FlowBank Review

FlowBank is a Swiss-based online brokerage firm that offers a comprehensive range of financial services, including Forex trading, stocks, commodities, and cryptocurrencies. Whether you’re a seasoned trader or new to the world of Forex trading, this review aims to equip you with the necessary information to make an informed decision about FlowBank’s offerings.

We will delve into various aspects of FlowBank, including its background and company overview, account types and offerings, trading platforms, trading conditions, customer support, security and regulatory compliance, as well as the educational resources available. By the end of this review, you will have a clear understanding of FlowBank’s strengths, and weaknesses, and whether it aligns with your trading goals and preferences.

So, let’s dive into this review and explore what FlowBank has to offer in 2023, empowering you to make informed trading decisions and navigate the dynamic Forex market with confidence.

What is FlowBank?

FlowBank is a leading online brokerage firm based in Geneva, Switzerland. With a rich history dating back to its establishment in 2018, FlowBank has rapidly emerged as a prominent player in the financial industry. The company’s founding vision was to provide traders with a secure and transparent trading environment, backed by a commitment to regulatory compliance.

FlowBank operates as a licensed and regulated financial intermediary authorized by the Swiss Financial Market Supervisory Authority (FINMA). This regulatory oversight ensures that FlowBank adheres to strict standards and guidelines, providing clients with a reliable and trustworthy platform for their trading activities.

Since its inception, FlowBank has focused on developing a comprehensive range of financial services to cater to the diverse needs of traders. The company offers a variety of account types, including individual, joint, and corporate accounts, so that clients can select the one that best suits their trading tastes and ambitions.

FlowBank offers trading in a variety of marketplaces, including equities, indices, commodities, cryptocurrencies, and Forex currency pairs. Traders may diversify their portfolios and take advantage of chances in many asset classes thanks to this wide range.

FlowBank’s comprehensive trading platforms demonstrate its dedication to the user experience. The company offers a web-based platform that can be used with current web browsers, negating the need to install any software. In addition, FlowBank provides mobile trading programs for iOS and Android devices, allowing users to conduct transactions while on the road and stay connected. These platforms provide sophisticated charting tools, current market information, programmable user interfaces, and effective order execution capabilities.

FlowBank has put in place strict security and regulatory compliance procedures to protect client cash and personal information. The company uses segregated client accounts to ensure the separation of customer cash from operating funds and advanced encryption technologies to secure transactions.

The offering of worthwhile educational resources shows FlowBank’s commitment to education. To improve their trading knowledge and abilities, traders can access video lessons, webinars, e-books, articles, and other training tools. FlowBank wants to help traders make wise trading decisions and enhance their overall trading performance by arming them with educational content.

Advantages and Disadvantages of Trading with FlowBank?

Trading with FlowBank comes with several advantages and disadvantages that traders should consider. It is essential for traders to weigh these advantages and disadvantages in the context of their trading goals, preferences, and risk appetite.

Here is a summary of the key points:

Benefits of Trading with FlowBank

Trading with FlowBank offers numerous benefits that can enhance the trading experience for both new and experienced traders. These factors contribute to a positive trading experience and make FlowBank an attractive choice for traders seeking a reputable and comprehensive brokerage service.

Here, we delve into the key benefits of choosing FlowBank as your trading partner.

Regulatory Compliance

FlowBank operates as a licensed and regulated brokerage firm authorized by the Swiss Financial Market Supervisory Authority (FINMA). This regulatory oversight ensures that FlowBank adheres to strict standards and guidelines, providing traders with a secure and trustworthy trading environment.

Wide Range of Tradable Instruments

FlowBank offers access to a diverse range of financial instruments, including Forex currency pairs, stocks, indices, commodities, and cryptocurrencies. This extensive selection enables traders to diversify their portfolios and take advantage of opportunities in different asset classes.

User-Friendly Trading Platforms

FlowBank provides traders with intuitive and technologically advanced trading platforms. The firm offers a web-based platform that can be accessed through modern web browsers, eliminating the need for software installation.

Additionally, FlowBank offers mobile trading applications for iOS and Android devices, enabling traders to stay connected and execute trades on the go. These platforms are equipped with advanced charting tools, real-time market data, customizable interfaces, and efficient order execution capabilities.

Competitive Trading Conditions

FlowBank offers competitive trading conditions that can benefit traders of all levels. The firm provides tight spreads, low commissions, and various leverage options, allowing traders to optimize their trading strategies.

