Exness Review

Numerous online Forex brokers will be vying for your business if you trade on the foreign exchange financial markets. One of the innumerable brokers is Exness. If you visit any financial news website, you’ll probably be bombarded with many online advertisements from forex brokers.

Consider various checklists when selecting the broker or trading services that are best for you. Exness may be regarded as a reliable financial service provider and a licensed broker with highly competitive trading fees. Additionally, they have a very low spread, a great payment system, and offer top-notch educational resources and customer service. Exness has a 96 out of 99 trust rating.

Exness has brokerage offices in the British Virgin Islands, Curacao, Sint Maarten, South Africa, Cyprus, Seychelles, and the United Kingdom.

This article will reveal, among other things, all you need to know about choosing a better broker. You’ll discover honest facts and our undiluted stance about Exness broker.

What is Exness?

Exness is the brand name of the international brokerage firm, a Cyprus broker with two main offices in Seychelles that provide its services. They started operation in 2008 and are currently ranked high in forex ratings.

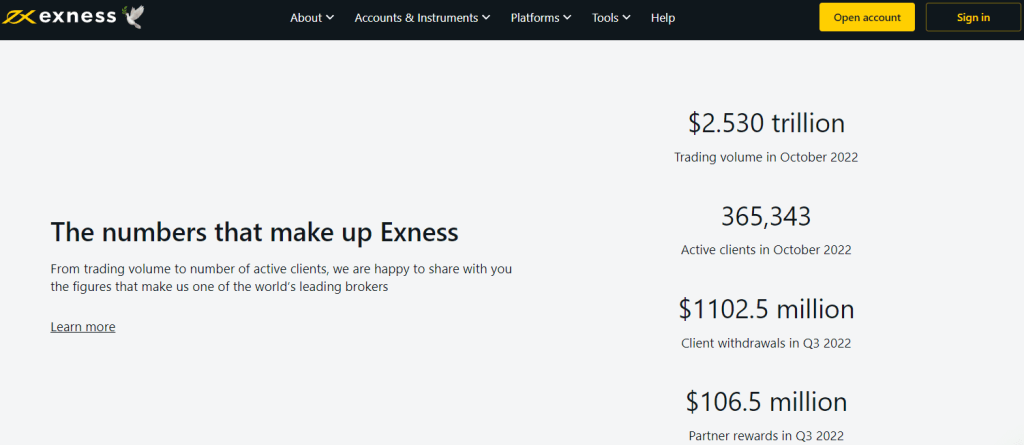

The total monthly trading volume for the corporation is USD 325.8 billion. Exness presently offers CFDs for stocks, energy, metals, and more than 120 currency pairings, including cryptocurrencies and stocks. The service provided by Exness offers traders beneficial working conditions, including cheap commissions, immediate order execution, and fund withdrawal.

Earnings on tiny deposits up to $999 are possible because of the infinite leverage they offer. Depending on the requirements of the traders, there are various choices of accounts to start with. It is possible to open a demo account, which serves as a training tool and a demo account for experienced traders.

Exness does not only offer reliable and stable brokerage services, but it also makes provisions for a cozy trading environment.

Advantages and Disadvantages of Trading with Exness

Benefits of Trading with Exness

We’ve seen some rare features you can enjoy when trading with Exness. The spreads on some trading accounts might even be zero or tiny, which allows you to trade with no risk. Without depositing real money, you can test the waters with the demo account, which has no expiration date. You must enter the verification code if you withdraw your money, which further secures your account.

Exness is the only broker that offers you a rebate on trades, and you can get up to $16 per lot. It applies to traders who have already registered. Up to $16 is given to program participants for each lot. The number of trades is used to determine bonuses. The user’s account shows how much money has accrued in bonuses. For new sorts of accounts, there are yet to be any bonus programs available right now.

The primary account option is appropriate for traders of all experience levels and provides a free demo account. These trading accounts offer excellent execution, various market indicators, no requotes, and commission-free trading.

