Position in Rating | Overall Rating | Trading Terminals |

173rd  | 2.9 Overall Rating |  |

FinFx Review

This review will talk about FinFx’s most important features, such as its account types, trade platforms, and customer service. People who read this will also learn about the broker’s rules and safety steps.

In order to give traders a good idea of what to expect, the review will go into detail about FinFx’s pricing system, spreads, and leverage options. No matter how much experience a trader has, this review is meant to help them decide if FinFx is a good choice.

Lastly, the study will talk about possible cons, such as the fact that there aren’t any advanced trading tools. By the end, readers will know everything they need to know about FinFx to decide if it meets their trade needs.

What is FinFx?

With its headquarters in Finland, FinFx is a forex broker that works with users of all levels. It lets people use well-known tools like MetaTrader 4 to trade forex, commodities, and indices. It is a safe place to trade because it is regulated by Finland’s financial officials.

The broker has a number of different account types with spreads and leverage that are affordable. FinFx also accepts a number of different payment ways, which makes it easier for traders to add and remove funds. It has a customer service team that can help with any problems.

FinFx has good trading tools, but it doesn’t have some of the more complicated tools that other brokers do. Traders who want the newest technology might be able to find better options somewhere else.

FinFx Regulation and Safety

The Finnish Financial Supervisory Authority keeps an eye on FinFx and makes sure the broker follows strict rules and guidelines when it comes to mutual funds. Traders who use the site can feel safe and trusting because of this rule. The funds of clients is also kept in separate accounts, which is another safety measure.

FinFx protects user data and transactions with SSL encryption and other security measures that are standard in the business. This keeps personal and financial information safe by preventing entry by people who aren’t supposed to have it. People who trade can be sure that their information is safe.

But it’s important to keep in mind that FinFx only regulates in Finland. This could be a problem for sellers in other places. Local users are well protected, but people from other countries should think about this when picking a broker.

FinFx Pros and Cons

Pros:

- Competitive spreads

- Regulated by Finland

- Multiple account types

- SSL encryption for security

Cons:

- Limited trading tools

- Only regulated in Finland

- Basic platform options

- No 24/7 support

Benefits of Trading with FinFx

FinFx trading has a lot of perks for both new and experienced traders. The broker offers spreads and leverage that are competitive, which can help buyers make the most money possible. FinFx also has different types of trading accounts for traders with different needs.

FinFx makes sure that trading is safe because it is controlled by Finland’s financial authority. Traders can be sure that their money is safe because it is kept in separate accounts and the site uses SSL encryption to keep data safe. These steps make things safer for users.

One more benefit is the range of trading systems, such as the well-known and popular MetaTrader 4. So, traders can use a tool they are already familiar with and find easy to use.

