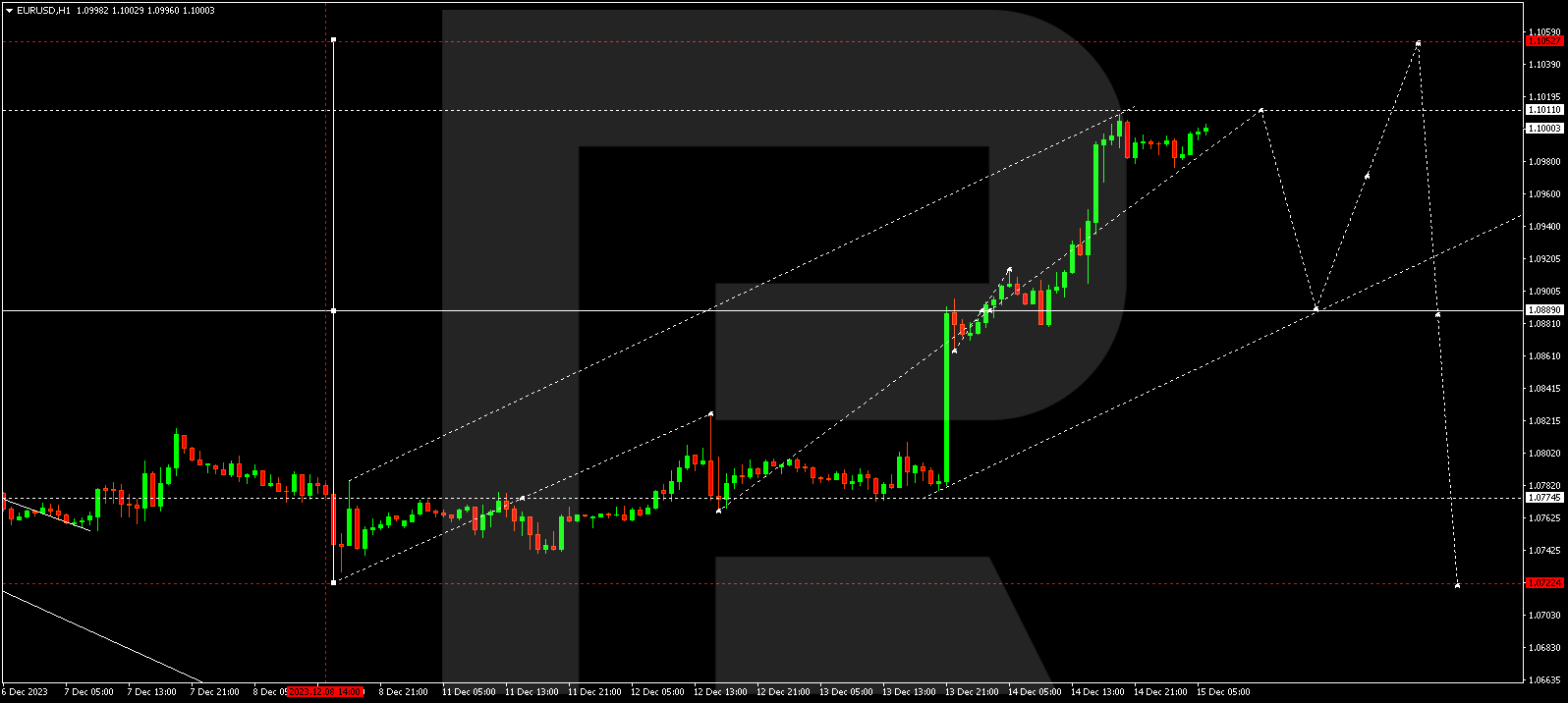

EURUSD, “Euro vs US Dollar”

EURUSD has reached a local growth wave target of 1.1000. Today a consolidation range is forming below this level, potentially expanding to 1.1010. Subsequently, the price could break the range downwards, targeting 1.0890 (a test from above). Next, another growth link to 1.1050 could develop, marking the end of this growth wave potential.

