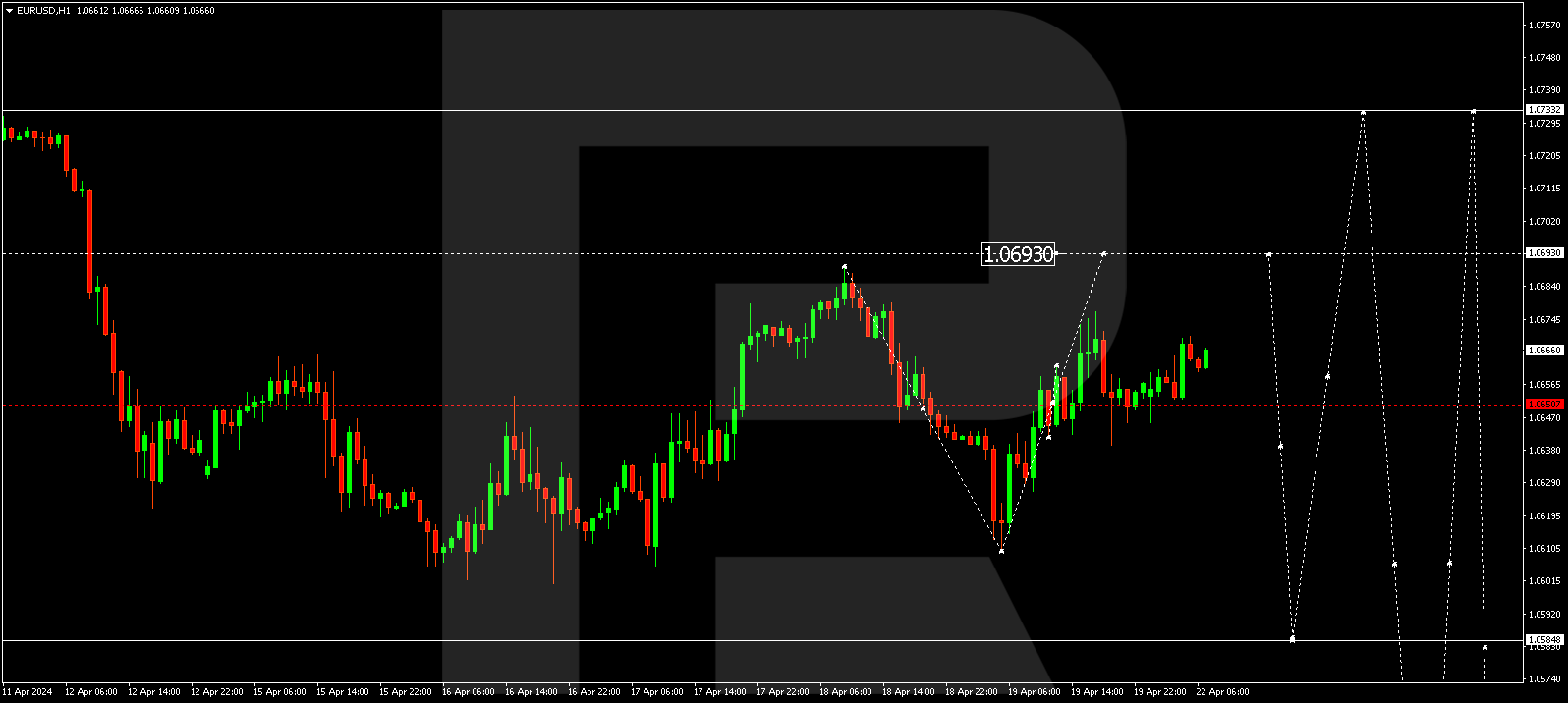

EURUSD, “Euro vs US Dollar”

The EURUSD pair continues developing a consolidation range around 1.0650. A growth link targeting 1.0693 is not excluded, after which a decline towards 1.0585 might follow. This is a local target. Once this level is reached, a correction to 1.0733 could begin, followed by a decline to 1.0440.

