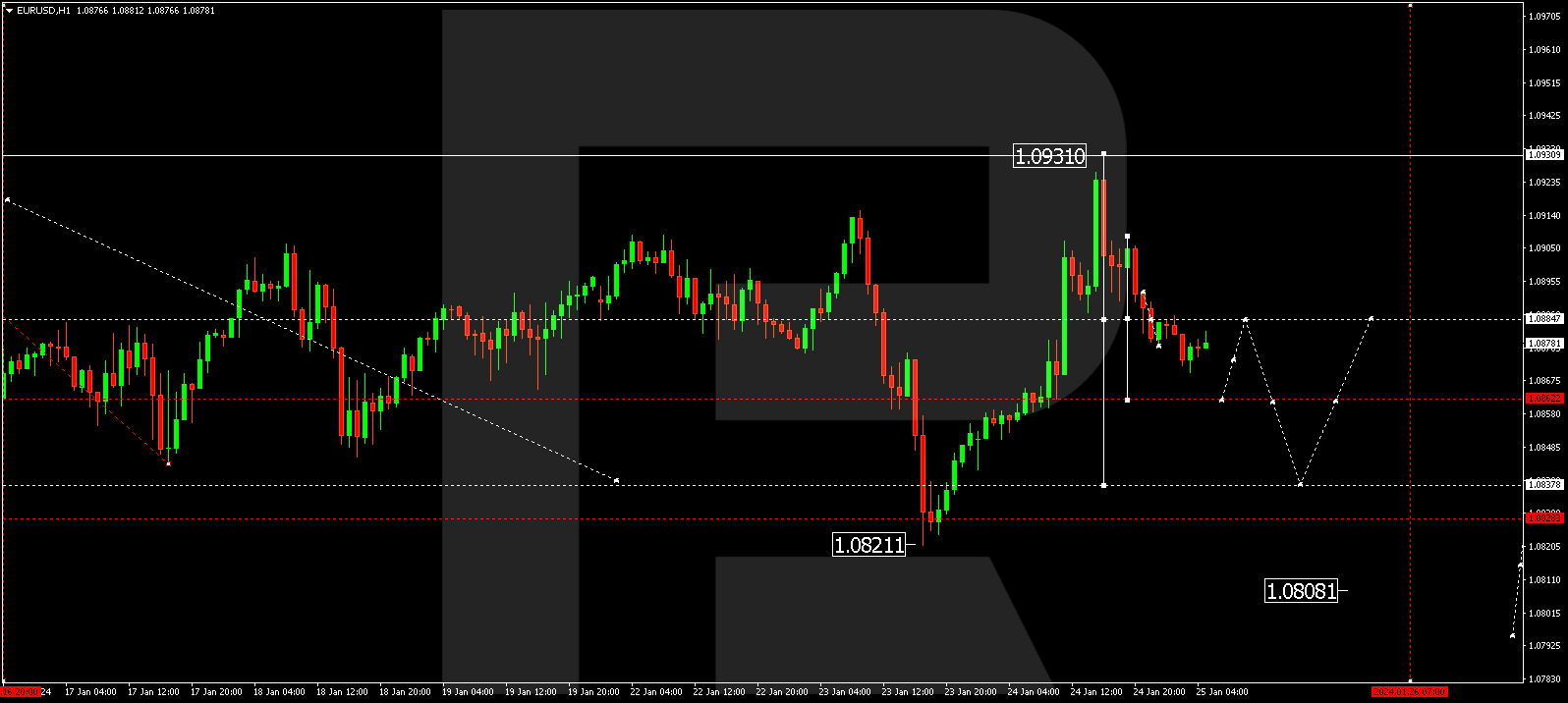

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction wave to 1.0931 (a test from below), forming a decline impulse to 1.0889 and its correction to 1.0907 today. A structure of the second decline impulse to 1.0862 is currently forming. Upon reaching this level, the quotes might correct to 1.0884 (a test from below) and subsequently drop to 1.0833. This is the first target.

