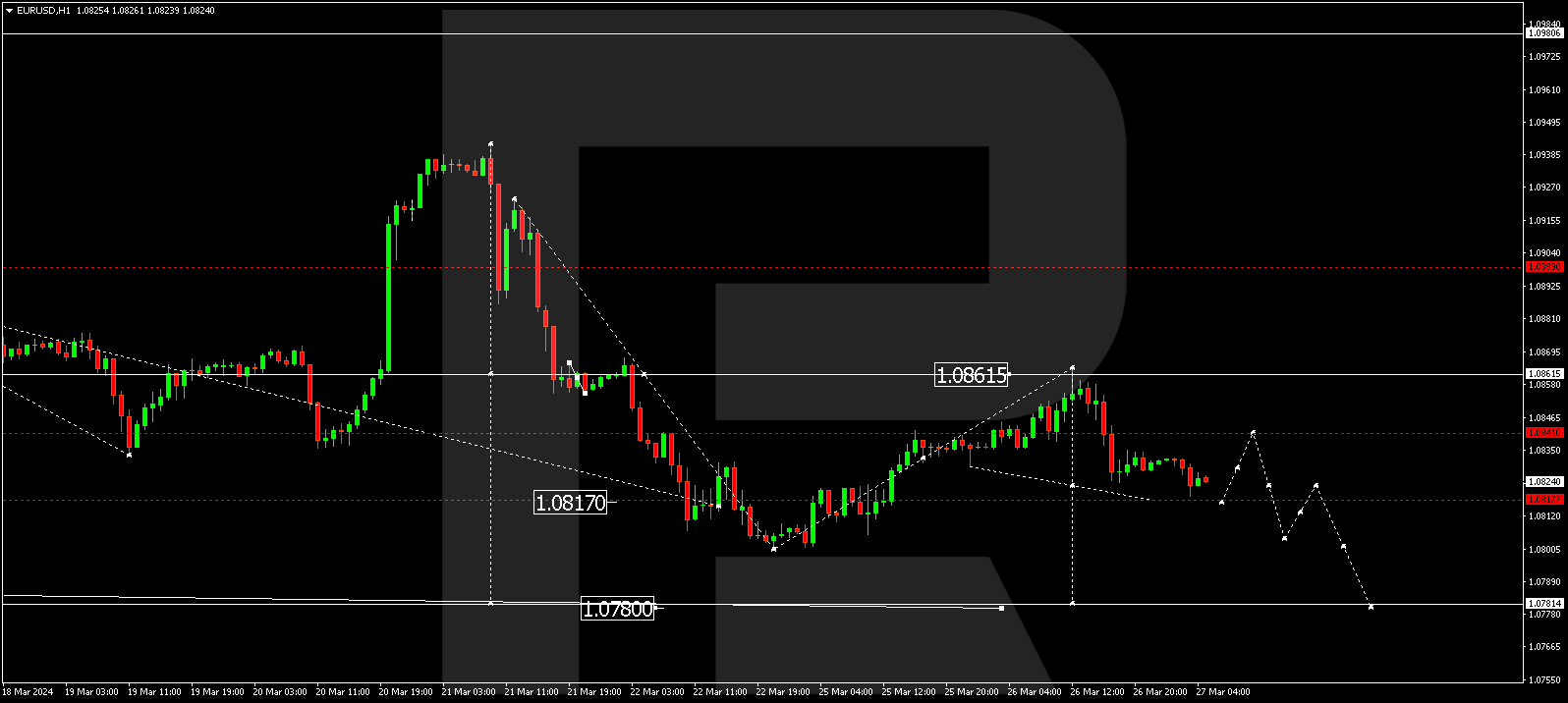

EURUSD, “Euro vs US Dollar”

The EURUSD pair corrected to 1.0863 and performed a decline wave to 1.0820. A consolidation range is currently forming above this level. With an upward escape from the range, a correction link towards 1.0840 is not excluded. With a downward breakout, the potential for a decline to 1.0805 might open, from which level the trend could continue to 1.0780.