The ability to practice trading with a small fund is also appropriate for people with limited funds. The Exness Trade mobile app is a sophisticated trading tool that makes it simple for users to carry their trading accounts wherever they go. The app allows users to trade currency pairs, cryptocurrencies, and stock market investments.

It also provides powerful technical tools, real-time notifications, and other features. The mobile app can be used to monitor and manage your portfolio as well.

You can create several accounts and change settings using the Exness app. Another benefit of Exness is that it offers free VPS hosting. When using the Exness mobile app, some users have noted a pop-up window and that the MT5 platform can be a little slow. On some Android devices, the Exness Trading mobile app may not function.

Generally speaking, Exness has won numerous accolades, including the coveted FPA and CFA awards. You can look at these accolades to learn what sets it apart from other forex brokers.

Exness is the only broker that offers you a rebate on trades, and you can get up to $16 per lot. It applies to traders who have already registered. Up to $16 is given to program participants for each lot. The number of trades is used to determine bonuses. The user’s account shows how much money has accrued in bonuses. For new sorts of accounts, there aren’t any bonus programs available right now.

Exness Pros and Cons

Pros

- Free VPS hosting

- Instant withdrawal of money 24/7

- Narrow spreads

- Multiple trading platforms: MT4, MT5, MultiTerminal and mobile platform

Cons

- The lack of multi-currency accounts

- The Exness Training resource section is currently available only in English. Could benefit from being offered in multiple languages

