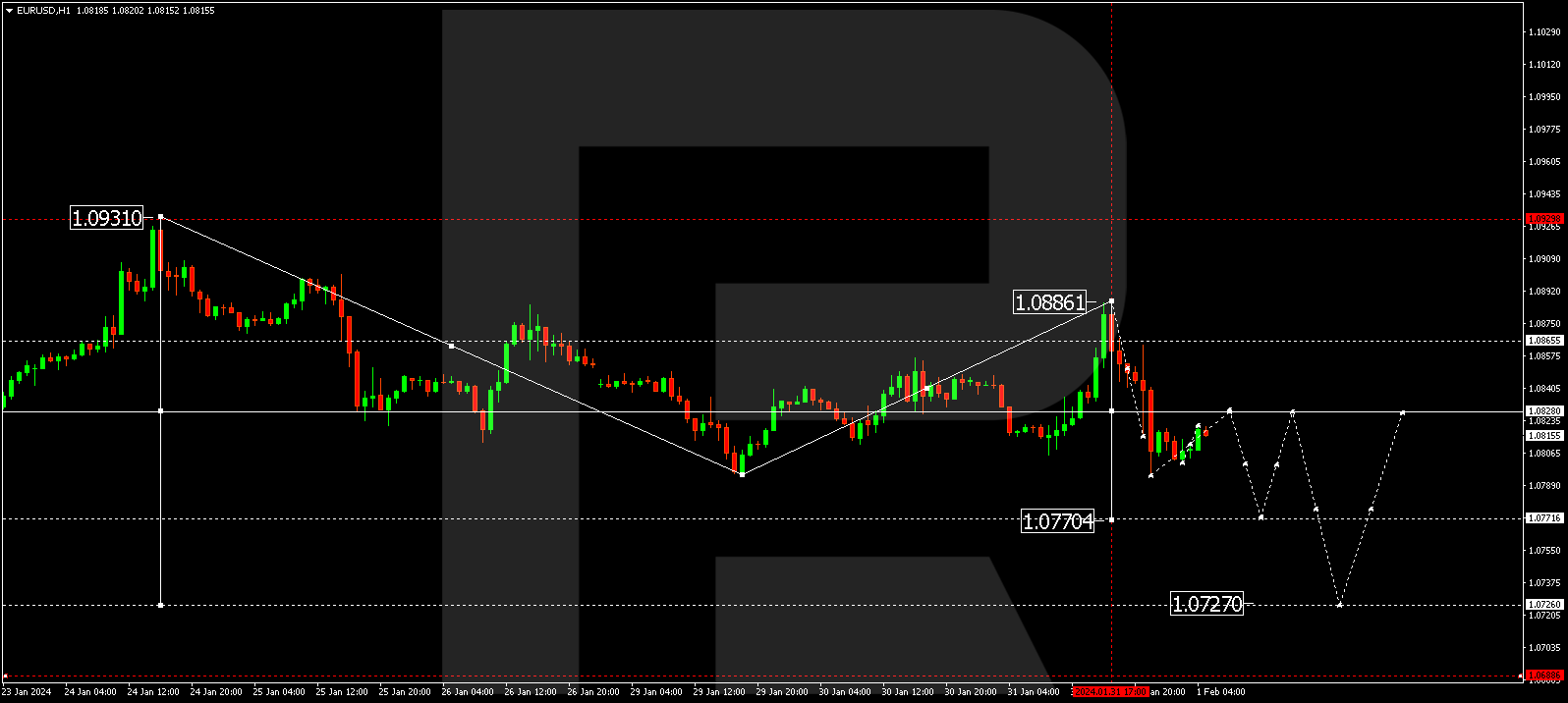

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a correction wave to 1.0886. The news provoked a decline impulse to the 1.0816 level and a correction to 1.0860. Today the market has performed a structure of a decline wave to 1.0794. Next, a correction link to 1.0828 is expected. Once the correction is over, the decline wave might extend to 1.0770. This is a local target.

