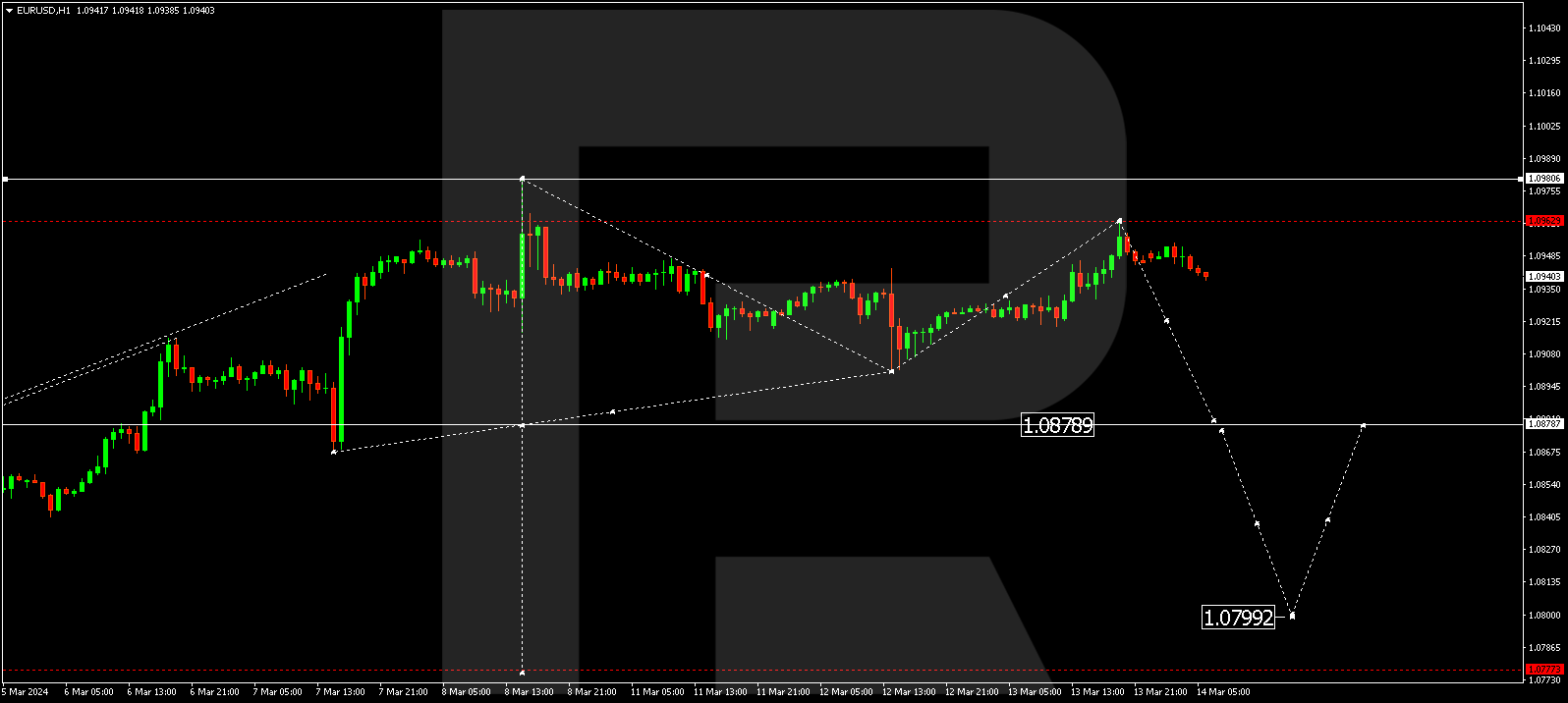

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a correction wave towards 1.0963. Practically, the market has set the frames for a consolidation range. A decline link to 1.0878 is expected today. Breaking this level, the price could extend the trend to 1.0800, from which level the wave structure might form towards 1.0777. This is the first target.

