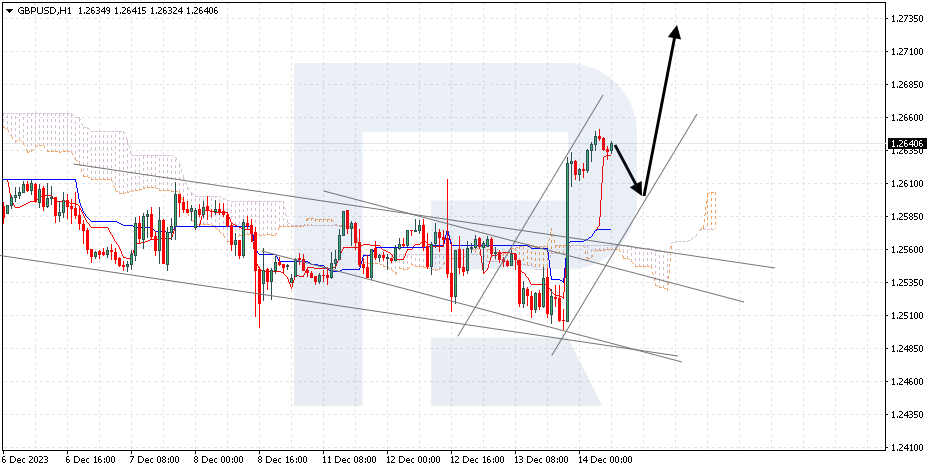

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is rebounding from the Tenkan-Sen line. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 1.2605 is expected, followed by a rise to 1.2735. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1.2505, which will indicate a further decline to 1.2415.

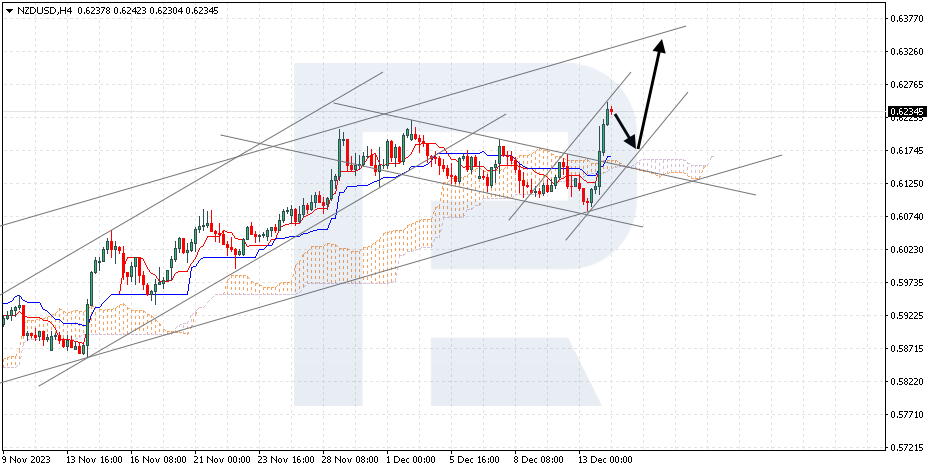

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has found a foothold above the resistance level. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 0.6175 is expected, followed by a rise to 0.6325. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 0.6095, which will indicate a further decline to 0.5995.

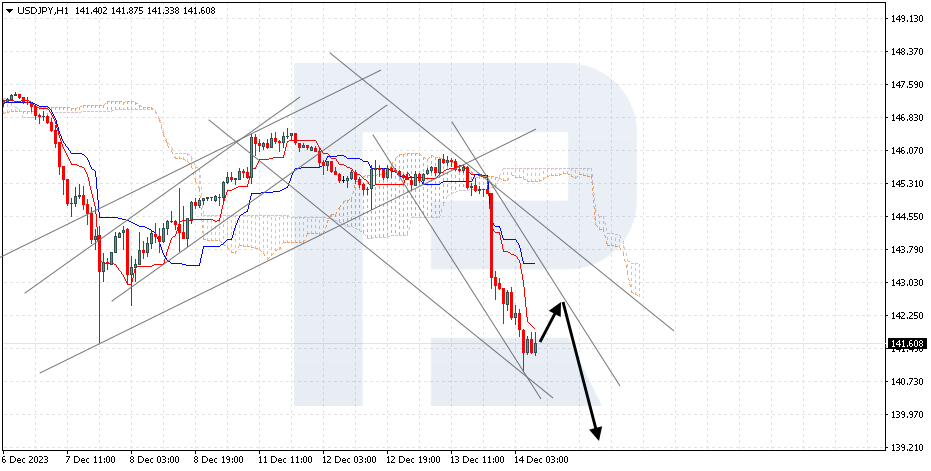

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is correcting after an aggressive decline. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Tenkan-Sen line at 142.35 is expected, followed by a decline to 139.15. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 146.05, which will indicate a further rise to 147.10.