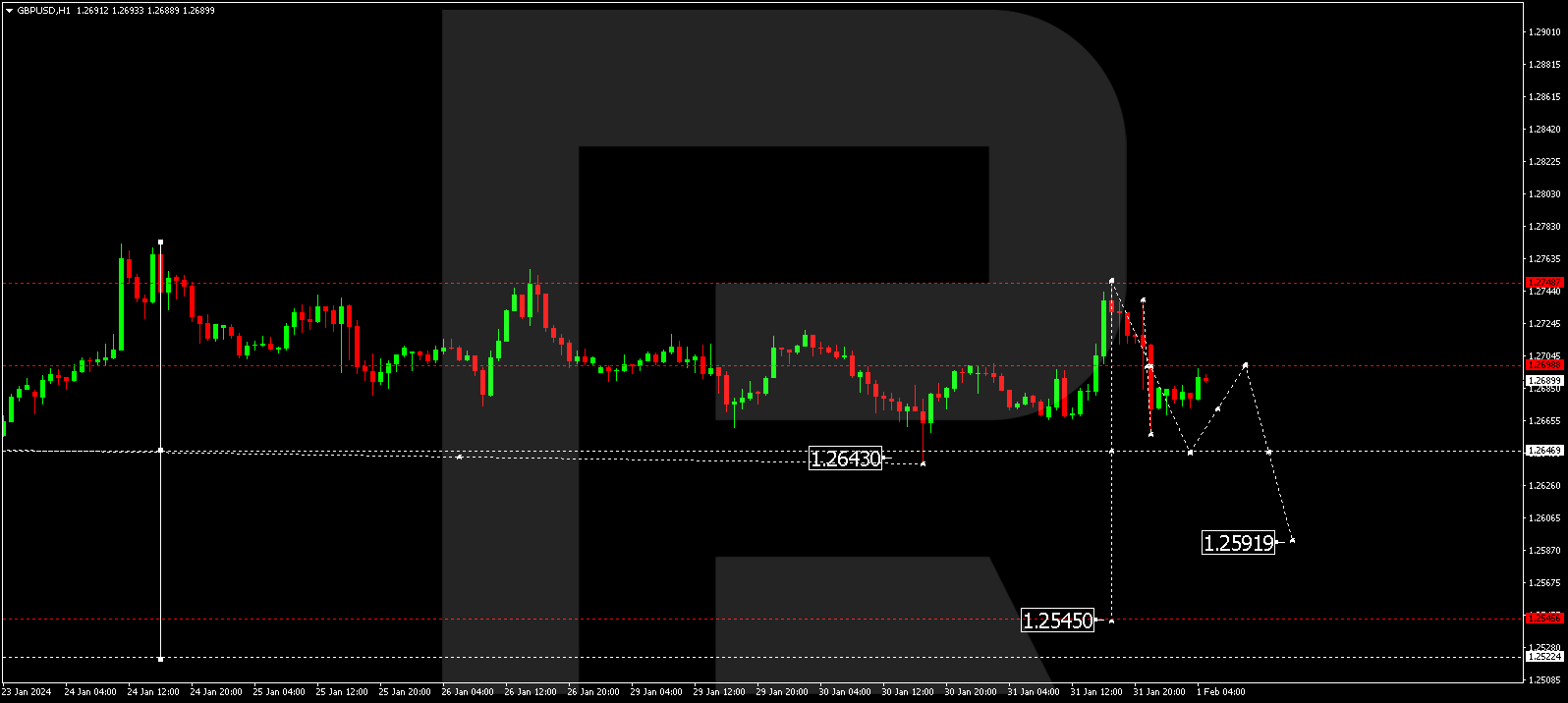

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a corrective wave to 1.2748. A decline wave to 1.2646 might form today. This is the first target. Once this level is reached, a correction to 1.2698 might follow. Next, a decline to 1.2592 is expected. This is a local target.

