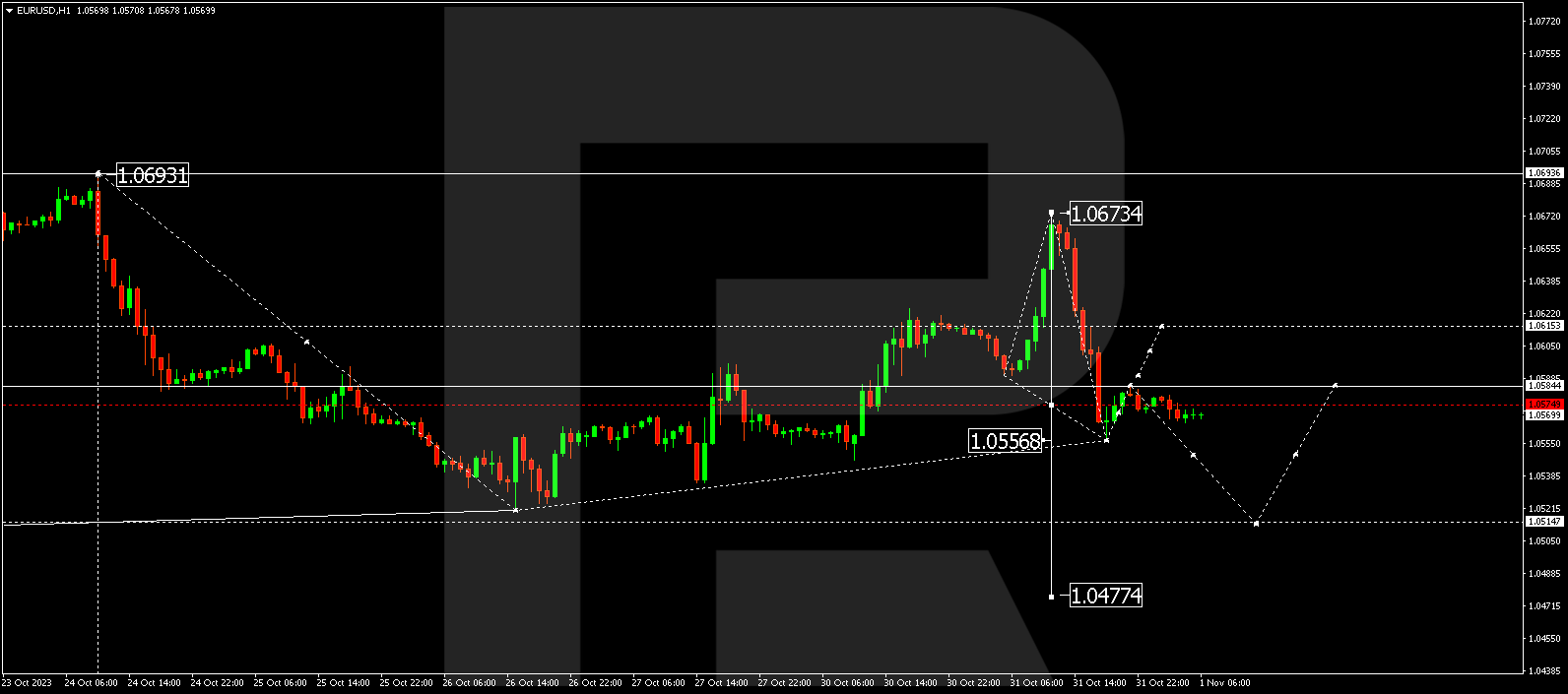

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction to 1.0673 and started to decline rapidly. The price has achieved the first target of 1.0557. Today a consolidation range is forming above this level. With an upward breakout, the price might rise to 1.0600 (a test from below). A downward breakout will open the potential for a decline to 1.0515, from where the trend could continue to 1.0477. This is a local target.

