6 Types of Forex Trading Strategies That Work and How to Choose them

I have been mentoring amateur and advanced forex traders for twenty years now, and I often get asked this—“What is the best forex trading strategy?” or “What are the best forex trading strategies that work?” Many new traders will expect a magic bullet solution to this question. Maybe there’s this mythical breakout strategy. Or probably a trend-following approach. How exactly does he get it to work? What is the secret? The bald truth, however, is that the answer is not so straight-forward.

This guide will teach you the proper methods to use when choosing the ideal forex trading strategy for your personality. Having this strategy down to pat will make the road ahead much clearer.

You may have been caught in the loop of learning strategy after strategy. Even after applying what you learned, you may not have been finding much success. From one strategy to the other, you keep hoping the next one will be your lucky break—an endless cycle of frustration. The cycle ends here.

Stop right now and read this guide in full. Take this advice from a trader who has been trading and mentoring traders for the last twenty years, and frankly has seen all that needs to be seen.

Contents

- What type of Forex trader are you?

- What’s your preferred time to trade?

- What’s your preferred holding strategy?

- Choosing the Best Forex Trading Strategies That Work For You

- Position Trading Forex Strategy

- Forex Swing Trading Strategies

- Forex Range Trading Strategies

- Forex Breakout Strategies

- Forex Trend Trading Strategies

- Forex Trading Strategy: Top Down Approach

- Conclusion on Forex Trading Strategies

What type of Forex Trader are you?

So, ask yourself this. Do you see yourself as an aggressive trader, a conservative trader, or something in between? If you rank yourself in between, do you feel you tend towards the aggressive or the conservative end of the spectrum? At ease, there are no wrong answers here. Each answer is right. Your answer is based on your personality. Knowing how you tend to trade will help in finding the right trading strategy for you.

“Now, you might not be sure of the section of the spectrum where your lot falls. It may not have been something that you have given much thought to prior to now. Here’s a scenario that can help you decide.

Let’s say you deposit $10,000 into your trading account. How much of this capital do you intend to risk per trade? A 1% risk per trade will translate to risking $100. Are you okay with winning only a hundred bucks from your ten thousand dollar investment? If your answer is yes, then this could be a sign that you are a conservative trader. If you would rather risk greater percentages of your starting capital for a chance of greater profit, then you’re most likely to be an aggressive trader, and that’s fine.

Let’s take a look at another scenario. You were brave enough to risk 3% of your starting $10,000. Unfortunately, you lost five trades in quick succession, bringing your total losses to $1500. At this point, you spot the perfect trade. All your instincts are screaming that you make this trade. What would you do at this point? Would you continue trading at a 3% risk so as to slowly recoup your losses? This is a conservative sign. Or would you go all out with a 15% risk chance in a bid to recoup all your losses at once? This is an aggressive sign.

Why does knowing whether you’re aggressive or conservative matter?

Does awareness of your trading idiosyncrasies matter when all you’re trying to do is make a profit? Yes, it does. You see, your base nature determines what type of forex trading strategy would work for you.

This is for aggressive traders. When you trade, you are often out to make large amounts of money in as little time as possible. To achieve this goal, you have to make high value wins. There are two common approaches to this. The first approach involves taking trades with higher risk percentage per trade. And of course, if you win on trades that have a bigger risk percentage, it will lead to the big wins you desire. The second approach involves increasing the volume of your trades while maintaining the standard risk percentage per trade. Each individual trade may not pay much, but you make up for the lack of quality with sheer quantity.

The first approach above is a daredevil approach. While it sometimes pays, it has been known to take lots of aspiring traders to the cleaners. A series of unlucky trades with big losses is all you need to see your capital fly away. Superficially, the second approach looks better than the first. Here, there’s a minimum of risk. But this approach confines you to trading in the short term with bigger quantity but lower quality trades. Luckily, there is a third way. This way is more rewarding the second and less risky than the first. Instead of taking a truckload of trades, or going for trades that are so risky, they seem foolhardy; you can do this—hunt out trades with a small risk to high reward ratio. For a lesser amount of risk, these trades promise greater profits. While nothing in this field is sure-fire, this is my preferred approach.

What’s your preferred time to trade?

