Finotrader Review

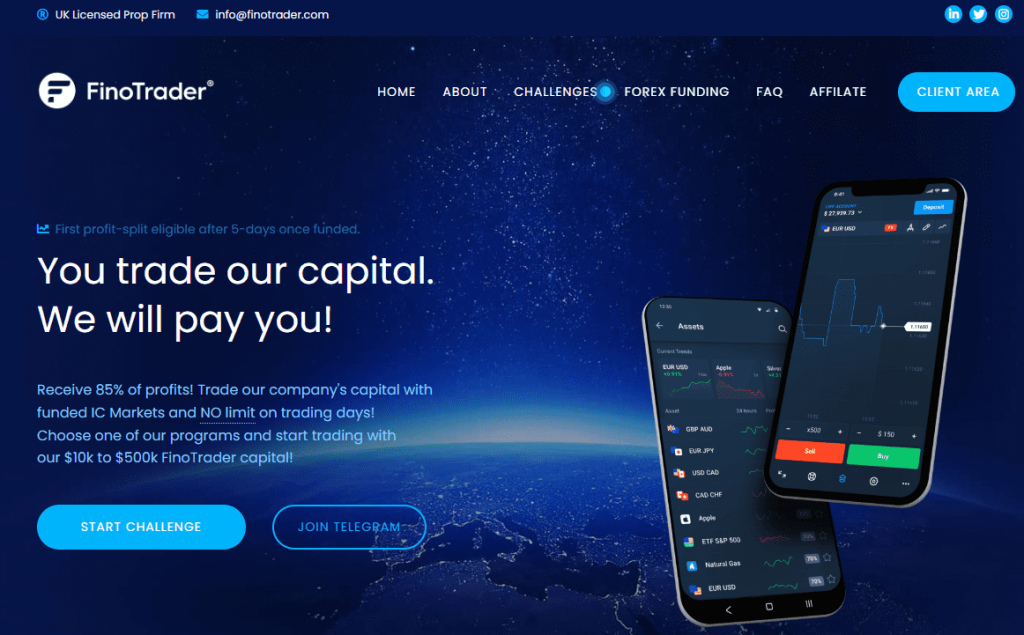

Capital and skills are the prerequisites to succeed in the investment world; it is impossible to generate significant and consistent returns without either of them. While skills can be polished through good training programs, Finotrade takes responsibility for your capital.

The broker promises to provide investment capital of up to $500,000 for eligible traders. Hundreds of traders regularly use Finotrade capital to make the most of their skills; FinoTrade lets its users keep up to 85% of their trading profits, allowing them to compute massive gains.

However, Finotrade isn’t flawless, and we have seen traders struggling with withdrawals, customer support, and trading platforms. If you’re looking to start trading with FinoTrade, you’re at the right spot.

In this blog post, we will discuss everything you need to know about FinoTrade, including its offerings, platforms, fees, and licenses. We’ll also include our experienced insights to assist you in making the right decision.

What is Finotrader?

Finotrade was founded in 2018 and is owned by Finotec trading UK limited; the company also owns YCM-Invest, which helps large capital traders with fund management and investments.

Finotrade has spread gradually in different regions over the last few years. They began in the UK, but their services are offered in most parts of the UK, Africa, and Europe.

Finotrade’s strongest selling point is its commendable licensing; The broker is licensed by the FCA UK; it complies with the financial services compensation scheme(FSCS), which makes it relatively safe for brokers.

A compensation scheme acts as a leeway for traders if the broker goes into insolvency. Finotrader is primarily a prop firm that caters to an audience of over 50000 traders.

The company offers an MT4 trading platform, its own trading academy, attractive spreads, and decent trading experience.

Finotrade has attained rapid popularity amongst traders due to its unique challenges; the reward schemes offer an incentive for traders to invest their funds in challenges and increase their profits. Usually, the broker has five challenge options for traders to choose from.

The rewards can be as high as a funded capital of over $500,000; traders can enter the challenge with a minimum trading fee and complete their trades to enjoy their commission. The challenges usually have a maximum daily loss determining traders’ procession in the following rounds.

Finotrade traders can also enter into trading agreements with the broker to get additional funds for their trading. The extra capital is a blessing for low-capital traders, who are well-versed in the trading world. However, the Finotrade capital scheme can be a double-edged sword- we will talk about it shortly.

Advantages and Disadvantages of Trading with Finotrader

Benefits of Trading with Finotrader

A broker determines the ultimate success of a trader; they must provide practical profit-making opportunities with minimal risks to enable traders towards a successful journey.

