Exclusive Markets Review

Exclusive Markets is a global broker offering a range of trading options, including forex, commodities, indices, and stocks. Their platform is designed for accessibility, catering to both new and experienced traders. With a user-friendly interface and multiple account types, traders have flexibility in their investments.

Exclusive Markets supports MetaTrader 4 and 5, industry-leading platforms known for reliability and a suite of advanced tools. These platforms help users execute trades efficiently and provide in-depth analysis tools for better market insights. Additionally, the broker’s mobile apps allow trading on the go, ensuring traders stay connected.

The broker emphasizes security by employing robust encryption protocols to safeguard user information. Exclusive Markets is regulated by the Seychelles Financial Services Authority (FSA), offering a layer of trust for clients concerned with safety. Overall, Exclusive Markets provides accessible trading solutions in a regulated environment.

What is Exclusive Markets?

Exclusive Markets is a global online brokerage firm offering access to over 5,000 financial instruments, including forex, commodities, indices, stocks, ETFs, and cryptocurrencies. Established in 2011, the company operates under the regulation of the Seychelles Financial Services Authority (FSA) with license number SD031.

Traders can utilize the MetaTrader 4 and MetaTrader 5 platforms, available on desktop, web, and mobile devices, to execute trades and analyze markets. Exclusive Markets provides various account types to accommodate different trading styles and experience levels, with leverage options up to 1:2000.

The broker emphasizes security and transparency, implementing robust encryption protocols to protect user data. Additionally, Exclusive Markets offers educational resources and customer support to assist traders in making informed decisions.

Exclusive Markets Regulation and Safety

Exclusive Markets is a brokerage firm regulated by the Seychelles Financial Services Authority (FSA) under license number SD031. While this provides a level of oversight, it’s important to note that the FSA is considered a Tier-3 regulator, which may offer less stringent supervision compared to Tier-1 regulators.

The company emphasizes the security of client funds by partnering with top-tier banks and financial institutions. Additionally, Exclusive Markets offers insurance to protect clients’ funds against unforeseen events.

However, some reviews have raised concerns about the broker’s offshore regulation and the absence of an investor compensation fund, which could impact the safety of client funds.

In summary, while Exclusive Markets implements certain measures to safeguard client funds, potential investors should carefully consider the implications of its regulatory status and the associated risks.

Exclusive Markets Pros and Cons

Pros:

- Low fees

- Diverse assets

- User-friendly

- Regulated

Cons:

- Limited support

- High spreads

- Regional restrictions

- No crypto

Benefits of Trading with Exclusive Markets

Exclusive Markets offers a range of benefits for traders seeking a comprehensive trading experience.

Traders have access to over 5,000 financial instruments, including forex, commodities, indices, stocks, ETFs, and cryptocurrencies. This extensive selection allows for portfolio diversification and the ability to capitalize on various market opportunities.

The broker supports MetaTrader 4 and MetaTrader 5 platforms, known for their reliability and advanced features. These platforms offer robust charting tools, technical indicators, and automated trading capabilities, catering to both novice and experienced traders. Exclusive Markets provides multiple account options, such as Cent, Standard, Standard Plus, Exclusive, and Shares accounts. This variety accommodates different trading styles and experience levels, with features like low minimum deposits and leverage up to 1:2000.

The broker offers tight spreads starting from 0.0 pips and low commission fees, enhancing cost-effectiveness for traders. Additionally, high leverage options enable traders to maximize their market exposure. Exclusive Markets provides educational materials, including tutorials and webinars, to help traders enhance their skills. A dedicated customer support team is available 24/7 to assist with any inquiries or issues. These features collectively make Exclusive Markets a compelling choice for traders seeking a versatile and supportive trading environment.