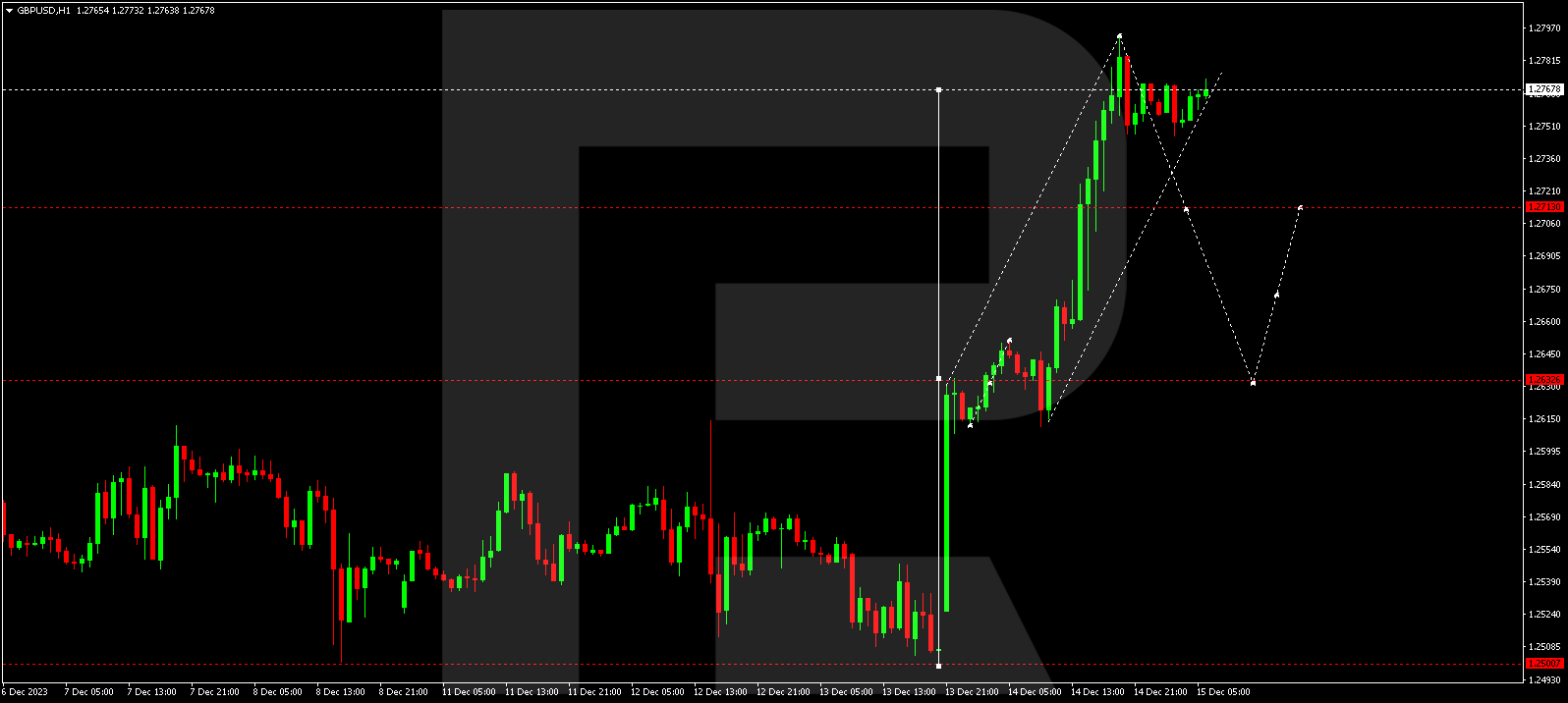

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a growth wave, reaching 1.2790. Today a consolidation range could form below this level. A downward breakout will open the potential for a downward movement to 1.2700, potentially continuing to 1.2630. This is the first target.

