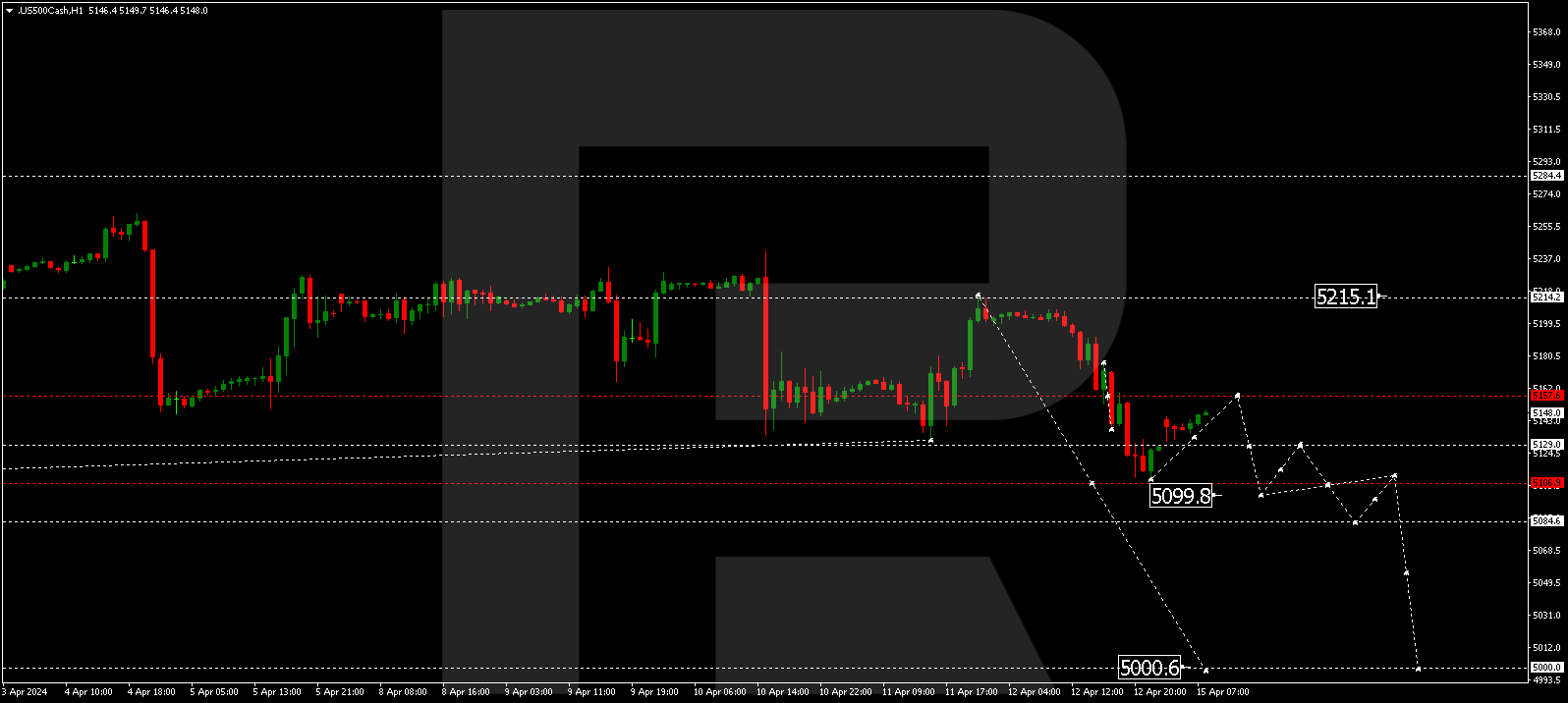

EURUSD, “Euro vs US Dollar”

The EURUSD pair completed a decline wave, reaching 1.0622. Today, the market is forming a consolidation range above this level. With an upward breakout, a correction phase targeting 1.0678 could follow. Once the correction is over, a new decline wave towards 1.0583 might start. A downward breakout will open the potential for a downward movement to the local target of 1.0583.