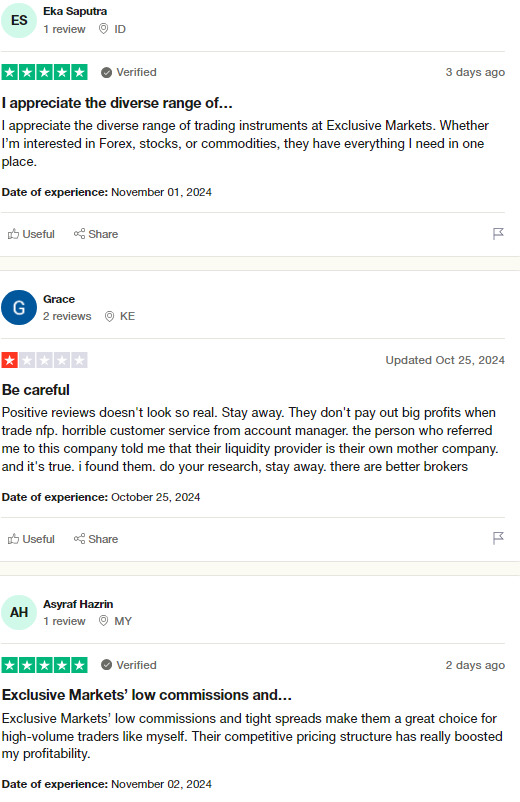

Exclusive Markets Customer Reviews

Exclusive Markets has received mixed feedback from its clients. Some traders commend the broker for its diverse range of financial instruments and user-friendly platforms, highlighting the availability of MetaTrader 4 and 5 as advantageous. Additionally, the provision of various account types caters to different trading needs.

However, concerns have been raised regarding the broker’s regulatory status. Exclusive Markets is regulated by the Seychelles Financial Services Authority (FSA), which is considered a Tier-3 regulator. This has led some clients to question the level of oversight and protection provided.

In summary, while Exclusive Markets offers a broad spectrum of trading options and platforms, potential clients should carefully consider the regulatory environment and assess whether it aligns with their personal risk tolerance.

