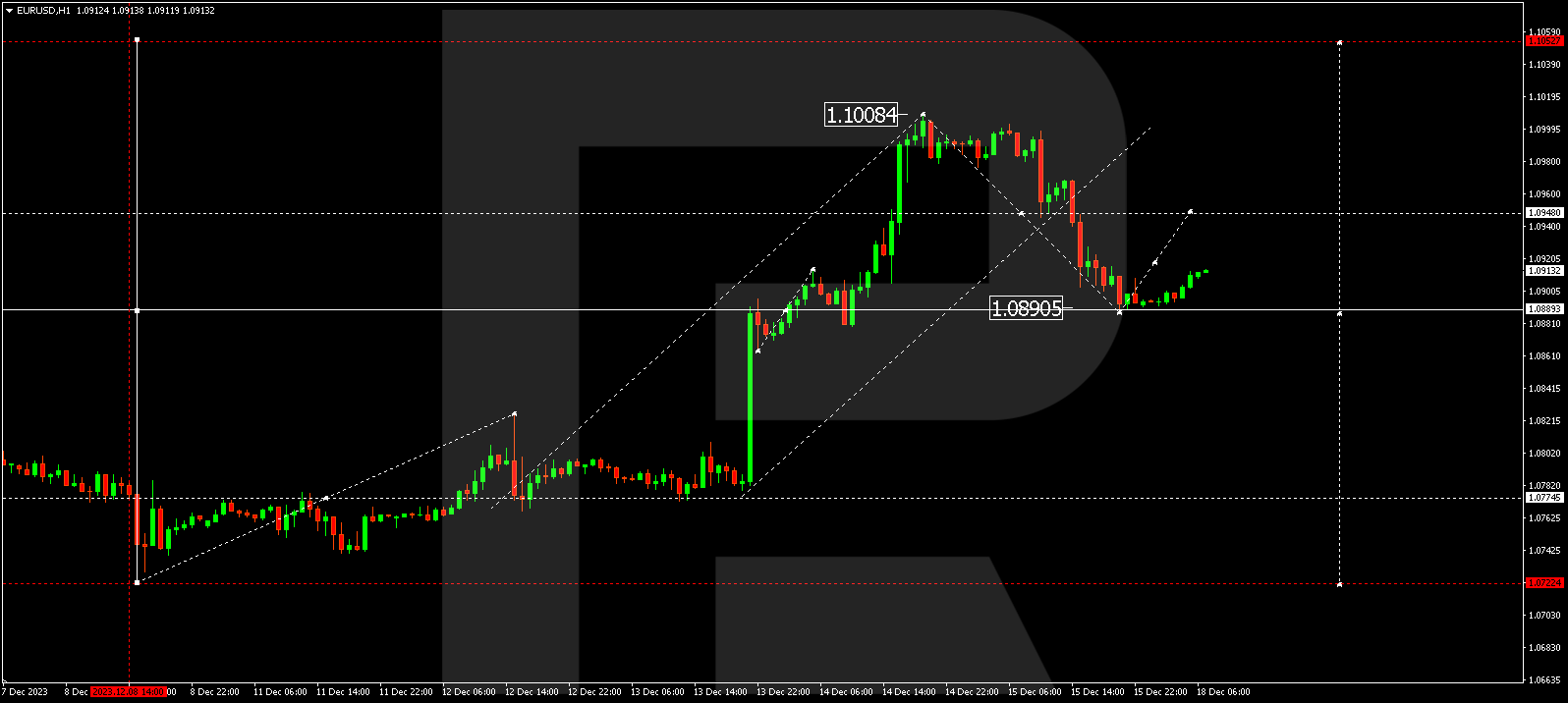

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction to 1.0889. A growth link to 1.0949 is expected today. Practically, a consolidation range is forming around 1.0950. With an escape from the range upwards, the quotes could rise to 1.1050. With a downward escape, the potential for a price decline to 1.0770 might open.