- Analysis of the Main Features of the Forex Broker

Analysis of the Main Features of the Forex Broker

4.7 Overall Rating |

4.5 Execution of Orders |

4.7 Investment Instruments |

4.5 Withdrawal Speed |

4.8 Customer Support |

4.5 Variety of Instruments |

4.8 Trading Platform |

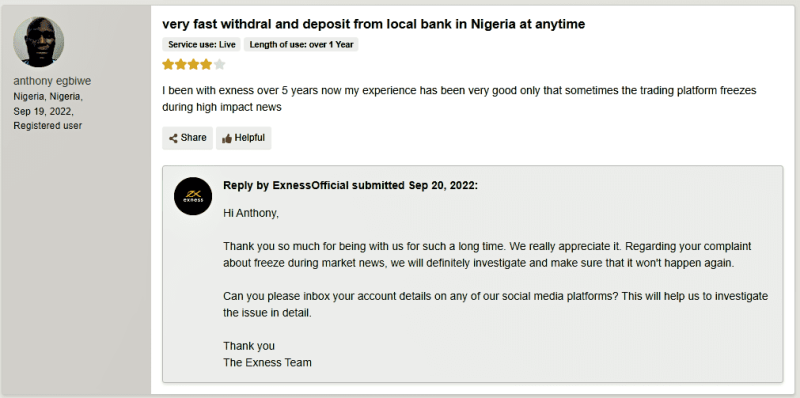

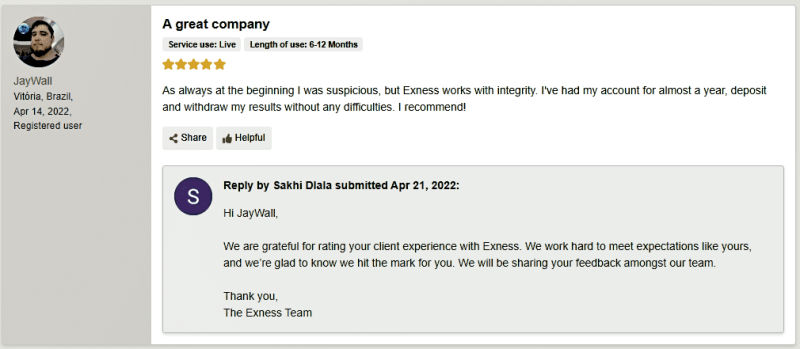

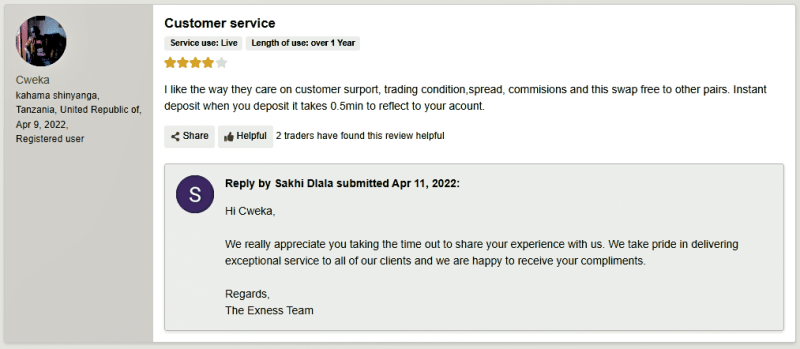

Exness Customer Reviews

Our experts have checked several reviews of Exness of different platforms and found that most traders are quite happy with the excellent commissions, low spreads, and 24/7 customer support. Based on all the reviews and our own analysis, we believe that Exness is a good forex broker.

Traders are also happy about fast withdrawals, and deposits also reflect in Exness account in just a few seconds. Exness is a great broker with low spreads, fast order execution, good customer service, and a user-friendly platform.

Exness Spread, Fees, and Commissions

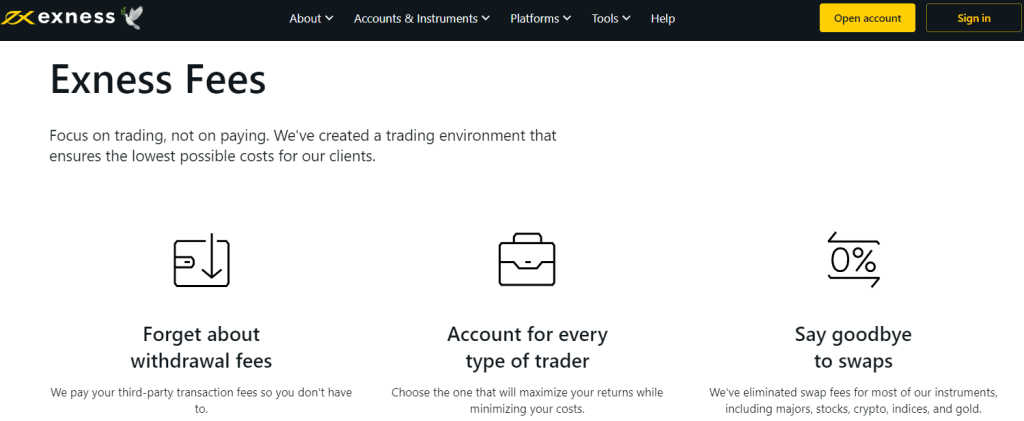

Exness is a reliable and transparent crypto broker that doesn’t overcharge its users in fees. The platform’s fee structure varies depending on the account type, but it is always clearly laid out. Additionally, there is no fee for inactive accounts. Although, if you want to deposit or withdraw money from your account, Exness does charge transaction fees that vary depending on the payment method chosen.

Exness Spread

- Exness (Standard account): EURUSD 1, GBPUSD 1.1, USDJPY 1.3

- Roboforex (Pro-Standard): EURUSD 1.4, GBPUSD 1.0, USDJPY 2.0

- Forex4you: EURUSD 2, GBPUSD 3, USDJPY 2

Exness Forex Fees

So far, Exness has one of the lowest ECN account fees in the market. Below are the details about exness forex fees:

- Standard Account EURUSD Average Spread: 1 pip

- Standard Account Fee: $0

- ECN Account Fee: $3.5 per lot

- ECN Account EUR Average Spread: 0.1 pip

Exness CFDs Spread and Fees

Exness has an impressive, low spread compared to other brokers competing in the market. The platform’s starting point for its spread is 0.0 pips, with a commission of only $3.5 when using the ECN account — this includes trading EUR/USD/GBP pairs.