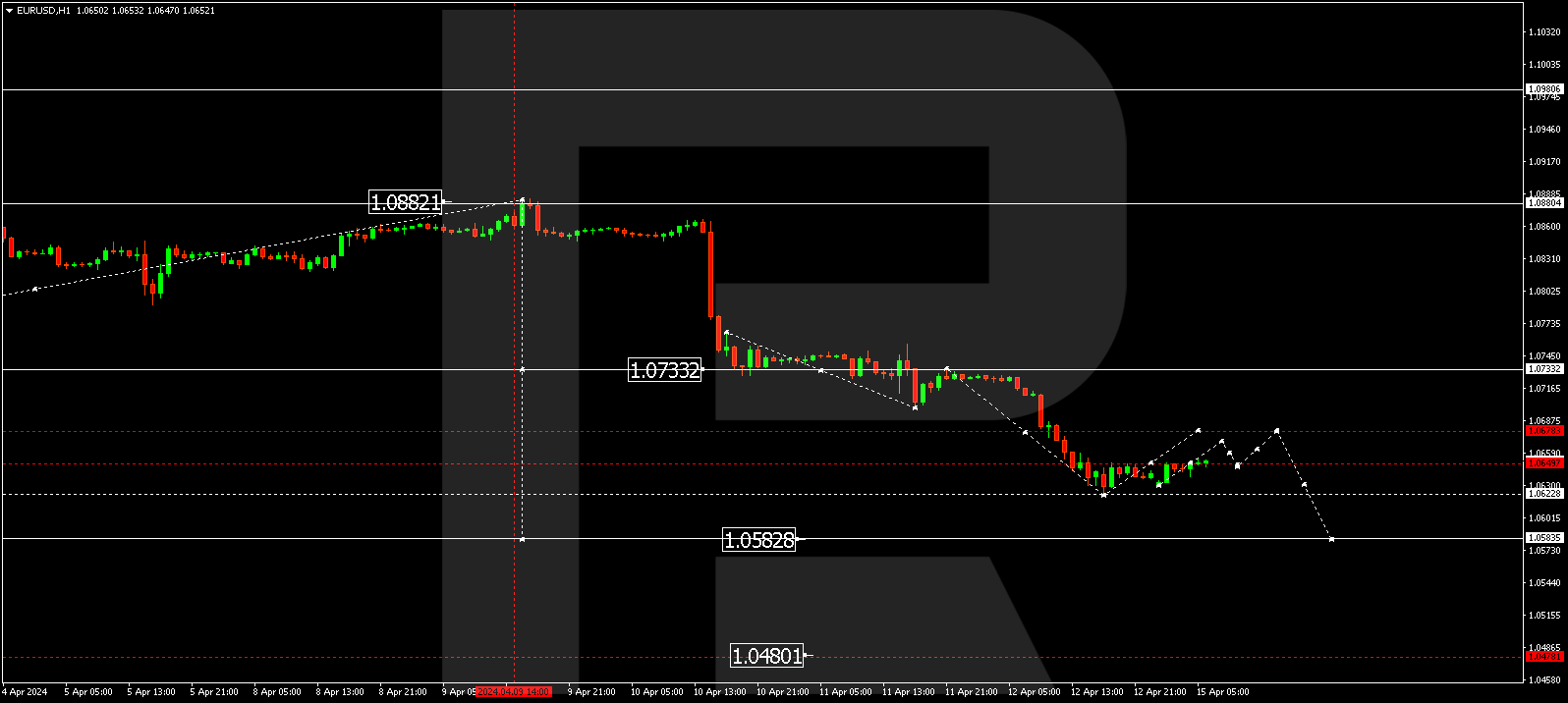

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has formed a consolidation range around the 1.2544 level and, breaking below it, completed a decline wave towards 1.2426. Today, the market is forming a new consolidation range above this level. With an upward breakout, a correction phase targeting 1.2484 is not ruled out, followed by a decline to 1.2380. A downward breakout will open the potential for a downward movement to 1.2380, with the trend potentially continuing to the local target of 1.2353.