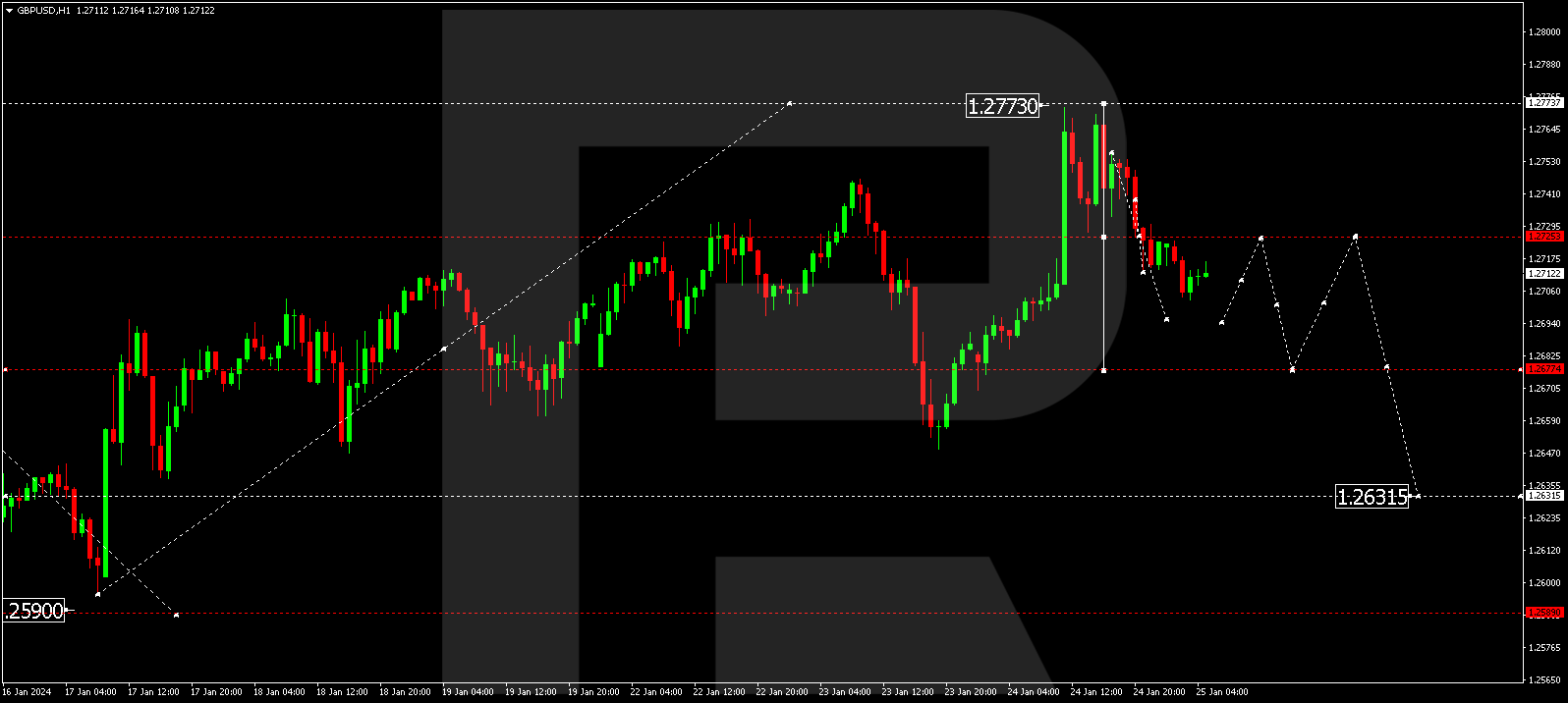

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has formed a correction wave to 1.2773, performing a decline impulse to 1.2733 and its correction to 1.2755 today. A structure of the second decline impulse to 1.2695 is currently forming, which might later be followed by a correction link to 1.2722 (a test from below). Next, the wave could extend to 1.2675, which is the first target.