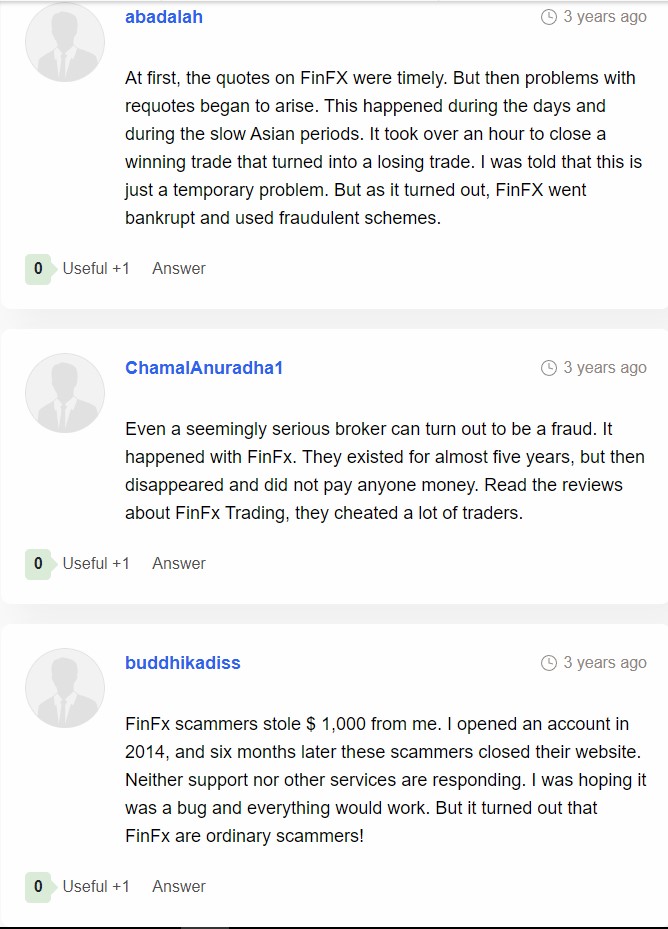

FinFx Customer Reviews

Customers who have used FinFx have given it mixed reviews. A lot of people like the exchange because it has competitive spreads and a safe place to trade. They like that the platform is simple to use and gives them the choice of MetaTrader 4.

However, some traders are worried about the lack of advanced trading tools and features. Some of them think that FinFx doesn’t have as many modern choices as other brokers. Traders who want the newest technology in their trading systems might not like this.

FinFx is generally thought to be a trustworthy broker for basic dealing. However, some clients think it could be better by providing more advanced tools and a wider range of services.

FinFx Spreads, Fees, and Commissions

FinFx has competitive spreads that change based on the type of account and the state of the market. Spreads are pretty low for most major currency pairs, which makes it appealing to buyers who want their fund invests primarily. Spreads may get wider, though, during times of high fluctuation.

There aren’t any hidden fees with FinFx, but buyers should be aware that overnight swap fees may become due. These fees can add up if you hold on to trades for a long time, especially if you are using leverage.

In terms of fees, FinFx’s basic accounts mostly let you trade without paying any fees. There may be a small fee, though, for more specialized accounts with smaller spreads. This setup is flexible enough to work with a range of trade styles.

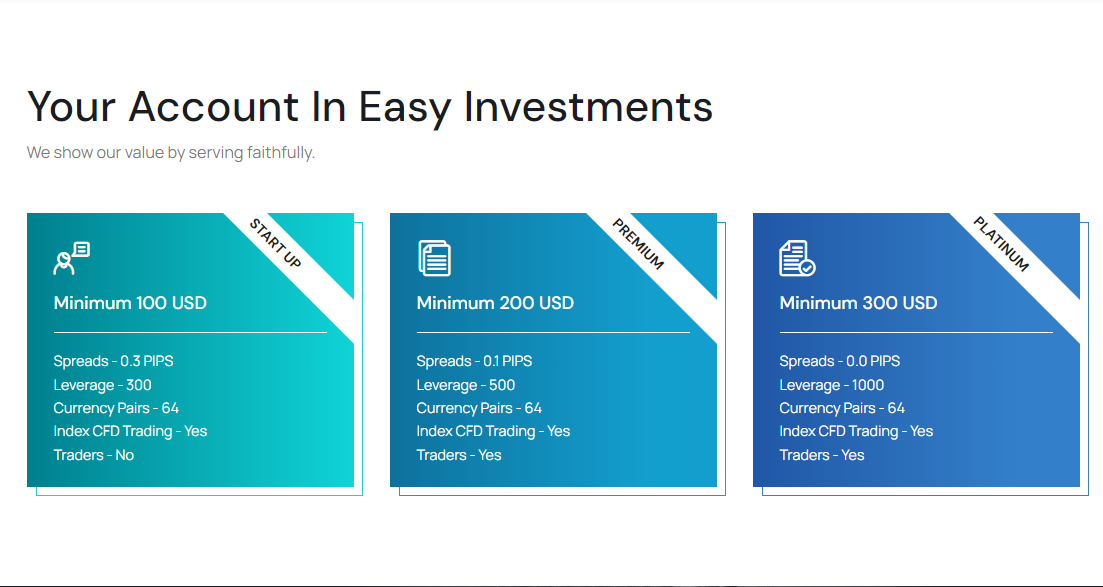

Account Types

FinFx has account kinds for all traders. FinFx gives choices for beginners seeking commission-free trading, professionals seeking advanced functionality,reduced spreads and minimum deposit requirements. A quick overview of account kinds is below.