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a consolidation range around 146.93. By now, the range has extended to 146.00. Once the price reached this level, a technical return to 147.00 happened (a test from below). A new decline wave to 145.15 might develop today.

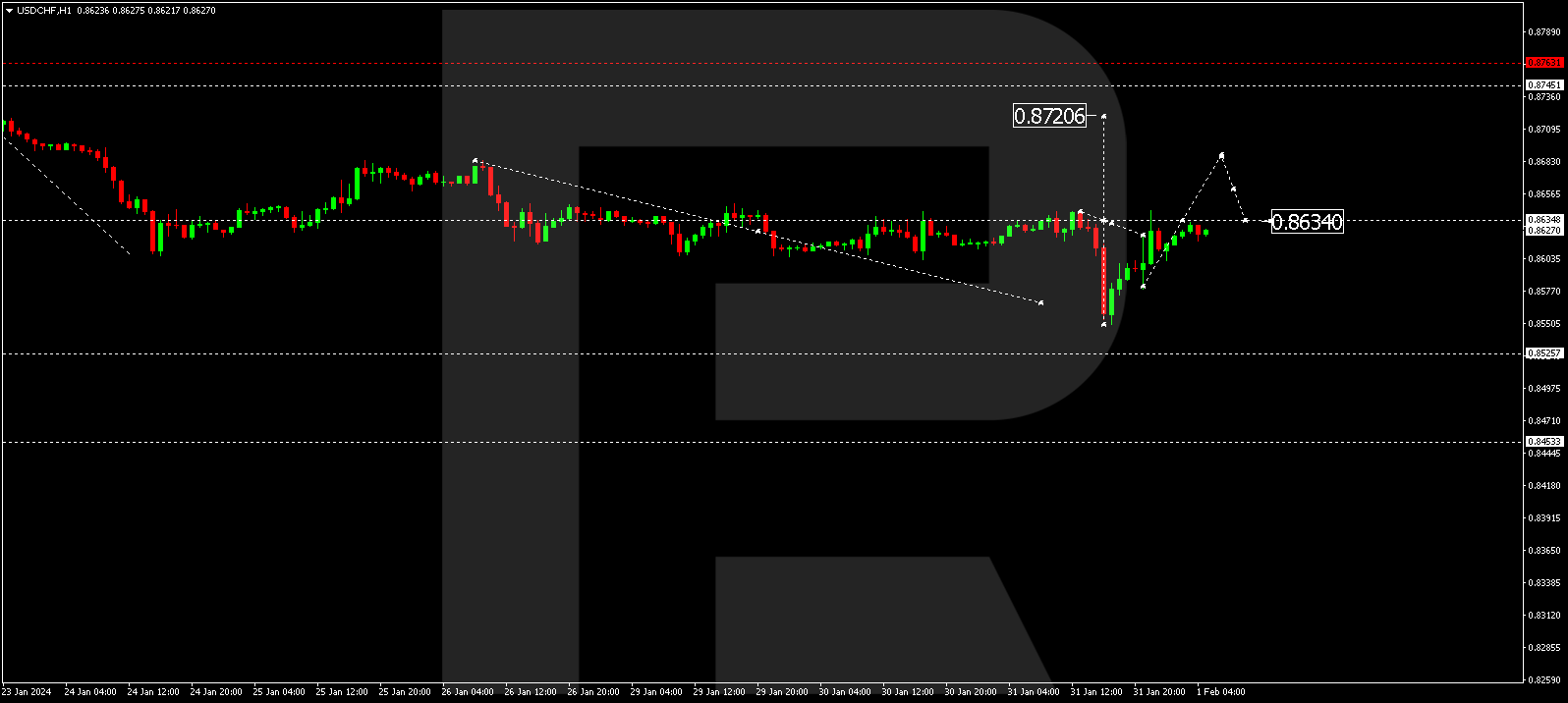

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has corrected to 0.8555. Today the market is forming a growth wave to 0.8634. Once this level is reached, a consolidation range could form around this level. With an escape upwards, a growth wave could develop towards 0.8686, from where the trend might extend to 0.8720. This is the first target.

