Fibo Group Review

Forex brokers act as intermediaries between retail traders and the global currency and financial markets, offering platforms for trading foreign currencies. The importance of choosing the right Forex broker cannot be overstated; it ensures access to essential tools, resources, and support necessary for effective trading. Fibo Group stands out in the crowded Forex market. As an international financial holding company that has been operating since 1998, Fibo Group holds the distinction of being among the pioneers in the Forex brokerage industry.

We delve into Fibo Group’s offerings, including its diverse trading and managed accounts options, efficient deposit and withdrawal processes, and competitive commission structures. By blending expert analysis with real trader experiences, we aim to present a balanced view that highlights both the strengths and areas for improvement of Fibo Group. Our goal is to furnish you with all the necessary details to determine if Fibo Group aligns with your trading needs and preferences, making it your broker of choice in the dynamic Forex market.

What is Fibo Group?

Fibo Group or Fibo Group Holdings Limited is a renowned international financial holding company with a strong presence in the Forex market since 1998. Recognized as one of the pioneering brokers in the industry, Fibo Group has established a reputable standing among traders worldwide. The company’s longevity and experience in Forex trading highlight its reliability and commitment to providing quality services.

Offering a wide range of trading and investing services, Fibo Group caters to a diverse clientele. From individual traders to institutional investors, the company’s offerings are designed to meet the varied needs of the market. This versatility underscores Fibo Group’s capacity to adapt and evolve, maintaining its relevance and appeal in the competitive Forex landscape.

Benefits of Trading with Fibo Group

Trading with Fibo Group has offered me a range of benefits that significantly enhanced my trading experience. One of the standout advantages is the diversity of trading platforms, including MetaTrader 4 and MetaTrader 5, which catered to my needs whether I was looking for user-friendliness or advanced trading features. These platforms facilitated my access to a wide array of trading instruments, enabling me to diversify my portfolio across currencies, CFDs, spot metals, and cryptocurrencies effortlessly.

Another significant benefit I found was the transparency in fees and commissions. Fibo Group made it clear from the outset what the costs of trading would be, without any hidden charges. This transparency allowed me to plan my trading strategy and budget more effectively, without worrying about unexpected expenses eating into my profits.

Lastly, the customer support offered by Fibo Group was commendable. With multiple channels available for assistance, including online chat and phone support, I always felt supported. Although the response times could vary, especially during peak hours, the availability of support in multiple languages made it easier for me to navigate through my trading journey.

Fibo Group Regulation and Safety

The regulation and safety of your Forex broker are crucial aspects to consider before you start trading. Fibo Group is regulated by the British Virgin Islands Financial Services Commission (BVI FSC), an international regulator known for its high level of authority. This information, gathered from my trading experience with Fibo Group, signifies that the broker operates within strict regulatory frameworks designed to protect traders.

Fibo Group’s adherence to regulatory requirements, including the use of segregated accounts, is a key factor in ensuring the safety of traders’ funds. Segregated accounts keep clients’ funds separate from the company’s operational funds, offering an additional layer of security. This practice is in line with BVI FSC’s stringent guidelines, which aim to safeguard investors’ capital and maintain trust in the financial services provided.

Furthermore, Fibo Group offers negative balance protection, a feature that prevents traders from losing more money than they have in their trading accounts. This safety measure is crucial, especially in highly volatile markets. Additionally, the broker provides a mechanism for the settlement of disputes involving an independent arbitrator, ensuring fair resolution processes. Knowing these details about Fibo Group’s regulation and safety measures is vital as it highlights the broker’s commitment to providing a secure trading environment.