Finotrade has brought together traders from different regions; they have attracted traders with expertise in trading and motivation to put their skills to the test. The best benefit of Finotrade is its challenges.

Every trader enters the market hoping to make a profit; Finotrade has simplified the process by allowing traders to make great profits by partaking in easy challenges.

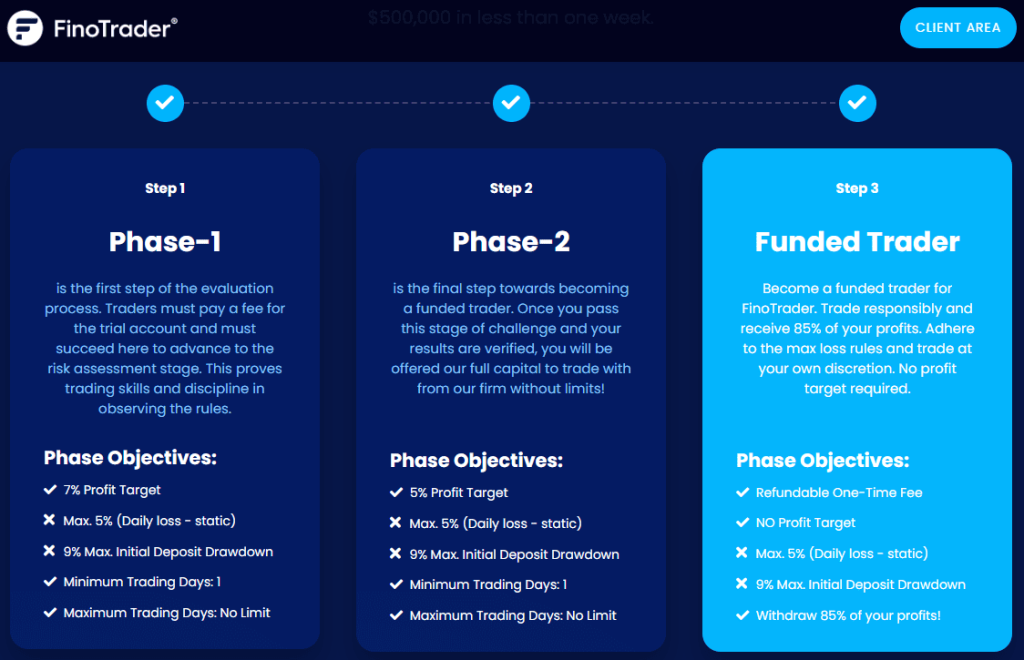

Traders have to pass through 2 phases to get access to Finotrade funds. These traders can act as fund managers and get up to 85% of profits without additional risks.

Although the phases have some tricky conditions, the challenges can bear fruitful results once completed. Traders also favor Finotrade due to its educational academy; the broker provides a great learning platform for traders before they make a real-time investment.

The academy has divided trading into multiple segments, and traders go through every step to polish their trading skills. However, the trading institute has a small upfront cost.

We were also impressed by Finotrade’s offerings range; they have over 100 different assets for traders to diversify their portfolios and minimize their risks.

Finotrade’s MT4 trading platform is designed to assist forex trading, but traders can also trade commodities, Indices, CFDs, and precious metals. We also expect them to add cryptocurrencies to their portfolio as well.

The trading platform also comes with VPS technology that maintains trading security and integrity, assisting retail traders with continuous trading operations.

Finotrade Pros and Cons

Pros

- Wide range of assets, including Forex and CFDs

- Access to over $500,000 in funds

- MT4 trading platform with VPS technology

- Affordable spreads and fee structure

Cons

- Challenges are difficult to win.

- A refundable surcharge may take months to return.

Difficulties Met By The Traders Who Participated in The Brokers Challenge

Finotrade’s challenges became popular amongst traders; they presented an opportunity for expert traders to make massive profits with little investment. However, the FinoTrade fund isn’t lying around for traders to use; instead, they must go through aggressive evaluation criteria to show their abilities.

#1. Daily Loss Limit

Usually, traders struggle with the minimum daily loss limit of 5%. If any trader exceeds the loss limit, they’d fail the evaluation criteria and return to phase 1. The 5% limit is difficult for traders to achieve in a volatile forex market.

Expert traders must stay on their toes to avoid loss if the market crashes. Phase 1 has a maximum 9% drawdown allowed; it is difficult to achieve for traders if the market stays low for several days.

