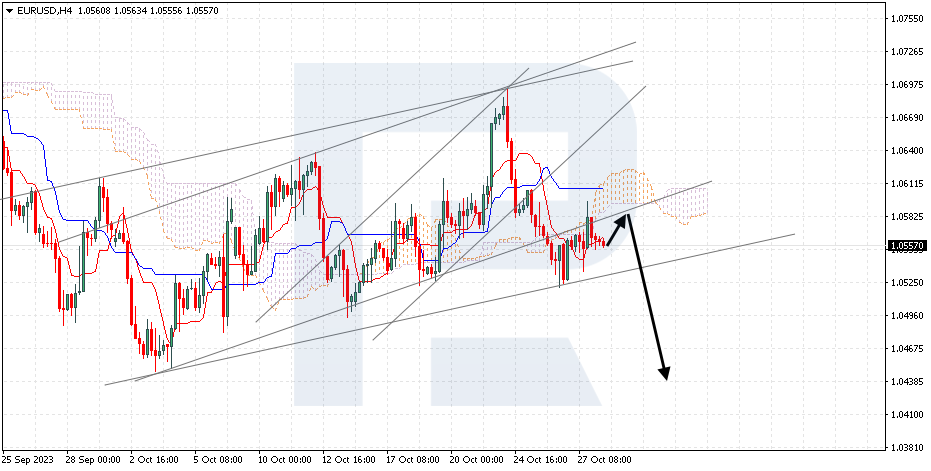

EURUSD, “Euro vs US Dollar”

EURUSD is pushing off the Tenkan-Sen line. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower boundary of the Cloud is expected at 1.0580, followed by a decline to 1.0440. An additional signal confirming the price drop could be a rebound from the lower boundary of the ascending channel. The scenario might be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1.0645, followed by a rise to 1.0740. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the bullish channel with the quotes securing under 1.0505.

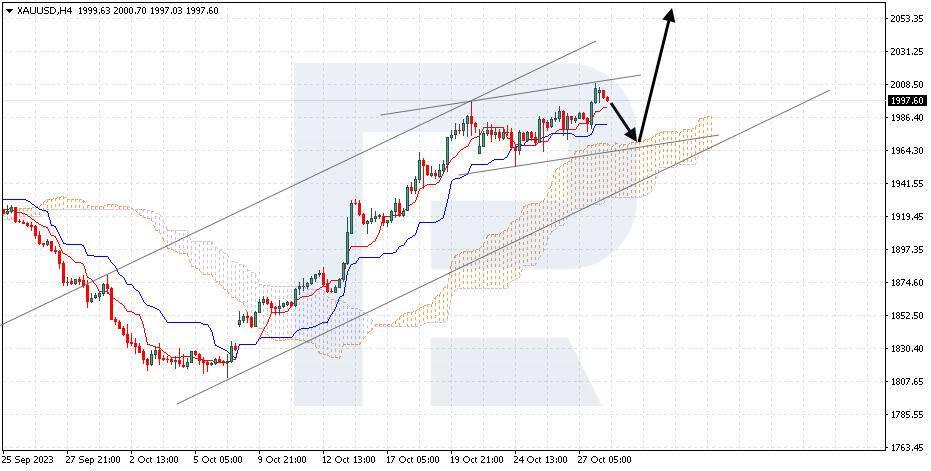

XAUUSD, “Gold vs US Dollar”

Gold is correcting upon renewing a local high. The instrument is going above the Ichimoku Cloud, revealing an uptrend. A test of the upper boundary of the Cloud is expected at 1970, followed by a rise to 2055. An additional signal confirming the growth could be a rebound from the lower boundary of the bullish channel. The scenario might be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1920, which could lead to a further decline to 1875.

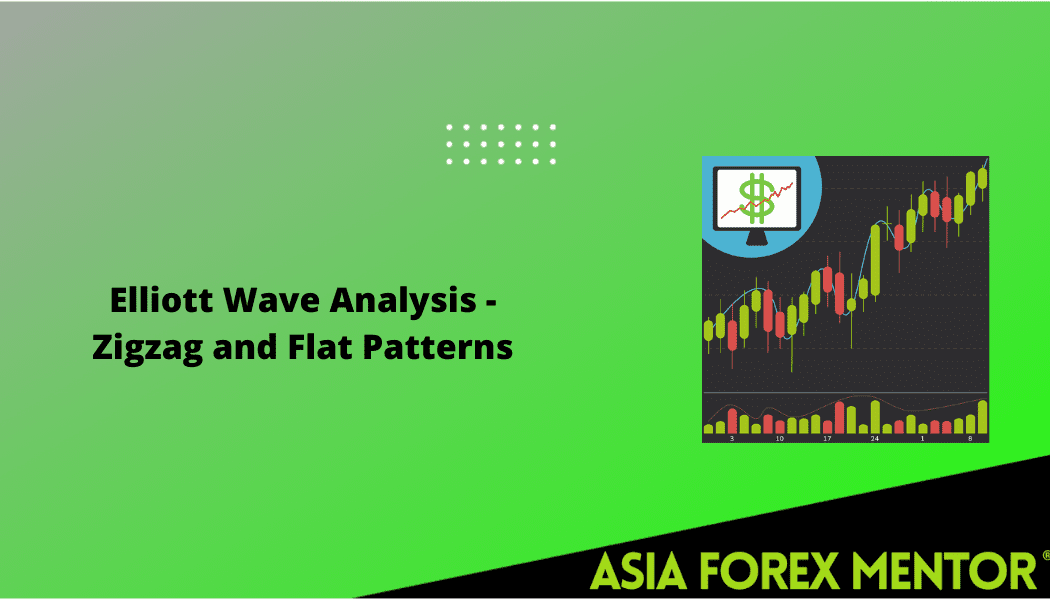

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has secured above the upper boundary of the descending channel. The instrument is going above the Ichimoku Cloud, revealing an uptrend. A test of the Tenkan-Sen line at 0.9015 is expected, followed by a rise to 0.9155. An additional signal confirming the growth could be a rebound from the upper boundary of the bearish channel. The scenario might be cancelled by a breakout of the lower boundary of the Cloud with the price securing under 0.8905, which could mean further falling to 0.8725.