Fidelcrest Review

Financial trading is a business activity that consists of many opportunities to earn massive profits. However, the basic requirement for this activity is funds The bigger the investments, the more sizeable the profits. As, not all traders have the monetary advantage of investing massive funds, many proprietary trading firms help such traders with funded accounts. Fidelcrest is one such proprietary firm that provides funds of up to $2 million to qualified traders.

A prop firm is a great option for many traders and investors who have proficient trading skills but lack the money to invest more and earn more from trading. These firms allow experienced traders to make huge investments and consequently earn for themselves as well as the firm.

In this Fidelcrest review, we aim to provide all the necessary information regarding the prop firm, its fund eligibility requirement, trading challenges, funded account types, and other processes. After reading this review, traders can decide whether or not Fidecrest is the right prop trading firm that would cater to their trading needs.

What is Fidelcrest?

Fidelcrest is a proprietary trading firm that has been providing funded trading services to traders and investors across the world since 2018. Fidelcrest is among the only few offshore proprietary platforms that also provide services to USA citizens; therefore, the volume of customers on Fidelcrest is massive.

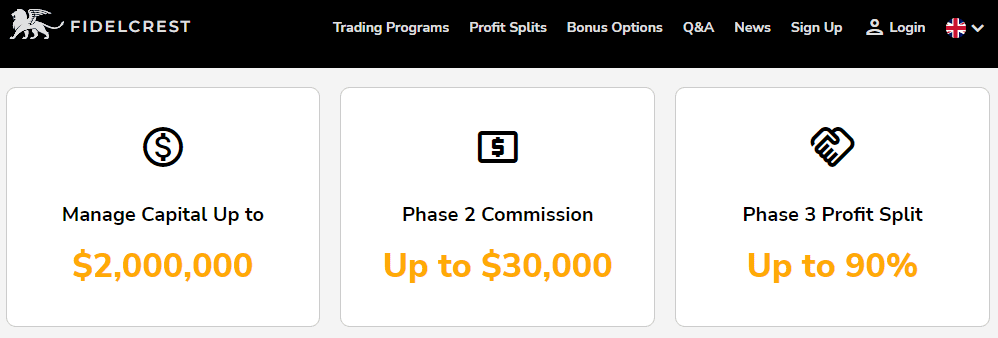

Fidelcrest provides trading services to traders and assists in funding up to $2 million to traders who pass the Fidelcrest challenge. Fidelcrest offers various account types options to traders to choose an account that best suits their trading requirements. Moreover, there is a two-phase challenge that traders must pass before being eligible for a live trading funded account.

Other than this, there are many other trading facilities that Fidelcrest provides to its customers, including a variety of trading instruments, an advanced MT4 trading platform, affordable trading cost, high leverage, and provision of bonuses and rewards such as acceleration plan, plan double, etc.

Advantages and Disadvantages of Trading with Fidelcrest

Benefits of Trading with Fidelcrest

There are many advantages of trading with a prop firm. The biggest advantage is the provision of a funded account which enables traders to earn massive profits by trading effectively. The funds the broker provides help the trader and generate profits for the prop firm.

Moreover, the challenge phases that the prop firm creates to evaluate skillful and consistent traders are also a benefit for the customers. As with high-profit targets and difficult trading conditions in these challenges, a prop firm prepares for the traders for live trading. These challenges provide a great platform to practice and test the trading skills of the traders to trade better and earn more profits.

In addition to this, Fidelcrest provides many features for traders to customize their trading services according to their trading style. For instance, traders can choose from four different account types Protrader normal, Pro trader aggressive, Micro trader Normal, and Micro trader aggressive. Each account type has different trading specifications and requirements that cater to different traders’ needs.

Fidelcrest Pros and Cons

Pros

- Low spreads

- Wide range of deposit and withdrawal methods, including Crypto

- Covers losses in first few trials

- Low commission rates

Cons

- Rigorous validation process

- Robots, EAs, and copy trading are not allowed

Difficulties Met by the Traders who Participated in the Brokers Challenge

#1. Parameters in the Verification phase

Most of the traders have complaints regarding the limits set in the second stage. The first phase is much easier, with a 10% drawdown limit; however, it shrinks to just 5% in the second phase. This limit gives almost no room for error to the traders.

