Finq Review

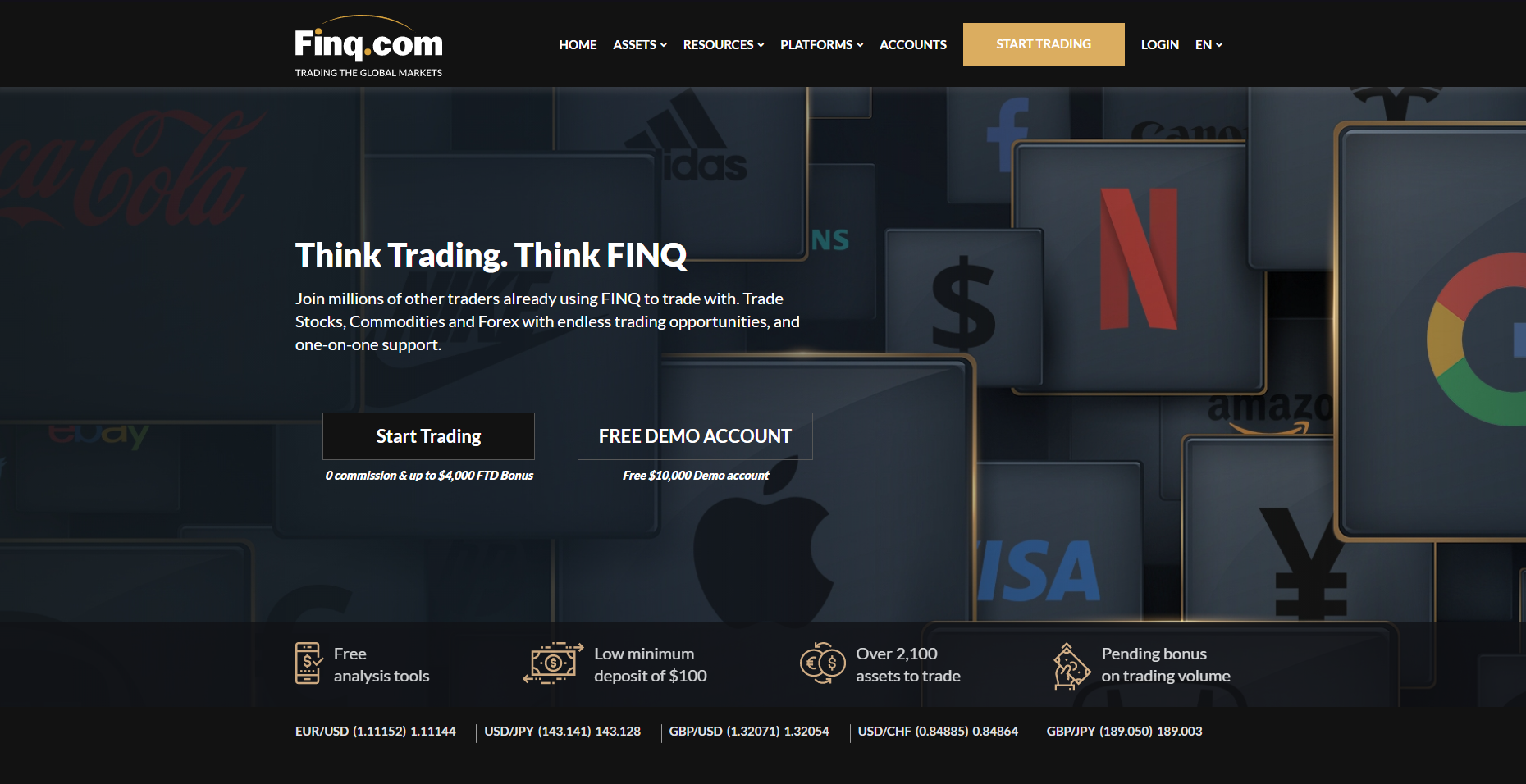

Finq is an all-in-one online trading tool that focuses on CFDs. It gives users access to over 2,100 assets, such as stocks, forex, commodities, ETFs, and more. It gives traders tools for both the web and mobile devices, so they can trade easily on any device. Because it is flexible, it's good for users who want things to be simple and easy to use.