Different strokes for different folks, they say. Here are five stereotypes for preferred trading time. You could fit into one of them, be a mixture of two or more, or have entirely different time habits altogether.

You trade after working hours, likely in the evening after work. You are on the computer from maybe 7 pm to 11 pm and look to take trades during this period.

You look at the charts in the morning before you go to work or at night. You then plan your trades and execute them on the daily or higher timeframe.

You look at the charts in the morning, plan your trades, and set alerts on your mobile. During the day, if there’s an alert and if you are free, you can execute the trade on your mobile or desktop.

You watch the charts throughout the day, spotting setups to enter and exit.

You look at the chart once or every few weeks, and trade them with a longer-term trading time span.

What’s your preferred holding strategy?

1. Short term trade

Here, your focus is on speed. Get in quick, get out equally quickly, make a profit. Ideally, this sort of trade (known as scalping) is carried out while the trader is looking at the charts. It’s an ideal holding strategy for aggressive traders who want large volumes of trade. Other strategies that fall in here include:

Ranging trading

Swing trading

2. Medium-term trades

This one is for the more conservative traders. Here you buy and hold for something ranging from one to seven days before you sell. Strategies here include:

Top-down approach

Multiple confirmations Breakout trades

3. Long term trades

This is for the ultraconservatives. The trade could be kept on ice for weeks, or even months. Just buy, hold, and wait.

4. Hybrid trades

This type of trade is like a cross between the medium and the long term frames. Depending on the situation, you can hold on good trades for days, weeks, months, or even years.

5. Combination trades

This combines the short term with the medium term. Here, you can scalp to get those daily paychecks. You can then combine this with the more profitable medium-term trades.

Now, let’s get into the nitty-gritty. I’m going to be listing and explaining some of the various forex trading strategies. Depending on your personality, one of these strategies will appeal to you. This is the trading strategy you should follow, as it will give you the most success.

Choosing the Best Forex Trading Strategies That Work For You

Over the years, I have discovered that these strategies are the most effective for one who wants to make money from trading right from the get-go. (Read: How much money can you make trading forex)

Easy Mode (Simple Forex Trading Strategy)

Position trading Forex Strategy

Top-down approach

Medium Mode

Forex Breakout Strategies

Forex Trend Trading Strategies

Hard Mode

Forex Swing Trading Strategies

Forex Scalping Strategies

Forex Range Trading Strategies

Listed above are the categories of trading strategies. Each category has different strategies within it. The ones in the “hard/difficult” category are those with a high risk to small reward ratio. This means you must make many trades to make a decent profit, and a single loss can kill your multiple wins. You may need 3-5 wins to recoup a single loss.

