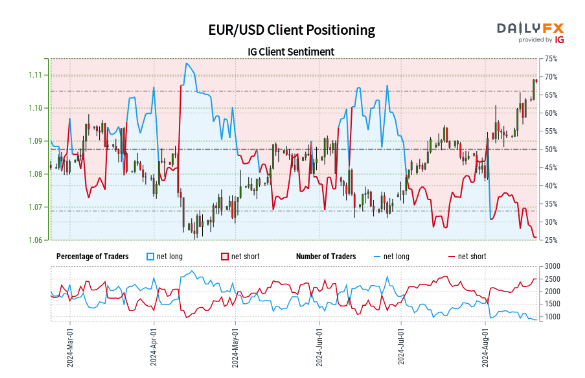

EUR/USD Market Sentiment Overview

Currently, only 25.61% of traders are net-long on EUR/USD, with the ratio of short to long traders standing at 2.90 to 1. Recent shifts in trader positions reveal a decrease of 8.49% in net-long positions since yesterday, and a more significant drop of 27.19% from last week. On the other hand, net-short positions have increased by 9.83% over the last day and by 17.79% over the past week.

Taking a contrarian approach to market sentiment, the fact that the majority of traders are net-short suggests that EUR/USD prices may be poised to rise. The growing net-short positions, particularly when compared to the previous day and week, support a bullish contrarian outlook for EUR/USD. This analysis implies that despite most traders betting against EUR/USD, the currency pair could see an upward move, with the increasing short positions further reinforcing this positive forecast.

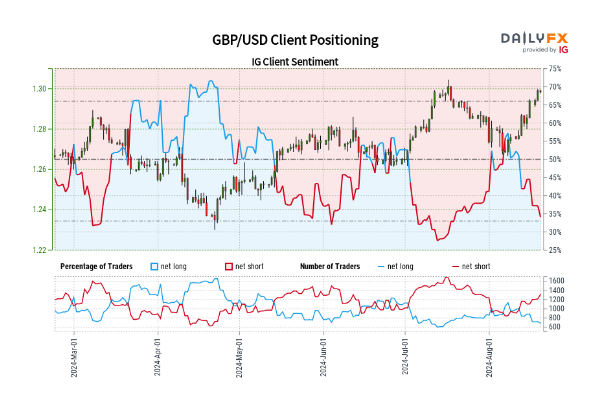

GBP/USD Market Sentiment Overview

In the case of GBP/USD, 34.22% of traders are currently net-long, with a short-to-long ratio of 1.92 to 1. Recent data shows that net-long positions have decreased by 6.33% since yesterday and have fallen by 32.24% from last week. Conversely, net-short positions have increased by 8.18% over the past day and by 35.65% over the last week.

Using a contrarian perspective on market sentiment, the prevalent net-short positioning suggests that GBP/USD prices could potentially rise. The increase in net-short positions, both in the short term and over the past week, points to a bullish outlook for GBP/USD. This analysis indicates that despite the majority of traders holding short positions, the contrarian view signals that GBP/USD may experience an upward trend, with the recent shifts in trader positions strengthening this forecast.