Fibo Forex Review

Fibo Forex is a leading online forex broker that offers traders access to the global financial markets. According to our latest rankings, Fibo Forex is currently ranked #28 in the AFM list of forex brokers. The company offers a range of trading products, including forex, commodities, and CFDs on stocks and indices.

Fibo Forex is a popular choice for both novice and experienced traders, thanks to its user-friendly platform and competitive trading conditions. The company offers a variety of trading accounts, including standard, ECN, and VIP accounts, with leverage of up to 1:500. Additionally, Fibo Forex offers a range of educational resources and analytical tools to help traders make informed decisions.

In this review, we will take a closer look at Fibo Forex and evaluate its trading conditions, platform features, customer support, and other important factors. We will provide a comprehensive analysis of the company’s strengths and weaknesses, to help you decide whether Fibo Forex is the right broker for your trading needs.

What is Fibo Forex?

FIBO Group is a multinational financial services company that provides online trading services to retail and institutional clients around the world. The company was established in 1998 and is headquartered in Vienna, Austria. FIBO Group offers a range of financial instruments, including Forex, commodities, stocks, and indices. The company operates in a highly regulated industry and is licensed and regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission of the British Virgin Islands (FSC).

One of the main offerings of FIBO Group is Forex trading, which involves buying and selling currencies in order to profit from changes in exchange rates. The company provides access to a wide range of currency pairs, including major, minor, and exotic pairs. FIBO Group also offers competitive trading conditions, including low spreads, high leverage, and fast execution speeds. In addition, the company provides clients with access to advanced trading tools and platforms, such as the popular MetaTrader 4 platform.

FIBO Group has received positive feedback from traders, who appreciate the company’s transparency, reliability, and customer service. Traders have noted that FIBO Group provides fast and efficient withdrawals, competitive pricing, and a range of educational resources to help clients improve their trading skills. In general, FIBO Group is a reputable and well-regulated financial services provider that offers a range of trading services to clients around the world.

Advantages and Disadvantages of Trading with Fibo Forex

Benefits of Trading with Fibo Forex

Trading with Fibo Forex provides traders with several benefits that can help them succeed in the financial markets.

Huge Range of Trading Platforms

Firstly, the company offers a wide range of trading platforms, including terminal versions for mobile devices, which allows traders to access their accounts and trade on-the-go. This provides traders with flexibility and convenience, allowing them to stay on top of their trades and take advantage of market opportunities from anywhere in the world.

24/7 Technical Support

Another benefit of trading with Fibo Forex is the company’s 24/7 technical support. Fibo Forex provides traders with access to a dedicated support team that is available around the clock to assist with any technical issues or questions. This ensures that traders can get help whenever they need it, which can be particularly important during periods of high volatility or unexpected market events.

Great Selection of Currency Pairs

Finally, Fibo Forex offers a large selection of currency pairs, with over 60 pairs available to trade. This allows traders to diversify their portfolios and take advantage of different market conditions. In addition, Fibo Forex provides competitive trading conditions, such as low spreads and high leverage, which can help traders maximize their profits

Fibo Forex Pros and Cons

Pros

- Massive selection of forex instruments available to trade

- Advanced technical solutions and cutting-edge trading platforms

- Multiple account types suitable for different trading strategies

- Flexible deposit and withdrawal options with fast processing times

Cons

- Higher minimum deposit required for optimal trading conditions

- No FIX API connectivity for advanced traders seeking direct market access

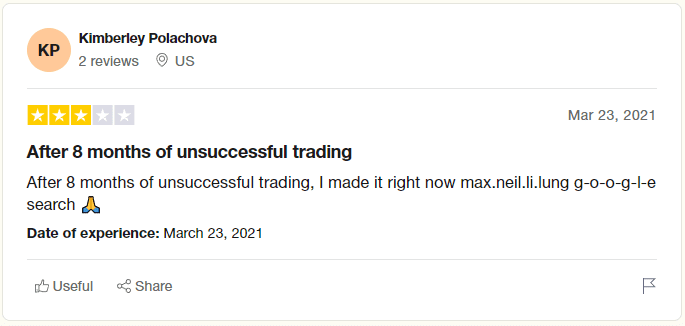

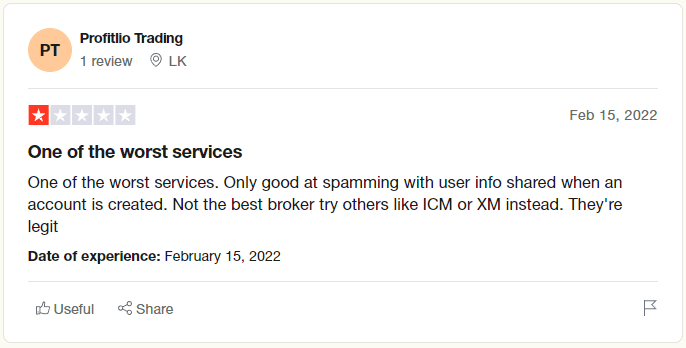

Fibo Forex Customer Reviews

Fibo Forex has received mixed reviews from its customers, with some finding it useful and easy to use, while others are skeptical about its legitimacy.