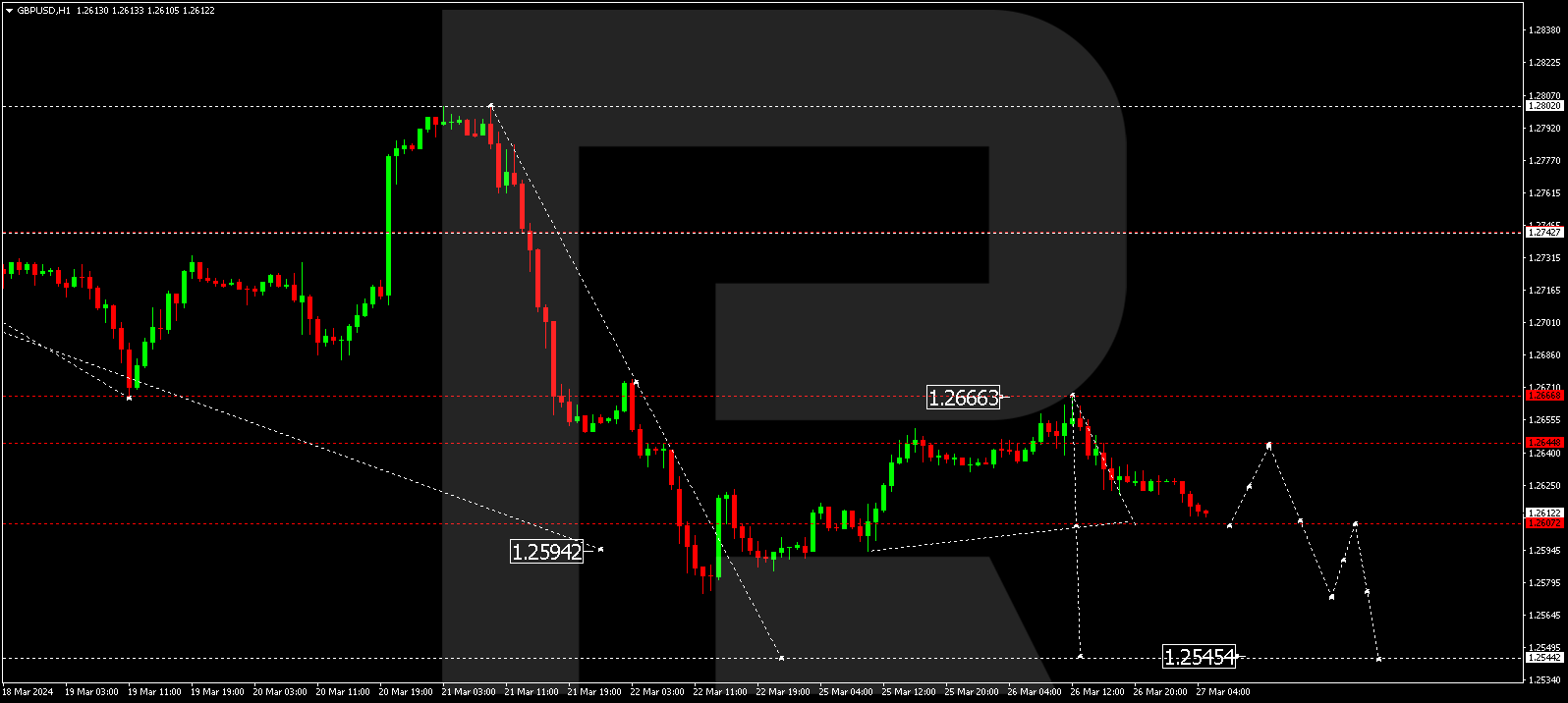

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair corrected to 1.2666 and formed a decline wave to 1.2608. Currently, a consolidation range is forming above this level. With an upward escape from the range, a correction towards 1.2636 is expected. With a downward breakout, the potential for a decline wave to 1.2574 might open, from which level the trend might extend to 1.2545.