Fibo Group Pros and Cons

Pros

- Multiple platforms, mobile included

- 24/7 support

- 60+ currency pairs

- Award-winning broker

- Global regulation

Cons

- PAMM withdrawal fees

- Limited promotions

- High initial deposits

Fibo Group Customer Reviews

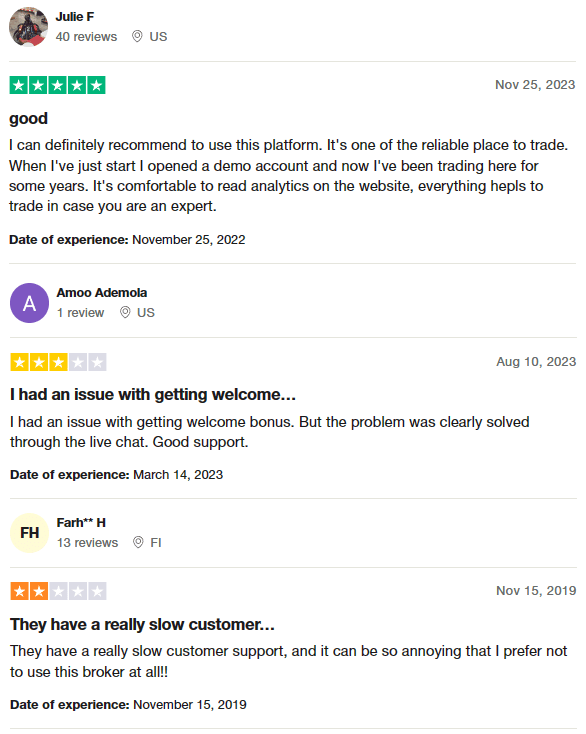

Fibo Group Broker garners mixed reviews from its customers, reflecting a range of experiences. Many users praise the platform for its reliability and the array of tools and features available, such as demo accounts, analytics, and copy trading options. The ability to trade real stocks and hold shares for the long term is highlighted as a significant benefit, appealing to a diverse set of traders and investors. Customer support experiences vary, with some appreciating the prompt resolution of issues, notably with the welcome bonus through live chat, while others express frustration over slow response times, which can detract from the overall trading experience. Despite the criticisms, the platform’s comprehensive trading capabilities encourage some users to recommend Fibo Group as a reliable trading destination.

Fibo Group Spreads, Fees, and Commissions

After thoroughly analyzing Fibo Group’s trading conditions, it’s clear that transparency is a key aspect of their fee structure. No hidden commissions exist within the company, which is a significant point of trust for traders. Depositing funds into an account varies in cost depending on the method used: WebMoney carries a 0.8% commission, while Skrill charges 3.9%. Notably, methods like Connectum, RegularPay, Blockchain.com , BITPAY, Raidospare, and Neteller do not incur any commission.

For those preferring bank transfers, the commission is subject to the sending bank’s fees, generally falling between $35 to $50. Credit card deposits through YooMoney service are levied a 2.35% commission. When it comes to withdrawals, fees range from 0.8% to 4%, depending on the withdrawal method chosen. Additionally, traders should be aware of swaps, the commission charged for transferring an open trade to the next day. This detailed breakdown aims to equip traders with the necessary information to navigate Fibo Group’s fee structure effectively.

Account Types

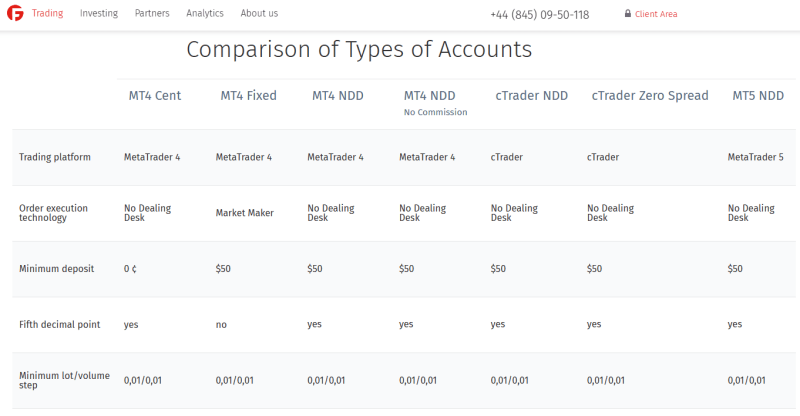

Fibo Group offers a variety of account types to cater to different trading styles and experience levels. They also offer a demo account for risk-free trading. Here’s a concise overview to help you choose the one that best fits your trading needs:

- MT4 Cent: Ideal for beginners or those looking to test their trading systems. It requires no minimum deposit, offers a maximum leverage of 1:1000, and features spreads starting from 0.6 pips.

- MT4 Fixed: Suited for experienced traders who prefer classic trading conditions with fixed spreads. This account has a $50 minimum deposit, spreads from 2 pips, and operates without commission.

- MT4 NDD: Tailored for traders seeking direct interaction with liquidity providers, making it perfect for scalping. It has a $50 minimum deposit, spreads starting at 0 pips, and a commission of 0.003% of the transaction amount.

- MT4 NDD No Commission: A great choice for scalpers who prefer no commission fees. This account features spreads beginning at 0.8 pips and requires a $50 minimum deposit.

- cTrader NDD: Designed for cTrader platform users, suitable for intraday trading. It offers spreads from 0 pips, a $50 minimum deposit, and a commission rate of 0.003% of the transaction amount.

- MT5 NDD: Best for professional traders utilizing scalping strategies, automated advisors, or trading signals. This account demands a $1,000 minimum deposit, with spreads from 0 pips and a commission of 0.006% of the transaction amount.

Each account type is designed with specific trader needs in mind, ensuring a tailored trading experience. Whether you’re just starting out or are a seasoned trader, Fibo Group provides options to support your trading strategy.