FlowBank also supports a wide range of order types, including market orders, limit orders, and stop orders, giving traders the flexibility to execute trades according to their preferences.

Strong Customer Support

FlowBank places a strong emphasis on delivering reliable and efficient customer support. The firm offers multiple channels of communication, including email support, telephone support, and live chat.

FlowBank’s knowledgeable and responsive customer support team is readily available to assist clients with account-related inquiries, technical issues, trading platform guidance, and general support, ensuring a smooth trading experience.

Educational Resources

FlowBank recognizes the importance of education in trading success and provides traders with valuable educational resources. These resources may include video tutorials, webinars, e-books, articles, and other educational materials.

By offering access to educational content, FlowBank aims to empower traders, enabling them to make informed trading decisions and improve their overall trading performance.

FlowBank Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making. Conducting thorough research and evaluating personal requirements will help determine if FlowBank is the right brokerage choice for their trading journey.

Pros

- Regulatory Compliance: FlowBank operates as a licensed and regulated brokerage firm authorized by the Swiss Financial Market Supervisory Authority (FINMA). This regulatory oversight ensures that the firm adheres to strict standards and provides clients with a secure and transparent trading environment.

- Wide Range of Tradable Instruments: FlowBank offers a diverse selection of financial instruments, including Forex currency pairs, stocks, indices, commodities, and cryptocurrencies. This enables traders to diversify their portfolios and take advantage of various market opportunities.

- User-Friendly Trading Platforms: FlowBank provides intuitive and technologically advanced trading platforms. Their web-based platform and mobile applications offer features such as advanced charting tools, real-time market data, customizable interfaces, and efficient order execution capabilities, facilitating a seamless trading experience.

- Competitive Trading Conditions: FlowBank offers competitive trading conditions, including tight spreads, low commissions, and leverage options. Traders can benefit from a range of order types, allowing them to execute trades according to their specific strategies.

- Reliable Customer Support: FlowBank emphasizes responsive and knowledgeable customer support. Traders can access support through various channels, including email, telephone, and live chat, ensuring prompt assistance with inquiries and concerns.

Cons

- Limited Availability of Account Types: FlowBank’s account types may have limitations, potentially excluding certain types of traders or entities. It is important to ensure that the available account options align with specific trading needs and preferences.

- Country Restrictions: FlowBank may have restrictions on its services, limiting access for traders from certain jurisdictions. Traders should verify if FlowBank operates in their country of residence before considering opening an account.

- Platform Features: While FlowBank’s trading platforms offer advanced features, some traders may find that specific functionalities they desire are missing. It is advisable to carefully evaluate the platform’s features to determine if they meet individual trading requirements.

- Limited Educational Resources: FlowBank provides some educational resources, but the range and depth may be limited compared to other brokerage firms. Traders seeking extensive educational materials may need to supplement their knowledge from external sources.

- Account Funding Options: FlowBank’s available account funding options may not be as extensive as those offered by other brokers. Traders should review the available funding methods to ensure they can conveniently deposit and withdraw funds.

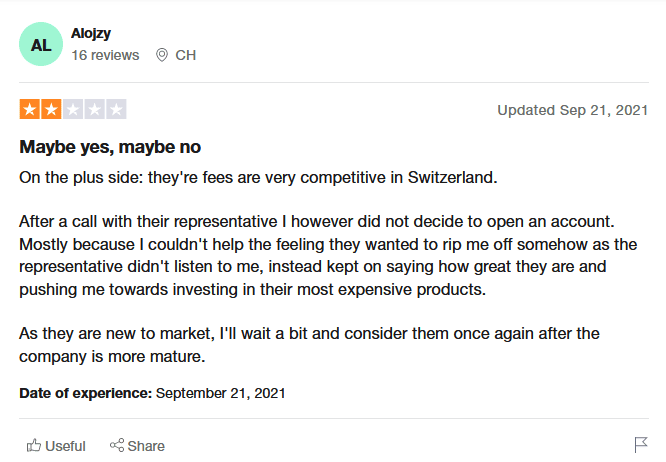

FlowBank Customer Reviews

When considering a brokerage firm like FlowBank, it is valuable to take into account the experiences and opinions of actual customers. By examining customer reviews, you can gain insights into the quality of services, trading experience, customer support, and overall satisfaction with FlowBank as a trading platform.