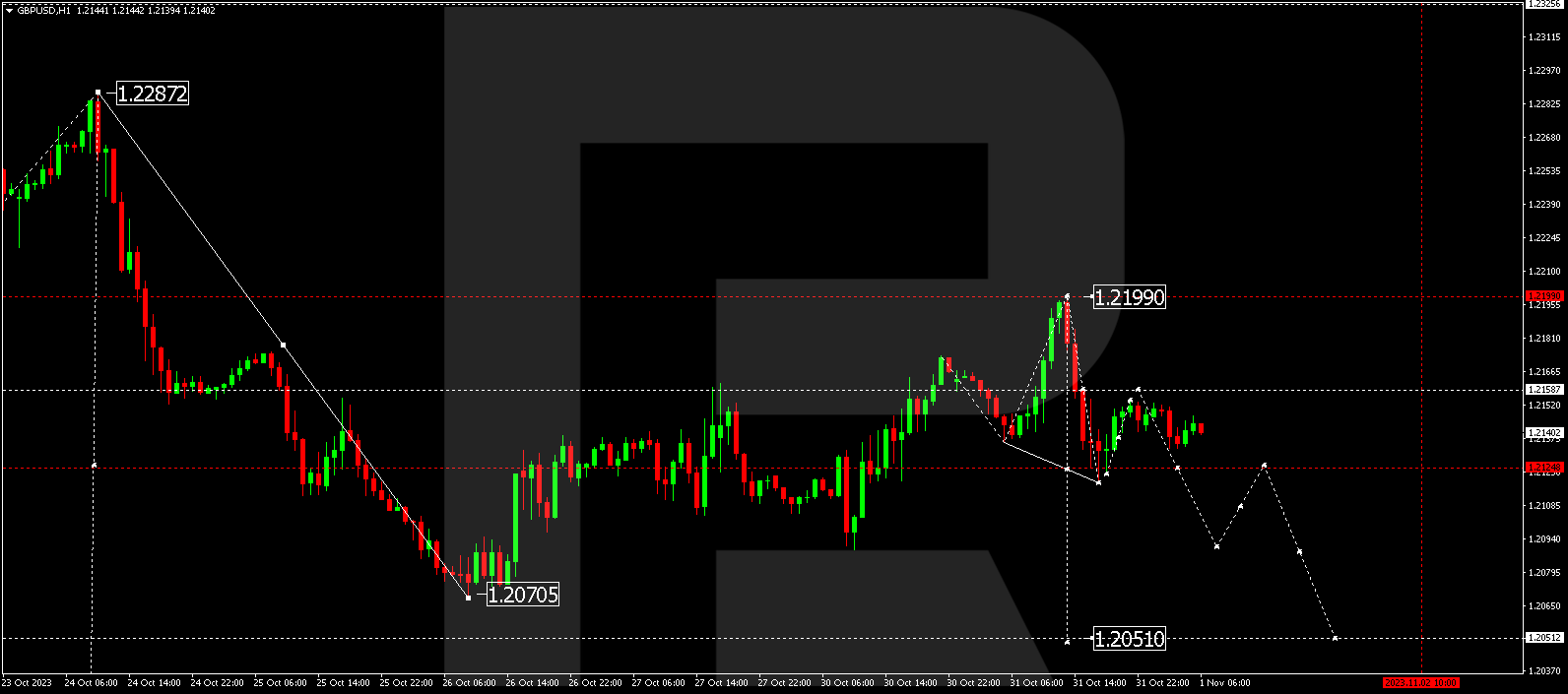

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has corrected to 1.2199 and started to decline rapidly. The price has reached the first target of 1.2120. A link of growth to 1.2158 is not excluded today, followed by a decline to 1.2090 with the trend potentially developing to 1.2050. This is a local target.

