GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting after a rebound from the support level. The instrument is going under the Ichimoku Cloud, which implies a downtrend. A test of the lower boundary of the Cloud at 1.2605 is expected, followed by a decline to 1.2365. The decrease could be additionally supported by a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 1.2675, which will entail a further rise to 1.2765.

XAUUSD, “Gold vs US Dollar”

Gold is declining within a bearish channel. The instrument is going below the Ichimoku Cloud, which implies a downtrend. A test of the Tenkan-Sen line at 2005 is expected, followed by a decline to 1925. The decrease could be additionally supported by a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 2085, which might entail a further growth to 2145.

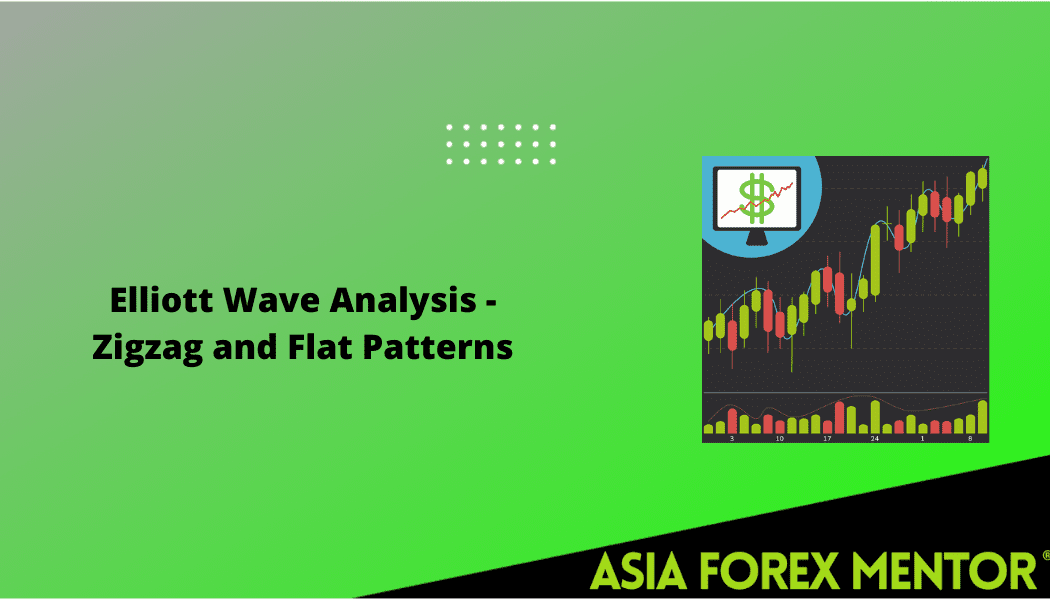

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has found a foothold above the signal lines of the indicator. The instrument is going within the Cloud, which implies a flat. A test of the lower Cloud boundary at 0.6135 is expected, followed by a rise to 0.6295. The growth could be additionally supported by a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower Cloud boundary with the price finding a foothold under 0.6095, which might entail a further decline to 0.5995. Meanwhile, the growth might be confirmed by a breakout of the upper boundary of the bearish channel, with the price finding a foothold above 0.6205.