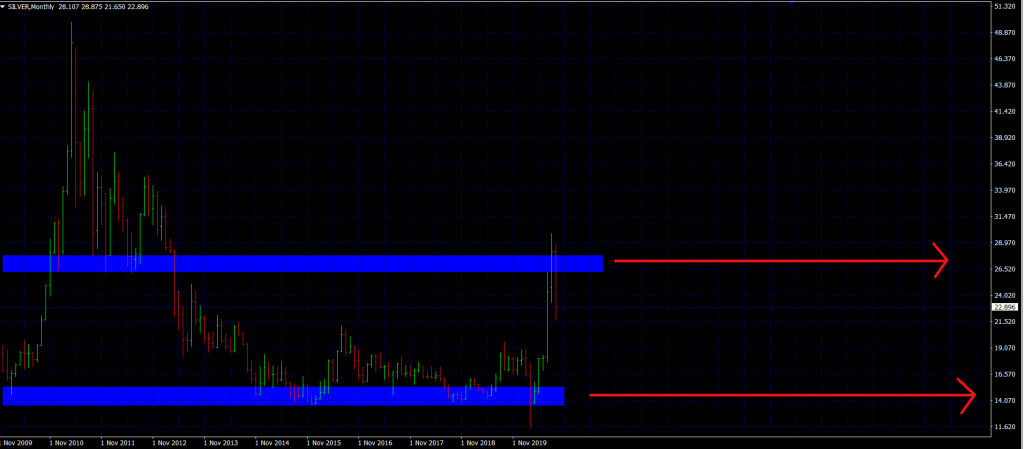

Position Trading Forex Strategy

This is an ‘easy mode’ strategy with a mid to long-term holding timeframe. It’s good for forex trading for beginners. If you are a beginner, then position trading is probably the best way to make money from trading. The method involved is very similar to buying stocks—buy at a low price, then hold. Hold for as long as it takes for the price to rise above the level at which you bought it. Then, sell and make your profit. The only extra to a professional trader who does position trading is their ability to read the market, time the best possible entry before the upswing, and exit around the highest level before the market drops. A person that doesn’t know much about any tactical analysis can still follow their gut and buy options they consider promising. Keeping a target price in their minds, they can get out whenever the market reaches that level and still make a profit. Pretty neat, isn’t it?

A professional trader following the same gut instinct will be better at reading the market. They can anticipate a retracement and enter at the break. This way, they’re getting in at a better and lower price than the typical investor would. The pro then carefully monitors the price rise. When price reaches the target area of the typical investor, he could get out. But the pro understands that there is a chance that the price will rise even further, so he continues to trail it. This way, if the market drops, then he gets out around the same level as the typical investor. But if the market continues going strong, he will trail it upwards for greater profits.

Every investor has the opportunity to enter any trade they wish to. But even from the same trade, one investor could make a profit while another makes a loss. The critical difference is in how properly they timed their entry and exit points. Slight variances here can lead to vast differences in outcome. When position trading, you can buy pairs at low pricing. That is, you buy a stock, a commodity, a forex pair while the price is low. For example, the stock may be worth $100 currently. However, if it has gone up to $400 before, you can buy it at that $100 with the belief that it will rise to $400 again. That would be a threefold return on investment.

Why is this strategy considered to be an easy one? It’s because if you buy the position and hold the trade, even in the worst-case scenario, the stop loss for the trade is set at 0. Moreover, it is very unlikely that the price will ever fall down to that 0. Bearing this in mind, any losses you take along the way are temporary. Proper strategy and patience will soon see you recouping those losses and making some additional profit.

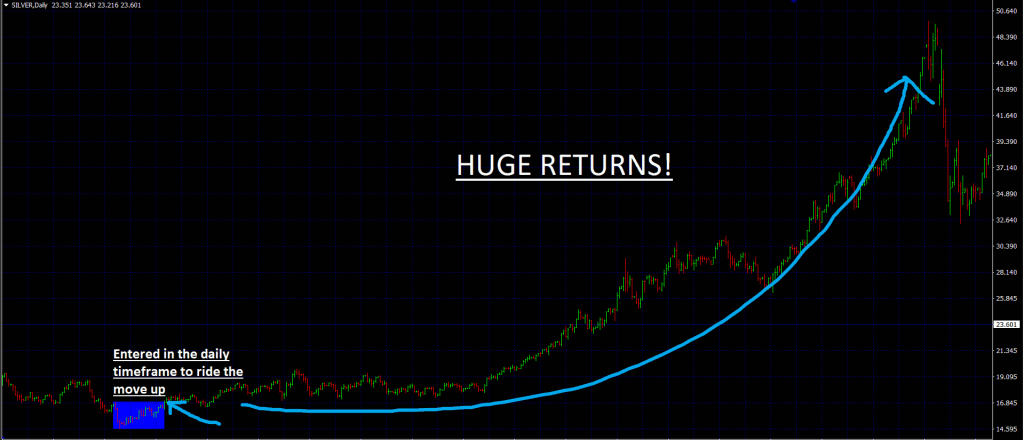

Some examples of position holding below

Silver bought at the low of $15, exit at $27. Almost 2X returns.

Crude Oil bought a low at around $10, exit at $40. 4X returns.

Forex Swing Trading Strategies

This is a ‘Hard mode’ strategy with a short to midterm holding timeframe. Why is swing trading considered a difficult strategy? The principle behind swing trading is that the trader buys when it swings low and sells when it swings high. MACD Histogram, Stochastic Indicator, Bollinger Bands Forex, ATR Indicator and RSI Forex Indicators are some of the typical trading indicators used for swing trading.