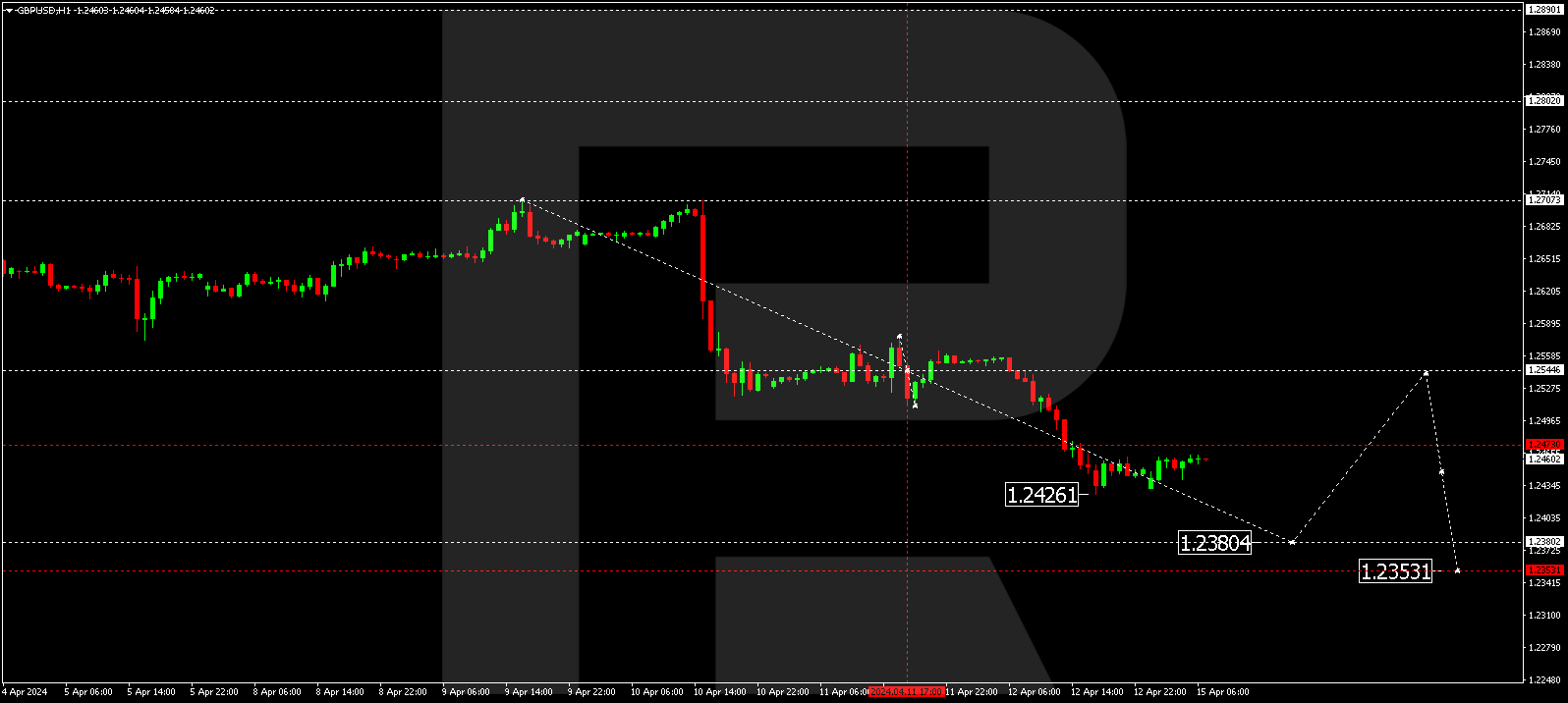

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has formed a consolidation range below 153.33 and, breaking above it, maintains its upward trajectory to 154.00. After reaching this level, the price could correct to 153.33 (testing from above). Next, another growth wave could start, aiming for 154.51, from where the trend could expand to 155.75.

