Finansero Review

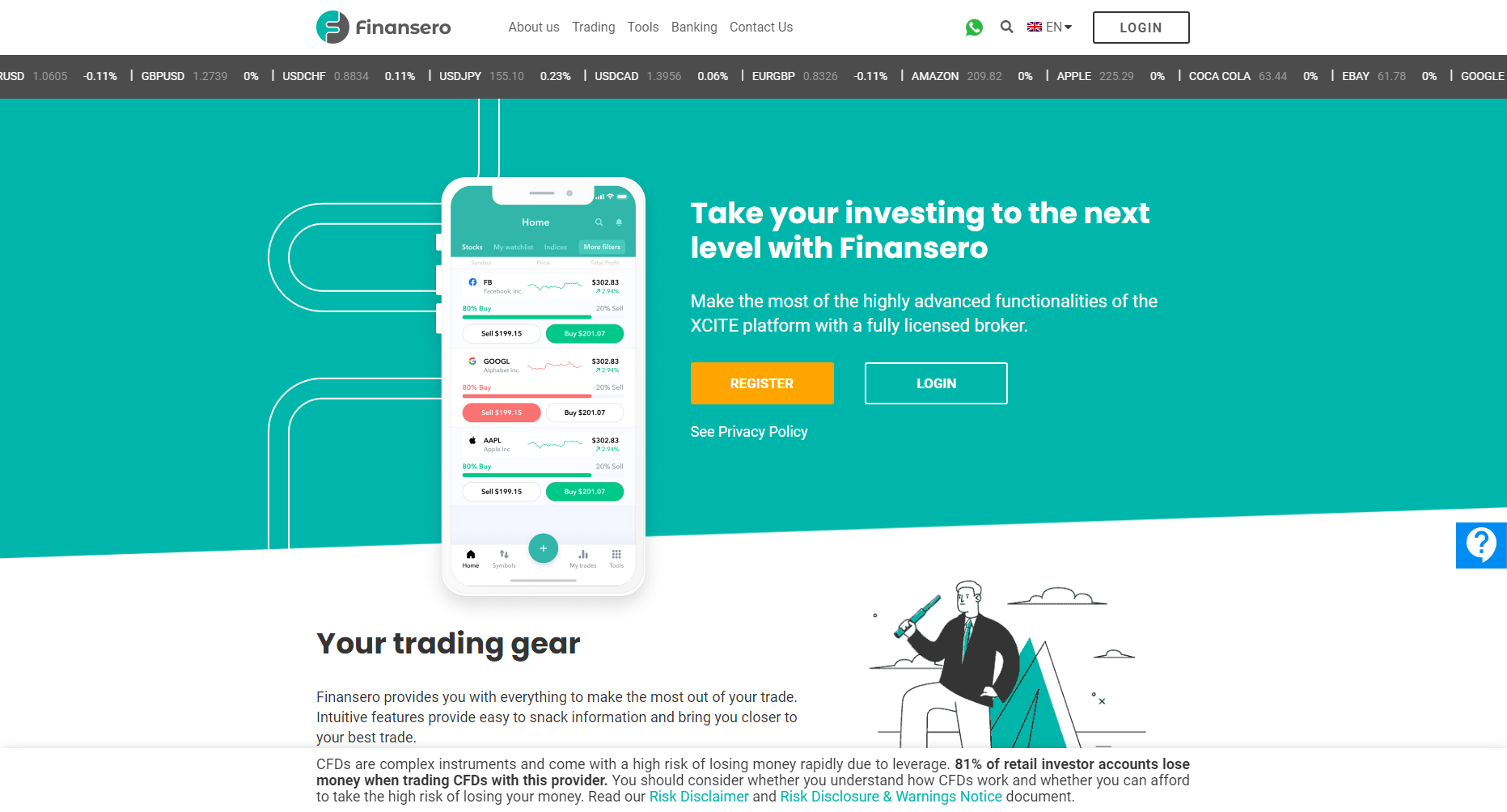

Finansero is an online trading platform designed to provide users with a comprehensive suite of tools for managing investments. It offers access to various asset classes, including forex, commodities, stocks, and cryptocurrencies, allowing traders to diversify their portfolios. With a user-friendly interface, Finansero aims to accommodate both novice and experienced investors by offering intuitive navigation and accessible trading features.