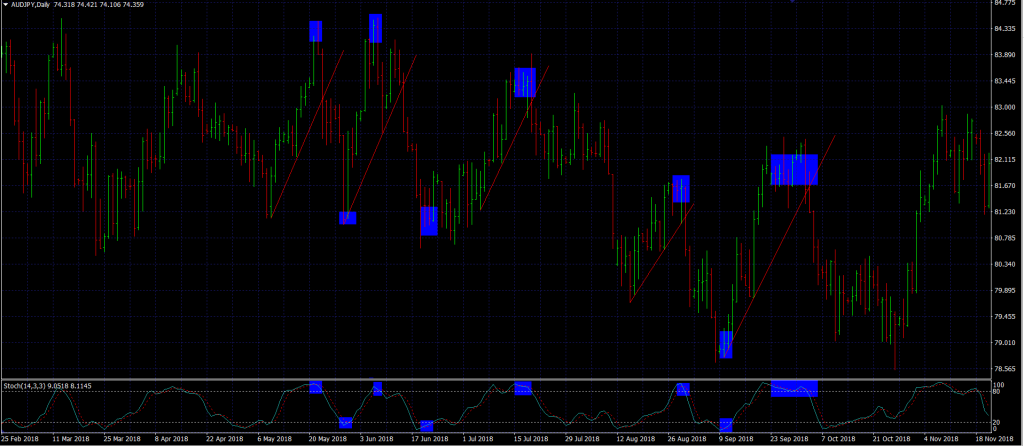

Here’s an example. Note how the Stochastic matches every swing high and low. It also indicates when it reaches the overbought and oversold levels.

Why Swing Trading Strategies are considered difficult is because You may not be able to accurately determine when the price is high or when it is low. Sometimes you may think that the price has peaked, and it proves you wrong by going on a strong rally. Other times, you may think the price has hit rock bottom, but once again, it surprises you by falling to new depths. Let’s look on the bright side. There are safety triggers that can alert you that a trend is about to change before you enter a trade.

Also read: 5 types of Swing Trading Strategies that work

Combination of Stochastic and Trendline Trading to time the entry

When played right, forex swing trading strategies can prove to be a very profitable endeavour.