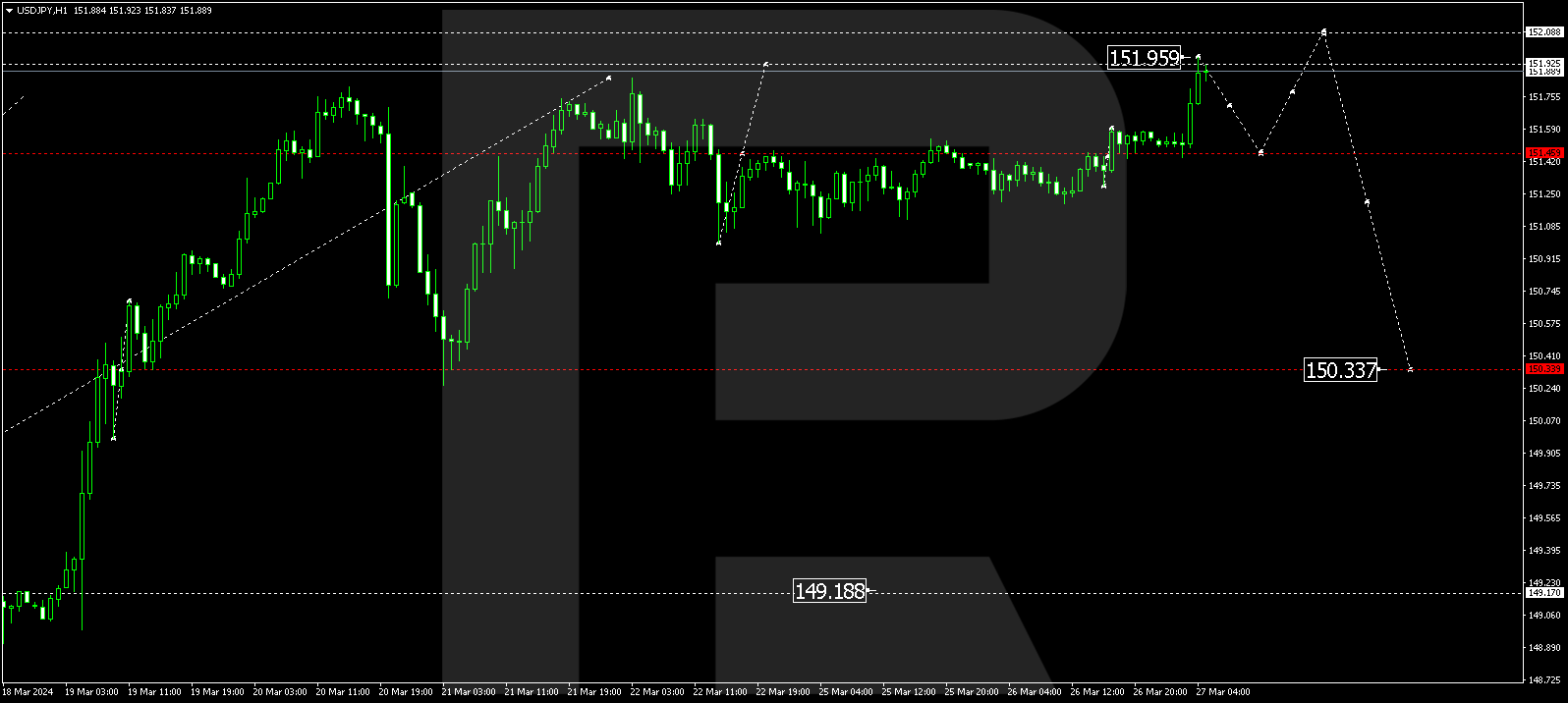

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a growth wave to 151.96. A correction towards 151.46 is not excluded today (testing from above). Once the correction is over, a growth wave to 152.10 could start, from which level the trend might extend towards 152.70.