Finq's multilingual customer service is one of its best features. It's open 24 hours a day, seven days a week, so traders can get help right away when they need it. Whether you're new to trading or have been doing it for a while, Finq wants to make it easy and safe for you to handle your trades.

To help readers decide if Finq is the right platform for their investing needs, this review will take an in-depth look at its features, platform functionality, and customer service. The review will cover the variety of assets available for trading, how user-friendly the web and mobile platforms are, and how Finq compares to other trading platforms in terms of convenience and reliability. Additionally, the quality of customer support will be assessed, including the availability of multilingual help and response times. By the end, readers will have a comprehensive understanding of what Finq offers and whether it suits their trading preferences.

What is Finq?

Finq is an online trading platform that allows users to trade Contracts for Difference (CFDs) across a wide range of markets. With more than 2,100 assets available, including stocks, commodities, forex, ETFs, indices, and bonds, it offers traders diverse investment options. Finq trading instruments are reliable just like the other Forex broker has. This is very good for a trading forex platform these days.

The platform is accessible on both web and mobile, providing flexibility for users to trade anytime, anywhere. It has good materials like trading instruments for faster transactions. Additionally, Finq offers multilingual customer support, available 24/5, ensuring that traders can get assistance whenever they need it.

Finq Regulation and Safety

Finq is overseen by the Seychelles Financial Services Authority (FSA), which makes sure that the company follows all international financial rules. This set of rules helps protect traders by making sure that the site is open and accountable in how it works. Using this security, all trading platform should be secured and safe.

When it comes to safety, Finq uses advanced security measures like encryption and safe transactions to keep user info and money safe while using the trading platform. Traders can use the site with confidence because they know their personal information and investments are safe because of the focus on safety and regulation.

Finq Pros and Cons

Pros

- 2,100+ assets

- Web & mobile platforms

- 24/5 support

- FSA regulation

Cons

- Limited regulation

- No 24/7 support

- Few resources

Benefits of Trading with Finq

Users can get a lot out of trading with Finq. Traders can spread their portfolios by using the platform's access to over 2,100 assets, such as stocks, forex, and commodities. Finq gives people freedom by letting them trade from anywhere with its web and mobile platforms.

One more benefit of Finq is that it has multilingual customer service 24 hours a day, seven days a week. This helps traders fix problems quickly. The Seychelles Financial Services Authority (FSA) also oversees the platform, making it a safe and open place to trade.

Finq Customer Reviews

Different sellers have had different things to say about Finq. A lot of people like the site because it has a lot of useful features and is easy to use on both computers and phones. The multilingual customer service that is available 24 hours a day, seven days a week is often praised as a plus that helps sellers when they have problems.

But some sellers have pointed out things that could be done better. Some reviews say that there aren't enough learning materials for newbies and that customer service isn't available 24/7. Overall, Finq's reviews show a mix of positive and negative comments.

Finq Spreads, Fees, and Commissions

Finq has spreads that are affordable on a lot of different assets, such as forex, stocks, and commodities. The spreads are different for each asset, with tighter spreads for big forex pairs. Traders can keep costs under control while dealing in different markets.

In terms of fees and expenses, Finq does not charge any for trades, which is a plus for many traders. But there may be extra fees, like overnight or inactivity fees, that users should be aware of before they make their deals.