Traders only need to deposit a minimum of 1 GBP/USD/EUR when opening a trading account on Exness. This makes them ideal for people who don’t require advanced features and research tools.

The average commission of Exness group is $8.25 while the average spread is 1 pip.

Exness Non-Trading Fees

Inactivity and withdrawal fees are common with many crypto platforms, but Exness differs. They don’t charge any inactivity fees. However, their withdrawal charges depend on the payment method you choose. The platform supports payment systems like Bank Card, Perfect Money, and Webmoney.

Withdrawal Fee

Withdrawal fees at Exness depend on the payment method you select. Every broker has a unique fee structure for withdrawals, processing times, and currency conversion fees.

The minimum deposit for a Bank Card is $10, while the minimum withdrawal amount is $3. On the other hand, if you’re using Perfect Money, the minimum deposit becomes $50 with a correspondingly lowered minimum withdrawal of only $2.

How Exness Fees Compare to other Brokers

Account Types

Let’s discuss the different types of accounts offered by Exness:

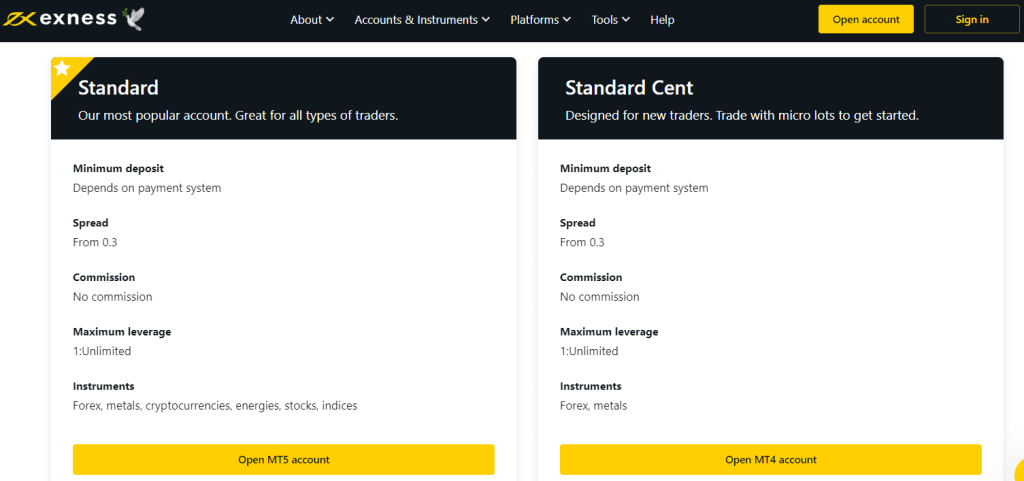

Standard accounts: are the most widely used and are appropriate for all traders. The smallest down payment is $1, with a starting spread of 0.3 pip.

Standard Cent: accounts help practice a trading method(s) you are trying out; for experienced and beginning traders. The minimum deposit is $1, but unlimited leverage is available. The spread starts at 0.3 pip.

Standard Plus: All traders should use Standard Plus as their account type. The smallest down payment is $1. The spread starts at one pip.

Raw Spread: is a trading account for seasoned investors. Low spreads and a commission of up to $3.5. It is a professional account with zero spreads for 95% of the trading day and requires a minimum deposit of $200.

Zero: is another account type withover 95% of the trading day for 30 currency pairings and offers a professional account with zero spreads. The minimum deposit is $200, and the commission is $3.5 for each lot and one-way transaction.

Pro: Pro is an account with swift order execution and no trading commissions for professional traders. The lowest down payment is $200, and a lot starts at 0.01.