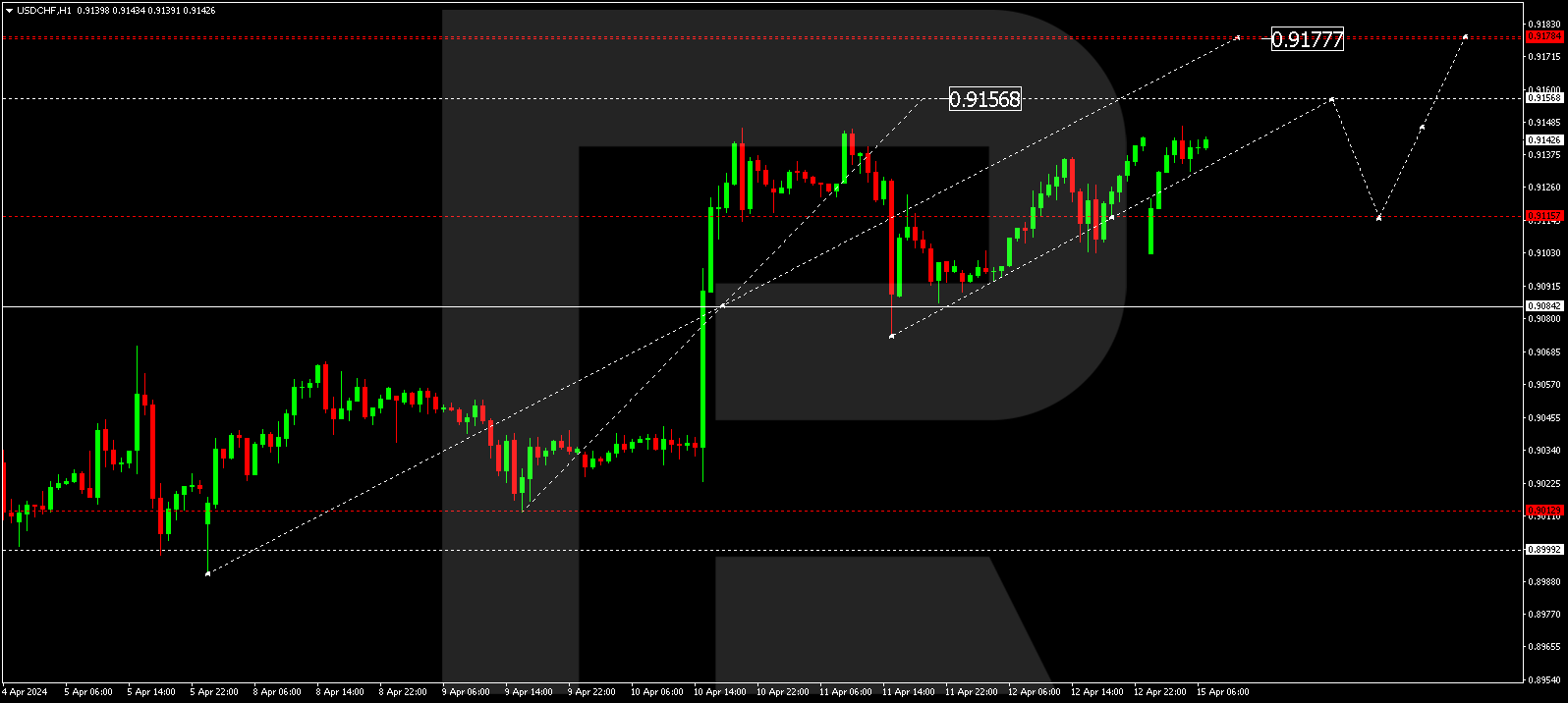

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair is currently in a consolidation phase around 0.9115. A rise to 0.9156 is not ruled out today, followed by a correction towards 0.9115 (testing from above). Once the correction is over, another growth wave could start, aiming for the local target of 0.9177.