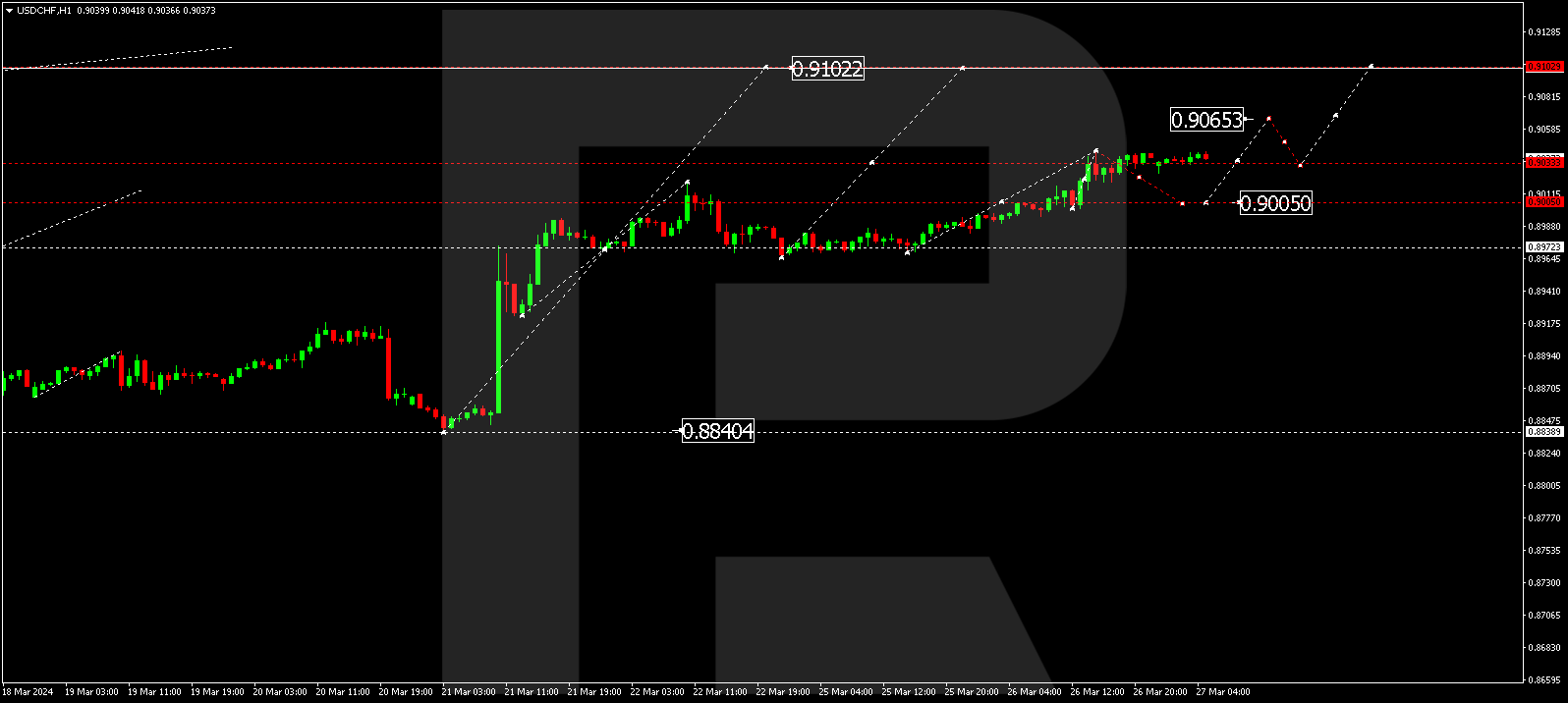

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has completed a growth wave towards 0.9040. A consolidation range is forming under this level today. With a downward escape from the range, a correction link to 0.9005 is not excluded, while with an upward breakout the potential for a growth wave towards 0.9066 might open, from which level the trend could continue to 0.9103.

