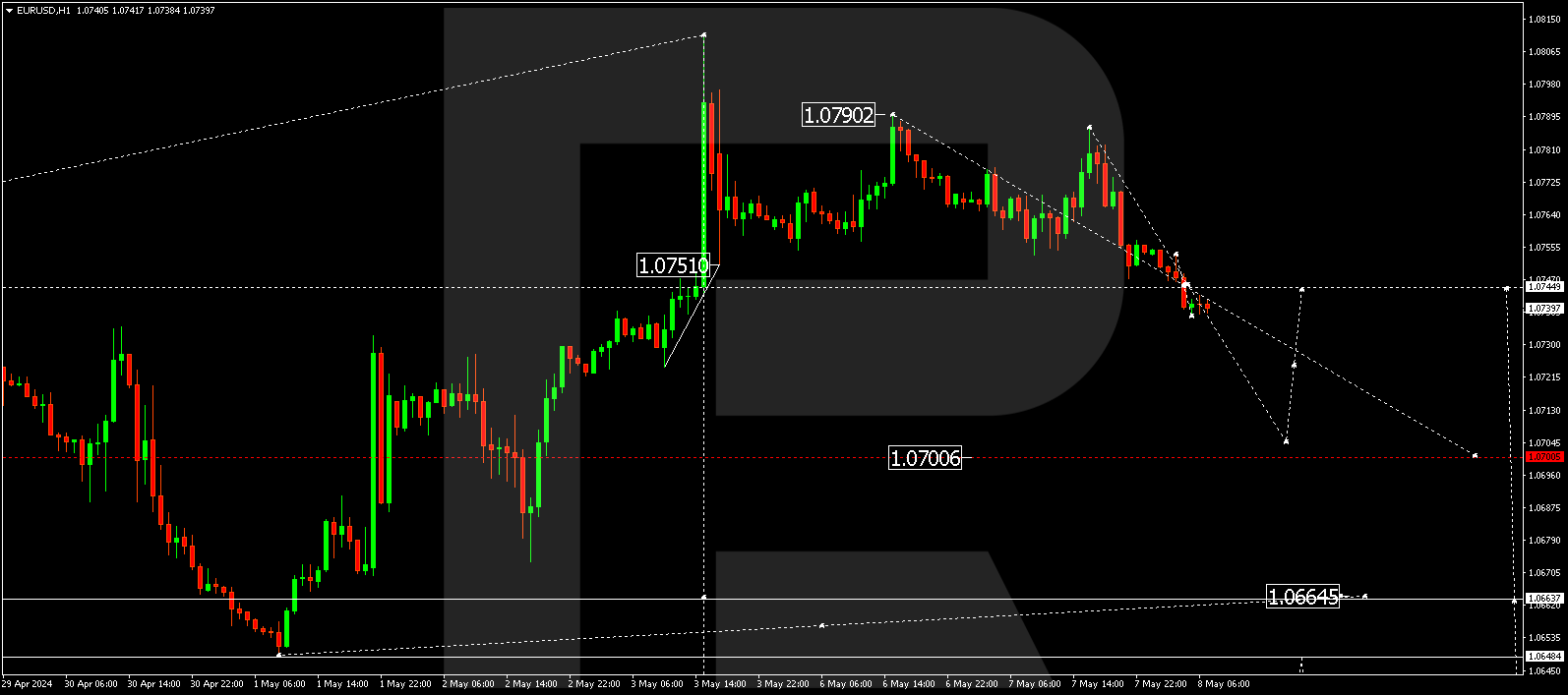

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a downward impulse, reaching 1.0737. Today, the market is forming a narrow consolidation range above this level. With an upward breakout, a corrective phase is not ruled out, aiming for 1.0757. With a downward breakout, the trend might continue to 1.0700. A breakout of this level will open the potential for a decline wave towards the local target of 1.0580.

