Position in Rating | Overall Rating | Trading Terminals |

235th  | 2.0 Overall Rating |  PROPRIETARY |

Firstrade Review

Choosing the best Forex broker is crucial for trading success. Your decision may have an impact on fees,

platform usability, and the tools that are available to you during trading. Choosing a broker who aligns with your trading objectives and style is essential to optimizing financial market opportunities.

Firstrade, a well-known brokerage firm, founded in 1985, has its main office in New York. Firstrade is renowned for giving traders of all skill levels with an intuitive trading platform, a large selection of investment options, and reasonable prices. It offers a secure and user-friendly environment for both new and seasoned investors, with operations in 30 countries.

In this detailed study, I will look into Firstrade’s salient characteristics and possible areas for improvement. You will learn about its trading tools, options for accounts, charge schedules, and other features. This review will help you decide whether Firstrade aligns with your trading objectives by providing an unbiased assessment backed by professional judgments and real user experiences.

What is Firstrade?

Firstrade is an online brokerage company with headquarters in the United States that offers both individuals and companies a variety of investing services. Firstrade is renowned for its easy-to-use website, commission-free stock, ETF, and option trading, and dedication to providing reasonably priced investing alternatives.

Firstrade Regulation and Safety

Firstrade is a renowned online broker that places a high priority on investor protection and regulation. Reputable financial agencies, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), supervise its operations. These oversight organizations make sure Firstrade complies with regulations intended to safeguard traders by enforcing stringent compliance standards.

Firstrade has been in business for about 40 years and has one of the best regulatory records of any broker established in the United States. Traders can feel safe knowing their money is handled in an ethical and secure manner because of this history of compliance and openness.

In addition, Firstrade is a member of the Securities Investor Protection Corporation (SIPC), which offers up to $500,000 in insurance coverage for client accounts (including $250,000 for cash claims). This makes the platform even safer and more dependable.

Traders can benefit from a safe trading environment supported by robust regulatory oversight and tried-and-true safety protocols by using Firstrade. To make sure your investments are secure, always check the credentials of a broker.

Firstrade Pros and Cons

Pros

- Commission-free trading

- Wide range of account types

- Strong regulatory track record

- User-friendly trading platform

- Access to educational resources and research tools

- No account maintenance fees

Cons

- Limited research tools

- No forex trading

- No futures trading

- Limited customer support options

Benefits of Trading with Firstrade

Firstrade provides a number of benefits to traders seeking a dependable and affordable platform. One of the main advantages is that it allows traders to keep a larger portion of their profits through commission-free trading on stocks, ETFs, and options. This makes it the best option for novice and seasoned traders who want to cut expenses.

There are several investing opportunities available on the platform as well. With the ability to access equities, bonds, mutual funds, exchange-traded funds (ETFs), and more, traders can create a varied portfolio. A wide range of trading methods and financial objectives are served by Firstrade’s broad product offerings.

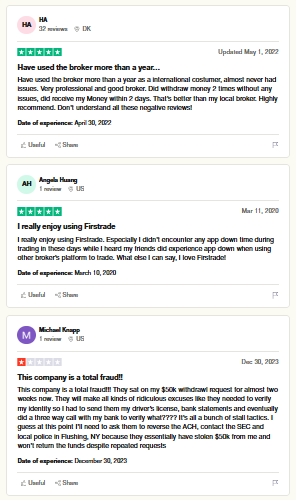

Firstrade Customer Reviews

Firstrade Spreads, Fees, and Commissions

Firstrade stands out as the most affordable US-based broker, fundamentally benefitting the investors for the same. It provides zero-commission trading on stocks, ETFs, and options—no contract fees for options trades—a rarity in the industry. Besides, mutual funds, load, no-load, or no-transaction-fee (NTF) based are all free to trade, so Firstrade is quite appreciated by mutual fund investors. The $19.95 and $0.50 per contract are charged on broker-assisted trades, CDs in the primary market are charged $30, and fixed-income securities are traded on a net-yield basis.

Non-trading bargain Firstrade prices at $75 for full ACAT, $55 for partial transfers. The disappointing part is that uninvested cash earns very little in interest on Firstrade, only 0.45% annually, a laggard compared to its competitors in this category. All in all, the straightforward and low-cost structure puts Firstrade among the choices of traders that wish to make the most profit while paying the least in fees.