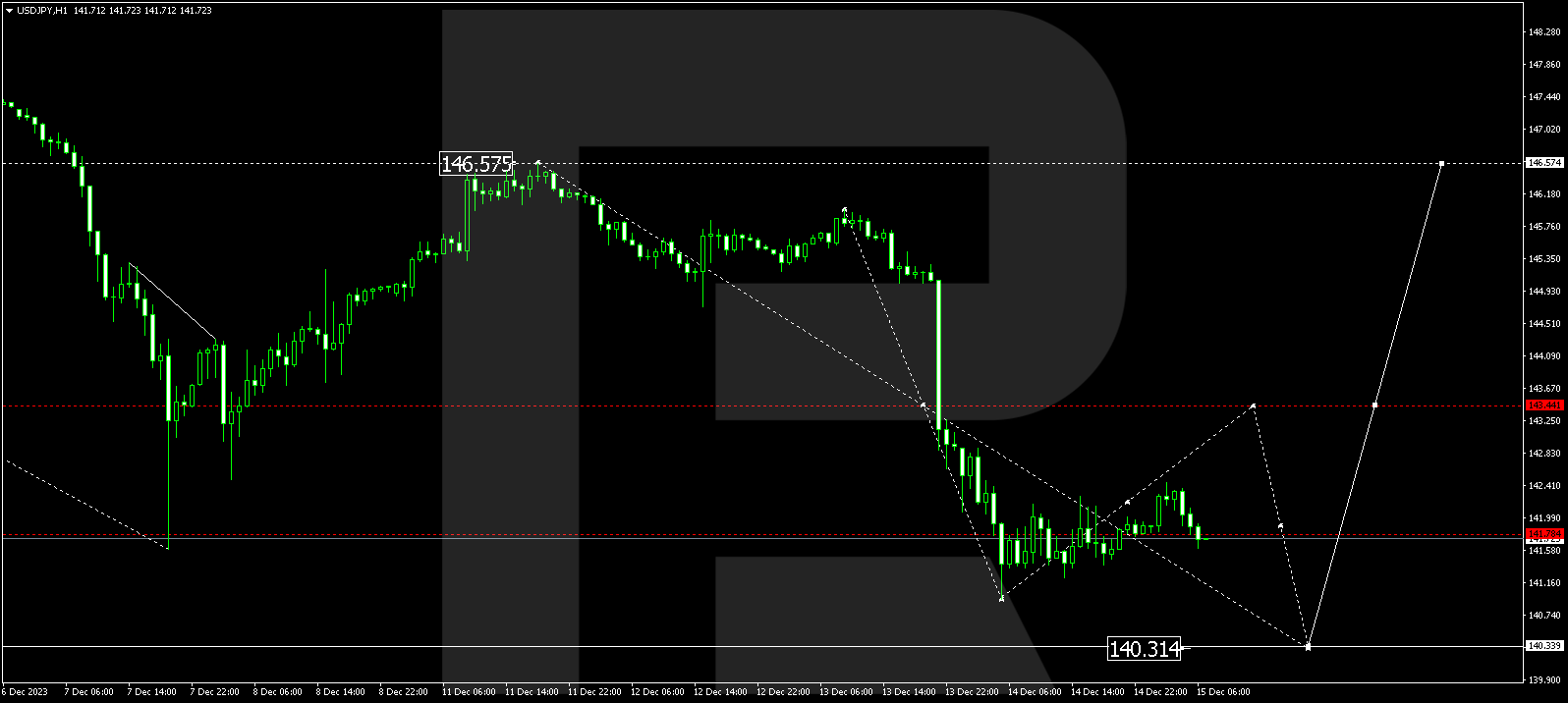

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is currently in a consolidation phase around 141.80. An upward breakout will open the potential for a correction to 143.40, followed by a possible decline to 140.33. Subsequently, the price could rise to 143.43, with the trend potentially continuing to 146.55. This is the first target.

