Hey, traders! Ezekiel here with the latest market insights and a few bonus tips to help you elevate your trading game. Here’s the scoop:

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• EUR/USD plunges to a 2-year low of 1.0220 as Fed-ECB policy divergence pressures the Euro

• US stock futures rise slightly as markets attempt to rebound from a shaky start to 2025

• Learn how to spot, trade, and profit from the powerful Head & Shoulders pattern like a pro

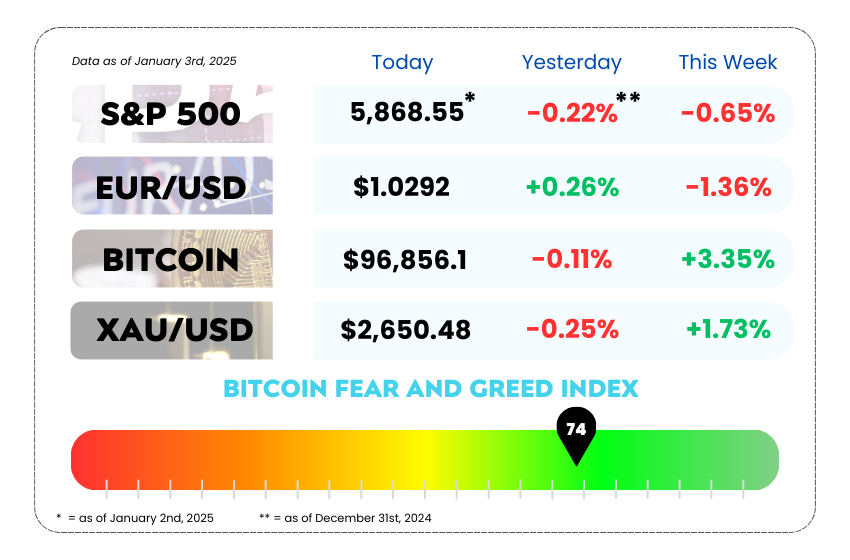

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

💶 EUR/USD Edges Closer to Parity: Fed vs. ECB Policy Showdown 💵

The U.S. dollar is strutting its stuff, heading towards a 7% annual gain for 2024 as of Friday, while Japan’s yen braces for its fourth straight year of losses. Why? Traders are betting big on robust U.S. economic growth, which might keep the Federal Reserve cautious about rate cuts all the way into 2025.

What’s Driving the Drama?

On one side of the Atlantic 🌊, Fed officials are signaling fewer rate cuts in 2025, while across the pond, ECB policymakers are sticking to their easing cycle like a karaoke machine stuck on repeat.

- The Fed’s dot plot suggests rates could hit 3.9% by year-end, with two cuts in the pipeline instead of the four forecasted in September.

- The US Dollar Index (DXY) remains a heavyweight champ 🥊, hovering near its two-year peak of 109.00, despite a slight dip on Friday.

Meanwhile, over in Europe, the ECB’s slower policy easing is doing little to counterbalance the Fed’s hawkish vibes. This divergence is putting the Euro under some serious pressure.

EUR/USD Daily Chart as of January 3rd, 2025 (Source: TradingView)

Where Are We Heading?

The EUR/USD technicals paint a bearish picture:

- The 20-week EMA is trending lower at 1.0620, while the 14-week RSI has hit oversold territory near 30.00.

- Support could emerge at the psychological 1.0100 level, but upside potential seems capped near the weekly high of 1.0458.

In the short term, traders are glued to the US ISM Manufacturing PMI data dropping at 15:00 GMT. Expectations? A contraction reading of 48.4, keeping pressure on manufacturing activity.

The Fed-ECB policy divergence isn’t just about interest rates—it’s about the broader economic picture. The Fed’s cautious optimism about the US economy, combined with policy underpinnings like tight immigration and higher tariffs, is fueling a stronger dollar. Meanwhile, Europe struggles to shake off its economic malaise.

Our advice? Keep an eye on key support levels like 1.0100 and how economic data shapes Fed sentiment. This isn’t a time to bet against the Greenback lightly—it’s playing with a tailwind. 🌬️

🚀 US Stock Futures Try for a Comeback, But Santa Might Skip Wall Street 🎅

The markets are feeling a little festive this Friday, but it’s looking like the “Santa Claus Rally” might have missed its sleigh ride. S&P 500 futures (ES=F) are up 0.2%, with similar gains for the Dow Jones (YM=F) and the tech-heavy Nasdaq (NQ=F) ticking up 0.3%. That’s a decent start, but let’s not break out the eggnog just yet.

What’s Going Down? (Or… Up?) 📉📈

- The S&P 500 is limping into 2025, riding a five-session losing streak (its worst since April), and both the S&P and Dow are set to end the week down over 1%.

- The Nasdaq? A holiday hangover of nearly 2% weekly losses. Yikes. 😬

Tesla’s Rollercoaster 🎢⚡

Oh, Tesla. The EV kingpin saw its China sales hit record highs in 2024, but Wall Street wasn’t impressed. After reporting its first-ever annual decline in global sales, shares skidded 6% on Thursday and are now stuck on the flatline.

US Steel Drama 🛠️🇺🇸

Meanwhile, US Steel’s stock tumbled almost 8% on news that President Biden is blocking Nippon Steel’s $14.9 billion takeover bid, citing political and economic concerns. Tough break for the steel giant—and even tougher for its shareholders.

The Bigger Picture 📊

Eyes are now on Friday’s US manufacturing data, which could reveal if the economy is strong enough to keep the Fed from slashing rates anytime soon. A weak print might add more coal to Wall Street’s stocking this year. 🎄🔥

Here’s the deal: The Santa Claus Rally isn’t just holiday fluff—it’s a market barometer that hints at January and yearly performance trends. But this year’s rocky start has traders on edge. Our advice? Watch Tesla and US manufacturing data closely—they’re not just headlines, they’re signals for broader market sentiment. 📉

Looks like 2025 is already testing our trading resolve. Hang tight—it’s going to be a ride. 🚀

MEMES OF THE DAY

Ever feel like the market waits for you to step away before it takes off? 🤔

Your account deserves a good night’s sleep 💤