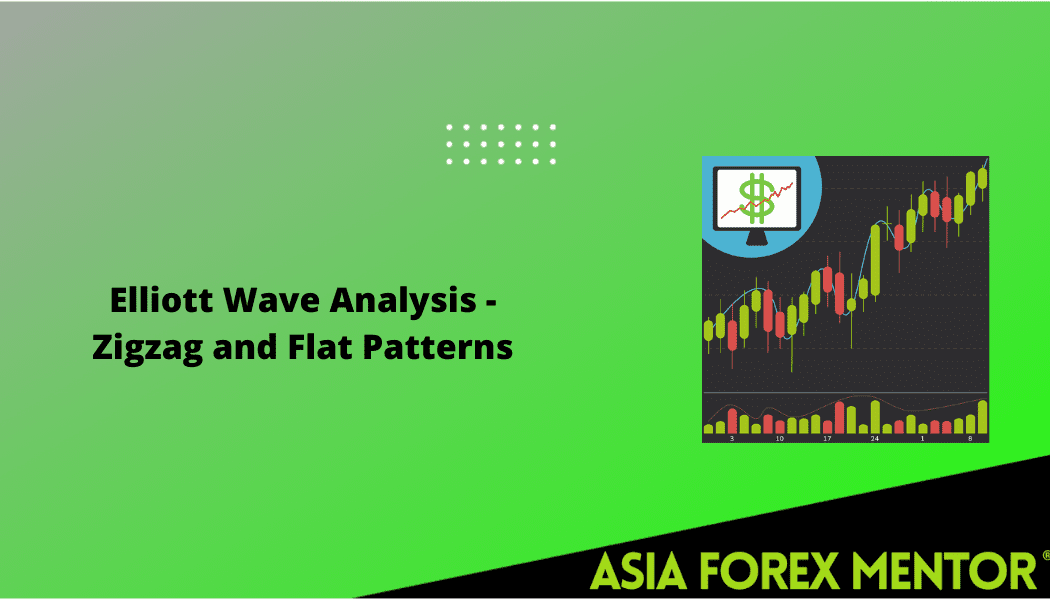

EURUSD, “Euro vs US Dollar”

EURUSD is rising within a bullish channel. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 1.0795 is expected, followed by a rise to 1.0920. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.0715, indicating a further decline to 1.0625.

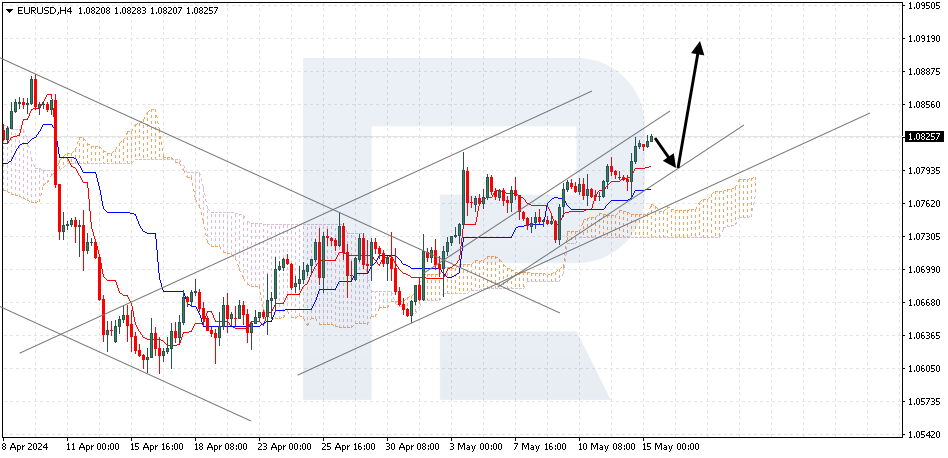

XAUUSD, “Gold vs US Dollar”

Gold is rebounding from the upper boundary of the descending channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 2335 is expected, followed by a rise to 2415. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 2290, which will signal a further decline to 2265. Meanwhile, the rise could be confirmed by a breakout of the upper boundary of the bearish channel, with the price finding a foothold above 2370.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has exited the Triangle pattern boundaries. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 0.6025 is expected, followed by a rise to 0.6145. An additional signal confirming the rise will be a rebound from the upper boundary of the Triangle pattern. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.5950, indicating a further decline to 0.5860.