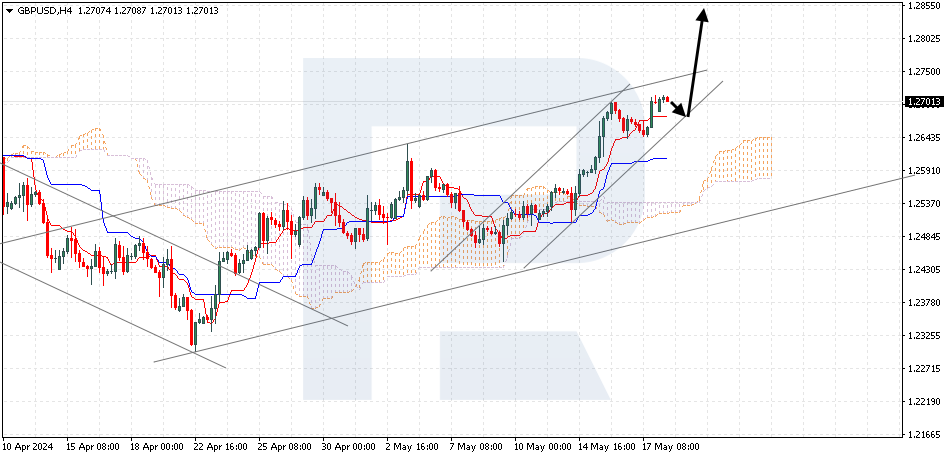

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has gained a foothold above the indicator’s signal lines. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 1.2685 is expected, followed by a rise to 1.2855. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.2480, indicating a further decline to 1.2385. Meanwhile, the rise could be confirmed by a breakout of the upper boundary of the bullish channel, with the price finding a foothold above 1.2775.

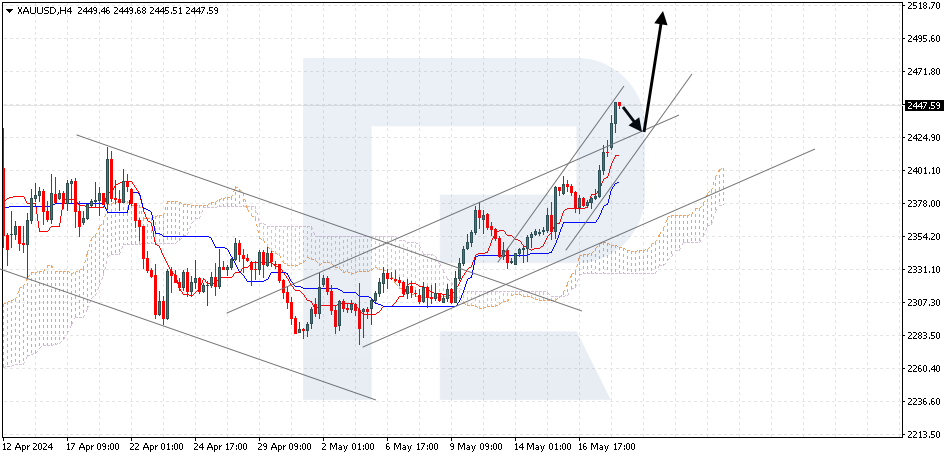

XAUUSD, “Gold vs US Dollar”

Gold has exited the bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 2435 is expected, followed by a rise to 2515. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 2310, which will signal a further decline to 2270.

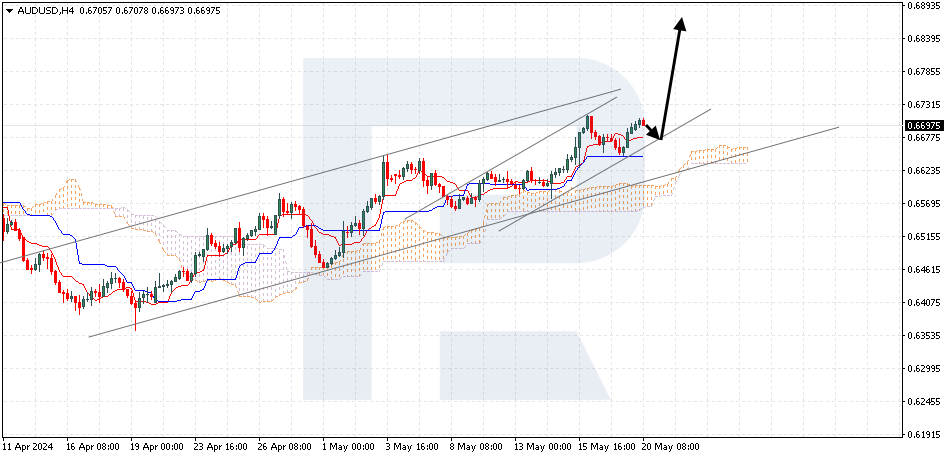

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is rebounding from the resistance level. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 0.6675 is expected, followed by a rise to 0.6855. An additional signal confirming the rise will be a rebound from the lower boundary of the ascending channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.6515, which will indicate a further decline to 0.6425.