However, traders can still avoid breaching the statistic using the stop-loss feature. They can set stop loss at 2-3% for volatile traders to ensure their portfolio doesn’t incur an excess loss. Nonetheless, stop-loss features can often backfire if used without market evaluation.

#2. Profit Target

Although FinoTrade has set low profit and drawdown targets, they can still be challenging due to volatile markets. The profit target for Phase 1 of the challenge is set at 7%- the industrial norm is 10%.

Traders must achieve the 7% profit target with closed trades to pass the evaluation criteria. Fortunately, FinoTrade only has 1 day of minimum trading requirement for each phase, making it relatively easier for traders to maximize trading potential.

We believe trading has no shortcuts, and if you’re to gamble your positions, there is a substantial chance of failure. The profit target can be achieved easily through smart trading; you should use the available resources and leverage to maximize your returns.

Similarly, we recommend dividing your profit target into smaller segments. It’ll assist in monitoring your short-term progress.

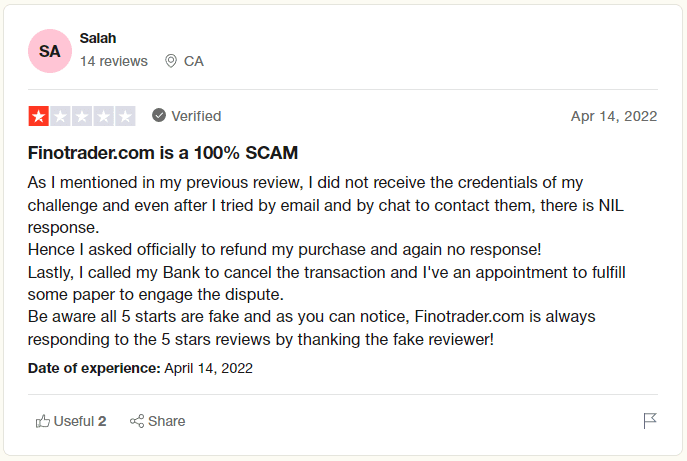

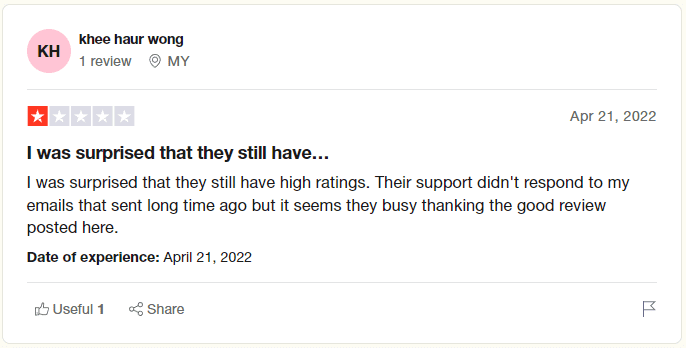

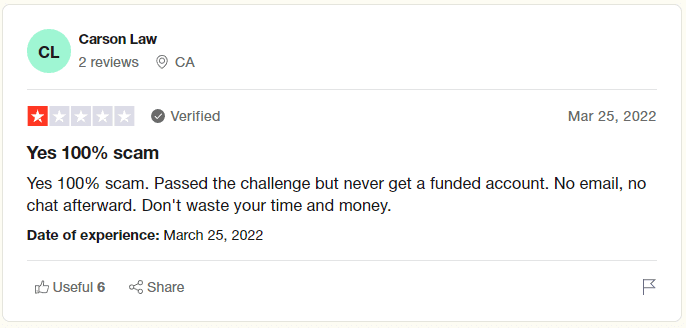

Finotrade Customer Reviews

A broker’s customer reviews are essential in determining its real-time efficiency. Existing customers are a good source of information about a broker’s practices and profitability.

We analyzed multiple review platforms to understand the general customer opinion about Finotrade. However, the analysis hasn’t brought admirable results about Finotrade, and the reviews suggest Finotrade’s involvement in illegal practices.

Finotrade has a 2.2-star rating on Trustpilot, where most customers have rated it 1 star. The common complaint amongst the reviewers was the funded account; they accused Finotrade of ghosting them and scamming their investment.

Many customers mention that they completed FinoTrade’s challenges quickly and expected to get credentials for the FinoTrade-funded account.

However, the clients never received access to the original account, and the broker stopped responding to their queries. They weren’t successful at retrieving their deposit fee even after several attempts.

Finotrade has responded to a few of the complaints on different channels, but the problem hasn’t been solved for any trader. The international brokerage firm is accused of holding client funds with lame excuses.