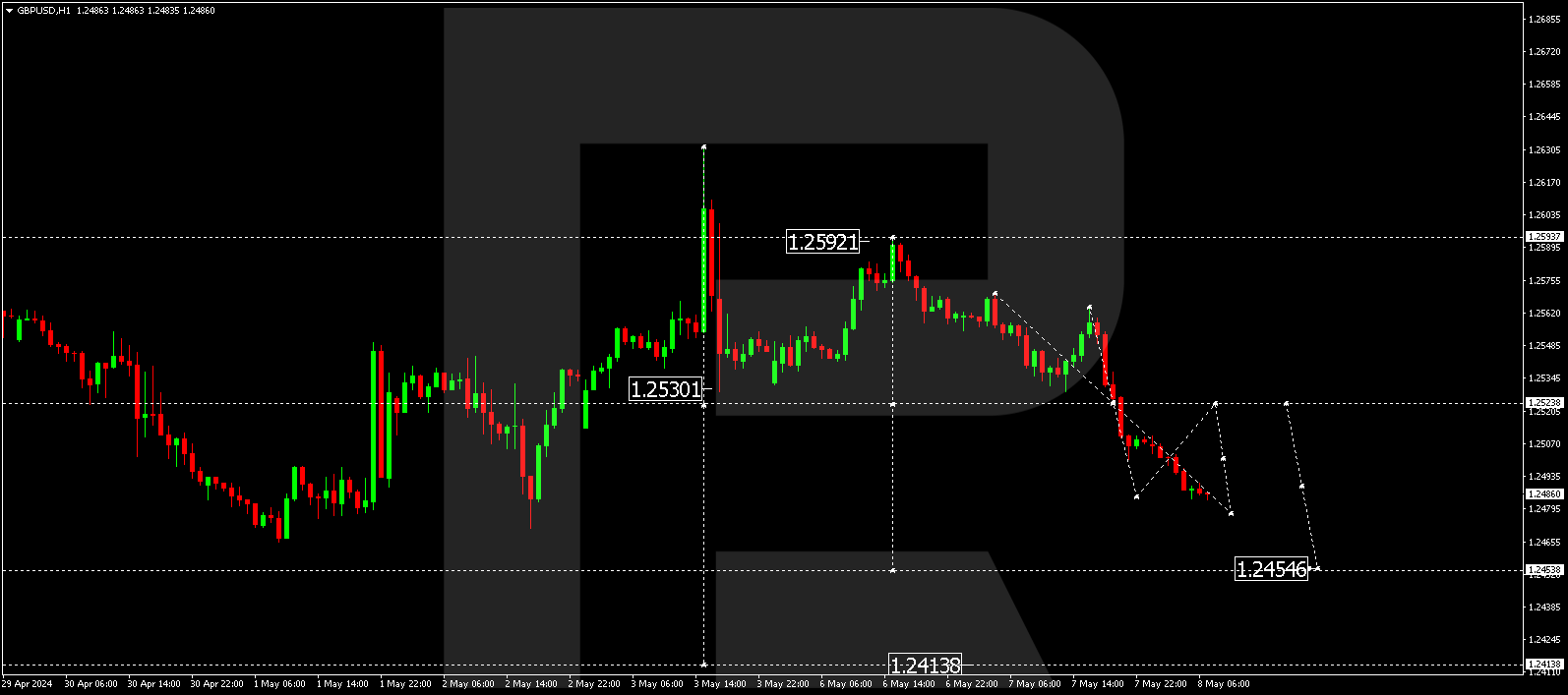

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has broken below 1.2525 and continues to develop a wave to 1.2414. After the price reaches this level, a corrective phase could follow, targeting 1.2525 (testing from below). Next, a new decline wave could start, aiming for 1.2270 and potentially continuing to 1.2170. This is the target of the first decline wave by trend.