One of the standout features of Finansero is its competitive pricing structure, which includes low spreads and minimal fees. The platform also emphasizes security, implementing advanced encryption and compliance with regulatory standards to protect user data and transactions. These measures aim to build trust among users by ensuring a secure and transparent trading environment.

Overall, Finansero presents itself as a versatile option for traders seeking a platform that combines ease of use with robust financial tools. Its focus on accessibility, cost-effectiveness, and security makes it an appealing choice for those looking to manage their investments efficiently.

What is Finansero?

Finansero is an online trading platform that provides users with access to key financial markets, including forex, stocks, commodities, and cryptocurrencies. Designed for simplicity, Finansero aims to accommodate both new and experienced traders through a user-friendly interface and essential tools that make trading straightforward and accessible. By focusing on ease of use, Finansero ensures that users can navigate and engage with the platform confidently.

One of the primary benefits of Finansero is its competitive fee structure, which includes low trading costs and minimal fees. This cost-effective approach helps users manage investments efficiently without worrying about excessive expenses. Additionally, Finansero provides essential analytics and tools that assist traders in making informed decisions, supporting them in their investment journey.

Finansero Regulation and Safety

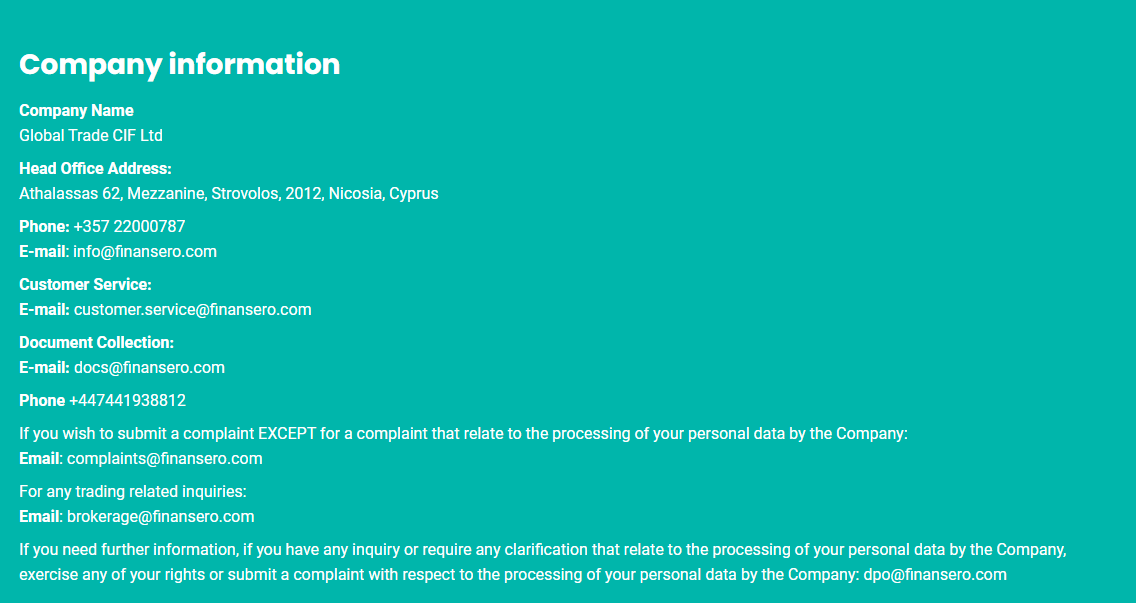

Finansero is committed to providing a secure and regulated environment for its users. Finansero is headquartered in Cyprus and operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC). The platform operates under strict regulatory standards, ensuring that all trading activities comply with industry norms and legal requirements. This regulatory adherence is aimed at building trust with users by upholding transparency and accountability in its operations.