On one hand, some customers have praised FIBO for its reliable and user-friendly platform, as well as its helpful educational resources and trading tools. They have also reported making significant profits through trading with the company.

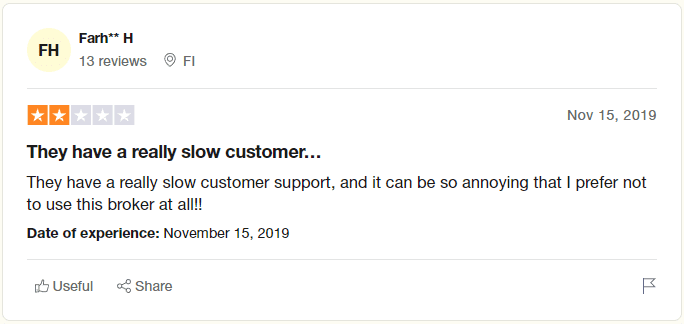

However, others have expressed concerns about the company’s trustworthiness, with some labeling it a scam. These customers claim to have lost money due to certain issues. Additionally, some have reported issues with FIBO customer service, including slow response times and unhelpful support staff.

Overall, it is clear that FIBO Group has both satisfied and dissatisfied customers, and it is important for potential clients to do their own research and exercise caution before investing in any financial services provider. As with any investment, it is crucial to carefully evaluate the risks and benefits and make an informed decision based on one’s individual financial situation and goals.

Fibo Forex Spreads, Fees, and Commissions

Spreads

Fibo Group offers both fixed and floating spreads, with spreads starting as low as 0.3 pips for EUR/USD. The difference between fixed and floating spreads is that fixed spreads remain constant regardless of market conditions, while floating spreads can change depending on market volatility. This means that traders who prefer more certainty in their trading costs may prefer fixed spreads, while those who are willing to accept more risk for the potential of lower costs may prefer floating spreads.

Fees

Fibo Group charges both deposit and withdrawal fees. For deposits, there is a range of options available, but bank transfers incur a fee between $35-50. Other deposit methods are generally free. Withdrawal fees start from 0.5%, which can be a significant cost for traders who frequently withdraw funds from their trading account. Traders should consider the fees associated with depositing and withdrawing funds when deciding which broker to use.

Commissions

Commissions are another cost that traders need to consider when trading with Fibo Group. The amount of commission charged depends on the trading account used and the financial instrument traded. The MT4 NDD Account and cTrader NDD Account charge commissions starting from 0.003% of the transaction amount, while the MT5 NDD Account charges commissions starting from 0.005%. These commissions are in addition to the spreads and other fees charged by Fibo Group, so traders should factor them into their overall trading costs.

Account Types

Fibo Group offers a range of trading accounts to cater to the diverse needs of its clients. Traders can choose from a variety of account types, including the MT4 Cent, MT4 Fixed, MT4 NDD, Commission-free MT4 NDD, cTrader NDD, and MT5 NDD. Additionally, traders can open a demo account to access the MetaTrader 4 platform and practice trading strategies without risking real money. For Muslim traders, an Islamic, swap-free account is also available. With such a wide variety of account types, Fibo Group strives to offer traders maximum flexibility and convenience in managing their trading activities. Let’s briefly discuss each of these account types:

MT4 NDD Account

The MT4 NDD account offered by Fibo Group is designed for traders who prefer fast order execution and require access to interbank liquidity. This account type employs No Dealing Desk (NDD) technology that connects traders directly with the largest liquidity providers from around the world. This means that clients can trade with prices from a diverse range of global electronic networks, allowing for fast and accurate execution of orders.

The MT4 NDD account may be particularly useful for traders who engage in intraday trading, especially on news releases that can cause high market volatility. With a minimum deposit of just $50, traders can access this account type, which offers a commission of 0.003% from the amount of each transaction and allows for managed accounts.

MT4 NDD No Commission Account

The MT4 NDD No Commission account offered by Fibo Group is similar to the regular MT4 NDD account but does not charge any commissions for trading. This account type employs No Dealing Desk (NDD) technology that connects traders directly with the largest liquidity providers from around the world, allowing clients to access prices from a diverse range of global electronic networks.