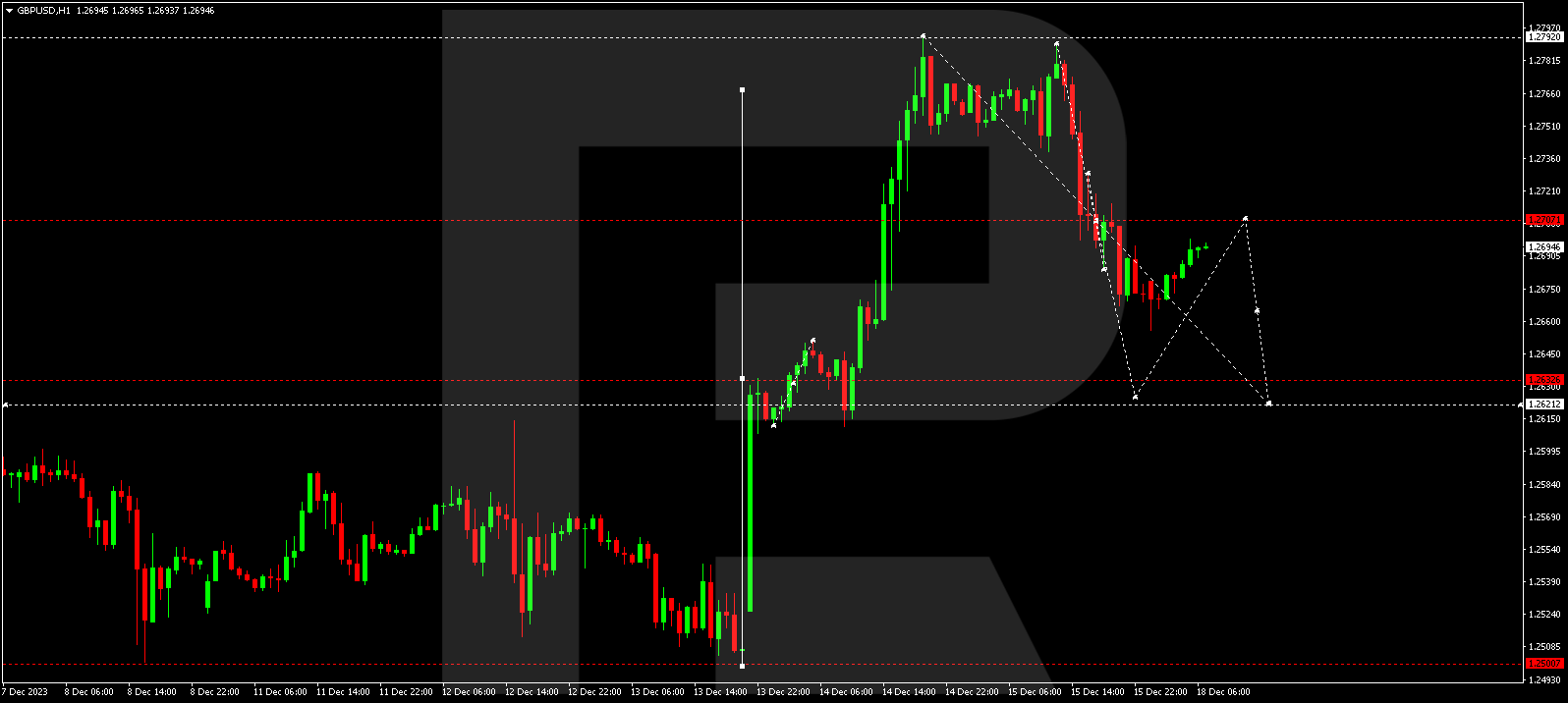

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a correction wave to 1.2656. A growth link to 1.2707 is expected today, followed by a decline to 1.2622. Upon reaching this level, the pair could start a growth structure to 1.2707. Practically, a wide consolidation range could develop around this level. With a downward escape, the potential for a decline wave to 1.2500 might open.