Exclusive Markets Spreads, Fees, and Commissions

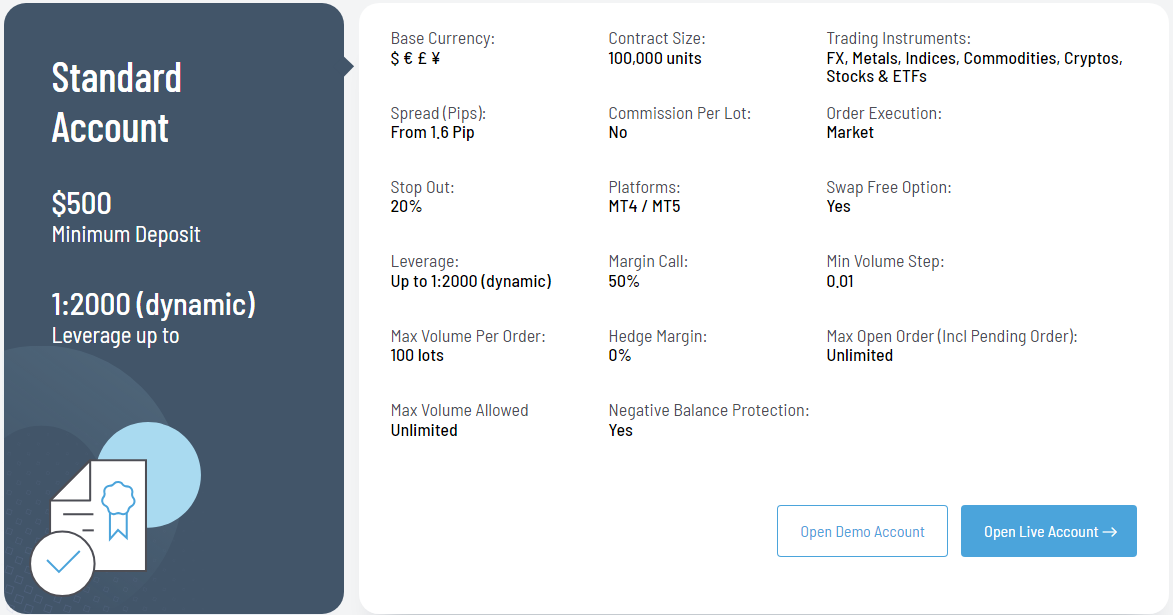

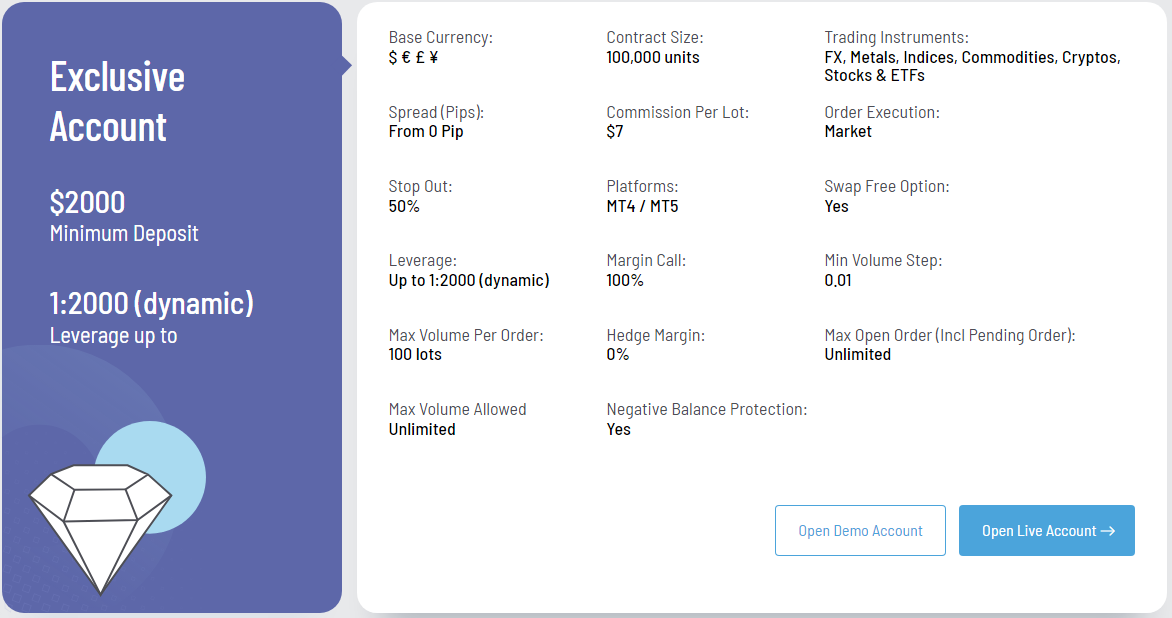

Exclusive Markets offers several account options with varying spreads and fees, catering to different trading needs. The Standard Account has no commissions, requires a $500 deposit, and provides spreads starting from 1.6 pips. For traders who need lower spreads, the Exclusive Account offers spreads from 0.0 pips with a $7 commission per lot, requiring a $2,000 minimum deposit.