A reviewer mentions that the broker didn’t process their withdrawal, claiming the KYC documents weren’t complete.

However, the trader got a general reply that didn’t identify the missing document. Overall, we couldn’t trace many positive reviews about Finotrade, and the negative reviews are a major dent in their publicity. Finotrade must ensure that traders’ demands are met asap to protect its vulnerable image in the community.

Finotrade Fees and Commissions

Unlike other brokers, Finotrade’s primary focus is its challenge plans. Although they offer separate trading plans through their platform, the official website has dedicated most content to signing up for the challenge.

The broker offers five trading plans with different one-time fees to enter the evaluation criteria. The fee range starts from $255 for a $10,000 funded account, while the $250,000 funded account can be availed with a one-time fee of $1550. Once a trader has entered the challenge, they can trade through the MT4 platform and earn their profits.

The company has signed up with IC markets that allow its traders to access global asset markets. Traders are offered an STP/ECN account, enabling them to maximize their profits.

However, the ECN account has a $10,000 minimum deposit and is usually suitable for high-volume traders only. The brokers are offered competitive trading conditions and spreads.

The spreads on Forex start from 0 pips and will change depending on different currencies. The average spread for GBPUSD is 0.4 pips, while it’s slightly higher for EUR-USD pairs.

The website hasn’t mentioned elaborate details about the spreads, which can be risky for traders. Surprisingly, Finotrade- an FCA-regulated broker- hasn’t mentioned its trading fees clearly; the lack of details also supports the negative reviews it has gotten on different platforms.

The company isn’t any more detailed on its commissions; however, the commissions start from 0.0035% per lot and may change depending on your trading frequency. Our sources also suggest that Finotrade charges a swap fee on their trades that are open overnight.

Account Types

Overall, in our review, you may realize that Finotrade’s services are oriented towards high-volume traders, and the notion can also be supported by its account types. The company has four trading account types to trade major currency pairs.

The currency offerings differ based on your account type, but most start with 34 currency pairs and 11 CFDs.

- The classic account requires a minimum deposit of $1000; it is pretty high compared to other brokers. The account offers basic trading features and conditions; traders may require additional resource tools for a better trading experience. Finotrade provides daily reports about the markets drafted by professional traders. The classic account gives access to video tutorials that may come in handy for new traders.

- Gold Account comes with a minimum deposit of $10000; the features are still insufficient considering the high deposit requirement. However, gold account holders get additional invitations to webinars and seminars about financial markets. The spreads for gold accounts are comparatively better than classic accounts, but they are still higher than other industry leaders.

- A platinum account is for traders with a trading capital of over $25000. The platinum account allows traders to trade in their comfort zone, providing continuous trading operation throughout the week. A platinum account allows traders to access automated robot strategies and general accounts managers.

- The VIP account is exclusively for investors with over $100,000 in trading capital; it is the most prestigious account at Finotrade and comes with a complete delegation of trading responsibilities. The account holder not only gets all features offered by prior accounts but also dedicated fund managers and exceptional customer care.

If we objectively look at the account types, most aren’t suitable or applicable for everyday traders. Regardless of the requirements, traders have better options to invest their funds and get better services.

However, we would advise traders to experience the service with a demo account before signing up. It’ll give you a good perception of the trading interface and the value it provides.

How to Open Your Account?

Finotrade has multiple account types, and if you’ve decided to sign up with them, the sign-up procedure is similar to most other brokers. However, unlike other prom firms, it doesn’t offer a sign-up bonus due to its compliance with the FCA laws.

- Head to the Finotrade official website, and on the top bar, click on ‘client area.’ It’ll direct you to a login page.

- You should now click on the ‘Sign up’ button at the bottom; the next form will require your usual id creation details.

- Once you proceed, the email verification will be sent to your account; you can click on the link to verify your account.

- Now, you can simply sign in to the trading room. You’ll be asked to select an account type and deposit method.

Usually, Finotrade takes up to 3-4 days to approve your account. Once you’ve created an account, you can select the challenge program. It’ll require a one-time fee to start the evaluation process.

However, if you aren’t sure about signing up for a challenge, you can learn more about FinoTrade’s resources in its information panel.

Finotrader Customer Support

The next significant factor for any broker is their customer support. We tried contacting Finotrade’s customer support on multiple occasions, but the responses weren’t impressive.

The broker doesn’t have dedicated agents for live chat support; the chatbot is controlled by Artificial Intelligence and cannot comprehend trading questions.