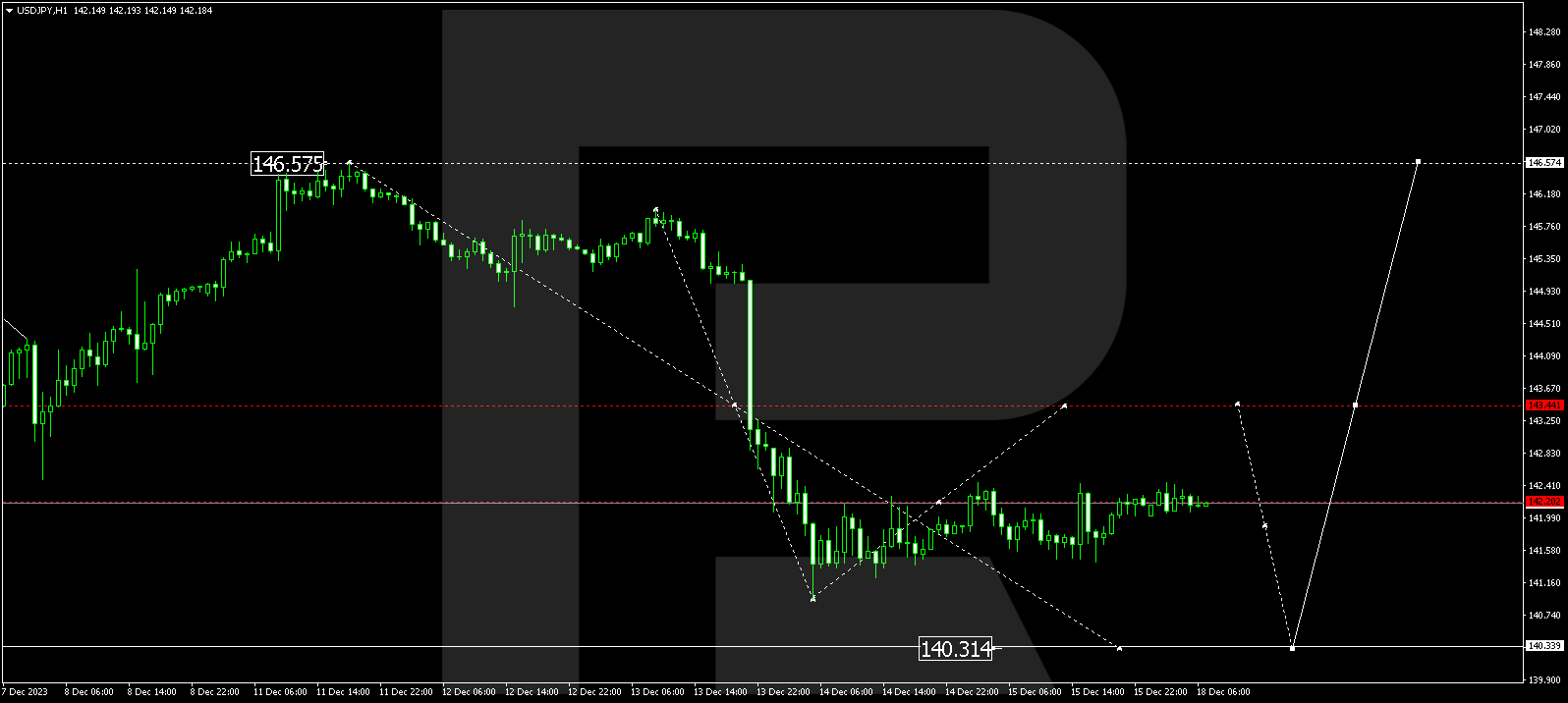

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues developing a consolidation range around 142.22 without any obvious trend. With an escape upwards, the potential for a correction to 143.44 might open, followed by a decline to 140.33. Next, a rise to 143.43 is expected, from where the trend might continue to 146.55. This is the first target.

