German Economic Outlook Worsens Significantly

Germany's economic prospects are deteriorating rapidly, according to the latest ZEW survey, which highlights the “strongest decline in economic expectations over the past two years.” The report suggests that this pessimism is largely driven by high uncertainty, stemming from ambiguous monetary policy, disappointing US economic data, and escalating concerns about the Middle East conflict. These factors have recently contributed to turmoil in international stock markets, according to ZEW President Professor Achim Wambach, PhD.

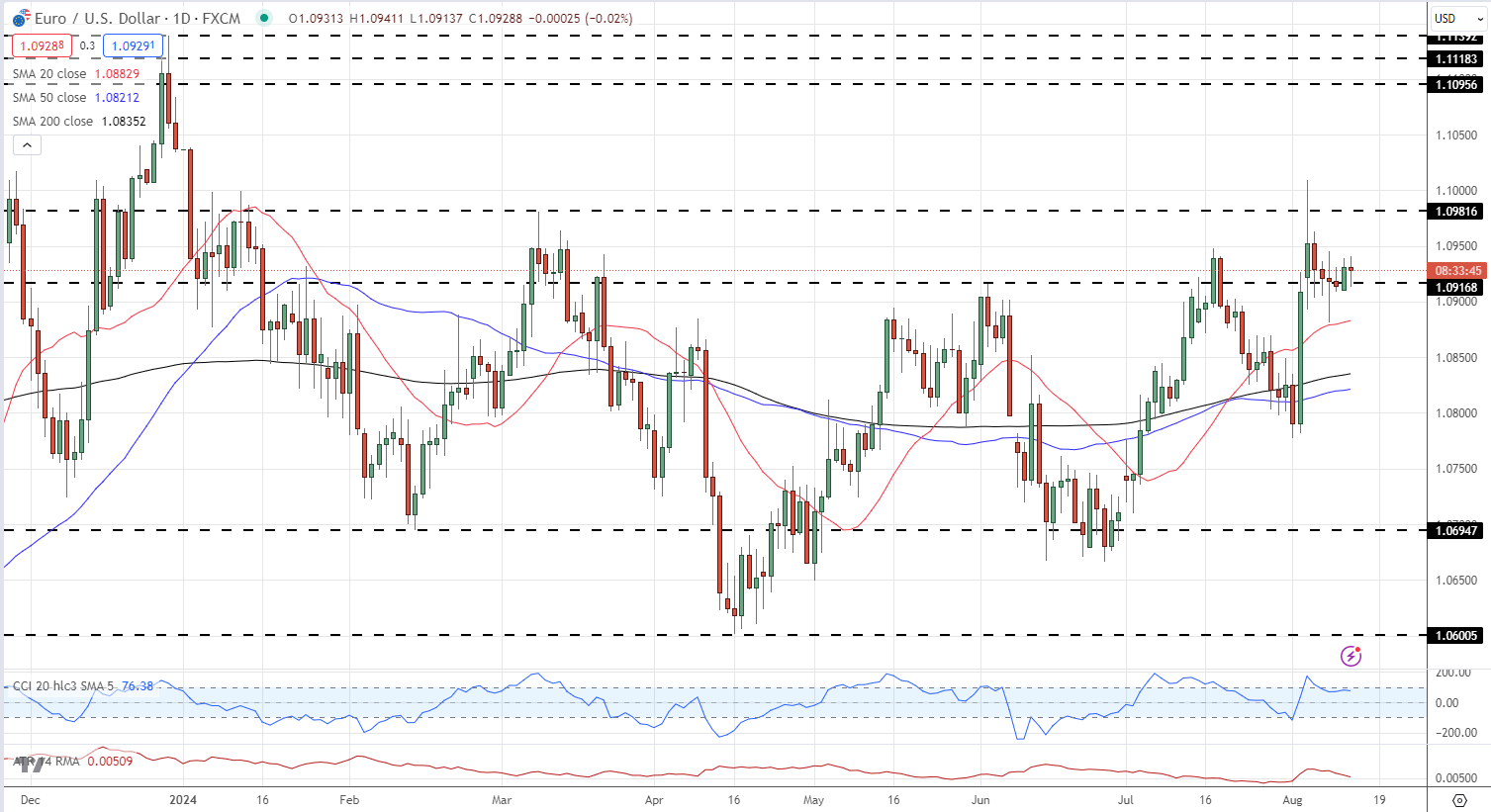

The EUR/USD pair dipped slightly against the US dollar but remains within a narrow, short-term range. Key support is identified near last Thursday’s low at 1.0881 and the 50-day SMA at 1.0883, while initial resistance stands at 1.0950.

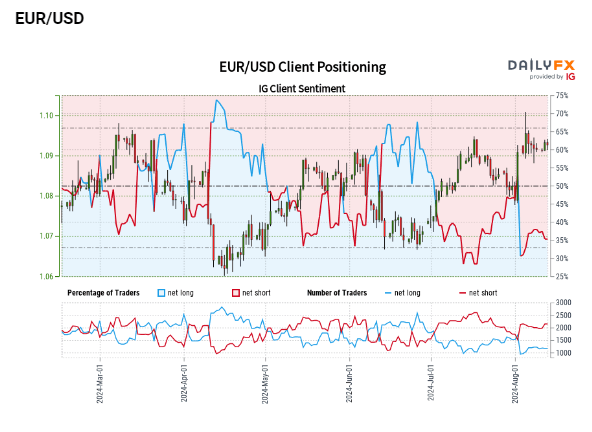

Market Sentiment Indicates Potential EUR/USD Shift

Retail trader data reveals that 37.51% of EUR/USD traders are net-long, with the short-to-long ratio at 1.67 to 1. The number of traders net-long has increased by 2.42% since yesterday and by 14.11% over the past week. Conversely, net-short traders have decreased by 0.42% from yesterday but have risen by 2.32% over the past week.