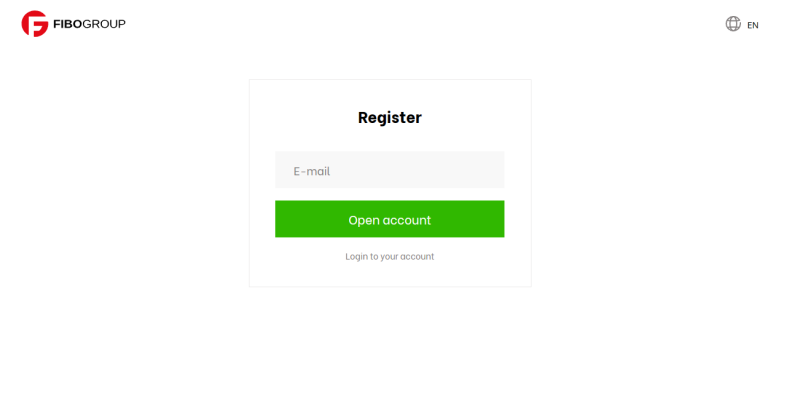

How to Open Your Account

- The user starts by navigating to the Fibo Group website.

- They find and click the “Open Trading Account” option on the main page.

- The next step involves entering their phone number.

- Users must then input their first and last name in English.

- An email address is required, which will be used for logging in.

- Account access information is sent to the user’s email.

- It’s advised that new users undergo the verification process.

- Finally, users can log into their personal account using the details received and should ensure all verification steps are complete before making any deposits.

Fibo Group Trading Platforms

Based on my experience, Fibo Group offers multiple trading platforms including access to two of the most popular and widely used trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms cater to traders of all experience levels, providing a robust set of tools for technical analysis, automated trading through Expert Advisors (EAs), and advanced charting capabilities.

MT4 is renowned for its user-friendly interface, making it an excellent choice for beginners, yet it also possesses depth in features that appeal to the more experienced traders. On the other hand, MT5, with its enhanced functionality, caters to traders looking for additional features such as more timeframes, built-in economic calendars, and improved order management capabilities.

What Can You Trade on Fibo Group

Based on my experience trading with Fibo Group, the range of trading instruments available is quite diverse, catering to various trading preferences and strategies. One of the primary offerings is currencies, where traders can engage in the Forex market, trading major, minor, and exotic currency pairs with competitive spreads and leverage.

CFDs (Contracts for Difference) are another significant component of Fibo Group’s offerings, allowing traders to speculate on the price movements of indices, stocks, and commodities without owning the underlying asset. This flexibility provides a broad market exposure and the opportunity to profit from both rising and falling markets.

Spot metals trading is also available, offering a way to trade gold and silver against the US dollar. This is particularly appealing for those looking to hedge against inflation or market volatility. Additionally, cryptocurrencies have become a popular trading instrument at Fibo Group, providing traders with the opportunity to trade digital currencies such as Bitcoin and Ethereum, among others, which introduces the potential for high volatility and profit opportunities.

Fibo Group Customer Support

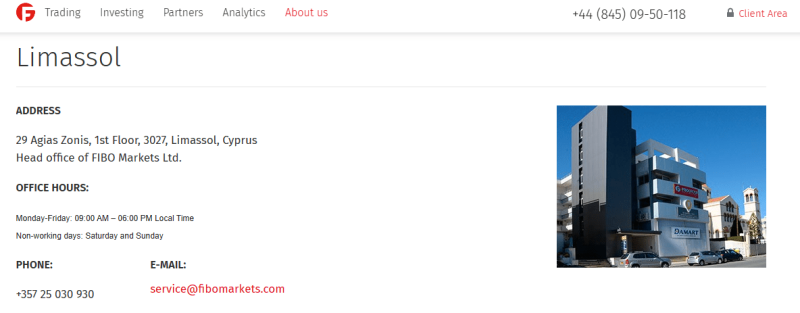

Fibo Group’s customer support is accessible and versatile, catering to different preferences for contact. You can reach out to them through multiple channels: phone numbers listed on their site, email, a live chat feature directly on the broker’s website, or through a feedback form available in your personal account.

This range of options ensures that help is readily available, whether you prefer the immediacy of live chat or the detailed record that email correspondence provides. Customer support is accessible from both the main site of the brokerage company and your personal account, making it convenient to get assistance directly within your trading environment. The team’s responsiveness and availability enhance the overall trading experience with Fibo Group.

Advantages and Disadvantages of Fibo Group Customer Support

Withdrawal Options and Fees

Fibo Group ensures prompt fund withdrawal upon client requests. The commission for withdrawals varies based on the method chosen, with specific limits on how much and how often funds can be withdrawn. This approach offers flexibility while maintaining a secure transaction environment.

The broker provides 10 withdrawal and deposit options, including bank transfers via SWIFT, YooMoney, Connectum, RegularPay, and several popular cryptocurrencies and e-wallets like Blockchain.com , BITPAY, WebMoney, Neteller, and Skrill. This diversity caters to a wide range of preferences and needs, ensuring that most traders find a convenient option.