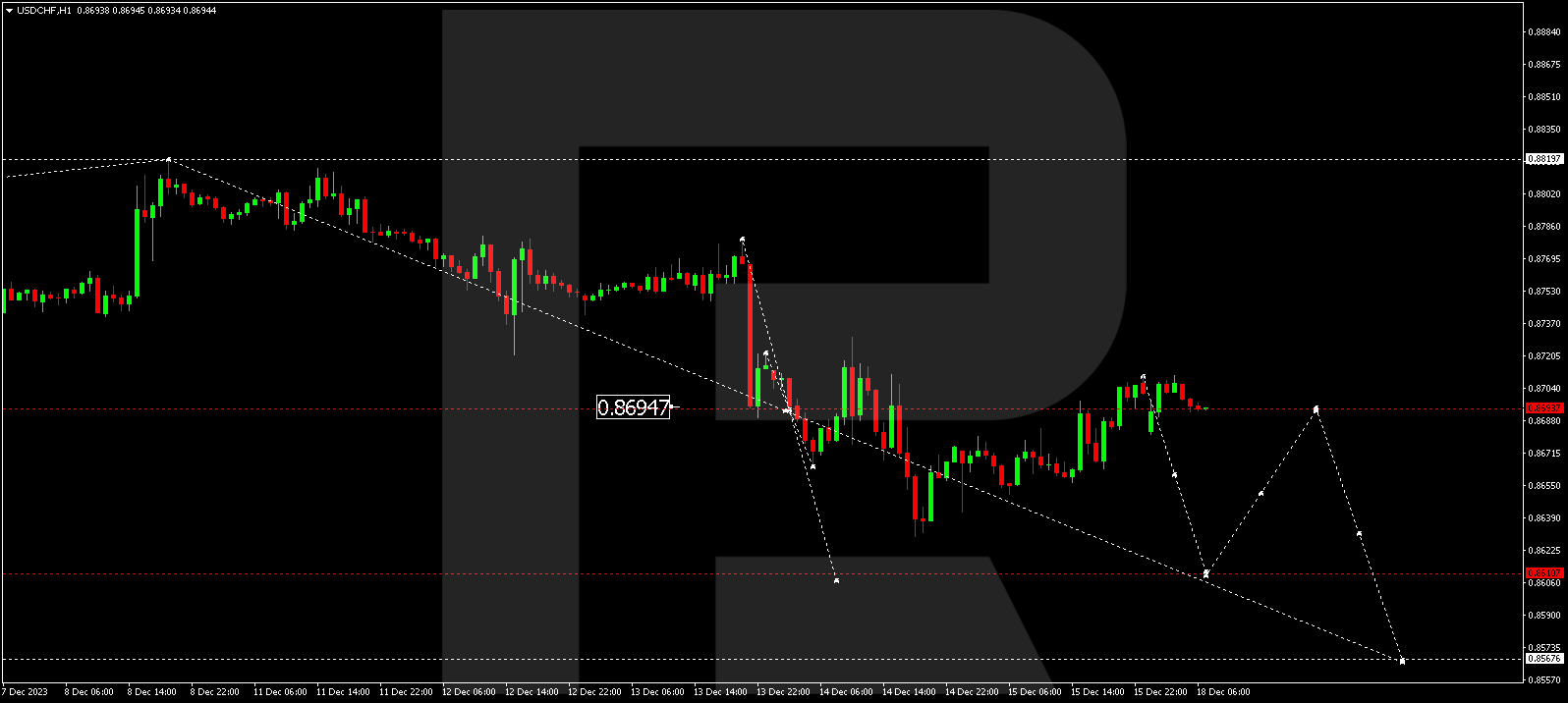

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues forming a consolidation range around 0.8694. A decline to 0.8610 is expected today, followed by a rise to 0.8694 (a test from below). Next, a decline to 0.8566 might form. Once this level is reached, a growth wave to 0.8800 could start.

