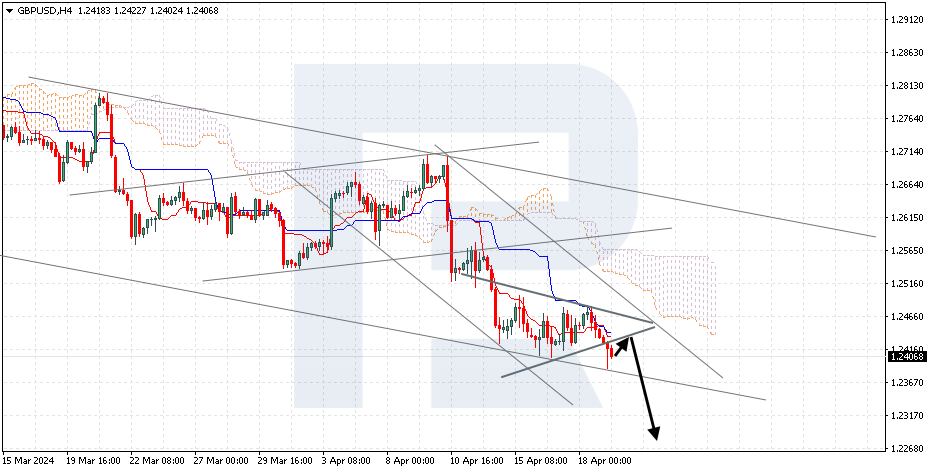

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has exited the Triangle pattern. The pair is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the Tenkan-Sen line at 1.2425 is expected, followed by a decline to 1.2275. An additional signal confirming the decline will be a rebound from the lower boundary of the Triangle pattern. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 1.2570, indicating a further rise to 1.2660. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the bearish channel, with the price gaining a foothold below 1.2345.

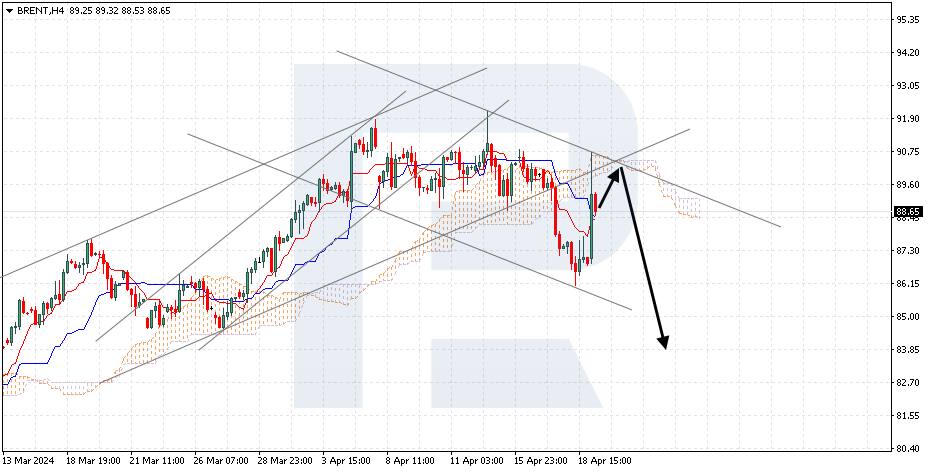

BRENT

Brent is declining following a rebound from the lower boundary of the bullish channel. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Cloud’s lower boundary at 89.65 is expected, followed by a decline to 83.85. An additional signal confirming the decline could be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the Cloud’s upper boundary, with the price securing above 91.55, indicating further growth to 94.05.

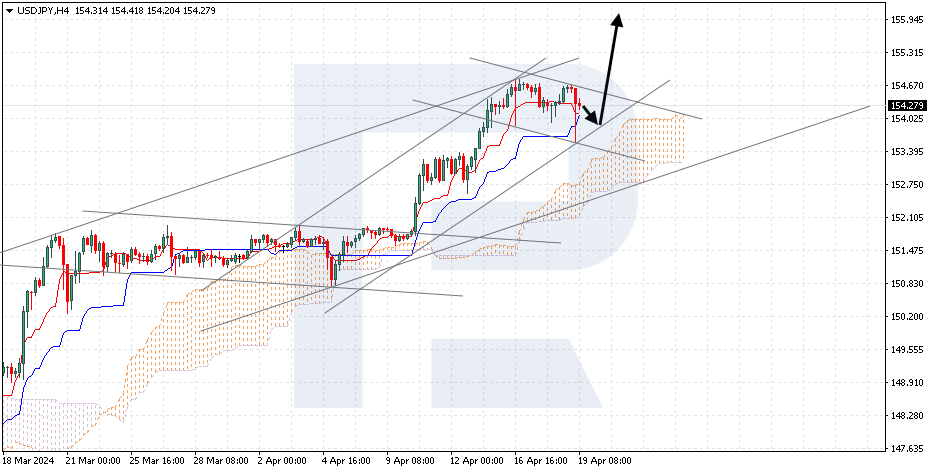

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is testing the support area. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 154.05 is expected, followed by a rise to 155.95. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 152.05, which will indicate a further decline to 151.05. Meanwhile, the rise could be confirmed by a breakout of the upper boundary of the bearish channel, with the price gaining a foothold above 154.85.