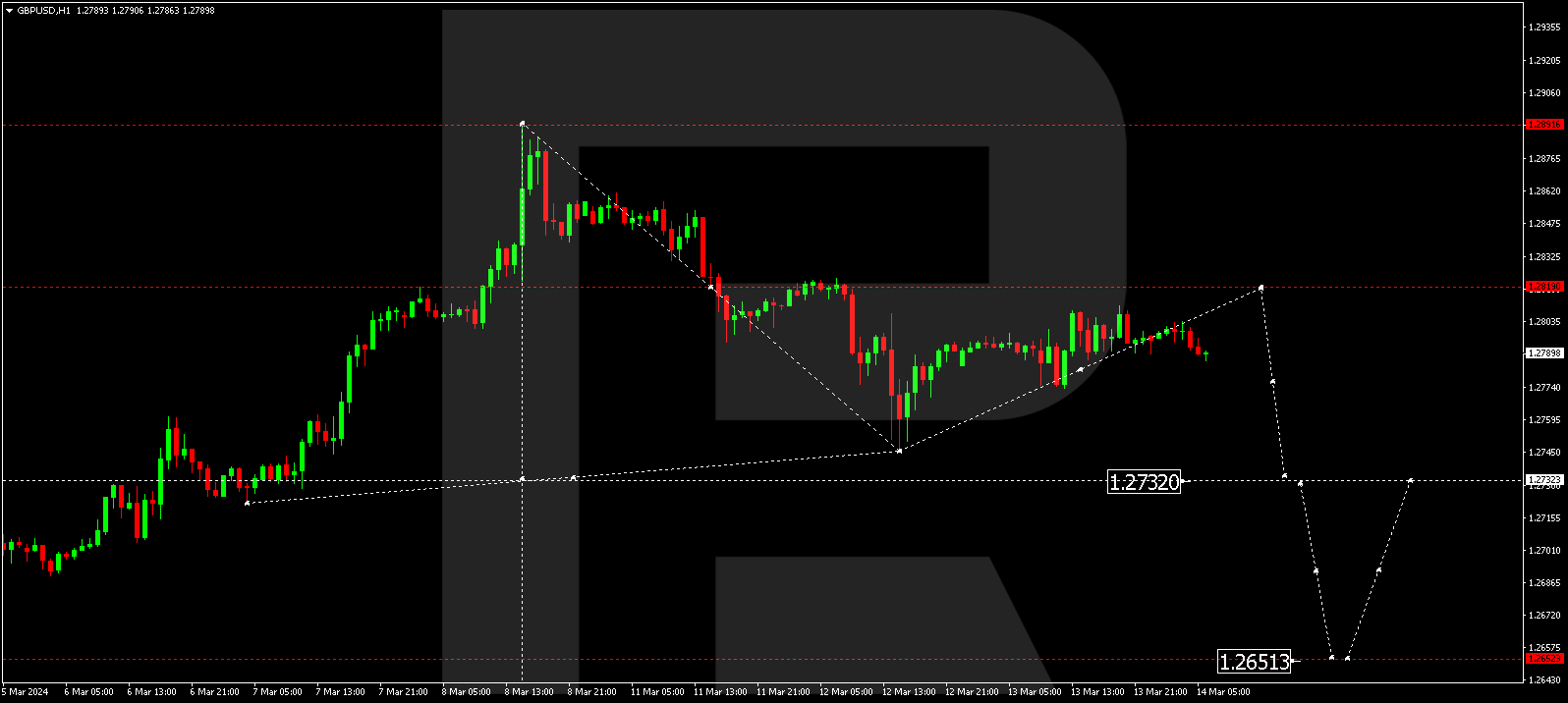

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair continues developing a corrective structure. A growth link to 1.2823 (testing from below) is not excluded today. Once this correction is over, a decline wave towards 1.2732 could start, from which level the trend might continue to 1.2651. This is a local target.

