TOGETHER WITH

Today’s special Wednesday edition is brought to you by AvaTrade — delivering the best online forex trading experience since 2006. Unlock a massive 20% bonus and take your trading to the next level!

Start your journey today, boost your account with extra funds, and maximize your trading potential.

Hey, traders! Ezekiel here, ready to share the latest market insights (and more

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Bitcoin moves with stocks, proving it’s a risk asset, not “digital gold.”

• EUR/USD steadies near 1.0300 ahead of key US CPI data

• Learn how to spot and trade the Ladder Top Pattern, a 5-candle formation signaling potential market drops

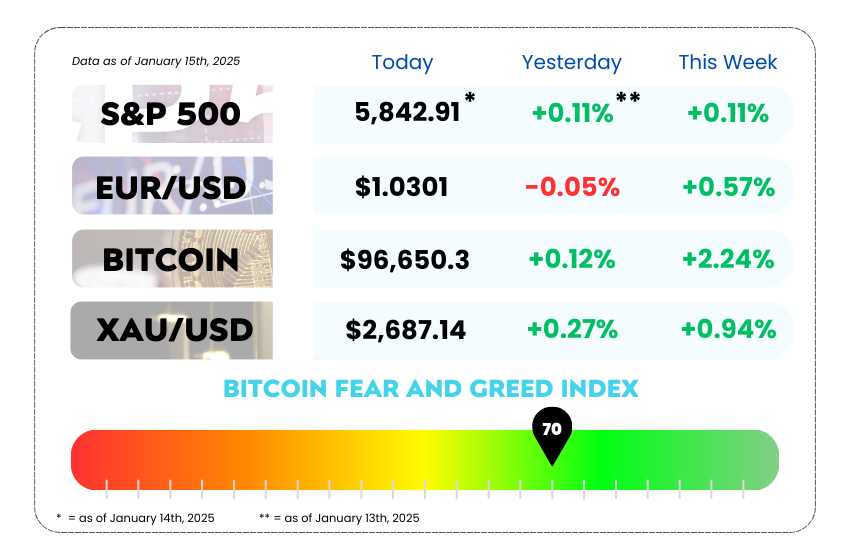

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

Bitcoin & Stocks: From Lone Wolves to Dance Partners

Bitcoin & Stocks: From Lone Wolves to Dance Partners

A year ago, Bitcoin was hyped as “digital gold,” the unshakable store of value meant to withstand market storms. Fast forward to today, and that description feels about as accurate as calling crypto “boring.” Instead, Bitcoin is moving hand-in-hand with the stock market, proving itself more of a risk-on asset than a safe haven.

The big moment came when the SEC approved Bitcoin spot ETFs, finally giving crypto a seat at the mainstream investing table. What followed was a blockbuster 2024:

• S&P 500: Climbed almost 25% during the year, driven by optimism about business-friendly policies.

• Bitcoin: Stole the spotlight with a staggering 130% rise in value.

But here’s the kicker: both markets moved in lockstep. When stocks soared, Bitcoin soared higher. When stocks cooled off, so did Bitcoin—proof that the two are more correlated than ever.

BTC/USD Daily Chart as of January 15th, 2025 (Source: TradingView)

Investors once looked to Bitcoin for stability outside traditional markets. But 2024 smashed that narrative. Now, Bitcoin is the poster child for risk-on behavior, rising and falling with the whims of stock market sentiment.

Take the post-election rally:

• The S&P 500 surged 6.5%, riding a wave of optimism about a business-friendly administration.

• Bitcoin? It shot up 50%, crossing $100,000 for the first time ever.

Yet as the hype cooled, both assets pulled back—Bitcoin falling below six figures and the S&P dipping under 5,900. Even so, crypto’s gains remain monstrous, highlighting its potential as a high-risk, high-reward play.

For the first time, Bitcoin isn’t just a speculative asset—it’s a political one. With crypto-friendly figures stepping into top roles (hello, SEC Chair Paul Atkins) and whispers of executive orders favoring digital assets, Bitcoin has become a key player in the mainstream financial and political narrative.

And let’s not forget the cash flow. Venture capitalists and crypto enthusiasts poured millions into campaign coffers, ensuring digital assets have a loud voice in policy decisions.

Bitcoin’s journey from outsider to mainstream darling is reshaping the crypto landscape. Spot ETFs opened the floodgates, attracting $107 billion in investments—a reminder that making Bitcoin easier to own equals more adoption.

But here’s the rub: Bitcoin’s newfound correlation with stocks means it’s no longer the uncorrelated hedge many hoped for. Instead, it’s a high-risk asset tied to market trends.

For traders, this means Bitcoin’s potential isn’t about safety—it’s about riding the waves.

Pro tip: Keep your eyes on both the crypto market and stock indices—they’re moving closer together than ever before.

Boost Your Trading Game with AvaTrade’s 20% Bonus

Boost Your Trading Game with AvaTrade’s 20% Bonus

Big news, traders! AvaTrade is dishing out an exclusive 20% bonus to help you kickstart or supercharge your trading journey.

Whether you’re eyeing forex, CFDs, or gold, this bonus is your chance to trade with extra firepower. And hey, who doesn’t love a little extra cash in their account?

• Sign up today, claim your 20% bonus, and take your trading strategy to the next level.

• It’s the perfect way to maximize your potential while exploring AvaTrade’s top-tier trading tools.

But don’t wait too long—this opportunity isn’t sticking around forever. Click “Register Now“ and make your move today.

EUR/USD Stays Strong, But the Spotlight’s on US Inflation

EUR/USD Stays Strong, But the Spotlight’s on US Inflation

The EUR/USD pair is chilling near 1.0300, following a solid recovery on Tuesday. But let’s be real—the real action kicks off today at 13:30 GMT when the US Consumer Price Index (CPI) for December drops.

• Economists are predicting headline inflation grew 0.3% MoM, while core inflation (the “no food, no energy, no drama” version) likely rose by 0.2% MoM—a touch slower than the last round.

• The annual CPI is expected to accelerate to 2.9%, with core inflation holding steady at 3.3%.

Translation? If prices stay sticky, the Fed might hold its ground on interest rates, putting those rate-cut dreams on pause. Fed watchers are betting on one rate cut this year, down from the two projected earlier.

The US Dollar Index (DXY), a scorecard for the greenback against its major rivals, slipped to 109.00 after weaker-than-expected Producer Price Index (PPI) data on Tuesday. Add to that last week’s surprisingly strong Nonfarm Payrolls (NFP), and traders are feeling less confident about a Fed pivot anytime soon.

US Dollar Index Daily Chart as of January 15th, 2024 (Source: TradingView)

EUR/USD rebounded from Monday’s two-year low of 1.0175, thanks to a divergence in momentum:

• The 14-day RSI formed a higher low at 35.00, even as the pair made lower lows.

• But don’t pop the champagne just yet—the pair is still swimming in bearish waters, with all Exponential Moving Averages (EMAs) pointing down.

Key levels to watch:

• Support: 1.0175 (Monday’s low).

• Resistance: 1.0437 (January 6 high).

The EUR/USD bounce to 1.0300 could be short-lived with US inflation data on the horizon. Signs of sticky price pressures may keep the Fed hawkish, strengthening the dollar and putting the Euro under pressure.

Traders should focus on the CPI release and be prepared for volatility. Solid risk management and a clear strategy will be key to navigating potential market swings. Stay informed and trade with precision.

MEMES OF THE DAY

Don’t let a 0.01% dip turn you into a panic-sell pro.

Chasing moonshots now, learning lessons later.