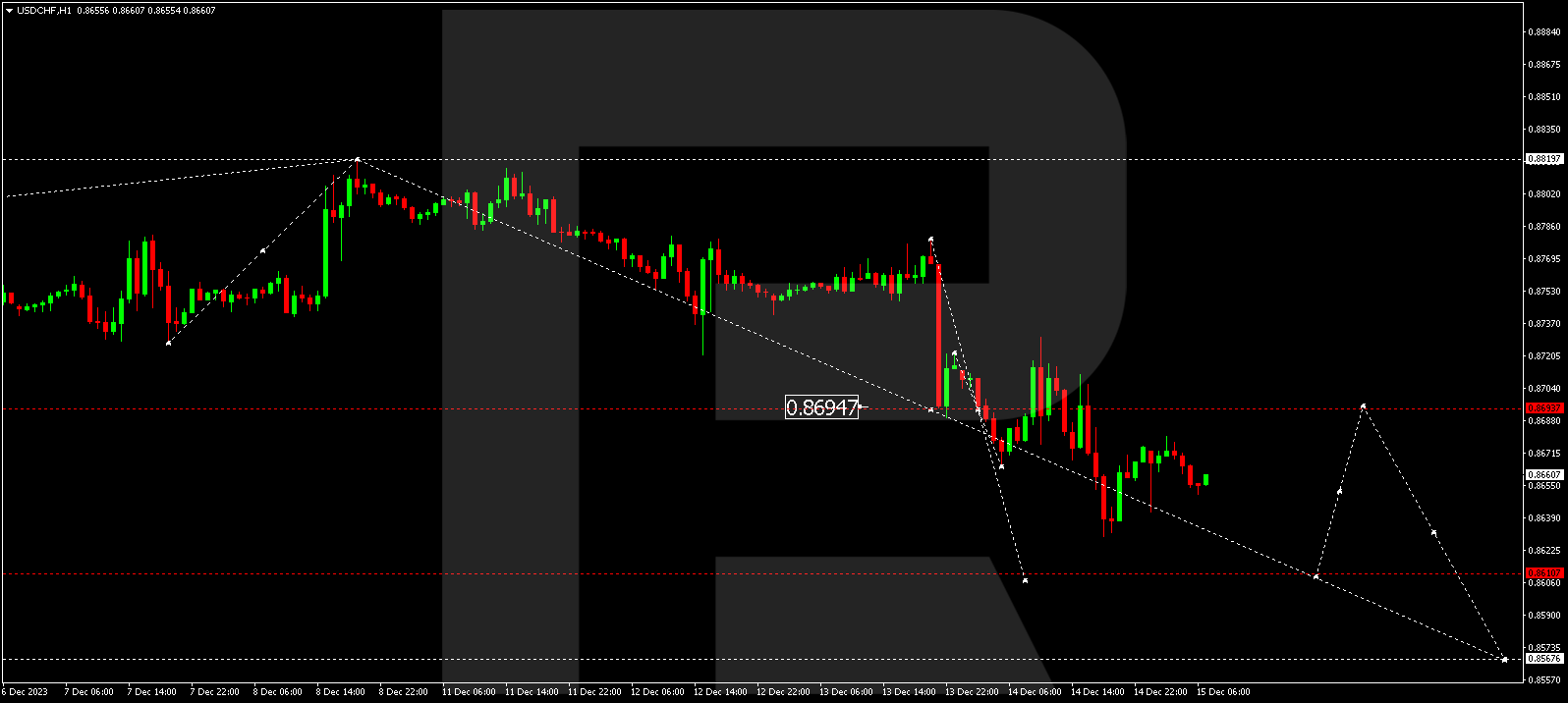

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has formed a consolidation range around 0.8694. A potential decline to 0.8610 may occur today, with a subsequent upward movement targeting 0.8694 (a test from below), followed by a drop to 0.8566. After the price reaches this level, a growth wave to 0.8800 could start.