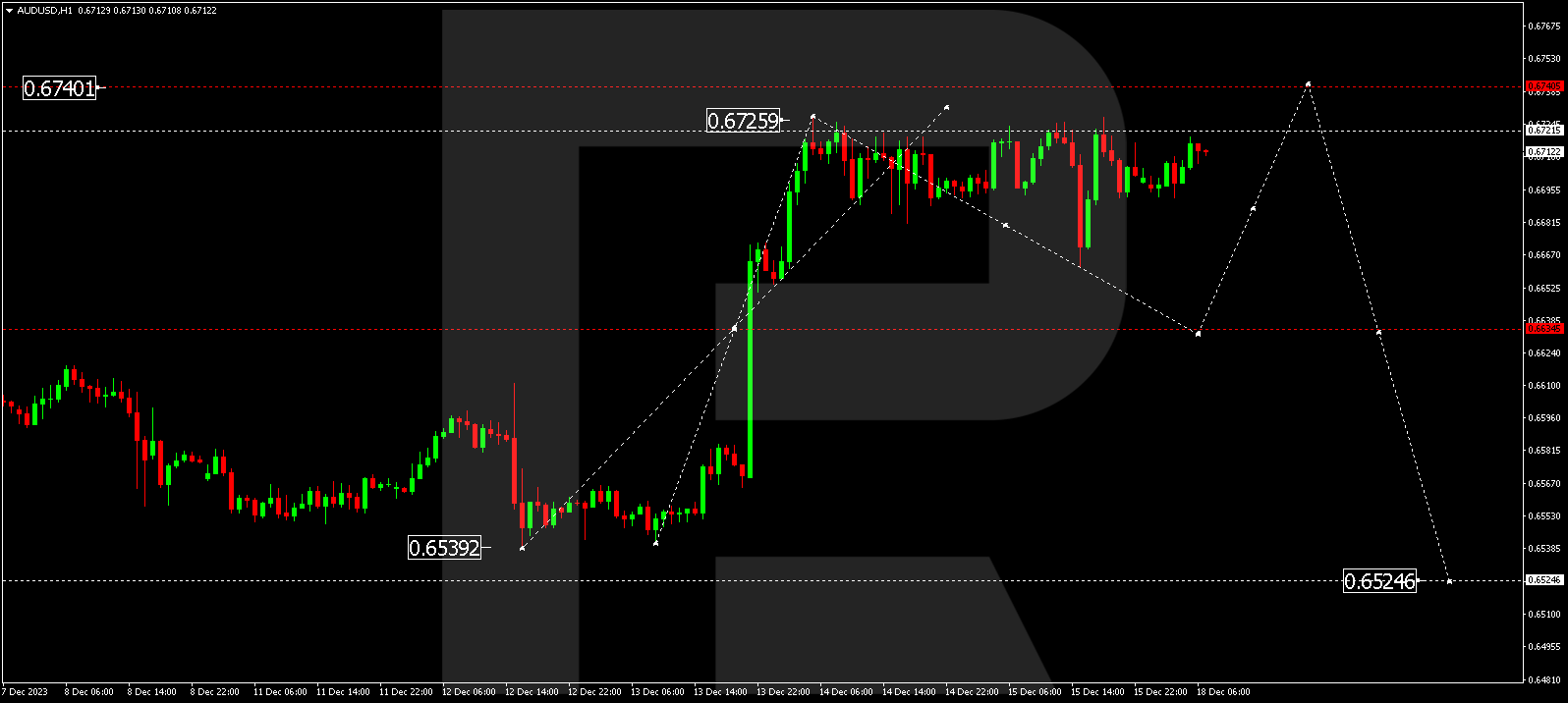

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues forming a consolidation range under 0.6700. With an escape downwards, a correction to 0.6633 might follow. Next, a growth link to 0.6740 is expected. Upon reaching this level, the price might begin a decline wave to 0.6525.