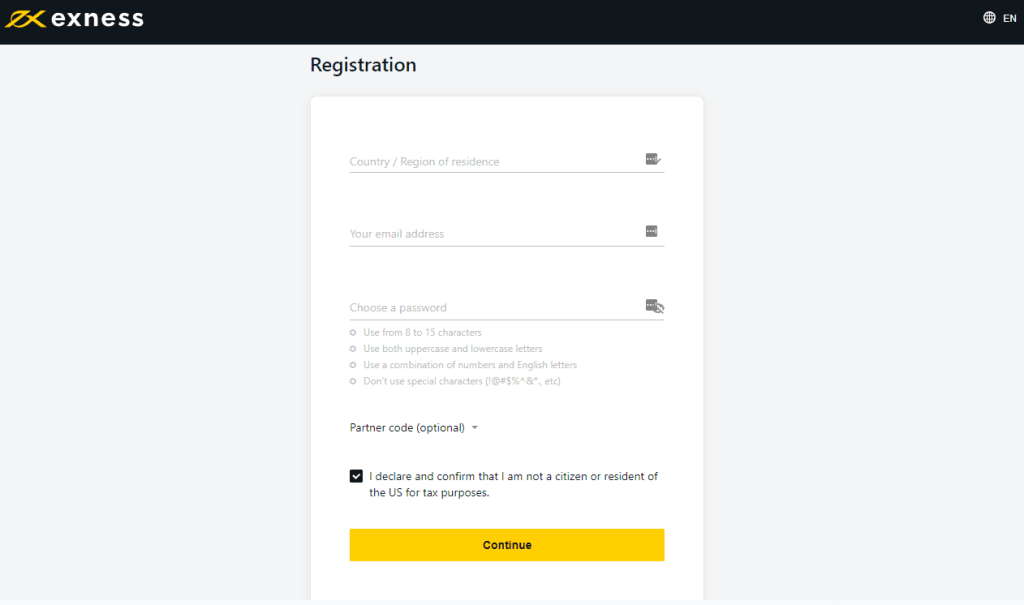

How To Open Your Account?

Opening an account on Exness is very easy, and the steps include the following;

- Visit Exness.com and click on “Open Account.”

- Select your country of residence; this will determine what payment method is available to you.

- Enter your email address.

- Generate a password for your Exness account by following the guidelines indicated.

- Enter a partner code (optional) to link your Exness account to another in the Exness partnership program.

- Note: if there’s any case of an invalid partner code, the entry field will be wiped so you can try again.

- Tick the box indicating you are not a citizen or resident of the U.S.; if not.

- Click Continue after providing all the required information.

- After completing the above process, you will be taken to your new Personal Area.

Pro tip: I advise that you verify your Exness account completely to access every functional feature accessible by fully verified Personal Areas.

What Can You Trade on Exness?

Exness offers more trading options than most other brokers, including 100+ Forex pairs and a variety of cryptocurrencies. Fewer indices and commodities are available, together with only more than 70 stock CFDs, compared to other brokers’ tradeable instruments.

Exness offers 14 cryptocurrency crosses, most of which are Bitcoin pairs like BTC/ZAR and BTC/XAU. Ripple, Litecoin, and Ethereum are additionally accessible. The maximum leverage is 1:200, far more than other brokers offer.

Metals: Exness offers palladium and platinum futures in addition to silver and gold crosses with the AUD, EUR, GBP, and USD. On gold, the maximum leverage is 1:2000, whereas on platinum and palladium futures, it is 1:100.

Energy: Both Brent and WTI oil are available as spot contracts through Exness. Leverage is limited to 1:50.

Exness provides CFDs on several worldwide indexes, such as the NASDAQ, S&P 500, FTSE100, DAX30, and Nikkei. Leverage is limited to 1:100.

Shares: Exness offers more than 70 share CFDs for trading, including well-known US IT firms and global energy corporations. Compared to other brokers, they provide a lesser selection of share CFDs.