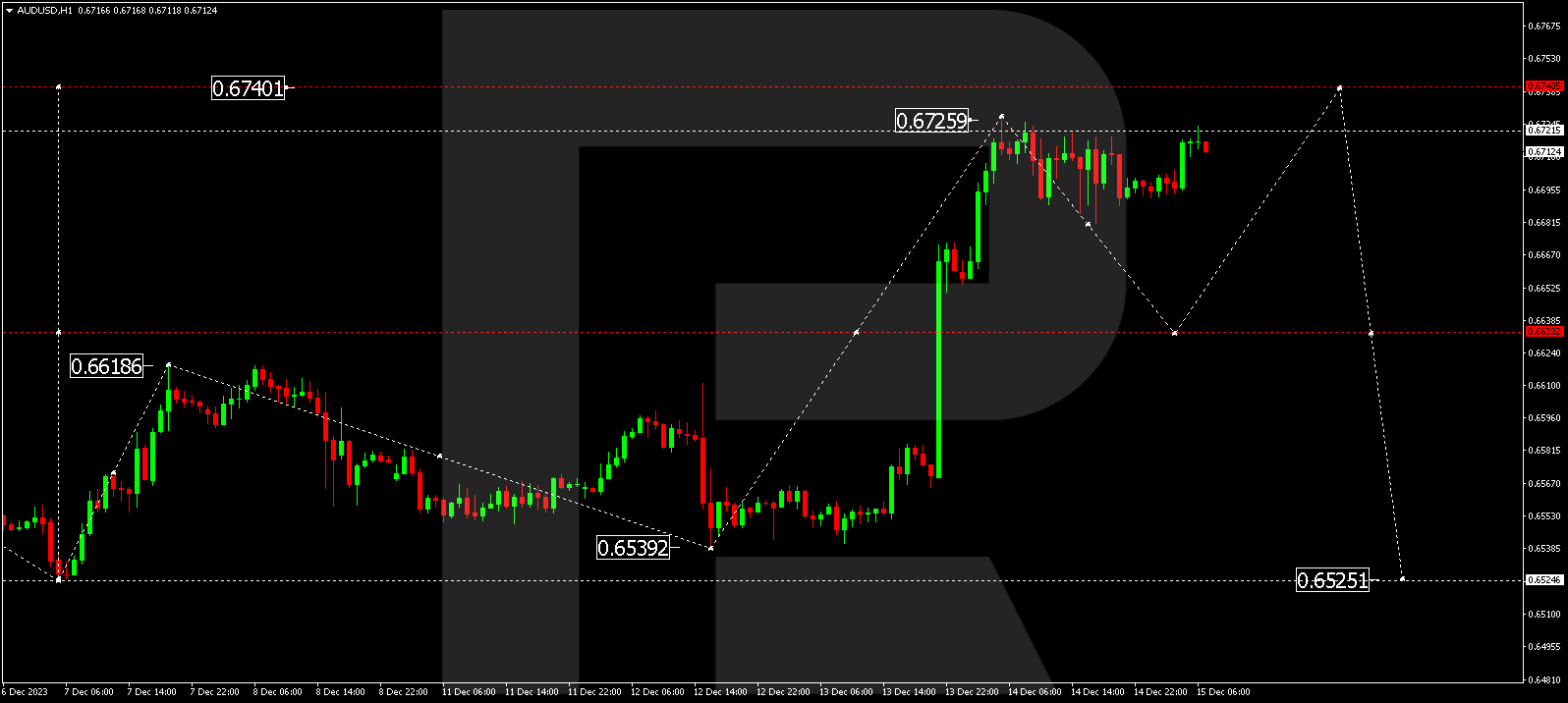

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is currently in a consolidation phase below 0.6727. Breaking below the range, the price might correct to 0.6633, subsequently rising to 0.6740. After the price hits this level, a decline wave towards 0.6525 could start.