How to Overcome the Difficulty

Mostly, all prop trading firms have 5% or lower drawdown criteria, which is difficult for traders. This challenge can be overcome by using the stop-loss strategy. By using the stop-loss feature, traders can put an auto option of selling the asset before it reaches the 5% loss limit.

#2. Two-Step Verification stages

There are many prop trading firms that have only one phase of challenges for the traders. However, Fidelcrest has a competitive two-step verification process with difficult conditions such as high-profit targets and a meager loss limit.

How to Overcome the Difficulty

Even when traders have tough verification parameters, with effective and consistent strategy it is possible to achieve this target. For minimum profit target of 20% in the verification stage, traders can divide the profit into small milestone rather than working on the overall target. With consistency and right moves it would be possible to reach the target within the allotted time.

Fidelcrest Customer Reviews

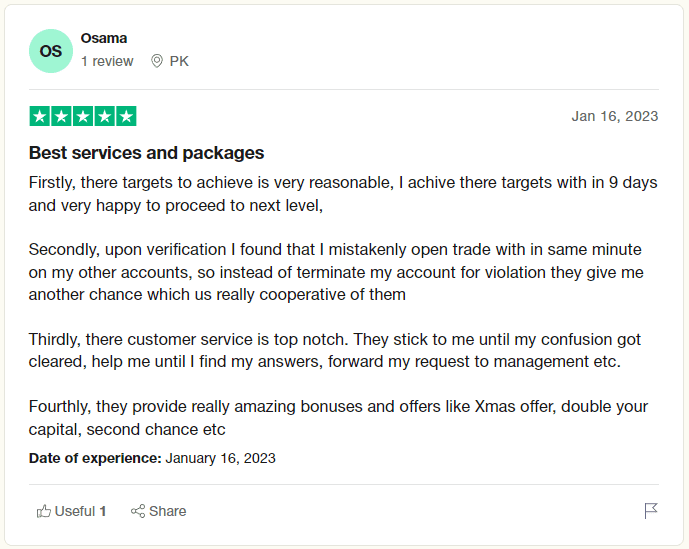

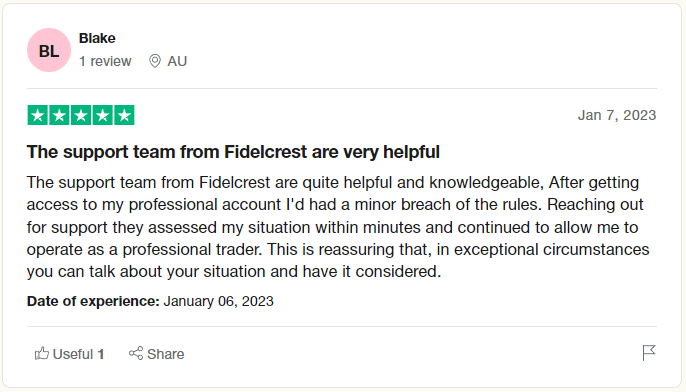

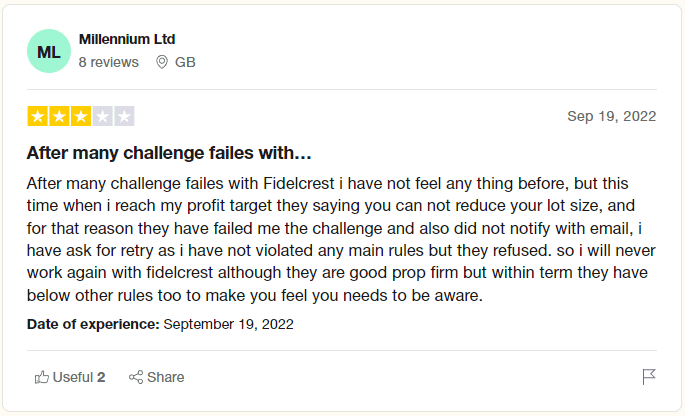

The customer reviews of Fidelcrest are mostly optimistic views about the prop trading firm. The clients who have had experience of being a Fidelcrest funded trader, praised the reasonable targets of the trading challenge and the fast-pace evalatin process. Moreover, mostly all the customers were satisfied with the customer support team of Fidelcrest. Everyone said that they got the technical assistance that they required or their queries were answered promptly

On the negative reviews, some traders put across their experience regarding the trading challenge and suggested that there are some more trading rules in their challenge account which are not explicitly mentioned however, they are a part of the Fidelcrest trading challenge. Moreover, the customer also affirmed that the prop firm also do not notify when the trader fail the challenge so it is confusing for traders.