Account Types

Brokerage Accounts

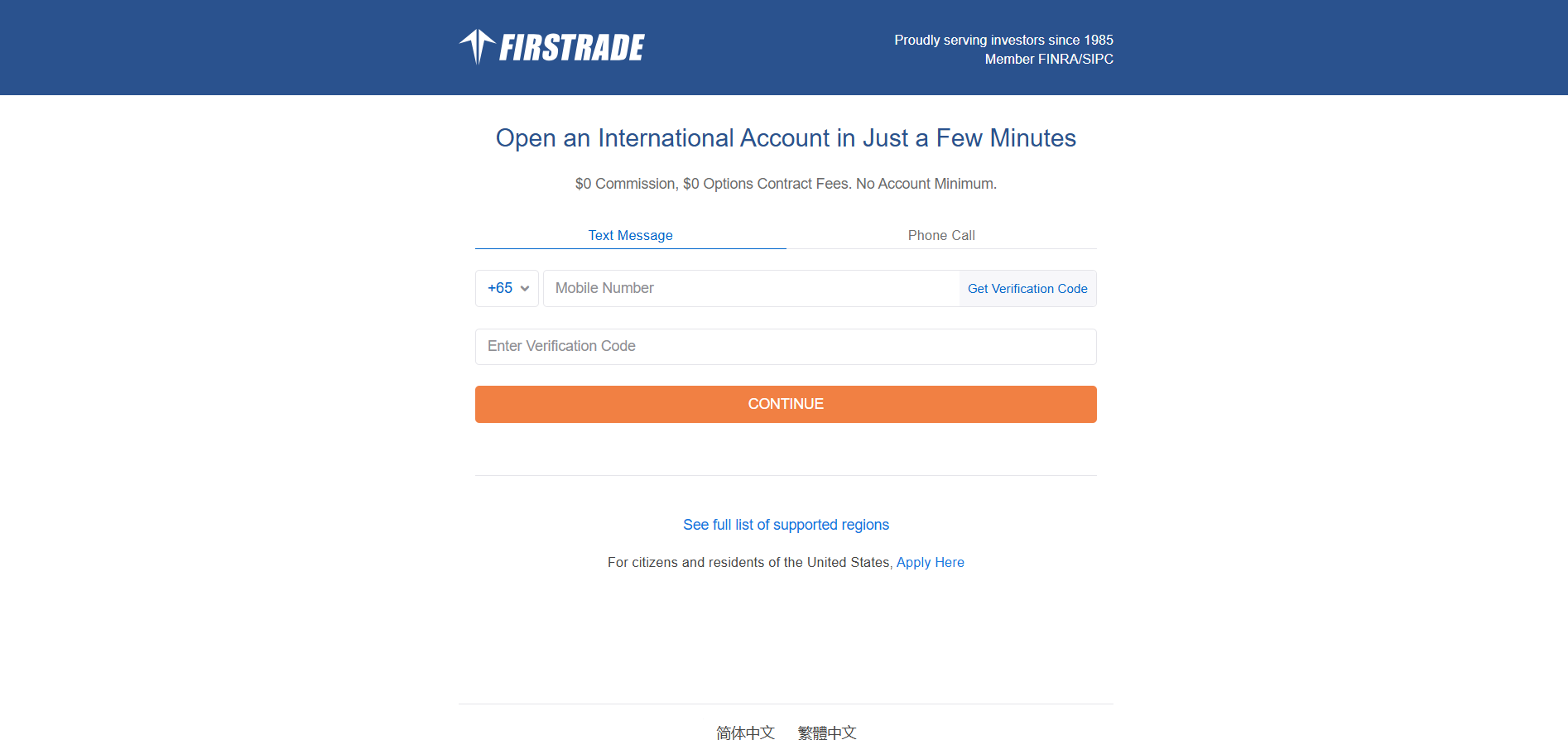

An account with Firstrade is simple and straightforward to get started. Just follow these steps:

1. Go to Firstrade’s website by using your web browser to type “Firstrade” in the address bar. Click on the “Open an Account” or “Sign Up” button on the homepage.

2. Select the correct application according to your residency. Firstrade has different procedures for U.S. residents and international clients.

3. Provide personal details such as your name, email address, date of birth, and contact number. Make sure the information is accurate to avoid delays in processing.

4. Fill out additional details about your employment and finances, which is standard for most brokerage accounts.

5. To comply with AML and KYC regulations, you need to upload one government-issued ID (driver’s license or passport). Most users pass the verification in a short time; otherwise, you may need further information.

6. Check your application and submit it. Then you will receive a notification from the system once your account is successfully opened.

Firstrade Trading Platforms

The Firstrade trading platform is easy to use and effective in catering to both beginner and experienced traders. The platform supports trading in various assets, including stocks, ETFs, options, and mutual funds. It is desktop-, iOS-, and Android-compliant, enabling traders to get access to their account and make trades whenever they want, wherever they are.

The Firstrade platform allows the most basic trading tools, including real-time quotes, charting, and news updates; these features assist traders in making informed decisions and keeping track of current market conditions. Users of Firstrade who request more advanced features have the chance to customize the visibility of their watchlists and select from order types in order to enhance the trading experience.