Analysts often adopt a contrarian stance toward crowd sentiment, suggesting that the EUR/USD may continue to rise given the current net-short positioning. However, the decreasing net-short positions compared to previous days could indicate a potential reversal in the EUR/USD trend, even though traders remain largely net-short.

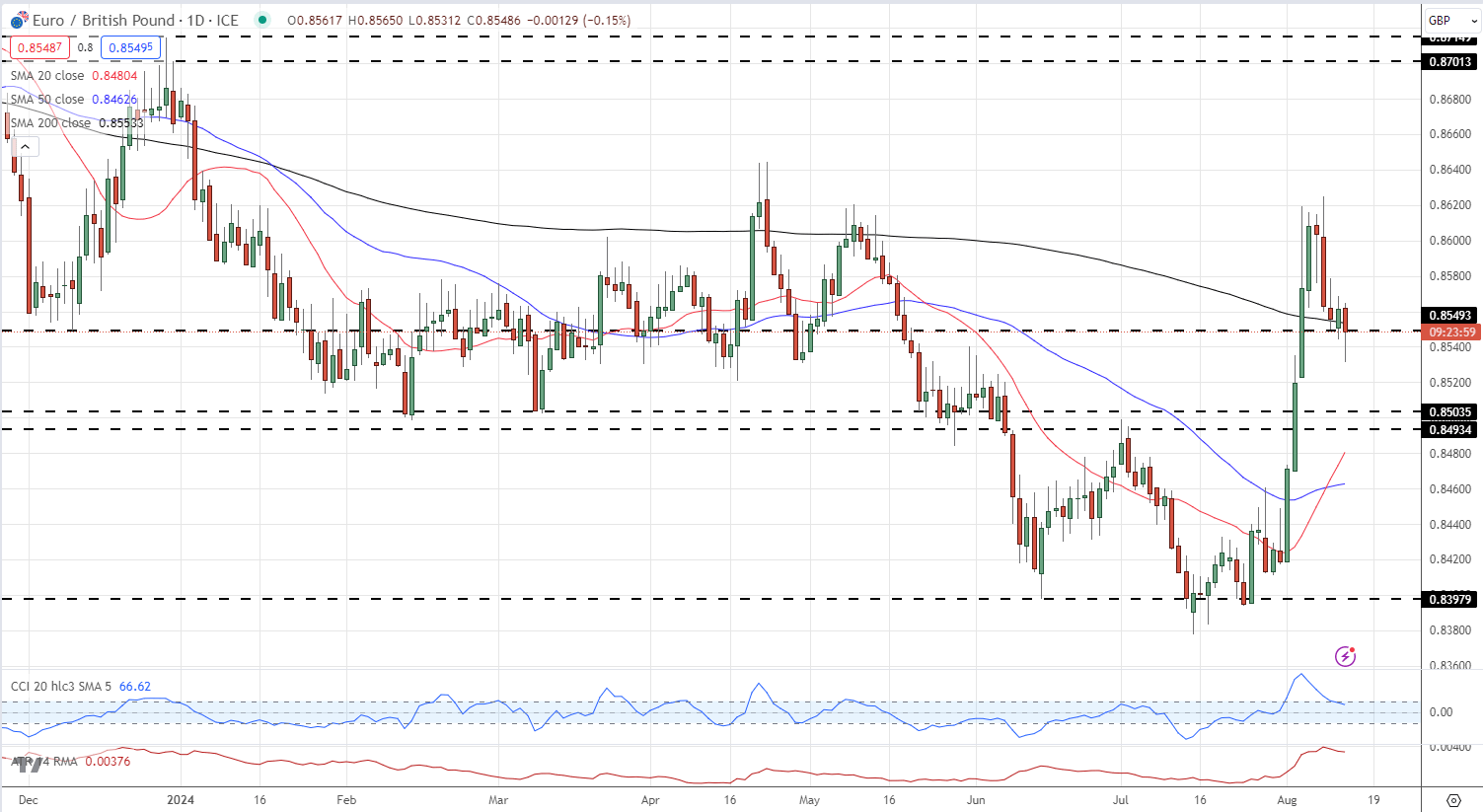

EUR/GBP Drops Amid Euro Weakness and Sterling Strength

The EUR/GBP pair slid to a new one-week low, influenced by a combination of Euro weakness and Sterling strength. Earlier today, UK data showed an unexpected drop in unemployment from 4.4% to 4.2%, reducing the likelihood of a UK rate cut.

After hitting a four-month high last week, EUR/GBP has since drifted lower, now fluctuating around a crucial level near 0.8550. If it falls further, 0.8500 could become the next focal point. In the short term, resistance is observed at 0.8580 and 0.8600.