Fidelcrest Fees and Commissions

All proprietary trading firms have subscription fees for opening an account for the challenges phases. Similarly, Fidelcrest also has a one-time subscription fee that traders have to pay if they want to open a virtual funded account on Fidelcrest.

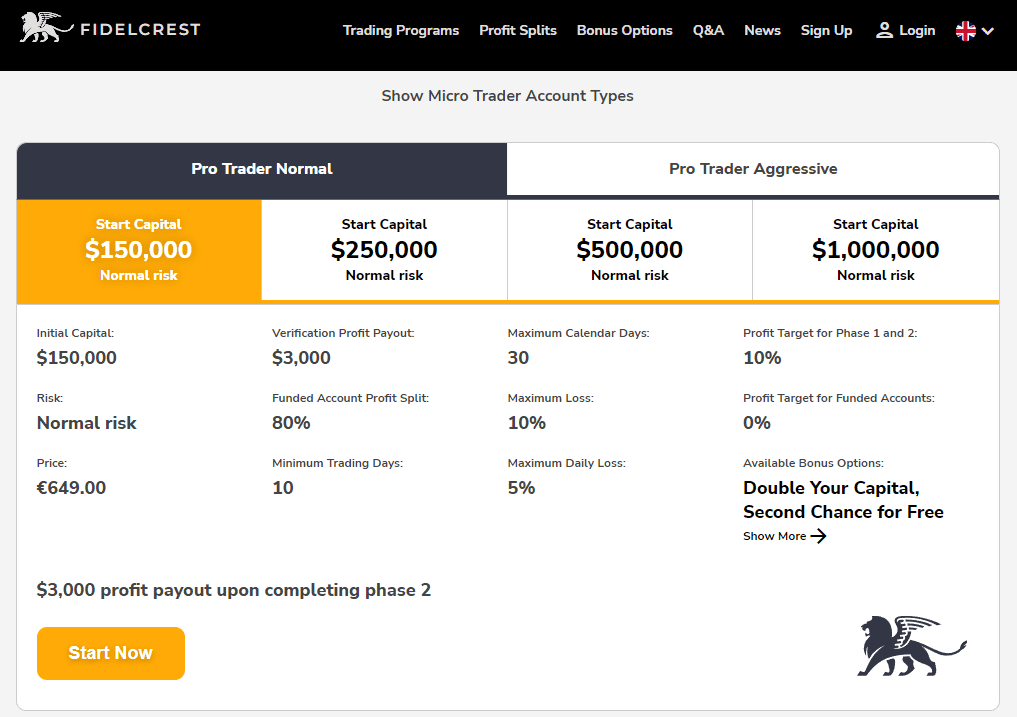

This fee varies according to the account type and the deposit amount of the trader. The subscription fee for a Micro trader normal account starts from €99, €249, or €449; for Micro Trader Aggressive, it is €149, €349, or €549; for Pro Trader Normal, it is €649, €999, €1799, or €2899; and for Pro Trader Aggressive, it is €1599 or €2899.

The commission rate of Fidelcrest is also low compared to other competitor prop firms. An average is $2 on the minimum amount per trade. Similarly, there are no withdrawal or fund deposit charges that Fidelcrest applies. However, third-party charges may apply.

Account Types

Fidelcrest, as a prop firm, offers multiple account types to its customers. Each account has a different specification for the traders. Basically, there are two account types, the Micro account and the Pro trader account, which differ in their trading terminals. Each of these accounts has a further option of normal or aggressive mode. The normal mode is for those traders who want to play safe and take minimal risks, whereas the aggressive account is for risk-taskers and ambitious traders.