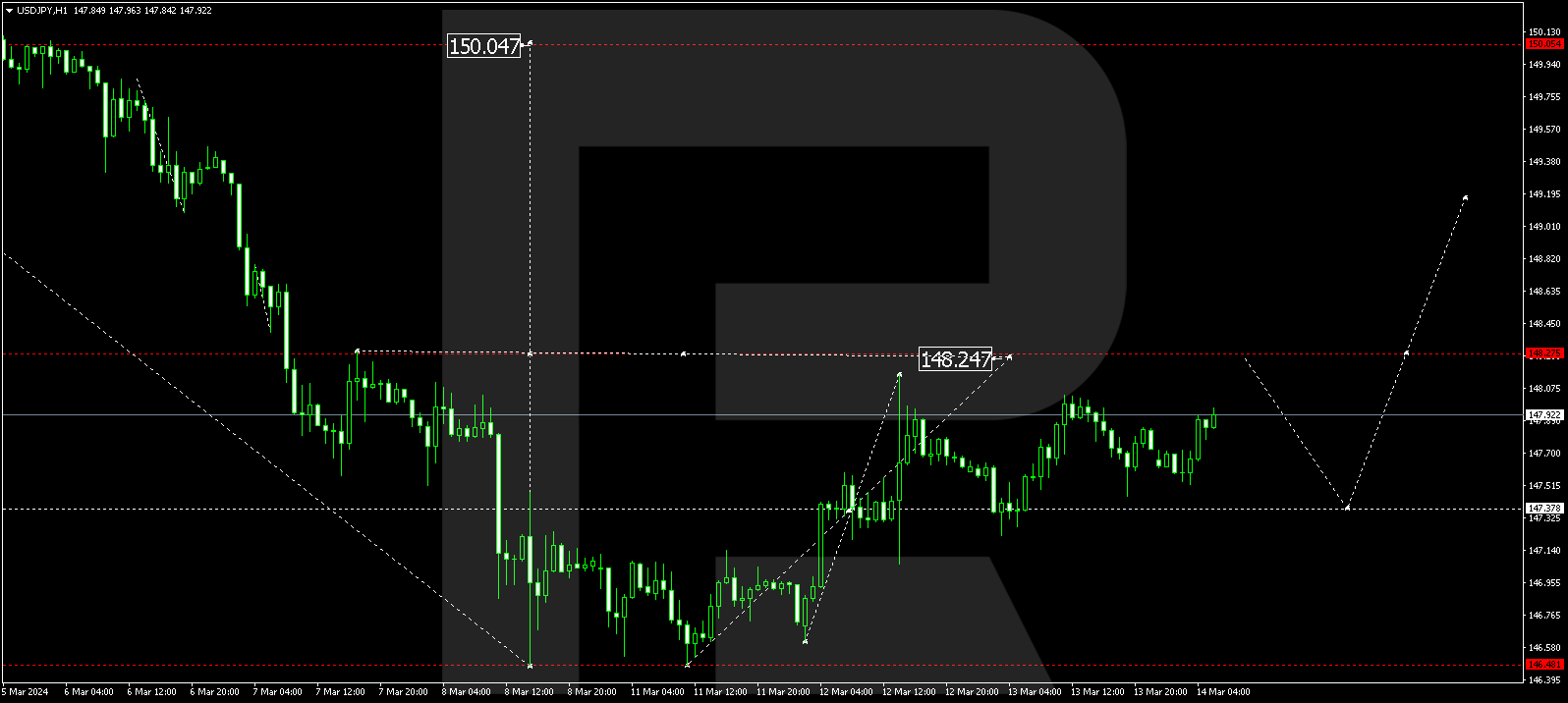

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a growth wave towards 148.28. Once this level is reached, a correction link to 147.37 is expected. Next, a new growth wave towards 149.19 could start. This is a local target.