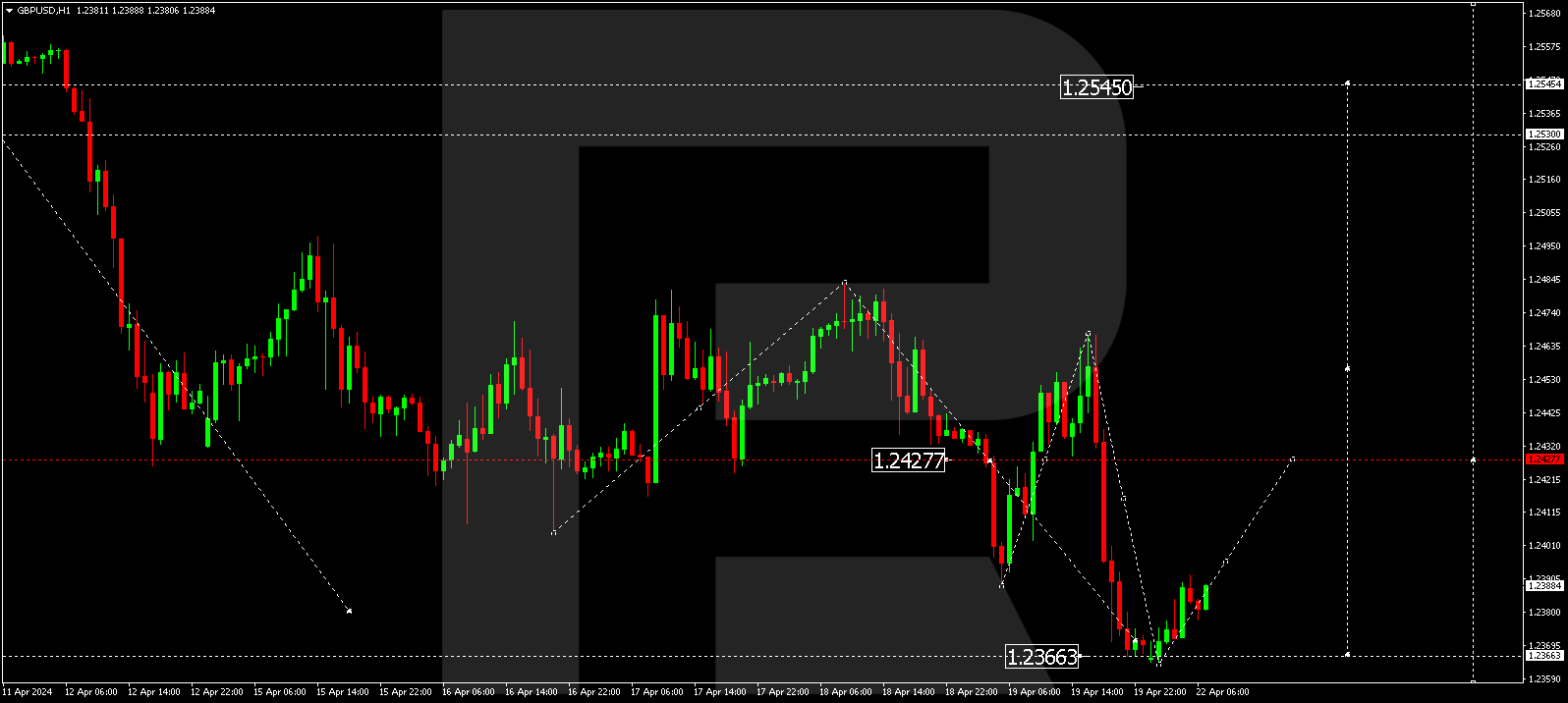

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a decline link targeting 1.2366. Today the market is forming a consolidation range above this level. With an upward escape from the range, a correction towards 1.2545 could start. With a downward escape, the trend could extend to 1.2222. This is a local target.