The MT4 NDD No Commission account may be particularly useful for traders who prefer fast order execution and engage in intraday trading, especially on news releases that can cause high market volatility. With a minimum deposit of just $50, traders can access this account type, which offers a spread from 0.8 pips and allows for managed accounts. This account type also supports multiple account currencies, including EUR, USD, GLD3, BTC4, ETH5, and more.

MT4 Fixed Account

The MT4 Fixed account offered by Fibo Group is a market maker account type that provides traders with fixed spreads starting from 2 pips. As a market maker, Fibo Group acts as a counterparty to traders’ trades, providing them with fixed quotes for their trades. Traders who prefer using expert advisors may find this account type suitable as the fixed spreads allow them to test their strategies and apply them to automated trading.

Expert advisors are based on historical price data, and having a fixed spread can help traders fine-tune their strategies accurately. With a minimum deposit of $50, traders can access this account type, which offers no commission fees and allows for managed accounts. The MT4 Fixed account supports multiple account currencies, including EUR, USD, RUR, CHF, and GBP.

MT5 NDD Account

The MT5 NDD account offered by Fibo Group is designed to be used on the popular MetaTrader 5 platform. This account type employs No Dealing Desk (NDD) technology, which allows traders to access prices from the largest liquidity providers for world electronic networks. The MT5 NDD account is particularly well-suited to traders who engage in intraday scalping and automated trading using expert advisors. This account type also offers a useful “market depth” instrument that provides traders with online market conditions, allowing them to make informed trading decisions.

With a minimum deposit of $50, traders can access this account type, which offers a spread from 0 pips and charges a commission of 0.005% from the amount of each transaction. The MT5 NDD account supports only one account currency, which is USD, and it does not allow for managed accounts. Overall, the MT5 NDD account is a great option for traders who prefer the advanced features of the MetaTrader 5 platform and want access to direct market pricing.

cTrader NDD Account

The cTrader NDD account offered by Fibo Group is an excellent option for traders who want to trade with the largest liquidity providers in the world. With no dealing desk technology implemented on this account, traders can trade directly with these providers.

The minimum deposit required for this account type is only $50, and the minimum lot/volume step is 0.01/0.01. The spread starts from 0 pips, and the commission charged is 0.003% from the amount of each transaction. This account is available in both USD and EUR, making it flexible for traders who prefer to trade in either currency. Additionally, there is no option for a managed account for this type of account.

How To Open Your Account?

To open a FiboGroup account, start by visiting their website and clicking on the “Login” button located at the top right corner of the page. From there, click on the “Open Live Account” button and fill out the registration form with your personal information, including your name, email address, phone number, and country of residence. You will also need to choose the account type, currency, and leverage you want to use. Once you’ve completed the form, read and agree to the terms and conditions of the broker before clicking on the “Open Account” button to submit your application.

After submitting your application, check your email for a confirmation message from FiboGroup. This message will contain your login credentials. Use these credentials to log in to your personal cabinet in FiboGroup. Once you’re logged in, you’ll need to complete the verification process, including email verification, identity verification, profile completion, residential address verification, questionnaire completion, and phone number verification. Completing these verification steps is necessary to ensure that your account is fully activated and ready for trading.

Once your FiboGroup account has been verified, you can start trading on their platform. Make sure to follow all of the necessary verification steps to ensure that your account is fully activated and ready for trading. FiboGroup offers a variety of account types and leverages to choose from, so you can select the one that best fits your trading needs. With a verified account, you can take advantage of FiboGroup’s trading tools and resources to start building your investment portfolio.

What Can You Trade on Fibo Forex

Fibo Group offers traders access to a diverse range of financial instruments. One of the most popular instruments available on Fibo Group is forex currency pairs, including major, minor, and exotic currency pairs. .

In addition to forex, Fibo Group also provides trading opportunities in commodities such as gold, silver, oil, and natural gas. Traders can take advantage of price movements in markets by trading CFDs, which allow them to profit from the difference between the opening and closing prices of a trade.

Finally, Fibo Group offers trading in stocks, indices, and cryptocurrencies. These markets enable traders to diversify their portfolios and potentially achieve higher returns. Nevertheless, trading in these markets involves a higher level of risk, and traders should conduct thorough research and analysis before making any trades.

Fibo Forex Customer Support

FIBO Group is known for its excellent customer support, boasting a double AA grade support rating due to its efficient and multi-lingual support system. The live chat feature works seamlessly, and customers typically receive a response within 30 seconds. The support staff is proficient in multiple languages, allowing them to provide timely solutions to customer issues regardless of their location.

The email support system at FIBO Group is equally impressive, with response times ranging from less than 15 minutes to 7 hours during their review. Although response times may vary based on the volume of queries and time of day, the support team was responsive and provided satisfactory solutions to queries.