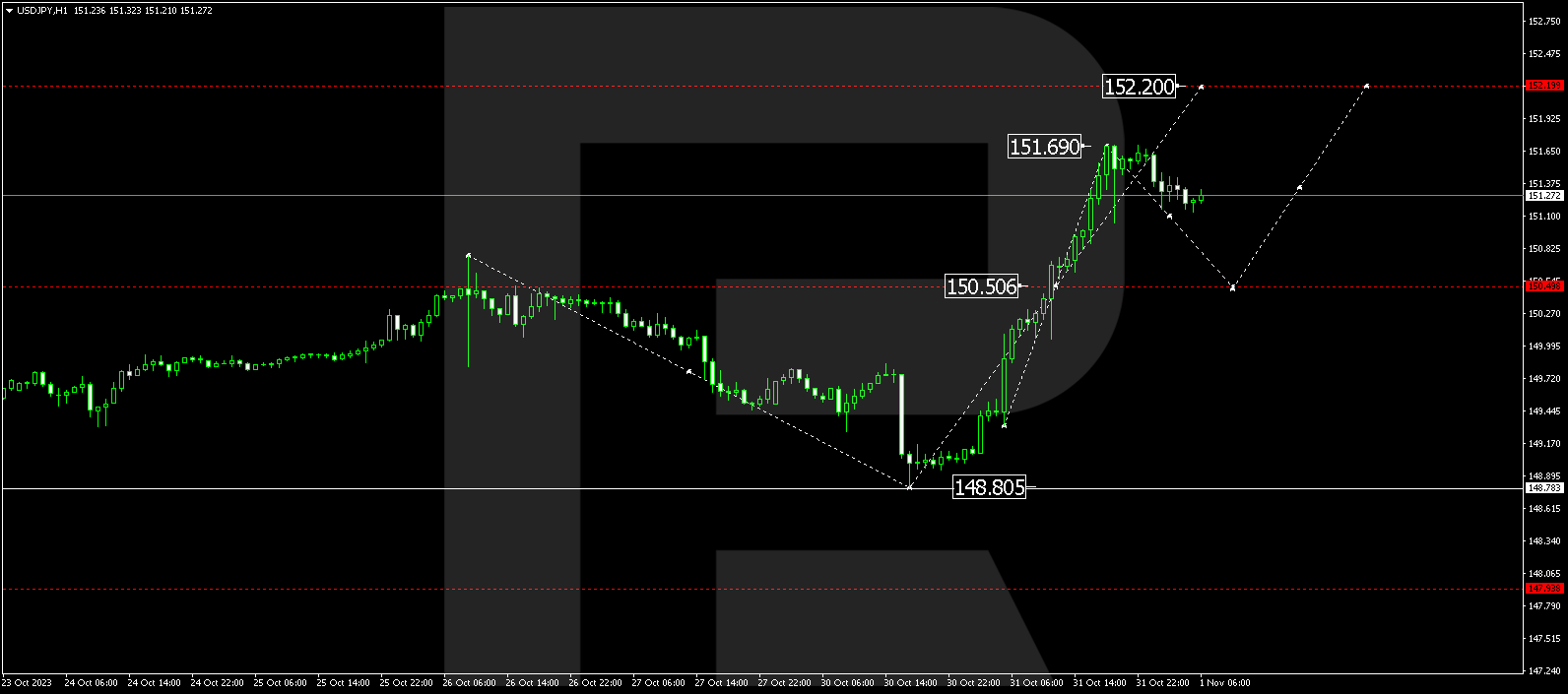

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a growth wave, reaching 151.69. Today the market is consolidating below this level. Breaking it downwards, the price might correct to 150.50. With an upward breakout, the trend could continue to 152.20.