Leverage is limited to 1:20.

Exness provides a wide selection of Forex pairs, even though some traders are unhappy that this broker only offers a tiny range of share CFDs and a modest selection of commodities. Given the volatility of these assets, the high leverage on the crypto CFDs is extremely rare. We encourage traders to utilize lower levels than the maximum offered.

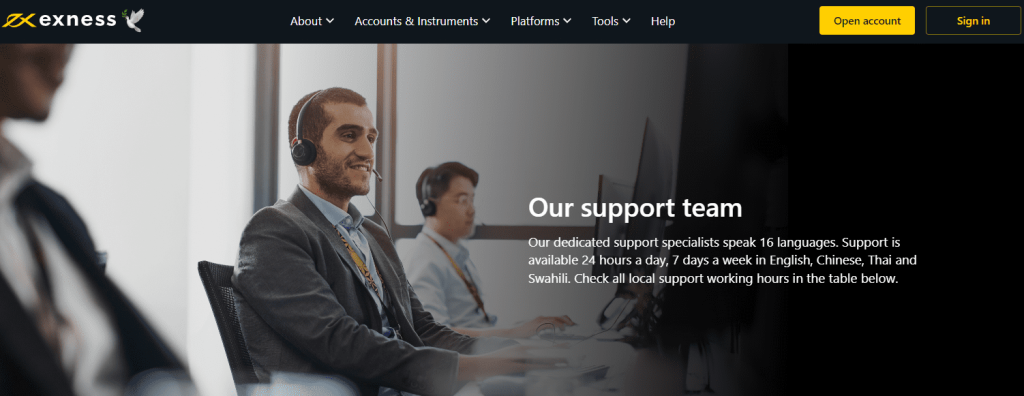

Exness Customer Support

Exness customer support is accessible 24\7 in 13 different languages. You can reach them via email, chat, and phone.

Live chat

Make sure to give your account number and support PIN if you’re an existing client. In the live chat, the bot can provide answers to your questions. When the bot can’t help, you will be directed to a customer service person.

I reached out to the Exness team via support@exness.com , and they responded within 24 hours. Make sure to give your account number and support PIN if you’re an existing client in the first email to fast-track the response time.

Phone

To speak to Exness’s international support team? Call on +35725030959

Exness Customer Support Advantages and Disadvantages

Contacts Table

Security for Investors

Withdrawal Options and Fees

This broker guarantees the funds withdrawal at the trader’s request without any transaction restrictions. Besides that, all currency inputs and outputs are available 24/7. Exness allowed several withdrawal options, including bitcoin, bank cards, internet banking, Skrill, Perfect Money, Neteller, Tether, MyBux, and WebMoney.

The minimum withdrawal amount depends on the payment method you are using. For example, the minimum withdrawal limit for WebMoney is 1 USD, and for Bitcoin and Skrill, 10 USD.

Traders can withdraw your funds through YooMoney within 24 hours. With Bitcoin, it may take up to 4 hours for the withdrawal to process, and with Tether — up to 72 hours. The term for those withdrawing their earnings to a Visa or Mastercard bank card is 3-5 days. Moreover, traders can use USD and EUR currency pairs to withdraw funds.

Exness Vs Other Brokers

#1. Exness vs. Avatrade

AvaTrade outperforms Exness, according to our in-depth study of over a hundred data-driven metrics, intensive research, and practical testing. AvaTrade is a well-rounded, reliable broker with outstanding social copy trading capabilities and superb training materials. AvaTrade offers traders access to its own proprietary platforms and third-party favorites like MetaTrader, and its commissions and market research are comparable to the industry as a whole.

Exness is a MetaTrader broker that also provides its client portal, Terminal, and Exness Social Trading app in addition to the complete MT4 and MT5 platform suites. Exness competes with the leading brokers in terms of spreads for its commission-based and Pro accounts, but it needs to catch up in research and education.