In addition, Firstrade provides a secure and cost-effective trading environment, with no commission fees for the trading of stocks, ETFs, and options. Customers are provided with a reliable trading platform underpinned by strong regulatory compliance designed to ensure that their investments are secured through every single trade.

What Can You Trade on Firstrade

Firstrade offers many different assets to trade, including stock, ETF, and options. Platform-wise, Firstrade is cost-effective, allowing for diversified investing or investment in one sole company, such as exchange-traded funds, with commission-free trading. It is a good option for independent traders who want straightforward simplicity and affordability in their investments.

Aside from stocks and ETFs, Firstrade has mutual funds and bonds in its repertoire. For instance, traders can invest in anything from no-load, no-commission mutual funds with no extra charge to a range of bonds that allow for building a well-diversified portfolio.

Forex and futures trading is not available at Firstrade, which goes into creating and delivering an entire trading experience for stocks and fixed-income investments. However, given the enhanced regulatory scrutiny that Firstrade has over it and the variety of products on offer, the platform is a good option for traders who prefer traditional assets in the stock and ETF category, as well as bill-based views.

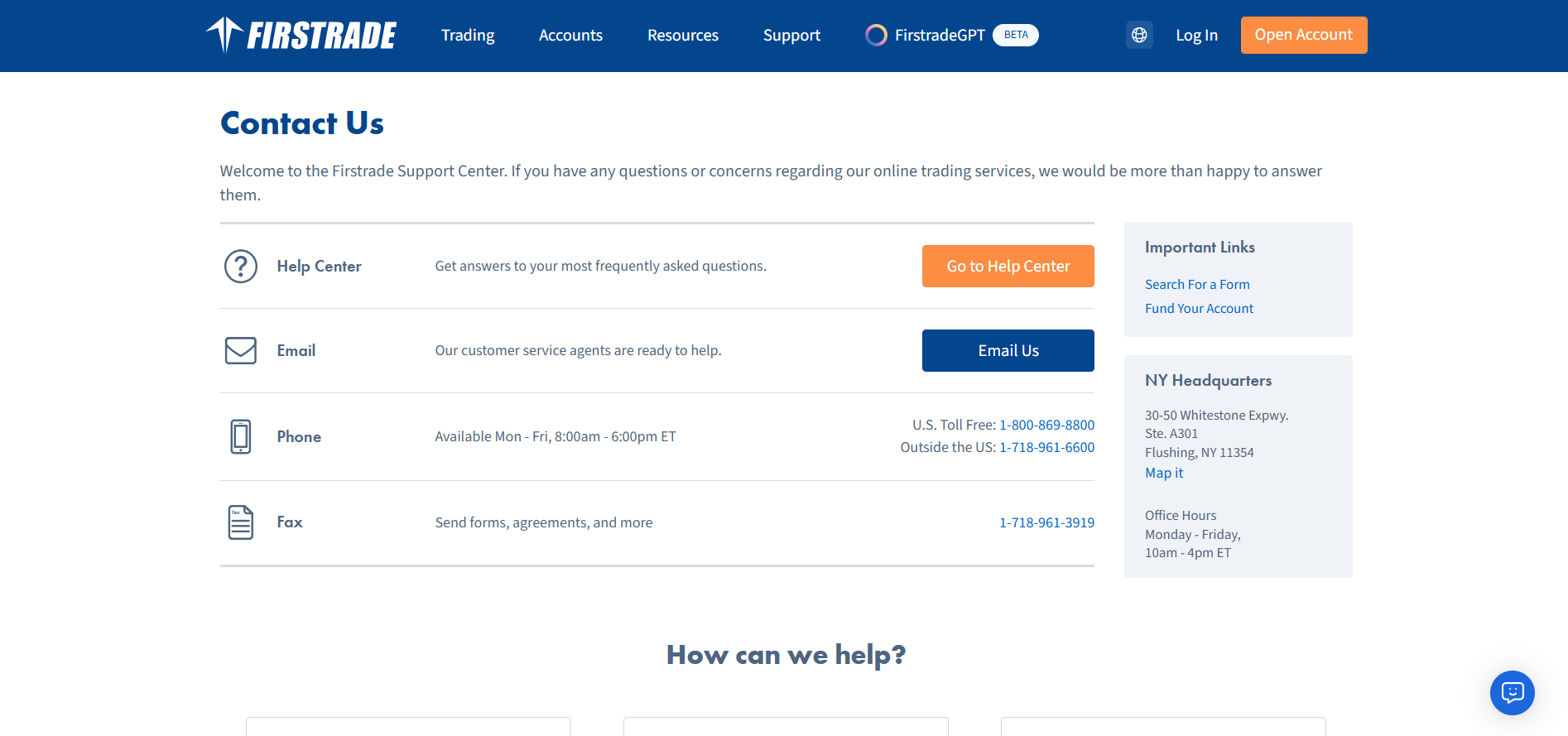

Firstrade Customer Support

Advantages and Disadvantages of Firstrade Customer Support

Withdrawal Options and Fees

Firstrade provides its clients with convenient and reliable withdrawal methods that frequently include transactions through banks. All deposits and withdrawals must be made via bank transfers, which guarantees that the procedure is safe and straightforward. There is no minimum amount required, making it a hassle-free start for any trader to trade and invest using Firstrade.