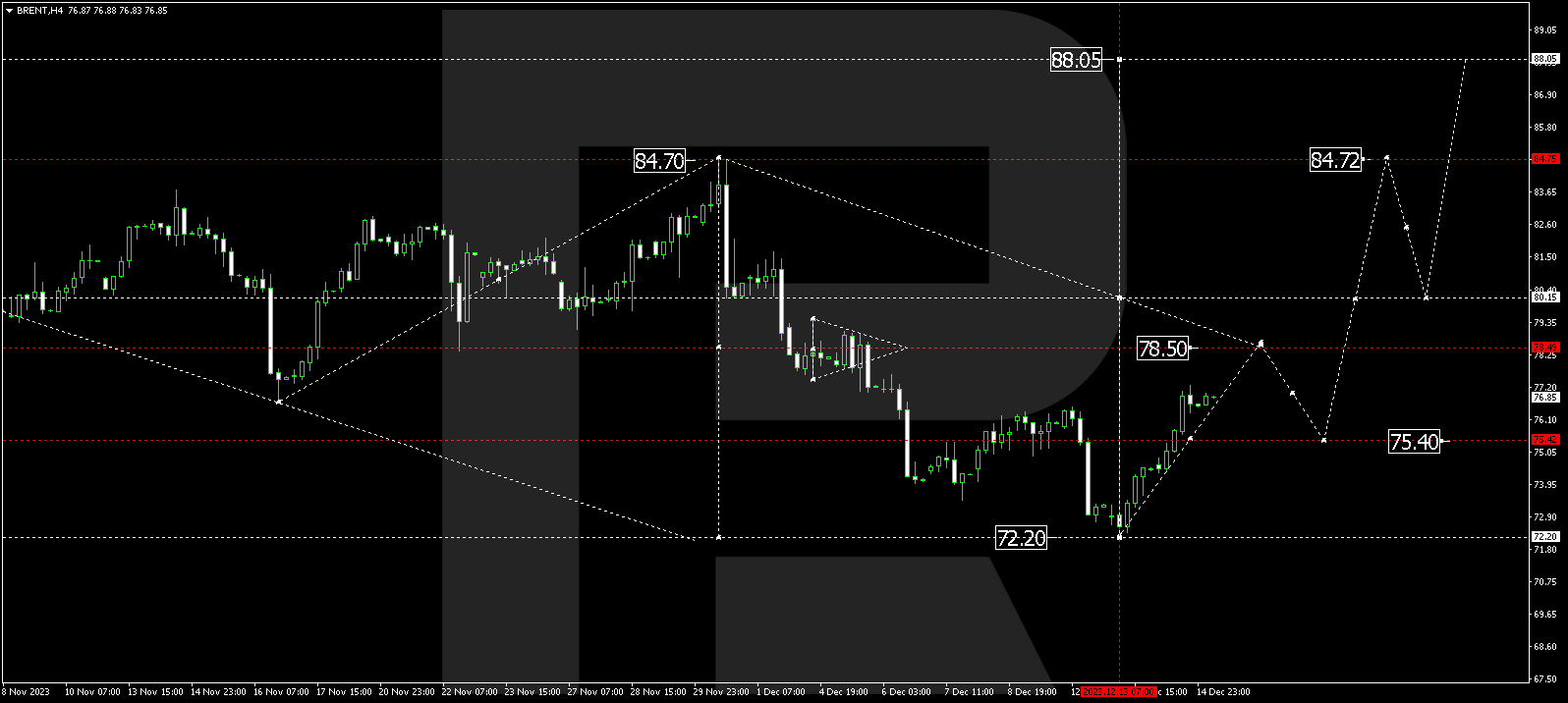

BRENT

Brent continues its upward momentum, targeting 78.50. Once the price reaches this level, it could correct to 75.40. Next, a growth link to 80.15 is expected, from where the trend could develop to 84.72.