1. Start Up: The Start Up lets you trade without paying any fees, but the gaps are a little wider. It’s great for people who are just starting out or who trade in small amounts and want a simple, low-cost, and minimum deposit choice.

2. Premium Account: Spreads are smaller on the Premium Account, and there is a small fee for each trade. It’s perfect for traders with a lot of knowledge who want lower spreads and fair prices.

3. Platinum Account: The Platinum Account has the lowest spreads, but there is a fee for each deal. This account is made for skilled traders who want to trade quickly and have more money in the market.

FinFx also offers demo account and micro account that can be access by going into their website page. The users can also view their account currencies inside their accounts and trading platforms.

How to Open Your Account

1. Start by going to the FinFx website. If you want to open an account, visit the FinFx page. To start the process, find the “Open Account” button and click it. It’s usually at the top of the home page.

Fill out the form to sign up – Fill out the signup form with your name, email address, and other contact information. Figure out what kind of account will work best for you before you open one.

Show proof of who you are – After you send in your information, you’ll need to share a government-issued ID and proof of address to prove who you are. After being checked out, you can add money to your account and begin selling.

Put a minimum initial deposit – After creating the account, make a deposit according to the user’s preferences on how will they start.

It’s easy to make a start in FinFx because of the user-friendly instructions and platforms.

FinFx Trading Platforms

FinFx has many automated trading tools so that all traders can find one that works for them. MetaTrader 4 (MT4) is the main program that can be used in CFD trading. It is known for having an easy-to-use interface and powerful trading tools. An enormous number of traders, both new and experienced, believe MT4.

FinFx offers Mobile Trading in addition to MT4, so users can trade while they’re out and about with their phones or computers. Traders can keep an eye on their positions from anywhere at any time with this tool and their multiple portfolio managers.

FinFx does not, however, provide some of the more advanced trading tools that its rivals do. Most traders don’t need MT4, but those who want the newest tools might want to look at other choices.

What Can You Trade on FinFx

FinFx gives buyers access to many markets, such as forex, where they can trade major, minor, and exotic currency pairs. This makes it good for buyers who want to profit from changes in the value of currencies around the world.

FinFx lets you trade in metals like gold, silver, and oil, as well as forex. People who want to diversify their portfolios beyond currency dealing can use these assets.

Traders can bet on how the global stock markets will do by using indices trading, which is part of FinFx. This variety lets traders try out different markets and tactics based on what they like.

FinFx Customer Support

FinFx gives a range of ways for customers to get help, such as live chat and email. Traders can get help with account issues, technology issues, or just general questions. The help team is quick to respond and try to answer questions right away.

The broker’s website also has a part called “Frequently Asked Questions” (FAQs) that answers common questions. This lets users quickly find answers without needing direct help. This is very helpful for traders who are just starting out on the site.

FinFx does not, however, offer support 24 hours a day, seven days a week. This could be a problem for buyers in different time zones or who need help when the company is not open for business. They don’t also have an investment adviser who can help the users on how to properly invest significantly depending on the customer preferences.

Advantages and Disadvantages of FinFx Customer Support

Withdrawal Options and Fees

FinFx gives traders a number of ways to receive their money, such as bank transfers, credit cards, and e-wallets. This gives them a choice in how they want to get to their money. This is a simple process, and users can pick the way that works best for them.