While individual experiences may vary, these reviews can provide valuable perspectives. Here, we will explore a compilation of customer reviews to offer a glimpse into the general sentiment surrounding FlowBank.

It is important to note that customer reviews reflect the personal experiences and opinions of individuals and may not represent the overall consensus. Nevertheless, they can provide valuable insights into the strengths and potential areas for improvement of FlowBank as reported by its clients.

FlowBank Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It’s not just about the trading platform’s capabilities or the variety of markets available to trade.

Costs associated with each trade can quickly add up and impact your bottom line, especially for active traders. In this section, we’ll examine the fee structure at FlowBank and how it may affect your trading experience.

FlowBank aims to provide competitive spreads for traders, ensuring cost-efficiency in trading. The specific spreads offered by FlowBank can vary depending on the trading instrument and prevailing market conditions. Tight spreads are sought after, as they reduce the cost of entering and exiting positions.

In addition to spreads, FlowBank may charge certain fees and commissions. Commission fees may be applicable for specific types of trades, such as stock trading, based on either the trade size or a fixed rate per transaction. Financing fees, also known as swap rates, may apply for leveraged positions held overnight.

You should review the fee schedule provided by FlowBank to understand the costs associated with trading and account services. It’s important to note that the fee structure can be subject to change, and traders are encouraged to consult FlowBank’s official website or contact customer support for the most up-to-date and accurate information regarding spreads, fees, and commissions.

Account Types

FlowBank offers various account types to cater to the diverse needs of traders. These account options are designed to accommodate different trading preferences and requirements.

Let’s explore the account types offered by FlowBank:

Individual Account

The individual account is the most common and widely used account type. It is designed for individual traders who want to trade on their own behalf. This account type provides a personalized trading experience and allows traders to manage their investments independently.

Joint Account

FlowBank also offers joint accounts, which are suitable for multiple individuals who want to trade collectively. Joint accounts are commonly used by spouses, family members, or business partners who wish to pool their resources and trade together. This account type enables joint decision-making and shared access to the trading account.

Corporate Account

FlowBank provides corporate accounts for businesses and corporate entities. Corporate accounts allow companies to conduct trading activities on behalf of their business operations. This account type may require additional documentation and verification to ensure compliance with regulatory requirements.

Other Account Types

FlowBank may offer additional account types tailored to specific needs or trading styles. These could include accounts for professional traders, high-net-worth individuals, or specialized accounts for specific trading strategies. The availability of these account types may vary, and traders should consult FlowBank directly for detailed information.

It’s important for traders to carefully consider their trading goals, preferences, and requirements when choosing an account type. Each account type may have specific features, benefits, and eligibility criteria. You should review the terms and conditions associated with each account type to ensure they select the option that aligns with their trading objectives.

How To Open Your Account?

Opening an account with FlowBank is a straightforward process. Here’s a step-by-step guide. Be sure to check FlowBank’s official website for any changes to this process.

Visit the FlowBank Website: Go to the official FlowBank website using a web browser.

Click on “Open an Account”: Look for the “Open an Account” or a similar button or link on the website’s homepage. Click on it to start the account opening process.

Choose the Account Type: Select the account type that best suits your trading needs, such as individual, joint, or corporate accounts. Review the features and requirements of each account type before making your selection.

Complete the Application Form: Fill out the account application form provided by FlowBank. You will typically need to provide personal information, including your name, address, contact details, and financial information. For corporate accounts, additional company-related information may be required.

Submit Supporting Documentation: FlowBank may require supporting documentation to verify your identity and comply with regulatory requirements. This may include a copy of your identification documents (such as a passport or driver’s license) and proof of address (such as a utility bill or bank statement). For corporate accounts, documentation such as company registration details, articles of incorporation, and beneficial owner information may be necessary.

Agree to Terms and Conditions: Review and accept the terms and conditions presented by FlowBank. Ensure you understand the rights and obligations associated with opening and maintaining an account with the brokerage.

Fund Your Account: Once your account application is approved, you will need to fund your account to start trading. FlowBank typically provides multiple funding options, such as bank transfers, credit/debit cards, or electronic payment systems. Choose the method that is most convenient for you and follow the instructions provided by FlowBank to deposit funds into your trading account.

Start Trading: With your account funded, you can now access the trading platforms provided by FlowBank and begin executing trades in the available financial markets. Familiarize yourself with the platform’s features, tools, and order execution process to make the most of your trading experience.