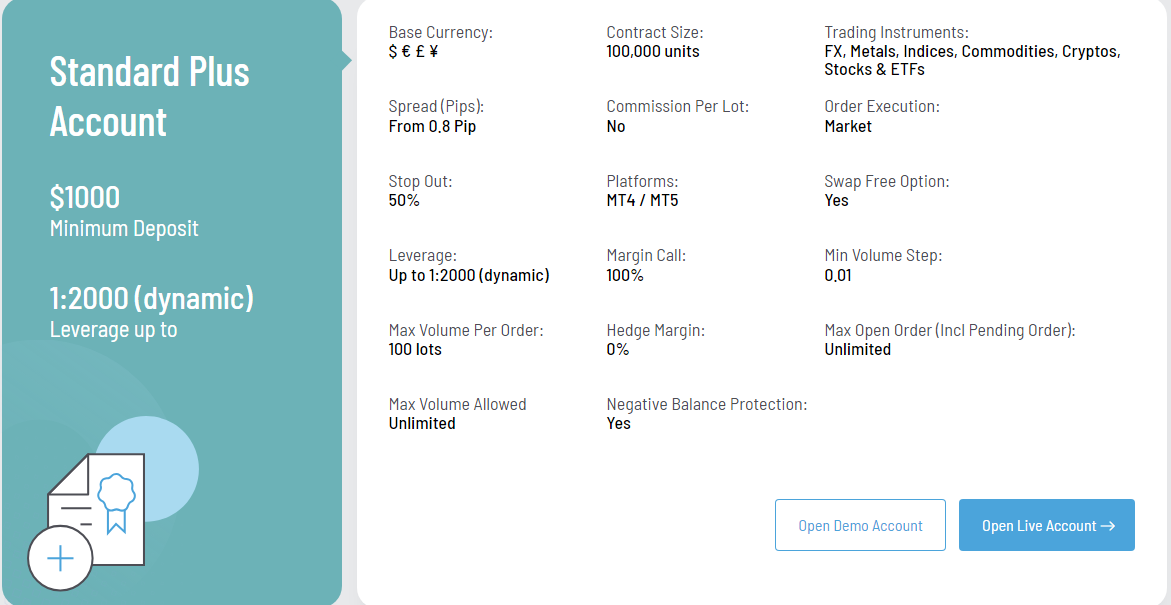

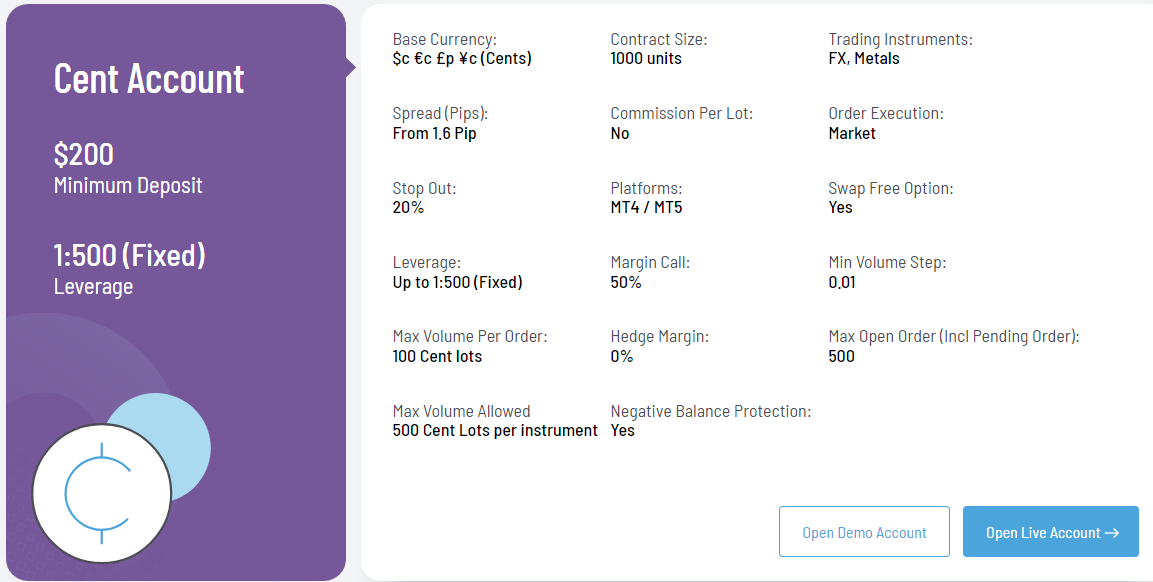

The Standard Plus Account offers 0.8-pip spreads without commission for a $1,000 deposit. Beginners can use the Cent Account with a $200 deposit and spreads from 1.6 pips, also commission-free. For share trading, the Shares Account charges a $2.5 per share commission with a $5,000 deposit.