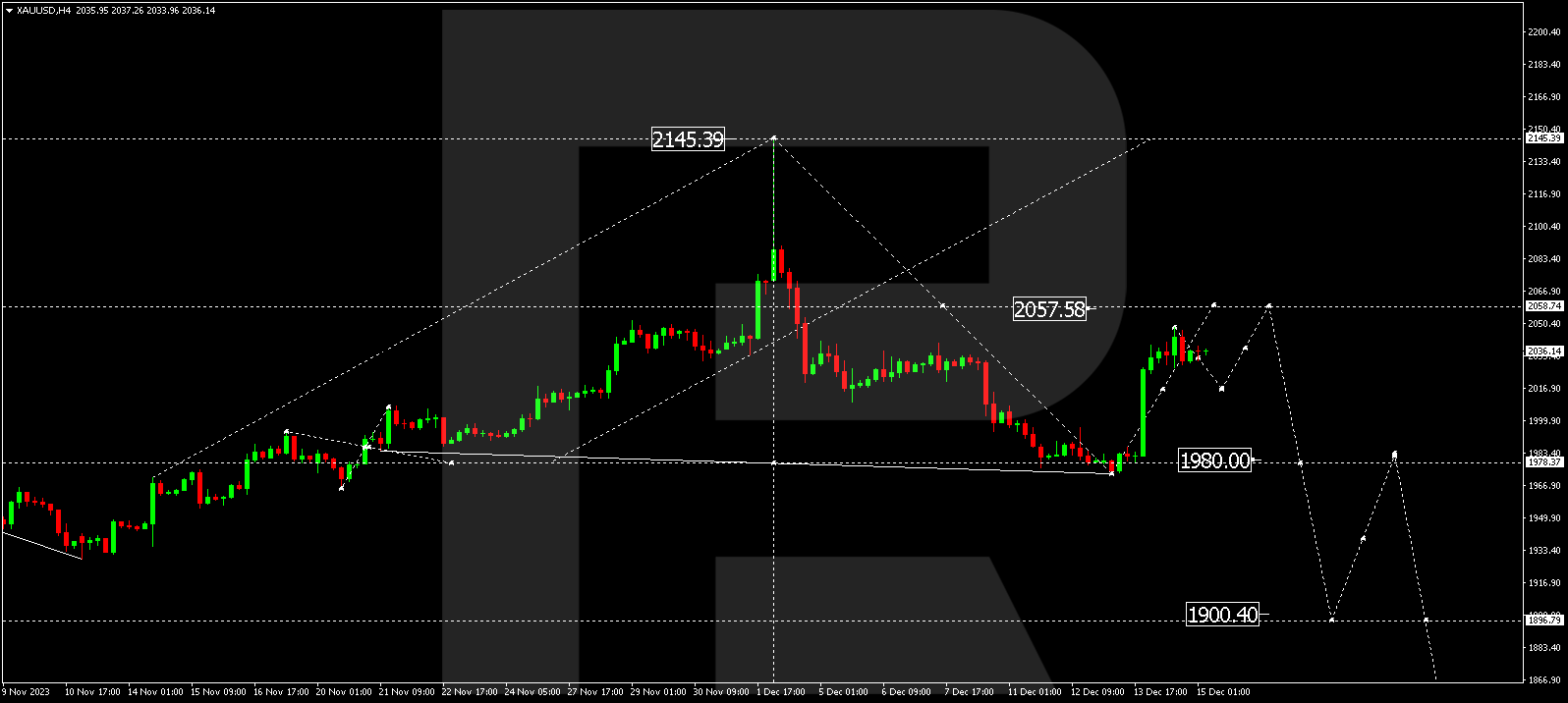

XAUUSD, “Gold vs US Dollar”

Gold is forming a consolidation range below 2047.50. The price could decline to 2018.55 and then climb to 2058.75. This rise is seen as a correction link as part of the previous downward movement. Following the correction, another decline wave towards 1980.00 is expected.