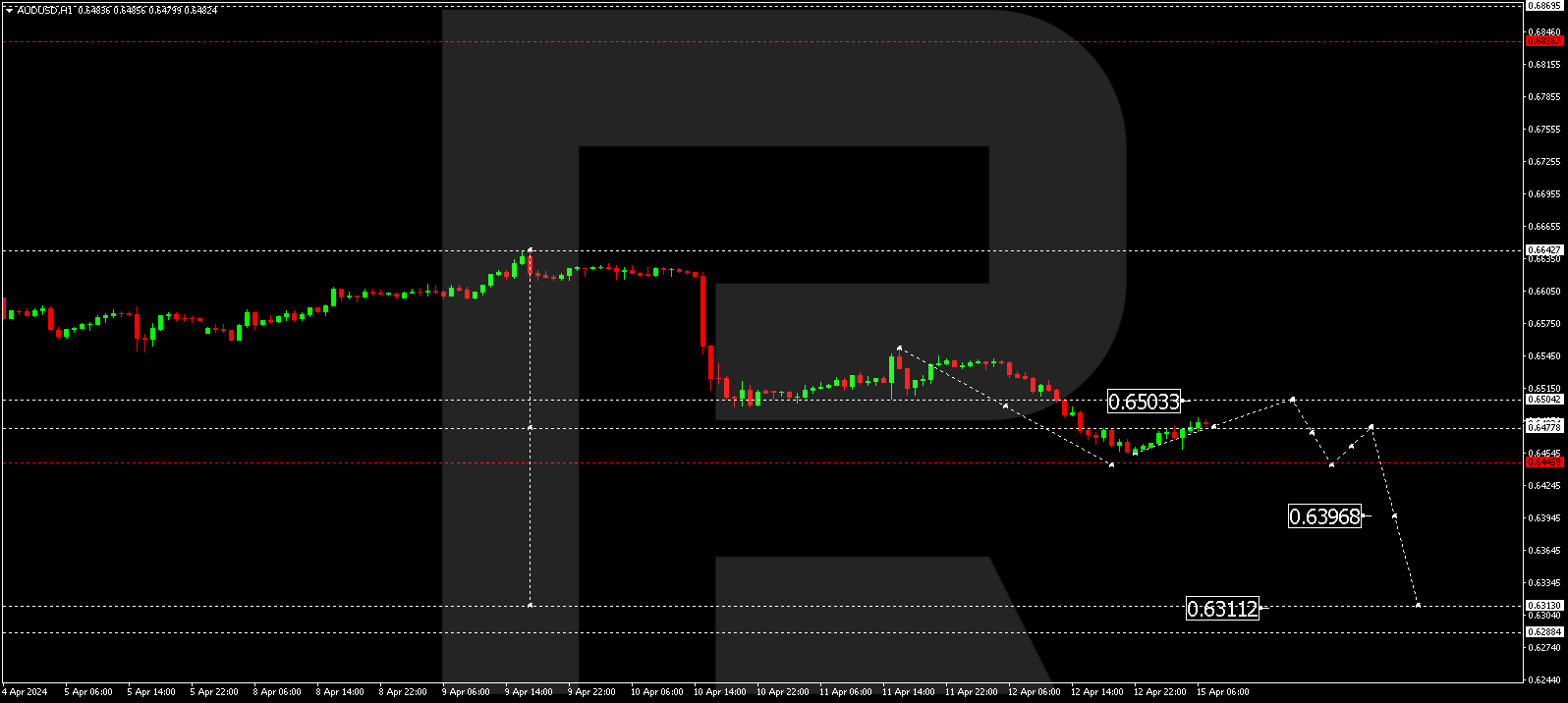

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a decline wave, reaching 0.6455. A correction towards 0.6503 might occur today. Next, the price is expected to start its downward movement to 0.6444, with the trend potentially continuing to 0.6400.