While Exness demands a $1 minimum deposit, AvaTrade requires a $100 minimum. AvaTrade offers spreads of 0.91, while Exness offers spreads of 0.9, according to our testing. Exness accepts PayPal (Deposit/Withdraw), Skrill (Deposit/Withdraw), Visa/Mastercard (Credit/Debit), Bank Wire (Deposit/Withdraw), and PayPal (Deposit/Withdraw) as popular choices. AvaTrade payment methods include using Credit Cards, Debit cards, FasaPay, JCB Cards, Mastercard, MoneyGram, Neteller, Perfect Money, Skrill, Swift, WebMoney, Western Union, and Wire Transfers.

Compared to Exness, AvaTrade has a broader range of investment alternatives, including Forex Trading (Spot or CFDs), Spread Betting, Social Trading / Copy Trading, Metals, Energies, Agricultural, and U.S. Stocks (CFD). However, neither of these platforms supports ETFs. When comparing the total number of tradeable symbols, AvaTrade has 1260, whereas Exness has only 112.

Trading Central (Recognia), Daily Market Commentary, Stock Charts, Forex News (Top-Tier Sources), and Social Trading / Copy Trading are some of the research and research tools that AvaTrade offers traders. In contrast, Exness provides the following tools: Trading Central (Recognia) and Forex News (Top-Tier Sources). Exness is regulated by FSA, CySEC, FCA, FSCA, FSC, and CBCS. while CBoI, ASIC, FSA, FSCA, FSB regulates Avatrade

#2. Exness vs Roboforex

Exness is a MetaTrader broker that also provides its client portal, Terminal, and Exness Social Trading app in addition to the complete MT4 and MT5 platform suites. Exness competes with the leading brokers in terms of spreads for its commission-based and Pro accounts, but it needs to catch up in research and education.

Tier-1 regulators go above and beyond by putting brokers through a more rigorous screening procedure, imposing higher capital requirements, and regularly monitoring brokers. Exness has FCA authorization from the United Kingdom. However, RoboForex (RoboMarkets) does not, nor do they have authorization from ASIC in Australia, IIROC in Canada, SFC in Hong Kong, CBI in Ireland, FSA in Japan, MAS in Singapore, FMA in New Zealand, or FINMA in the United States.

Tier-2 and tier-3 licenses are still significant when determining how trustworthy a forex broker is. Exness and RoboForex (RoboMarkets) both have Tier 2 licenses from CySEC (Cyprus), but neither has a Tier 2 license from CBRC (China), SEBI (India), ISA (Israel), CBR (Russia), FSCA (South Africa), SEC (Thailand), or DFSA / Central Bank Authorized (UAE). Exness has no tier-3 licenses, but RoboForex (RoboMarkets) is authorized by the IFSC (Belize), and neither does SCB (Bahamas), BMA (Bermuda), FSC (British Virgin Islands), CIMA (Cayman Islands), FSC (Mauritius), or VFSC (Venezuela) (Vanuatu).

A Desktop Platform (Windows) is offered by both Exness and RoboForex (RoboMarkets). However, neither company has a proprietary platform like cTrader, DupliTrade, or ZuluTrade.

The entire MetaTrader suite, which includes both MetaTrader 4 and MetaTrader 5, is available on Exness and RoboForex. RoboForex requires a minimum deposit of $100, whereas Exness only requires a deposit of $1.

Exness offers spreads of 0.9 (as of May 19), according to our testing, while RoboForex offers spreads of 1.4. (Jan 2022).

In contrast to RoboForex, which offers Bank Wire (Deposit/Withdraw), Visa/Mastercard (Credit/Debit), PayPal (Deposit/Withdraw), and Skrill (Deposit/Withdraw), Exness supports Bank Wire (Deposit/Withdraw), Visa/Mastercard (Credit/Debit), and Skrill (Deposit/Withdraw).