Forex Range Trading Strategies

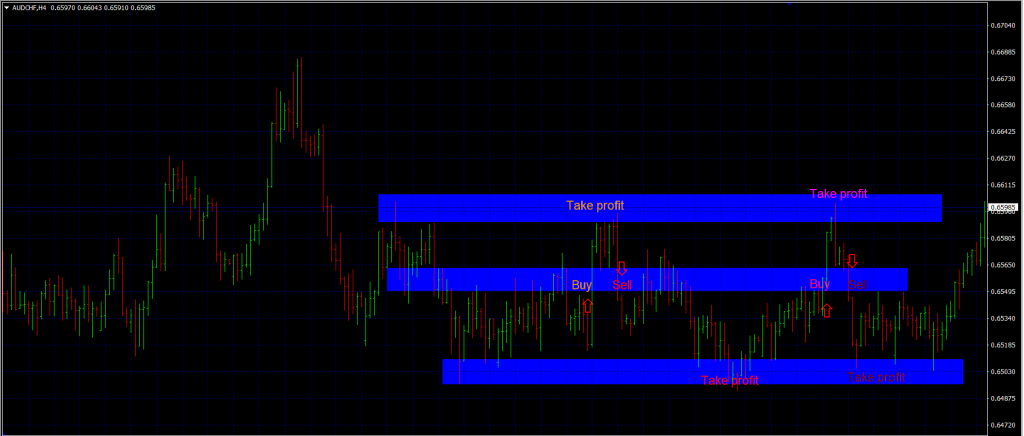

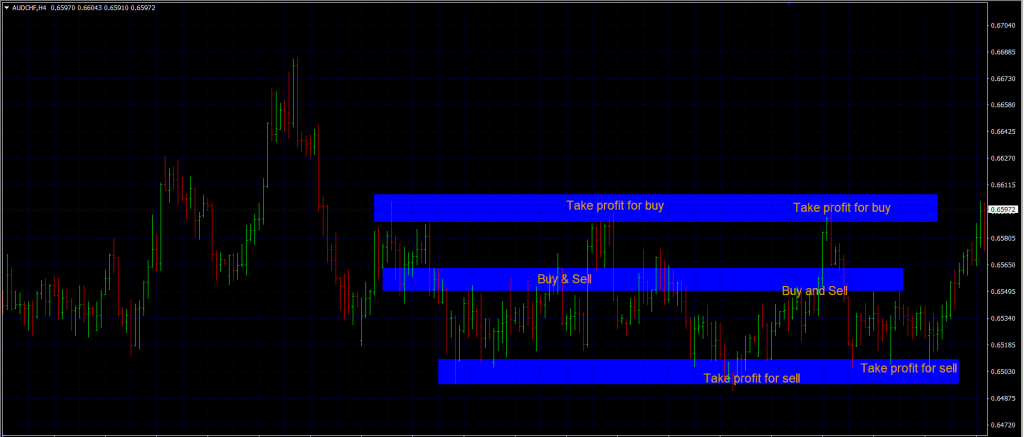

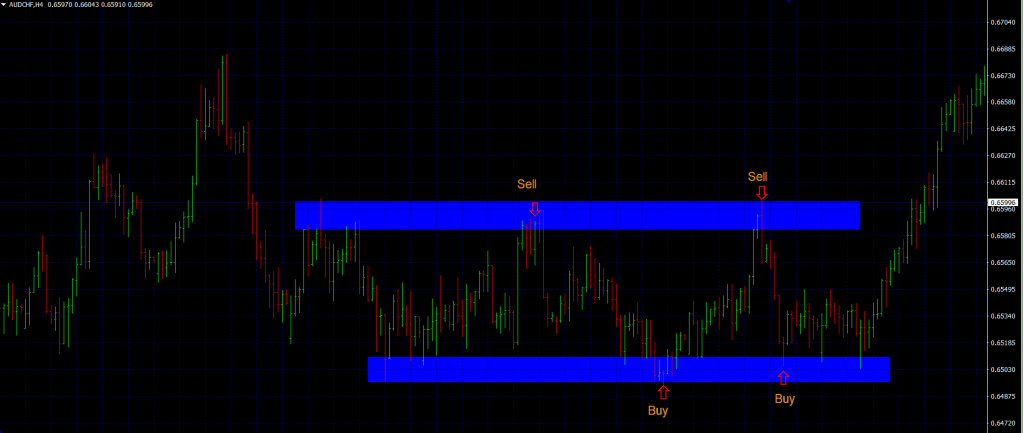

This is a ‘medium to hard mode’ of trading, with a short to mid-term holding timeframe. Normally, range trading works by the trader determine the two levels supporting the current price movement. There is a resistance level at the top and a support level below. On a normal day, prices can range between these two levels for a long time before breaking out either upwards or downwards. A large number of traders will simply place their entry point at either the upper rejection point or the lower one. Then, they’ll patiently wait for prices to rise or fall, depending on the option they chose.

This strategy is a dream come true for scalpers. With this, they can perform multiple trades, each lasting only a few minutes. Buy at the lows, sell at the highs, rinse, and repeat. They’ll keep repeating this until the price finally breaks out from between the support and resistance forex levels.

Another common scalping strategy is entering in the middle of a ranging movement. This involves buying when prices cross the middle section and taking profit at the upper rejection area. This is followed by selling when prices cross the middle section and taking profit at the bottom rejection level.

Yet another scalping strategy is placing a buy-and-sell position in the middle. This way, if the price goes down, the scalper can close the sell trade and make a profit. When the price goes back up, they will then close the buy trade at around breakeven level or a little loss. Using this pattern, sell profit outweighs the buy loss, and the scalper makes a profit. If they don’t want to trade this way, they can also wait for prices to go up and then close their buy trade for a profit. Either way, a profit is made.

There are many pros and cons to the methods above. Your entry and exit timing is everything, and knowing when to get out before the market breaks out from the range trading zone is key. If you are a thrill seeker and like to feel the adrenaline pumping in your veins, then scalping is for you. The above are some of the forex day trading strategies scalper use. A trader’s reaction time while scalping has to be fast as the decision on entry and exit points are often made in mere minutes.