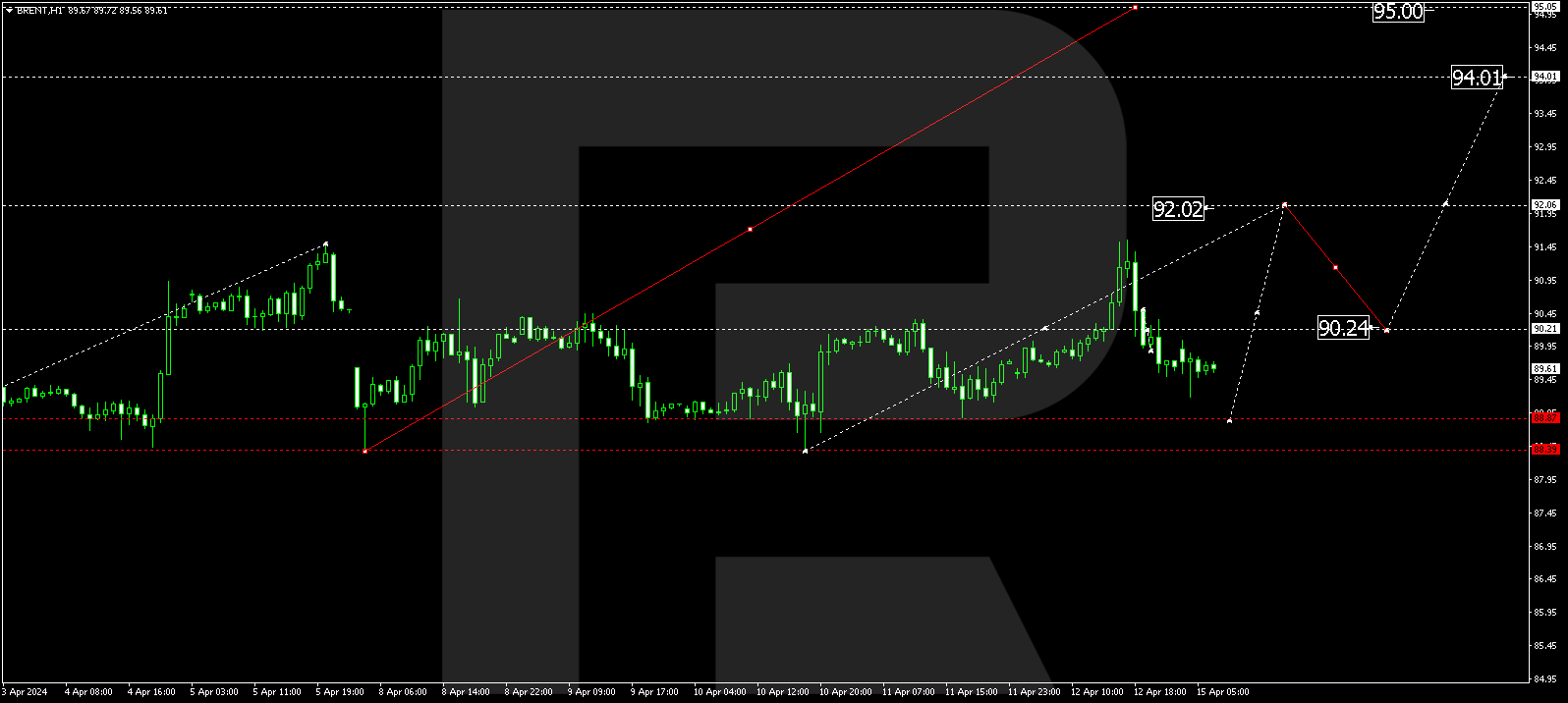

BRENT

Brent has completed a growth wave, reaching 91.55. A correction phase targeting 88.88 is not ruled out today. Once the correction is over, another growth wave to the local target of 92.00 could start. After reaching this level, the price could correct to 90.25 and then embark on a new growth wave, targeting 94.00. The trend might continue to 95.00.

