GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is rebounding from the support level. The instrument is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the lower boundary of the Cloud at 1.2585 is expected, followed by a decline to 1.2395. An additional signal confirming the decline will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1.2675, which will mean further growth to 1.2765.

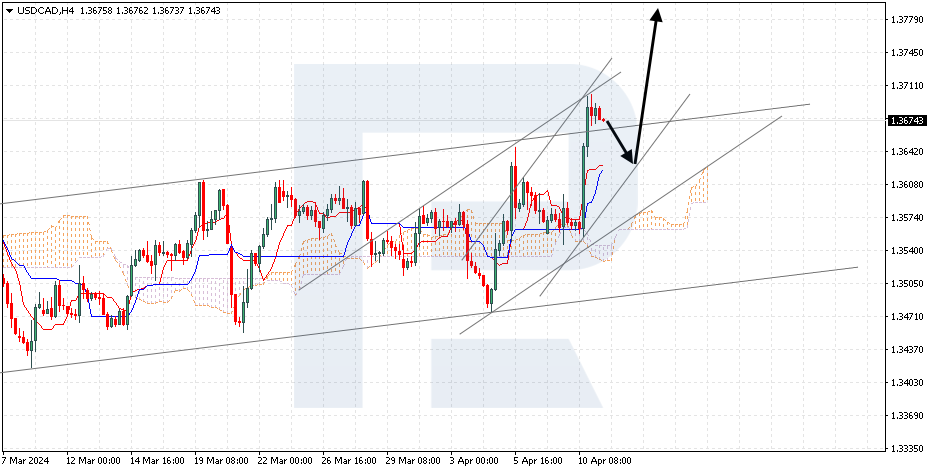

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD has secured above the upper boundary of the bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 1.3635 is expected, followed by a rise to 1.3775. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing under 1.3510, which will mean a further decline to 1.3415.

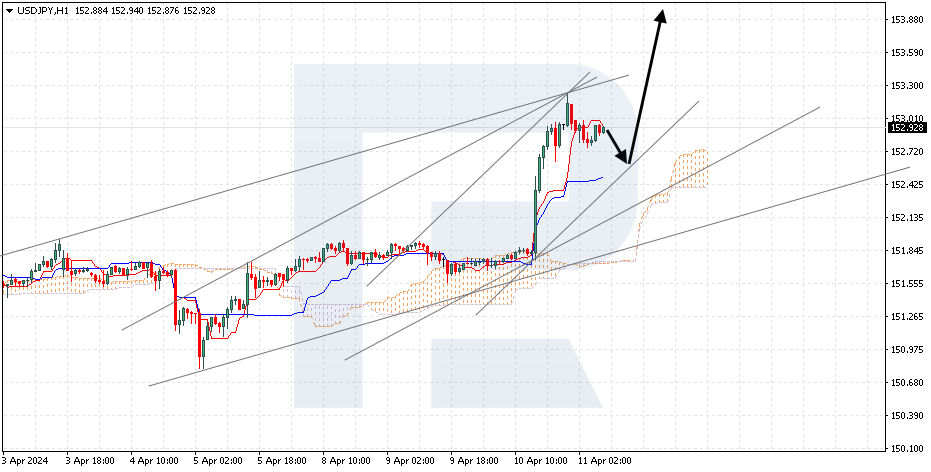

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is testing the signal lines of the indicator. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 152.65 is expected, followed by a rise to 153.85. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing under 151.25, which will mean a further decline to 150.35.