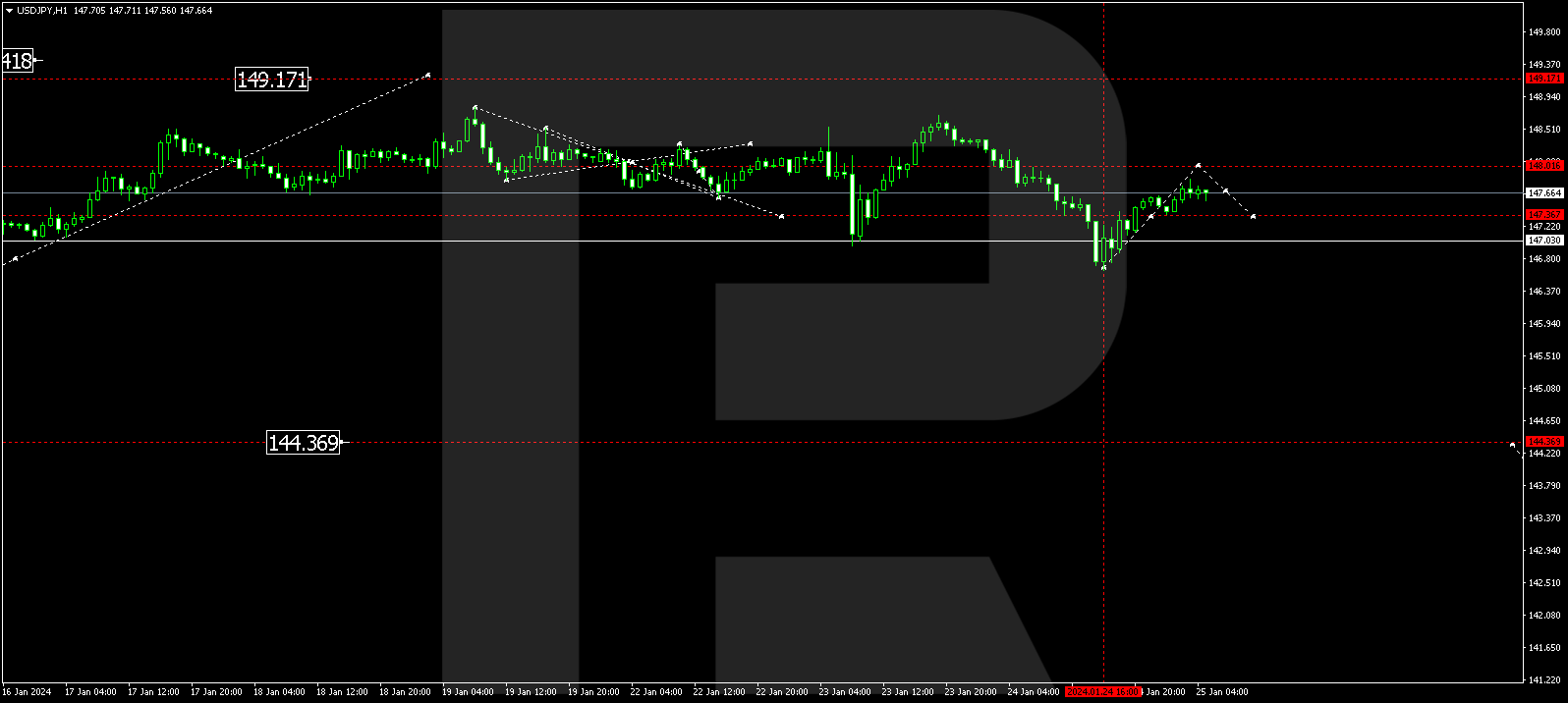

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is forming a growth structure to 148.02. Once this level is reached, a correction link to 147.40 is not excluded. Next, the pair could rise to 149.17. This is the first target.