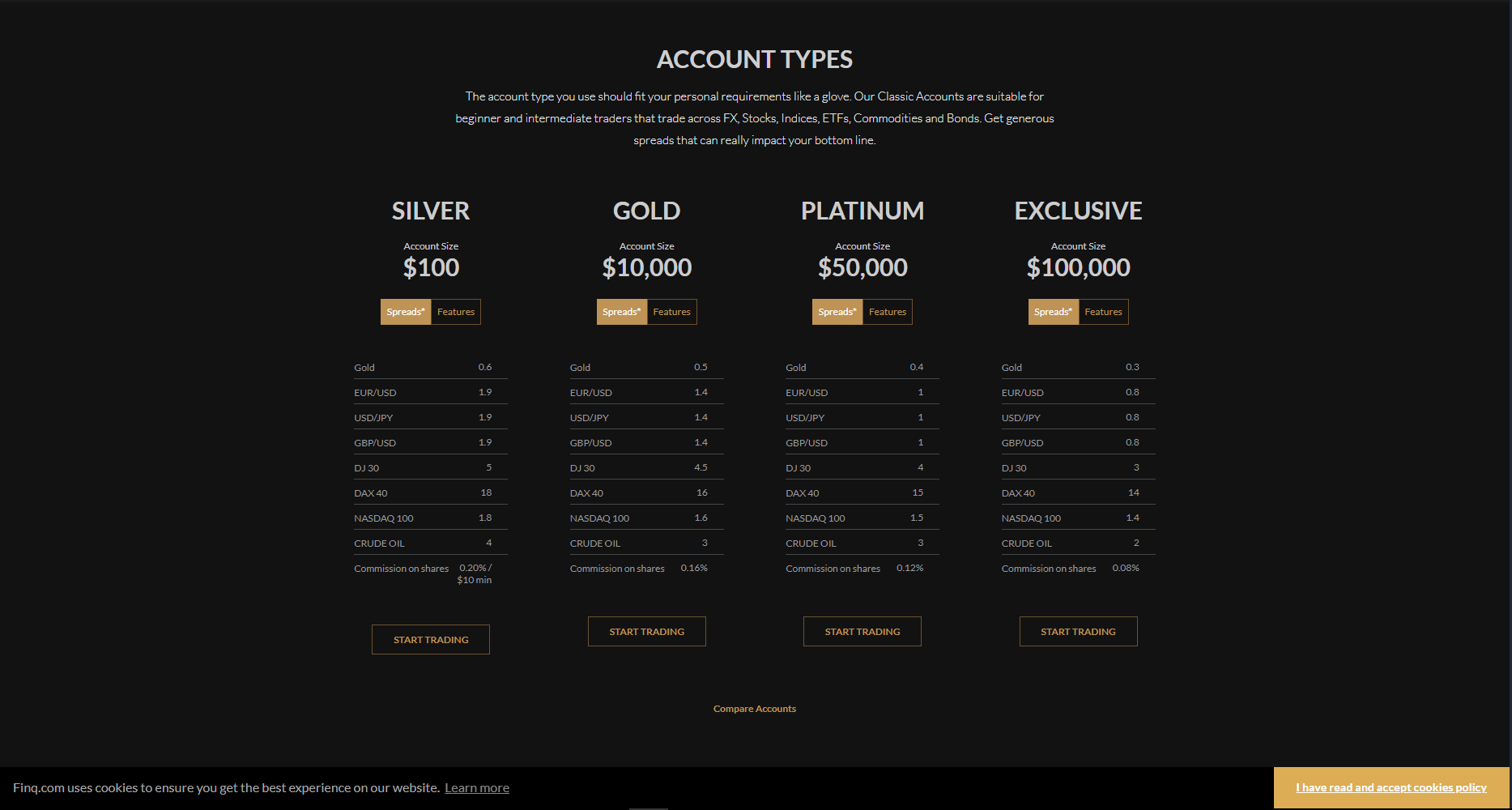

Account Types

Finq lets traders of every level, from newbies to experts, choose from different account types to meet their needs from basic to exclusive account. For new traders, basic accounts come with standard features. For knowledgeable traders, advanced accounts come with smaller spreads and more tools. These are what the broker offers so that the traders can pick the account that matches their trading style and goals the best.

Finq lets traders of every level, from newbies to experts, choose from different account types to meet their needs from basic to exclusive account. For new traders, basic accounts come with standard features. For knowledgeable traders, advanced accounts come with smaller spreads and more tools. These are what the broker offers so that the traders can pick the account that matches their trading style and goals the best.