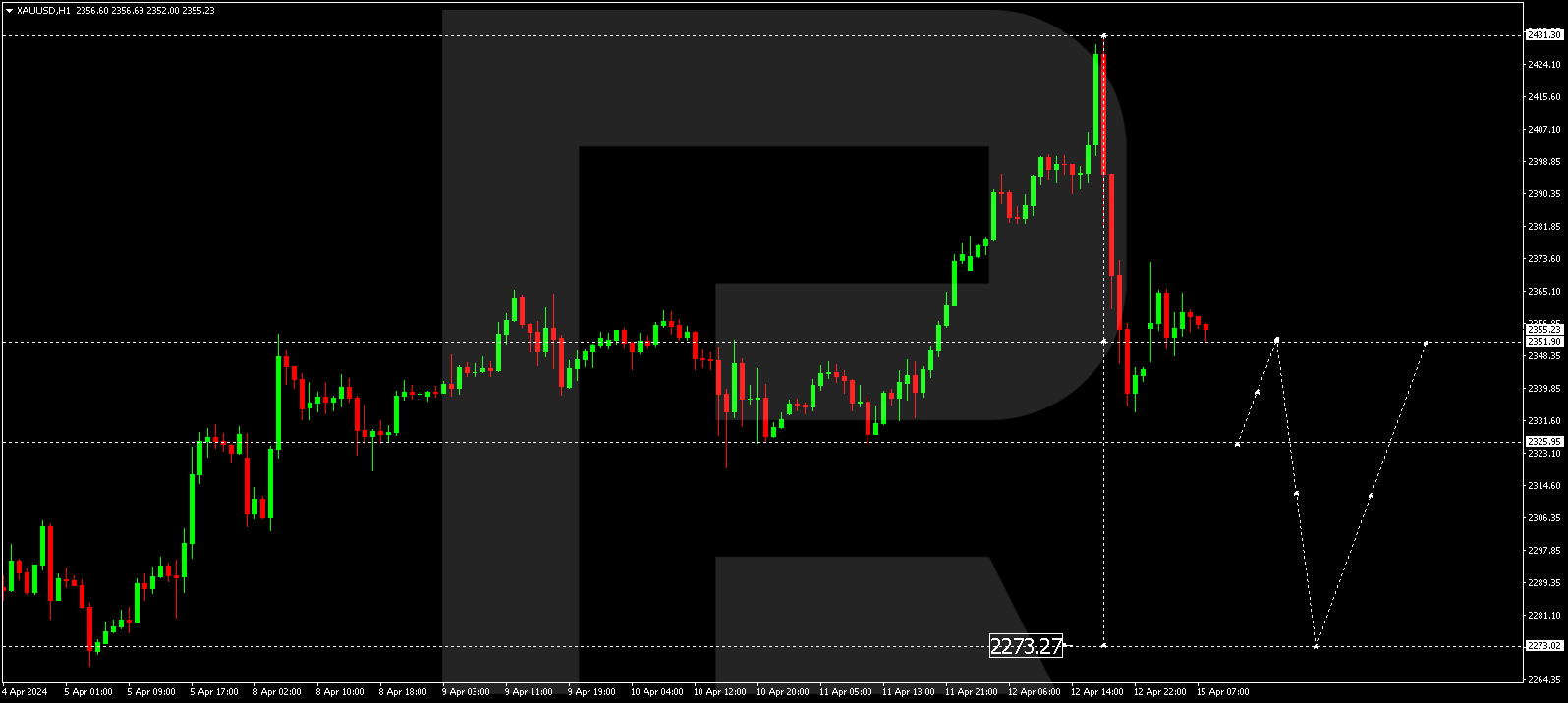

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave towards 2431.50, with a subsequent decline impulse towards 2333.83. The market is forming a consolidation range around 2352.00 today. An upward breakout towards 2380.50 is not ruled out. A downward breakout will open the potential for a decline towards 2326.00, from where the movement might continue to 2273.27. After hitting this level, the price is expected to rise to 2355.00.