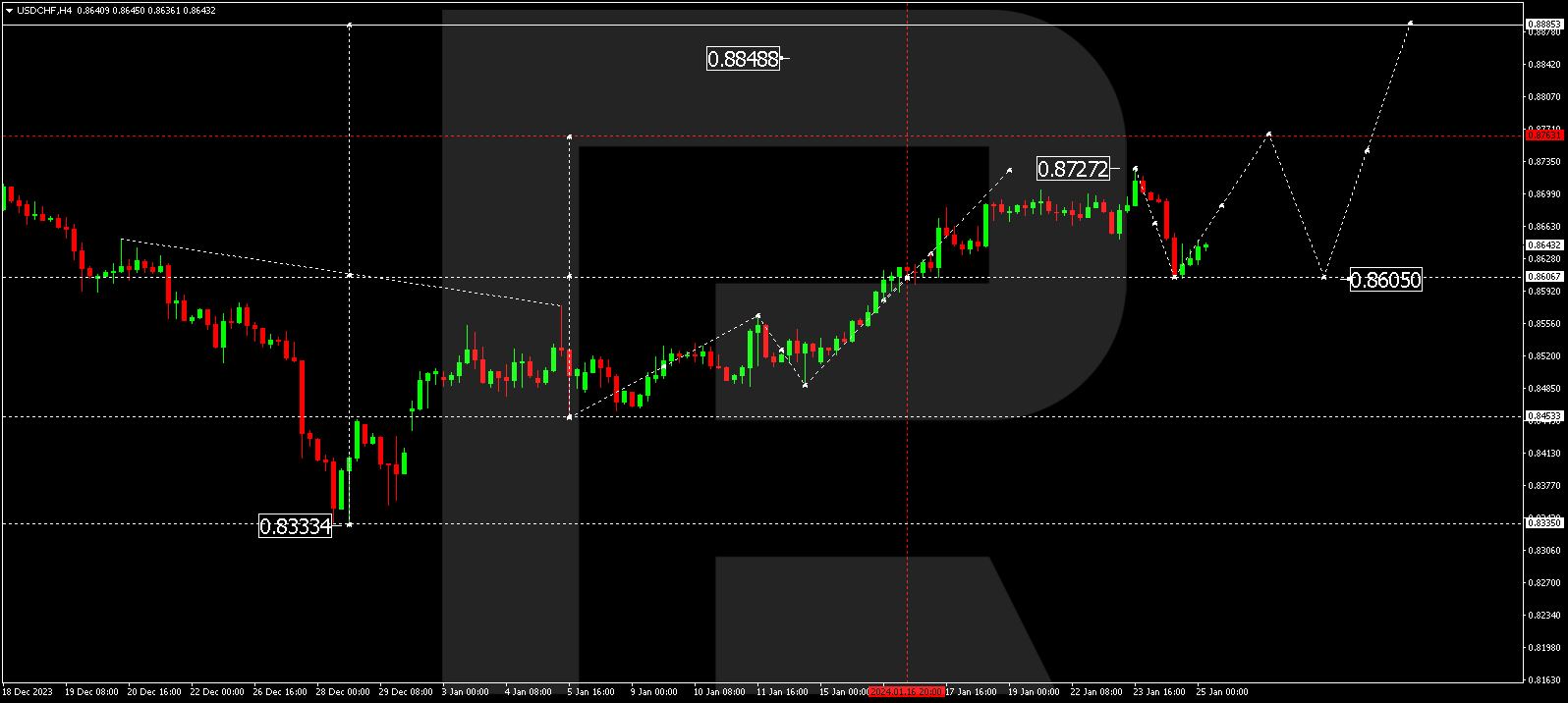

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a correction wave to 0.8605. A growth wave to 0.8686 might develop today. With a breakout of this level, the potential for a rise to 0.8727 might open, from where the trend could extend to 0.8760.