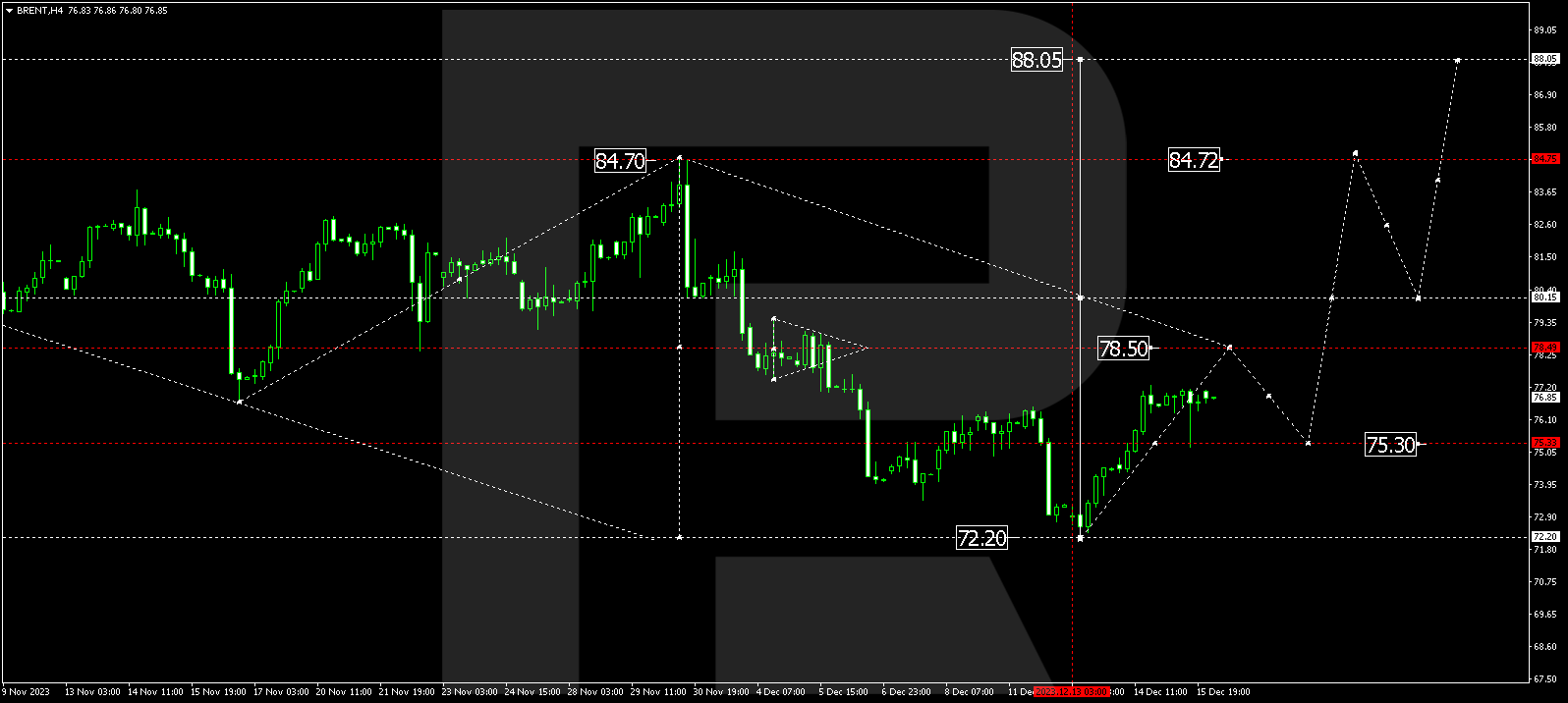

BRENT

Brent continues developing a growth wave to 78.50. Once this level is reached, a correction link to 75.30 might follow. Next, a growth link to 80.15 is expected, from where the trend could continue to 84.72. This is a local target.