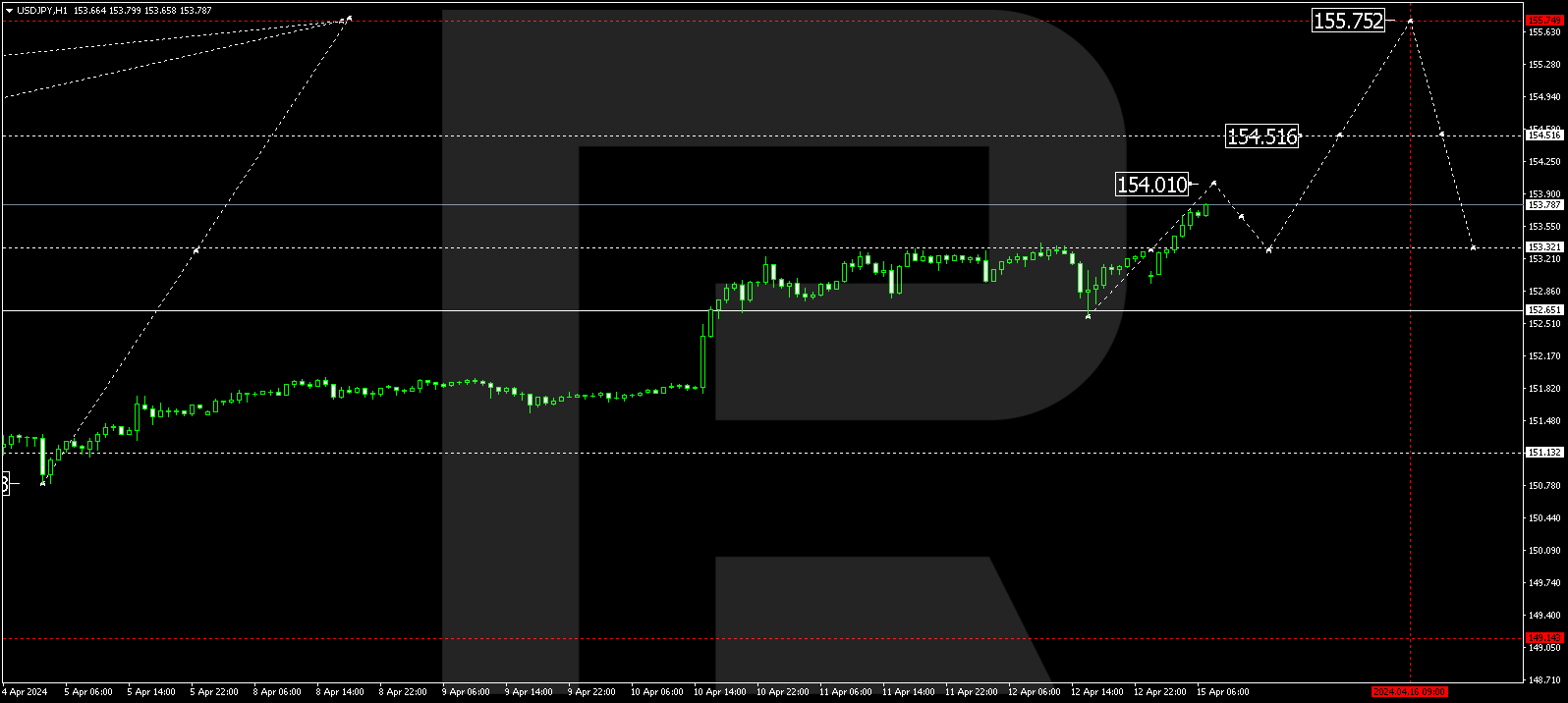

S&P 500

The stock index has completed a decline wave, reaching 5109.5. A correction phase towards 5157.5 could follow today. After the correction, a decline wave targeting 5099.9 could start. Next, a consolidation range is expected to develop around this level. With a downward breakout, the price might maintain its downward trajectory to 5084.0, with the trend potentially developing to the local target of 5000.0.