Exclusive Markets does not charge deposit fees, but a 1.8% fee applies to withdrawals. Traders should consider potential additional costs, such as swap fees for overnight positions, although swap-free options are available for a limited time. These options make it essential for traders to choose an account that aligns with their trading frequency and cost preferences.

Account Types

Exclusive Markets offers a range of account types tailored to meet the needs of traders at different experience levels. From beginners who are just starting their trading journey to professionals seeking premium benefits, each account type provides unique features and services. Whether you’re looking for essential tools or VIP access, these accounts are designed to support various trading styles and preferences, giving traders flexibility and control over their investments. This diverse selection allows users to choose an account that best aligns with their skills, goals, and trading requirements.

Standard Account

The Standard Account is designed for entry-level traders who are just starting out. It provides essential trading features with limited access to advanced tools. This account type typically offers low minimum deposit requirements and basic market analysis tools, making it suitable for beginners.

Standard Plus Account

The Standard Plus Account is ideal for traders who have some experience and want more features than the Basic Account. It includes additional tools like daily market insights, a broader selection of tradable assets, and lower spreads compared to the Basic level. This account is a good choice for intermediate traders.

Cent Account

The Cent Account caters to advanced traders seeking enhanced benefits and greater access to exclusive trading resources. With this account, users enjoy tighter spreads, dedicated customer support, and access to webinars and educational materials, helping them make more informed decisions.

Exclusive Account

The Exclusive Account is tailored for professional traders or high-net-worth individuals. It provides the highest level of service, including priority support, custom trading strategies, the lowest spreads available, and VIP access to market events and exclusive insights.

How to Open Your Account

Opening an account with Exclusive Markets is a straightforward process, designed to help traders get started quickly and efficiently. With a few simple steps, prospective users can access a range of trading tools and resources tailored to their experience level and investment goals. Exclusive Markets ensures a user-friendly experience, guiding each applicant through the process from registration to verification. Here’s a step-by-step breakdown of how to open your account.

Step 1: Registration

To begin, users must complete the Registration process by visiting the Exclusive Markets website. Here, they’ll fill out a simple form with their basic information, such as name, email address, and contact details. Once submitted, they’ll receive an email to verify their account.

Step 2: Account Selection

After registering, users are prompted to choose an Account Type that aligns with their trading goals and experience level. Options range from Basic to Platinum, each offering varying features to accommodate different levels of trading activity and investment needs.

Step 3: Identity Verification

Next, users must complete Identity Verification to meet regulatory requirements. This involves uploading necessary documents, like a government-issued ID and proof of address, ensuring a secure and compliant trading environment.

Step 4: Funding the Account

Once verified, users can proceed to Fund Their Account by selecting a preferred payment method from options such as bank transfer, credit card, or digital wallet. After funding, the account is activated, allowing users to start trading immediately on the Exclusive Markets platform.

Exclusive Markets Trading Platforms

MT4 is renowned for its user-friendly interface and robust features, making it a popular choice among traders. It offers advanced charting tools, a wide range of technical indicators, and supports automated trading through Expert Advisors (EAs). Traders can execute various order types and access real-time market data, facilitating informed decision-making. The platform is available on desktop, web, and mobile devices, ensuring flexibility and convenience.

MT5 builds upon the capabilities of MT4, providing enhanced features suitable for more advanced trading strategies. It includes additional timeframes, an economic calendar, and improved charting tools. MT5 also supports a broader range of order types and offers a more sophisticated strategy tester for backtesting trading algorithms. Like MT4, MT5 is accessible on desktop, web, and mobile platforms, allowing traders to manage their accounts seamlessly across devices.

Both platforms are designed to cater to traders of all experience levels, offering comprehensive tools and resources to navigate the financial markets effectively.

What Can You Trade on Exclusive Markets

Exclusive Markets offers a diverse range of trading instruments, allowing clients to engage in various financial markets.

Forex Trading

Traders can access over 60 currency pairs, including major, minor, and exotic pairs, enabling participation in the global foreign exchange market.