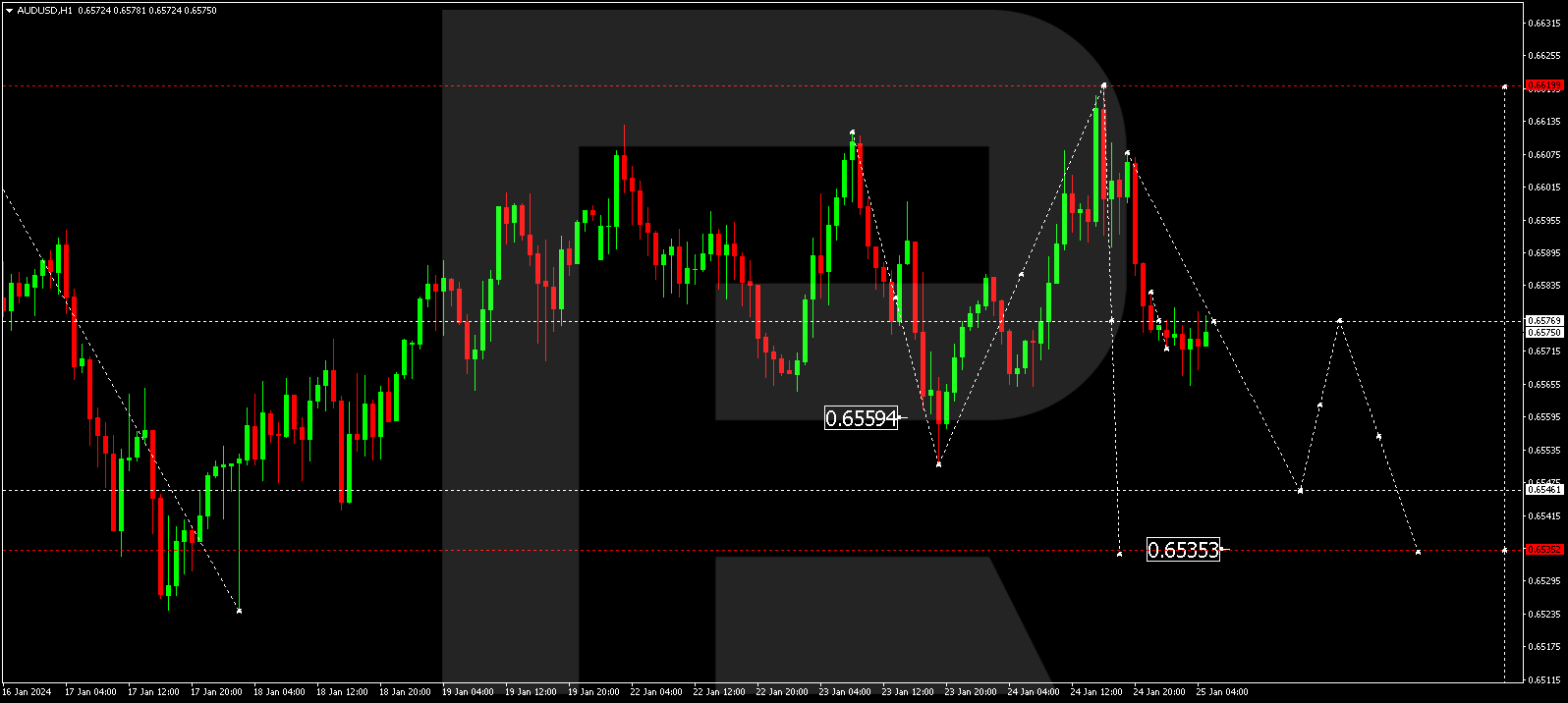

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has performed a decline wave to 0.6577, and today the market is forming a consolidation range around this level. An escape from the range downwards and a wave continuation to 0.6546 is expected. This is a local target. Once it is reached, a link of correction to 0.6577 is not excluded (a test from below), followed by a decline to 0.6536, which is the first target.