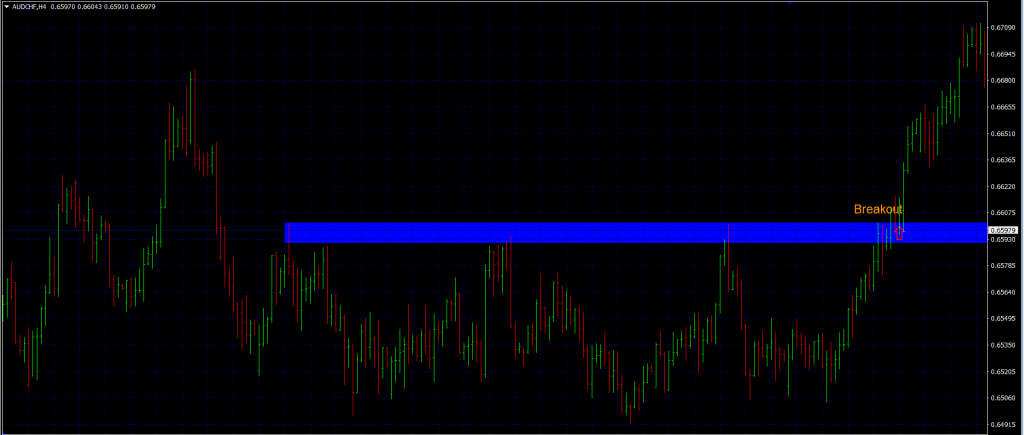

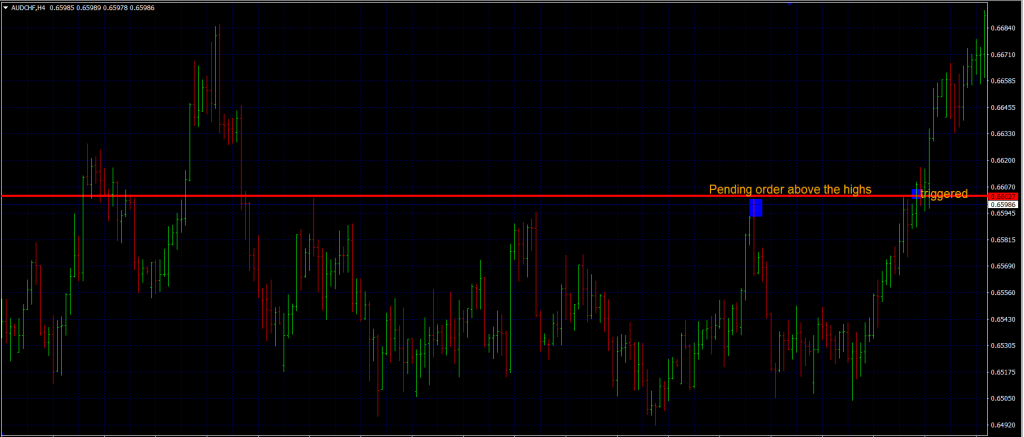

Forex Breakout Strategies

This is a medium mode strategy with a medium-term holding timeframe. Personally, I have always had a soft spot in my heart for forex breakout strategies. The reason for this is not far fetched. Breakout strategies usually come into play after bursts from range. These bursts often occur after long periods of the price middling within the proper boundaries.

In the example above, the price has been ranging in the box before it eventually broke out. Usually, after a long consolidation, the break that follows is a strong one that marks the start of a trending movement. There are many ways to trade a breakout. Some use pending orders above the breakout level. The pending orders indicate the start of a breakout so the savvy trader can get in and ride the move.

Other traders often wait for a close above the support or resistance level before they enter the market.

Alternatively, you can wait for the prices to retrace before entering. Even after a breakout, the prices can still come up to the support level or down to the resistance level. This approach is much safer and can offer the trader a better risk reward ratio.

There is no one way to play a forex breakout strategy. It is best if the decision is made on the spur of the moment, of course, informed by studying the charts. When prices break and start to move, the market is in a state of great flux. If handled properly, profit margins are high this period. So, why is this a medium mode strategy and not an easy one? This is because breakouts could be deceptive. The prices could seem like they are breaking through the limits. However, immediately after the trader places a trade, they return to fluctuate within normal boundaries. The difficulty in predicting when a real breakout is about to occur is why this is not an easy strategy.