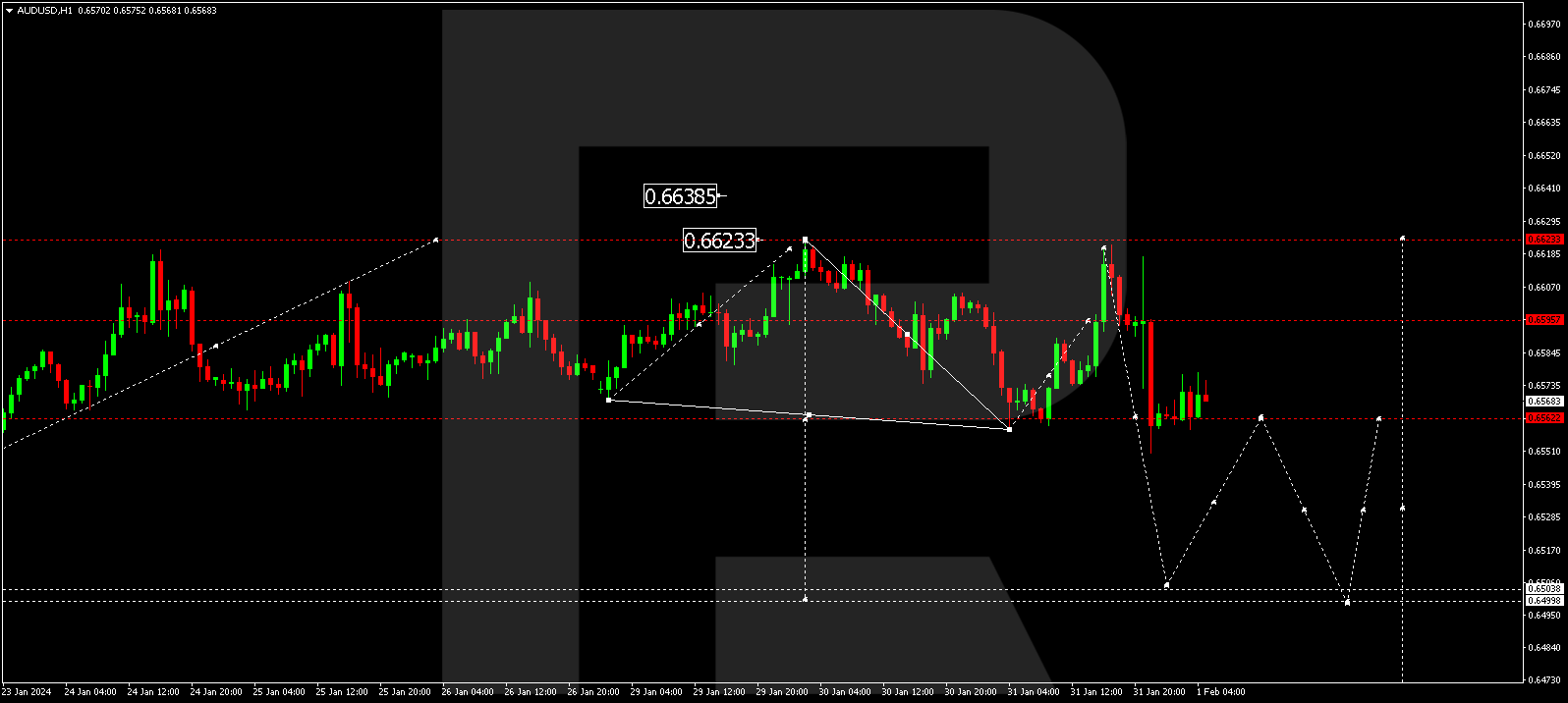

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a decline wave to 1.6562. A consolidation range is now forming above this level. With an escape from this range downwards, the decline wave could extend to 0.6504. This is a local target. Once this level is reached, a correction link to 0.6560 is not excluded, followed by a decline to 0.6500.