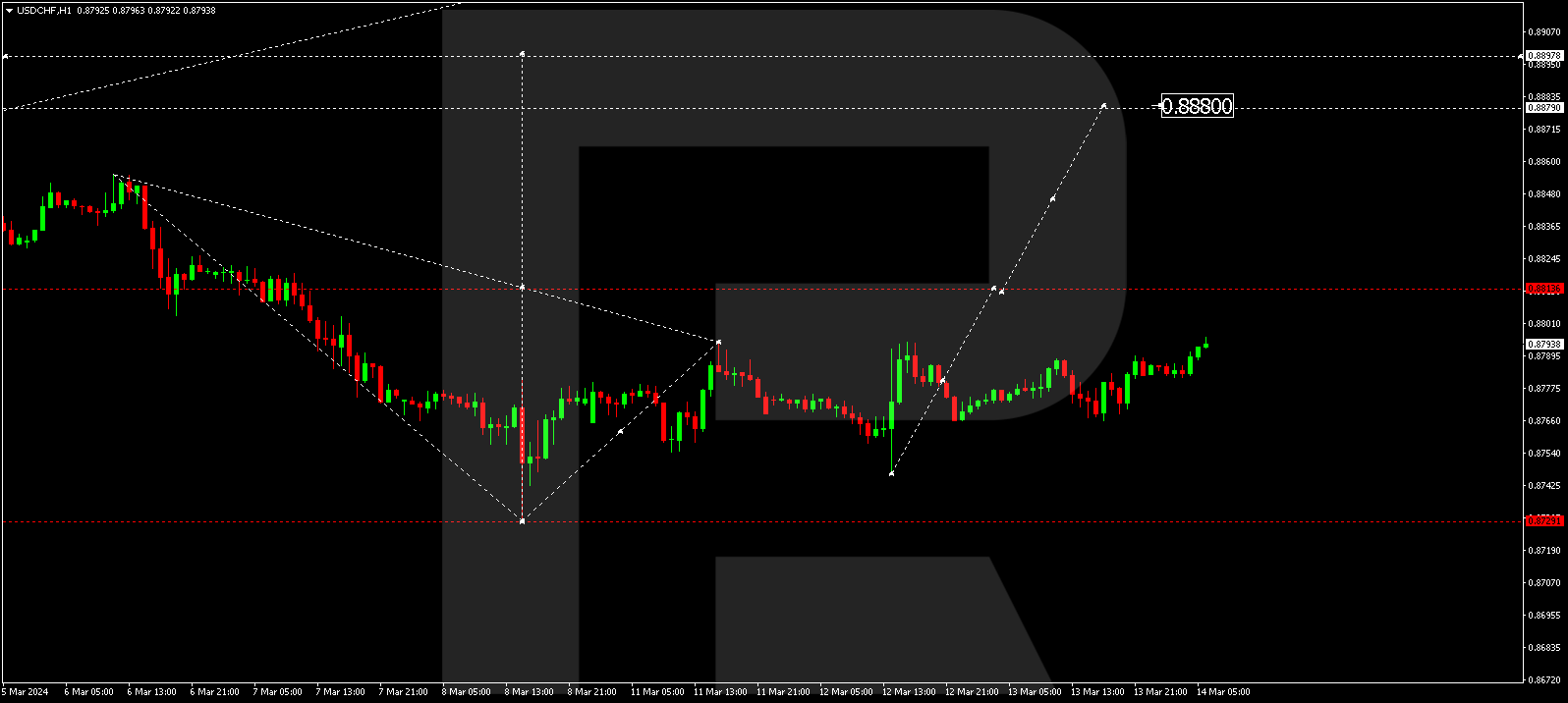

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues developing a growth structure towards 0.8814, and if this level breaks, the potential for a wave to 0.8880 could open. This is a local target. Once this level is reached, the quotes might correct to 0.8815 (testing from above) and rise to 0.8898. This is the main target of the growth wave.