To protect user data and funds, Finansero employs advanced security measures by regulated Global Trade CIF Ltd, including encryption protocols and secure data storage. These features help safeguard personal and financial information, minimizing risks related to data breaches and unauthorized access. By prioritizing user security, Finansero works to create a safe platform where users can trade confidently.

Finansero Pros and Cons

Pros

- CySEC-regulated

- User-friendly platform

- Diverse asset selection

- Comprehensive education

Cons

- Limited withdrawal options

- High inactivity fees

- Wide spreads

- No MT4/MT5 support

Benefits of Trading with Finansero

Finansero provides several advantages for traders, including access to multiple asset classes such as forex, stocks, commodities, and cryptocurrencies. This variety enables users to diversify their portfolios, catering to different investment strategies and market interests. The platform’s low fees and competitive spreads make it cost-effective, allowing traders to manage their investments without worrying about high trading costs.

In addition, Finansero emphasizes security and regulatory compliance, giving users confidence in a safe trading environment. With tools like MetaTrader 4, WebTrader, and mobile applications, Finansero offers flexibility for traders to access markets from any device, ensuring convenience and accessibility for a seamless trading experience.

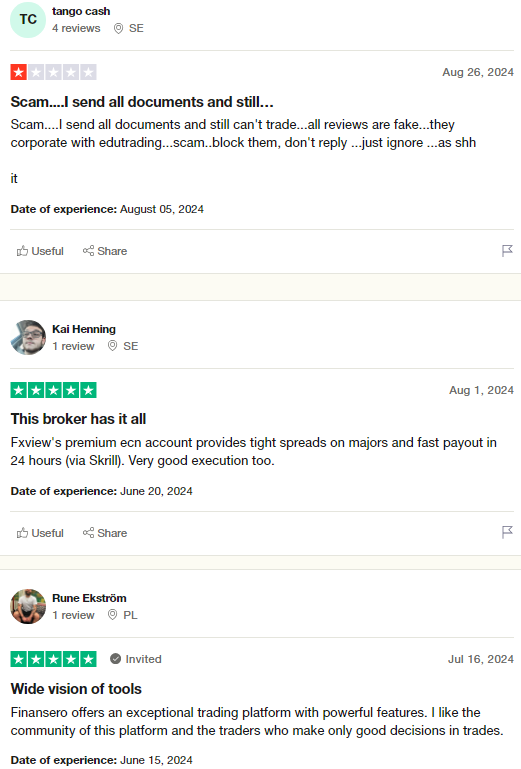

Finansero Customer Reviews

Finansero has received generally positive feedback from its users, particularly for its user-friendly interface and broad market access. Many traders appreciate the platform’s range of financial instruments, such as forex, stocks, commodities, and cryptocurrencies, which allows them to diversify their portfolios easily. This flexibility has been highlighted as a strong point by users looking for a well-rounded trading platform.

Another area where Finansero excels, according to reviews, is its competitive fee structure. Users frequently mention the platform’s low trading costs, which help them manage investments without worrying about excessive fees. The minimal charges and transparent pricing have contributed to high satisfaction among traders who value cost-effectiveness.

Finansero Spreads, Fees, and Commissions

Finansero offers a competitive fee structure aimed at providing cost-effective trading. The platform’s spreads are generally low, allowing traders to execute trades without excessive costs. For most accounts, Finansero does not impose additional commissions, which appeals to traders focused on keeping expenses minimal. This setup makes it suitable for those seeking a straightforward and affordable trading experience.

In addition to low spreads and commission-free options, Finansero does not charge for deposits or withdrawals, though users should be mindful of potential third-party fees. The absence of hidden charges helps traders plan their strategies and manage funds without unexpected costs. Overall, Finansero’s transparent approach to fees and commissions supports its goal of offering accessible and budget-friendly trading.