Mirco Trader Normal accounts

Traders have the option of 10,000, 25,000, and 50,000 virtual funds in this account. Moreover, in the first challenge phase, the maximum total loss limit is 10%, whereas the daily drawdown limit is 5%. The profit target for each phase in this account is 5%. Additional bonus in this account includes double your capital and a second chance for free.

Micro Trader Aggressive Accounts

As this account has higher subscription fees of 140 Euros, it also differs in the profit target of 15%, two times higher than the normal account. Moreover, the overall minimum loss limit is 20%, and the daily loss limit is 10%. Other than this, all the features of Micro aggressive accounts are similar to the Micro normal accounts.

Pro Trader Normal Accounts

The range of initial capital in the Pro trader normal and aggressive accounts are $150,000, $250,000, and $500,000, respectively. The minimum subscription fee of a Pro trader’s normal account is 649 Euros. The maximum loss limits are 10%, and the daily loss limit is 5%. Moreover, this account’s profit target for both phases is 10%.

Pro Trader Aggressive Accounts

The subscription is higher than the pro trader’s normal account, that’s 999 Euros. The maximum loss limit increases to 20% total and 10% daily. Similarly, the 30 days profit target is 20% for these aggressive accounts. The available bonus options are the same as the other account types.

How To Open Your Account?

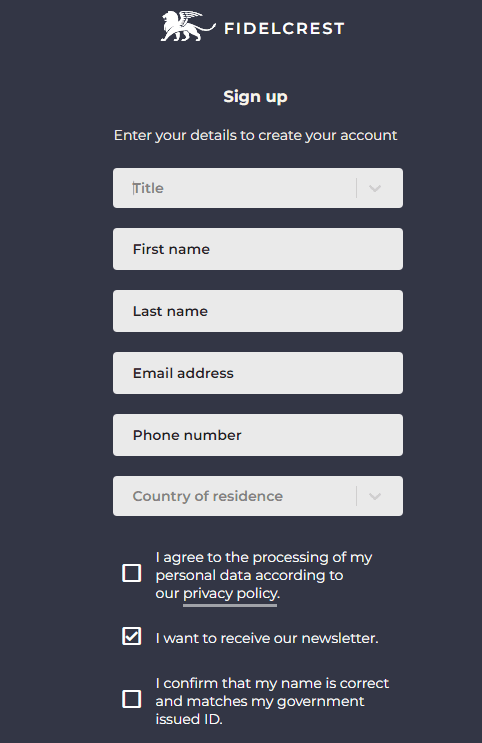

The account activation process on Fidelcrest is simple and quick. The first step is to open the official website of Fidelcrest on your browser. Next, on the first landing page, multiple tabs say “Start now.” The website will redirect to the registration page by clicking on this tab.

On the registration page, users will have to fill out a form with all their personal details, including first name, last name, email, phone number, and country of residence. After filling out the form, click on “next,” and the verification link will be sent to the given email address along with the account login details.

Once the registration step is done, the user can now go back to the website and log in to their accounts with the received details. Here the user can choose the account type they want to open, Micro trader or Pro trader, with their chosen risk mode (normal or aggressive). Moreover, the user will also have to choose their preferred virtual initial capital amount. Once these selections are made, click next.

The final step is the payment process. The user will have to pay the subscription fee according to their chosen account type and risk mode. After paying this fee, the user will finally have an account on Fidelrecrst to complete the trading challenges and earn a funded account of up to $ 2 million.

What Can You Trade on Fidelcrest

Fidelcrest allows its traders the facility to trade in 175+ financial instruments. These are asset-based or currency-based. The customers can take the liberty to set their trading objectives. They can deal with an extensive list of options available.

The clients can trade in Forex trading, Cryptocurrencies, CFDs on commodities, metal, stocks, and other digital options. With the help of the tools, you can monitor the average response time. You can set higher profit targets to move along the evaluation phase.

This platform is ideal for beginners as well as advanced traders. Its wide range of trading instruments and professional model are ideal. They facilitate trading and achieving higher targets.

