Hey traders, Ezekiel here with some new market insights and a few bonus tips to elevate your trading. Here’s what you need to catch up on:

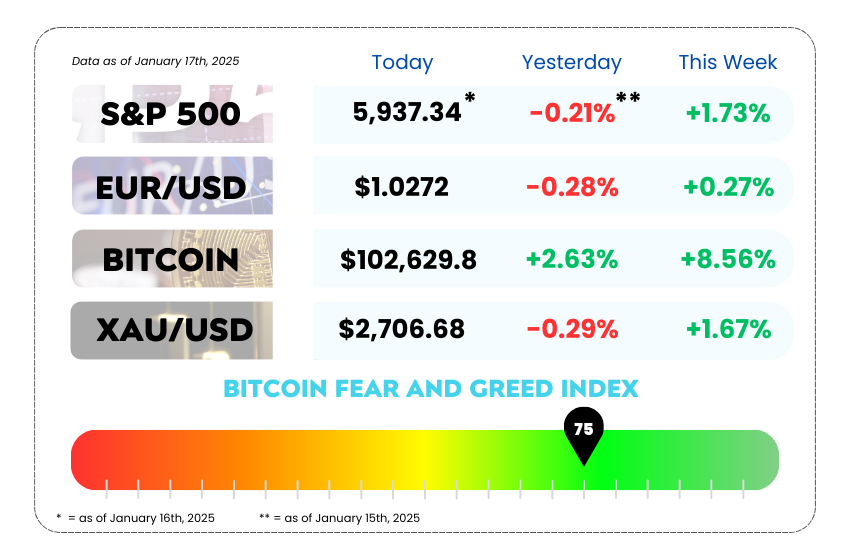

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• The US dollar drops after soft inflation data, while the pound falls on weak retail sales

• Microsoft’s AI push is slow, but analysts bet on long-term growth

• Learn how Smart Money Concepts reveal market movements and improve your trading strategy

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

💥Is the Dollar Losing Its Mojo? Sterling’s Struggles Are Just the Beginning 💸

This week, the dollar took a breather, edging up slightly on Friday but heading into the weekend with a potential loss. After a surprisingly soft core inflation report, the greenback’s six-week winning streak is in jeopardy.

Meanwhile, across the pond, the pound took another hit as retail sales fell short of expectations—could this be the beginning of a rough patch for Europe’s biggest currencies? 🤔

Dollar’s Moment of Weakness

The US dollar has been on a roll for weeks, but this week, inflation data cooled off unexpectedly, and suddenly, the idea of interest rate cuts is back on the table. After a strong run, the Dollar Index, which tracks the greenback against a basket of major currencies, climbed 0.1% on Friday to 108.930. But don’t get too excited—the dollar is still on track for a 0.5% weekly drop.

So, what’s driving the dip? Well, inflation slowed in the US more than analysts had predicted, which raised the odds of the Federal Reserve adopting a more dovish stance.

However, the Fed’s cautious approach to rate cuts (for now) hasn’t fully erased concerns that inflationary pressures might still linger—leading to a more volatile greenback ahead.

As analysts at ING point out, there’s still plenty of uncertainty in the mix, and despite a short-term drop, the dollar hasn’t found a clear catalyst to crash. The market’s still eyeing Trump-era policies and global inflation factors, so don’t count the dollar out just yet. 😅

US Dollar Index Daily Chart as of January 15th, 2025 (Source: TradingView)

Sterling Struggles After Retail Sales Drop

On the other side of the world, the British pound took a serious hit this week. After a 0.3% drop in retail sales for December (bouncing off an earlier small gain), the pound dropped to 1.2197 against the US dollar. Not exactly great news for the UK, which is already teetering on the edge of a potential economic contraction. 📉

And it doesn’t stop there. Earlier data already showed that the UK barely scraped through growth in November, so the outlook isn’t exactly glowing. The Bank of England is expected to announce rate cuts next month, and market sentiment suggests that two rate cuts in 2025 are already priced in. In short? The pound might be in for a longer, rougher ride.