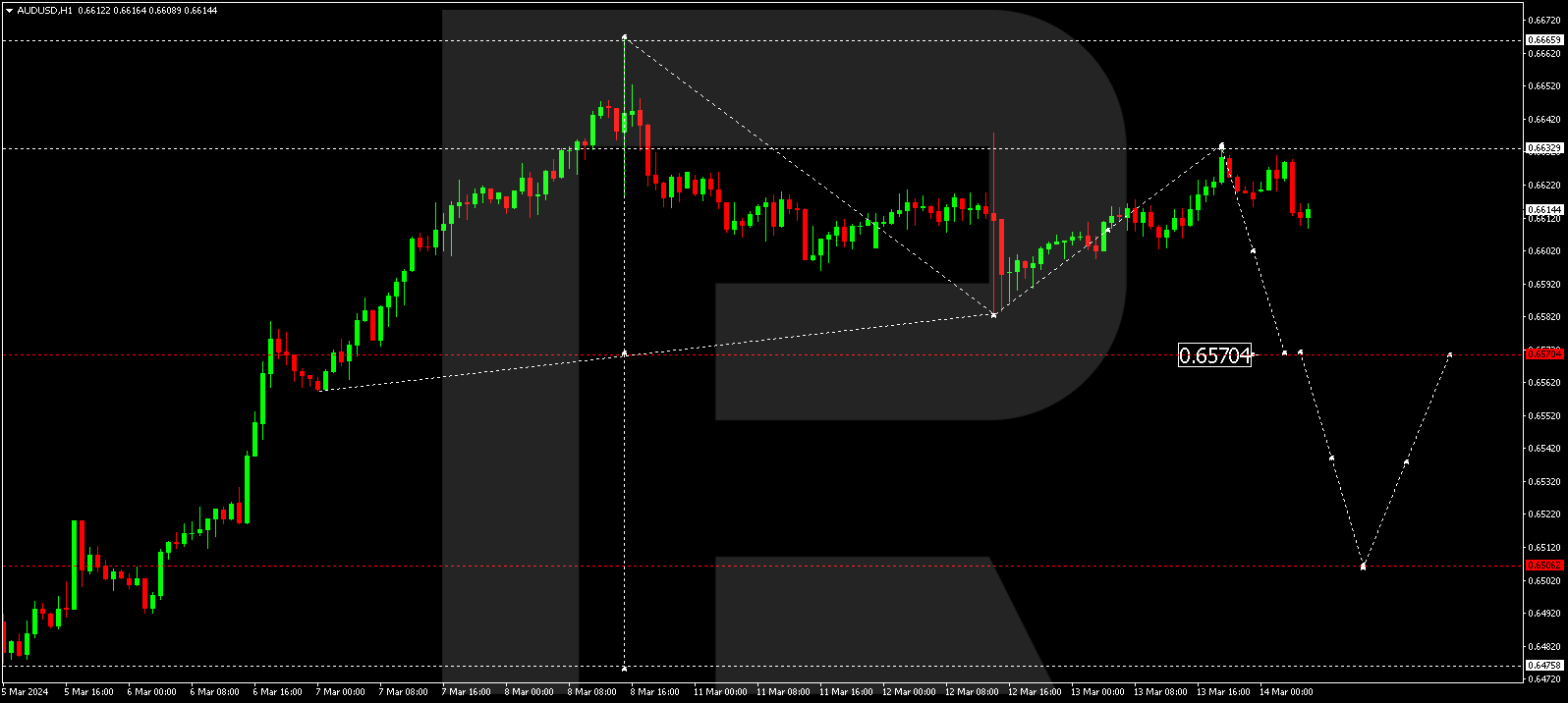

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a correction wave towards 0.6633. A decline wave to 0.6570 might develop today. If this level also breaks, the trend could extend to 0.6505. This is a local target.