It is important to note that the specific steps and requirements may vary based on your location, account type, and regulatory considerations. Always refer to the official FlowBank website or contact their customer support for the most up-to-date and accurate information regarding the account opening process.

What Can You Trade on FlowBank?

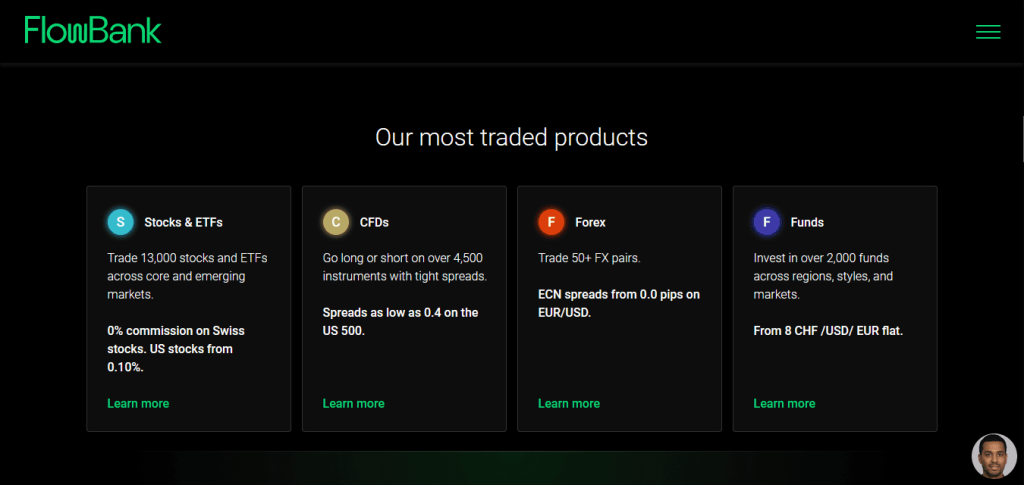

On FlowBank, traders have access to a diverse range of financial instruments across various markets, allowing traders to access multiple markets from a single platform. While specific offerings may evolve over time, here are some of the common instruments you can trade on FlowBank:

Forex (Foreign Exchange): FlowBank provides access to the global Forex market, allowing traders to trade major, minor, and exotic currency pairs. Popular currency pairs such as EUR/USD, GBP/USD, USD/JPY, and more are available for trading.

Stocks: FlowBank offers a selection of stocks from major global exchanges. Traders can trade stocks of well-known companies across various industries, including technology, finance, healthcare, and more. FlowBank may provide access to stocks listed on exchanges such as NASDAQ, NYSE, LSE, and more.

Indices: Traders can also participate in index trading through FlowBank. Major indices, including the S&P 500, NASDAQ 100, FTSE 100, DAX 30, and others, are typically available for trading. Index trading allows traders to speculate on the performance of a group of stocks, representing a specific market or sector.

Commodities: FlowBank offers a range of commodities for trading, allowing traders to speculate on the price movements of these physical goods. Commonly traded commodities include gold, silver, crude oil, natural gas, agricultural products, and more.

Cryptocurrencies: FlowBank provides access to the cryptocurrency market, allowing traders to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others. Cryptocurrency trading offers opportunities for traders interested in the digital asset class.

FlowBank’s diverse range of tradable assets enables traders to diversify their portfolios and take advantage of opportunities in different markets, providing flexibility and options for various trading strategies and preferences.

FlowBank Customer Support

FlowBank prioritizes providing reliable and efficient customer support to assist traders with their inquiries, account management, and trading needs.

Here is an overview of the customer support offered by FlowBank:

Support Channels

FlowBank offers multiple channels of communication to ensure accessibility and prompt assistance. Traders can reach out to FlowBank’s customer support team through the following channels:

- Email Support: Traders can send their inquiries or concerns via email to FlowBank’s dedicated support email address. The support team aims to respond to queries in a timely manner.

- Telephone Support: FlowBank provides a phone support service, allowing traders to speak directly with a customer support representative. The telephone support line is available during specified business hours.

- Live Chat: FlowBank offers a live chat feature on its website, enabling traders to engage in real-time text-based conversations with customer support representatives. This allows for immediate assistance and quick resolution of queries.

Knowledge Base and FAQ

FlowBank maintains a comprehensive knowledge base and frequently asked questions (FAQ) section on its website. Traders can access this resource to find answers to common questions, explore educational materials, and access self-help resources.