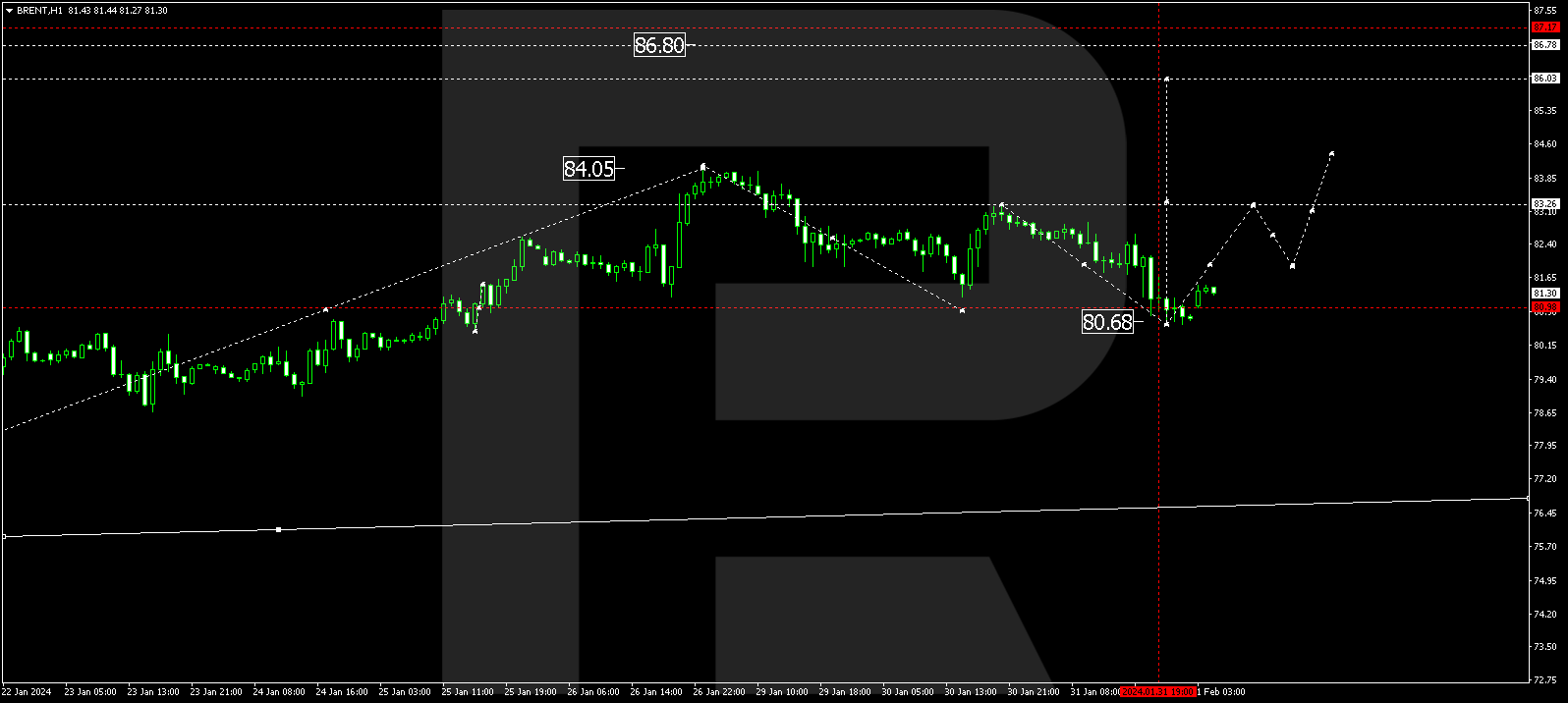

BRENT

Brent has performed a correction link to 80.70. Currently, the market is forming a consolidation range above this level. With an escape from the range upwards, the potential for a growth wave to 83.26 could open. And if this level also breaks upwards, the potential for a growth wave to 86.03 might open. This is a local target.