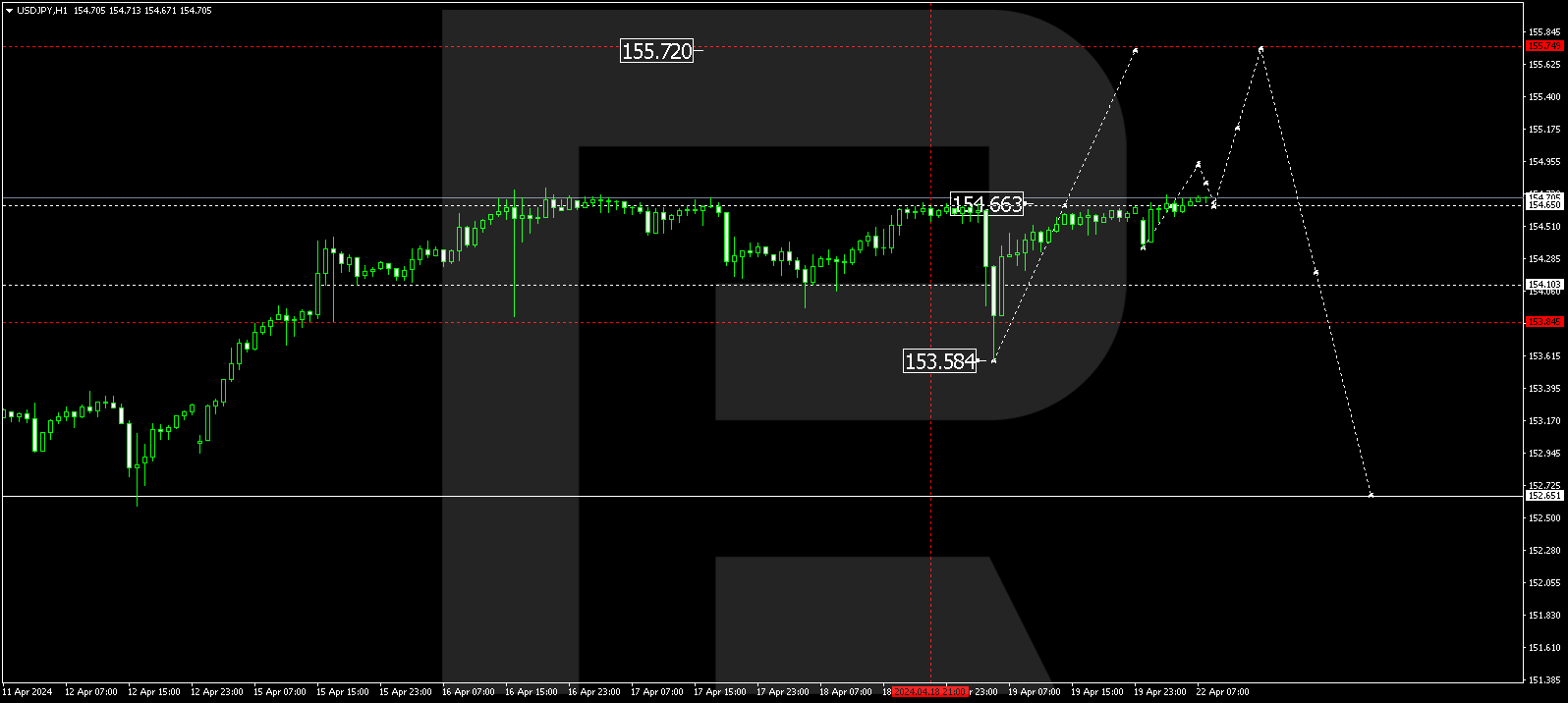

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair is forming a consolidation range around 154.65. An upward escape from the range might open the potential for a wave towards 155.15. With a downward escape, a correction link targeting 154.33 is not excluded, followed by a rise to 155.75. This is the first target.