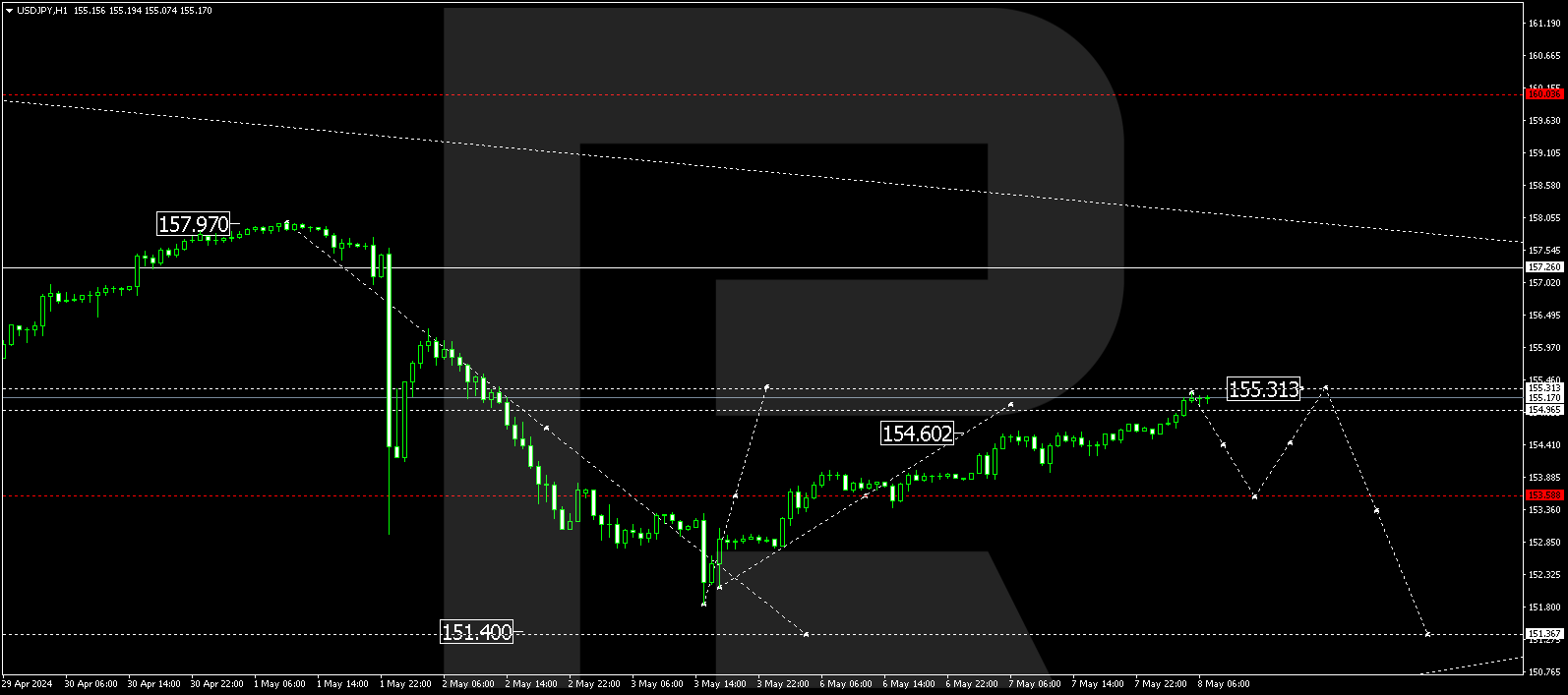

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a corrective wave, reaching 155.25. A new consolidation range could form below this level. With a downward breakout, another decline wave could develop, targeting 153.58. If this level also breaks, the trend might continue to 151.40 representing the first target of the decline wave.