Different traders have different methods of addressing this issue. Here is one. If you have a strong gut feeling that this breakout is not a true one, don’t enter at the breakout. Instead, wait for the retracement and enter there.

Forex Trend Trading Strategies

More often than not, it is safest to follow the trend. Here’s what I mean.

When the trend is moving up, you absolutely want to be on that trend. Get in on a nice spot and ride it for all its worth! For strong trends, a lot of profit is up for grabs! Here are some ways to access profit.

1. Price action

A good price action trading bar such as a pin bar / doji candle supplies the extra confirmation needed to get in and ride the move.

2. Retracement

What goes up must come down, and what comes down must surely go up. But if the uptrend or downtrend is strong, there is a likelihood that its complement will just be a minor retracement. Entering at this retracement allows the trader to get in on a low in a method reminiscent of swing trading.

3. Fibonacci

Fibonacci is also another method used to identify a retracement. There are some important levels in Fibonacci. The major ones are 50% and 61.8%.

Here’s a trend-following trade that retraced to the Fibonacci 50% level before shooting back down.

Forex Trading Strategy: Top Down Approach

This is an easy to medium mode strategy with a short to long term holding timeframe. This is one of the professional forex trading strategies approaches has personally earned me a lot of money. To play this, you have to understand how to use multiple time frames. Simply put, you detect a good trade in a higher time frame (monthly or weekly time frame). You then hold on to the trade and execute in a lower time frame for the greatest profit margin possible.

If you play this strategy, your entry and your stop-loss will be in the lower time frame, where prices are relatively low. In contrast, your profit will be from the higher time frame, leading to a huge profit margin. This strategy has a special place in my heart, and is part of my staple strategy.

Conclusion on Forex Trading Strategies

I often say that there are more variations of forex trading strategies than traders. Don’t get lost. The key is to find the right forex trading strategy for you. What works for others may not be the same for you. Identify the type of trader that you are. Are you looking for an easy, medium, or hard level of strategy? What is your preferred holding time frame? What time are you able to trade each day? Are you an aggressive trader, conservative trader or somewhere in between? With these parameters in mind, carefully select the strategy that suits you the best, backtest them to make sure it is at least successful for the last 3 years and if you found a winner. (Also read: How to be a successful Trader) You are on the right track! Stick to it and I look forward to hearing your success story!

What do you think about this guide? Let me know how your experience was with the strategy you used. Which forex trading strategies worked best for you?

I’ll love to know the experiences you had with the forex trading strategies that you have tried before and what worked best for you

Splendid article Ezekiel! I’m new to forex trading and the guide above is really informative!

Cheers bro!

I’m a forex breakout trader and the article is really insightful! Keep them coming Ezekiel

Thank you Megan

Hi Ezekiel, I’m a rather conservative person. What forex trading strategies will you recommend to me?

Start off with the position holding strategy, then based on your preferred holding timeframe and style, find another strategy and backtest it. Once you have good results on that, you’ve got another strategy in the bag.

Sir, thank you for this guide! I’m reading it for the 2nd time now to really absorb it

Great that you found it helpful Mohan!

Hi…Ezikiel, very insightful and informative article u be jux made my day,,,remain my best sir!!!

Hi Ezekiel, the article is very informative. I’m more conservative in trading and I use a lot of top down approaches and breakout strategies. It’s been working for me so far!

First I would love to appreciate your help for us to grow in trading. I’m new to trading, but all I think was the Conservative. I’m enrolled on your course, and I know I will be a consistent profitable trader. Thanks to you my mentor!

First I would love to appreciate your help for us to grow in trading. I’m new to forex trading, but all I think I’m like the Conservative. I’m enrolled on your course, and I know I will be a consistent profitable trader. Thanks to you my mentor!

Great to hear from you Ermias! Being conservative is not an issue, in fact it could be a virtue. Just know when to strike when the opportunity comes. :)

Hi Ezekiel, Is it possible to backtest price action strategies? If so, what is a good software to do so?

Yes it’s possible to backtest price action strategies. I usually do a manual backtest on the mt4. Alternatively, you can use software like forex tester or if you know a little coding, you can craft out a ea to test your strategy.