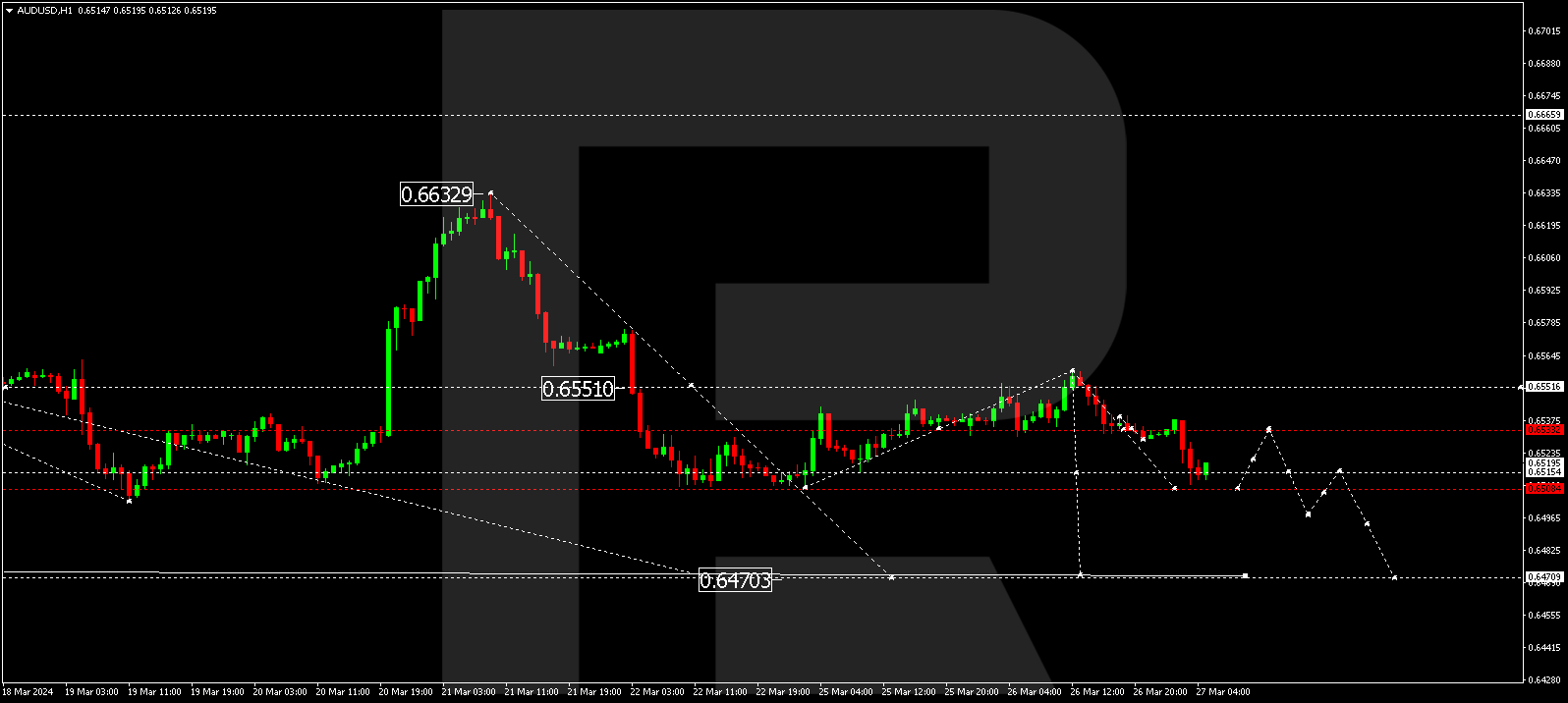

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair corrected towards 0.6557 and formed a decline wave to 0.6511 today. Currently, a consolidation range is forming above this level. With an upward escape from the range, the potential for a correction towards 0.6534 could open. A downward escape might open the potential for a decline to 0.6495, from which level the trend could continue to 0.6470.