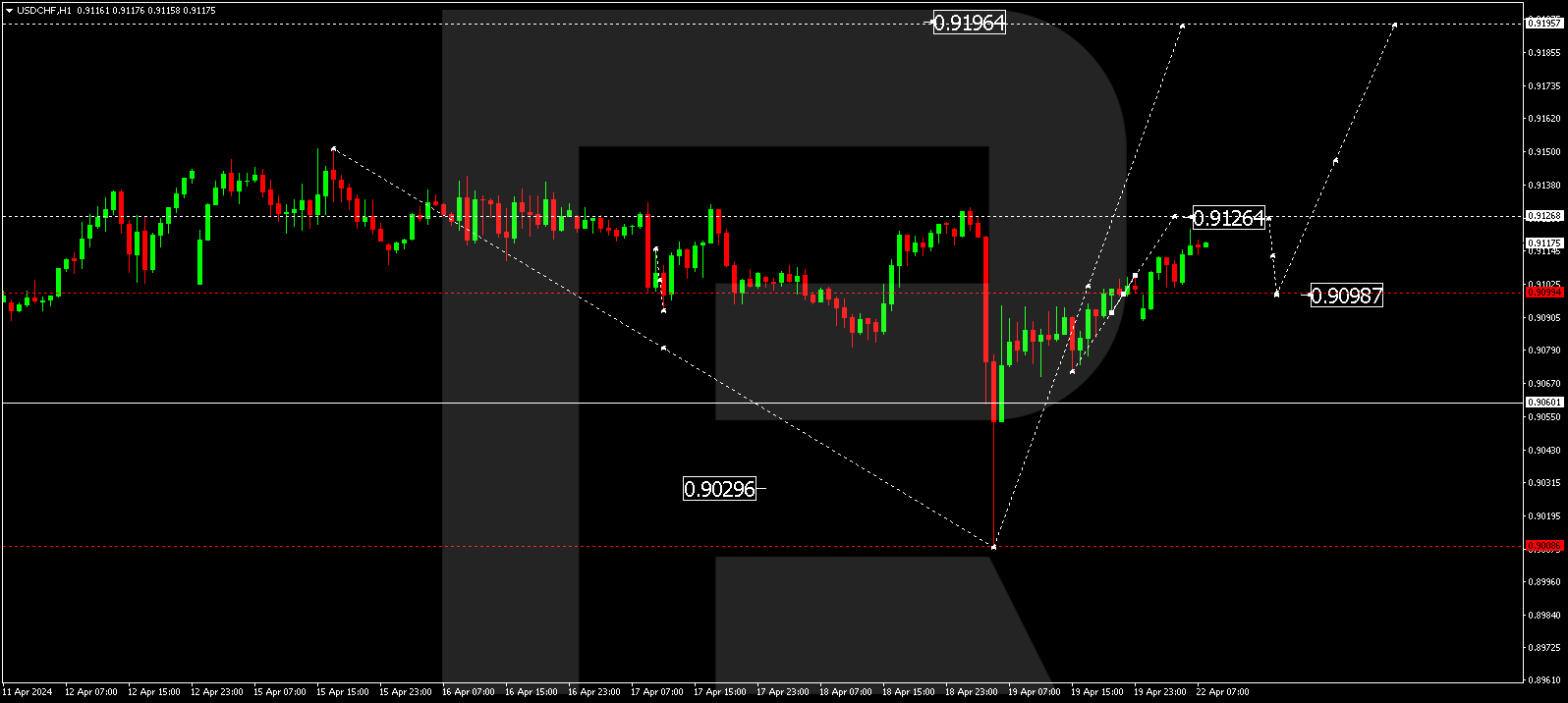

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has formed a consolidation range around 0.9099. With an upward escape from the range, the potential for a wave towards 0.9126 could open, from where the trend might extend to 0.9195. This is a local target. With a downward escape from the range, a correction link targeting 0.9060 is not excluded, followed by further development of the growth wave towards 0.9195.