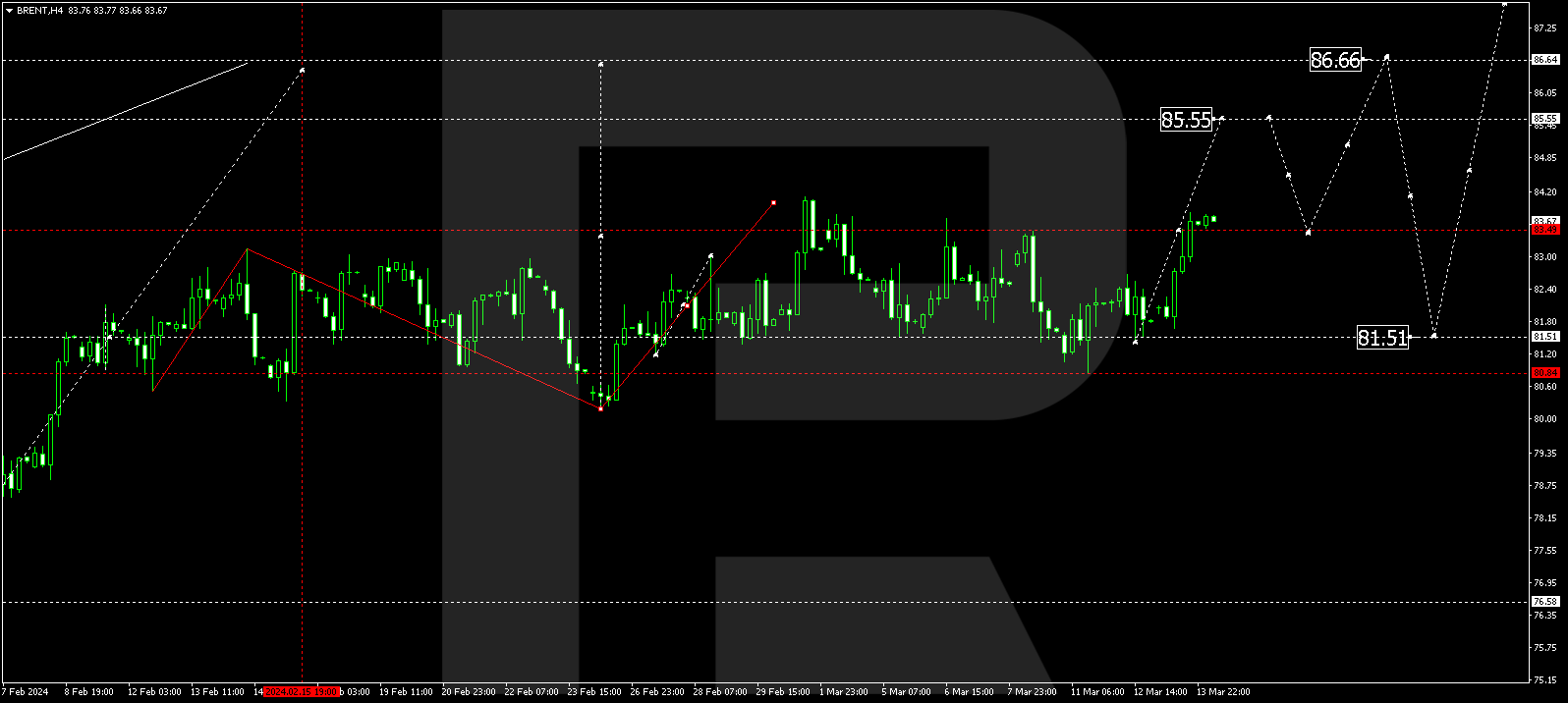

BRENT

Brent has completed a growth wave to 83.82. A consolidation range is expected to form under this level today. With an upward escape from the range, a growth link to 85.55 is expected, from which level the trend might continue to 86.66. This is the first target.