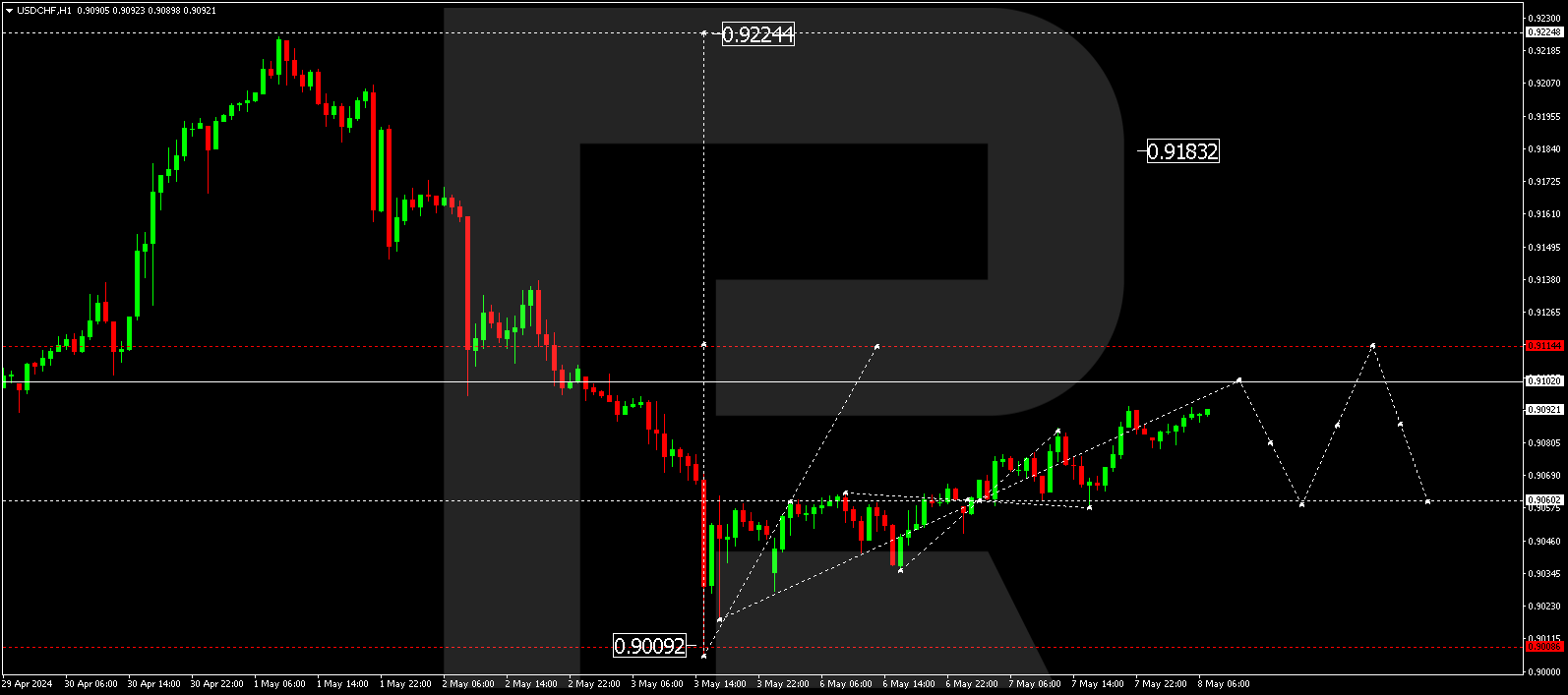

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues to develop a growth wave towards 0.9114. After the price reaches this level, a corrective phase could follow, targeting 0.9060 (testing from above). Next, a new growth wave might start, aiming for 0.9180 and potentially continuing to 0.9222. This is the first target of the growth wave.