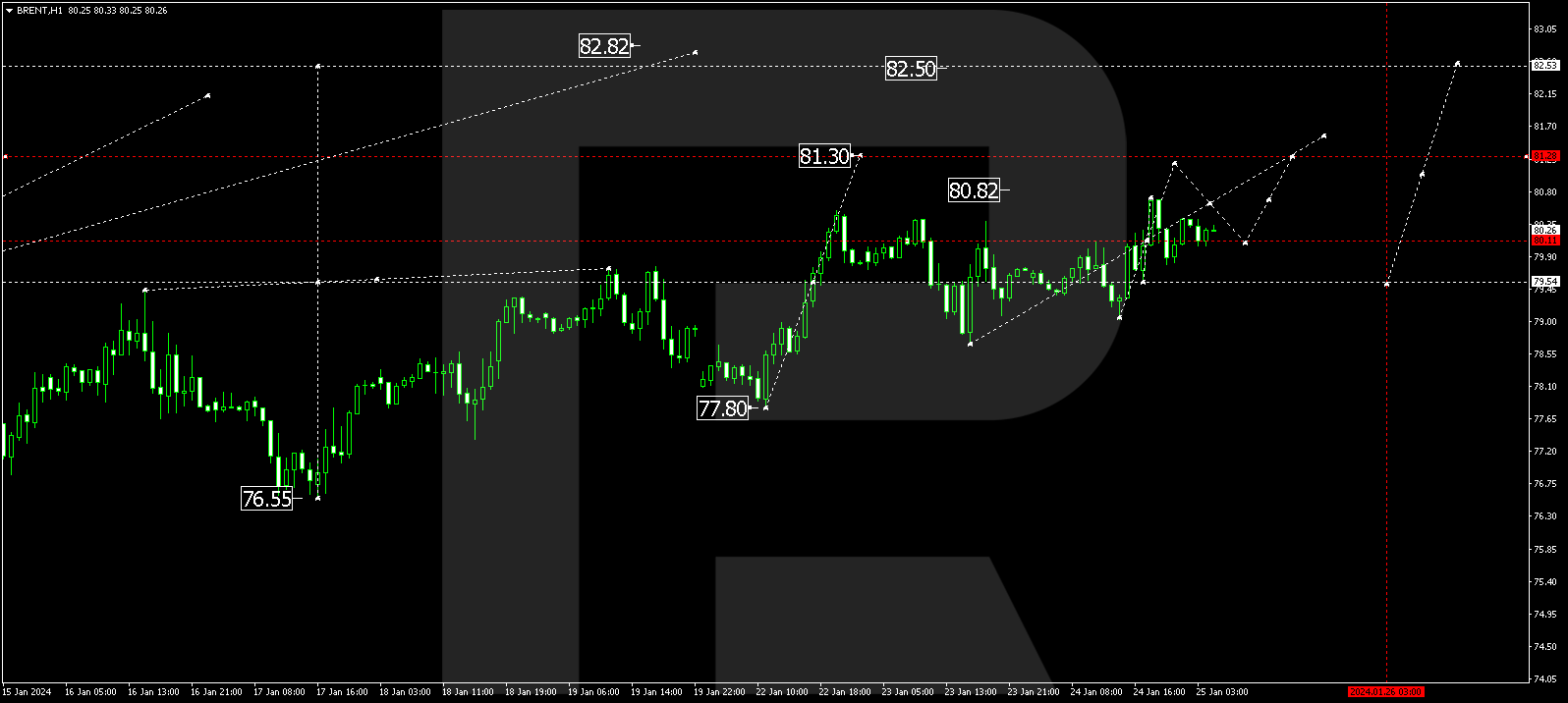

BRENT

Brent has completed a growth structure to 80.72. Today the market has corrected to 79.80. A consolidation range is currently forming above this level. An escape upwards and further development of the wave towards 81.20 is expected, from where the trend could continue to 82.55. This is a local target.