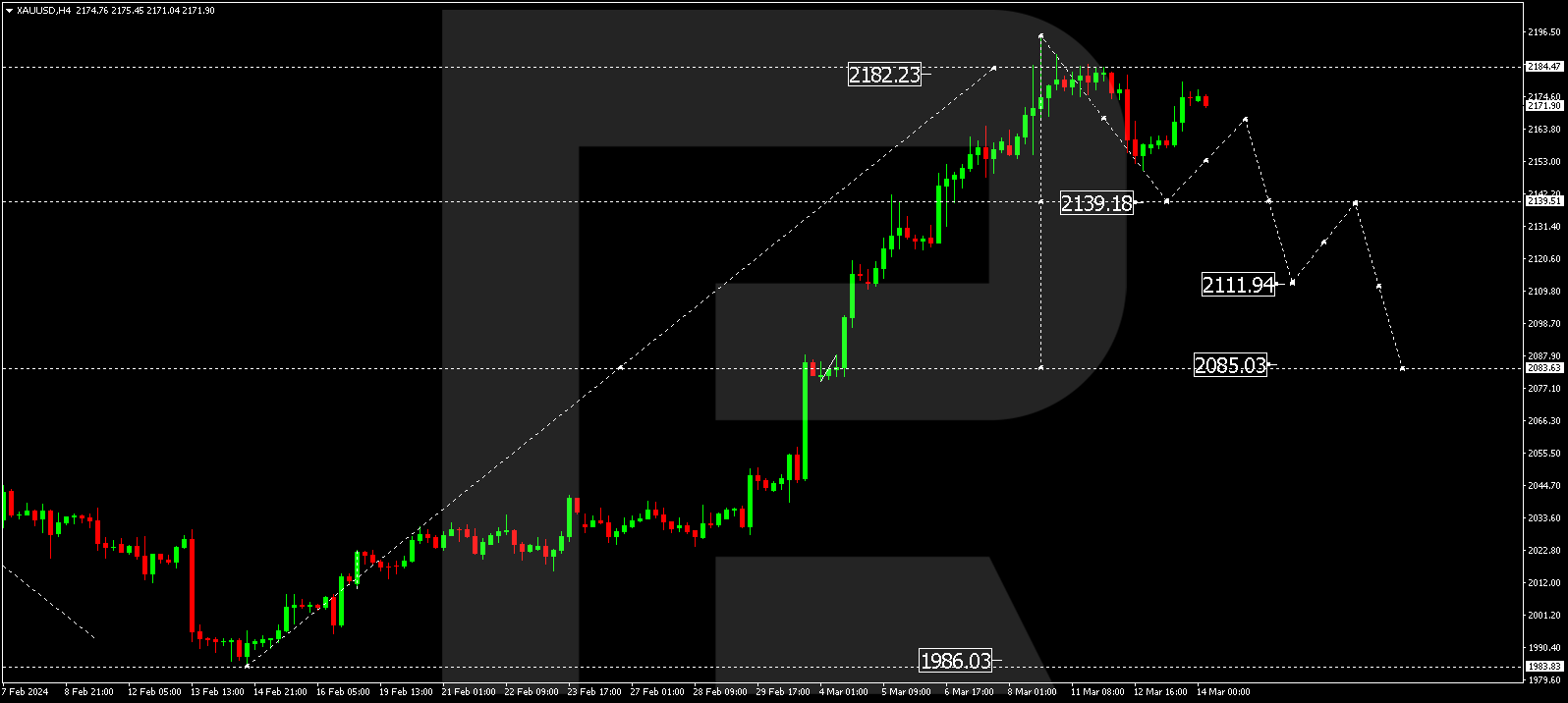

XAUUSD, “Gold vs US Dollar”

Gold continues forming a decline wave structure to 2140.00. Once this level is reached, a growth link to 2165.00 is not excluded. Next, the decline wave might extend to 2111.00, from which level the trend could continue to 2085.00. This is the main target of the correction.