Here’s a list of Finq account types:

1. Basic Accounts – Ideal for beginners with standard features.

2. Silver Accounts – Offers lower spreads and additional tools.

3. Gold Accounts – Provides tighter spreads and faster withdrawals.

4. Platinum Accounts – Includes personalized support and more advanced features.

5. Exclusive Account – Highest tier with premium benefits, tailored for professional traders. This is equivalent to the VIP premium accounts

6. Demo account – Good for new to trading industry.

These account types the broker offers determine what a trader should avail since this is the most important part of their starting point. Every trading accounts has its own advantages and disadavantages but demo account is the safest. Finq demo account is available if the customer is just a beginner and new to forex trading.

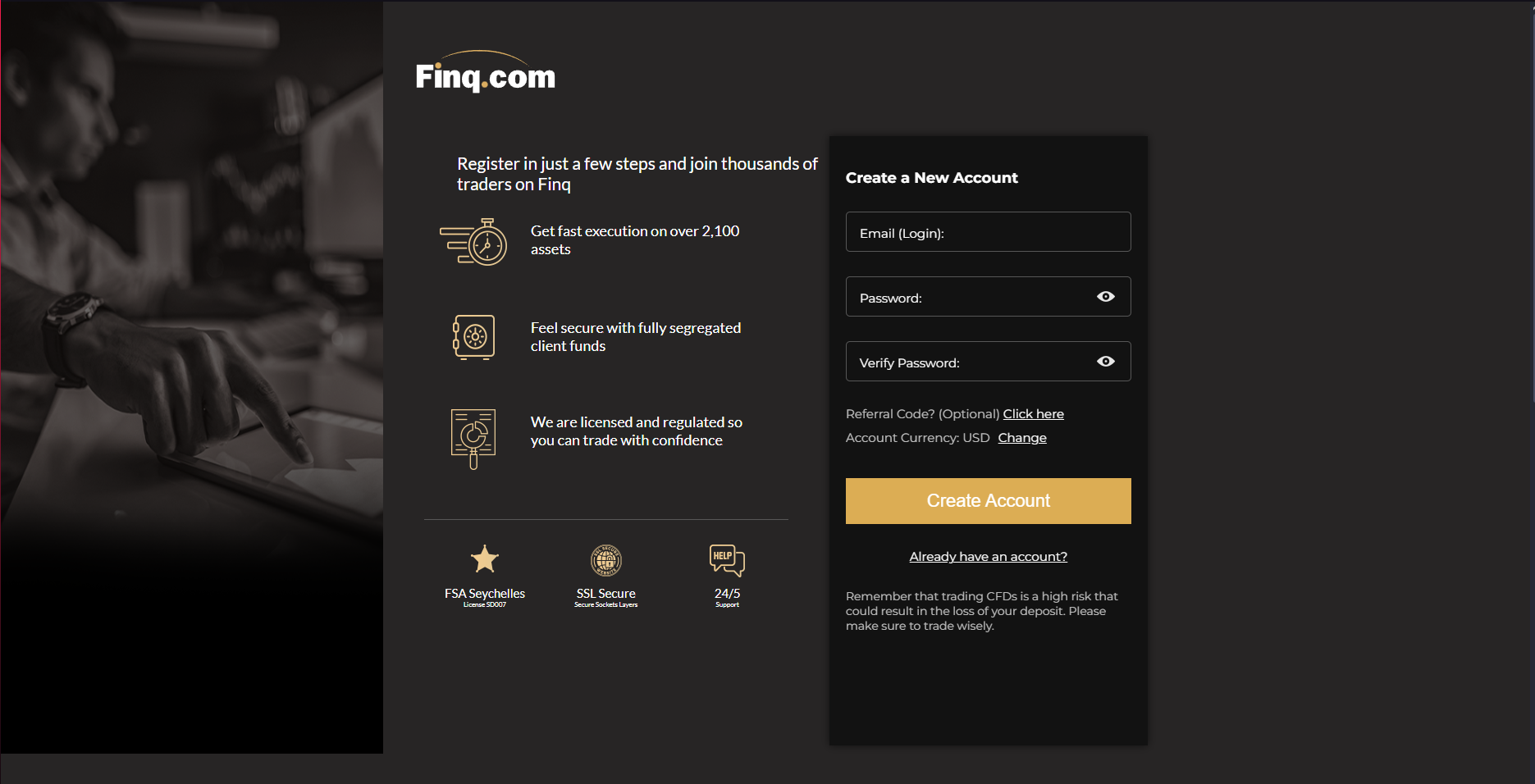

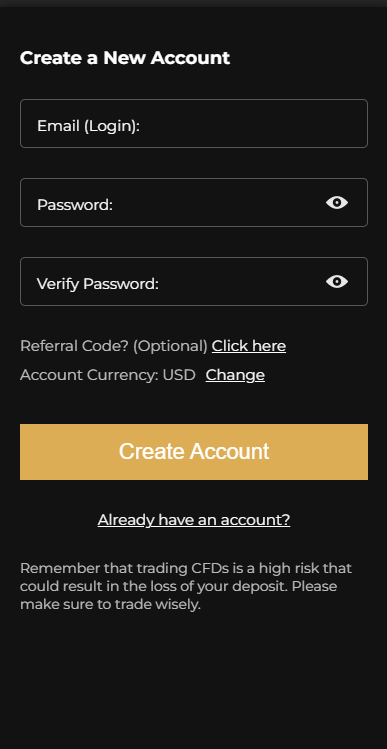

How to Open Your Account

Here are the steps to create account with Finq:

1. Visit the Finq website – Go to the official Finq website.

2. Click on “Open Account” – Locate and click the “Open Account” or “Sign Up” button. Choose from the account types available and the user should go to the next step.

3. Fill out the registration form – Enter your personal details, such as your name, email address, and phone number.

4. Submit verification documents – Provide a government-issued ID and proof of address for identity verification.

5. Wait for account approval – Finq will review your documents and verify your account.

6. Fund your account – Once approved, deposit funds into your account according to the customer's discerned minimum deposits.

7. Start trading – You can now begin trading with Finq.

Finq Trading Platforms

Finq has three trading platforms, which are MetaTrader 4 (MT4), WebTrader and App Trade. Many people know MetaTrader 4 as a trading platform that has powerful charting tools, technical evaluation features, and the ability to use Expert Advisors (EAs) for automatic trading. It works for traders of all levels who want to have more control over their plans using these trading platforms.