Metals

The platform provides trading opportunities in precious metals such as gold and silver, offering options for those interested in commodities.

Commodities

Clients can trade a variety of commodities, including energy products like crude oil and natural gas, as well as agricultural products.

Indices

Exclusive Markets offers trading on major global indices, allowing traders to speculate on the performance of stock markets worldwide.

Stocks

The platform provides access to over 200 stock CFDs from leading companies in the US and Europe, enabling traders to invest in individual equities.

ETFs

Clients can trade over 40 ETF CFDs, offering exposure to a broad range of sectors and asset classes through exchange-traded funds.

Cryptocurrencies

Exclusive Markets includes cryptocurrency trading, featuring popular digital assets like Bitcoin, Ethereum, and others, catering to the growing interest in digital currencies.

This extensive selection allows traders to diversify their portfolios and explore various market opportunities within a single platform.

Exclusive Markets Customer Support

Exclusive Markets offers comprehensive customer support to assist clients with their trading needs. Their Customer Service department is available 24 hours a day, Monday to Friday, ensuring timely assistance. Clients can reach out via email at support@exclusivemarkets.com or utilize the Live Chat feature on their website for immediate help.

For those preferring direct communication, Exclusive Markets provides support through phone, WhatsApp, and Line, offering multiple channels to accommodate client preferences.

This multi-channel approach ensures that clients can receive prompt and effective support, enhancing their overall trading experience.

Advantages and Disadvantages of Exclusive Markets Customer Support

Withdrawal Options and Fees

Exclusive Markets offers a variety of withdrawal options to accommodate the diverse needs of its clients. Understanding the available methods and associated fees is crucial for efficient fund management. Below is an overview of the withdrawal options and their respective details.

Bank Transfers

Clients can withdraw funds directly to their bank accounts. Processing times typically range from 1 to 5 business days. Exclusive Markets does not charge fees for bank transfers; however, clients should verify with their banks for any applicable charges.

Credit/Debit Cards

Withdrawals to credit or debit cards are available, with processing times varying depending on the card issuer. Exclusive Markets does not impose fees for these transactions, but clients should consult their card providers for any potential fees.

E-Wallets

Exclusive Markets supports withdrawals through various e-wallets, including Skrill, Neteller, and Perfect Money. These methods often offer faster processing times, typically within 24 hours. The broker does not charge fees for e-wallet withdrawals; however, clients should check with the e-wallet service for any applicable fees.

Cryptocurrencies

For clients preferring digital currencies, Exclusive Markets facilitates withdrawals in cryptocurrencies such as Bitcoin and Tether. Processing times are generally quick, often within a few hours. Exclusive Markets does not charge fees for cryptocurrency withdrawals, but network fees may apply.

It’s important to note that while Exclusive Markets does not charge fees for most withdrawal methods, third-party charges may apply depending on the chosen method. Clients are advised to consult with their financial service providers to understand any additional costs.

Exclusive Markets Vs Other Brokers

#1. Exclusive Markets vs AvaTrade

Exclusive Markets and AvaTrade are both online brokers offering a range of trading services, but they differ in several key areas. Exclusive Markets, established in 2020, provides various account types, including Cent, Standard, Standard Plus, Exclusive, and Shares accounts, each with specific features and minimum deposit requirements. The broker offers leverage up to 1:2000 and supports trading in forex, metals, indices, commodities, cryptocurrencies, stocks, and ETFs. Exclusive Markets operates under multiple regulatory bodies, including the LFSA, BVI FSC, VFSC, and MFSA. AvaTrade, founded in 2006, offers a single standard account with a minimum deposit of $100 and provides access to over 1,250 instruments, including forex, stocks, indices, commodities, ETFs, bonds, and cryptocurrencies. AvaTrade is regulated by several top-tier authorities, including ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, and AFM. The broker offers various trading platforms, such as MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions, and AvaSocial, catering to both beginner and advanced traders.