As far as banking costs are concerned, Firstrade takes $25 away for outgoing Bank wire transfers. However, there is no minimum amount requirement and thus allows traders to manage their funds flexibly. For electronic transfers that will be made before 13:00 ET, Firstrade deals with them within the same working day, thus, the customers get their money promptly.

Although it is normal that electronic transfers cause the money to arrive within two business days, only check withdrawals are enabled for domestic U.S. accounts. Among them are the traders who have got uninterrupted access to funds, but the availability of check withdrawals for international clients is something that international clients should not overlook.

Firstrade Vs Other Brokers

#1. Firstrade vs XM

Firstrade and XM are both brokers, but they offer different services for traders. Firstrade focuses on commission-free trading for U.S.-based stocks, ETFs, and options, while XM offers access to over 1,000 instruments, powerful platforms, and higher leverage. XM has a lower minimum deposit requirement of $5, offers leverage up to 1:1000 for non-EU countries, and provides more funding options like Apple Pay and Google Pay, making it more accessible for global traders.

Verdict: XM is the better choice for traders looking for higher leverage, more instruments, and flexible funding options. With a low minimum deposit and a wider global reach, XM offers a more versatile platform than Firstrade.

#2. Firstrade vs RoboForex

Firstrade and RoboForex are somewhat similar in that they both supply types of trading strategies, buy and sell stocks. Firstrade provides a way to trade U.S. stocks and ETFs without paying commissions which is beneficial to a customer who is more interested in long-term investments. Conversely, RoboForex offers over 12,000 tradable instruments of which Forex, stocks, and commodities are part, have MT4 and MT5 trading platforms, and support the copy-trading feature. In addition, Roboforex customers may utilize higher leverage, which gives more flexibility to active traders and those who need.

Verdict: RoboForex is the best option for the traders who are seeking a wide spectrum of financial instruments, higher leverage, and innovative features like copy trading. Firstrade is mostly useful for U.S. citizens who participate in low-cap stock and ETF trading.

#3. Firstrade vs Exness

Firstrade is a U.S.-focused broker that specializes in commission-free stock, ETF, and options trading. It’s ideal for investors who want a straightforward, low-cost platform. Exness offers a much wider range of financial instruments, including cryptocurrencies and CFDs, with leverage up to unlimited, which appeals to more experienced and global traders. Exness also provides 24/7 customer support and fast withdrawals, enhancing the overall trading experience.

Verdict: Exness is the better choice for traders seeking a broader range of assets, higher leverage, and round-the-clock support. Firstrade is a great option for U.S. investors looking for simple, low-cost trading in stocks and ETFs.

Also Read: XM Review 2024 – Expert Trader Insights

Conclusion: FXNovus Review

Firstrade would be a suitable choice for U.S. customers as it provides commission-free trading while focusing on investment products such as stocks, ETFs, and options. This provides an easier way to trade as there is no minimum deposit required, the trading platform is easy to use, and the broker is reliable when it comes to regulation.

For traders that engage in Forex and look to broad assets all around the world, Firstrade will not be the sensitivity target. Nevertheless, Firstrade’s focus on US stocks and ETFs combined with great customer service and great educational material will make it easy for both beginner and long-term traders.

Because of their focus on U.S. assets, Firstrade will be attractive to clients looking for a low-risk approach to investing. The broker’s effective KYC must also be highlighted as it makes it suitable for those who are looking for a broker who operates transparently and reliably.

Also Read: Exness Review 2024 – Expert Trader Insights

Firstrade Review: FAQs

Is Firstrade regulated?

Yes, Firstrade is a regulated broker. It is a member of FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation), ensuring that it operates under strict U.S. financial regulations to protect its clients’ investments.

What assets can I trade on Firstrade?

On Firstrade, traders can access a variety of assets, including U.S. stocks, ETFs, options, and mutual funds. While Firstrade does not offer Forex or cryptocurrency trading, it provides a solid selection of traditional investments, making it ideal for investors focused on U.S.-based markets.

Does Firstrade offer customer support?

Yes, Firstrade provides responsive customer support via phone and email. Although there is no live chat, the support team is dedicated to resolving issues efficiently, ensuring traders receive the help they need.

OPEN AN ACCOUNT NOW WITH FIRSTRADE AND GET YOUR BONUS