1. MetaTrader 4 (MT4): One of the most popular trading platforms globally, known for its user-friendly interface and advanced charting tools. It supports automated trading through Expert Advisors (EAs), and offers a wide range of indicators and analytical tools. MT4 is ideal for forex and CFD traders.

2. WebTrader: Finq's WebTrader platform is a web-based trading tool that allows users to trade directly from their browsers without needing to download any software. It provides a user-friendly interface, making it easy for both beginners and experienced traders to navigate and manage their trades efficiently.

3. App Trade: Finq's app trade platform allows users to trade directly from their smartphones or tablets, offering flexibility for traders on the go. The app is available for both Android and iOS devices, providing a seamless experience across mobile platforms. It features a simple, intuitive interface, making it easy for users to monitor the markets and execute trades quickly.

What Can You Trade on Finq

Traders on Finq can pick from a lot of different products all over the world. One of these is forex, where they can trade different types of currencies, such as major, minor, and exotic options. Finq also has world-class metals like gold, oil, and silver, as well as stocks from major stock markets around the world.

Traders can also put their money into ETFs (Exchange-Traded Funds) and bonds, which gives them more ways to spread out their interests. Finq has more than 2,100 assets, so traders with a range of trading goals and methods can find something they like.

One of the main things Finq does is offer forex trading. Advanced market research is used on the platform to make forex trading better. Finq wants to give customers a better place to trade by putting an emphasis on competitive forex products.