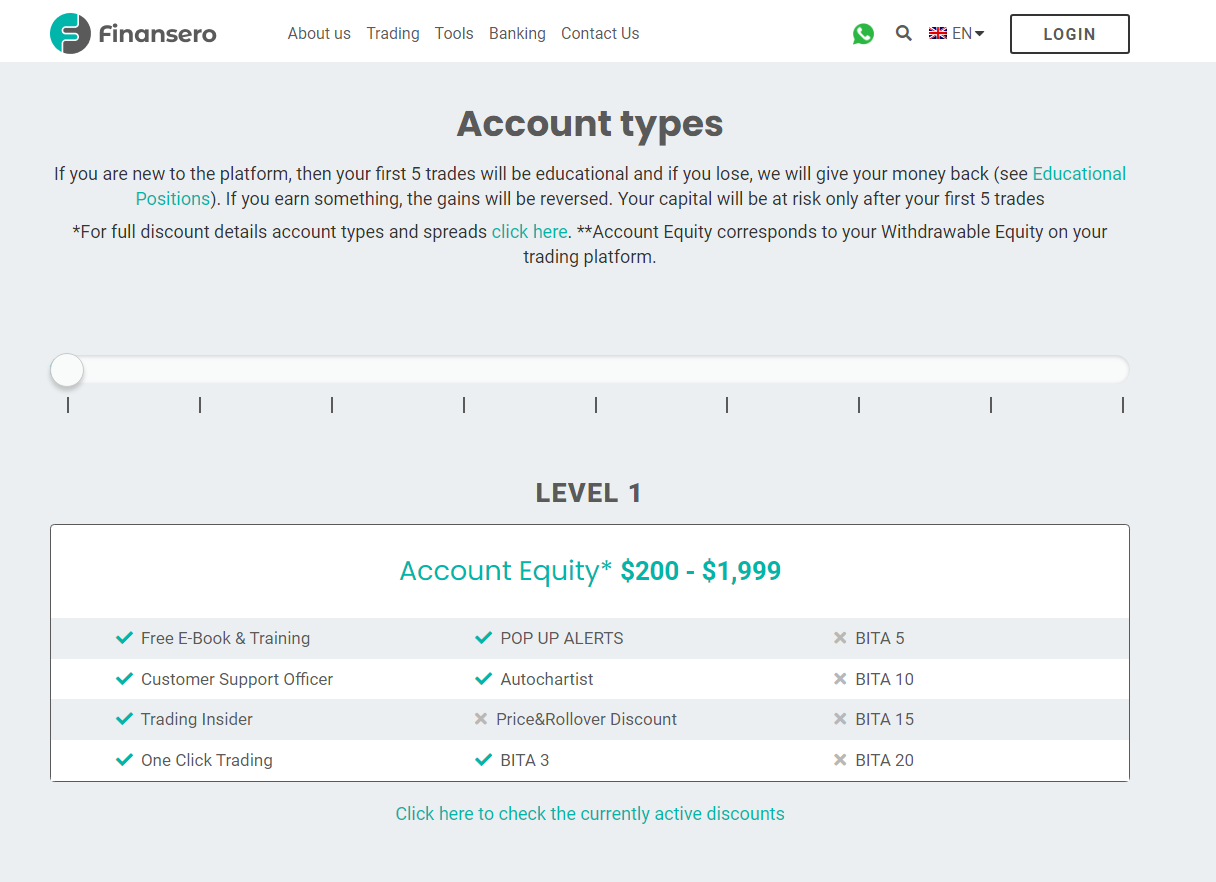

Account Types

Finansero provides a range of trading account options to suit traders of various experience levels and investment capacities depending on the minimum deposit required. The platform offers two primary categories: Retail and Professional accounts, each designed with unique features to support different trading needs.

Retail Accounts

Retail accounts are intended for individual traders and are divided into nine levels based on account equity. The levels range from Level 1, starting at $200, to Level 9 for accounts exceeding $100,000. Each level offers progressively enhanced benefits, such as reduced trading fees and access to advanced trading tools, catering to a broad spectrum of traders.