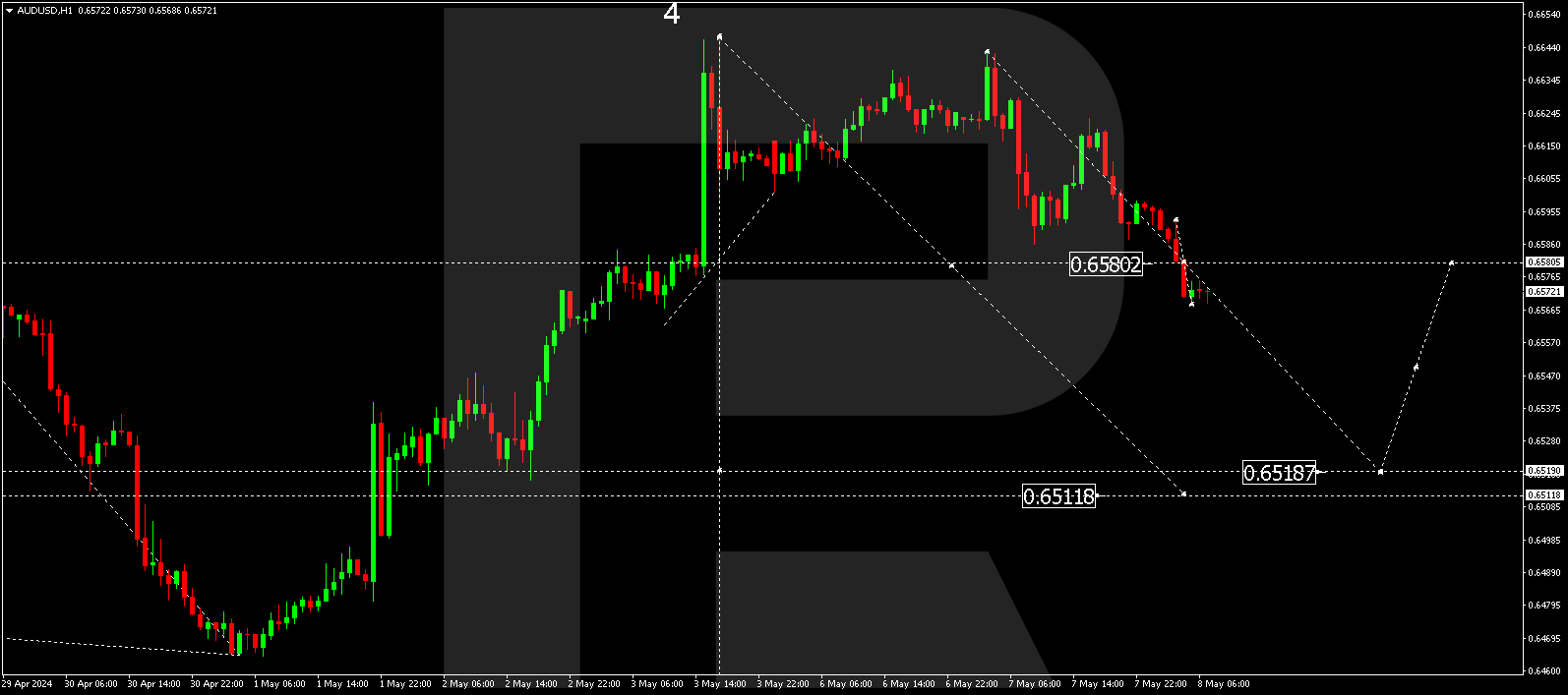

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a decline wave, reaching 0.6568. Today, the market is forming a narrow consolidation range above this level. With an upward breakout, a corrective phase is not ruled out, aiming for 0.6595. A downward breakout will open the potential for a wave towards 0.6515, with the trend potentially continuing to the decline wave’s first target of 0.6400.