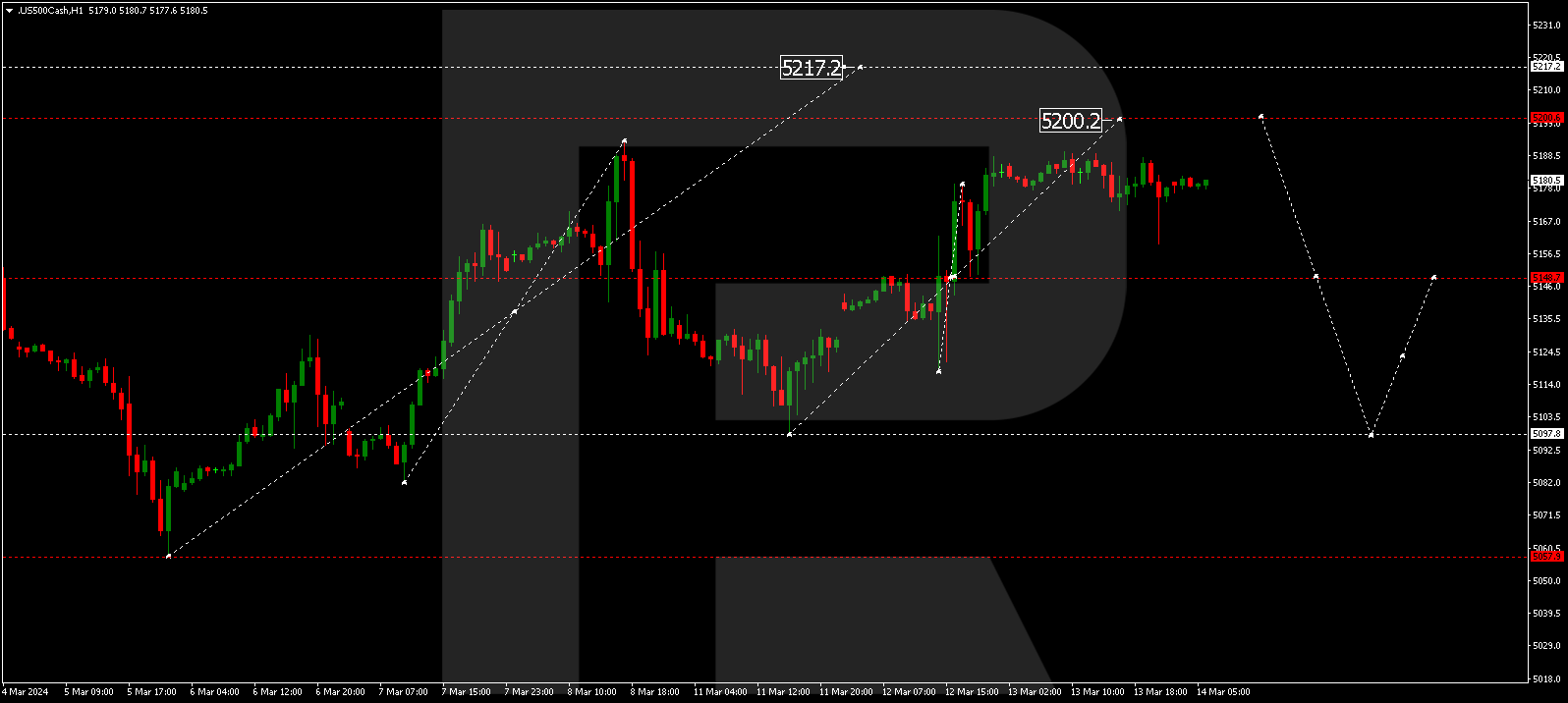

S&P 500

The stock index continues forming a consolidation range around 5148.0. Today the range might expand to 5200.0. Once this level is reached, a decline wave to 5100.0 could begin, probably followed by a growth link towards 5148.0 (testing from below). Next, a decline wave to 5055.0 could start.