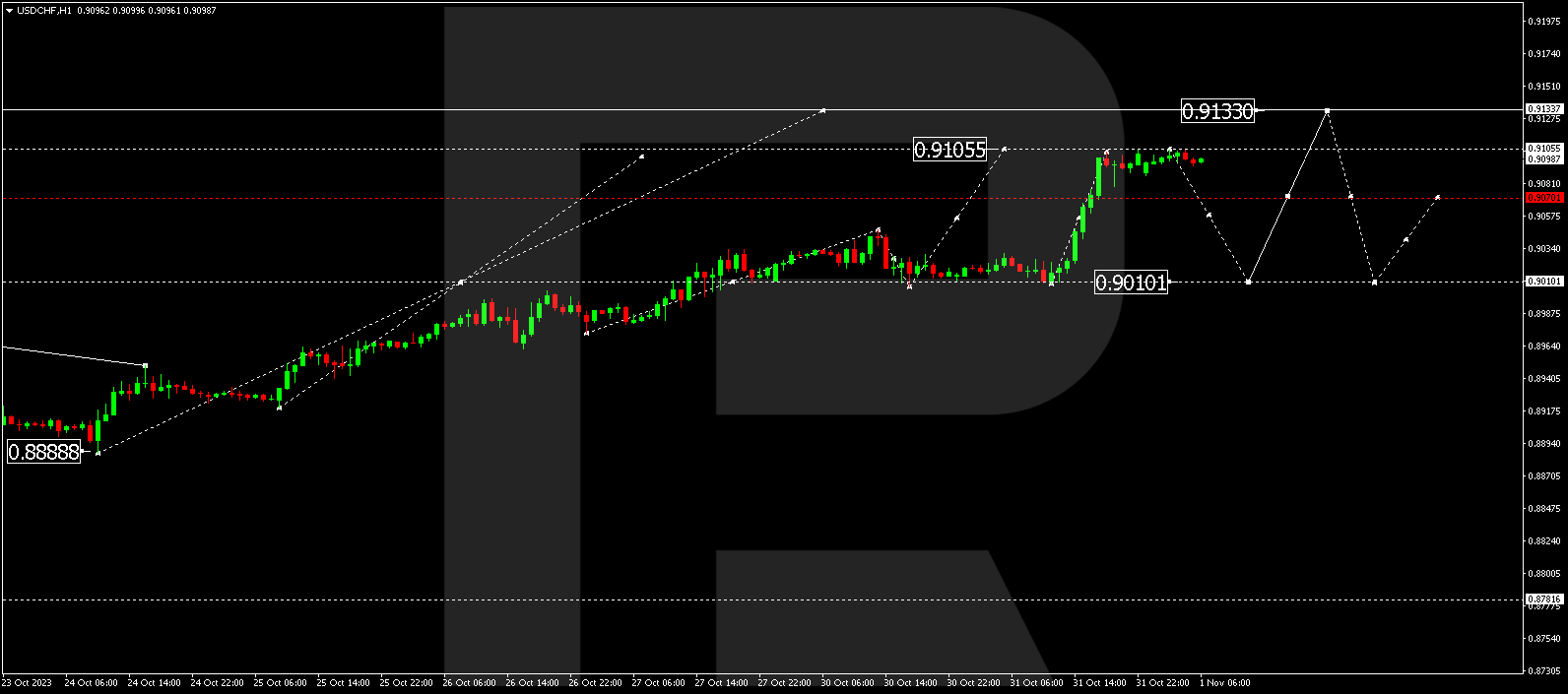

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a growth wave, reaching 0.9105. Today a downward movement to 0.9070 could start, followed by a rise to 0.9133. This is the first target.