Multilingual Support

FlowBank aims to provide support to traders in multiple languages. While the specific languages supported may vary, the availability of multilingual customer support enhances accessibility and accommodates a diverse user base.

Personal Account Manager

Depending on the account type and trading activity, FlowBank may assign a dedicated personal account manager to certain clients. This account manager can provide personalized assistance, guidance, and support tailored to the trader’s specific needs.

It’s important to note that the availability of customer support channels and response times may vary based on business hours, market conditions, and other factors. Overall, FlowBank strives to deliver reliable and responsive customer support, offering multiple channels of communication to assist traders with their inquiries, technical issues, account-related matters, and general support needs.

Advantages and Disadvantages of FlowBank Customer Support

It’s important to consider these advantages and disadvantages of FlowBank’s customer support in the context of one’s individual trading needs and preferences. While FlowBank strives to offer reliable and responsive support, traders should assess their own requirements and determine if the level of support provided aligns with their expectations.

Here are some potential advantages and disadvantages of FlowBank’ customer support:

Security for Investors

Ensuring the security of investments is a top priority for investors when choosing a brokerage firm. The safety and protection of funds and personal information are crucial factors to consider.

Let’s explore the security features and considerations that FlowBank provides to instill confidence and trust in its investors.

Withdrawal Options and Fees

Withdrawal options and fees are important considerations for investors when choosing a brokerage firm. FlowBank offers various withdrawal options to provide flexibility and convenience for its clients. Here is an overview of withdrawal options and potential fees associated with withdrawing funds from a FlowBank account.

Here are some general considerations regarding withdrawal options and fees:

FlowBank may charge fees for processing withdrawals. These fees can vary depending on the specific withdrawal method chosen and the client’s account type. It is advisable for clients to review FlowBank’s fee schedule or contact customer support to understand the applicable fees associated with withdrawals.

Additionally, it’s essential to consider that some banks or payment processors involved in the withdrawal process may impose their own fees or charges. You should inquire with their financial institutions about any potential fees on their end.

FlowBank aims to provide transparency and convenience through its user-friendly FlowBank app and online banking platform with thorough flow bank protocols. Clients can easily manage their accounts, view balances, and initiate withdrawals while staying informed about the specific terms and conditions related to withdrawal fees and charges.

FlowBank is committed to offering competitive trading fees for a diverse range of instruments, including Swiss stocks and major currency pairs. Traders can leverage the market insights and financial news resources provided by FlowBank to make informed trading decisions.

It’s worth noting that FlowBank maintains a minimum account funding requirement, which traders should be aware of before opening an account. For experienced traders seeking advanced features and customizable interfaces, the FlowBank Pro platform offers a professional-grade trading experience.

With these offerings, FlowBank caters to the needs of traders, providing a seamless trading environment that combines convenience, competitive pricing, market insights, and advanced trading capabilities.

FlowBank Vs Other Brokers

When comparing FlowBank to other brokerage firms, it’s essential to consider various factors that can impact the trading experience and meet individual trading preferences. Here, we’ll explore the comparisons between FlowBank and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. FlowBank Vs AvaTrade

When comparing FlowBank to AvaTrade, both brokers have their strengths and considerations. FlowBank is regulated by FINMA, providing a secure trading environment, while AvaTrade is regulated by multiple financial authorities, enhancing its credibility. FlowBank offers a diverse range of tradable instruments, including Forex, stocks, indices, commodities, and cryptocurrencies.

AvaTrade also provides a similar selection of instruments. In terms of trading platforms, FlowBank offers user-friendly web and mobile platforms, while AvaTrade provides popular platforms like MT4 and MT5.

Both brokers aim to offer competitive spreads and commissions, but specific fees may vary. Customer support is emphasized by both brokers, with multiple channels available. Education and research resources are also provided by both brokers.

Verdict: If regulatory compliance and security are top concerns, FlowBank’s authorization by the Swiss Financial Market Supervisory Authority (FINMA) provides a high level of regulatory oversight and trustworthiness. FlowBank also offers a diverse range of tradable instruments and user-friendly platforms, with competitive spreads and a focus on reliable customer support.

#2. FlowBank vs. RoboForex

When comparing FlowBank and RoboForex, there are several key factors to consider. FlowBank is regulated by the Swiss Financial Market Supervisory Authority (FINMA), ensuring compliance with strict regulatory standards.