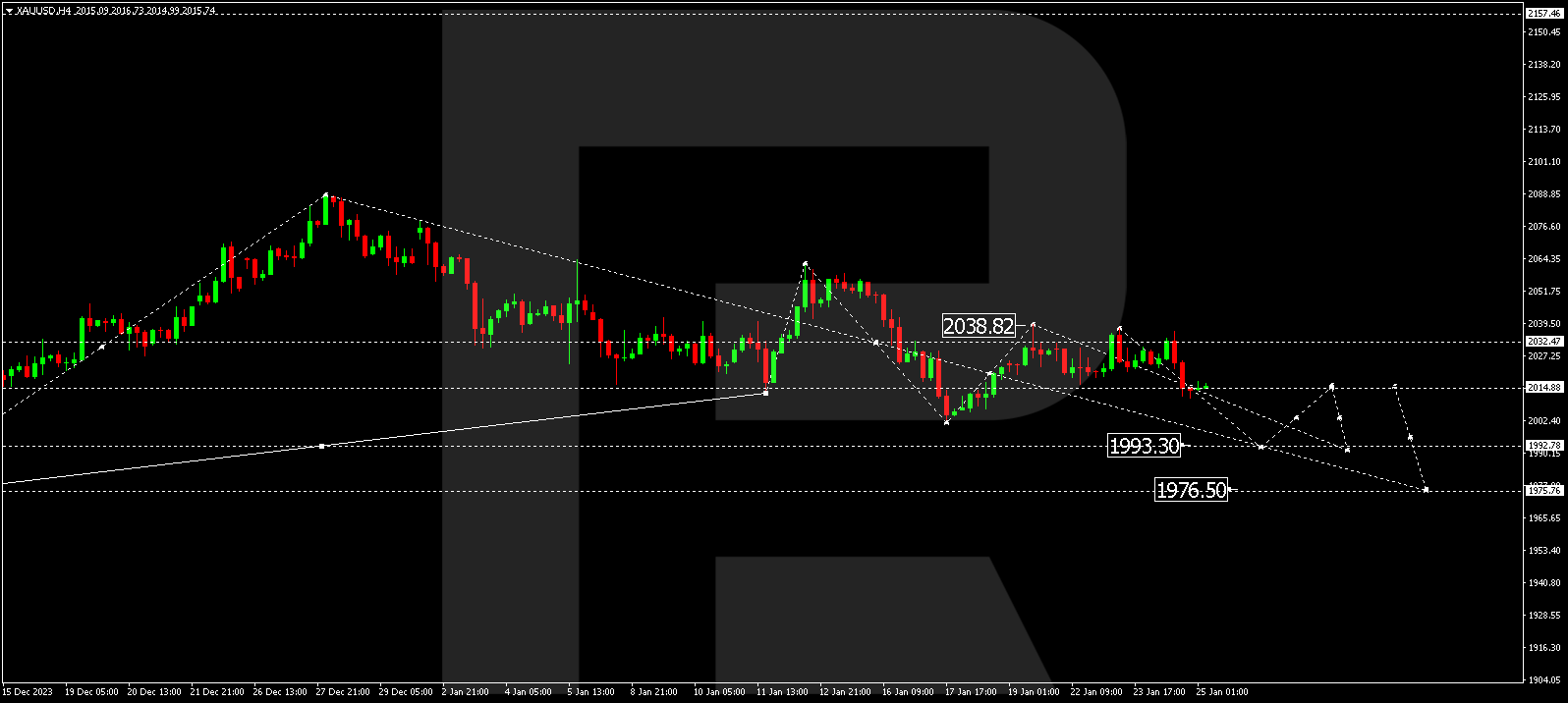

XAUUSD, “Gold vs US Dollar”

Gold has performed a decline wave to 2011.17. Currently, the market is forming a narrow consolidation range. A downward escape from the range could open the potential for a decline wave to 1993.30, followed by a correction to 2014.00 (a test from below). Next, a decline to 1976.50 might form. This is a local target.

