Hey traders, Ezekiel here with fresh market insights and a few extra tips to take your trading to the next level. Here’s what you need to know:

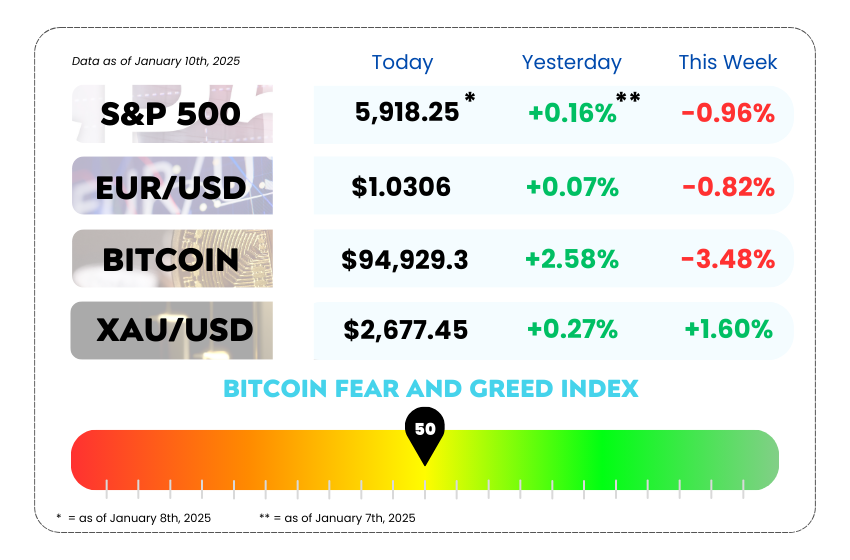

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• The dollar rallies on strong yields, while the pound slides and global currencies wobble

• Markets drop ahead of jobs report; Nvidia hit by export curbs

• Learn how to combine Fibonacci, Trendlines, Harmonics, and Elliott Waves for smarter, more accurate market analysis and predictions with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚗Dollar Stays in the Driver’s Seat, While Sterling Hits the Skids📉

The dollar is flexing its muscles again this week, looking primed for a sixth consecutive weekly win 🏆 against other major currencies. What’s fueling the greenback’s glow-up?

Elevated U.S. bond yields and whispers of another strong U.S. jobs report. Meanwhile, the pound continues its downward spiral, hitting lows that feel like they belong in a history book.

What’s Happening in the Market? 🌍

U.S. 10-year Treasury yields are sitting pretty at 4.69%, climbing 10 basis points this week. Investors are bracing for non-farm payroll data 📊 that could solidify the Fed’s “higher for longer” rate stance.

Forex pros like ING’s Francesco Pesole think robust job numbers today could squash hopes for a March rate cut and push the timeline even further. TL;DR? Bad news for rate doves, good vibes for the dollar.

Yen, Euro, and the Dollar Index at a Glance 🌏💱

The yen danced around briefly at 157.62 per dollar before flattening at 158.12. Rising inflation in Japan may prompt an upgrade to the central bank’s price forecast this month.

Euro zone? Flat. The euro stayed put at $1.0299, not far from last week’s two-year low of $1.0224. Forecasters even predict parity with the dollar by 2025, according to a Reuters poll. 😮

The dollar index stayed steady at 109.15, heading for a 0.2% weekly rise—its longest winning streak since 2023. 🚀

US Dollar Index Daily Chart as of January 10th, 2025 (Source: TradingView)

The dollar’s six-week streak is no joke, and the U.S. jobs data today could add more fuel to its rally. Keep an eye on non-farm payroll numbers—a strong report could reinforce the narrative that the Fed isn’t budging on high rates. For forex traders, the pound and yen are showing how complex global markets can get when traditional rules don’t apply.

Pro Tip: Stay flexible, watch bond yields, and don’t ignore central bank chatter. It’s a volatile world out there—make it work for you.

🛏️ Wall Street Hits the Snooze Button as Jobs Report Steals the Spotlight 📉

Friday brought a slow start for US stock futures, as investors hit pause ahead of the highly anticipated monthly jobs report. With Wall Street craving clarity on the Fed’s next move, all eyes are on the data to either fuel or fizzle hopes for interest rate cuts.

Here’s the vibe:

- Dow futures dipped 0.2%, the S&P 500 slid 0.3%, and the Nasdaq 100 took the biggest hit, down 0.4%. 📉

- The weekly scorecard? All three indexes are staring down red numbers for the week.

Nvidia Gets Zapped ⚡💻

In other news, Nvidia is feeling the heat. The AI chip king’s stock slipped ahead of fresh White House chip export curbs. The Biden administration seems intent on tightening the screws with some last-minute rule changes—moves Nvidia says are aimed at undermining Trump’s incoming administration. 🤷♂️

This week’s market lull is a classic example of how macro data can hold Wall Street hostage. A strong labor report might reinforce the Fed’s hawkish tone, boosting the dollar and weighing on equities. Meanwhile, weak data could create more confusion than clarity. For traders, the best play is to stay agile and watch the ripple effects across asset classes.

Pro Tip: Watch how Nvidia’s chip drama impacts tech-heavy indices—it’s a reminder that geopolitics and tech are more linked than ever.

MEMES OF THE DAY

Plot twist: The brokers were the real players all along! 🎭

Introverts be like: ‘Sorry, I’m busy…watching the market breathe.’ 📊👀