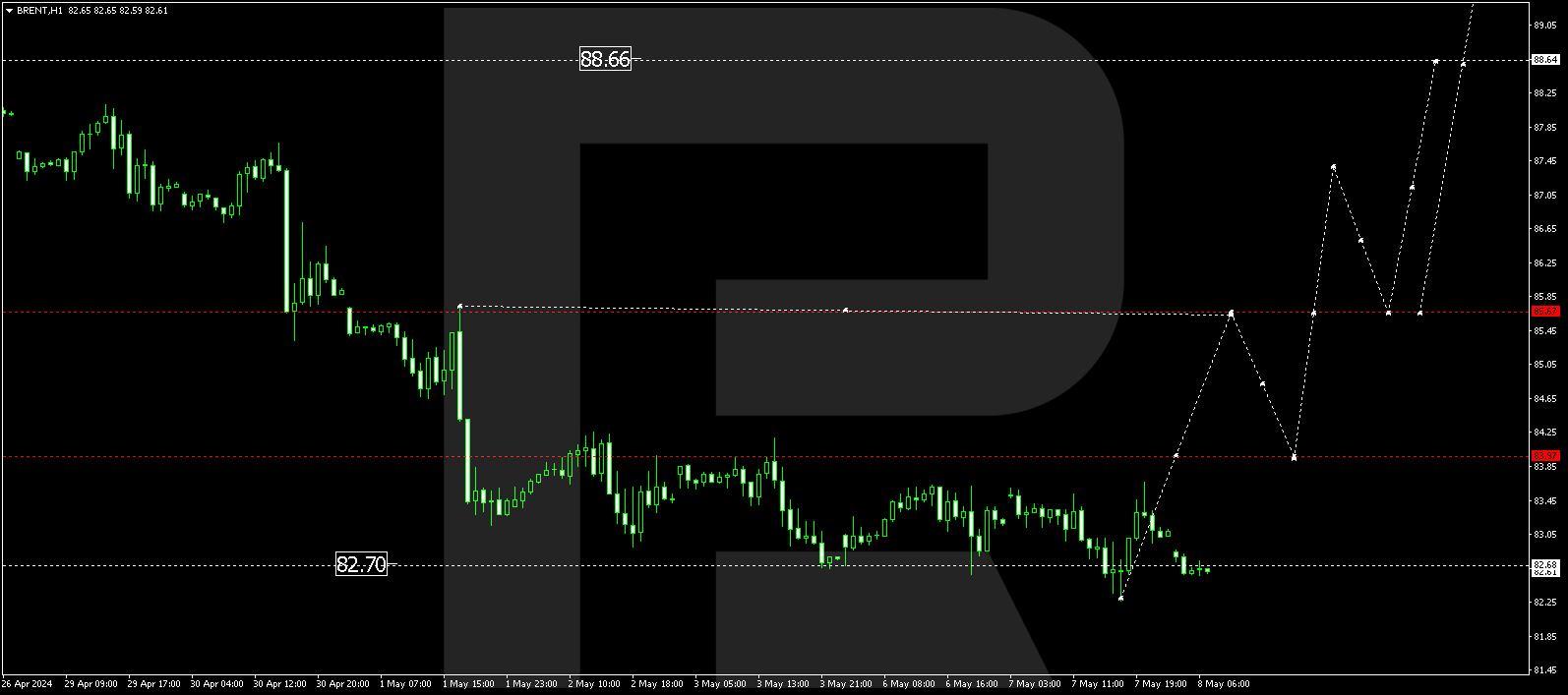

BRENT

Brent continues to develop a narrow consolidation range around 83.33, with the price potentially exiting the range upwards, aiming for 85.65. After the price hits this level, a corrective phase is not ruled out, targeting 84.00. Subsequently, a new growth wave could start, aiming for the local target of 88.64.

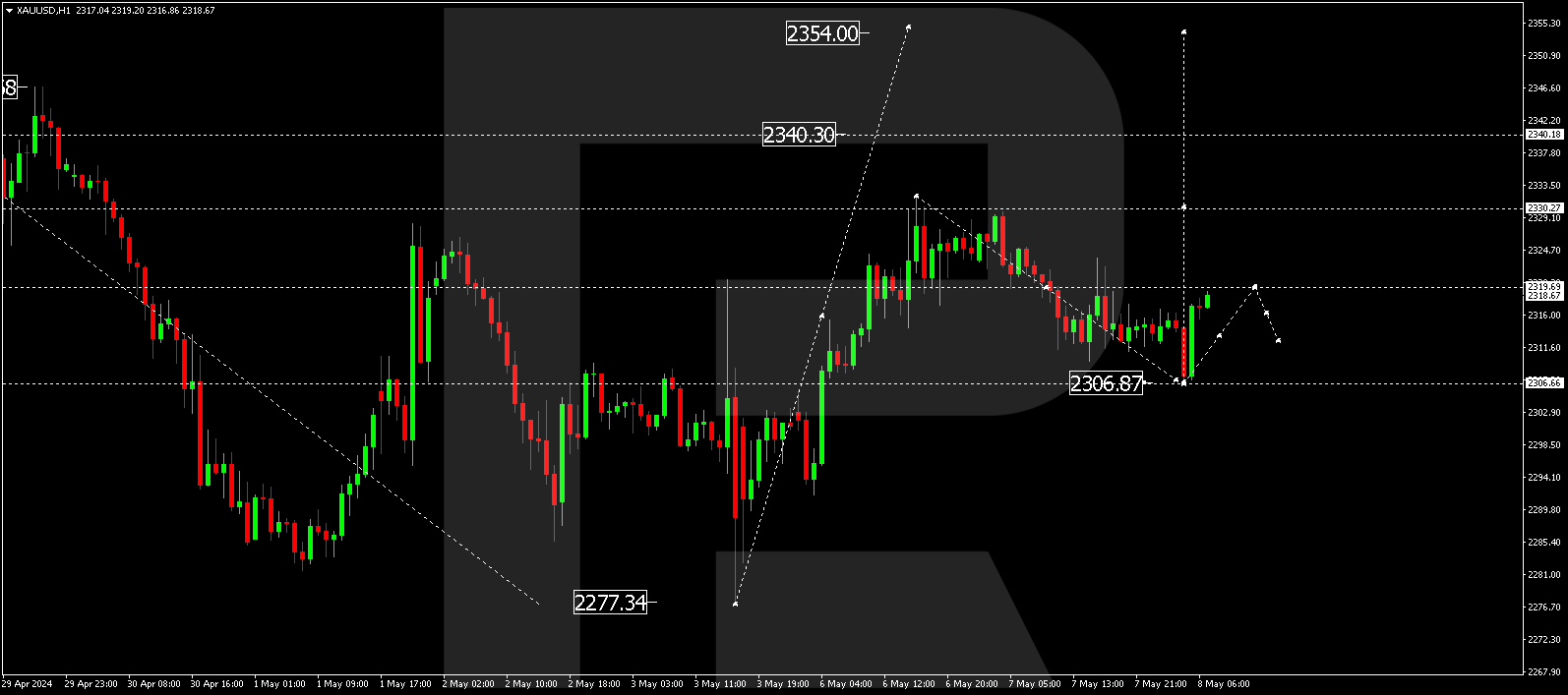

XAUUSD, “Gold vs US Dollar”

Gold is currently in a consolidation phase around 2320.00. An upward breakout will open the potential for a wave towards 2354.00. With a downward breakout, the correction might continue to 2266.00.