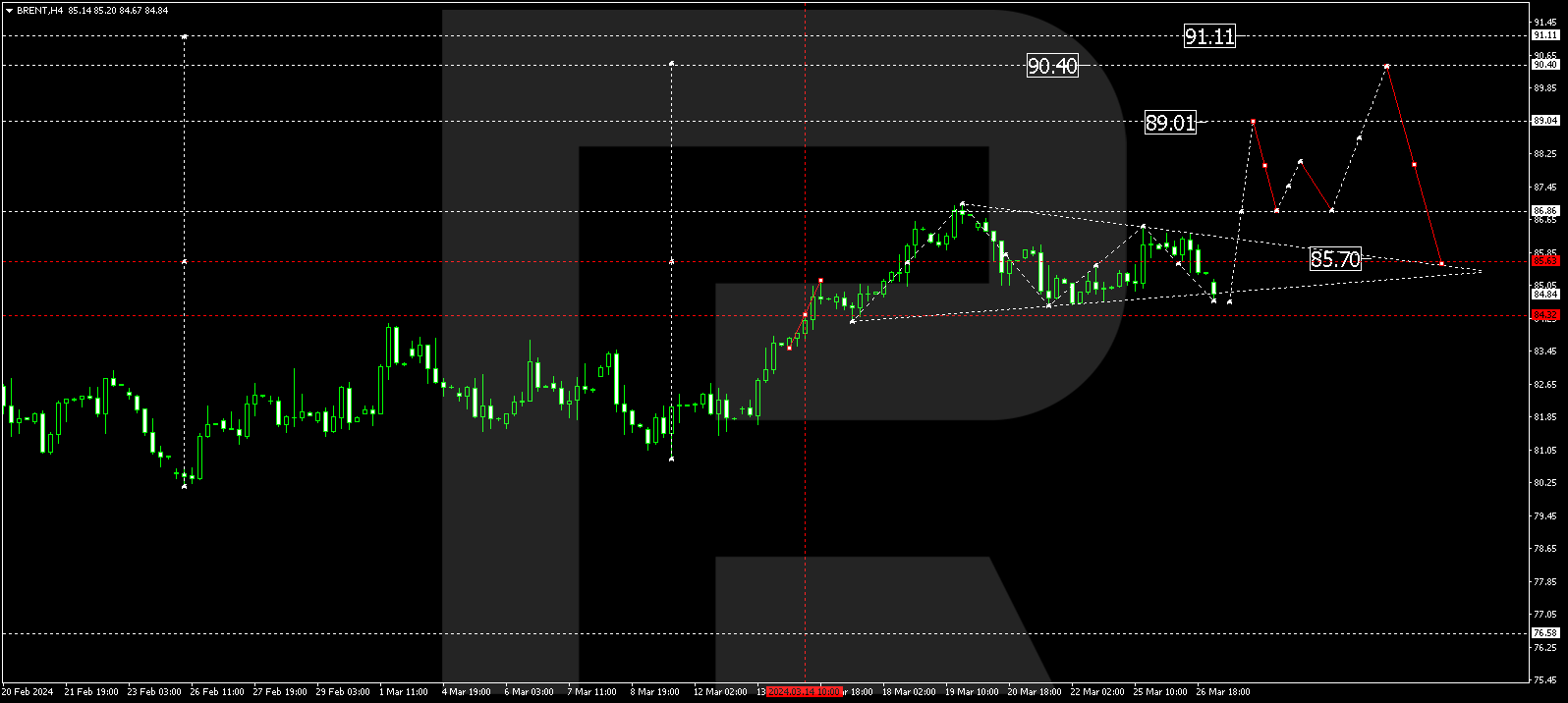

BRENT

Brent continues developing a consolidation range around 85.65 without any obvious trend. A decline link towards 84.33 is not excluded, followed by a rise to 86.86, from which level the trend might extend to 89.00. This is a local target.