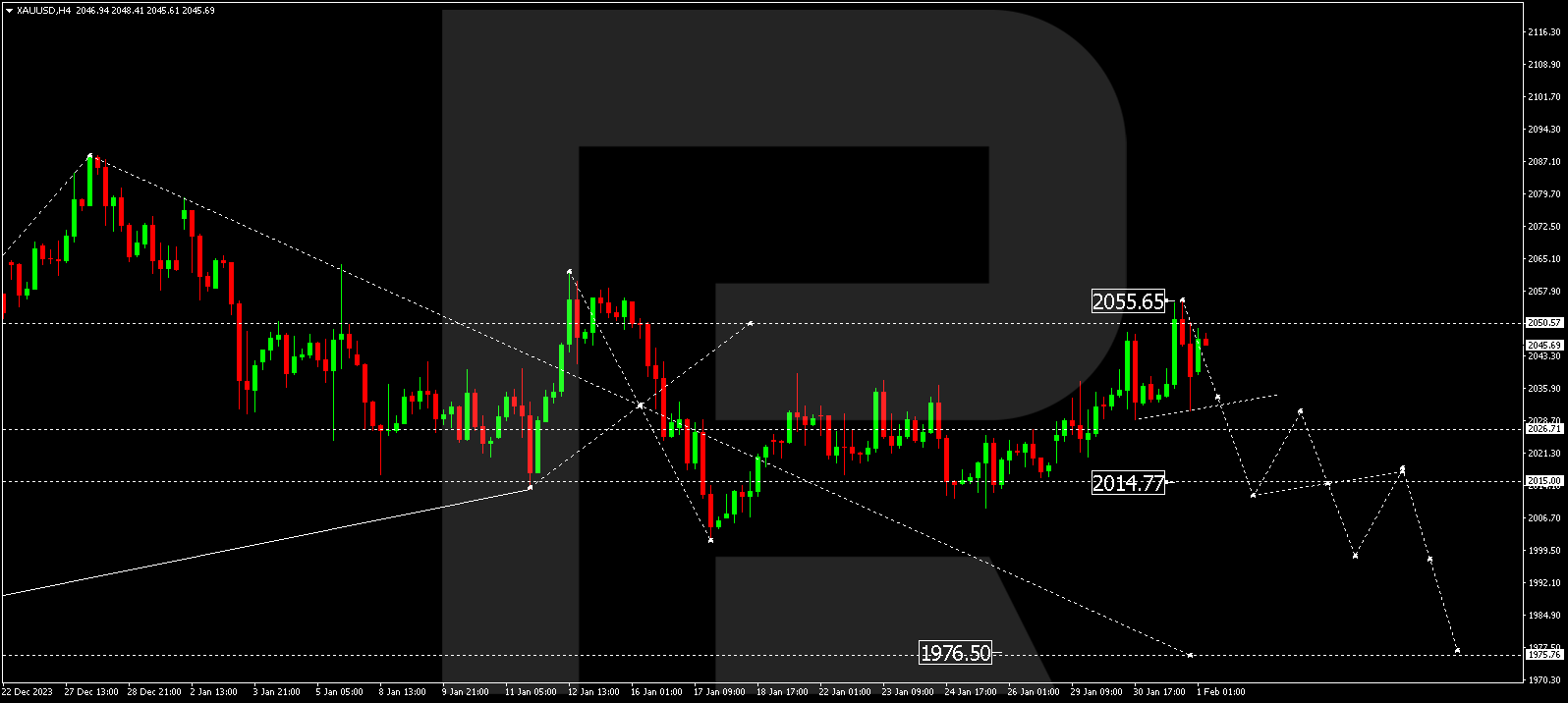

XAUUSD, “Gold vs US Dollar”

Gold has corrected to 2055.65. Today the market has completed a decline wave to 2030.81 and a correction to 2049.39. A decline structure to 2014.77 is expected to form. Next, a consolidation range might appear around this level. With a downward escape from the range, the trend could continue to 1976.50.