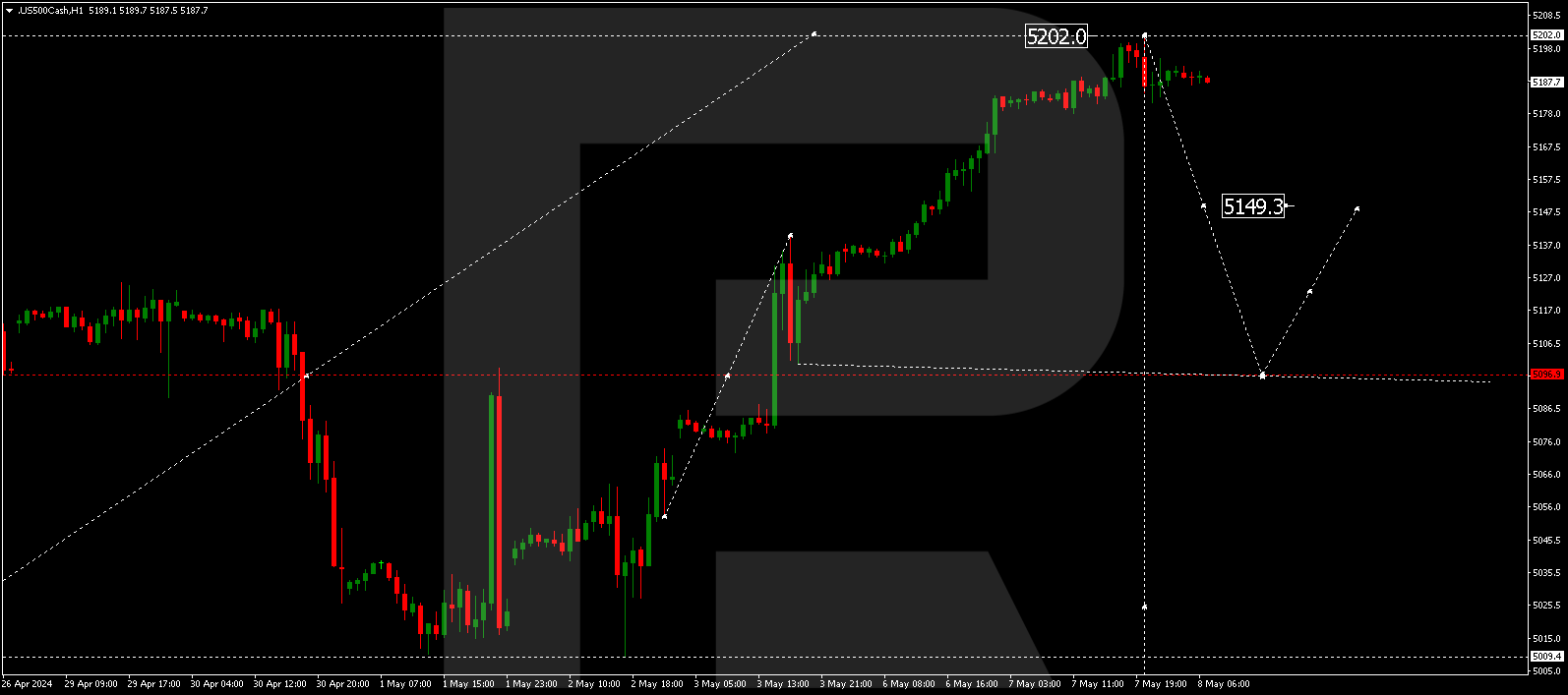

S&P 500

The stock index is currently in a consolidation phase below 5202.0. A downward breakout will open the potential for a decline wave towards 5097.0. Once the price reaches this level, a corrective phase might follow, targeting 5149.0. Next, the price could decline to 5000.0 representing the first target of another decline wave.