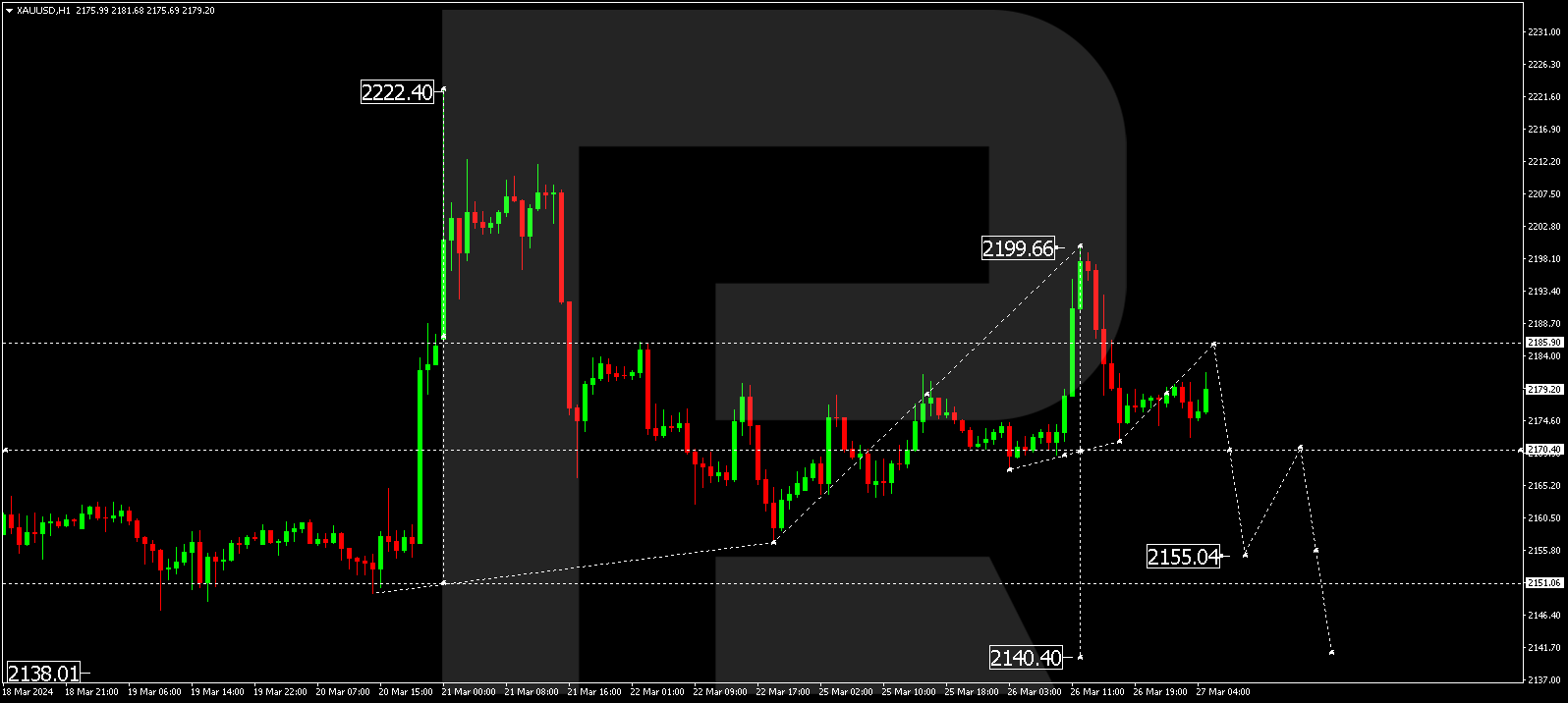

XAUUSD, “Gold vs US Dollar”

Gold has completed a correction wave to 2199.66 and a decline wave towards 2177.27 today. A consolidation range is currently forming above this level. With an upward escape from the range, a correction link to 2185.90 is not excluded. With a downward escape, the potential for a decline wave to 2155.33 might open, from which level the trend could extend to 2140.40.