Finq Customer Support

Finq offers multilingual premium customer support to assist traders with any issues they may encounter. The support team is available 24/5, ensuring that users can get help during most of the trading week. This service is accessible through various channels, including live chat, email, and phone, making it easy for traders to reach out when they need assistance whether what account types the user has.

Finq's customer support is designed to help with everything from account issues to platform navigation. By offering support in multiple languages, Finq ensures that traders from different regions can communicate effectively and receive timely solutions to their concerns.

Advantages and Disadvantages of Finq Customer Support

Withdrawal Options and Fees

Finq gives its users a number of withdrawal methods, which makes it easy withdraw funds. Traders can get their money back through bank payments, credit/debit cards, and e-wallets such as Skrill and Neteller. Users in different parts of the world will have options because these withdrawal methods are available.

As for fees, Finq doesn't charge any for most withdrawal ways, but traders should check with their payment provider to see if they charge any third-party fees. Also, the time it takes to make a withdrawal depends on the method used. For example, bank transfers usually take longer than e-wallets.

Finq Vs Other Brokers

#1. Finq vs AvaTrade

When you compare Finq and AvaTrade, you can see that both give you access to a lot of different products, such as forex, stocks, and commodities. Finq lets you trade more than 2,100 assets, and AvaTrade does the same, but focuses on forex and bitcoin options. MetaTrader 4 is also supported by both systems. This gives users more advanced tools for analysis and trading strategies.

Finq has multilingual customer service 24 hours a day, five days a week, but AvaTrade has customer service 24 hours a day, seven days a week, which may be more handy for some traders. AvaTrade is also regulated in more places than Finq, which makes it a better choice for traders who want a lot of governmental oversight.

#2. Finq vs RoboForex

Finq and RoboForex are both trading systems that let you buy and sell a lot of different things, like forex, stocks, and commodities. Finq gives you access to more than 2,100 assets, and RoboForex does the same, but focuses on forex and cryptocurrencies. Both systems work with well-known tools like MetaTrader 4, which gives traders access to more advanced analysis tools.

Finq offers multilingual customer service 24 hours a day, five days a week, but RoboForex offers customer service 24 hours a day, seven days a week, which may be more suitable for some users. RoboForex also stands out because it has lower minimum deposit requirements than Finq. This makes it easier for new users to use.

#3. Finq vs Exness

Finq and Exness both let you trade a lot of different things, like forex, stocks, and commodities. With Finq, you can trade more than 2,100 assets, and with Exness, you can focus on forex dealing with low spreads. MetaTrader 4 is supported by both platforms and gives traders access to advanced research tools.

Finq offers multilingual customer service 24 hours a day, five days a week, but Exness offers help 24 hours a day, seven days a week, which may be more convenient for some users. Exness is also known for letting you withdraw money right away, but Finq has a lot of different ways to remove money, which can make the process take longer.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Finq Review

Overall, Finq stands out for its extensive asset selection and user-friendly platforms, making it appealing to both beginners and experienced traders. With the added benefit of tight spreads and multiple withdrawal options, it caters to traders who prioritize flexibility in their investments.

For those looking for a platform that combines convenience, security, and support, Finq offers a balanced solution just like the other forex brokers. While there are minor improvements that could be made, it remains a dependable choice for traders looking to grow and diversify their portfolios.

While there are areas for improvement, such as adding more educational resources and offering 24/7 support, Finq remains a strong choice for those looking for a secure and easy-to-use trading experience. Overall, it’s a platform worth considering for traders of all levels.

Finq Review: FAQs

Is Finq for beginner traders?

Finq is beginner-friendly and easy to use just like most traders said. However, its limited educational offerings may compel new traders to get outside learning materials.

Is Finq regulated?

Finq is regulated by the Seychelles Financial Services Authority (FSA), assuring safe and transparent trading.

Can I trade Finq on my phone?

Finq offers an Android and iOS mobile trading platform so traders may trade from anywhere.

OPEN AN ACCOUNT NOW WITH FINQ AND GET YOUR BONUS