EUR/USD Technical Analysis

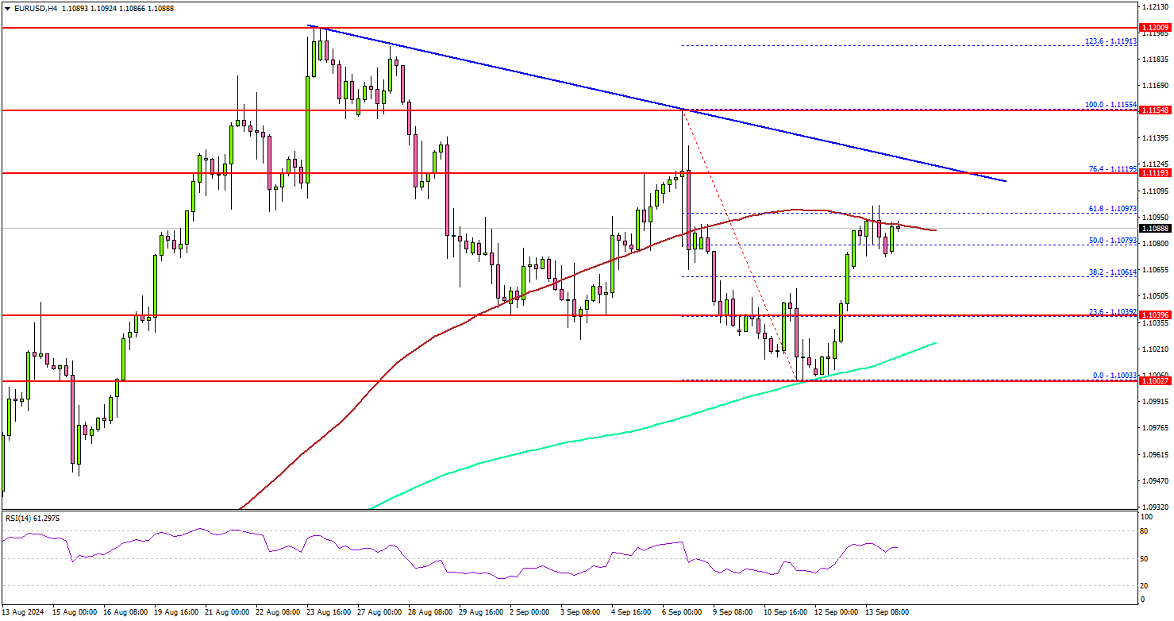

In the 4-hour chart, EUR/USD managed to break above the 50% Fibonacci retracement level of the recent downward movement, spanning from the 1.1155 swing high to the 1.1003 low. The pair remained steady above the 200 simple moving average (green, 4-hour), yet encountered difficulty in surpassing the 100 simple moving average (red, 4-hour).

The pair also encountered selling pressure near the 61.8% Fibonacci retracement level of the same downward move, specifically around 1.1100.

Additionally, a key bearish trend line has emerged with resistance at 1.1110. If EUR/USD manages to break above the 100 simple moving average (red, 4-hour) and clear this trend line, it could pave the way for a rise towards 1.1150. A further increase might even lead to testing the 1.1200 zone.

On the downside, immediate support rests near 1.1040. The next critical support level can be found near the 200 simple moving average (green, 4-hour) at 1.1020. If the pair breaks below this point, it could lead to a deeper decline. The next major support lies around 1.0950.