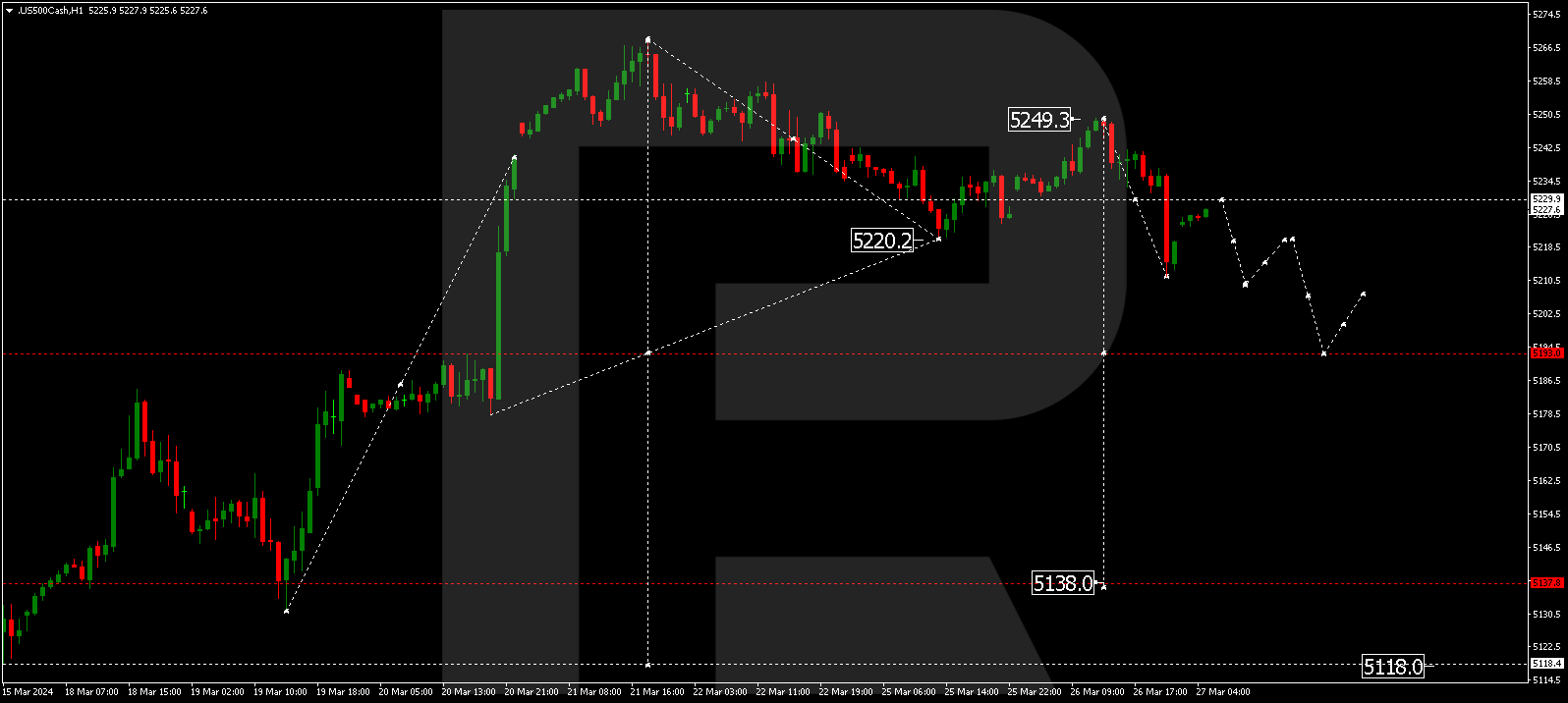

S&P 500

The stock index has completed a correction wave to 5249.3 and a decline wave to 5212.0. A consolidation range is currently forming above this level. With an upward escape from the range, a correction link to 5230.0 is not excluded. With a downward escape, the potential for a wave to 5200.0 might open, from where the trend could continue to 5193.0. This is a local target.