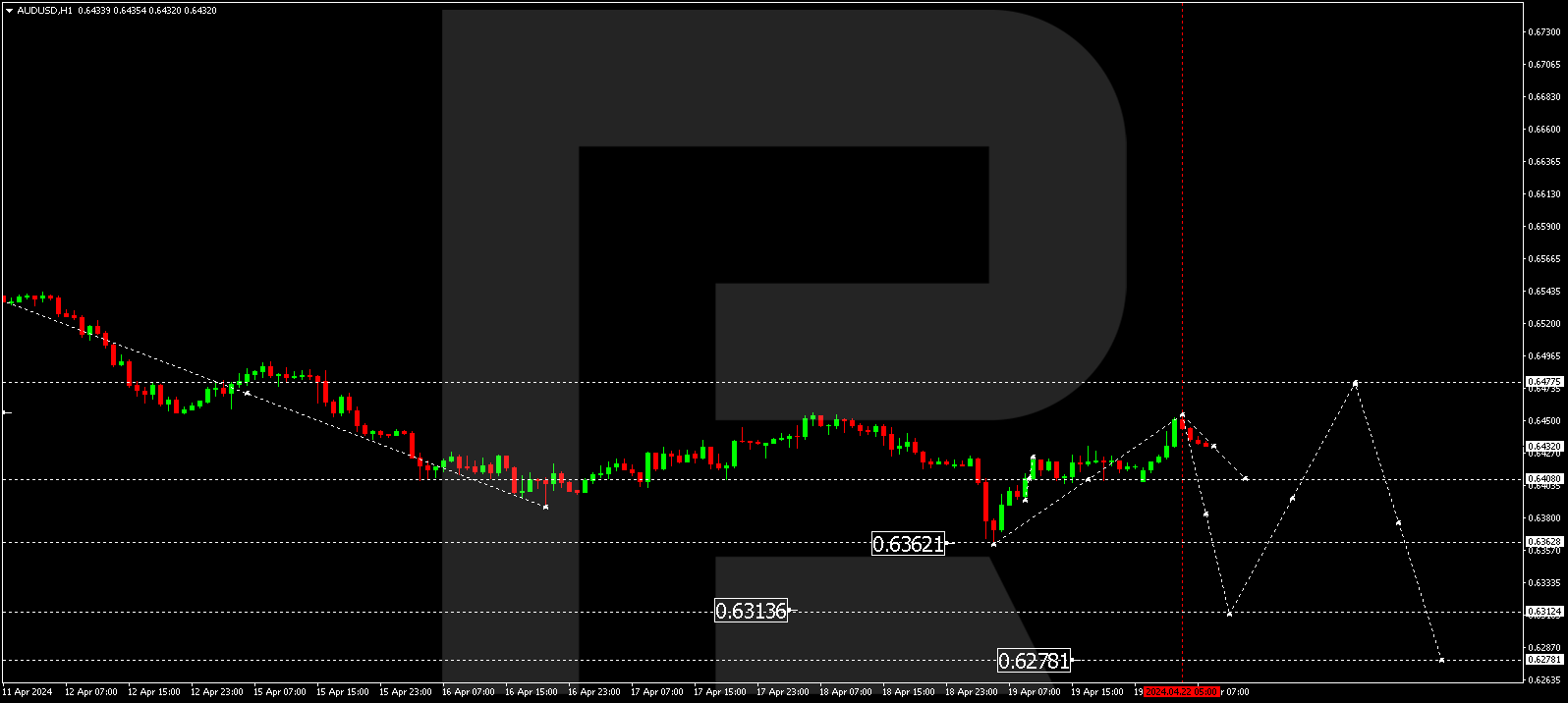

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair continues developing a consolidation range around 0.6408. With a downward escape from the range, the potential for a wave towards 0.6306 might open. With an upward escape from the range, a correction towards 0.6500 could follow, from where the trend could extend to 0.6300.