Withdrawals to electronic systems are credited within minutes, offering swift access to funds. However, credit card withdrawals through YooMoney, Connectum, and RegularPay, and bank transfers via SWIFT, take longer—up to 10 business days and 3-5 working days, respectively. Withdrawal and deposit currencies include USD, EUR, GBP, CHF, BTC, ETH, and RFC, providing a broad selection for international traders.

It’s important to note that withdrawals over $1,000 require verification, a standard security measure to protect client funds and comply with financial regulations. This step ensures that Fibo Group maintains high levels of trust and safety for its clients’ transactions.

Fibo Group Vs Other Brokers

#1. Fibo Group vs AvaTrade

Fibo Group and AvaTrade are both respected brokers in the Forex and CFD trading space, but they cater to different types of traders based on their offerings and regulatory environments. Fibo Group, operating since 1998, offers a strong presence in the Forex market with its diversified account types and is regulated by the BVI FSC, appealing to traders looking for variety and flexibility in their trading strategies. AvaTrade, on the other hand, has been around since 2006 and boasts a larger global footprint with more than 300,000 registered customers and a wide range of financial instruments. It’s heavily regulated across multiple jurisdictions, making it a top choice for traders prioritizing security and a wide range of trading instruments.

Verdict: For traders prioritizing regulatory security and a wide range of financial instruments, AvaTrade might be the better choice. However, Fibo Group stands out for those seeking a broker with a variety of account types and a long-standing history in the Forex market.

#2. Fibo Group vs RoboForex

RoboForex, since 2009, focuses on delivering excellent trading conditions using cutting-edge technologies. It offers a vast selection of trading options across eight asset classes, catering well to traders with diverse styles and volumes. Fibo Group, with its long history and wide range of account types, competes closely but caters more to Forex traders looking for specific trading environments. RoboForex’s wide platform selection and innovative ContestFX for demo accounts provide a unique edge for traders focusing on technology and flexibility.

Verdict: RoboForex might be better for traders who value a wide range of trading options and innovative technology. Fibo Group, however, is still a strong competitor for Forex-focused traders seeking diverse account types and a robust trading platform.

#3. Fibo Group vs Exness

Exness distinguishes itself with its high trading volume and offers a wide array of CFDs, including over 120 currency pairs, and the unique feature of unlimited leverage for small deposits. It caters to a broad spectrum of traders with various account types, from beginners to seasoned traders, and emphasizes low commissions and instant order execution. Fibo Group, while offering a solid Forex trading platform and variety in account types, might appeal more to traders looking for specific Forex services and account flexibility. Exness’s approach to providing a cozy trading environment and diverse trading instruments might be more appealing to traders looking for a broad CFD offering and innovative account features.

Verdict: For those looking for a wide range of CFDs and innovative features like unlimited leverage, Exness could be the preferable choice. Fibo Group remains a viable option for Forex traders focused on account type variety and a tailored trading experience.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH FIBO GROUP

Conclusion: Fibo Group Review

In conclusion, Fibo Group stands out as a reliable and versatile Forex broker, with a solid track record since 1998. It offers traders a variety of account types, making it suitable for both beginners and experienced traders looking for specific trading conditions. The availability of platforms like MetaTrader 4 and MetaTrader 5, along with access to a wide range of trading instruments, including currencies, CFDs, spot metals, and cryptocurrencies, adds to its appeal.

Customer support is a strong suit for Fibo Group, providing multiple channels for assistance, including online chat, phone, and email. However, potential clients should be aware of the limitations in customer support availability, particularly over weekends and during peak hours. The transparency in fees and commissions, with no hidden charges, alongside the diverse withdrawal and deposit options, underscores its commitment to straightforward and accessible trading experiences.

Yet, it’s crucial to consider the cons, such as early withdrawal fees from PAMM accounts, limited promotions, and high minimum deposit requirements that might deter new traders. While these factors might weigh against the broker for some, Fibo Group’s strengths in platform diversity, account options, and regulatory compliance solidify its position as a commendable choice for those navigating the Forex market.

Also Read: RoboForex Review 2024- Expert Trader Insights

Fibo Group Review: FAQs

What trading platforms does Fibo Group offer?

Fibo Group provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to a variety of trading preferences and strategies.

Are there any hidden fees with Fibo Group?

No, Fibo Group maintains transparency with its fees and commissions, ensuring traders are aware of all costs upfront, with no hidden charges.

Can beginners trade with Fibo Group?

Yes, beginners can trade with Fibo Group, thanks to the availability of a cent account with no minimum deposit requirement, making it an accessible choice for new traders.

OPEN AN ACCOUNT NOW WITH FIBO GROUP AND GET YOUR BONUS