Euro’s Lackluster Performance

Meanwhile, the euro isn’t exactly flourishing either. EUR/USD dipped slightly to 1.0300 as traders wait for the final consumer price data for the eurozone. Analysts at ING believe this level is undervalued, but it’s not going to recover anytime soon—especially with the looming uncertainty around US protectionist policies and their potential impacts on European markets.

Yen’s Up, Yuan’s Down

Looking east, the Japanese yen made some notable moves, rising by 0.3% to 155.79 against the dollar, hitting its highest level in nearly a month. With the Bank of Japan hinting at a potential interest rate hike next week, the yen has gained some traction. 💹

On the flip side, the Chinese yuan dropped slightly to 7.3289, after a major spike earlier this week, despite positive GDP growth figures out of China (up 5.4% in Q4). It looks like the yuan’s still in a holding pattern after a flurry of stimulus measures.

This week’s forex action shows how inflation data and central bank signals are shaping currency movements globally. The US dollar’s retreat could signal a shift, but with all eyes on the Fed’s next moves, it’s still too early to call.

Meanwhile, the pound is on shaky ground, and with potential rate cuts coming, it might not find solid footing anytime soon. Keep an eye on the yen as Japan hints at tighter monetary policy, while the yuan’s recovery looks a little less certain for now.

🚀 Microsoft’s AI Gamble: Slower Adoption, But Big Rewards Down the Line? 🤖

Microsoft is betting big on AI—but is it too early to see the returns? After pumping tens of billions into artificial intelligence, Microsoft’s stock has been under the microscope, with shares struggling to hold onto their gains. While the AI hype train seems to have slowed, the big question is whether this will be a temporary setback or the beginning of something bigger. 📉➡️📈

The Slow Burn of AI Adoption

Let’s be real: AI adoption isn’t happening overnight. Despite Microsoft’s heavy push with services like Copilot, consumers have been much slower to adopt than anticipated. Google’s Gemini, ChatGPT, and Meta AI are all far more popular with users—leaving Microsoft in the dust when it comes to AI’s consumer-facing side. 😬

But this doesn’t mean AI’s dead in the water for Microsoft—it’s more of a long-term game. Analysts and investors seem to be betting on the future rather than the present. Despite its recent setbacks, Microsoft is still widely recommended on Wall Street. Over 90% of analysts are buying the stock, and it’s got a 20% upside potential over the next 12 months. 📊

AI Isn’t the Only Show in Town

Let’s not forget—Microsoft isn’t just about AI. The company’s also got a thriving Azure cloud business, and its Office 365 suite just got a 30% price hike, with AI tools bundled in. Even if AI adoption is slow to pick up, Microsoft’s overall growth trajectory is still strong, with revenue expected to rise 14% this year alone. 💼💡

The Big Picture: Patience Pays

Sure, Microsoft’s current valuation might seem a bit high, and the stock has underperformed compared to the Nasdaq 100 in 2024, but let’s zoom out a bit. Microsoft’s bet on AI might not pay off instantly, but the long-term upside is massive.

As Christopher Ouimet, a portfolio manager at Logan Capital Management, says, “AI adoption might not be linear, but it should end up being massive.” 🌍🚀

For now, investors are watching closely. The upcoming second-quarter results later this month will give a fresh glimpse into the company’s progress, especially around Azure and AI services. Will they see the growth they’re hoping for? Or will Microsoft need to pivot again? ⏳

Microsoft’s stock story isn’t just about the here and now—it’s about positioning for the future. Despite short-term turbulence, AI’s potential to transform the company is undeniable. Keep an eye on how adoption grows over the next few years, and remember: slow and steady might win this race. 📈

MEMES OF THE DAY

When you put in the work… and the market says ‘Nope!’ 😂

When you’re living the dream… until the news ruins your day. 😂💔