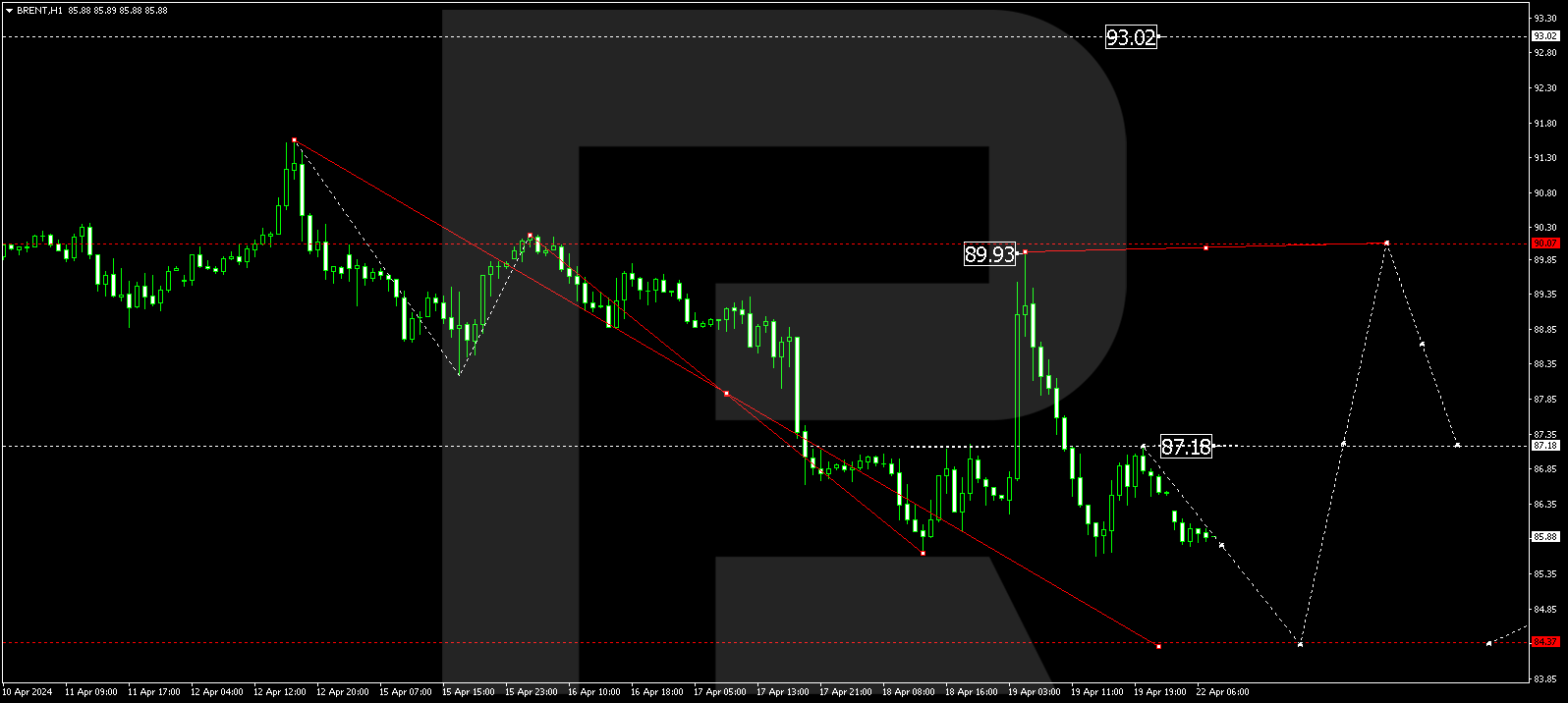

BRENT

Brent continues developing a consolidation range around 87.17. With a downward escape from the range, a further correction towards 84.44 is not excluded. With an upward escape, the potential for a wave targeting 90.00 might open, from which level the trend could extend to 95.00.