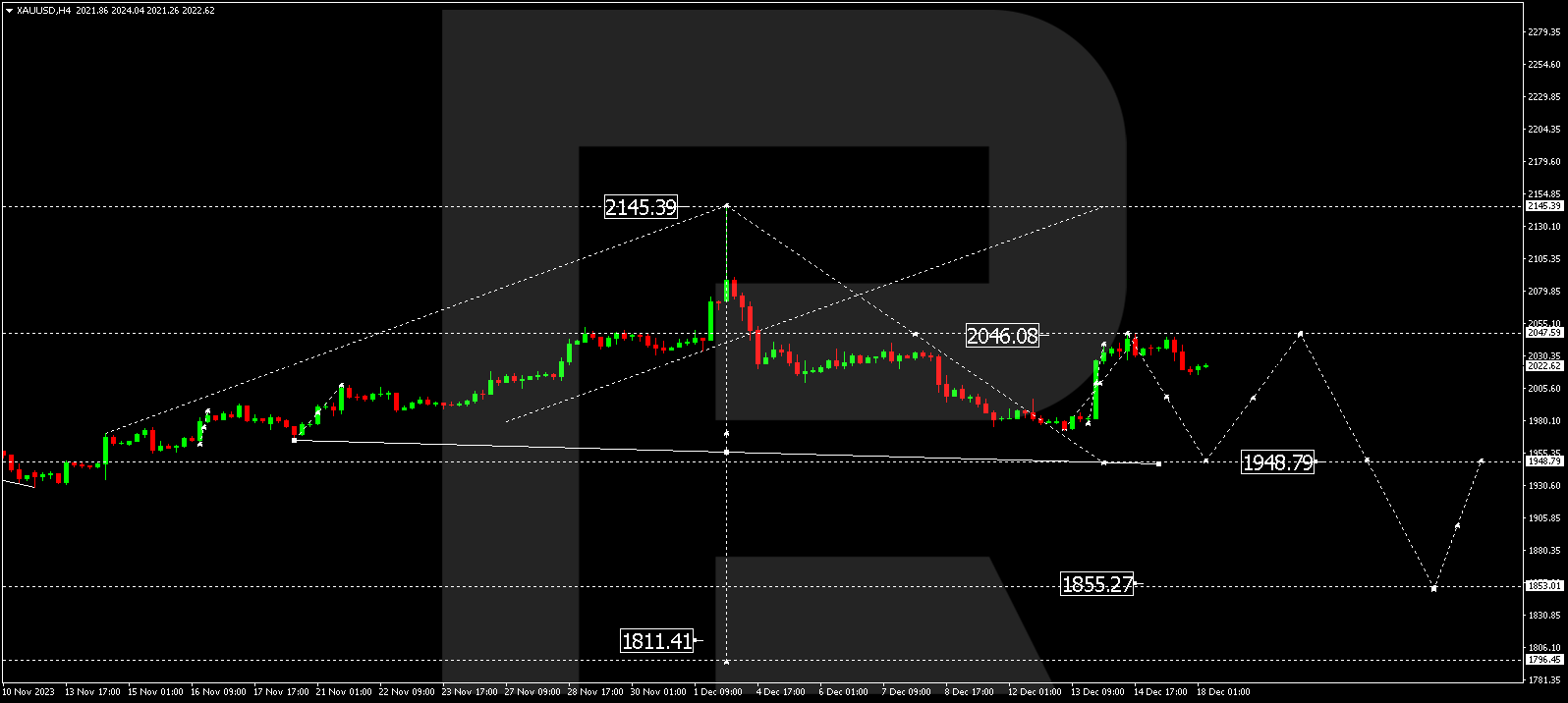

XAUUSD, “Gold vs US Dollar”

Gold has completed a correction to 2047.55. Next, a decline wave to 1948.80 might form, followed by a growth link to 2047.50. After that, the price could drop to 1940.00, from where the wave might continue to 1855.00.