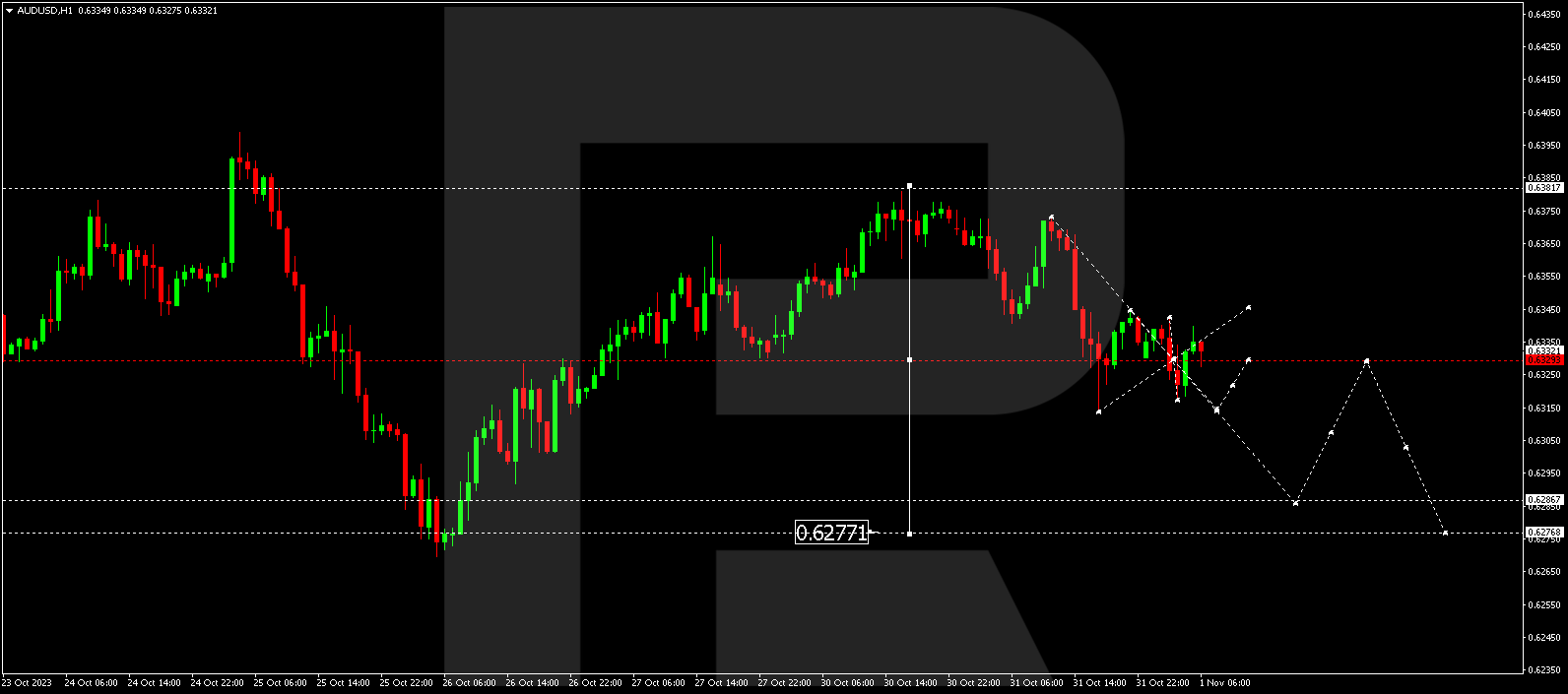

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues developing a consolidation range around 0.6330. With a downward breakout, a decline wave might continue to 0.6286, from where the trend could expand to 0.6270. This is the first target.