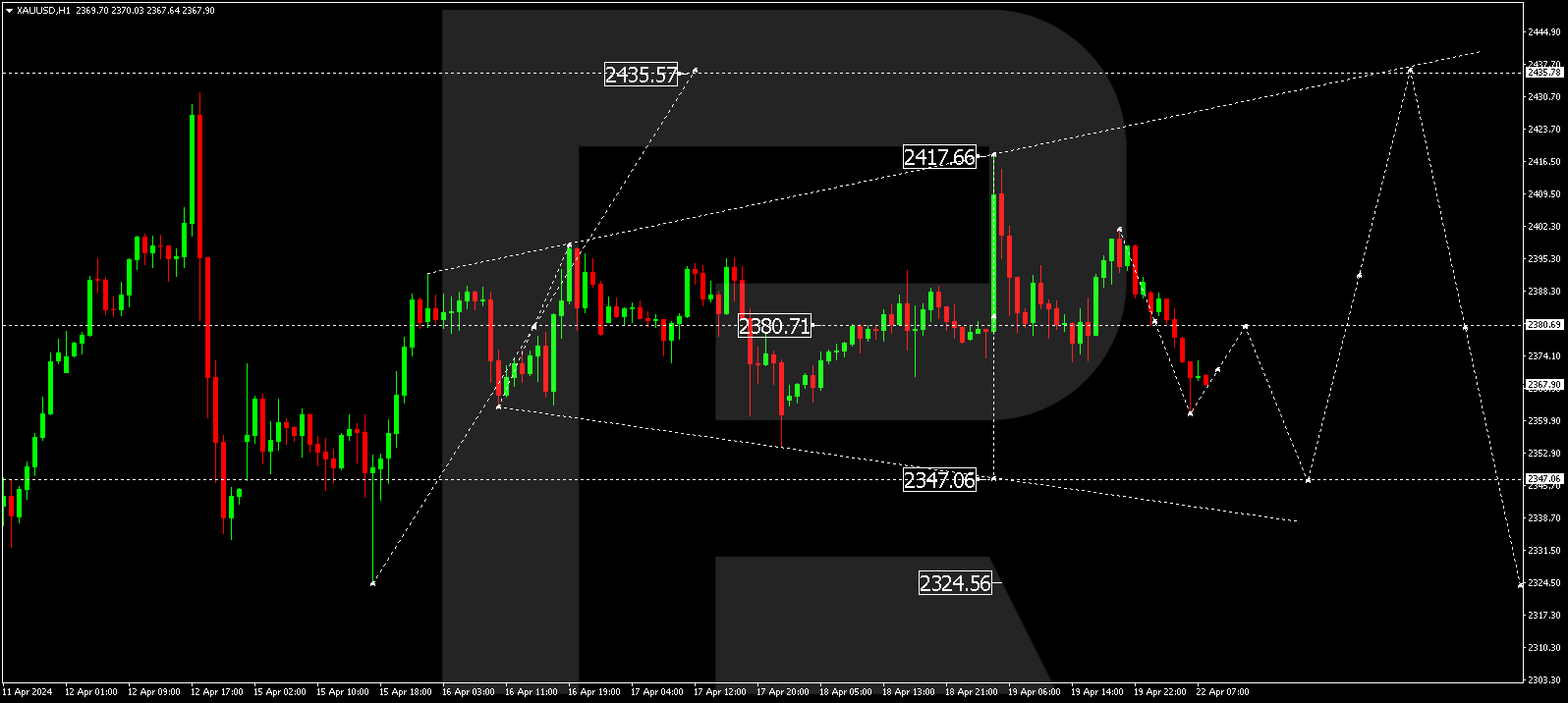

XAUUSD, “Gold vs US Dollar”

Gold continues developing a consolidation range around 2380.70. A decline link towards 2347.00 is expected today, followed by a rise to 2380.70 (testing from below). With an upward escape from the range, a growth link targeting 2435.80 is not excluded. With a downward escape, the correction might extend towards 2324.55.