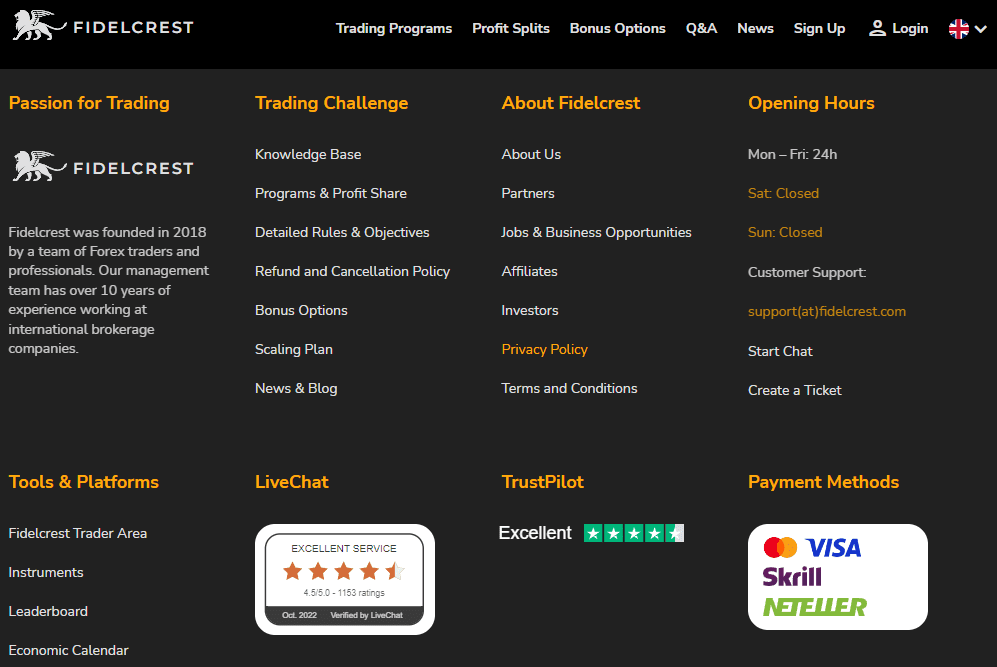

Fidelcrest Customer Support

The customer service of Fidelcrest has some strengths and some flaws. When considering its strengths, Fidelcrest provides top-notch technical assistance to its customers. In fact, this assistance is not only available for the account holders on Fidlecrest, but all website visitors can get technical assistance through its live chat window. Moreover, the customer reviews of the live chat assistance suggest its efficiency.

Moreover, customer service is also available in multiple languages considering the multilingual customers that are linked with Fidelcrest. Similarly, this is also available 24 hours a day, five days a week.

Conversely, the methods of reaching out to the customer service staff are very limited. Users can either contact support through the live chat box on the webpage or by email. Both these methods do not involve direct communication like that on a phone call.

In addition to this, the customer staff is also not available on the weekends, so users will have to wait for their responses even if they urgently require an immediate response.

Fidelcrest Customer Support Advantages and Disadvantages

Contacts Table

Security for Investors

Withdrawal Options and Fees

After the trader feels like he has made a significant profit. Then he can easily request a withdrawal. There are usually no delays in this process. It usually done immediately or can take up to 3 business days to receive the funds.

You can use various methods for this. Bank transfer, PayPal, credit cards, and debit cards for withdrawals and payments. Fidelcrest has no minimum payment charges for withdrawals. This makes the experience much better for the client.

There is no minimum withdrawal amount as well. The subscription fee to make a micro trader normal account with minimum risk is €99. This is very low compared to other prop firm offers.

What makes Fidelcrest Different from other Prop Firms

A provision of up-to-the-mark services makes this platform ahead of many other traders in the market. It has the fastest evaluation program. After it can allow traders to manage funded accounts up to $2 Million.

With smaller objectives and training programs, it is one of the optimum facilities. It helps traders gain experience. Apart from offering capital, this service provides traders with larger trading grounds. They can do this through several assets to expand trading horizons worldwide.

With its advanced interface, you can not only customize but monitor your dashboard. It helps you to stay up-to-date with a market value in a few clicks. You can also choose an account type for yourself.