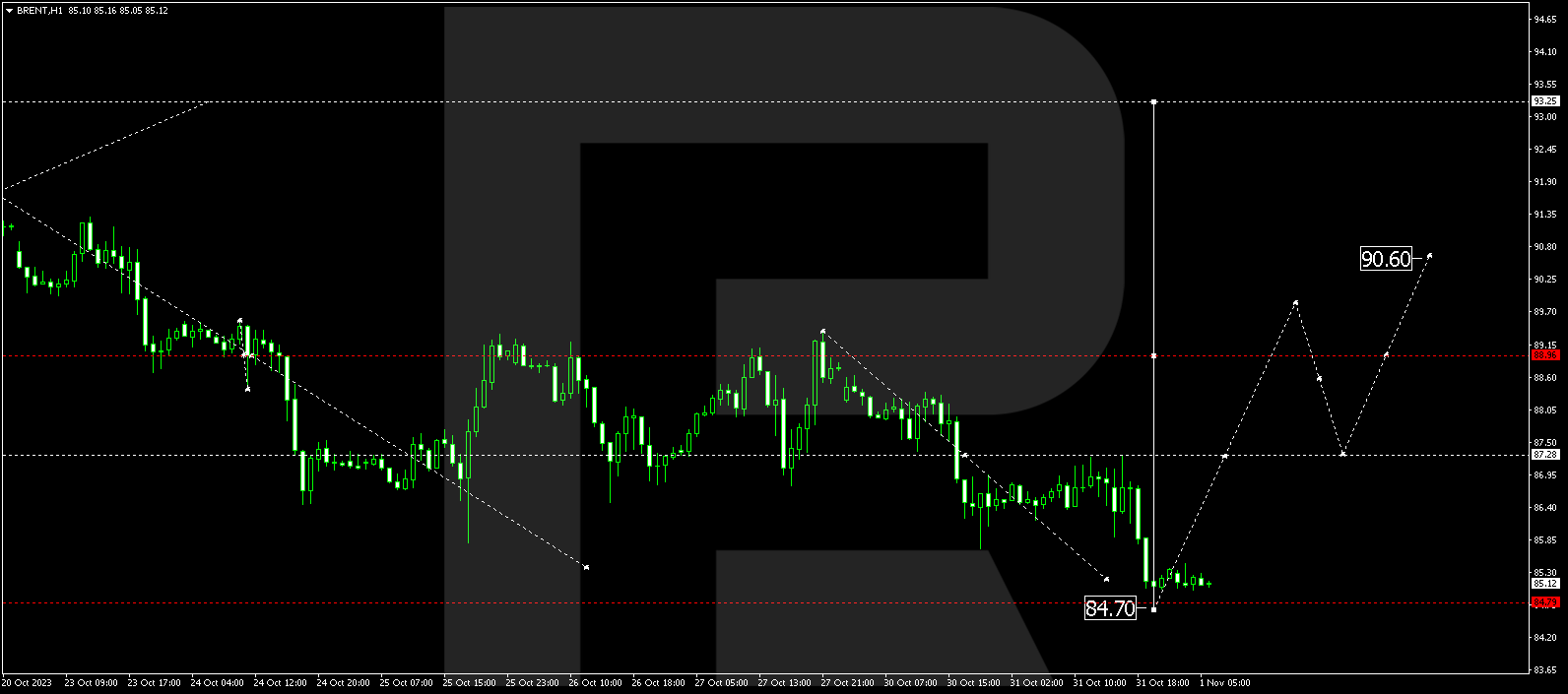

BRENT

Brent has completed a correction to 84.70. Today a consolidation range is expected to form above this level. An upward breakout might lead to a new growth wave to 87.30. If this level breaks too, this will open the way for an upward movement to 95.00. This is a local target.

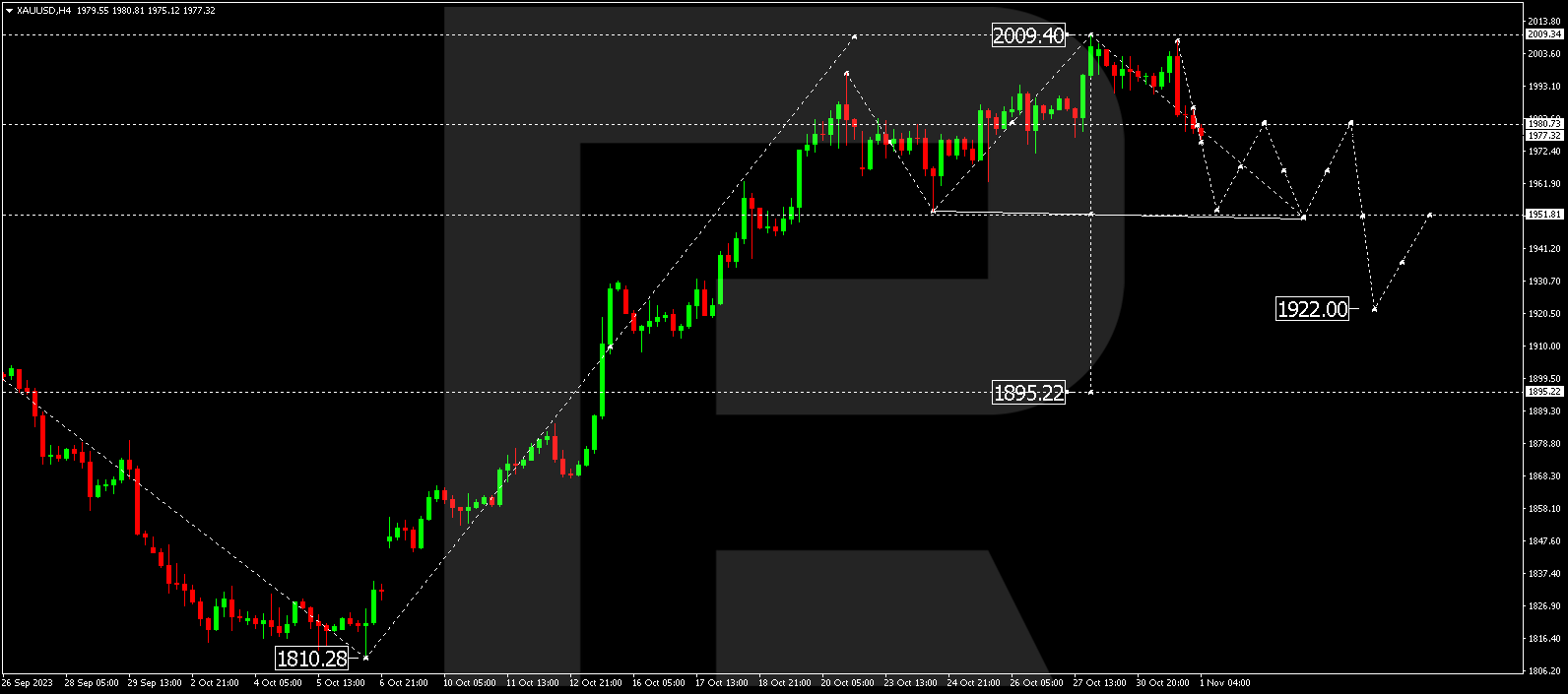

XAUUSD, “Gold vs US Dollar”

Gold continues to form a decline wave to 1952.00. After the price hits this level, it might rise to 1980.00 (a test from below) and then decline to 1951.80. This is the first target.

