Hey, traders! Ezekiel here with the latest market insights and a few bonus tips to help you elevate your trading game. Here’s the scoop:

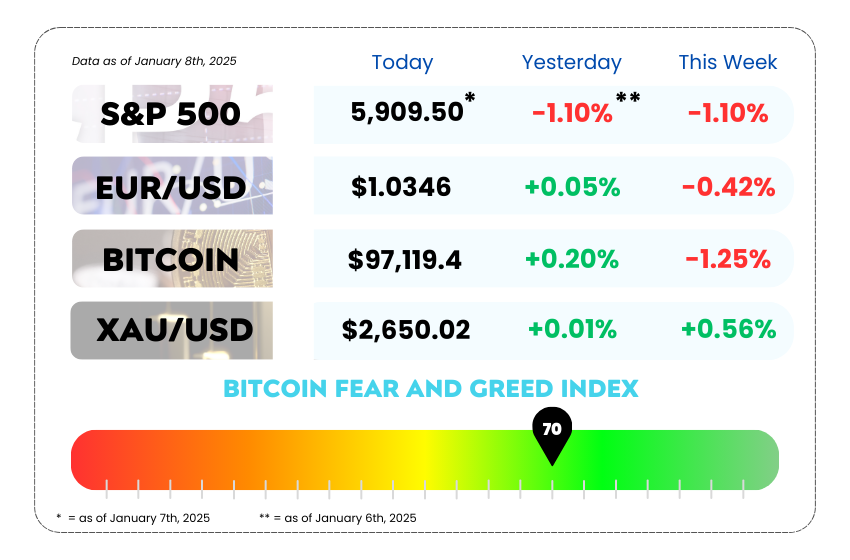

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• EUR/USD slips 0.4% on Tuesday, failing to reclaim the 1.0400 level amid Dollar strength

• Stronger-than-expected PMI and labor market data send crypto and tech stocks tumbling

• Learn to buy low and sell high using premium and discount zones

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

📉 EUR/USD Flubs Its Comeback: Euro Bulls Left Hanging 📉

The EUR/USD pair, affectionately called “Fiber” (because… traders love nicknames), stumbled again on Tuesday, dropping 0.4% as its attempt to reclaim the 1.0400 level fizzled out like flat soda. 🥤

Despite hovering slightly above last week’s 26-month low, the Euro isn’t exactly winning any popularity contests. Here’s the tea:

Why is Fiber Feeling Fragile?

- Inflation Drama, But Make It Boring 📊: European inflation (HICP) ticked up to 2.4% YoY in December from 2.2%. Traders yawned. Most of the price increases are seen as “old news” or tied to one-off items, so there’s not much for Euro bulls to celebrate.

- The Dollar’s Hot Streak Continues 🏋️♂️: US ISM Services PMI and Prices Paid data came in hotter than your local pizza oven. This spooked markets into thinking the Fed might slam the brakes on those dreamy 2025 rate cuts.

- Euro Bulls Running on Empty 🐂: Since peaking at 1.0900 in November, EUR/USD has shed over 6.5%, rejected at the 200-day EMA like a bad Tinder date.

Wednesday’s Doubleheader: EU & US Data

The midweek calendar is PACKED 🎟️:

- German Retail Sales & EU PPI 🇩🇪🇪🇺: Forecasts point to rebounds, but whether they’ll be enough to give the Euro some much-needed adrenaline remains to be seen.

- US ADP Employment & Fed Minutes 🦅📜: Traders will analyze these like Sherlock Holmes looking for clues about Friday’s Nonfarm Payrolls and (hopefully) some softening in the labor market.

EUR/USD Daily Chart as of January 8th, 2025 (Source: TradingView)

What’s Next for EUR/USD?

The pair has shed over 6.5% since peaking above 1.0900 in early November. With the 200-day EMA creeping down toward 1.0700, the Euro needs a serious rally just to stay afloat. Right now, it feels like it’s caught in quicksand, inching closer to 1.0200 unless something shifts dramatically.

EUR/USD is facing a double whammy—weak European fundamentals and a resilient US economy. If you’re trading Fiber, stay cautious and keep an eye on critical levels like 1.0400 and the 50-day EMA near 1.0500. A break below these could signal further downside, while any relief rally will likely need stronger-than-expected EU data or softer US employment figures to gain traction.

For now, the Dollar’s dominance isn’t just a phase—it’s the main event. 📊 Make sure your trades align with the market sentiment, and always remember: Timing beats luck.

📉 Why Is Crypto Down Today? Bitcoin & Tech Stocks Take a Hit 📉

The crypto market took a nosedive on January 7, 2025, as stronger-than-expected economic data threw a wrench into hopes for Federal Reserve rate cuts. Bitcoin led the fall, tumbling over 5% to $96,909, while Ethereum slid 8%, and Solana wasn’t far behind, dropping 7%. 😬

What’s Driving the Sell-Off?

Two major economic reports are shaking things up:

- Stronger PMI Data 📊: The ISM’s December PMI surged to 54.1, up from November’s 52.1, signaling a surprisingly strong economy.

- Sticky Labor Market Data 💼: The JOLTS report revealed higher-than-expected job openings, though the quit rate dropped to 1.9% from October’s 2.1%, showing workers are less confident about jumping ship.

These numbers have markets worried that rate cuts may take longer to materialize, with traders now betting on less than a 50% chance of cuts before June. The Federal Reserve is expected to hold steady at its January meeting, and that’s got everyone—from crypto bulls to tech investors—feeling the squeeze.

Ripple Effects Across Markets

It’s not just crypto. The S&P 500 fell 1.1%, and the Nasdaq dropped 1.9%. Even Nvidia, the golden child of AI, slid 6.2%, despite CEO Jensen Huang hyping new initiatives at CES.

This correction shows how tightly linked crypto and traditional markets have become, especially as investors react to macroeconomic signals. With Bitcoin’s fall below $97,000, keep an eye on key support levels near $95,000—a break below could signal further downside.

For traders, this is a classic lesson in rate expectation recalibration. As long as the Fed holds its hawkish tone, the market mood will stay edgy. Stay nimble, focus on the long-term fundamentals, and always remember—volatility is the name of the game in both crypto and Forex. 🚀

MEMES OF THE DAY

Your $100 account didn’t stand a chance. 💀

Full-time trader, part-time account destroyer. 💻