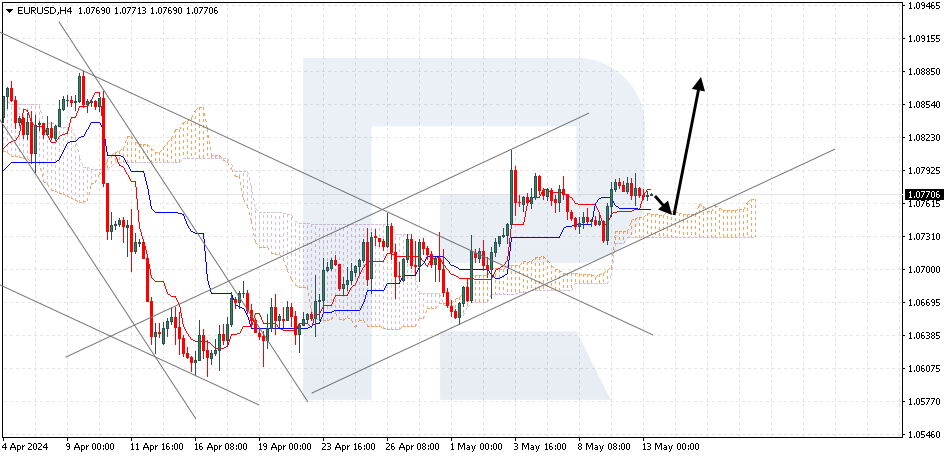

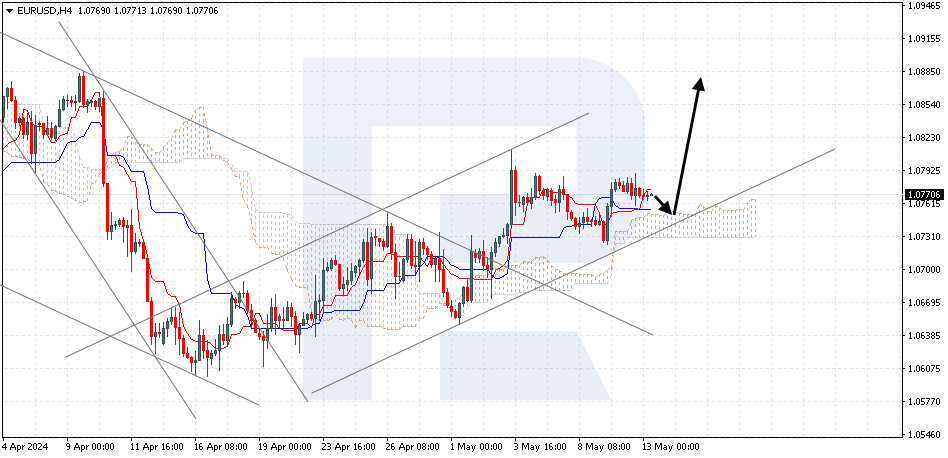

EURUSD, “Euro vs US Dollar”

EURUSD is rebounding from the indicator’s signal lines. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Cloud’s upper boundary at 1.0755 is expected, followed by a rise to 1.0885. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.0705, indicating a further decline to 1.0610.

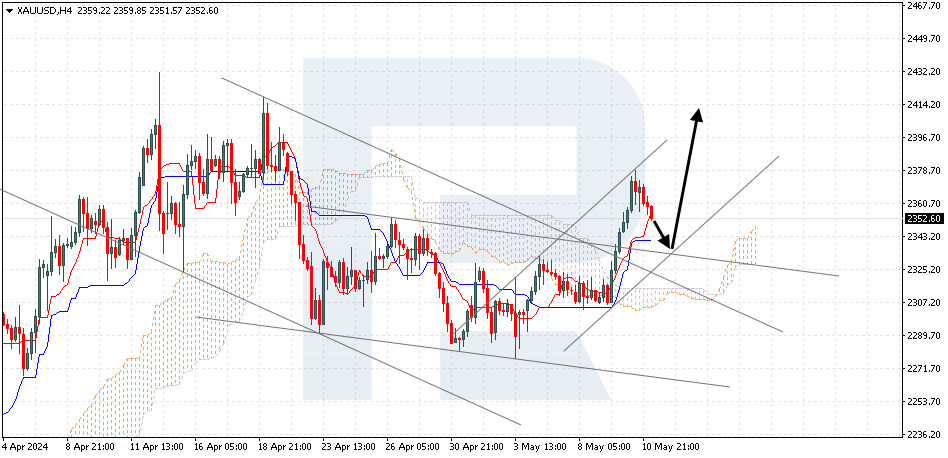

XAUUSD, “Gold vs US Dollar”

Gold is declining after a rebound from the resistance level. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 2335 is expected, followed by a rise to 2415. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 2285, which will signal a further decline to 2245.

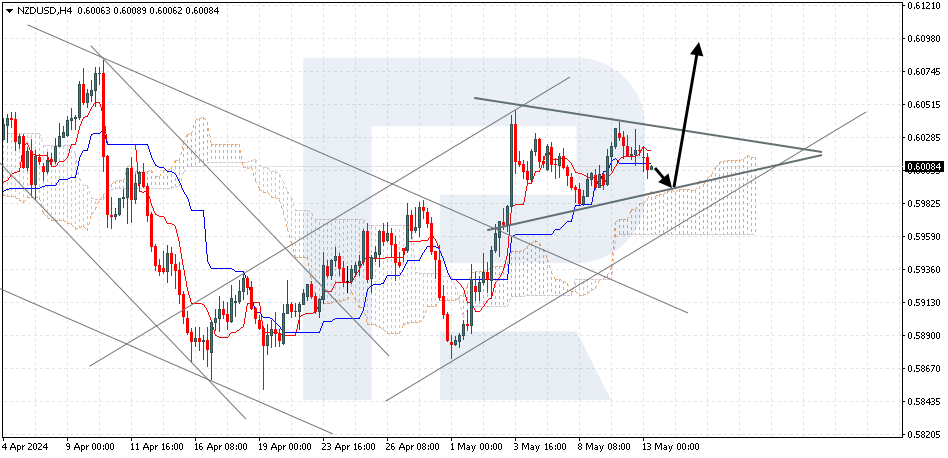

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is correcting within a Triangle pattern. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Cloud’s upper boundary at 0.5995 is expected, followed by a rise to 0.6095. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.5950, indicating a further decline to 0.5860. Meanwhile, the rise could be confirmed by a breakout of the upper boundary of the Triangle pattern, with the price finding a foothold above 0.6040.