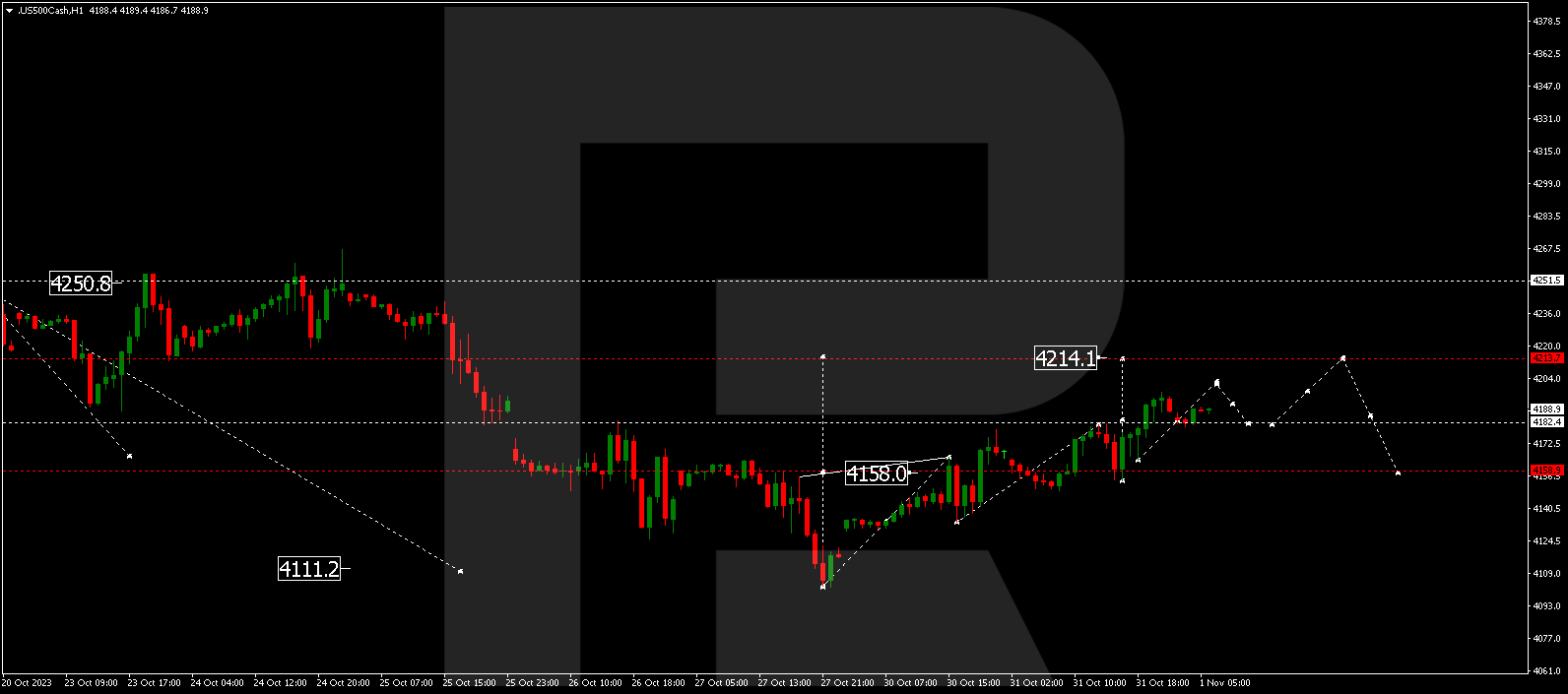

S&P 500

The stock index continues to develop a correction to 4213.7. After reaching this level, the price could continue its movement to 4111.0, with the trend potentially developing to 4000.0.