They offer a diverse range of tradable instruments, including Forex, stocks, indices, commodities, and cryptocurrencies. FlowBank provides user-friendly web-based and mobile trading platforms, competitive spreads, and emphasizes reliable customer support.

RoboForex is regulated by various financial authorities, and they also offer a wide selection of tradable instruments, including Forex, stocks, indices, commodities, and cryptocurrencies. RoboForex provides multiple trading platforms, including proprietary options and popular third-party platforms.

They offer competitive spreads, but specifics may vary based on account type and trading conditions. Ultimately, the choice between FlowBank and RoboForex will depend on individual trading preferences, such as regulatory requirements, available instruments, platform preferences, and desired levels of customer support.

Verdict: If regulatory compliance and security are key concerns, FlowBank’s authorization by the Swiss Financial Market Supervisory Authority (FINMA) provides a high level of oversight and credibility. FlowBank offers a diverse range of tradable instruments, user-friendly platforms, competitive spreads, and reliable customer support.

#3. FlowBank vs. Alpari

When comparing FlowBank and Alpari, there are important factors to consider. FlowBank is regulated by the Swiss Financial Market Supervisory Authority (FINMA), ensuring adherence to strict regulatory standards. They offer a wide range of tradable instruments, including Forex, stocks, indices, commodities, and cryptocurrencies. FlowBank provides user-friendly web-based and mobile trading platforms, and competitive spreads, and places a strong emphasis on reliable customer support.

On the other hand, Alpari is a global broker regulated by various financial authorities depending on the region. For example, in the UK, Alpari is regulated by the Financial Conduct Authority (FCA). Alpari offers a diverse selection of tradable instruments, including Forex, stocks, indices, commodities, and more.

Both brokers aim to provide competitive spreads and offer customer support, although specific offerings may vary. The choice between FlowBank and Alpari depends on individual trading preferences, including regulatory requirements, available instruments, platform features, and desired customer support levels.

Verdict: If a trader is looking for something specific, such as regulatory compliance, a diverse range of instruments, user-friendly platforms, competitive spreads, and strong customer support, FlowBank appears to be a suitable choice. With regulation by the Swiss Financial Market Supervisory Authority (FINMA), FlowBank offers a high level of regulatory oversight and trustworthiness. They provide a wide range of tradable instruments, user-friendly platforms, competitive spreads, and emphasize reliable customer support.

Conclusion: FlowBank Review

After a comprehensive review of FlowBank, it is evident that the brokerage offers several noteworthy features and benefits for traders. With its regulation by the Swiss Financial Market Supervisory Authority (FINMA), FlowBank provides a high level of trust and regulatory compliance.

The diverse range of tradable instruments, including Forex, stocks, indices, commodities, and cryptocurrencies, allows traders to access various markets and diversify their portfolios.

FlowBank’s user-friendly web-based and mobile trading platforms, equipped with advanced charting tools and efficient order execution capabilities, contribute to a seamless trading experience.

Competitive spreads and a commitment to reliable customer support further enhance the appeal of FlowBank. The availability of multiple communication channels and a strong emphasis on prompt responses ensure that traders can seek assistance whenever needed.

FlowBank presents itself as a reputable and reliable brokerage option, offering a secure trading environment, diverse instruments, user-friendly platforms, competitive spreads, and responsive customer support.

Traders seeking a regulated and trustworthy broker with a wide range of trading options and robust support may find FlowBank to be a suitable choice. It is crucial for you to carefully assess their individual needs, trading goals, and risk tolerance before making a final decision.

FlowBank Review FAQs

Is FlowBank regulated and trustworthy?

Yes, FlowBank is regulated by the Swiss Financial Market Supervisory Authority (FINMA), one of the most reputable regulatory bodies in the financial industry. This regulation ensures that FlowBank operates in compliance with strict standards, providing traders with a secure and trustworthy trading environment.

What tradable instruments are available on FlowBank?

FlowBank offers a diverse range of tradable instruments, including Forex currency pairs, stocks, indices, commodities, and cryptocurrencies. Traders have access to a wide array of markets and can build diversified portfolios based on their trading preferences and strategies.

What are the available trading platforms on FlowBank?

FlowBank provides user-friendly web-based and mobile trading platforms. These platforms offer advanced charting tools, real-time market data, efficient order execution, and a seamless trading experience. Traders can access their accounts, monitor market movements, place trades, and manage their positions conveniently from their preferred devices.