Professional Accounts

Professional accounts are available for experienced traders who meet specific qualifications. These accounts offer higher leverage options and additional features but may require traders to waive certain regulatory protections offered to retail clients. This structure ensures that advanced traders have the resources and flexibility they need to pursue sophisticated trading strategies.

By providing these account types, Finansero accommodates both beginner and seasoned traders, ensuring a tailored experience for each client funds.

How to Open Your Account

Opening an account with Finansero is designed to be a simple and efficient process. By following these steps, new users can quickly set up their accounts and access the platform’s features.

Step 1: Visit the Finansero Website

Begin by going to the official Finansero website and selecting the “Sign Up” or “Create Account” option to start the registration process.

Step 2: Complete the Registration Form

Fill out the required form with your personal details, including your name, email, and preferred account type. Ensure accuracy to facilitate verification.

Step 3: Verify Your Identity

Upload the necessary identification documents, such as a passport or driver’s license, to comply with Finansero’s verification standards.

Step 4: Fund Your Account

Once your identity is verified, deposit funds using one of the available payment methods. After funding, your account will be ready for trading on Finansero’s platform.

Finansero Trading Platforms

Finansero provides a variety of trading platforms to meet the needs of different traders. Its primary platform is MetaTrader 4 (MT4), known for its robust charting tools, technical indicators, and support for automated trading, making it ideal for both beginners and experienced traders. Finansero also offers a WebTrader option, allowing users to access their accounts through any browser, providing flexibility and ease for those who prefer not to download software.

For traders who need on-the-go access, Finansero has mobile apps available for both iOS and Android. These mobile platforms provide essential trading features, real-time data, and account management capabilities. Additionally, the broker offers professional accounts, which require an application to use. Finansero provides its users with a proprietary trading platform called XCITE, available for both desktop and web use.

What Can You Trade on Finansero

Finansero offers a diverse range of tradable assets, enabling traders to participate in various global markets. This variety allows users to tailor their trading strategies according to their interests and expertise.

Forex

Trade major, minor, and exotic currency pairs in the world’s most liquid market, benefiting from competitive spreads and high liquidity.

Stocks

Access over 120 top stocks from leading global companies, offering opportunities to trade shares of well-known corporations.

Indices

Engage in trading on the movement of more than 23 major indices worldwide, with low spreads starting from 0.0 pips.

Commodities

Buy and sell precious metals like gold and silver, as well as energy products such as oil, with competitive pricing across a range of metal and energy products.

Cryptocurrencies

Trade major cryptocurrencies, available seven days a week, accessing a diverse range of the largest and most popular digital currencies.

By offering this extensive selection of trading instruments, Finansero caters to both novice and experienced traders seeking to diversify their portfolios.

Finansero Customer Support

Finansero offers customer support through multiple channels, including live chat, email, and phone, ensuring that users can easily reach assistance when needed. Many traders appreciate the prompt and helpful responses from the support team, which adds value to their overall experience on the platform.

Additionally, Finansero offers multilingual support to cater to its international user base, making it accessible for clients from various regions. The platform also features a comprehensive FAQ section, allowing users to find answers to common questions quickly. This commitment to support reflects Finansero’s focus on user satisfaction and ease of use.

Advantages and Disadvantages of Finansero Customer Support

Withdrawal Options and Fees

Finansero provides several secure withdrawal methods to accommodate its global clientele, ensuring flexibility and ease when accessing funds. Each method is designed to cater to different preferences, with varying processing times and possible third-party fees.

Bank Transfers

Withdraw funds directly to your bank account. This option is reliable for larger withdrawals but may take a few business days to process.

Credit/Debit Cards

Withdrawals can be transferred back to your credit or debit card. Processing times are generally quicker but may vary based on your card provider.

E-Wallets

Supported e-wallets, such as Skrill and Neteller, allow for fast and convenient transfers. These are ideal for users seeking quicker access to funds.