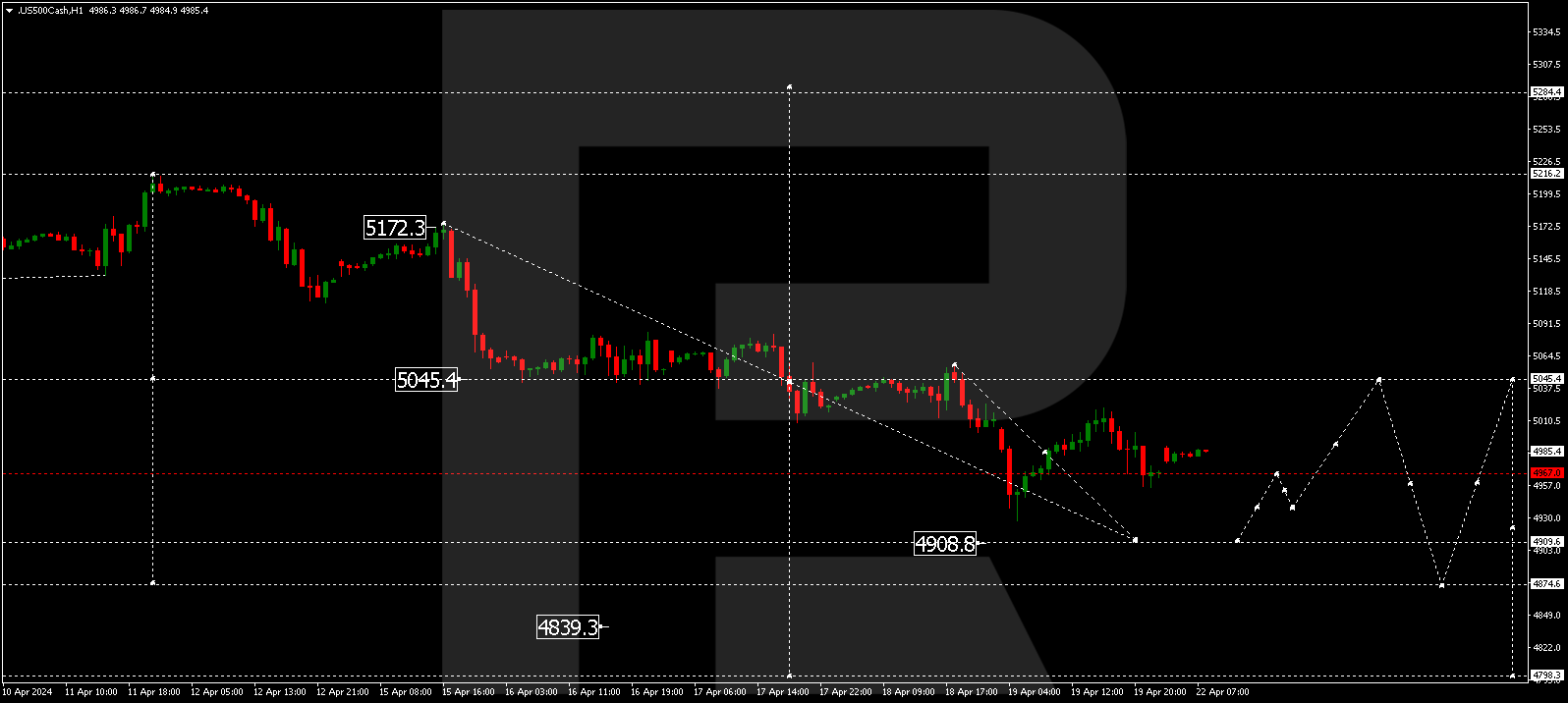

S&P 500

The stock index has formed a consolidation range around 4967.0. With a downward escape from the range, the potential for a wave targeting 4909.0 might open. With an upward escape, a correction link to 5045.5 (testing from below) is not excluded. Next, a decline by the trend to 4798.0 is expected. This is the first target.