Although FIBO Group does not offer phone support, the efficient live chat and email support system make up for it. The support team is skilled at resolving customer issues in a timely manner, reducing the impact of the absence of phone support. Overall, FIBO Group’s customer support is reliable and efficient, with a team that can communicate in multiple languages and provide effective solutions to customer issues.

Advantages and Disadvantages of Fibo Forex Customer Support

Security for Investors

Withdrawal Options and Fees

Fibo Forex offers a variety of withdrawal options to cater to the needs of its clients. You can withdraw funds using bank wire transfer, credit and debit cards, e-wallets like Neteller, Skrill, and WebMoney, and other options such as FasaPay, PayZ, Paysafe Card, PerfectMoney, Bitpay, Blockchain, Raido Finance, and Raido Spare. With such a wide range of options, you can choose the one that is most convenient and cost-effective for you.

The withdrawal fees for Fibo Forex start from 0.5%, which is a competitive rate compared to other brokers. However, the specific fees may vary depending on the withdrawal method you choose, the amount you want to withdraw, and your location.

Overall, Fibo Forex offers a range of withdrawal options with competitive fees and efficient processing times to ensure that you can access your funds easily and quickly.

Fibo Forex Vs Other Brokers

#1. Fibo Forex vs Avatrade

FIBO Group and AvaTrade are both reputable online brokers with various trading platforms and financial instruments. While FIBO Group offers forex, CFDs, cryptos, and spot metals, AvaTrade offers stocks, options, CFD, forex, crypto, and volatility index.

AvaTrade also offers a wider range of account currencies and is regulated across more continents. Both brokers offer demo accounts and require a minimum deposit to start trading, with FIBO Group requiring $50 and AvaTrade requiring $100. Additionally, AvaTrade offers a welcome bonus of 20% up to $10,000 on allowed countries.

According to our analysis, both FIBO Group and AvaTrade have their strengths and weaknesses. The best broker for you depends on your trading preferences and needs. If you are interested in forex, CFDs, cryptos, and spot metals, then FIBO Group may be a better choice for you. On the other hand, if you want to trade a wider range of financial instruments, including stocks, options, forex, and crypto, then AvaTrade may be a better fit.

#2. Fibo Forex vs Roboforex

FIBO Group and RoboForex are both reputable online brokers offering multiple trading platforms and a wide range of instruments for trading. While FIBO Group has a higher minimum deposit and offers fewer instruments, it is regulated by CySEC and FSC BVI. On the other hand, RoboForex has a lower minimum deposit, offers more instruments, and is regulated by IFSC.

Both brokers offer various account types, mobile apps, and leverage levels for trading. Additionally, RoboForex offers promotions and bonus programs, while FIBO Group offers educational resources for traders.

Now if you are looking for a wider range of instruments and lower minimum deposit, then RoboForex may be a better choice for you. However, if you prefer to trade with a broker regulated by CySEC and FSC BVI and value educational resources, then FIBO Group may be the better option.

#3. Fibo Forex vs Alpari

When comparing FIBO Group and Alpari, both offer a range of trading instruments including forex, CFDs, and cryptocurrencies. However, Alpari has a wider range of account types and payment methods, as well as offering binary options trading. While FIBO Group offers more trading platforms including MetaTrader 5 and cTrader, Alpari has a mobile app for iOS, Android, and Windows.

Both brokers offer Islamic accounts and demo accounts, but FIBO Group has the advantage of offering MAM accounts for money managers. In terms of spreads, FIBO Group generally offers lower spreads than Alpari, and they also offer a bonus for new traders.

Now when it comes to spreads, FIBO Group generally offers lower spreads than Alpari. FIBO Group also offers a bonus for new traders, which may be attractive for some. If we take this into account and if these factors are very important for you, in that case, FIBO should be your go to option.

Conclusion: Fibo Forex Review

There is no denying the fact that FIBO Group is a well-established and reputable financial services provider that offers a wide range of trading instruments, including Forex, commodities, stocks, and indices. With its competitive trading conditions, advanced trading platforms, and extensive educational resources, FIBO Group has become a popular choice for traders around the world.

While there have been some mixed customer reviews, FIBO Group’s regulatory compliance, range of account options, and 24/7 technical support make it a strong contender for those seeking a reliable and transparent broker. However, traders should carefully evaluate the costs and risks associated with trading with FIBO Group and ensure they have a solid understanding of the financial markets before making any investment decisions.

Fibo Forex Review FAQs

Is Fibo Forex legit?

Yes, Fibo Forex is a legitimate organization as it is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) in the EU and authorized by the Financial Services Commission (FSC) in the British Virgin Islands (BVI).

What is Fibo Forex minimum deposit?

The minimum deposit for FIBO Forex is $50 or R800.

How long does Fibo Forex withdrawal take?

The time it takes for a payment to reflect depends on the payment method used. Some payments may show up immediately, while others may take several days to appear in the account.