Cryptocurrencies

For those preferring digital currency transactions, Finansero supports withdrawals in major cryptocurrencies. This option typically offers fast processing with minimal fees.

Finansero does not impose additional fees for withdrawals; however, third-party charges from banks or payment providers may apply. Processing times can vary based on the chosen method, typically ranging from instant to a few business days. For the most accurate and up-to-date information, it’s advisable to consult Finansero‘s official resources or contact their customer support.

Finansero Vs Other Brokers

#1. Finansero vs AvaTrade

Finansero and AvaTrade both offer diverse trading options, but they cater to slightly different needs. Finansero provides high leverage up to 1:3000, focusing on forex, stocks, indices, commodities, and cryptocurrency, making it ideal for traders seeking flexibility with competitive spreads. AvaTrade, with a broader range of assets, including ETFs and bonds, offers multiple platforms like MetaTrader 4 and 5, appealing to traders looking for platform variety and added tools. Both platforms are regulated, ensuring security across trading activities.

Verdict: Finansero is well-suited for traders seeking higher leverage options and a user-friendly interface, particularly those interested in cryptocurrency trading. AvaTrade appeals to traders who prioritize a wide range of account types, competitive spreads, and access to multiple trading platforms to accommodate various trading strategies.

#2. Finansero vs RoboForex

Finansero and RoboForex both provide diverse trading options, yet they differ in focus. Finansero offers high leverage up to 1:3000 and focuses on forex, stocks, commodities, and cryptocurrencies, appealing to traders looking for flexibility. RoboForex provides multiple account types and platforms like MetaTrader and cTrader, ideal for traders seeking platform versatility and low spreads. Both platforms support a broad range of assets and are well-regulated.

Verdict: Finansero is a strong choice for those prioritizing high leverage and simple access to crypto. RoboForex suits traders needing various platforms and account options.

#3. Finansero vs Exness

Finansero and Exness are both reputable online trading platforms offering a variety of financial instruments. Finansero provides access to over 300 assets, including forex, stocks, commodities, indices, ETFs, and cryptocurrencies, with leverage up to 1:30 for retail clients and up to 1:200 for professional clients. The platform features the proprietary XCITE trading platform, which is user-friendly and equipped with advanced tools. Exness offers a wide range of instruments, including forex, metals, cryptocurrencies, energies, indices, and stocks, with leverage up to 1:2000. It supports MetaTrader 4 and 5 platforms, known for their robust features and reliability. Both brokers are regulated, ensuring a secure trading environment.

Verdict: Finansero is suitable for traders seeking a user-friendly platform with a diverse asset selection and educational resources. Exness is ideal for those who prefer high leverage options and the familiarity of MetaTrader platforms.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH FINANSERO

Conclusion: Finansero Review

The bottom line, Finansero stands out as a versatile and accessible trading platform suited for traders of all levels. With a wide range of asset classes in the market trends, including forex, stocks, commodities, and cryptocurrencies, it enables users to diversify their portfolios easily. The platform’s competitive fee structure, low spreads, and absence of hidden charges make it a cost-effective choice for budget-conscious traders.

Moreover, Finansero prioritizes security and regulatory compliance, creating a reliable environment for managing investments. Its responsive customer support and range of trading platforms, including MT4 and mobile apps, further enhance the user experience. Overall, Finansero combines affordability, accessibility, and security, making it a solid choice for traders looking to navigate multiple markets with ease.

Finansero Review: FAQs

What types of assets can I trade on Finansero?

Finansero offers trading in forex, stocks, commodities, and cryptocurrencies, allowing users to diversify across various markets.

Does Finansero charge fees for deposits or withdrawals?

Finansero does not charge for deposits or withdrawals, though third-party fees from banks or payment providers may apply.

How can I contact Finansero customer support?

Finansero provides support through live chat, email, and phone, with multilingual assistance available for international users.

OPEN AN ACCOUNT NOW WITH FINANSERO AND GET YOUR BONUS