Exness provides a wider range of investment alternatives than RoboForex (RoboMarkets), enabling you to trade foreign exchange (F.X.) (Spot or CFDs), metals, energies, and U.S. stocks (CFD). When comparing the number of tradeable symbols overall, Exness has 112. RoboForex has 12,000. (RoboMarkets).

Exness provides traders with the following resources and tools for research: Trading Central and Forex News (Top-Tier Sources) (Recognia). The following tools are provided by RoboForex (RoboMarkets): Daily Market Commentary, Stock Charts, Foreign Exchange News from Top-Tier Sources, and Social Trading and Copy Trading.

#3. Exness vs Alpari

Exness was founded in 2008 and is a well-known financial trading agency in Cyprus. Exness provides services to clients worldwide and is governed by the Cyprus Securities and Exchange Commission (CySEC), CRFIN, the Netherlands Authority for the Financial Markets (AFM), the Bank of France, the National Securities Market Commission (CNMV), the Commissione Nazionale per le Società e la Borsa (CONSOB), the Finansinspektionen (FI), and the Komisja Nadzoru Finansowego (KNF).

To comply with its financial authorities, Alpari may service you from a separate corporate entity, depending on the nation from which you are trading. The Financial Services Authority (FSA) of Saint Vincent and the Grenadines oversees Alpari.

Exness does not publish its annual report online or listed on any stock exchanges. Although this is not the best for a broker, you should double-check everything before moving further. The most crucial factor to take into account is safety. There is no PLC listed for Alpari.

Exness and Alpari both have a one-dollar minimum deposit. Exness has about 100 financial instruments on its trading platform, compared to up to 50 offered by Alpari. While Exness has 0 equities listed, the Alpari trading platform has 0 stocks. Alpari provides its users with MT4, MT5, Web Trader, Binary, Tablet & Mobile apps trading platforms. Exness offers retail traders access to its platforms for MT4, MT5, Mac, Web Trader, Tablet, and Mobile apps.

Payment methods available on Alpari are Bitcoin Payments, Credit Card, Diners Club, EasyPay, Ethereum Payments, FasaPay, GlobePay, Maestro, Mastercard, Neteller, PayRedeem, Perfect Money, RBK Money, Skrill, UnionPay, Vietcombank Transfer, WebMoney, Wire Transfer. Exness has Bitcoin Payments, Credit Card, Mastercard, Visa, and Wire Transfers as its payment methods.

How Exness Trading Options Compare against other Brokers

Conclusion: Exness Review

If you have conviction in your brokerage firm, you may commit more time and effort to technical analysis and developing forex strategies. Research before selecting a broker may boost your chances of success in the competitive forex market.

Exness is a Russian CFD broker with more than 72,000 customers worldwide. It offers trading on more than 100 Forex currency pairs, a limited selection of cryptocurrencies, and more than 70 stock CFDs, indices, and commodities. Unlike most brokers, Exness offers nine different account types on the MT4 and MT5 platforms.

Both deposits and withdrawals are free, and customer assistance is available around-the-clock. Exness trading charges are typically lower than the industry average, but its market analysis and education still need to be improved compared to other large brokers. Exness offers very high degrees of leverage despite its very low minimum deposits. Thus, newbies should exercise caution, especially with small deposits.

Exness Review FAQs

Is Exness safe and legit?

Yes, it is.

Exness is not only regulated and licensed by two of the strictest and most demanding authorities. It also holds customer funds in separate accounts and procures client protection.

Exness is also a member of an investor compensation program, which pays a certain amount to each customer in case of company insolvency.

Does Exness offer a demo account?

Yes, it does,

Exness offers a free, improved demo trading account for amateur traders to practice. The Demo account interface is user-friendly and automatic, the same as the live trading dashboard.

Is Exness regulated by FCA?

Yes, the Exness trading platform is licensed and regulated by dominating global governing bodies, one of which is the FCA with Registration Number 730729, authorizing you to trade, acknowledging your financial security is secured.