The live chat process was pretty slow, and the responses weren’t cohesive with the query. Nonetheless, you can still contact Finotrade through phone, email, and fax.

We advise you to call the broker if you want any information. The broker offers multi-lingual support and can cater to questions about trading platforms and services.

An email is more suitable for registering your complaints with the broker and receiving responses from higher management. However, many customers have accused Finotrade of ghosting customer emails; therefore, we can’t be sure about its efficiency.

Advantages and Disadvantages of Finotrader Customer Support

Security for Investors

Withdrawal Spreads, Options, and Fees

The ease of withdrawal determines a broker’s legitimacy; over the last 2-3 years, we have seen various brokers, who promise attractive rates and convince traders to deposit their life savings, but when it comes to withdrawals, they are unreachable.

Finotrade has been relatively straightforward in its withdrawal process and options. The broker claims that it charges no fee on any deposits and withdrawals. However, some intermediaries may charge around 2.5-3% commission.

Traders can file for a withdrawal from their trading application. However, the transfers can’t be made to separate bank accounts; your deposit and withdrawal account should be the same to comply with the AML laws in the UK.

FinoTrade supports over 10 different transfer methods, and some new entrants are on the list. Traders can withdraw their funds into union pay, MasterCard, Visa, and other banking channels. The VIP account has some concessions on payment provider fees and fund management.

Overall, we have some doubts about Finotrade’s withdrawal policy. Although the system and policies follow industrial standards, a significant proportion of customers have reported problems with the withdrawal process.

Some traders acclaim that Finotrade used lame excuses and requirements to delay and withhold their funds. Nonetheless, the problem may be regional due to security laws presiding in some jurisdictions.

What makes Finotrader different from other Prop Firms

Prop firms have become popular in the trading community over the last few years. Funding Talent was one of the first firms to venture into the prop firm industry, and their lucrative offerings attracted a large audience to the industry.

A prop firm lets its clients use the broker’s capital to make trades, just like Finotrade provides its funded accounts. A fixed share of profits is given to the trader for their performance.

We aren’t usually supportive of prop firms due to their harsh regulations that make it difficult for traders to get a funded account; however, the policies introduced by Finotrade are relatively flexible, and it gives a real chance for traders to get a fully-funded account.

Finotrade has simplified the evaluation process for traders, which allows a better chance for professional traders to reach their goals. The broker has reduced the minimum profit rate to 5% for phase 2 and 7% for phase 1, below the industry average of 10%.

Similarly, they also offer better maximum drawdown rates compared to the industry. Traders get a flexibility of up to 5% daily losses and 9% cumulative losses on their trades. Many leading prop firms won’t allow a loss of over 3% per day or 5% in total.

However, before we summarize the topic, it is essential to note that prop firms haven’t been as profitable as traders expect them to be. We have seen professional investors suffer losses due to hidden trading fees and brokers’ inconsiderate attitudes.

Conclusion: Finotrader Review

Finotec Trading UK is the founding company behind Finotrade- the parent company has had many successful ventures in the capital investments industry. Finotrade’s growth has been impressive; since its foundation in 2018, the company has catered to a larger audience through its attractive services.

Summarily, the high commission payouts offered by Finotrade are lucrative for most traders. It presents an opportunity for them to make 85% returns on their trade without investing any amount.

The FCA regulation also speaks for the broker’s legitimacy; the FCA license is difficult to attain for most brokers due to complex policies. However, with Finotrade’s license, we can be comfortable with investing our funds with them.

Nonetheless, we can’t ignore their customer reviews; most users have had trouble receiving their funds from Finotrade, and the broker hasn’t provided any convincing reply to the investors’ problem. If the problems are genuine, traders should avoid the broker. Nonetheless, Finotrade should also focus on reviving its image on social platforms to avoid negative publicity.

Finotrader Review FAQs

Is Finotrade regulated?

Finotrade was founded in 2018; it is owned by Finotec Trading UK. The company operates under an FCA license, which makes it credible for investors. However, an FCA license also has some cons, including the restriction on bonuses and high leverage.

What are accounts available at Finotrade?

Finotrade’s services are primarily catered towards high trading volume traders and investors. The primary accounts start from $10,000, and the VIP account has a minimum deposit of $100,000. The company offers four accounts: classic, gold, platinum, and VIP.

Does Finotrade offer a demo account?

Yes, Finotrade allows its traders to experience the platform before investing. Traders can quickly sign up for a demo account and trade forex, CFDs, commodities, and precious metals. The broker also offers several challenges, but they are for traders with a strong investment background.