Verdict: AvaTrade, with its extensive regulatory oversight and diverse range of trading platforms, offers a more established and comprehensive trading environment suitable for both beginners and experienced traders. In contrast, Exclusive Markets, while providing high leverage and multiple account types, is a newer entrant with a focus on competitive spreads and a wide range of trading products.

#2. Exclusive Markets vs RoboForex

Exclusive Markets and RoboForex are both online brokers offering a variety of trading services, yet they differ in several key aspects. Exclusive Markets provides multiple account types, including Cent, Standard, Standard Plus, Exclusive, and Shares accounts, each with specific features and minimum deposit requirements. The broker offers leverage up to 1:2000 and supports trading in forex, metals, indices, commodities, cryptocurrencies, stocks, and ETFs. Exclusive Markets operates under multiple regulatory bodies, including the LFSA, BVI FSC, VFSC, and MFSA. In contrast, RoboForex offers five main account types: Prime, ECN, R StocksTrader, ProCent, and Pro, each tailored to different trading needs. The broker provides leverage up to 1:2000 and access to over 12,000 instruments, including forex, stocks, indices, ETFs, commodities, and futures. RoboForex is regulated by the International Financial Services Commission (IFSC) in Belize.

Verdict: RoboForex, with its extensive range of instruments and specialized account types, offers a comprehensive trading environment suitable for various trading strategies. Exclusive Markets, while providing high leverage and multiple account options, is a newer entrant with a focus on competitive spreads and a wide range of trading products.

#3. Exclusive Markets vs Exness

Exclusive Markets and Exness are both online brokers offering a range of trading services, yet they differ in several key areas. Exclusive Markets, established in 2020, provides various account types, including Cent, Standard, Standard Plus, Exclusive, and Shares accounts, each with specific features and minimum deposit requirements. The broker offers leverage up to 1:2000 and supports trading in forex, metals, indices, commodities, cryptocurrencies, stocks, and ETFs. Exclusive Markets operates under multiple regulatory bodies, including the LFSA, BVI FSC, VFSC, and MFSA. In contrast, Exness, founded in 2008, offers Standard Cent, Standard, Pro, and Zero accounts, with leverage up to 1:2000 and access to over 100 forex pairs, commodities, indices, cryptocurrencies, and stocks. Exness is regulated by top-tier authorities, including the FCA, CySEC, FSCA, and FSA.

Verdict: Exness, with its extensive regulatory oversight and a broad range of trading instruments, offers a more established and comprehensive trading environment suitable for both beginners and experienced traders. Exclusive Markets, while providing high leverage and multiple account types, is a newer entrant with a focus on competitive spreads and a wide range of trading products.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH EXCLUSIVE MARKETS

Conclusion: Exclusive Markets Review

In conclusion, Exclusive Markets offers a robust platform for traders seeking flexibility with account types, high leverage, and a wide array of trading instruments, including forex, commodities, stocks, and cryptocurrencies. Despite being a relatively new broker, Exclusive Markets has positioned itself as a competitive option, particularly for those looking for diverse trading options and customizable account structures. While it may lack the established reputation of some older brokers, its regulatory oversight and user-centric features provide a solid foundation for both novice and seasoned traders looking to expand their trading potential.

Exclusive Markets Review: FAQs

What types of accounts does Exclusive Markets offer?

Exclusive Markets provides multiple account types, including Cent, Standard, Standard Plus, Exclusive, and Shares accounts, each catering to different trading levels and goals with varying minimum deposits and features.

Is Exclusive Markets regulated?

Yes, Exclusive Markets operates under the regulatory oversight of several authorities, including the LFSA, BVI FSC, VFSC, and MFSA, offering users a layer of security and compliance.

What trading instruments are available on Exclusive Markets?

Exclusive Markets offers access to a broad range of trading instruments, including forex, stocks, indices, commodities, ETFs, and cryptocurrencies, allowing traders to diversify their portfolios.

OPEN AN ACCOUNT NOW WITH EXCLUSIVE MARKETS AND GET YOUR BONUS