There may be fees for some transfer methods, even though most of them are easy to use. The fees for bank payments are usually higher than the fees for e-wallets or card withdrawals, which are usually cheaper.

FinFx tries to handle withdrawals fast, but the exact time needed depends on the method used. It could take a few days for bank transfers to go through, but e-wallets generally send money faster.

FinFx Vs Other Brokers

#1. FinFx vs AvaTrade

When looking at FinFx vs. AvaTrade, both brokers offer good trading choices, but they are geared toward different types of traders. FinFx tries to keep things simple by only giving MetaTrader 4 and basic tools. AvaTrade, on the other hand, has more platforms, such as MetaTrader 5, AvaOptions, and WebTrader, which traders seeking more advanced features may find appealing.

FinFx is controlled by the Finnish Financial Supervisory Authority. AvaTrade, on the other hand, has licenses in many places around the world, such as Europe, Australia, and South Africa, which makes it more accessible to traders from those countries.

Both brokers offer competitive spreads when it comes to fees, but AvaTrade has more choices for commission-free accounts and a wider range of assets, such as stocks and cryptocurrencies, which could make it better for traders who want to trade in more markets.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. FinFx vs RoboForex

FinFx and RoboForex are both good brokers for dealing, but they are different in some important ways. FinFx is a simpler and clearer broker that lets you trade forex, commodities, and stocks mostly through MetaTrader 4. RoboForex, on the other hand, has more platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and its own R StocksTrader, which is designed for more experienced traders who want more choices.

FxFin is regulated by the Finnish Financial Supervisory Authority, while RoboForex is controlled by Belize’s International Financial Services Commission (IFSC). Both brokers offer safety measures, but RoboForex is available all over the world and traders from more places are drawn to it because it has more rules.

RoboForex has spreads that are usually lower than those of other brokers, and some trade conditions can lead to commission-free accounts. It also gives you access to more assets, like stocks, cryptocurrencies, and CFDs, which makes it more appealing to traders who want a bigger range of trading instruments. Many people trust FinFx, but it might not have as many assets or platforms as other brokers.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. FinFx vs Exness

Although both brokers provide forex trading when comparing FinFx to Exness, their platforms and tools vary. Exness offers both MetaTrader 4 and MetaTrader 5, allowing traders access to more sophisticated tools and capabilities; FinFx mostly provides access to MetaTrader 4, which is appropriate for basic trading needs.

FinFx is controlled in terms of regulation by the Finnish Financial Supervisory Authority, so giving traders a safe space. Exness, however, is more globally controlled and more appealing to foreign traders seeking more general regulatory coverage as licenses from authorities in the UK, Cyprus, and South Africa control it.

Regarding costs and spreads, both brokers are competitive; on some accounts, Exness provides commission-free trading and smaller spreads. For individuals seeking a larger spectrum of markets, Exness also offers extra trading tools including equities and cryptocurrency.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: FinFx Review

Ultimately, especially for those utilizing MetaTrader 4, FinFx is a trustworthy forex broker offering a simple trading experience. For both novice and expert traders, Finland’s financial authorities’ safe control and competitive spreads make for a wise decision.

FinFx does not, however, have some of the more sophisticated tools and services available from other brokers. Traders seeking modern platforms or a larger asset selection could find better suited choices elsewhere.

FinFx generally fits traders who value simplicity, security, and fundamental investors and trading tools but might not satisfy those looking for more sophisticated trading solutions.

FinFx Review: FAQs

Is FinFx regulated?

Yes, FinFx is regulated by the Finnish Financial Supervisory Authority, ensuring a secure trading environment.

What trading platforms does FinFx offer?

FinFx primarily offers the popular MetaTrader 4 (MT4) platform, known for its ease of use and powerful trading tools.

What can I trade on FinFx?

You can trade forex, commodities, and indices on FinFx, giving you access to multiple markets.

OPEN AN ACCOUNT NOW WITH FINFX AND GET YOUR BONUS