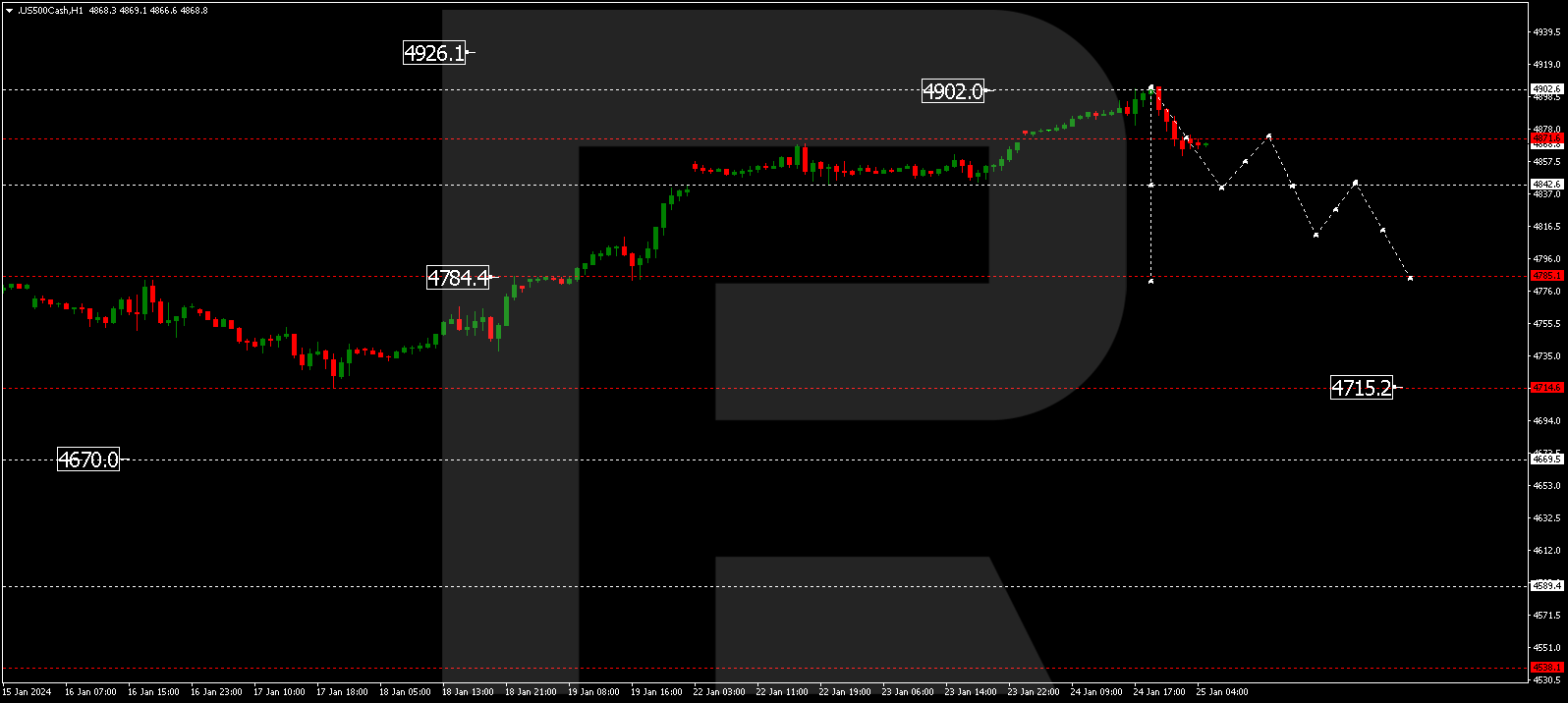

S&P 500

The stock index has completed a structure of a growth wave to 4902.0. Today the market is forming a decline structure to 4842.5. Once this level is reached, a correction to 4871.0 is forming. Next, a decline to 4815.5 might follow. This is a local target.