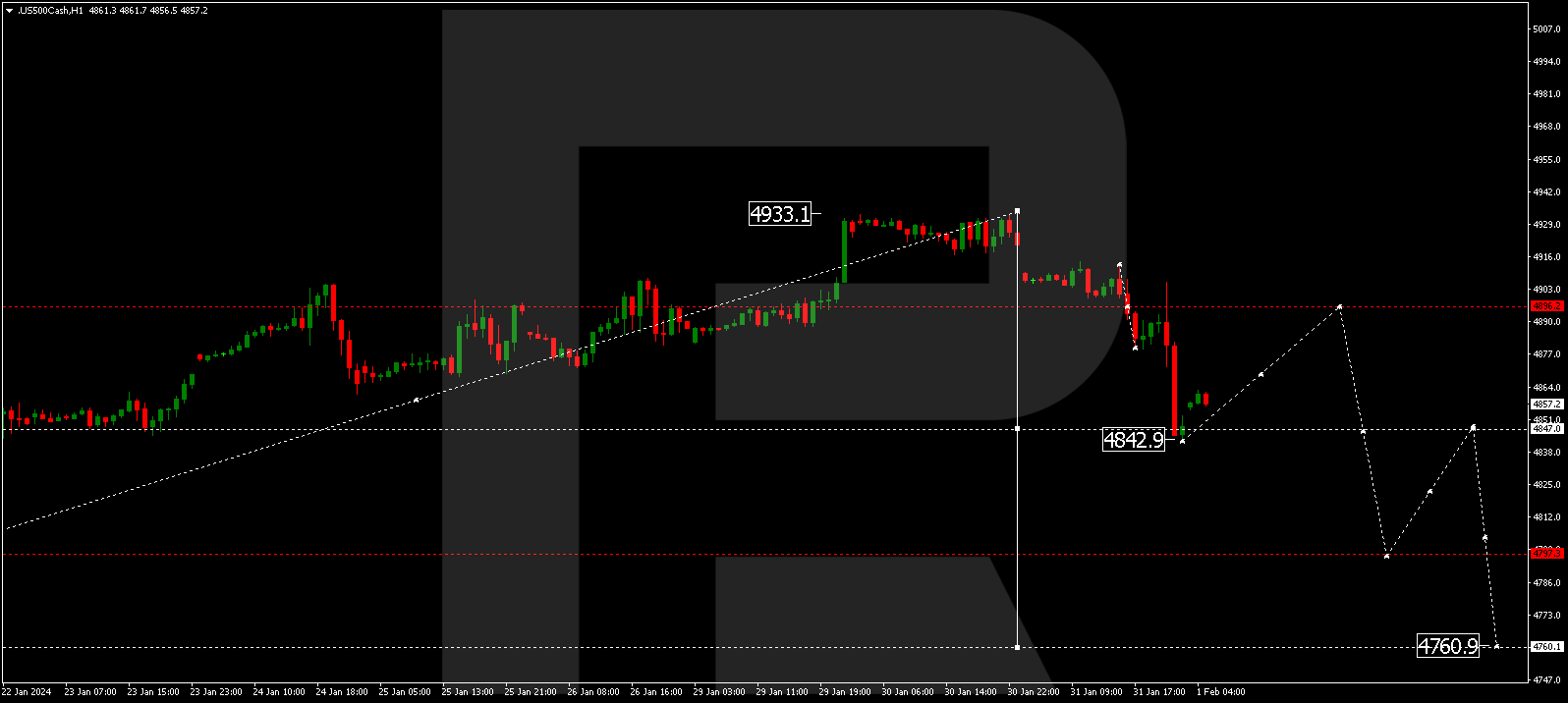

S&P 500

The stock index has completed a decline wave to 4843.0. Today a correction to 4896.0 might form. Once it is over, a decline wave to 4797.0 could follow. This is a local target. Next, a growth link to 4847.0 and a decline to 4760.0 are expected.