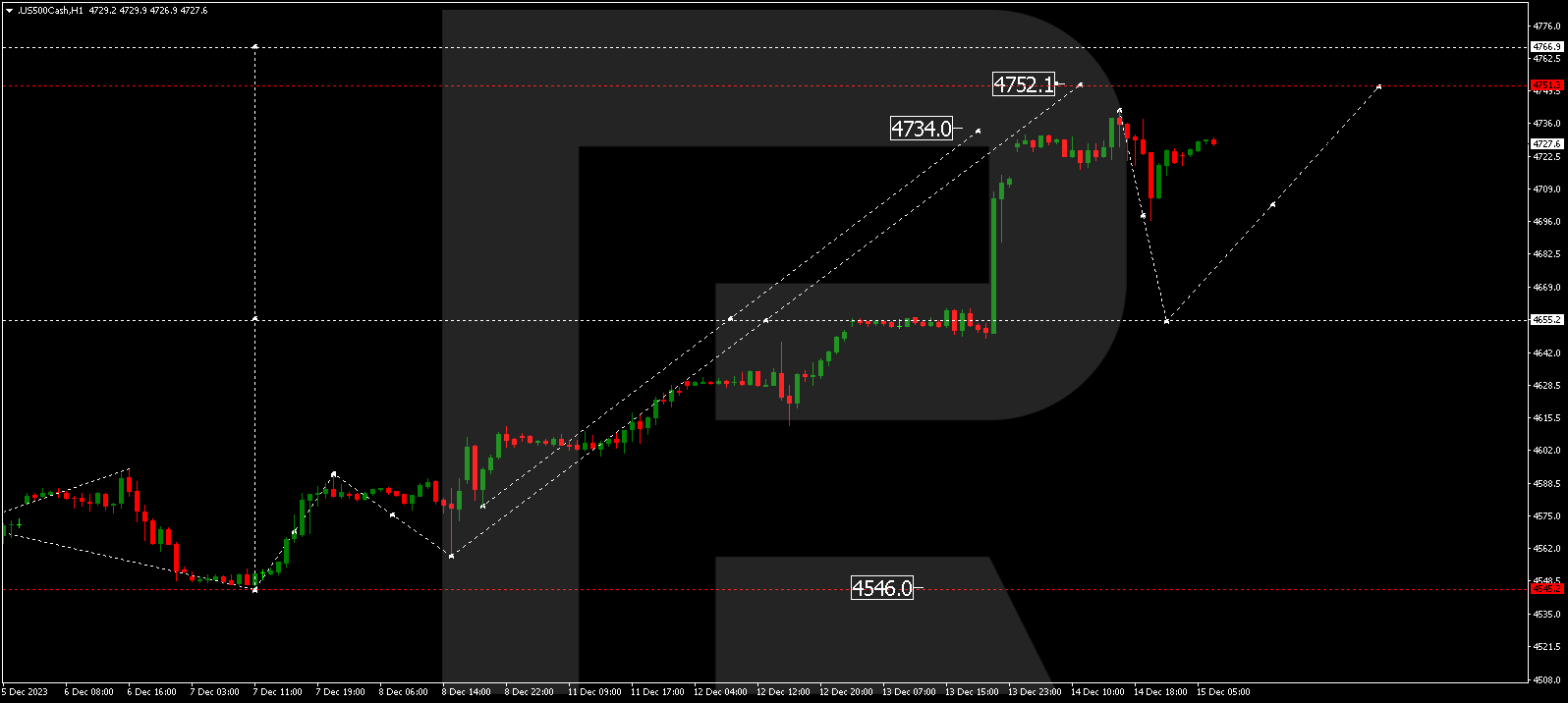

S&P 500

The stock index is currently in a consolidation phase around 4725.0. With an upward breakout, the consolidation range could expand to 4751.0. A corrective decline to 4655.5 could follow, with the price subsequently rising to 4767.0.