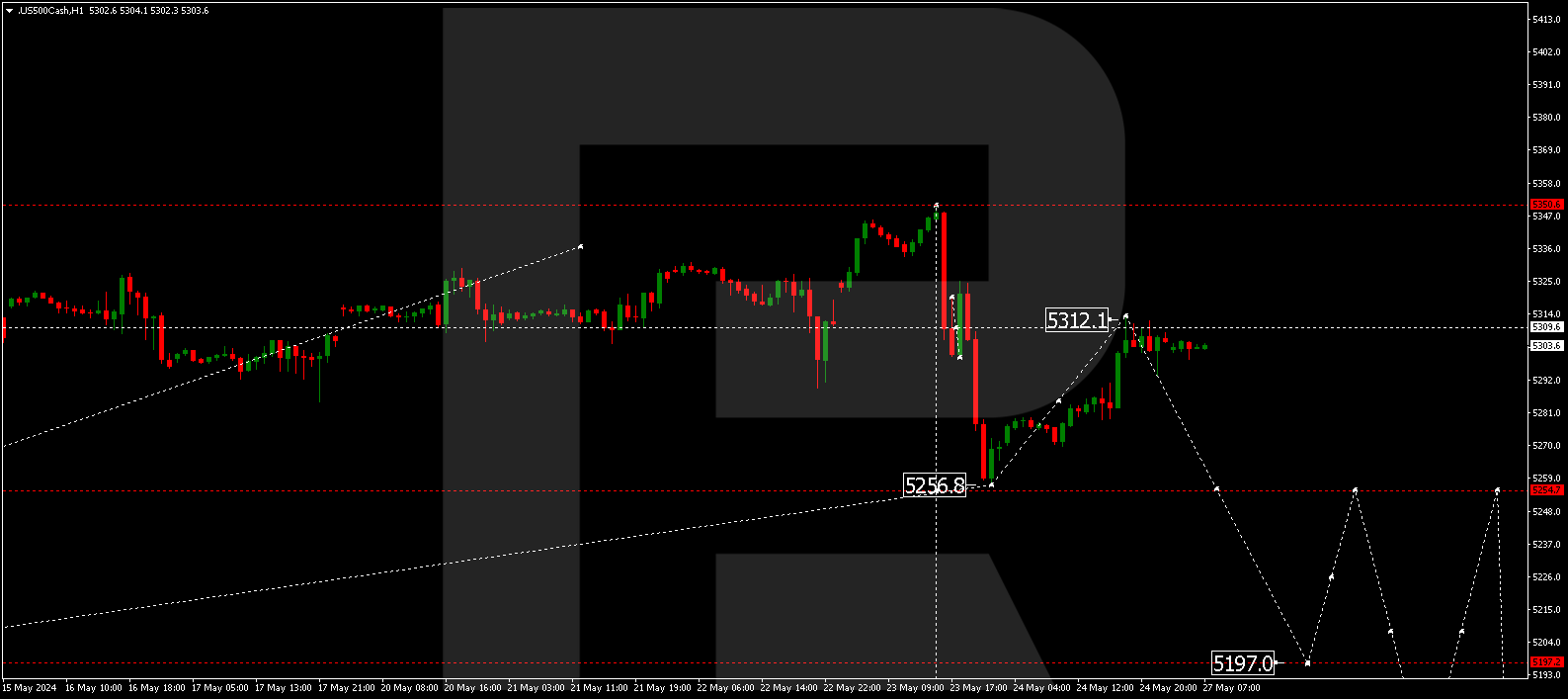

S&P 500

The stock index has formed a downward impulse targeting 5257.0 and a correction towards 5312.0. Today, the market is forming a consolidation range below this level. A downward breakout will open the potential for a wave towards 5197.0, potentially expanding towards 5160.0. This is the first target.