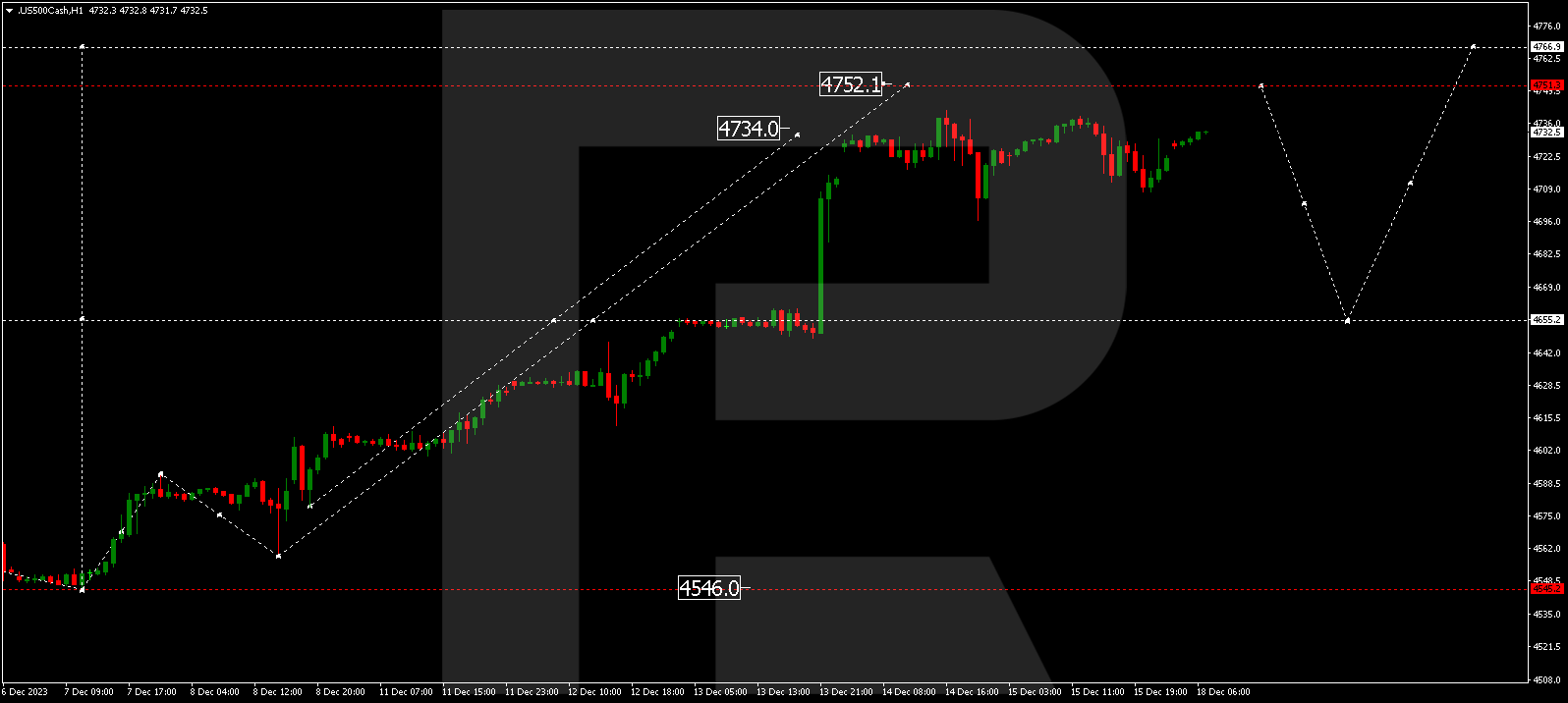

S&P 500

The stock index continues developing a consolidation range around 4722.0 without any obvious trend. With an escape upwards, the range could extend to 4751.0. Next, a corrective decline to 4655.5 might form, followed by a growth link to 4767.0.