They can set their risk mode according to investment and be free to differentiate the profit. The standards and services of Fidelcrest place it in the league of the best proprietary trading firm on the internet.

How Can Asia Forex Mentor Help You Pass Fidelcrest’s Evaluation?

At Asia Forex Mentor, we’re committed to guiding traders through the intricacies of Fidelcrest’s evaluation process. Our inception in 2008 by our founder, Ezekiel Chew, in Singapore was marked by modest beginnings. Ezekiel’s first foray into mentoring was teaching a handful of friends about the nuances of forex trading.

Our growth has been exponential, thanks to Ezekiel’s distinctive teaching techniques. Before long, his reputation reached institutional circles, leading trading companies and banks to tap into his expertise for their teams.

Recognizing the need for a structured educational path, Ezekiel birthed the AFM Proprietary One Core Program. This isn’t just another trading course; it’s a master blueprint. It’s tailored to help traders formulate a solid trading strategy, penetrate the layers of forex market analytics, and foster a steady hand at account management.

Our program is exhaustive, featuring 26 detailed lessons encapsulating more than 60 focused subtopics. Each section is augmented with crisp online videos, further enriched by Ezekiel’s invaluable insights and real-world examples.

Crafted to cater to both novices and seasoned traders, the One Core Program stands as a beacon for those striving to ace Fidelcrest’s evaluation, ensuring they’re equipped with the knowledge and skills to thrive.

Our Journey at Asia Forex Mentor

At Asia Forex Mentor, our track record is evident in the strides we’ve made within the forex industry. Led by our founder, Ezekiel Chew, we’ve facilitated the growth of many, including retail traders, bank professionals, and individuals in trading and investment sectors. Many of our students, who started with little or no knowledge, have honed their skills to become competent forex traders, with some advancing to roles as fund managers.

The One Core Program, our central offering, is comprehensive in its scope. It delves into topics like bar-by-bar backtesting and essential principles of trading psychology. Ezekiel shares insights on the utility of trading diaries and provides guidelines for effective forex trading. Within the program, learners are introduced to tools and strategies, including our auto stop-loss tool and the set-and-forget approach. Additionally, the course provides an overview of our free trade philosophy and contrasts different stop loss strategies.

For those interested, the One Core Program comes with a seven-day trial period. The course can be accessed for a fee of $997. Alternatively, if participants wish to skip the trial, they can enroll directly at a rate of $940. We invite you to explore and evaluate the program’s offerings for yourself.

Conclusion: Fidelcrest Review

To start a trading journey or season your skills it is ideal to make an account on a proprietary trading firm. Fortunately, Fidelcrest brings you an optimum service. It brings with it a team of forex experts and professionals.

These with the help of advanced software locate, find and train traders. It provides them with capital to trade in the financial markets. With several account types, advanced tools, and a zero-commission policy, this platform is top-tier for traders.

It deals with various economic instruments such as Forex trading, Cryptocurrencies.CFDs, stocks, and other commodities. A fast evaluation challenge makes this process streamlined. You need skill and patience to get verified through this evaluation.

Apart from a few technical flaws, Excellent customer support and a user-friendly interface are also great features of this platform. Hopefully, this review helps you gain enough knowledge about Fidelcrest. It can help you make an informed decision.

Fidelcrest Review FAQs

Is Fidelcrest legit?

Yes, Fidelcrest is an authentic and legitimate platform many current account holders have. Once you have to prove your skills as a trader through a demo account. This platform allows you to invest funds through its capital after that.

Its automated system allows for smooth functioning and high performance. It comes with the provision of micro-aggressive accounts to manage.

Is Fidelcrest Regulated?

This platform does not originally trade or hold funds. Thus it does need regulation. It gains funds through third-party brokers. FCA regulates them. These third-party brokers only invest capital to keep the firm going.

There is no such need. The traders are holding and trading through this service in the financial markets.

What are the fees on Fidelcrest?

There is no commission fee for this service and it offers very low spreads. Moreover, there are no withdrawal fees or minimum deposit fees on the opening of an account.

All these provisions make Fidelcrest one of the best proprietary trading firms in the market, proving its mark.